Cross purchase buy sell agreement life insurance information

Home » Trend » Cross purchase buy sell agreement life insurance informationYour Cross purchase buy sell agreement life insurance images are ready in this website. Cross purchase buy sell agreement life insurance are a topic that is being searched for and liked by netizens now. You can Download the Cross purchase buy sell agreement life insurance files here. Download all free photos and vectors.

If you’re searching for cross purchase buy sell agreement life insurance pictures information linked to the cross purchase buy sell agreement life insurance topic, you have visit the ideal site. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

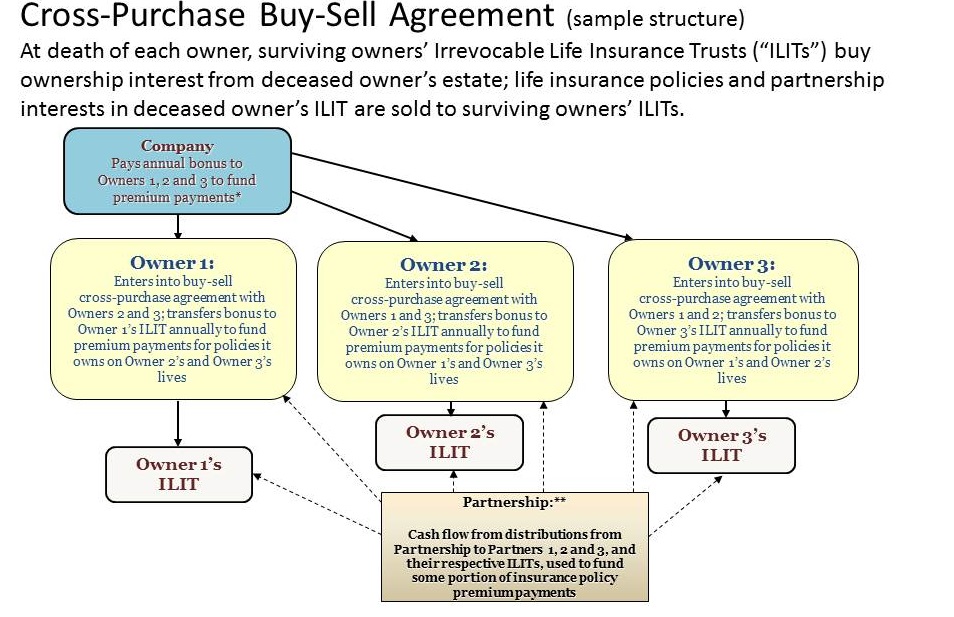

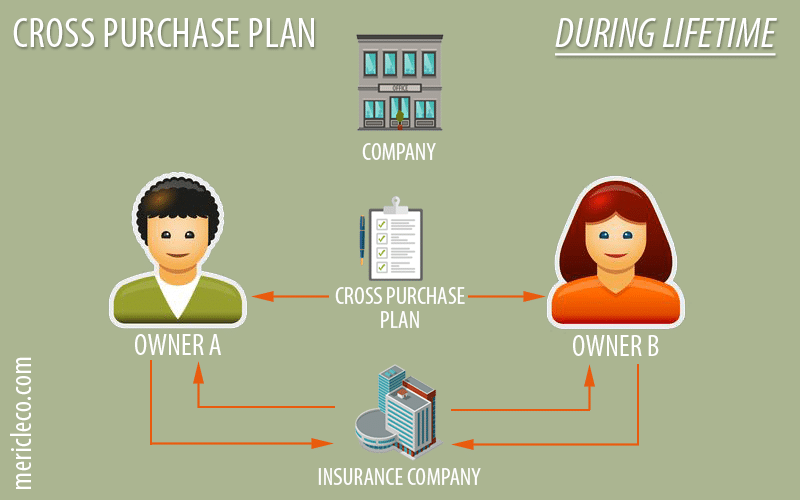

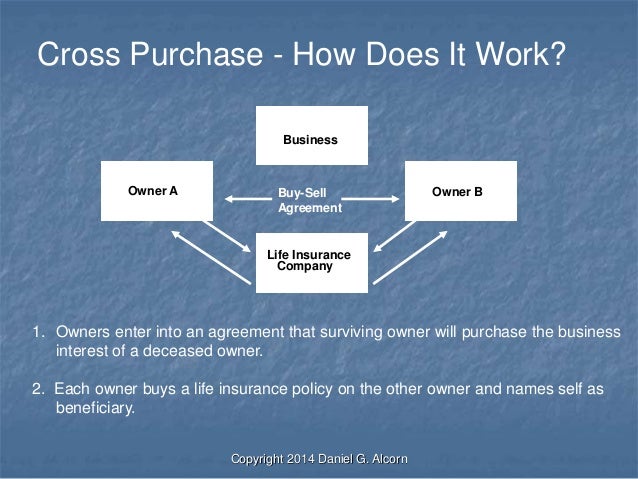

Cross Purchase Buy Sell Agreement Life Insurance. These agreements can include a variety of protections. More business owners require exponentially more life insurance policies. In some cases, the agreement might be a hybrid of the two. Cross purchase plan in a cross purchase plan, each owner purchases a life insurance policy on the other owner or owners.

Life Insurance Buy Sell Agreements & Arrangements for From mericleco.com

Life Insurance Buy Sell Agreements & Arrangements for From mericleco.com

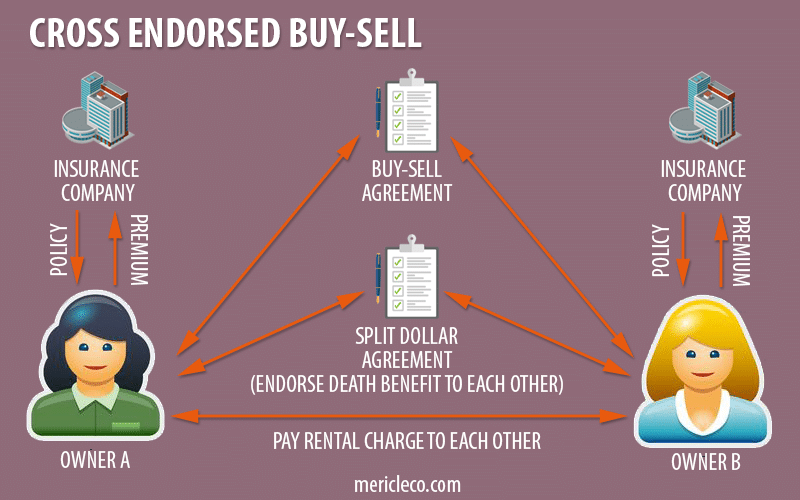

Suppose something unexpected happens, and one of the business owners passes away. These agreements can include a variety of protections. This agreement is funded with individual life insurance. For example, one partner may buy life insurance policies for the others, and when a partner dies, the payout from the policy can be used to purchase their shares. The trust must be carefully drafted to ensure that the owners do not have incidents of ownership in their own policies. Cross purchase plan in a cross purchase plan, each owner purchases a life insurance policy on the other owner or owners.

How many total life policies are needed for this agreement?

The value of the insurance proceeds must be equal to the value of the other�s ownership interest. The cross purchase buy sell agreement gives business owners a simple way to protect themselves by using affordable life insurance. Using cross purchase vs buy sell helps to solve several issues that may arise during the execution of a joint business venture. Cross purchase” issue must be addressed when the agreement is drafted. The trust must be carefully drafted to ensure that the owners do not have incidents of ownership in their own policies. With multiple owners, this can get very complex and complicated.

Source: redbirdagents.com

Source: redbirdagents.com

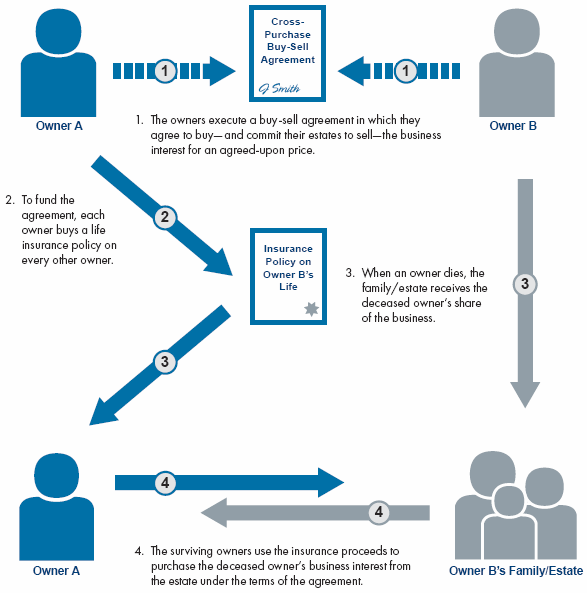

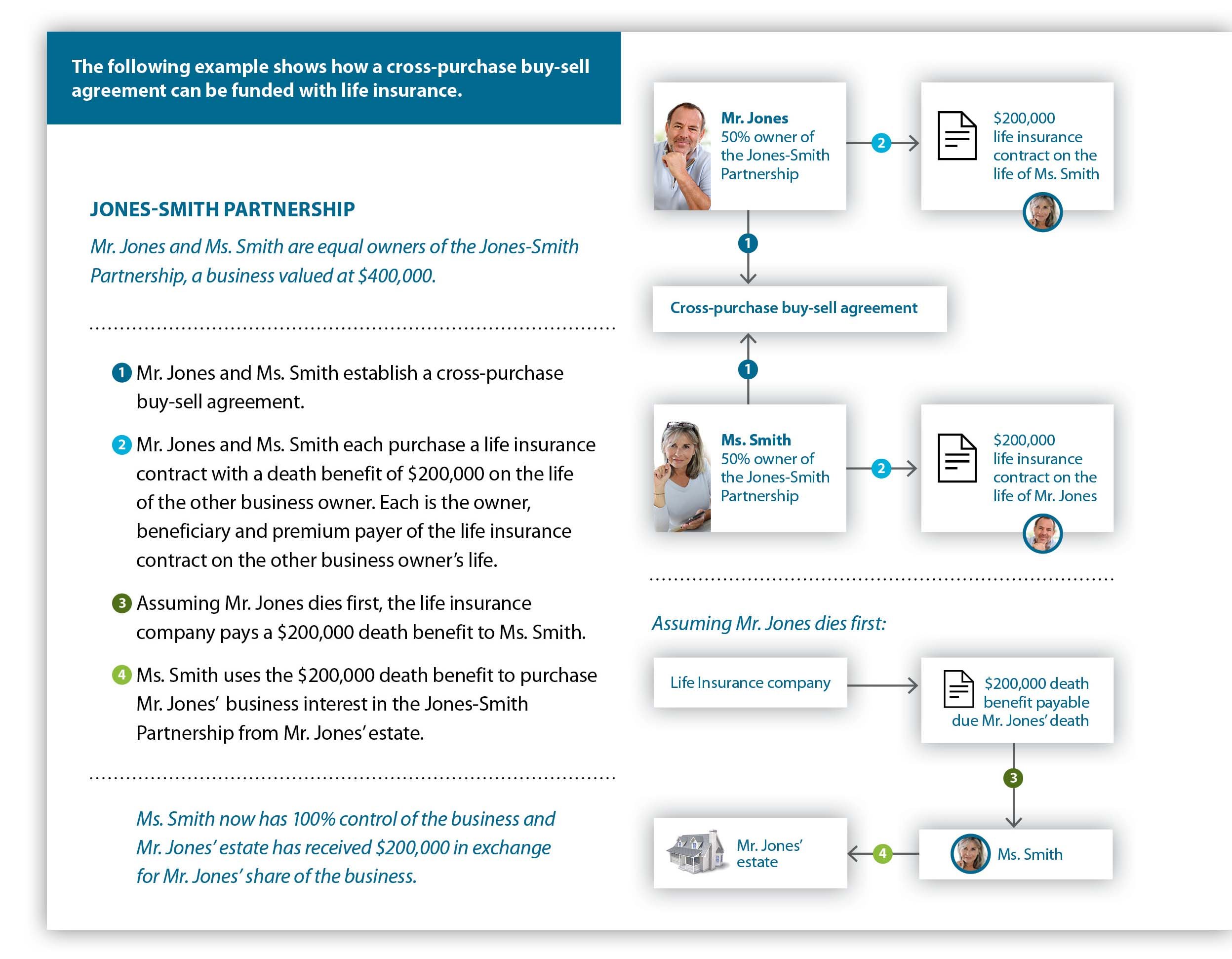

The value of the insurance proceeds must be equal to the value of the other�s ownership interest. Each owner pays the annual premiums on the policy they own and each is the beneficiary of the policy. Cross purchase plan in a cross purchase plan, each owner purchases a life insurance policy on the other owner or owners. Often funded by life insurance, these agreements are essentially deals struck between owners, partners, or key employees of a business, permitting the sale of their ownership share. The value of the insurance proceeds must be equal to the value of the other�s ownership interest.

Source: riw.com

Source: riw.com

Cross purchase” issue must be addressed when the agreement is drafted. In some cases, the agreement might be a hybrid of the two. Many business owners choose one of two buy/sell agreement life insurance plans. This agreement is funded with individual life insurance. In addition, an insurance limited liability company, discussed later in this article, can also be used to maximize creditor protection and other tax benefits.

Source: mericleco.com

Source: mericleco.com

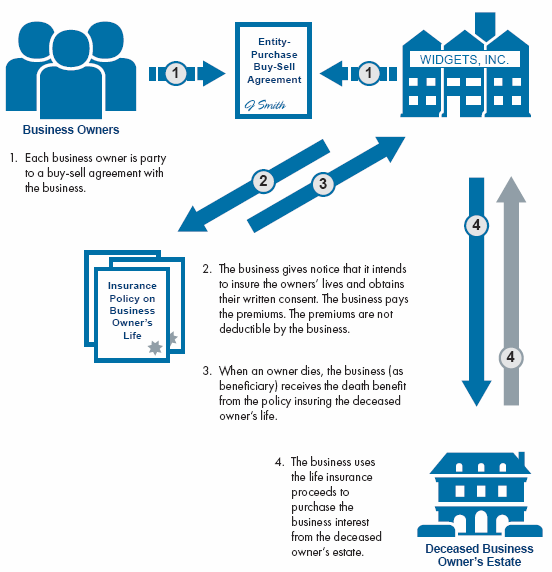

The value of the insurance proceeds must be equal to the value of the other�s ownership interest. While the business purchases an exiting owners interest in a an entity purchase plan, the remaining owners purchase the business interest of their departing or deceased partner with a the cross purchase plan. In addition, an insurance limited liability company, discussed later in this article, can also be used to maximize creditor protection and other tax benefits. This agreement is funded with individual life insurance. Using cross purchase vs buy sell helps to solve several issues that may arise during the execution of a joint business venture.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

The death of a partner is one of the primary triggers of a cross purchase buy sell agreement. When an owner dies, the surviving owners use the death benefit to purchase the deceased owner’s share of the business. With multiple owners, this can get very complex and complicated. These agreements can include a variety of protections. For example, one partner may buy life insurance policies for the others, and when a partner dies, the payout from the policy can be used to purchase their shares.

Source: de.slideshare.net

Source: de.slideshare.net

The cross purchase buy sell agreement gives business owners a simple way to protect themselves by using affordable life insurance. Many business owners choose one of two buy/sell agreement life insurance plans. Then, when an owner dies, the remaining owners use the payout from the life insurance policy to buy the deceased owner’s share of the. These agreements can include a variety of protections. Often funded by life insurance, these agreements are essentially deals struck between owners, partners, or key employees of a business, permitting the sale of their ownership share.

Source: chrismercer.net

Source: chrismercer.net

These agreements can include a variety of protections. The death of a partner is one of the primary triggers of a cross purchase buy sell agreement. In some cases, the agreement might be a hybrid of the two. The trust must be carefully drafted to ensure that the owners do not have incidents of ownership in their own policies. More business owners require exponentially more life insurance policies.

Source: mericleco.com

Source: mericleco.com

Using cross purchase vs buy sell helps to solve several issues that may arise during the execution of a joint business venture. Often funded by life insurance, these agreements are essentially deals struck between owners, partners, or key employees of a business, permitting the sale of their ownership share. The cross purchase buy sell agreement gives business owners a simple way to protect themselves by using affordable life insurance. This agreement is funded with individual life insurance. These agreements can include a variety of protections.

Source: myjourneytomillions.com

Source: myjourneytomillions.com

The trust must be carefully drafted to ensure that the owners do not have incidents of ownership in their own policies. Cross purchase” issue must be addressed when the agreement is drafted. Each partner must own a policy on the other partners Cross purchase plan in a cross purchase plan, each owner purchases a life insurance policy on the other owner or owners. If the agreement is funded with individual life insurance, what would it require?

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

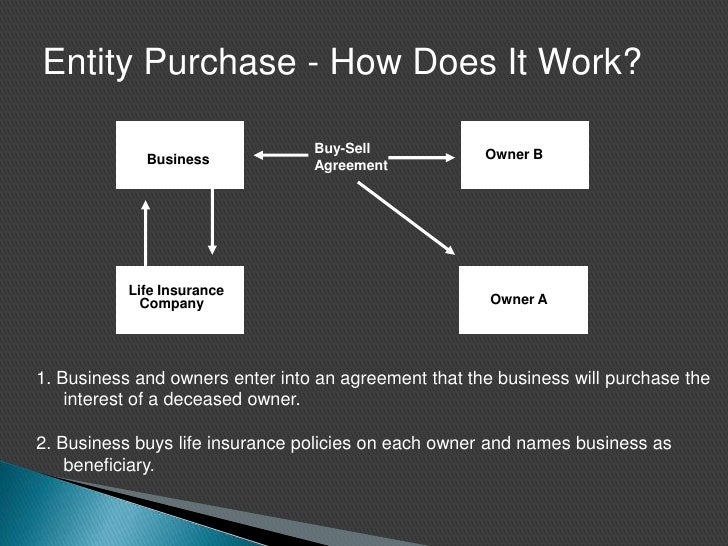

In some cases, the agreement might be a hybrid of the two. How many total life policies are needed for this agreement? If the agreement is funded with individual life insurance, what would it require? Many business owners choose one of two buy/sell agreement life insurance plans. While the business purchases an exiting owners interest in a an entity purchase plan, the remaining owners purchase the business interest of their departing or deceased partner with a the cross purchase plan.

Source: dixonwells.com

Source: dixonwells.com

While the business purchases an exiting owners interest in a an entity purchase plan, the remaining owners purchase the business interest of their departing or deceased partner with a the cross purchase plan. Often funded by life insurance, these agreements are essentially deals struck between owners, partners, or key employees of a business, permitting the sale of their ownership share. Cross purchase plan in a cross purchase plan, each owner purchases a life insurance policy on the other owner or owners. The cross purchase buy sell agreement gives business owners a simple way to protect themselves by using affordable life insurance. Then, when an owner dies, the remaining owners use the payout from the life insurance policy to buy the deceased owner’s share of the.

Source: yourlifeinsurance101.com

Source: yourlifeinsurance101.com

Often funded by life insurance, these agreements are essentially deals struck between owners, partners, or key employees of a business, permitting the sale of their ownership share. The trust must be carefully drafted to ensure that the owners do not have incidents of ownership in their own policies. The value of the insurance proceeds must be equal to the value of the other�s ownership interest. While the business purchases an exiting owners interest in a an entity purchase plan, the remaining owners purchase the business interest of their departing or deceased partner with a the cross purchase plan. Cross purchase plan in a cross purchase plan, each owner purchases a life insurance policy on the other owner or owners.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

For example, one partner may buy life insurance policies for the others, and when a partner dies, the payout from the policy can be used to purchase their shares. Cross purchase plan in a cross purchase plan, each owner purchases a life insurance policy on the other owner or owners. When an owner dies, the surviving owners use the death benefit to purchase the deceased owner’s share of the business. Each owner pays the annual premiums on the policy they own and each is the beneficiary of the policy. How many total life policies are needed for this agreement?

Source: yourlifeinsurance101.com

Source: yourlifeinsurance101.com

If the agreement is funded with individual life insurance, what would it require? While the business purchases an exiting owners interest in a an entity purchase plan, the remaining owners purchase the business interest of their departing or deceased partner with a the cross purchase plan. When an owner dies, the surviving owners use the death benefit to purchase the deceased owner’s share of the business. Each owner pays the annual premiums on the policy they own and each is the beneficiary of the policy. In addition, an insurance limited liability company, discussed later in this article, can also be used to maximize creditor protection and other tax benefits.

Source: slideshare.net

Source: slideshare.net

Each owner pays the annual premiums on the policy they own and each is the beneficiary of the policy. In addition, an insurance limited liability company, discussed later in this article, can also be used to maximize creditor protection and other tax benefits. The trust must be carefully drafted to ensure that the owners do not have incidents of ownership in their own policies. Each partner must own a policy on the other partners Suppose something unexpected happens, and one of the business owners passes away.

Source: gtldworldcongress.com

Source: gtldworldcongress.com

While the business purchases an exiting owners interest in a an entity purchase plan, the remaining owners purchase the business interest of their departing or deceased partner with a the cross purchase plan. More business owners require exponentially more life insurance policies. The cross purchase buy sell agreement gives business owners a simple way to protect themselves by using affordable life insurance. The value of the insurance proceeds must be equal to the value of the other�s ownership interest. The trust must be carefully drafted to ensure that the owners do not have incidents of ownership in their own policies.

Source: modernwoodmen.org

Source: modernwoodmen.org

How many total life policies are needed for this agreement? Each partner must own a policy on the other partners Cross purchase” issue must be addressed when the agreement is drafted. The death of a partner is one of the primary triggers of a cross purchase buy sell agreement. In some cases, the agreement might be a hybrid of the two.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

When an owner dies, the surviving owners use the death benefit to purchase the deceased owner’s share of the business. How many total life policies are needed for this agreement? In addition, an insurance limited liability company, discussed later in this article, can also be used to maximize creditor protection and other tax benefits. Cross purchase” issue must be addressed when the agreement is drafted. Many business owners choose one of two buy/sell agreement life insurance plans.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cross purchase buy sell agreement life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information