Dead peasant insurance walmart Idea

Home » Trend » Dead peasant insurance walmart IdeaYour Dead peasant insurance walmart images are ready in this website. Dead peasant insurance walmart are a topic that is being searched for and liked by netizens now. You can Download the Dead peasant insurance walmart files here. Get all free images.

If you’re searching for dead peasant insurance walmart pictures information linked to the dead peasant insurance walmart interest, you have pay a visit to the ideal site. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Dead Peasant Insurance Walmart. When a company names itself a (15). In the mid 1990’s, it is estimated that walmart purchased over 300,000 life insurance policies on its employees and named itself as the beneficiary. Is scathed for its use of such “dead peasant” policies. Walmart used to take out life insurance policies on their employees and keep the payouts when they died, a practice colloquially known as “dead peasant insurance” close 331

Walmart India walmart dead peasant life insurance From walmartindiaexposed.blogspot.com

Walmart India walmart dead peasant life insurance From walmartindiaexposed.blogspot.com

Is scathed for its use of such “dead peasant” policies. The practice is not, however, illegal in most states. These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. When a company names itself a (15). Dead peasant insurance is a slang term used to describe life insurance policies purchased by businesses on the lives of their ordinary employees for the express (14). When a company names itself a beneficiary on a policy bought in the name of a rank and file employee, it is known as dead peasants insurance.

Walmart stopped the practice in 2000, saying it was losing money.

Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli). Moore highlights an ugly truth about insurance policies that benefit companies, not the employees, when workers die. When a company names itself a (15). Is scathed for its use of such “dead peasant” policies. Walmart stopped the practice in 2000, saying it was losing money. Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli).

Source: musicians4freedom.com

Source: musicians4freedom.com

The practice is not, however, illegal in most states. When a company names itself a beneficiary on a policy bought in the name of a rank and file employee, it is known as dead peasants insurance. “dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s. Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli). Walmart stopped the practice in 2000, saying it was losing money.

Source: musaregui.blogspot.com

Source: musaregui.blogspot.com

What companies have dead peasant insurance? Is scathed for its use of such “dead peasant” policies. The practice is not, however, illegal in most states. Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli). “walmart gambled, lost $1.3b on ‘dead peasant’ policies, insurers say.” andrews publications.

Source: ten-thousand-suns.blogspot.com

Source: ten-thousand-suns.blogspot.com

These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. “dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s. One of the most publicized incidents of a corporation who tried to capitalize on the strategy of purchasing dead peasant policies as an investment was walmart. Moore highlights an ugly truth about insurance policies that benefit companies, not the employees, when workers die. Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli).

Source: freshavocat.blogspot.com

Source: freshavocat.blogspot.com

In the mid 1990’s, it is estimated that walmart purchased over 300,000 life insurance policies on its employees and named itself as the beneficiary. Dead peasant insurance works much like traditional life insurance, except the employer purchases the policy and pays the premiums. These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. When a company names itself a (15). Walmart used to take out life insurance policies on their employees and keep the payouts when they died, a practice colloquially known as “dead peasant insurance” close 331

Source: ten-thousand-suns.blogspot.com

Source: ten-thousand-suns.blogspot.com

In the mid 1990’s, it is estimated that walmart purchased over 300,000 life insurance policies on its employees and named itself as the beneficiary. What companies have dead peasant insurance? These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. The practice is not, however, illegal in most states. Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli).

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. Walmart stopped the practice in 2000, saying it was losing money. During the 90’s companies bought dead peasant insurance on million of employees, reaping billions of dollars in benefits. “dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s. When a company names itself a beneficiary on a policy bought in the name of a rank and file employee, it is known as dead peasants insurance.

Source: walmartindiaexposed.blogspot.com

Source: walmartindiaexposed.blogspot.com

Walmart stopped the practice in 2000, saying it was losing money. “dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s. The practice is not, however, illegal in most states. How does dead peasant insurance work? What companies have dead peasant insurance?

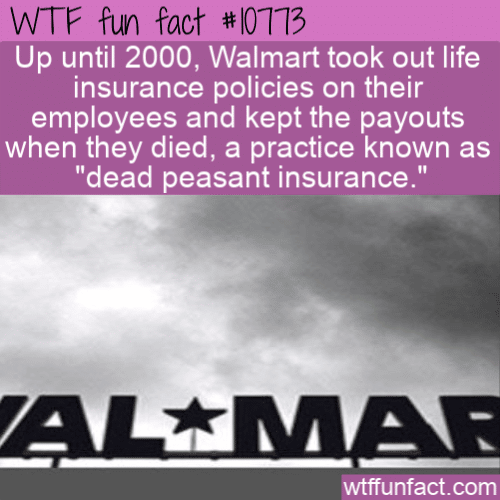

Source: wtffunfact.com

Source: wtffunfact.com

“walmart gambled, lost $1.3b on ‘dead peasant’ policies, insurers say.” andrews publications. In the mid 1990’s, it is estimated that walmart purchased over 300,000 life insurance policies on its employees and named itself as the beneficiary. Walmart stopped the practice in 2000, saying it was losing money. Is scathed for its use of such “dead peasant” policies. These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the.

Source: bharti-walmart.blogspot.com

Source: bharti-walmart.blogspot.com

One of the most publicized incidents of a corporation who tried to capitalize on the strategy of purchasing dead peasant policies as an investment was walmart. Today, virtually no corporations within the united states have dead peasant insurance policies because federal law eliminated the tax benefits. The death of felipe tillman These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli).

Source: clearmanlaw.com

Source: clearmanlaw.com

In the mid 1990’s, it is estimated that walmart purchased over 300,000 life insurance policies on its employees and named itself as the beneficiary. How does dead peasant insurance work? When a company names itself a (15). “dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s. The practice is not, however, illegal in most states.

Source: fun-x-facts.blogspot.com

Source: fun-x-facts.blogspot.com

During the 90’s companies bought dead peasant insurance on million of employees, reaping billions of dollars in benefits. Dead peasant insurance is a slang term used to describe life insurance policies purchased by businesses on the lives of their ordinary employees for the express (14). Walmart used to take out life insurance policies on their employees and keep the payouts when they died, a practice colloquially known as “dead peasant insurance” close 331 What companies have dead peasant insurance? The death of felipe tillman

Source: snopes.com

Source: snopes.com

Walmart stopped the practice in 2000, saying it was losing money. The death of felipe tillman Dead peasant insurance works much like traditional life insurance, except the employer purchases the policy and pays the premiums. Moore highlights an ugly truth about insurance policies that benefit companies, not the employees, when workers die. Dead peasant insurance is a slang term used to describe life insurance policies purchased by businesses on the lives of their ordinary employees for the express (14).

Source: autostraddle.com

Source: autostraddle.com

“dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s. “dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s. When a company names itself a (15). Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli). The practice is not, however, illegal in most states.

Source: clearmanlaw.com

Source: clearmanlaw.com

In the mid 1990’s, it is estimated that walmart purchased over 300,000 life insurance policies on its employees and named itself as the beneficiary. Walmart used to take out life insurance policies on their employees and keep the payouts when they died, a practice colloquially known as “dead peasant insurance” close 331 During the 90’s companies bought dead peasant insurance on million of employees, reaping billions of dollars in benefits. Is scathed for its use of such “dead peasant” policies. These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the.

Source: reddit.com

Source: reddit.com

When a company names itself a (15). In the mid 1990’s, it is estimated that walmart purchased over 300,000 life insurance policies on its employees and named itself as the beneficiary. Today, virtually no corporations within the united states have dead peasant insurance policies because federal law eliminated the tax benefits. These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. What companies have dead peasant insurance?

Source: bharti-walmart-exposed.blogspot.com

Source: bharti-walmart-exposed.blogspot.com

The death of felipe tillman When a company names itself a beneficiary on a policy bought in the name of a rank and file employee, it is known as dead peasants insurance. Walmart used to take out life insurance policies on their employees and keep the payouts when they died, a practice colloquially known as “dead peasant insurance” close 331 Moore highlights an ugly truth about insurance policies that benefit companies, not the employees, when workers die. “dead peasant” insurance became exceptionally messy and, some would argue, highly immoral in the 70s and 80s.

Source: bhartiwalmartexposed.blogspot.com

Source: bhartiwalmartexposed.blogspot.com

The death of felipe tillman Today, virtually no corporations within the united states have dead peasant insurance policies because federal law eliminated the tax benefits. What companies have dead peasant insurance? These life insurance policies are called ‘dead peasant’ policies — policies that a company takes out on its employees, naming the company — not the family’s survivors — as the. How does dead peasant insurance work?

Source: workdayminnesota.org

Source: workdayminnesota.org

Dead peasant insurance works much like traditional life insurance, except the employer purchases the policy and pays the premiums. Dead peasant insurance is a slang term used to describe life insurance policies purchased by businesses on the lives of their ordinary employees for the express (14). Walmart used to take out life insurance policies on their employees and keep the payouts when they died, a practice colloquially known as “dead peasant insurance” close 331 The practice is not, however, illegal in most states. When a company names itself a beneficiary on a policy bought in the name of a rank and file employee, it is known as dead peasants insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dead peasant insurance walmart by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information