Current scenario of insurance industry in india Idea

Home » Trending » Current scenario of insurance industry in india IdeaYour Current scenario of insurance industry in india images are ready. Current scenario of insurance industry in india are a topic that is being searched for and liked by netizens now. You can Download the Current scenario of insurance industry in india files here. Download all free photos.

If you’re searching for current scenario of insurance industry in india images information linked to the current scenario of insurance industry in india keyword, you have come to the ideal site. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

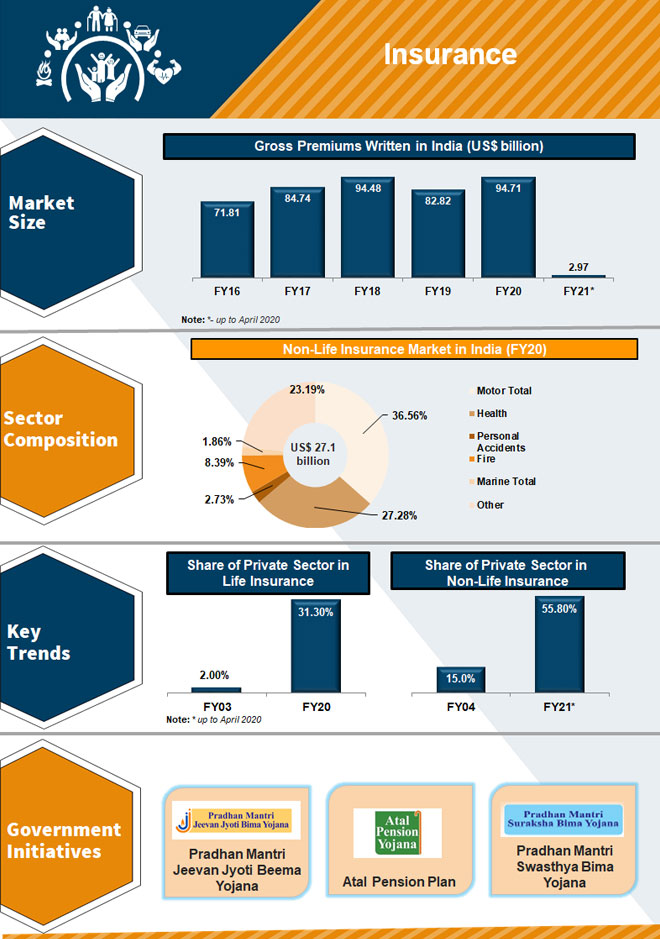

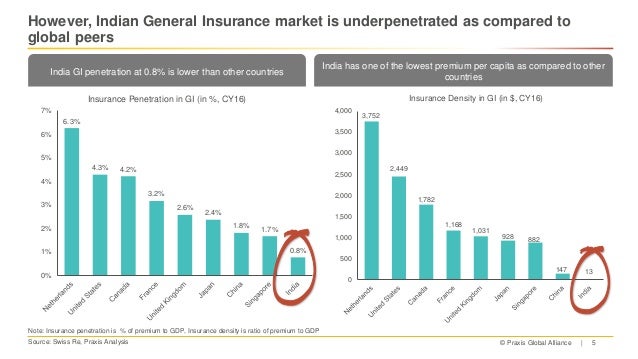

Current Scenario Of Insurance Industry In India. • in terms of insurance density india was ranked 73rd in 2017 with overall density at us$ 73. And the united india insurance company ltd. Indian life insurance industry changing scenario and need for innovation. Moreover, the insurance sector in india is expected to reach us$ 280 billion by the year 2020.

Life insurance business in India to contract in 2020 due From globaldata.com

Life insurance business in India to contract in 2020 due From globaldata.com

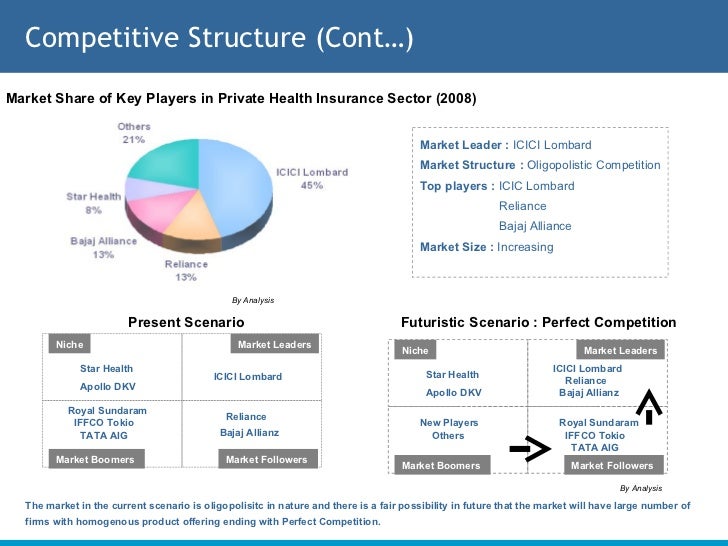

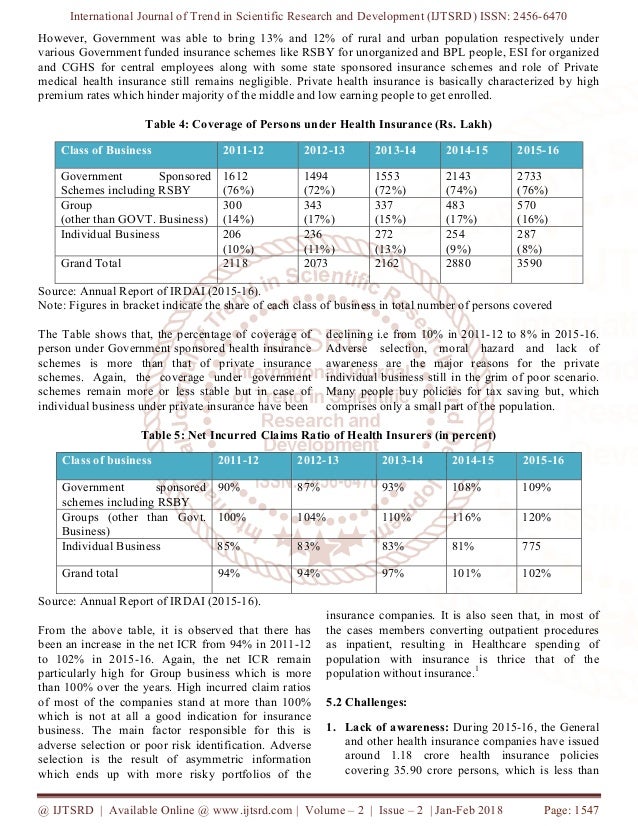

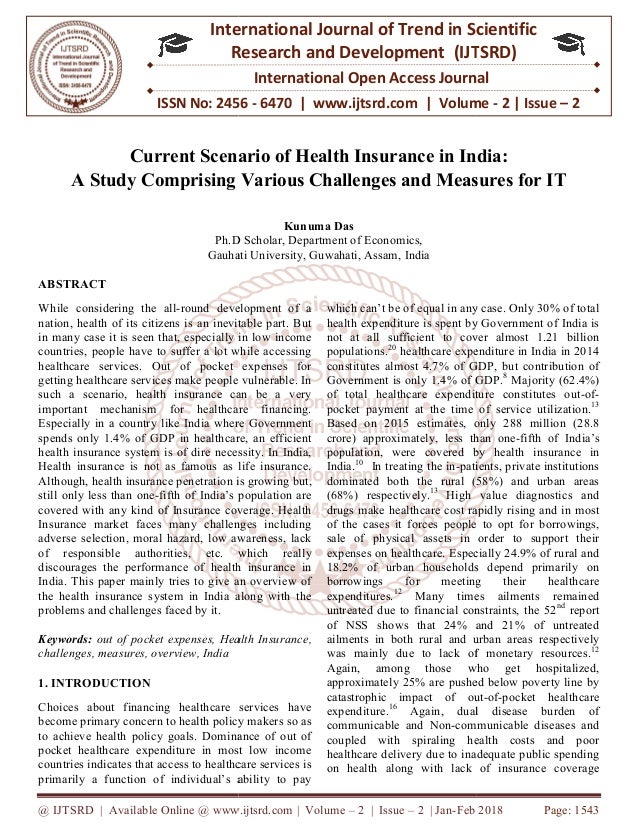

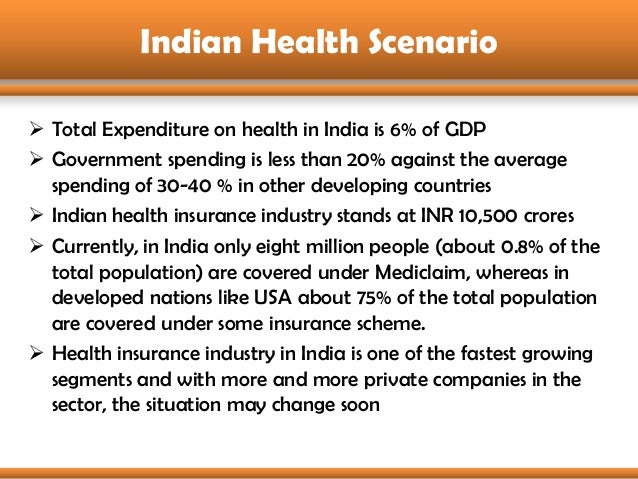

Demographic factors such as the growing middle class, young insurable population and retirement planning will support the growth of the indian life insurance segment. The life insurance industry in india grew by an impressive 36%, with premium income from new business at rs. Insurance brokers in india, are granted license by insurance regulatory & development authority. India is the market for insurance which covers both the state and private sector organisations. Life insurance industry in india:current scenario. Current scenario of insurance • at 3.69 per cent, india was ranked 41st in 2017 in terms of insurance penetration with life insurance penetration 2.76.

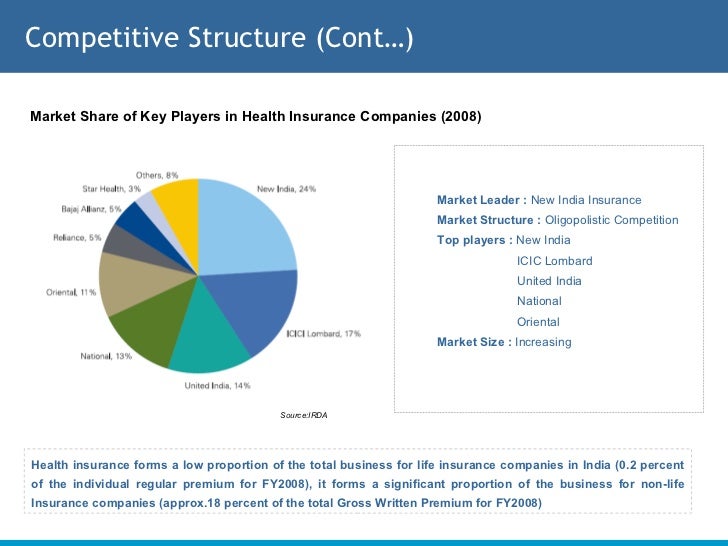

The growth of this sector is important from the perspective of overall growth of general insurance industry.

Life insurance industry in india:current scenario. 253.43 billion, braving stiff competition from private insurers. In india, when life insurance companies started operating in the middle of 20th century the evil play natural to all business had its sway. Indian insurance in the global scenario i.1 in life insurance business, india is ranked tenth in the world. According to industry experts, the market will. A study on service to sales method of life insurance companies.

Source: slideshare.net

Source: slideshare.net

253.43 billion, braving stiff competition from private insurers. What is the current scenario of insurance industry in india? Demographic factors such as the growing middle class, young insurable population and retirement planning will support the growth of the indian life insurance segment. Moreover, the insurance sector in india is expected to reach us$ 280 billion by the year 2020. There was a lot of cut throat competition as well as profiteering.

Source: quora.com

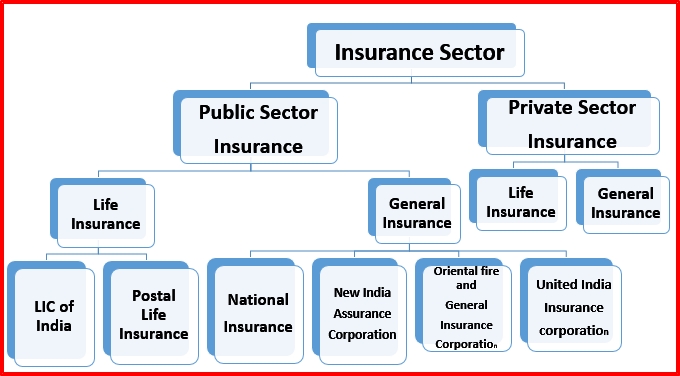

Hence, the business of insurance has always been closely. Health insurance is one of the major contributors of growth of general insurance industry in india. A study on service to sales method of life insurance companies. Hence, the business of insurance has always been closely. The insurance sector in india is majorly divided into two categories:

Source: slideshare.net

Source: slideshare.net

At the same time, problems in this sector are also many which are. Indian life insurance industry changing scenario and need for innovation. Current status of insurance sector. The insurance industry seeks to protect a country’s people, assets and businesses. Indian insurance industry overview & market development analysis last updated on dec, 17 2021 snapshot showcase infographic reports

Source: slideshare.net

Source: slideshare.net

According to industry experts, the market will. Indian insurance in the global scenario i.1 in life insurance business, india is ranked tenth in the world. India�s share in global life insurance market was 2.73 per cent during 2019. Three major players of insurance sector 1. • in terms of insurance density india was ranked 73rd in 2017 with overall density at us$ 73.

Source: slideshare.net

Source: slideshare.net

The insurance sector in india is majorly divided into two categories: And the current situation may lead to lower renewals of employee benefit and life and accident policies. Moreover, the insurance sector in india is expected to reach us$ 280 billion by the year 2020. Indians, who had always seen life insurance as a tax saving device, are now suddenly turning to the private sector and snapping up the new innovative products on offer. And the united india insurance company ltd.

Source: keplarllp.com

Source: keplarllp.com

Hence, the business of insurance has always been closely. Demographic factors such as the growing middle class, young insurable population and retirement planning will support the growth of the indian life insurance segment. According to industry experts, the market will. Life insurance industry in india:current scenario. Three major players of insurance sector 1.

Source: slideshare.net

Source: slideshare.net

The insurance is primarily a social device adopted by civilized society for mitigating the incidence of loss of income to families by unforeseen contingencies. Indian insurance industry overview & market development analysis last updated on dec, 17 2021 snapshot showcase infographic reports Insurance brokers in india, are granted license by insurance regulatory & development authority. Published on december 2017 | categories: The industry is going through a challenging phase now because of the general economic slowdown and this phase is expected to continue for some time.

Source: ibef.org

Source: ibef.org

According to industry experts, the market will. Gic was incorporated as a company. Current status of insurance sector. And the current situation may lead to lower renewals of employee benefit and life and accident policies. Insurance brokers in india, are granted license by insurance regulatory & development authority.

Source: slideshare.net

Source: slideshare.net

Impact on the indian insurance industry Life insurance industry in india:current scenario. Insurance brokers in india, are granted license by insurance regulatory & development authority. India is the market for insurance which covers both the state and private sector organisations. And the united india insurance company ltd.

Source: ibef.org

Source: ibef.org

The industry is going through a challenging phase now because of the general economic slowdown and this phase is expected to continue for some time. The life insurance industry in india grew by an impressive 36%, with premium income from new business at rs. Demographic factors such as the growing middle class, young insurable population and retirement planning will support the growth of the indian life insurance segment. (1999), life insurance business in india: Indian insurance in the global scenario i.1 in life insurance business, india is ranked tenth in the world.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

And the united india insurance company ltd. India�s share in global life insurance market was 2.73 per cent during 2019. The insurance sector in india is majorly divided into two categories: The present of insurance sector in india The national insurance company ltd., the new india assurance company ltd., the oriental insurance company ltd.

Source: slideshare.net

Source: slideshare.net

Life insurance industry in india:current scenario. There was a lot of cut throat competition as well as profiteering. Published on december 2017 | categories: Moreover, the insurance sector in india is expected to reach us$ 280 billion by the year 2020. And the current situation may lead to lower renewals of employee benefit and life and accident policies.

Source: globaldata.com

Source: globaldata.com

It alone accounts for around 29% of total general insurance premium income earned in india. Impact on the indian insurance industry Current scenario of insurance • at 3.69 per cent, india was ranked 41st in 2017 in terms of insurance penetration with life insurance penetration 2.76. What is the current scenario of insurance industry in india? Indians, who had always seen life insurance as a tax saving device, are now suddenly turning to the private sector and snapping up the new innovative products on offer.

Source: indianmirror.com

Source: indianmirror.com

253.43 billion, braving stiff competition from private insurers. However, the overall insurance reach in india still remains low. According to studies, the overall insurance penetration in india has reached to 3.69% in 2017 from 2.71% in 2011. The life insurance industry in india grew by an impressive 36%, with premium income from new business at rs. The national insurance company ltd., the new india assurance company ltd., the oriental insurance company ltd.

Source: websites–list.blogspot.com

Source: websites–list.blogspot.com

Insurance brokers are seen as intermediaries who ensure that both the parties to a contract obtain what they require and a third party who ensures that both the parties to the contract jointly benefit. However, the overall insurance reach in india still remains low. Insurance brokers, india & global scenario. Indian insurance in the global scenario i.1 in life insurance business, india is ranked tenth in the world. The industry is going through a challenging phase now because of the general economic slowdown and this phase is expected to continue for some time.

Source: slideshare.net

Source: slideshare.net

What is the current scenario of insurance industry in india? The growth of this sector is important from the perspective of overall growth of general insurance industry. Health insurance is one of the major contributors of growth of general insurance industry in india. The life insurance industry in india grew by an impressive 36%, with premium income from new business at rs. However, the overall insurance reach in india still remains low.

Source: topcount.co

Source: topcount.co

India is the market for insurance which covers both the state and private sector organisations. Compared to the previous year, the life insurance premium in india increased by 9.63 per cent whereas global life insurance premium increased by 1.18 per cent. Indian insurance industry overview & market development analysis last updated on dec, 17 2021 snapshot showcase infographic reports 107 insurers integrated and grouped into four companies viz. However, the overall insurance reach in india still remains low.

Source: pdfslide.net

Source: pdfslide.net

Was constituted as an autonomous body in 1999 to regulate and develop the insurance industry. The insurance is primarily a social device adopted by civilized society for mitigating the incidence of loss of income to families by unforeseen contingencies. Insurance brokers, india & global scenario. India is the market for insurance which covers both the state and private sector organisations. 253.43 billion, braving stiff competition from private insurers.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title current scenario of insurance industry in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea