Cyber insurance social engineering coverage Idea

Home » Trending » Cyber insurance social engineering coverage IdeaYour Cyber insurance social engineering coverage images are available. Cyber insurance social engineering coverage are a topic that is being searched for and liked by netizens now. You can Find and Download the Cyber insurance social engineering coverage files here. Find and Download all free images.

If you’re looking for cyber insurance social engineering coverage images information linked to the cyber insurance social engineering coverage topic, you have come to the ideal site. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

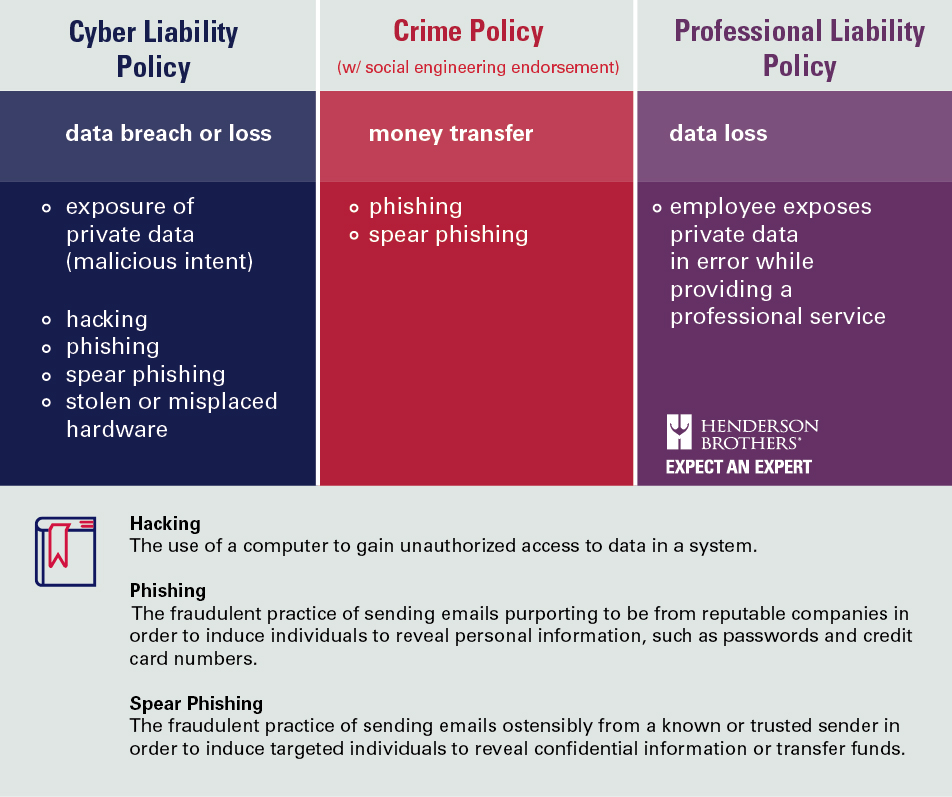

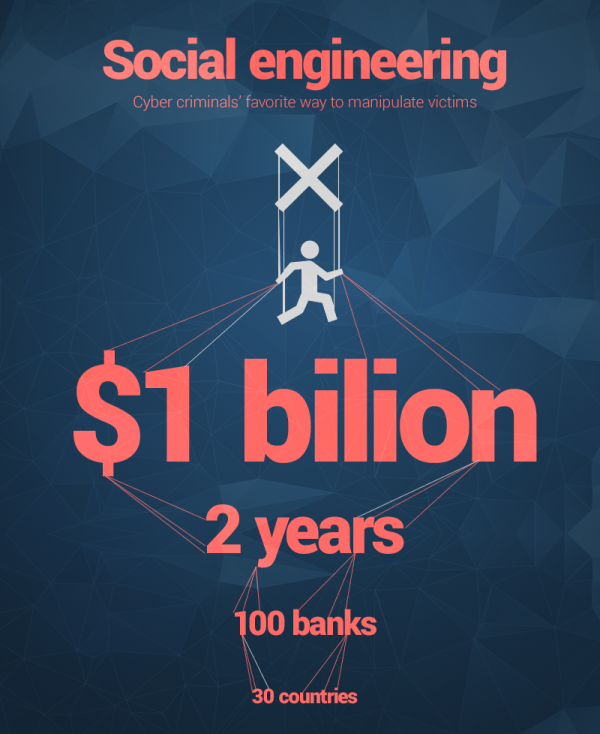

Cyber Insurance Social Engineering Coverage. As cyber insurers looked for a competitive edge in the marketplace, crime endorsements emerged, expanding coverage for funds stolen through social engineering fraud. These broad coverages may include phishing or business email compromise (bec), invoice manipulation, cryptojacking, telecom fraud, and funds transfer fraud. You may find yourself asking a professional of cybersecurity, “are social engineering attacks covered under insurance?” it is possible for coverage of both fund transfer fraud and social engineering fraud to be obtained through both crime insurance and cyber insurance. Some crime insurers now offer crime policies that expressly provide coverage for various deceptive funds transfers, including those effected through social engineering.

Maximize your cyber insurance coverage Charles River From crai.com

Maximize your cyber insurance coverage Charles River From crai.com

Cyber threats such as social engineering fraud and phishing may be covered by a cyber policy, depending on the insurer. Some crime insurers now offer crime policies that expressly provide coverage for various deceptive funds transfers, including those effected through social engineering. Cyber insurance responds to changing attacks both cyber policies and crime policies can offer coverage for social engineering fraud, but it’s important to make sure your policy language is keeping up with the changing attack styles noted above. However, this will depend on your carrier and class of business. Provides added protection when strong controls still fall short. These broad coverages may include phishing or business email compromise (bec), invoice manipulation, cryptojacking, telecom fraud, and funds transfer fraud.

Social engineering fraud coverage is typically not a standalone insurance coverage and is more commonly coupled with a commercial crime or cyber insurance policy.

Available as an endorsement to the crime insurance policy. Therefore the right cyber insurance coverage can help mitigate these additional damages for you and your business. Cyber threats such as social engineering fraud and phishing may be covered by a cyber policy, depending on the insurer. That means that businesses will have to get social engineering attack coverage through their cyber insurance broker, or assess if their commercial crime insurance can cover them. As of right now, social engineering attacks fall under a gray area that is unfortunately not covered by cyber insurance. These broad coverages may include phishing or business email compromise (bec), invoice manipulation, cryptojacking, telecom fraud, and funds transfer fraud.

Source: csoonline.com

Source: csoonline.com

Companies submitting social engineering claims have often faced coverage denials under their crime and cyber insurance policies. What does cyber insurance cover? That means that businesses will have to get social engineering attack coverage through their cyber insurance broker, or assess if their commercial crime insurance can cover them. Provides added protection when strong controls still fall short. As social engineering attacks continue to proliferate, insurers are responding with specialized coverages to provide specific social engineering coverage.

Source: gov-record.org

Source: gov-record.org

Some cyber insurers have begun to broadly cover a range of social engineering fraud losses, realizing the large gap that narrow coverage represents for their policyholders. It’s important to work with your broker to understand how a cyber and crime insurance policy can work together on social engineering coverage to your benefit. Some examples of the type of scams potentially covered under the social engineering coverage are: Therefore the right cyber insurance coverage can help mitigate these additional damages for you and your business. Crime insurance policies specifically cover only the theft of money.

Source: iipgh.org

Source: iipgh.org

Available as an endorsement to the crime insurance policy. Some examples of the type of scams potentially covered under the social engineering coverage are: Available as an endorsement to the crime insurance policy. Cyber insurance covers financial losses from data breaches, hacking, viruses, denial of service attacks, and other similar cyber events. The social engineering fraudster typically does not have any access to the insured’s network or system.

Source: cybersecurity360.it

Source: cybersecurity360.it

Cyber policies have always been designed to respond to schemes which result in stolen personal or confidential information. If confidential data is exploited by an attacker, issues of litigation may arise. With many companies purchasing cyber liability or data breach insurance today, it is understandable that these organizations would assume social engineering coverage is properly in place to respond to such a claim. It’s important to work with your broker to understand how a cyber and crime insurance policy can work together on social engineering coverage to your benefit. As of right now, social engineering attacks fall under a gray area that is unfortunately not covered by cyber insurance.

Source: youtube.com

Source: youtube.com

As social engineering attacks continue to proliferate, insurers are responding with specialized coverages to provide specific social engineering coverage. Therefore the right cyber insurance coverage can help mitigate these additional damages for you and your business. The social engineering fraudster typically does not have any access to the insured’s network or system. Companies submitting social engineering claims have often faced coverage denials under their crime and cyber insurance policies. Cyber insurance covers financial losses from data breaches, hacking, viruses, denial of service attacks, and other similar cyber events.

Source: natlawreview.com

If confidential data is exploited by an attacker, issues of litigation may arise. Cyber insurance covers financial losses from data breaches, hacking, viruses, denial of service attacks, and other similar cyber events. Insures a range of social engineering fraud losses, including: However, this will depend on your carrier and class of business. As social engineering attacks continue to proliferate, insurers are responding with specialized coverages to provide specific social engineering coverage.

Source: systemagic.co.uk

Source: systemagic.co.uk

Some crime insurers now offer crime policies that expressly provide coverage for various deceptive funds transfers, including those effected through social engineering. As cyber insurers looked for a competitive edge in the marketplace, crime endorsements emerged, expanding coverage for funds stolen through social engineering fraud. Social engineering fraud coverage is typically not a standalone insurance coverage and is more commonly coupled with a commercial crime or cyber insurance policy. Available as an endorsement to the crime insurance policy. You may find yourself asking a professional of cybersecurity, “are social engineering attacks covered under insurance?” it is possible for coverage of both fund transfer fraud and social engineering fraud to be obtained through both crime insurance and cyber insurance.

Source: advisenltd.com

Source: advisenltd.com

Some examples of the type of scams potentially covered under the social engineering coverage are: With cyberattacks on the rise, the update mitigates financial losses from phishing or. Provides added protection when strong controls still fall short. Some crime insurers now offer crime policies that expressly provide coverage for various deceptive funds transfers, including those effected through social engineering. Some cyber insurers have begun to broadly cover a range of social engineering fraud losses, realizing the large gap that narrow coverage represents for their policyholders.

Source: insurancejournal.com

Source: insurancejournal.com

These coverages often are available as endorsements to cyber, commercial crime, or fidelity policies. Available as an endorsement to the crime insurance policy. Cyber policies have always been designed to respond to schemes which result in stolen personal or confidential information. Social engineering fraud coverage is typically not a standalone insurance coverage and is more commonly coupled with a commercial crime or cyber insurance policy. As cyber insurers looked for a competitive edge in the marketplace, crime endorsements emerged, expanding coverage for funds stolen through social engineering fraud.

Source: hendersonbrothers.com

Source: hendersonbrothers.com

That means that businesses will have to get social engineering attack coverage through their cyber insurance broker, or assess if their commercial crime insurance can cover them. You may find yourself asking a professional of cybersecurity, “are social engineering attacks covered under insurance?” it is possible for coverage of both fund transfer fraud and social engineering fraud to be obtained through both crime insurance and cyber insurance. These coverages often are available as endorsements to cyber, commercial crime, or fidelity policies. It is crucial to not only take preventative measures but to also have insurance in the event damage is caused by a social engineering attack. Some crime insurers now offer crime policies that expressly provide coverage for various deceptive funds transfers, including those effected through social engineering.

Source: eclubofarizona.wordpress.com

Source: eclubofarizona.wordpress.com

With many companies purchasing cyber liability or data breach insurance today, it is understandable that these organizations would assume social engineering coverage is properly in place to respond to such a claim. However, this will depend on your carrier and class of business. After all, it is a cyber related crime for which coverage is. Cyber insurance responds to changing attacks both cyber policies and crime policies can offer coverage for social engineering fraud, but it’s important to make sure your policy language is keeping up with the changing attack styles noted above. As of right now, social engineering attacks fall under a gray area that is unfortunately not covered by cyber insurance.

Source: cybersecurity.gov.mt

Source: cybersecurity.gov.mt

Therefore the right cyber insurance coverage can help mitigate these additional damages for you and your business. Also, an increasing number of cyber insurers now expressly provide coverage for some of these risks. Provides added protection when strong controls still fall short. Social engineering fraud coverage is typically not a standalone insurance coverage and is more commonly coupled with a commercial crime or cyber insurance policy. These broad coverages may include phishing or business email compromise (bec), invoice manipulation, cryptojacking, telecom fraud, and funds transfer fraud.

Source: youtube.com

Source: youtube.com

It’s important to work with your broker to understand how a cyber and crime insurance policy can work together on social engineering coverage to your benefit. These broad coverages may include phishing or business email compromise (bec), invoice manipulation, cryptojacking, telecom fraud, and funds transfer fraud. We continue to dig into cyber insurance coverage this month by looking how your employees may fall victim to social engineering. It’s important to work with your broker to understand how a cyber and crime insurance policy can work together on social engineering coverage to your benefit. The social engineering fraudster typically does not have any access to the insured’s network or system.

Source: youtube.com

Source: youtube.com

It is crucial to not only take preventative measures but to also have insurance in the event damage is caused by a social engineering attack. Much of the industry has historically associated sef coverage with a crime policy, given that in many cases, sef is used to steal or illegally wire funds to the attacker. Some crime insurers now offer crime policies that expressly provide coverage for various deceptive funds transfers, including those effected through social engineering. Also, an increasing number of cyber insurers now expressly provide coverage for some of these risks. Suppose you have a $50 million cybersecurity incident policy with a $200,000 ceiling for social engineering and social engineering is responsible for.

Source: blog.varonis.com

Source: blog.varonis.com

It is crucial to not only take preventative measures but to also have insurance in the event damage is caused by a social engineering attack. It’s important to work with your broker to understand how a cyber and crime insurance policy can work together on social engineering coverage to your benefit. Much of the industry has historically associated sef coverage with a crime policy, given that in many cases, sef is used to steal or illegally wire funds to the attacker. Companies submitting social engineering claims have often faced coverage denials under their crime and cyber insurance policies. As of right now, social engineering attacks fall under a gray area that is unfortunately not covered by cyber insurance.

Source: stabilitynetworks.com

Source: stabilitynetworks.com

However, this will depend on your carrier and class of business. Insures a range of social engineering fraud losses, including: Suppose you have a $50 million cybersecurity incident policy with a $200,000 ceiling for social engineering and social engineering is responsible for. You may find yourself asking a professional of cybersecurity, “are social engineering attacks covered under insurance?” it is possible for coverage of both fund transfer fraud and social engineering fraud to be obtained through both crime insurance and cyber insurance. As of right now, social engineering attacks fall under a gray area that is unfortunately not covered by cyber insurance.

Source: staging.securanceconsulting.com

Source: staging.securanceconsulting.com

These broad coverages may include phishing or business email compromise (bec), invoice manipulation, cryptojacking, telecom fraud, and funds transfer fraud. With many companies purchasing cyber liability or data breach insurance today, it is understandable that these organizations would assume social engineering coverage is properly in place to respond to such a claim. However, this will depend on your carrier and class of business. Much of the industry has historically associated sef coverage with a crime policy, given that in many cases, sef is used to steal or illegally wire funds to the attacker. Some cyber insurers have begun to broadly cover a range of social engineering fraud losses, realizing the large gap that narrow coverage represents for their policyholders.

Source: corvusinsurance.com

Source: corvusinsurance.com

Cyber policies have always been designed to respond to schemes which result in stolen personal or confidential information. In today’s sophisticated world of cybercrime, even the most loyal employees can be duped into unknowingly handing over critical customer information or other sensitive data. Suppose you have a $50 million cybersecurity incident policy with a $200,000 ceiling for social engineering and social engineering is responsible for. Therefore the right cyber insurance coverage can help mitigate these additional damages for you and your business. Crime policies can contain exclusionary wording that precludes coverage for the voluntary parting of property or funds to a third party.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cyber insurance social engineering coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea