Death in service insurance for employees information

Home » Trend » Death in service insurance for employees informationYour Death in service insurance for employees images are ready. Death in service insurance for employees are a topic that is being searched for and liked by netizens now. You can Find and Download the Death in service insurance for employees files here. Download all free images.

If you’re looking for death in service insurance for employees images information related to the death in service insurance for employees topic, you have come to the ideal blog. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Death In Service Insurance For Employees. Is death in service the same as life insurance? Yet, according to insurance broker drewberry, only 13. 6.2 to prevent an exit interview questionnaire being issued and to prevent unnecessary communication with the next of kin, the leaver form must state “death in service”. To understand how much a policy pays out you don’t need a death in service calculator.

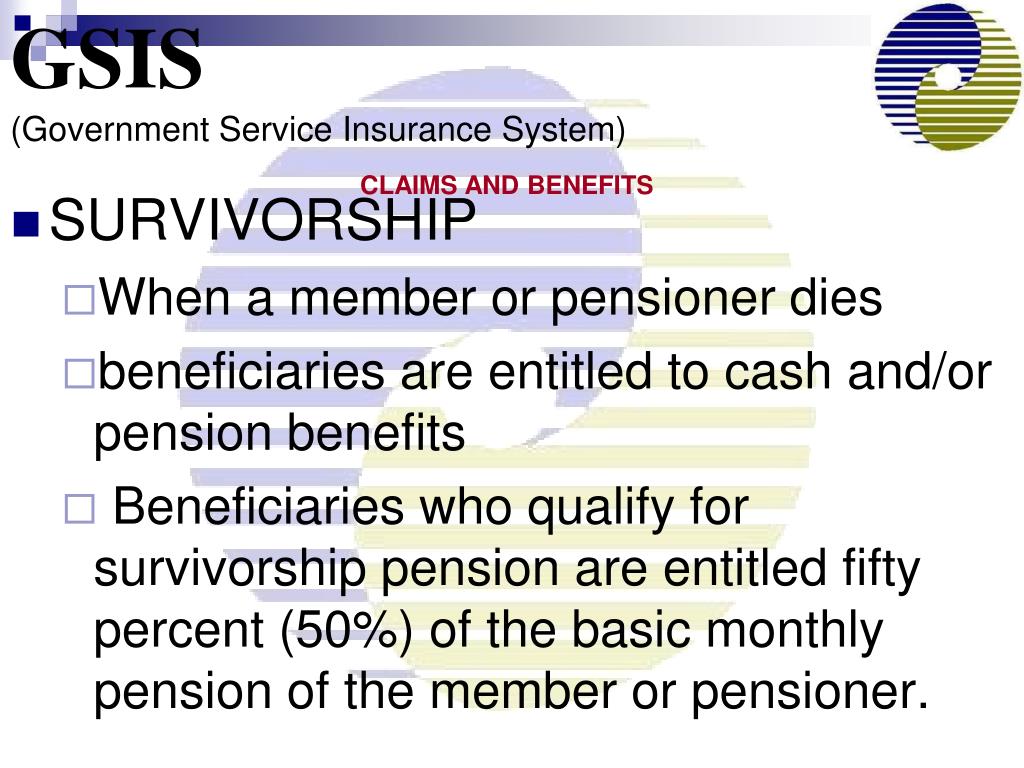

PPT Government Service Insurance System PowerPoint From slideserve.com

PPT Government Service Insurance System PowerPoint From slideserve.com

What is death in service insurance? To understand how much a policy pays out you don’t need a death in service calculator. Death in service insurance is a benefit offered by some employers that pays out a lump sum to a person of your choosing if you’re working for the company at the time of your death. It’s paid out as a tax free lump sum if you’re employed by the company (i.e. The definition of final remuneration for this purpose need not be the same as for the calculation of other benefits and may in this case be the rate payable at the date of death. As a business, the thought of losing one of your team in the event of their death is almost inconceivable.

Welcome to our guides section.

On the payroll) at the time of your death. Usually death in service pays out between two and four times your annual salary. Death in service insurance is a type of cover that may be offered as a benefit by the company you work for. For example, if you were earning £35,000 a year, three times this amount would be a lump sum of £105,000. There is no legal requirement for employers to provide a death in service benefit. What does death in service mean?

Source: planmoneytax.com

Source: planmoneytax.com

The death of a federal employee. What’s death in service cover and how does it work? Death in service insurance is a type of cover that may be offered as a benefit by the company you work for. Death in service insurance is a benefit offered by some employers that pays out a lump sum to a person of your choosing if you’re working for the company at the time of your death. So, check with your human resources department to see if you’re entitled to this cover.

Source: gocompare.com

Source: gocompare.com

Often, employers will provide guidance to employees at that initial stage and then when the employee is retiring, but rarely provide ongoing reminders about the need to keep these nominations under review. That’s what makes it similar to life insurance , but there are several things that make it different. 6.1 when a death in service occurs, the deceased employee’s line manager is responsible for completing a leaver form as soon as practicable. Usually death in service pays out between two and four times your annual salary. There are usually 3 types of benefit paid on death in service:

Source: slideserve.com

Source: slideserve.com

Death in service may be offered by companies as part of an employee’s benefits package. While death in service may sound similar to life insurance, there are in fact a number of differences. The payout is typically between 2 and 4. Usually death in service pays out between two and four times your annual salary. It held it was a loss to his dependants (not the employee) and only a nominal sum would be awarded of about £350.

Source: hollymumbycroft.org.uk

Source: hollymumbycroft.org.uk

The payout is typically between 2 and 4. What is death in service insurance? Put the date they died into the ‘date of leaving’ field in your next full payment submission ( fps ), and deduct tax using their. Unlike life insurance, death in service cover ends if you leave the company. Death in service insurance is a type of cover that may be offered as a benefit by the company you work for.

Source: protectmypeople.com

Source: protectmypeople.com

However, to put it simply, neither death in service premiums nor benefits are typically subject to taxation. So if you lose your job or move employers, you’ll no longer be protected. For example, if you were earning £35,000 a year, three times this amount would be a lump sum of £105,000. Usually death in service pays out between two and four times your annual salary. It held it was a loss to his dependants (not the employee) and only a nominal sum would be awarded of about £350.

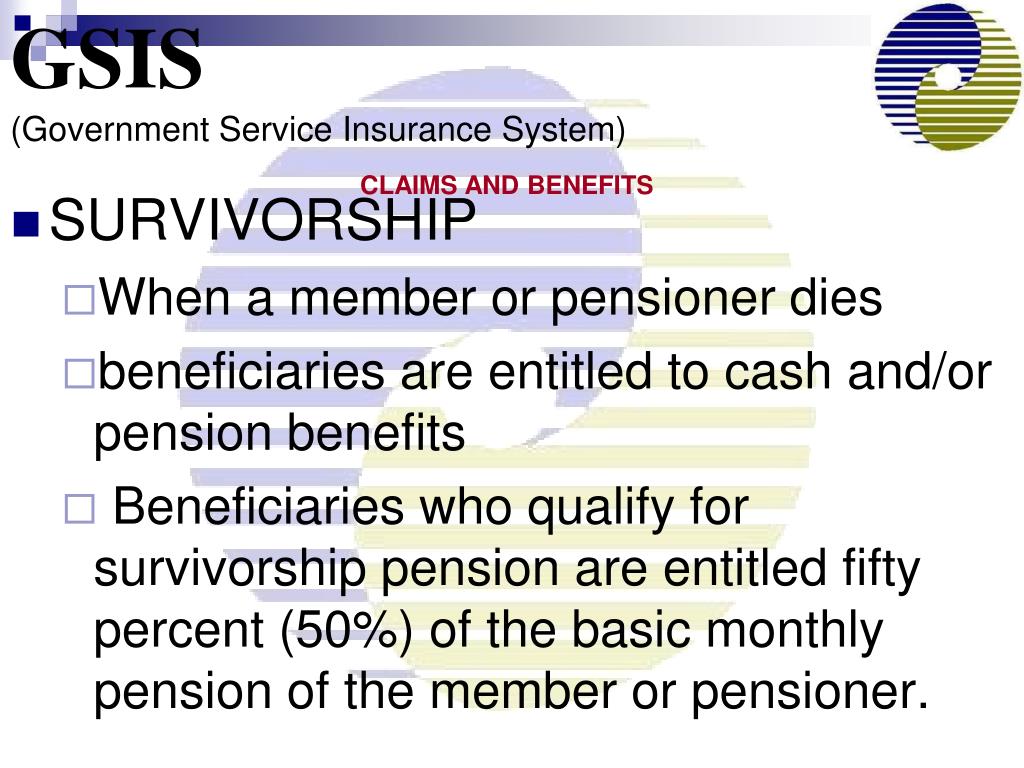

Source: pmadit.com

Source: pmadit.com

A death in service lump sum. That’s what makes it similar to life insurance , but there are several things that make it different. You must make all outstanding payments when an employee dies. So, check with your human resources department to see if you’re entitled to this cover. To understand how much a policy pays out you don’t need a death in service calculator.

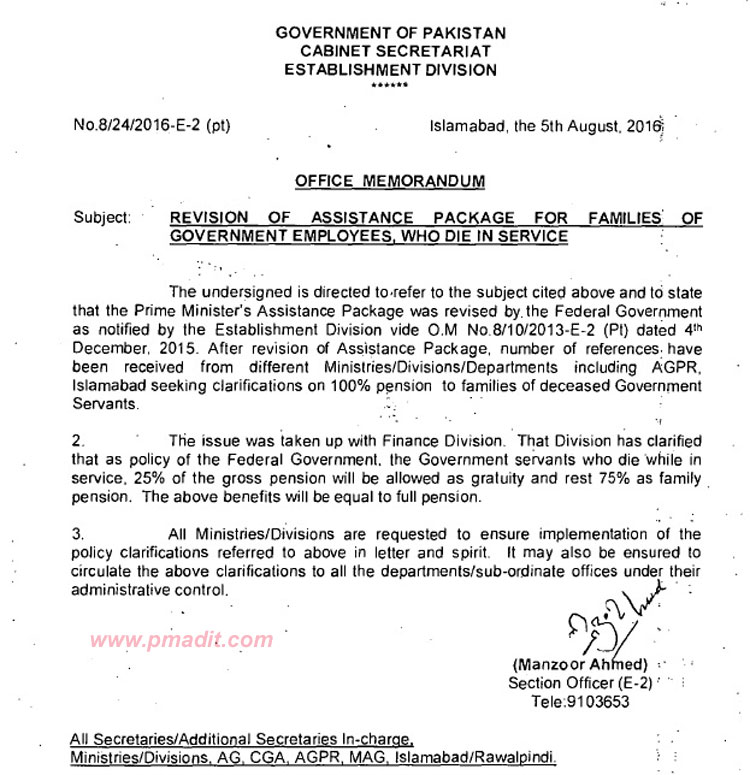

Source: nyretirementnews.com

Source: nyretirementnews.com

The payout is typically between 2 and 4. It’s paid out as a tax free lump sum if you’re employed by the company (i.e. So, check with your human resources department to see if you’re entitled to this cover. Under a death in service scheme the employer pays the premiums but the employee’s family are the ones who benefit from it. Death in service insurance is a type of cover that may be offered as a benefit by the company you work for.

Source: wagneragency.com

Source: wagneragency.com

The payout is typically between 2 and 4. It’s paid out as a tax free lump sum if you’re employed by the company (i.e. 6.2 to prevent an exit interview questionnaire being issued and to prevent unnecessary communication with the next of kin, the leaver form must state “death in service”. So if, at the time of your death, you are earning £50,000 a year from your company, then your dependents can expect to. Death in service may be offered by companies as part of an employee’s benefits package.

Source: financialtechtools.ca

Source: financialtechtools.ca

Ongoing emotional support we�ll give affected family members and colleagues access to bereavement counselling by qualified professionals.; How is death in service insurance taxed? So, check with your human resources department to see if you’re entitled to this cover. As a business, the thought of losing one of your team in the event of their death is almost inconceivable. It’s paid out as a tax free lump sum if you’re employed by the company (i.e.

Source: petkovichlaw.com

Source: petkovichlaw.com

What is death in service insurance? You must make all outstanding payments when an employee dies. It’s paid out as a tax free lump sum if you’re employed by the company (i.e. To understand how much a policy pays out you don’t need a death in service calculator. Yet, according to insurance broker drewberry, only 13.

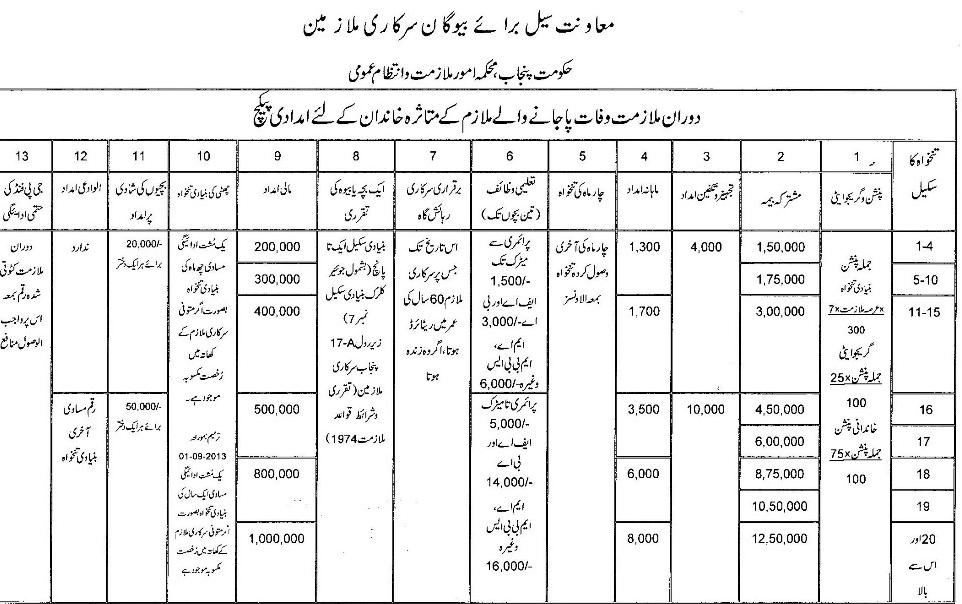

Source: gconnect.in

Source: gconnect.in

What is death in service cover? It’s paid out as a tax free lump sum if you’re employed by the company (i.e. Ongoing emotional support we�ll give affected family members and colleagues access to bereavement counselling by qualified professionals.; Death in service insurance is a type of cover that may be offered as a benefit by the company you work for. There is no legal requirement for employers to provide a death in service benefit.

Source: gsis.gov.ph

Source: gsis.gov.ph

A death in service lump sum. Is death in service the same as life insurance? How is death in service insurance taxed? To understand how much a policy pays out you don’t need a death in service calculator. (read more) how to buy death in service insurance.

Source: bizmalawionline.com

Source: bizmalawionline.com

It’s often offered as a company benefit. It’s a sum of money that’s paid out if you pass away. Here you can find answers to questions you may have about death in service insurance, the benefits to both employers and staff, definitions of common terms and more. Is death in service the same as life insurance? So, check with your human resources department to see if you’re entitled to this cover.

Source: bemoneyaware.com

Source: bemoneyaware.com

Under a death in service scheme the employer pays the premiums but the employee’s family are the ones who benefit from it. It’s often offered as a company benefit. Welcome to our guides section. So, check with your human resources department to see if you’re entitled to this cover. What is death in service insurance?

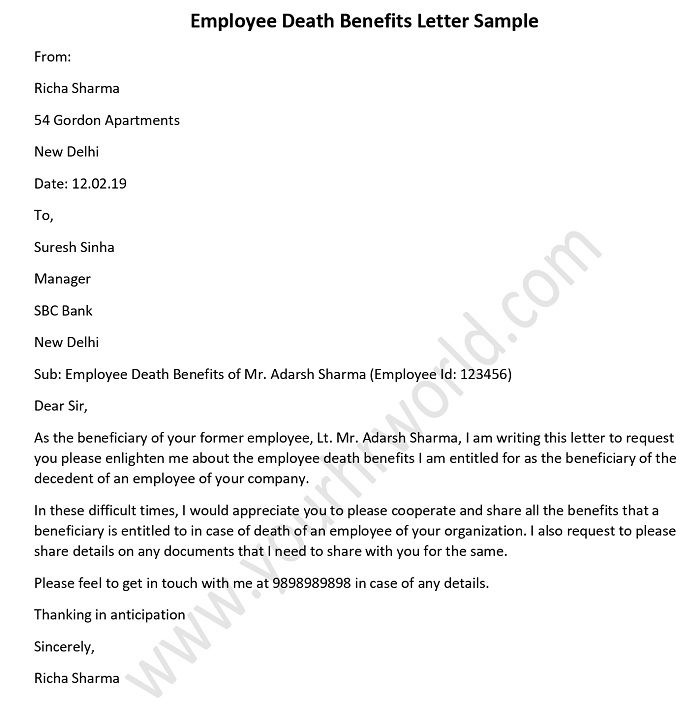

Source: yourhrworld.com

Source: yourhrworld.com

Usually death in service pays out between two and four times your annual salary. What is death in service insurance? People sometimes refer to a death in service benefit as ‘death insurance’, or a ‘death policy’. So if you lose your job or move employers, you’ll no longer be protected. Ongoing emotional support we�ll give affected family members and colleagues access to bereavement counselling by qualified professionals.;

Source: glxspace.com

Source: glxspace.com

So if you lose your job or move employers, you’ll no longer be protected. This can therefore cause confusion as to how and when hmrc taxes a death in service policy. It held it was a loss to his dependants (not the employee) and only a nominal sum would be awarded of about £350. Death in service insurance is a type of cover that may be offered as a benefit by the company you work for. Death in service may be offered by companies as part of an employee’s benefits package.

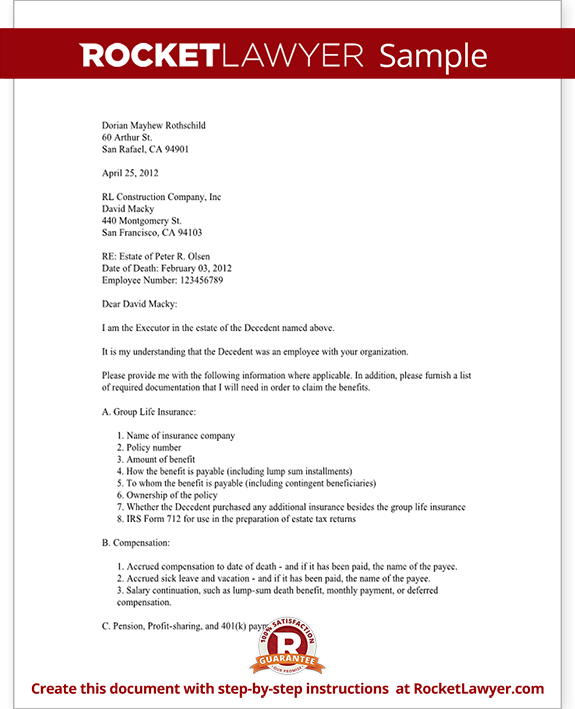

Source: rocketlawyer.com

Source: rocketlawyer.com

What’s death in service cover and how does it work? The death of a federal employee. The staff member just needs to be on your payroll. You must make all outstanding payments when an employee dies. How is death in service insurance taxed?

Source: infobuzzadda.com

Source: infobuzzadda.com

The definition of final remuneration for this purpose need not be the same as for the calculation of other benefits and may in this case be the rate payable at the date of death. While death in service may sound similar to life insurance, there are in fact a number of differences. Is death in service the same as life insurance? How much should employers pay out when tragedy strikes. Usually death in service pays out between two and four times your annual salary.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title death in service insurance for employees by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information