D and c insurance coverage Idea

Home » Trend » D and c insurance coverage IdeaYour D and c insurance coverage images are available in this site. D and c insurance coverage are a topic that is being searched for and liked by netizens now. You can Download the D and c insurance coverage files here. Find and Download all free photos and vectors.

If you’re looking for d and c insurance coverage images information related to the d and c insurance coverage keyword, you have come to the right site. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

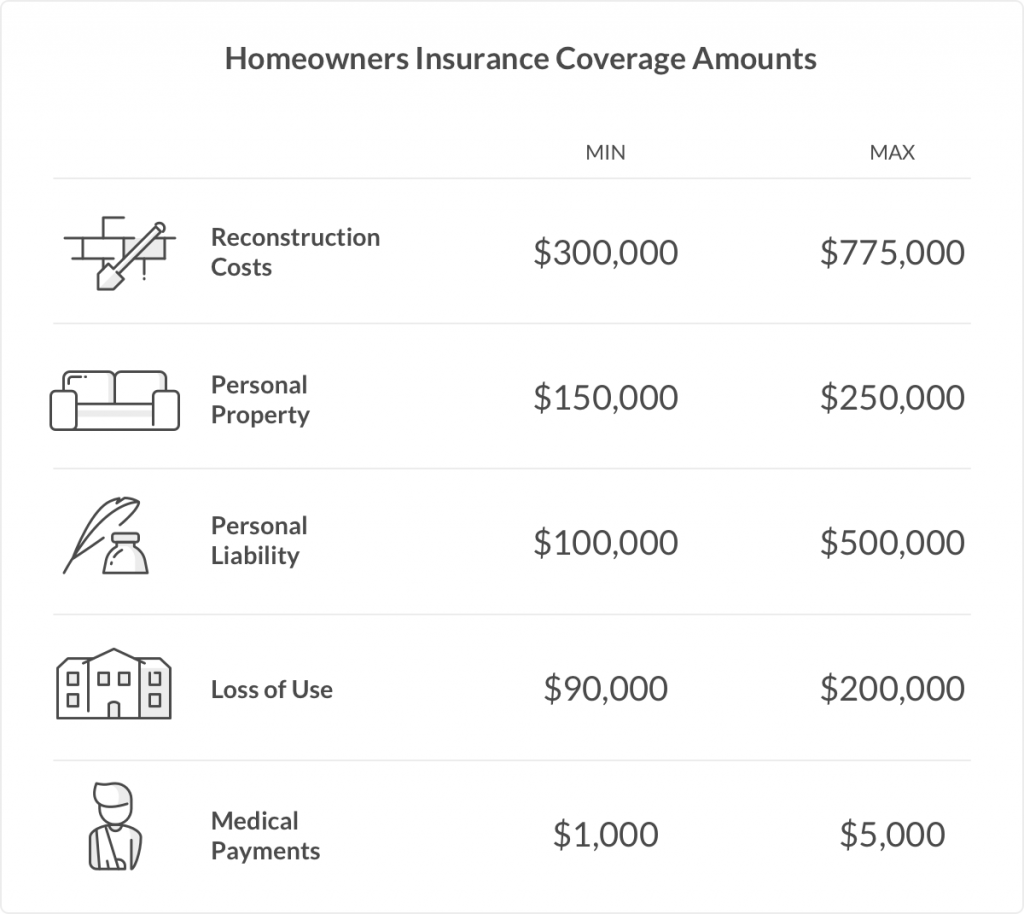

D And C Insurance Coverage. If you opt for a special personal property endorsement, you can get protection for damage caused by perils beyond the ones listed here. Side a, side b, and side c. Side c coverage is an important component of directors and officers liability insurance. The d&o policy reads as three separate coverages wrapped into one policy:

Life Insurance Quotes in Maryland, D.C. and Virginia YouTube From youtube.com

Life Insurance Quotes in Maryland, D.C. and Virginia YouTube From youtube.com

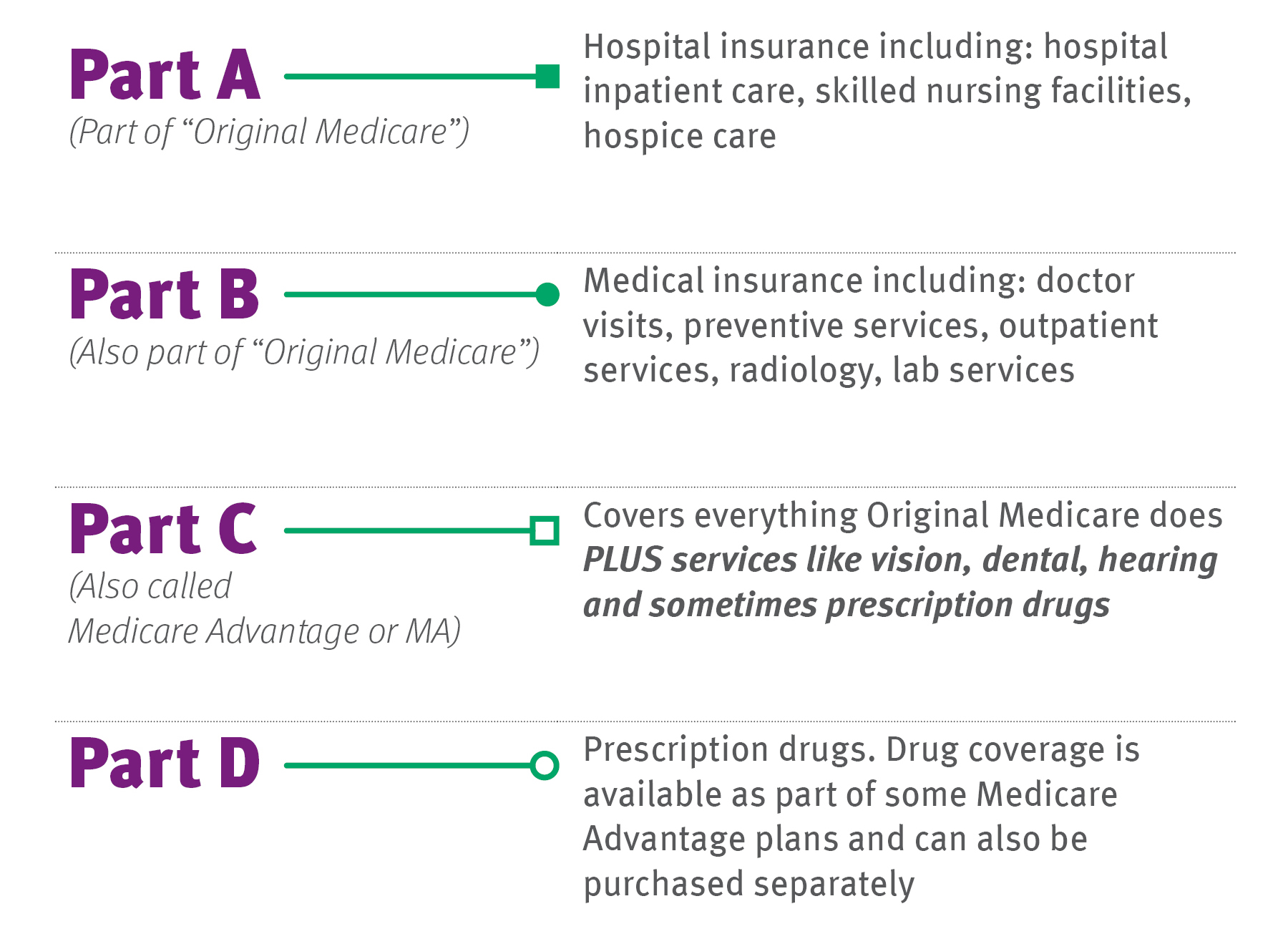

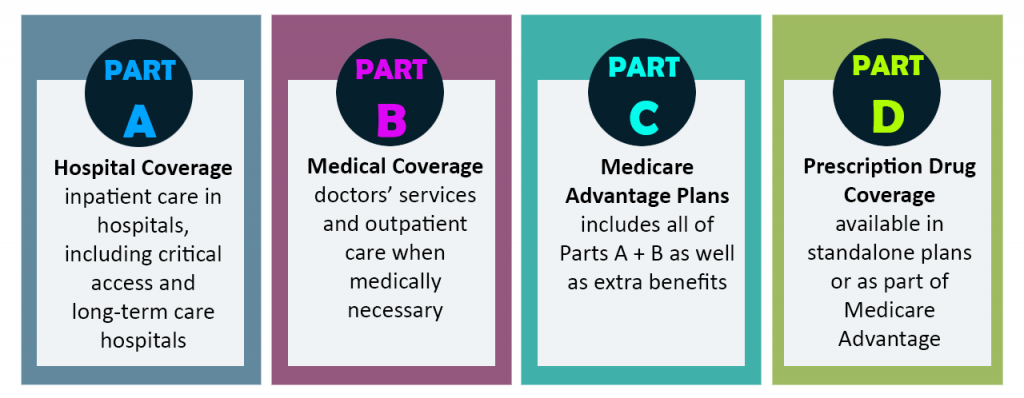

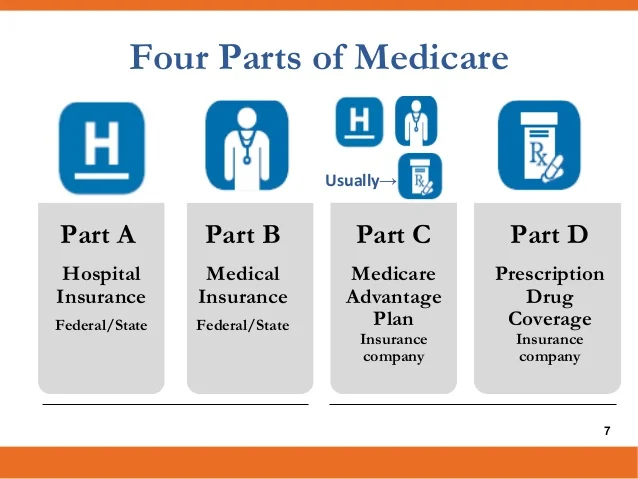

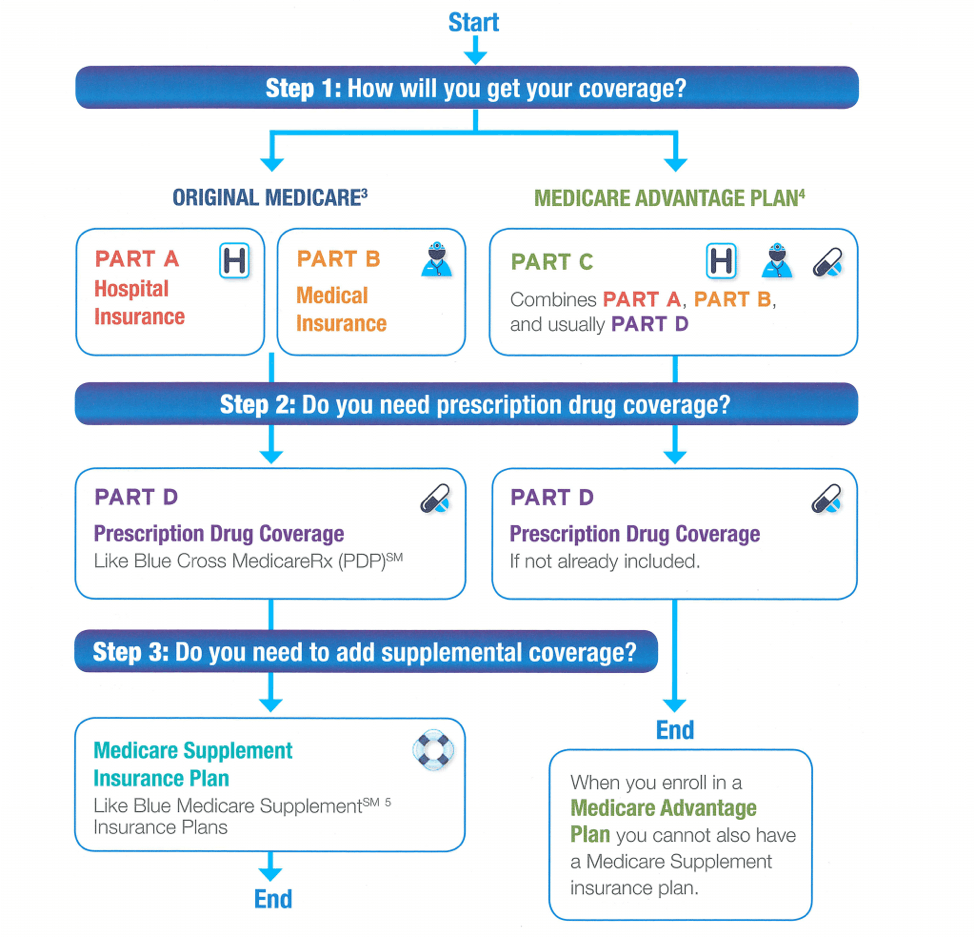

Over the years, parts c and d joined the family like a pair of welcome but complicated relatives. These policies provide assistance, but it�s often for smaller coverage than if you bought an ad&d insurance policy yourself. Side c coverage is an important component of directors and officers liability insurance. What personal property insurance covers. Indeed, part c used to be called medicare+choice. The d&o policy reads as three separate coverages wrapped into one policy:

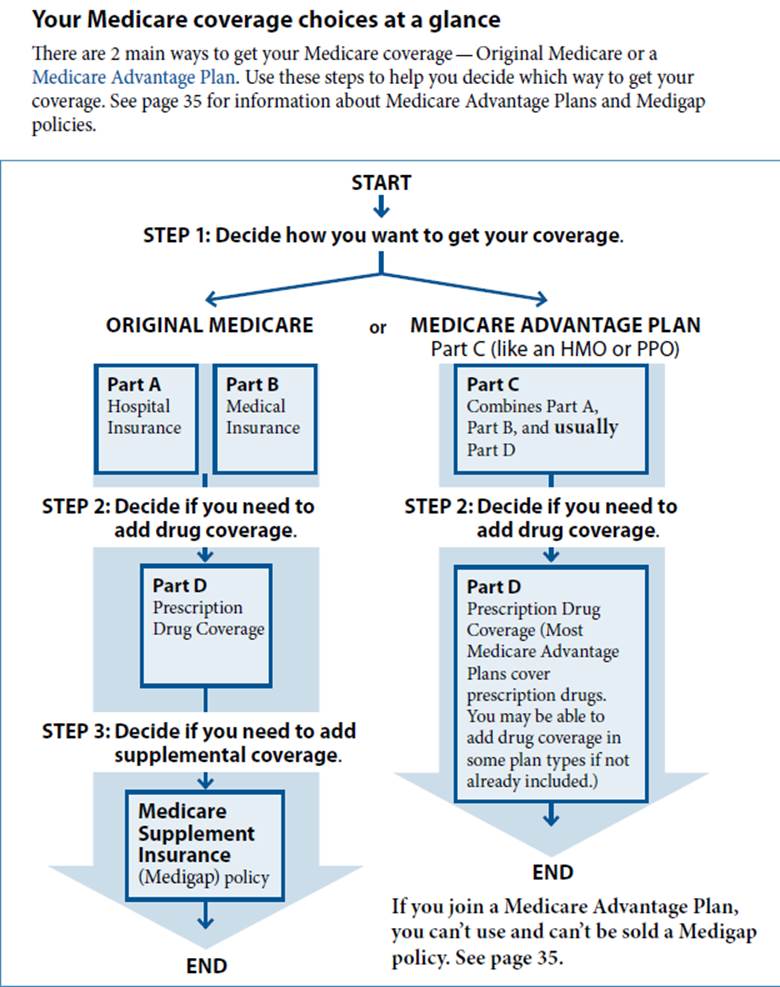

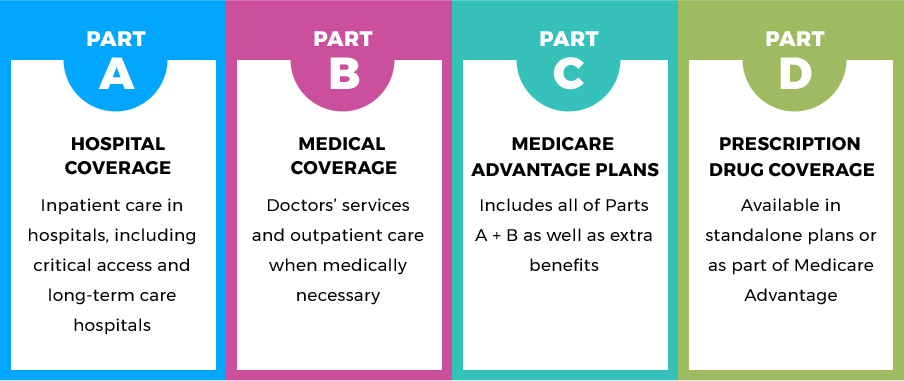

Medicare is a federal insurance plan.

While medicare part a and medicare part b are administered by the centers for medicare and medicaid services (cms), medicare part c and medicare part d are managed by private insurance companies. Indeed, part c used to be called medicare+choice. Should the entity be named along with the individual directors in a lawsuit, this coverage protects the balance sheet of the company. Many companies offer their employees free ad&d insurance as part of their benefits package. A d&o insurance policy has defined coverage for certain claims, and excludes coverage for other types of claims. Ad&d coverage kicks in if you die in a fatal accident or become disabled.

Source: elderlaw.us

Source: elderlaw.us

A directors & officers policy commonly provides protection for the following types of claims, among others: Medicare part c combines the benefits of part a and part b, while medicare part d covers prescription drugs. Coverage for claims asserted against the entity itself. While medicare part a and medicare part b are administered by the centers for medicare and medicaid services (cms), medicare part c and medicare part d are managed by private insurance companies. If you are not sure, it�s best to follow your.

Source: blog.cdphp.com

Source: blog.cdphp.com

A d&o insurance policy has defined coverage for certain claims, and excludes coverage for other types of claims. Over the years, parts c and d joined the family like a pair of welcome but complicated relatives. If you are not sure, it�s best to follow your. The d&o policy reads as three separate coverages wrapped into one policy: Should the entity be named along with the individual directors in a lawsuit, this coverage protects the balance sheet of the company.

Source: lemonade.com

Source: lemonade.com

While medicare part a and medicare part b are administered by the centers for medicare and medicaid services (cms), medicare part c and medicare part d are managed by private insurance companies. Indeed, part c used to be called medicare+choice. D&o insurance typically comprises three core, separate agreements, called side a, side b and side c. Medicare part a and part b are known collectively. Usually, your coverage c limit is 50% and 70% percent of your dwelling�s value.

Source: groupplansinc.com

Source: groupplansinc.com

Indemnifies the entity after the entity has paid the individuals named in the lawsuit. While public company d&o coverage restrict such claims solely to securities claims, private company d&o insurance provides broad coverage for claims made against the entity. Indemnifies the entity after the entity has paid the individuals named in the lawsuit. What personal property insurance covers. The average annual cost of $1,000,000 worth of.

Source: youtube.com

Source: youtube.com

Medicare part a and part b are known collectively. Should the entity be named along with the individual directors in a lawsuit, this coverage protects the balance sheet of the company. Over the years, parts c and d joined the family like a pair of welcome but complicated relatives. Medicare part c combines the benefits of part a and part b, while medicare part d covers prescription drugs. Most people underestimate how much property they have in their homes by 50%.

Source: valuepenguin.com

Source: valuepenguin.com

If you are not sure, it�s best to follow your. Over the years, parts c and d joined the family like a pair of welcome but complicated relatives. Medicare is a federal insurance plan. Ad&d coverage kicks in if you die in a fatal accident or become disabled. This coverage insures organizations for claims made directly against the organization by providing entity asset protections and coverage for defense costs.

Source: resources.medicaresolutions.com

Source: resources.medicaresolutions.com

If you opt for a special personal property endorsement, you can get protection for damage caused by perils beyond the ones listed here. Over the years, parts c and d joined the family like a pair of welcome but complicated relatives. This sounds like a lot, right? Covered claims may cover a wide range. The average annual cost of $1,000,000 worth of.

![Washington D.C. Car Insurance [Everything You Need to Know] Washington D.C. Car Insurance [Everything You Need to Know]](https://www.carinsurancecomparison.com/wp-content/uploads/dw/factors-affecting-car-insurance-rates-in-dc-O7goO.png) Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

What personal property insurance covers. Medicare parts a, b, c, and d are the four distinct types of coverage available to eligible individuals. Medicare is a federal insurance plan. This sounds like a lot, right? A directors & officers policy commonly provides protection for the following types of claims, among others:

Source: wehelpsolvethepuzzle.com

Source: wehelpsolvethepuzzle.com

What are side a, b, and c covers in a d&o policy? Indeed, part c used to be called medicare+choice. Medicare part a and part b are known collectively. Ad&d coverage kicks in if you die in a fatal accident or become disabled. The average annual cost of $1,000,000 worth of.

Source: healthpartnersmedicare.com

Source: healthpartnersmedicare.com

These policies provide assistance, but it�s often for smaller coverage than if you bought an ad&d insurance policy yourself. Many companies offer their employees free ad&d insurance as part of their benefits package. Most people underestimate how much property they have in their homes by 50%. Side a covers claims against directors. Specifically included (and excluded) claims.

Source: slideshare.net

Source: slideshare.net

A directors and officers (d&o) liability insurance policy is a very effective and essential liability cover necessary for all types of organisations. These policies provide assistance, but it�s often for smaller coverage than if you bought an ad&d insurance policy yourself. Side a, side b, and side c. Many companies offer their employees free ad&d insurance as part of their benefits package. This sounds like a lot, right?

Source: insurewithintegrity.com

Source: insurewithintegrity.com

Medicare part c combines the benefits of part a and part b, while medicare part d covers prescription drugs. The risk scenarios covered include prospectus liability, pension trust liability and employment practices liability. Under coverage c, covered property does not include: Medicare part a and part b are known collectively. Side a covers claims against directors.

![Washington D.C. Car Insurance [Everything You Need to Know] Washington D.C. Car Insurance [Everything You Need to Know]](https://www.carinsurancecomparison.com/wp-content/uploads/dw/dc-car-insurance-rates-by-company-vs-state-average-yEiGm.png) Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

Medicare part c combines the benefits of part a and part b, while medicare part d covers prescription drugs. If you are not sure, it�s best to follow your. D&o insurance typically comprises three core, separate agreements, called side a, side b and side c. Most people underestimate how much property they have in their homes by 50%. Medicare part a and part b are known collectively.

Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

Under coverage c, covered property does not include: This sounds like a lot, right? A d&o insurance policy has defined coverage for certain claims, and excludes coverage for other types of claims. Medicare part a and part b are known collectively. A directors & officers policy commonly provides protection for the following types of claims, among others:

Source: medicareworld.com

Source: medicareworld.com

Medicare parts a, b, c, and d are the four distinct types of coverage available to eligible individuals. While medicare part a and medicare part b are administered by the centers for medicare and medicaid services (cms), medicare part c and medicare part d are managed by private insurance companies. The average annual cost of $1,000,000 worth of. Each side protects one of the three items listed above: A directors & officers policy commonly provides protection for the following types of claims, among others:

![Washington D.C. Car Insurance [Everything You Need to Know] Washington D.C. Car Insurance [Everything You Need to Know]](https://www.carinsurancecomparison.com/wp-content/uploads/dw/monthly-average-dc-car-insurance-rates-by-zip-code-d7G96.png) Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

Each side protects one of the three items listed above: A directors & officers policy commonly provides protection for the following types of claims, among others: Coverage for claims asserted against the entity itself. Side a covers claims against directors. Should the entity be named along with the individual directors in a lawsuit, this coverage protects the balance sheet of the company.

Source: ocmedicare.com

Source: ocmedicare.com

The average annual cost of $1,000,000 worth of. Coverage for claims asserted against the entity itself. Indeed, part c used to be called medicare+choice. The d&o policy reads as three separate coverages wrapped into one policy: Covered claims may cover a wide range.

Source: pinterest.com

Source: pinterest.com

Covered claims may cover a wide range. What are side a, b, and c covers in a d&o policy? Ad&d coverage kicks in if you die in a fatal accident or become disabled. Side c coverage is an important component of directors and officers liability insurance. Medicare part a and part b are known collectively.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title d and c insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information