Cyber liability insurance companies Idea

Home » Trending » Cyber liability insurance companies IdeaYour Cyber liability insurance companies images are ready in this website. Cyber liability insurance companies are a topic that is being searched for and liked by netizens now. You can Download the Cyber liability insurance companies files here. Download all free photos.

If you’re searching for cyber liability insurance companies images information connected with to the cyber liability insurance companies interest, you have come to the ideal site. Our site always gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

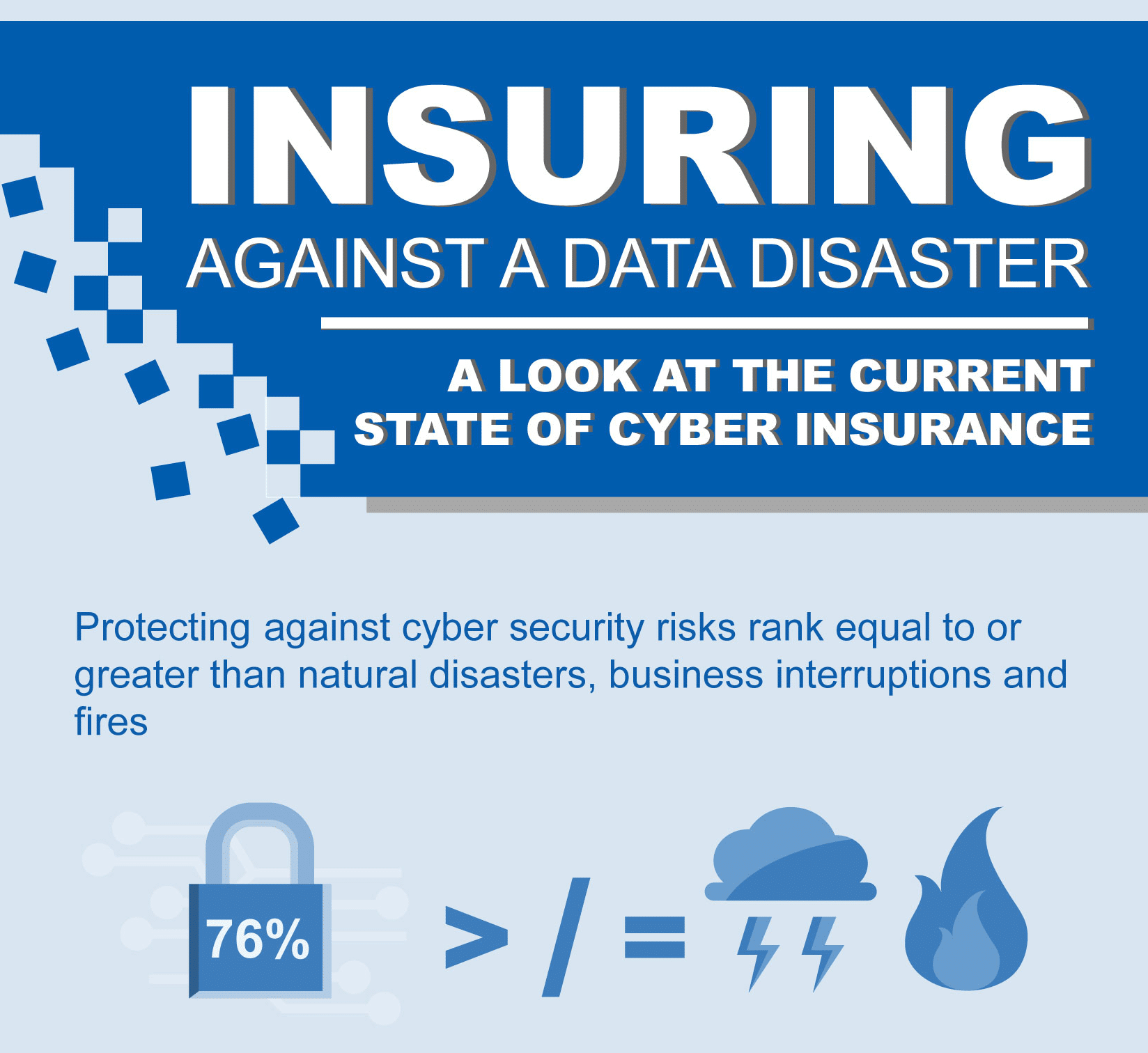

Cyber Liability Insurance Companies. They currently own the largest share—22%—of the cyber liability market. 86 percent of business owners believe that digital risk will continue to grow. We at integro accounting pride ourselves in protecting our business and, most importantly, our clients information. Online retail social media manufacturing

5 Reasons You Need Cyber Liability Insurance AMSkier From amskier.com

5 Reasons You Need Cyber Liability Insurance AMSkier From amskier.com

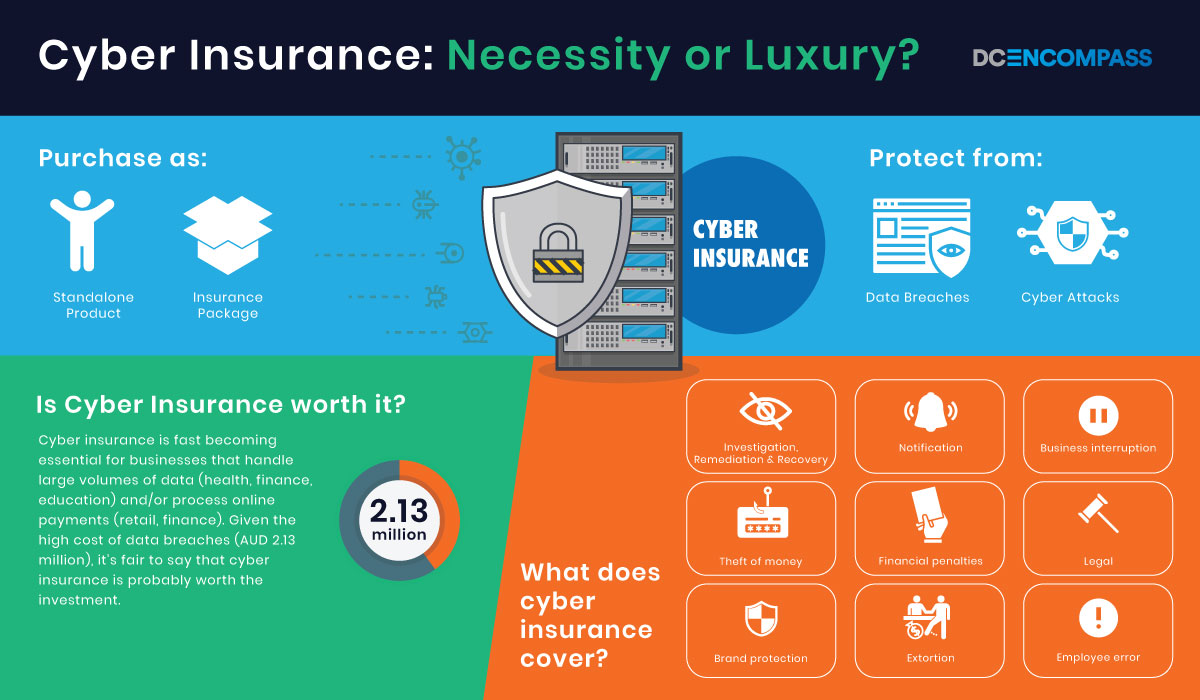

Customer notifications in the event of a breach. Cyber insurance cost depends on your business�s exposure to cyber risk and your coverage needs. Depending on your policy, this could include network repair, data recovery, investigations, public relations, legal fees, and more. In 2019, our annual survey of business owners found that: Cyber liability insurance for businesses. Cyber liability insurance cyber liability insurance protects small businesses from the high costs of a data breach or malicious software attack.

10 rows the hartford has been given an a+ rating by both am best and standard & poor’s.

Cyber liability insurance is a key policy for companies that handle credit card numbers, work in the cloud, or operate in cybersecurity. Number of employees volume and type of data handled industry risks policy coverage limits view cyber liability insurance costs what determines the cost of cyber liability coverage? Indemnification for legal fees and expenses. For those businesses registering and acquiring cyber liability insurance now, focus on the requirements. Accountants consultants contractors hair salons and barbers it services marketing companies real. This means that every business.

Source: comparitech.com

Source: comparitech.com

86 percent of business owners believe that digital risk will continue to grow. Cyber liability insurance covers data breach costs Online retail social media manufacturing Cyber liability insurance cyber liability insurance protects small businesses from the high costs of a data breach or malicious software attack. When it comes to cyber insurance market share, it holds slightly more of the market than fairfax at a 2% share.

Source: funender.com

Source: funender.com

Cyber liability insurance for businesses. Online retail social media manufacturing At minimum, cyber liability insurance helps companies comply with state regulations that require a business to notify customers of a data breach involving personally identifiable information. It covers expenses such as customer notification, credit monitoring, legal fees, and fines. 86 percent of business owners believe that digital risk will continue to grow.

Source: contentmx.com

Source: contentmx.com

[3] recently, aig won the 2018 award for cyber risk innovation of the year. Your insurance premiums are based on many factors, including your: Cyber liability insurance is an insurance policy that provides businesses with a combination of coverage options to help protect the company from data breaches and other cyber security issues. Some cyber insurance vendors to consider (and see our picks for top cyber insurance vendors): A few of the many businesses that should consider a cyber policy include:

Source: best10vpn.com

Source: best10vpn.com

Cyber liability insurance cyber liability insurance protects small businesses from the high costs of a data breach or malicious software attack. At minimum, cyber liability insurance helps companies comply with state regulations that require a business to notify customers of a data breach involving personally identifiable information. Some industries that have featured prominent cyber breaches in the past include: Data breaches are complicated and costly. To find out more click here, or for a tailored quote, call kingsbridge on 01242 808740.

Source: dcencompass.com.au

Source: dcencompass.com.au

Here are examples roundup of businesses that could benefit from a cyber liability insurance policy: At minimum, cyber liability insurance helps companies comply with state regulations that require a business to notify customers of a data breach involving personally identifiable information. Cyber insurance from aig is extremely customizable, with limits available of up to $100 million. Cyber liability insurance for companies. Cyber liability insurance is an insurance policy that provides businesses with a combination of coverage options to help protect the company from data breaches and other cyber security issues.

Source: ecommercetimes.com

Source: ecommercetimes.com

It covers expenses such as customer notification, credit monitoring, legal fees, and fines. A few of the many businesses that should consider a cyber policy include: 86 percent of business owners believe that digital risk will continue to grow. Many consider that only larger businesses are at risk of cyberattacks, but the truth is, a lot of small businesses in the united states have experienced data breaches. Data breaches are complicated and costly.

Source: southernstatesinsurance.com

Source: southernstatesinsurance.com

Privacy liability coverage protects your company from those liabilities arising out of a cyber incident or privacy law violation. Cyber insurance from aig is extremely customizable, with limits available of up to $100 million. Accountants consultants contractors hair salons and barbers it services marketing companies real. Cyber liability insurance is important. Cyber liability insurance for companies.

Source: dtc1.com

Source: dtc1.com

Hackers often target retailers , healthcare organizations , and financial service providers , but any business can fall victim to a data breach. This means that every business. Cyber insurance from aig is extremely customizable, with limits available of up to $100 million. A few of the many businesses that should consider a cyber policy include: At minimum, cyber liability insurance helps companies comply with state regulations that require a business to notify customers of a data breach involving personally identifiable information.

Source: iselect.com.au

Source: iselect.com.au

Cyber liability insurance protects companies in many industries who may be exposed to the internet or even work online. Cyber insurance cost depends on your business�s exposure to cyber risk and your coverage needs. Named after its base of operation in connecticut, the hartford focuses its cyber insurance coverage on the small business market, with products that address liability costs after a data breach. Privacy liability coverage protects your company from those liabilities arising out of a cyber incident or privacy law violation. Number of employees volume and type of data handled industry risks policy coverage limits view cyber liability insurance costs what determines the cost of cyber liability coverage?

Source: pinterest.com

Source: pinterest.com

Cyber liability insurance is an insurance policy that provides businesses with a combination of coverage options to help protect the company from data breaches and other cyber security issues. Cyber liability insurance is a key policy for companies that handle credit card numbers, work in the cloud, or operate in cybersecurity. Cyber insurance from aig is extremely customizable, with limits available of up to $100 million. Accountants consultants contractors hair salons and barbers it services marketing companies real. It�s not a question of if your organization will suffer a breach, but when.

Source: vanasekinsurance.com

Source: vanasekinsurance.com

Hackers often target retailers , healthcare organizations , and financial service providers , but any business can fall victim to a data breach. For those businesses registering and acquiring cyber liability insurance now, focus on the requirements. Such are typically excluded from traditional commercial general liability policies. In 2019, our annual survey of business owners found that: Depending on your policy, this could include network repair, data recovery, investigations, public relations, legal fees, and more.

Source: issuu.com

Source: issuu.com

Some industries that have featured prominent cyber breaches in the past include: We at integro accounting pride ourselves in protecting our business and, most importantly, our clients information. Many consider that only larger businesses are at risk of cyberattacks, but the truth is, a lot of small businesses in the united states have experienced data breaches. Cyber liability insurance costs small tech companies an average of $145 per month or $1,675 per year. Privacy liability coverage protects your company from those liabilities arising out of a cyber incident or privacy law violation.

Source: circlecitysnark.blogspot.com

Source: circlecitysnark.blogspot.com

Named after its base of operation in connecticut, the hartford focuses its cyber insurance coverage on the small business market, with products that address liability costs after a data breach. A few of the many businesses that should consider a cyber policy include: Cyber liability insurance cyber liability insurance protects small businesses from the high costs of a data breach or malicious software attack. 86 percent of business owners believe that digital risk will continue to grow. Online retail social media manufacturing

Source: managedencryption.co.uk

Source: managedencryption.co.uk

Travelers cyber insurance policyholders can also access tools and resources. Cyber liability insurance covers data breach costs Cyber liability insurance costs small tech companies an average of $145 per month or $1,675 per year. This means that every business. Cyber liability insurance for companies.

Source: keyinsurancejm.com

Source: keyinsurancejm.com

Cyber liability insurance is an essential service that helps companies cover financial burdens associated with cybersecurity incidents. Cyber liability insurance for companies. It�s not a question of if your organization will suffer a breach, but when. Cyber liability insurance is an insurance policy that provides businesses with a combination of coverage options to help protect the company from data breaches and other cyber security issues. Customer notifications in the event of a breach.

Source: evolvemga.com

Source: evolvemga.com

Cyber liability insurance is a key policy for companies that handle credit card numbers, work in the cloud, or operate in cybersecurity. Cyber liability insurance is an essential service that helps companies cover financial burdens associated with cybersecurity incidents. It�s not a question of if your organization will suffer a breach, but when. Your insurance premiums are based on many factors, including your: Cyber liability insurance for companies.

Source: securityledger.com

Source: securityledger.com

Cyber insurance from aig is extremely customizable, with limits available of up to $100 million. We at integro accounting pride ourselves in protecting our business and, most importantly, our clients information. Cyber insurance cost depends on your business�s exposure to cyber risk and your coverage needs. Aig is one of the best, a rated insurers for purchasing cyber liability insurance. Cyber liability insurance covers data breach costs

Source: techround.co.uk

Source: techround.co.uk

Some industries that have featured prominent cyber breaches in the past include: In 2019, our annual survey of business owners found that: Aig is one of the best, a rated insurers for purchasing cyber liability insurance. Here are examples roundup of businesses that could benefit from a cyber liability insurance policy: Cyber liability insurance costs small tech companies an average of $145 per month or $1,675 per year.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cyber liability insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea