Data science in insurance information

Home » Trend » Data science in insurance informationYour Data science in insurance images are ready. Data science in insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Data science in insurance files here. Download all free photos and vectors.

If you’re looking for data science in insurance pictures information related to the data science in insurance keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

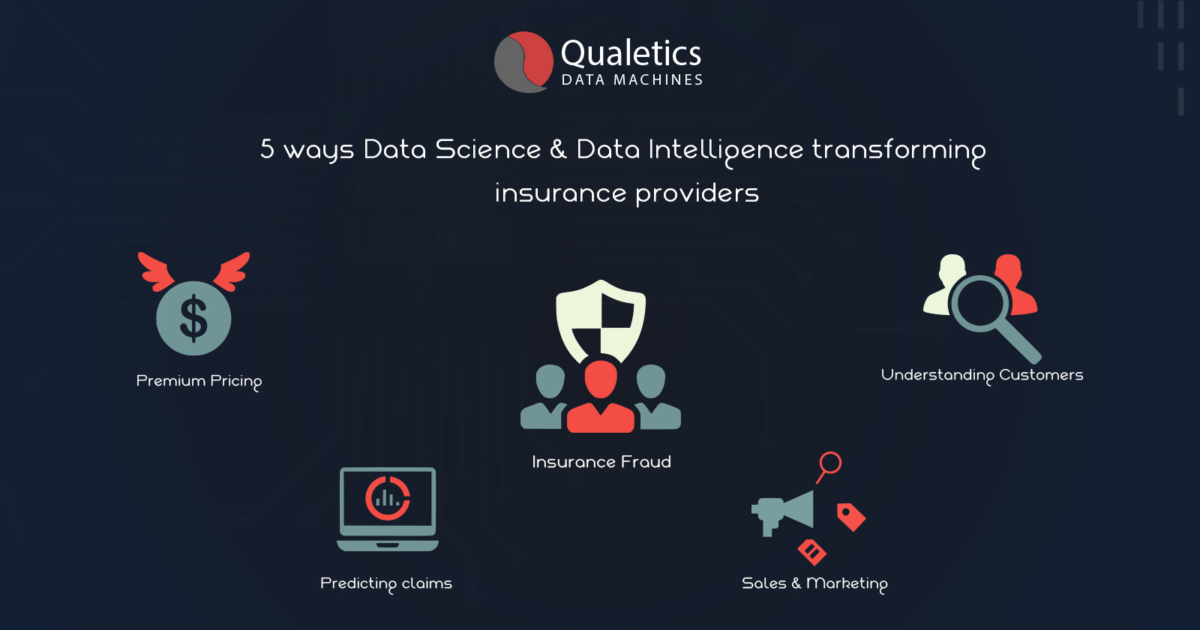

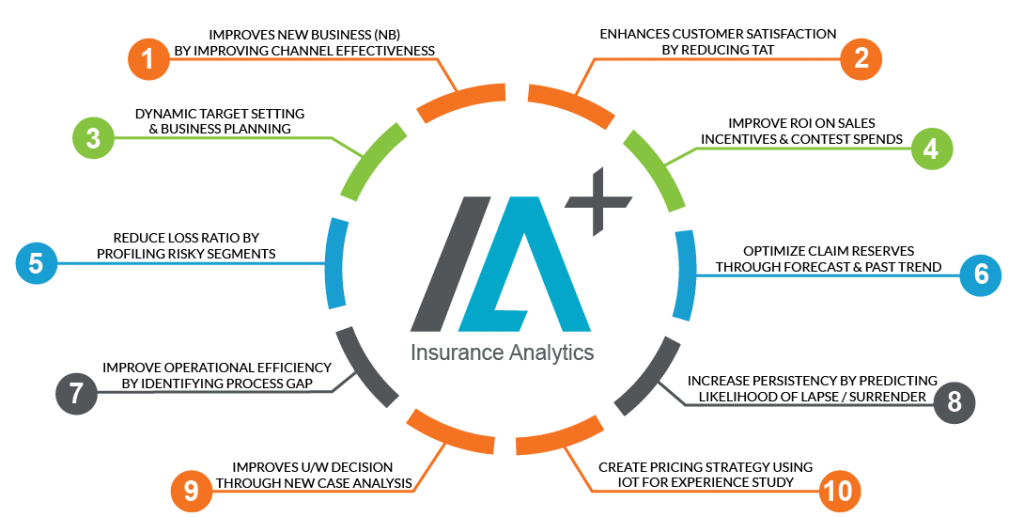

Data Science In Insurance. In the webinar, sudaman describes the current utilization of data science in the insurance industry as an analytics garage. This data science model helps in calculating the life time value of an insurance agent basing upon business done by him so far and expected business he can generate for the company in future. The conference brings together academics and practitioners in areas including data science, analytics, machine learning, artificial intelligence, computational statistics and software, as applied in the insurance industry. Price products based on policy holder behaviour;

Data Science in the Insurance Industry 360DigiTMG From 360digitmg.com

Data Science in the Insurance Industry 360DigiTMG From 360digitmg.com

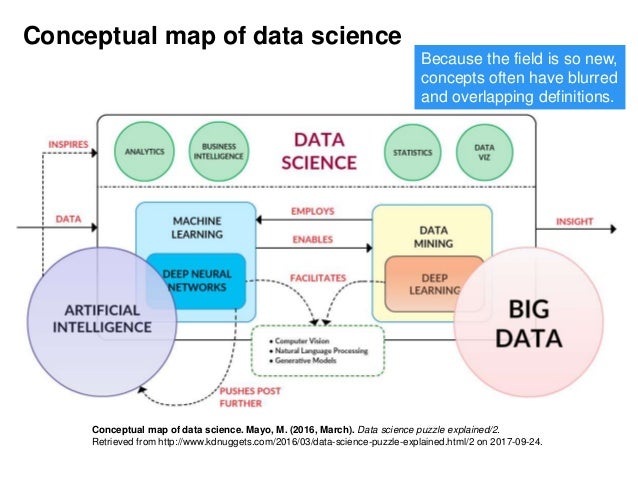

This more granular risk assessment should mean This article summarizes the main topics and findings from the swiss risk and insurance forum 2018. Emerging data analytics technologies centred on machine learning bring order and purpose to this unstructured data so that it can be more effectively mined for business insights. Aspects of the integration of data science techniques i n insurance a ctivities and of the challenges that go along with it. Therefore data governance must be an integral part of the platform that is used by data scientists to build, train and operationalize models. From data science garage to factory.

Emerging data analytics technologies centred on machine learning bring order and purpose to this unstructured data so that it can be more effectively mined for business insights.

Emerging data analytics technologies centred on machine learning bring order and purpose to this unstructured data so that it can be more effectively mined for business insights. Università cattolica del sacro cuore, milan. Aspects of the integration of data science techniques i n insurance a ctivities and of the challenges that go along with it. Then, via complex algorithms and associations, targeted. Organizations currently recognize that big data is a priority, but they are not efficiently leveraging it. In this paper, we summar ize the main fi ndings and discussions.

Source: neilsonmarketing.com

Source: neilsonmarketing.com

This is due to the fact that most of the population own at least one car, whilst not necessarily having a life insurance. This article summarizes the main topics and findings from the swiss risk and insurance forum 2018. Università cattolica del sacro cuore, milan. However, the adoption of new technologies is not just a modern trend but a necessity to maintain the competitive pace. Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly.

Source: 360digitmg.com

Source: 360digitmg.com

However, data science allows insurers to see their applicants’ risk profiles in much greater detail. The conference brings together academics and practitioners in areas including data science, analytics, machine learning, artificial intelligence, computational statistics and software, as applied in the insurance industry. Due to data science techniques, the insurers can collect the data from multiple channels and detect special dates and celebrations. Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly. Data collected by life insurance companies have historically been scarce compared to the general insurance companies (e.g.

Source: youtube.com

Source: youtube.com

In the webinar, sudaman describes the current utilization of data science in the insurance industry as an analytics garage. In the modern digital era, big data technologies help to process vast amounts of information, increase workflow efficiency, and reduce operational costs.… Data collected by life insurance companies have historically been scarce compared to the general insurance companies (e.g. From data science garage to factory. The insurance industry has always been quite conservative;

Source: emerj.com

Source: emerj.com

Fraud is a very real. Gain customer insight and assess their experience This is due to the fact that most of the population own at least one car, whilst not necessarily having a life insurance. Price products based on policy holder behaviour; Through data and analytics, they are able to make more intelligent assessments of each policyholder’s riskiness.

Source: nuvento.com

Source: nuvento.com

Through attune, the companies are seeking to transform the small commercial segment by harnessing data, artificial intelligence. Data collected by life insurance companies have historically been scarce compared to the general insurance companies (e.g. In this paper, we summar ize the main fi ndings and discussions. Due to data science techniques, the insurers can collect the data from multiple channels and detect special dates and celebrations. At pwc, we use data and analytics to help organisations in the insurance sector to:

Source: cxotalk.com

Insurance companies must be able to demonstrate to regulators all the experiments that their data scientists have performed and which model was put into production and how it was modified over time. Data science is becoming an increasingly vital skill in many core insurance functions, including risk assessment and pricing, reserving, fraud detection, customer segmentation, customer experience, product development, reporting and communication. The insurance industry has always been quite conservative; Gain customer insight and assess their experience This data science model helps in calculating the life time value of an insurance agent basing upon business done by him so far and expected business he can generate for the company in future.

Source: activewizards.com

Source: activewizards.com

Data collected by life insurance companies have historically been scarce compared to the general insurance companies (e.g. In a recent webinar, sudaman thoppan mohanchandralal, regional chief data and analytics officer at allianz benelux discussed the current state of data science in insurance and exciting. Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly. Price products based on policy holder behaviour; Using data science, the insurance companies can speed up the interaction with customers, give more tailored products and services, automate simple communication, improve customer satisfaction, and configure the most beneficial offer in no time.

Source: insuranalytics.ai

Source: insuranalytics.ai

Data science in insurance today. Aspects of the integration of data science techniques i n insurance a ctivities and of the challenges that go along with it. Organizations currently recognize that big data is a priority, but they are not efficiently leveraging it. In a recent webinar, sudaman thoppan mohanchandralal, regional chief data and analytics officer at allianz benelux discussed the current state of data science in insurance and exciting. Through attune, the companies are seeking to transform the small commercial segment by harnessing data, artificial intelligence.

Source: youtube.com

Source: youtube.com

In september 2016, aig and hamilton insurance group announced a joint venture with hedge fund two sigma to form attune, a data and technology platform to serve the $80 billion u.s. Price products based on policy holder behaviour; However, the adoption of new technologies is not just a modern trend but a necessity to maintain the competitive pace. Benefiting from the digital experience an appropriate premium based on the risk (and underwriting decision) would then be set. Fraud is a very real.

Source: montoux.com

Source: montoux.com

Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly. Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly. At pwc, we use data and analytics to help organisations in the insurance sector to: Through attune, the companies are seeking to transform the small commercial segment by harnessing data, artificial intelligence. Data science is becoming an increasingly vital skill in many core insurance functions, including risk assessment and pricing, reserving, fraud detection, customer segmentation, customer experience, product development, reporting and communication.

Source: qualetics.com

Source: qualetics.com

Through attune, the companies are seeking to transform the small commercial segment by harnessing data, artificial intelligence. Gain customer insight and assess their experience However, the adoption of new technologies is not just a modern trend but a necessity to maintain the competitive pace. Therefore data governance must be an integral part of the platform that is used by data scientists to build, train and operationalize models. Using data science, the insurance companies can speed up the interaction with customers, give more tailored products and services, automate simple communication, improve customer satisfaction, and configure the most beneficial offer in no time.

Source: cdotrends.com

Source: cdotrends.com

Small and midsize commercial insurance market. This is due to the fact that most of the population own at least one car, whilst not necessarily having a life insurance. This article summarizes the main topics and findings from the swiss risk and insurance forum 2018. Data collected by life insurance companies have historically been scarce compared to the general insurance companies (e.g. Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly.

Source: slideshare.net

Source: slideshare.net

Gain customer insight and assess their experience Choosing data science projects in 3d Data collected by life insurance companies have historically been scarce compared to the general insurance companies (e.g. Price products based on policy holder behaviour; Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly.

Source: youtube.com

Source: youtube.com

Through attune, the companies are seeking to transform the small commercial segment by harnessing data, artificial intelligence. Data science is becoming an increasingly vital skill in many core insurance functions, including risk assessment and pricing, reserving, fraud detection, customer segmentation, customer experience, product development, reporting and communication. Insurance companies must be able to demonstrate to regulators all the experiments that their data scientists have performed and which model was put into production and how it was modified over time. Due to data science techniques, the insurers can collect the data from multiple channels and detect special dates and celebrations. In the webinar, sudaman describes the current utilization of data science in the insurance industry as an analytics garage.

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

That event gathered experts from academia, insurance industry, regulatory bodies, and consulting companies to discuss the challenges arising from the impact of data science and, more generally, of digitalization to the insurance sector. The conference brings together academics and practitioners in areas including data science, analytics, machine learning, artificial intelligence, computational statistics and software, as applied in the insurance industry. In this paper, we summar ize the main fi ndings and discussions. Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly. Benefiting from the digital experience an appropriate premium based on the risk (and underwriting decision) would then be set.

Source: cognitiveclass.ai

Source: cognitiveclass.ai

Chester ismay and albert y. Due to data science techniques, the insurers can collect the data from multiple channels and detect special dates and celebrations. Data science is becoming an increasingly vital skill in many core insurance functions, including risk assessment and pricing, reserving, fraud detection, customer segmentation, customer experience, product development, reporting and communication. Data science in insurance today. Price products based on policy holder behaviour;

Source: slideshare.net

Source: slideshare.net

Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly. However, data science allows insurers to see their applicants’ risk profiles in much greater detail. Through attune, the companies are seeking to transform the small commercial segment by harnessing data, artificial intelligence. Chester ismay and albert y. Insurance companies must be able to demonstrate to regulators all the experiments that their data scientists have performed and which model was put into production and how it was modified over time.

Source: decisionmanagementsolutions.com

Source: decisionmanagementsolutions.com

Small and midsize commercial insurance market. Harnessing the power of data science selectively enables a company to improve the quality of decision making in key parts of the value chain, as well as to generate new business models on the fly. Using data science, the insurance companies can speed up the interaction with customers, give more tailored products and services, automate simple communication, improve customer satisfaction, and configure the most beneficial offer in no time. In this paper, we summar ize the main fi ndings and discussions. Then, via complex algorithms and associations, targeted.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title data science in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information