Csl insurance coverage information

Home » Trending » Csl insurance coverage informationYour Csl insurance coverage images are ready in this website. Csl insurance coverage are a topic that is being searched for and liked by netizens today. You can Find and Download the Csl insurance coverage files here. Download all free photos and vectors.

If you’re looking for csl insurance coverage pictures information linked to the csl insurance coverage interest, you have pay a visit to the ideal blog. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Csl Insurance Coverage. If all five drivers pursue claims against the tractor trailer’s insurance company and are successful in proving the truck driver’s negligence, all claims for damage to property and injuries will be paid from the $300,000 csl policy. Bodily injury coverage per person also, is csl better than split limits? Businesses seeking car insurance tend to see this type of limit the most — it’s rare for personal auto policies to lump both property damage and bodily injuries under one limit. A combined single limit is exactly what the name implies;

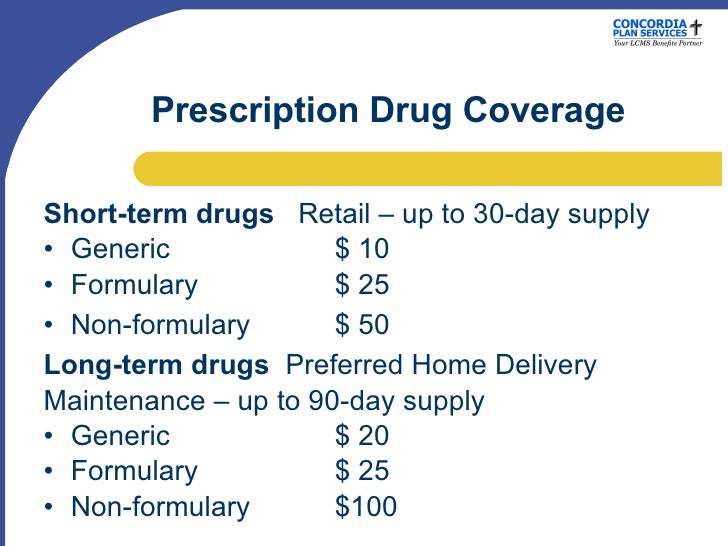

Liability is combined into one single limit. What would the csl of our sample policy be? The advantages of csl insurance New concordia health plan coverage for seminary students “option css” 3. Csl behring offers an excellent life insurance program. Combined single limit liability coverage (csl) this type of auto insurance coverage is a combination of all the liability limits (bodily injury and property damage).

100/300/50 represents $100k coverage to a single person, $300k to a single accident, and $50k to property damage !

Concordia seminary seminary student health care coverage concordia health plan of concordia plan services eustolio gomez director of education expanded coverage, greater value for students and families 2. Thus, if you total out an expensive $70,000 car and the driver has $110,000 of medical bills in total this csl policy will cover both the bodily injury and property damage claims fully since at $180,000 is below the $200,000 maximum limit. The limit will be used for everyone involved in the accident to share in the limit of $300,000 in our example. Yes, it would cover the. How i became a superhero plot; This is a very real possibility.

Source: countrysidelakes.com

Source: countrysidelakes.com

The limit will be used for everyone involved in the accident to share in the limit of $300,000 in our example. Split limit coverage splits the coverage amount into three limits, such as 50/100/25. Combined single limit liability coverage is more expensive but could provide greater protection! With a csl policy limit of $300,000, all the costs would be covered, as the medical expenses for both injured people and the cost of repairing or replacing the vehicle adds up to $269,000—which is within the policy limit. Rather than three separate limits, a combined single limit of liability (csl) policy provides one amount of coverage to use as needed for the expenses resulting from an accident.

Source: slideshare.net

Source: slideshare.net

What is the csl policy is not enough to cover all damages and injuries? How i became a superhero plot; Your property damage liability insurance provides coverage for property damage to another party’s auto which is damaged in an accident deemed to be your fault. The advantages of csl insurance Combined single limit liability is commercial auto insurance coverage that combines bodily injury and property damage.

Source: read.thebenildean.org

Source: read.thebenildean.org

Rather than three separate limits, a combined single limit of liability (csl) policy provides one amount of coverage to use as needed for the expenses resulting from an accident. Combined single limit means, per insweb insurance glossary, a single limit (csl) means the maximum amount. With csl limits your liability insurance limits look like this: The policy pays up to three years worth of salary to beneficiaries. January 21, 2022 5 letter word starts with o ends with s 0 comments.

Source: logonoid.com

Source: logonoid.com

January 21, 2022 5 letter word starts with o ends with s 0 comments. Click to read more on it. Liability is combined into one single limit. Csl stands for combined single limit (insurance liability limits of coverage) suggest new definition. There is not a split differential between the three main components.

With a csl policy limit of $300,000, all the costs would be covered, as the medical expenses for both injured people and the cost of repairing or replacing the vehicle adds up to $269,000—which is within the policy limit. That is simpler to understand, to be sure, and it does seem to be a better way to do the same job, which partly explains why such policies tend to be more expensive. What is split limit liability insurance? What is csl insurance coverage. Your property damage liability insurance provides coverage for property damage to another party’s auto which is damaged in an accident deemed to be your fault.

Source: esrl.noaa.gov

Source: esrl.noaa.gov

Combined single limit means, per insweb insurance glossary, a single limit (csl) means the maximum amount. Csl behring offers an excellent life insurance program. January 21, 2022 5 letter word starts with o ends with s 0 comments. The advantages of csl insurance If all five drivers pursue claims against the tractor trailer’s insurance company and are successful in proving the truck driver’s negligence, all claims for damage to property and injuries will be paid from the $300,000 csl policy.

Source: thehyphen.com.au

Source: thehyphen.com.au

Single limit liability vs split limit liability protection That is simpler to understand, to be sure, and it does seem to be a better way to do the same job, which partly explains why such policies tend to be more expensive. So if you purchase a $300 csl policy, your. What would the csl of our sample policy be? Csl policies offer broader coverage and for that reason, they tend to have a higher premium range.

Source: systemcsl.nl

Source: systemcsl.nl

Combined single limit liability is commercial auto insurance coverage that combines bodily injury and property damage. This means that you can select a set amount of coverage with your allied insurance agent at the time of the policy being set up, which in turn will protect you in the event of an at fault accident. In respect to this, what does 100k csl mean? Combined single limit liability coverage (csl) this type of auto insurance coverage is a combination of all the liability limits (bodily injury and property damage). What is the csl policy is not enough to cover all damages and injuries?

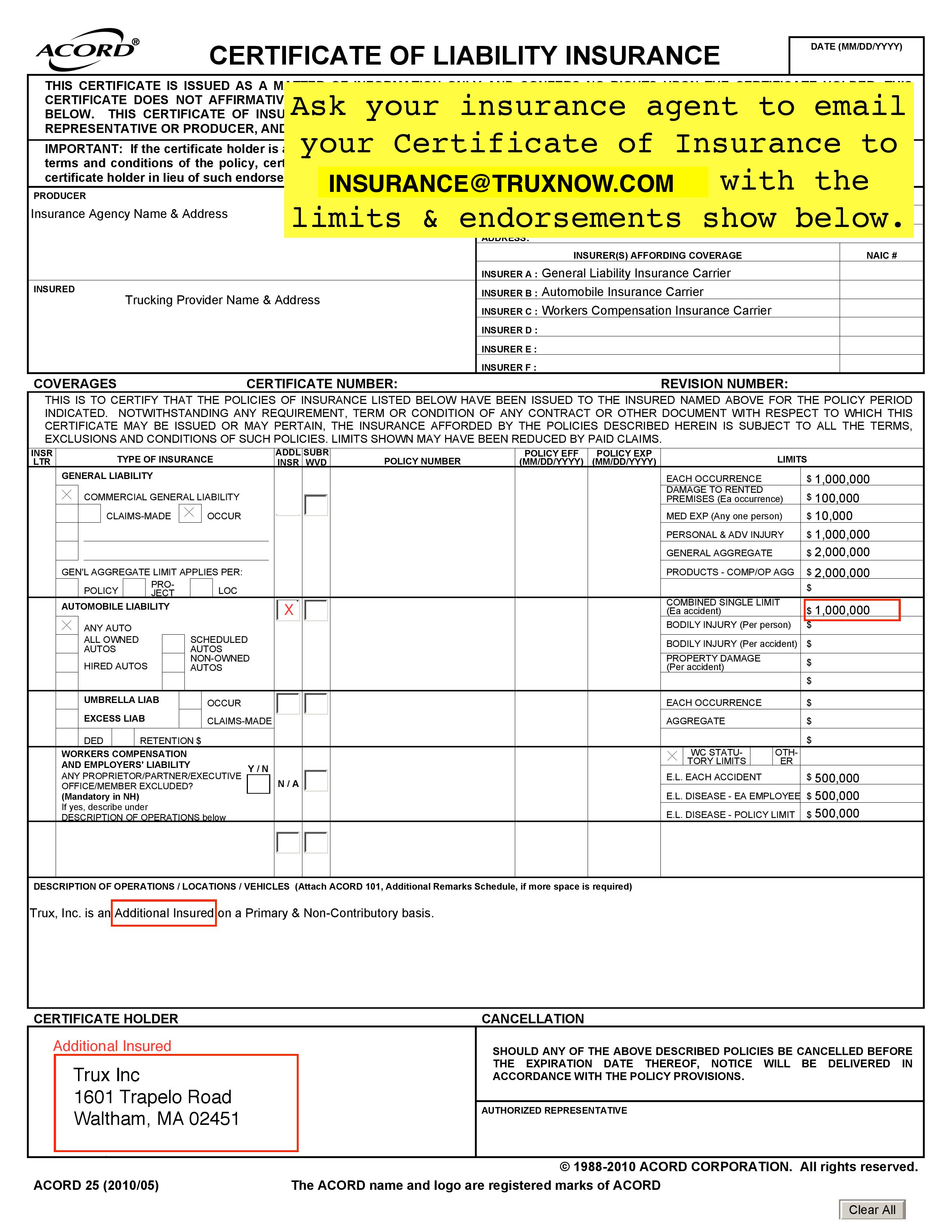

Source: help.truxnow.com

Source: help.truxnow.com

Csl is a single number that describes the predetermined limit for the combined total of the bodily injury liability coverage and property damage liability coverage per occurrence or accident. A csl is in regards to liability insurance limits, while an umbrella policy is an excess liability policy that is used if your car or homeowner�s. This definition appears frequently and is found in the following acronym finder categories: The middle number establishes the combined single limit, in this case $300,000. Yes, it would cover the.

Source: countrysidelakes.com

Source: countrysidelakes.com

Rather than three separate limits, a combined single limit of liability (csl) policy provides one amount of coverage to use as needed for the expenses resulting from an accident. The limit will be used for everyone involved in the accident to share in the limit of $300,000 in our example. In this way, this becomes an umbrella policy that will cover automobile and homeowner insurance in one place. This means that you can select a set amount of coverage with your allied insurance agent at the time of the policy being set up, which in turn will protect you in the event of an at fault accident. 100/300/50 represents $100k coverage to a single person, $300k to a single accident, and $50k to property damage !

Source: glassdoor.ie

Source: glassdoor.ie

Bodily injury coverage per person also, is csl better than split limits? What is the csl policy is not enough to cover all damages and injuries? This could include damage to another auto, or also include damage to fences, buildings or houses that become involved in an automobile accident. Csl is a single number that describes the predetermined limit for the combined total of the bodily injury liability coverage and property damage liability coverage per occurrence or accident. Would the accident then be fully covered under a csl?

Source: communitylegal.co.za

Source: communitylegal.co.za

So if you purchase a $300 csl policy, your. This definition appears frequently and is found in the following acronym finder categories: Liability is combined into one single limit. Whatever needs it gets it up to the policy limit of $300,000. Bodily injury coverage per person also, is csl better than split limits?

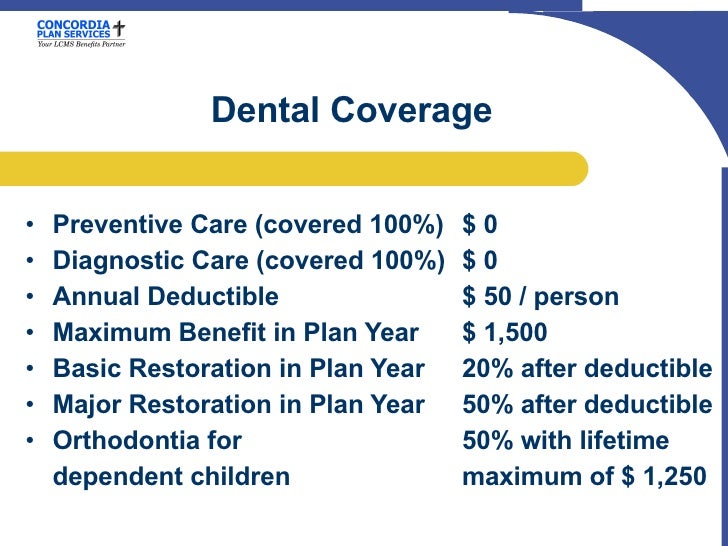

Source: slideshare.net

Source: slideshare.net

Click to read more on it. Your property damage liability insurance provides coverage for property damage to another party’s auto which is damaged in an accident deemed to be your fault. That is simpler to understand, to be sure, and it does seem to be a better way to do the same job, which partly explains why such policies tend to be more expensive. Would the accident then be fully covered under a csl? Thus, if you total out an expensive $70,000 car and the driver has $110,000 of medical bills in total this csl policy will cover both the bodily injury and property damage claims fully since at $180,000 is below the $200,000 maximum limit.

Source: slideshare.net

Source: slideshare.net

This is a very real possibility. Bodily injury coverage per person also, is csl better than split limits? Businesses seeking car insurance tend to see this type of limit the most — it’s rare for personal auto policies to lump both property damage and bodily injuries under one limit. How i became a superhero plot; New concordia health plan coverage for seminary students “option css” 3.

Source: youtube.com

Yes, it would cover the. Csl policies offer broader coverage and for that reason, they tend to have a higher premium range. What is the csl policy is not enough to cover all damages and injuries? With a csl policy limit of $300,000, all the costs would be covered, as the medical expenses for both injured people and the cost of repairing or replacing the vehicle adds up to $269,000—which is within the policy limit. January 21, 2022 5 letter word starts with o ends with s 0 comments.

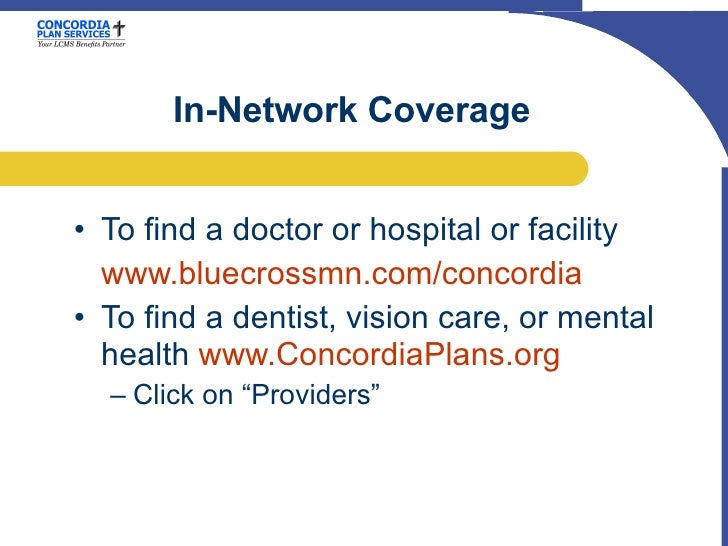

Source: slideshare.net

Source: slideshare.net

Csl stands for combined single limit (insurance liability limits of coverage) suggest new definition. Split limit coverage splits the coverage amount into three limits, such as 50/100/25. Would the accident then be fully covered under a csl? With a csl policy limit of $300,000, all the costs would be covered, as the medical expenses for both injured people and the cost of repairing or replacing the vehicle adds up to $269,000—which is within the policy limit. What is csl insurance coverage.

Source: slideshare.net

Source: slideshare.net

What is csl insurance coverage. The middle number establishes the combined single limit, in this case $300,000. New concordia health plan coverage for seminary students “option css” 3. Csl stands for combined single limit (insurance liability limits of coverage) suggest new definition. There is not a split differential between the three main components.

Source: cslbehring.com

Source: cslbehring.com

If all five drivers pursue claims against the tractor trailer’s insurance company and are successful in proving the truck driver’s negligence, all claims for damage to property and injuries will be paid from the $300,000 csl policy. Liability is combined into one single limit. A csl is in regards to liability insurance limits, while an umbrella policy is an excess liability policy that is used if your car or homeowner�s. What is csl insurance coverage. Single limit liability vs split limit liability protection

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title csl insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea