Data breach insurance Idea

Home » Trend » Data breach insurance IdeaYour Data breach insurance images are available. Data breach insurance are a topic that is being searched for and liked by netizens now. You can Download the Data breach insurance files here. Download all free photos and vectors.

If you’re searching for data breach insurance pictures information linked to the data breach insurance topic, you have pay a visit to the ideal site. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

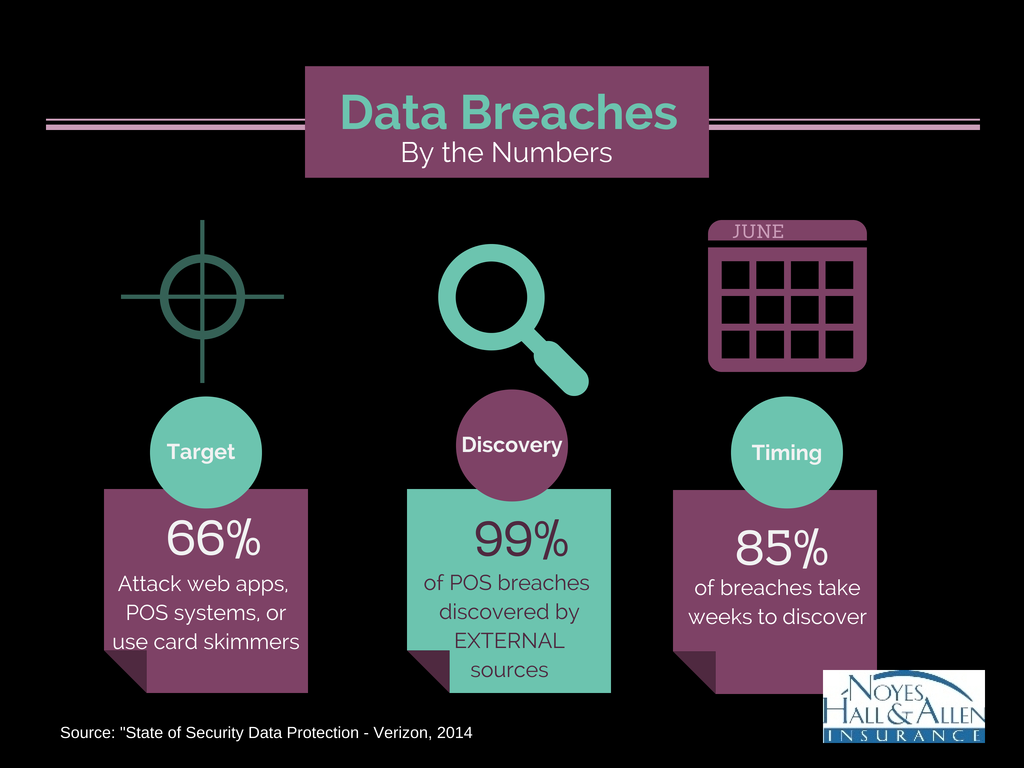

Data Breach Insurance. Turning back the clock may not be possible, but you. Data breaches and d&o coverage. Data breach insurance is a form of insurance designed to protect companies against damages caused by a data breach. Data breaches occur for a number of reasons, including hacking and poor cybersecurity procedures.

A Look at Data Breach Insurance from Another Angle Utica From szwinsurance.com

A Look at Data Breach Insurance from Another Angle Utica From szwinsurance.com

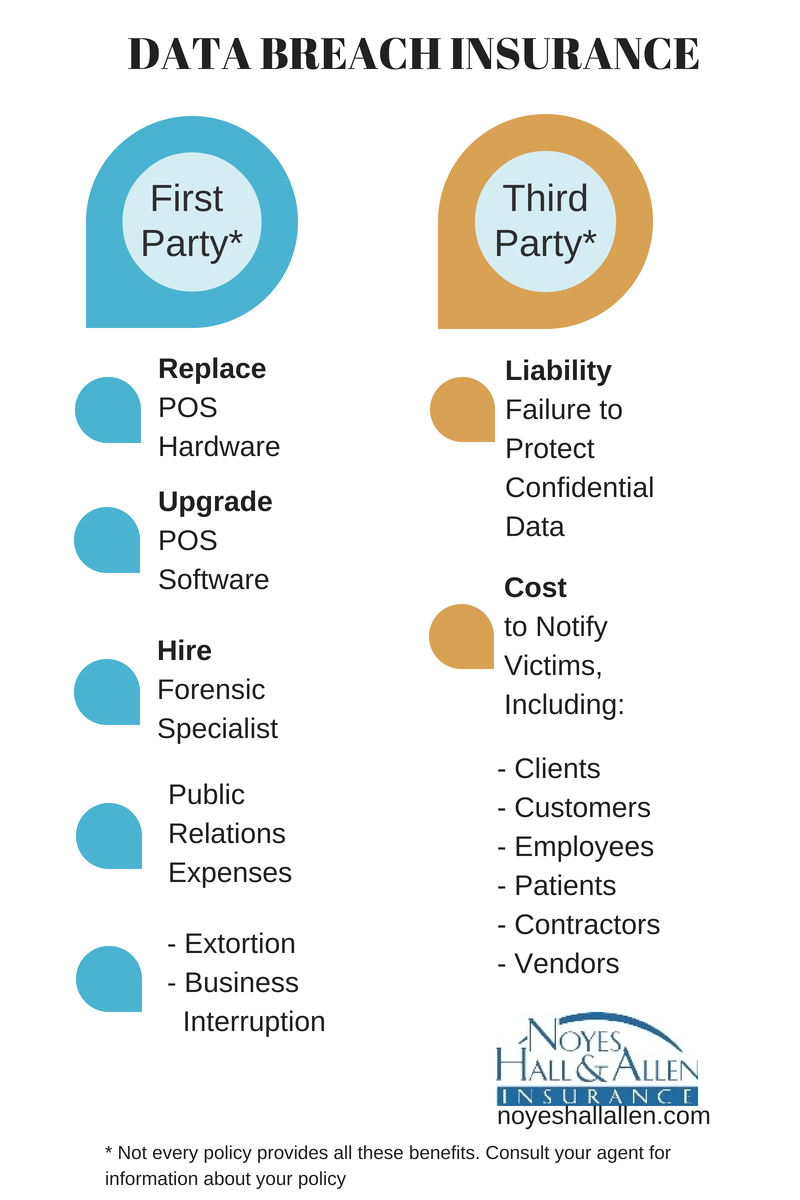

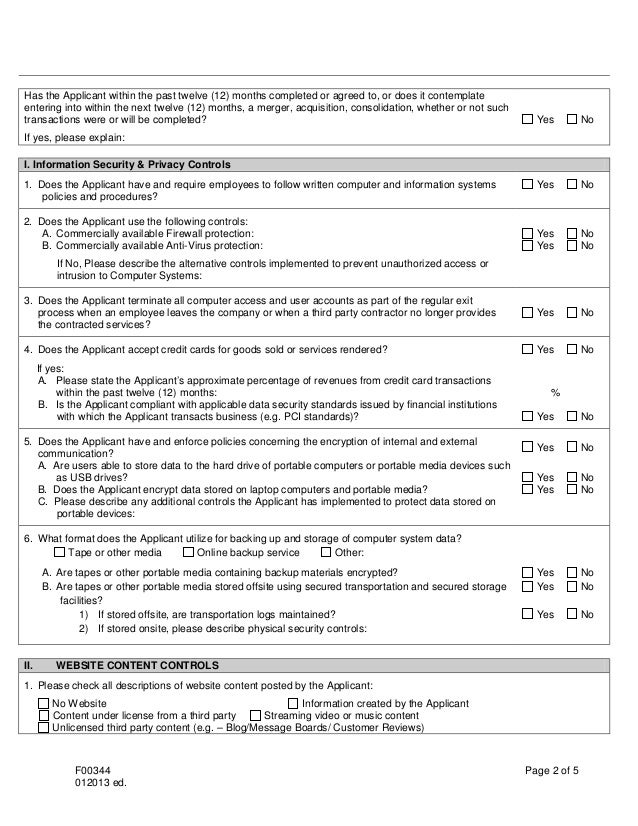

Cyber liability insurance is typically meant for larger businesses and offers more coverage to help prepare for, respond to and recover from cyberattacks. But it can help you prepare for and respond when a data breach occurs. This coverage helps you respond to a breach if personal client or employee data, patient health records, or business information becomes. As data breach insurance and cyber insurance have overlapping applications, the two terms are often interchanged. Data breach insurance is a type of monetary coverage purchased by organizations to protect financial interests in the event of data loss. How data breach insurance works.

Types of insurance you need to cover data breaches

Data breach insurance or cyber crime insurance is designed to cover your company’s liability if a data breach occurs and gives identity thieves or other cyber criminals access to the type of sensitive customer information that allows for identity theft, such as personally identifiable information (pii) like social security numbers, bank account info,. A data breach occurs when an. This coverage helps you respond to a breach if personal client or employee data, patient health records, or business information becomes. A breach is typically a single incident where confidential, or protected information, is either. Turning back the clock may not be possible, but you. Here’s an overview of each.

Source: otterstedt.com

Source: otterstedt.com

Data breaches occur due to various reasons, like hacking and poor cybersecurity procedures. Cyber & data breach liability coverages are developing on a daily basis as new threats emerge and new insurance companies enter the market. Cyber liability insurance is typically meant for larger businesses and offers more coverage to help prepare for, respond to and recover from cyberattacks. Regardless of the type of business, one thing is certain, if you’re a business in operation today, you face cyber risks. Cyber insurance can also cover loss suffered by the business.

Source: paradisoinsurance.com

Source: paradisoinsurance.com

Regardless of the type of business, one thing is certain, if you’re a business in operation today, you face cyber risks. Data breach insurance or cyber crime insurance is designed to cover your company’s liability if a data breach occurs and gives identity thieves or other cyber criminals access to the type of sensitive customer information that allows for identity theft, such as personally identifiable information (pii) like social security numbers, bank account info,. It helps cover costs related to system hacks or data security breaches in which sensitive information has been stolen and fraud has occurred or there is a reasonable. But it can help you prepare for and respond when a data breach occurs. Company’s stored data vary from simple to critical government information.

Source: databreachinsurancequote.com

Source: databreachinsurancequote.com

It helps cover costs related to system hacks or data security breaches in which sensitive information has been stolen and fraud has occurred or there is a reasonable. Data breach insurance is a type of monetary coverage purchased by organizations to protect financial interests in the event of data loss. A data breach occurs when an. Turning back the clock may not be possible, but you. Data breaches and d&o coverage.

Source: wedgwoodinsurance.com

Source: wedgwoodinsurance.com

Data breaches occur for a number of reasons, including hacking and poor cybersecurity procedures. It helps cover costs related to system hacks or data security breaches in which sensitive information has been stolen and fraud has occurred or there is a reasonable. Cyber insurance can also cover loss suffered by the business. Data breach insurance protects your private information from unauthorized use with rates as low as $37/mo. Below are some answers to commonly asked data breach insurance questions:

Source: gskinsurance.com.au

Source: gskinsurance.com.au

Your customers and shareholders may seek to hold you responsible for the damage, as the board is responsible for making decisions on behalf of the. Regardless of the type of business, one thing is certain, if you’re a business in operation today, you face cyber risks. What does data breach insurance cover? Data breach insurance is a type of cyber insurance coverage purchased by the company to protect their financial interests in case of data loss. But it can help you prepare for and respond when a data breach occurs.

Source: stratuminsurance.com

Source: stratuminsurance.com

What is data breach insurance? Data breach insurance is a form of insurance designed to protect companies against damages caused by a data breach. Coupled with the threats of operational error, supply failure and administrative mistakes, data breach insurance can be the ideal vehicle to transfer residual risk. Cyber & data breach liability coverages are developing on a daily basis as new threats emerge and new insurance companies enter the market. Having adequate data breach insurance, also known as network security and privacy liability coverage, is a paramount consideration for organizations of all sizes and industries, but particularly those whose business model is dependent upon online interactions and transactions.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Coupled with the threats of operational error, supply failure and administrative mistakes, data breach insurance can be the ideal vehicle to transfer residual risk. Data breach insurance generally covers incidents including and not limited to: A data breach occurs when an. Cyber & data breach liability coverages are developing on a daily basis as new threats emerge and new insurance companies enter the market. Below are some answers to commonly asked data breach insurance questions:

Source: szwinsurance.com

Source: szwinsurance.com

Definition of data breach insurance. Cyber liability insurance is typically meant for larger businesses and offers more coverage to help prepare for, respond to and recover from cyberattacks. Turning back the clock may not be possible, but you. Ways you prevent a data breach in your business. Here’s an overview of each.

Source: integritech.io

Source: integritech.io

Company’s stored data vary from simple to critical government information. Your customers and shareholders may seek to hold you responsible for the damage, as the board is responsible for making decisions on behalf of the. Data breach insurance protects your private information from unauthorized use with rates as low as $37/mo. Data breach insurance helps your business respond to breaches and can offer enough protection for small business owners. Data breach insurance is a great way to protect your business operations in the event of a cyber attack or cyber security breach.

Source: noyeshallallen.com

Source: noyeshallallen.com

What does data breach insurance cover? Defense and settlement costs if you are sued for alleged failure to prevent unauthorized access to, or use of, personal information; Data breaches occur due to various reasons, like hacking and poor cybersecurity procedures. Here’s an overview of each. Data breaches and d&o coverage.

Source: kernersville-insurance.com

Source: kernersville-insurance.com

Having adequate data breach insurance, also known as network security and privacy liability coverage, is a paramount consideration for organizations of all sizes and industries, but particularly those whose business model is dependent upon online interactions and transactions. A breach is typically a single incident where confidential, or protected information, is either. As data breach insurance and cyber insurance have overlapping applications, the two terms are often interchanged. As a general rule, small business owners can expect to pay between $650 and $1,000 a year for their data breach insurance. Data breach insurance is one way to help protect your company in the event of an attack or hacking incident.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Any cover for fines would be qualified by exclusions in respect of intentional, reckless or criminal acts. Coupled with the threats of operational error, supply failure and administrative mistakes, data breach insurance can be the ideal vehicle to transfer residual risk. Data breach insurance is a type of cyber insurance coverage purchased by the company to protect their financial interests in case of data loss. Cyber insurance can�t stop data breaches from happening. Cyber & data breach liability coverages are developing on a daily basis as new threats emerge and new insurance companies enter the market.

Source: noyeshallallen.com

Source: noyeshallallen.com

Types of insurance you need to cover data breaches Cyber insurance can�t stop data breaches from happening. Common terms used to describe data breach include data theft, data loss, cyber security, identity theft and cyber liability. Types of insurance you need to cover data breaches A data breach occurs when an.

Source: blackpointcyber.com

Source: blackpointcyber.com

A data breach occurs when an. Insufficient cybersecurity that leaves your company vulnerable to a data breach can be seen by your customers or shareholders as negligence or a breach of duty. Below are some answers to commonly asked data breach insurance questions: Data breach insurance helps your business respond to breaches and can offer enough protection for small business owners. How data breach insurance works.

Source: slideshare.net

Source: slideshare.net

Turning back the clock may not be possible, but you. Cyber insurance can�t stop data breaches from happening. However, make sure that you read your policy carefully before you sign up for this type of coverage. Data breach insurance is one way to help protect your company in the event of an attack or hacking incident. Your customers and shareholders may seek to hold you responsible for the damage, as the board is responsible for making decisions on behalf of the.

Source: yourpreferredinsurance.com

Source: yourpreferredinsurance.com

Your customers and shareholders may seek to hold you responsible for the damage, as the board is responsible for making decisions on behalf of the. Cyber & data breach liability coverages are developing on a daily basis as new threats emerge and new insurance companies enter the market. This coverage helps you respond to a breach if personal client or employee data, patient health records, or business information becomes. Turning back the clock may not be possible, but you. Definition of data breach insurance.

Source: mafolewouh.com

Source: mafolewouh.com

What does data breach insurance cover? A data breach occurs when an. Data breach insurance is a type of monetary coverage purchased by organizations to protect financial interests in the event of data loss. It helps cover costs related to system hacks or data security breaches in which sensitive information has been stolen and fraud has occurred or there is a reasonable. What does data breach insurance cover?

Source: dataresilience.com.au

Source: dataresilience.com.au

Cyber insurance can also cover loss suffered by the business. Consulting and forensic fees to identify and resolve the cause of a data breach; Get a fast quote and your certificate of insurance now. Regardless of the type of business, one thing is certain, if you’re a business in operation today, you face cyber risks. Data breach insurance is a great way to protect your business operations in the event of a cyber attack or cyber security breach.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title data breach insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information