Death insurance policy india information

Home » Trend » Death insurance policy india informationYour Death insurance policy india images are ready. Death insurance policy india are a topic that is being searched for and liked by netizens today. You can Find and Download the Death insurance policy india files here. Find and Download all royalty-free photos and vectors.

If you’re looking for death insurance policy india images information linked to the death insurance policy india keyword, you have come to the ideal blog. Our website always gives you suggestions for seeing the maximum quality video and image content, please kindly search and find more informative video articles and images that match your interests.

Death Insurance Policy India. Term insurance is that form of life insurance that is most easy to understand. Life insurance policy gives us chance to make positive changes in our life. We all work hard to enhance our family’s financial status &lifestyle, to fund our children’s education and. Features of a term life insurance policy in india.

Death Insurance Policy India Life Insurance Types Of From columbushot.blogspot.com

Death Insurance Policy India Life Insurance Types Of From columbushot.blogspot.com

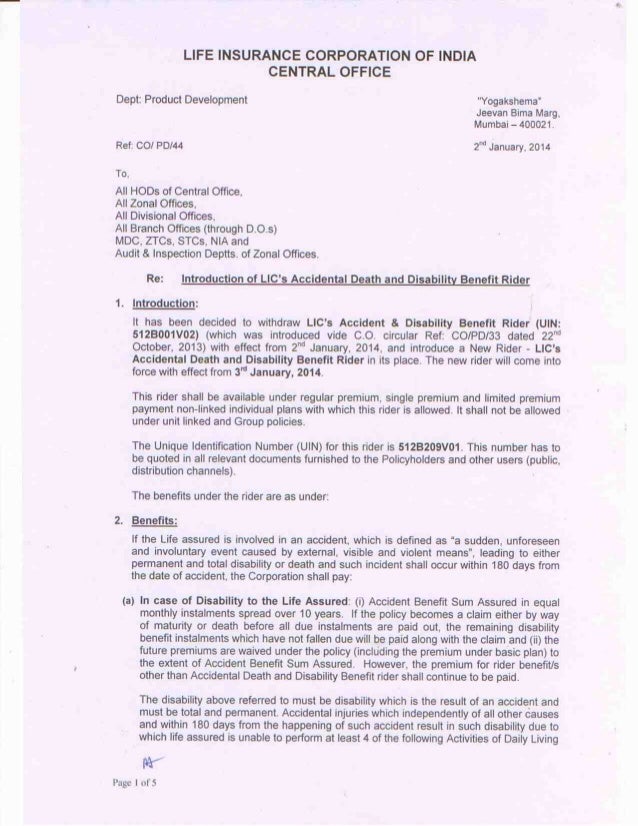

People are however less aware about the benefits of insurance that extend beyond death benefit or maturity benefit. Overall, general insurance comprises different types of insurance policy that offer financial protection against losses incurred due to liabilities such as bike, car. The insurance regulatory and development authority of india (irdai) specifies that there should be a suicide clause in the policy that governs this aspect. Option to include cover for 64 critical illnesses and accidents too. 100 % of the sum insured on the accidental death of the insured person. 5 type of health insurance policies in india #1.

There are primarily seven different types of insurance policies when it comes to life insurance.

Claiming for more than two policies if the beneficiary makes claims for two or more term insurance policies, then they should follow the steps as per the guidelines of the insurance regulatory and development authority of india. Types of insurance policies available in india. You can also add rider plans. Hdfc standard life insurance is a highly reputed private insurance company operating in india today. It is the one plan we recommend if you want to assure your loved ones of cost effective protection, if the worst were to happen. Personal accident insurance plans provide coverage against accidental death, disabilities, and hospitalisation expenses that one might incur due to an accident.

Source: taylorimagecollection.blogspot.com

Source: taylorimagecollection.blogspot.com

All the benefits covered in the plan are available to you and cannot be transferred. Term plan offers a sufficiently large amount to your family at the time of death of policyholder. This page lists some of the top personal accident insurance policies available in india. Best life insurance companies in india. We all work hard to enhance our family’s financial status &lifestyle, to fund our children’s education and.

Source: factly.in

Source: factly.in

100 % payment of the sum insured on permanent total disablement. At icici lombard, our accident insurance policy covers disability insurance along with accidental death insurance. 5 type of health insurance policies in india #1. If you have an individual health insurance policy, you alone will be eligible to claim the benefit of the entire sum assured. Every year, more than 8,000,00 people commit suicide around the world and 17% of them are from india.

Source: insurancefunda.in

Source: insurancefunda.in

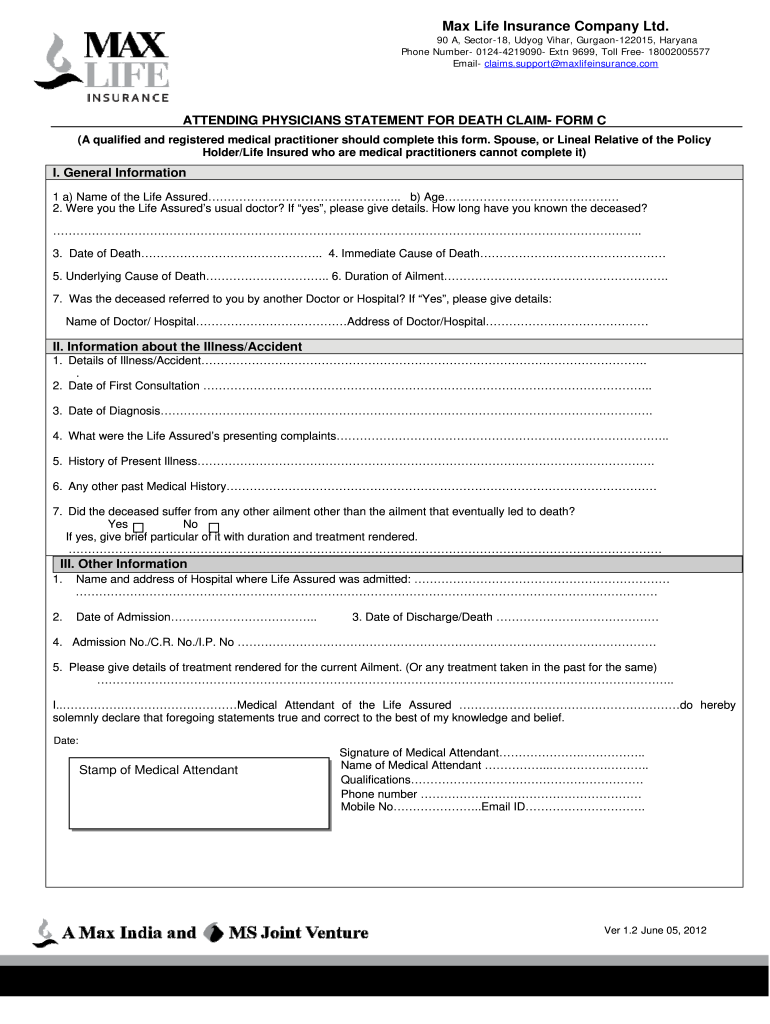

Max life is known for offering customized policy terms from 10 years to 35 years based on customer needs. 100 % payment of the sum insured in the event of loss of. 100 % of the sum insured on the accidental death of the insured person. Buy the best personal accident insurance policy online in india. Buy the best term insurance plan in india at just rs.

Source: taylorimagecollection.blogspot.com

Source: taylorimagecollection.blogspot.com

Save tax u/s 80c & 80d of income tax act 1961. The plan covers your family from the risk of death for the limited period called term. This combination provides financial protection against death throughout the lifetime of the policyholder with the provision of payment of lumpsum at the end of the selected policy term in case of his/her survival. Types of life insurance policies. The health insurance coverage offered under awaz health insurance is rs.15000, while the cover for death is rs.2 lakh.

Source: taylorimagecollection.blogspot.com

Source: taylorimagecollection.blogspot.com

The plan covers your family from the risk of death for the limited period called term. Overall, general insurance comprises different types of insurance policy that offer financial protection against losses incurred due to liabilities such as bike, car. Hdfc standard life insurance is a highly reputed private insurance company operating in india today. At reliance general insurance, we endeavor to provide you with the best possible personal accident insurance cover for you. Best term insurance company in india 2022.

Source: timesofindia.indiatimes.com

Source: timesofindia.indiatimes.com

100 % of the sum insured on the accidental death of the insured person. You can also add rider plans. Types of insurance policies available in india. Life insurance policy gives us chance to make positive changes in our life. Types of life insurance policies.

Source: punitshet.com

Source: punitshet.com

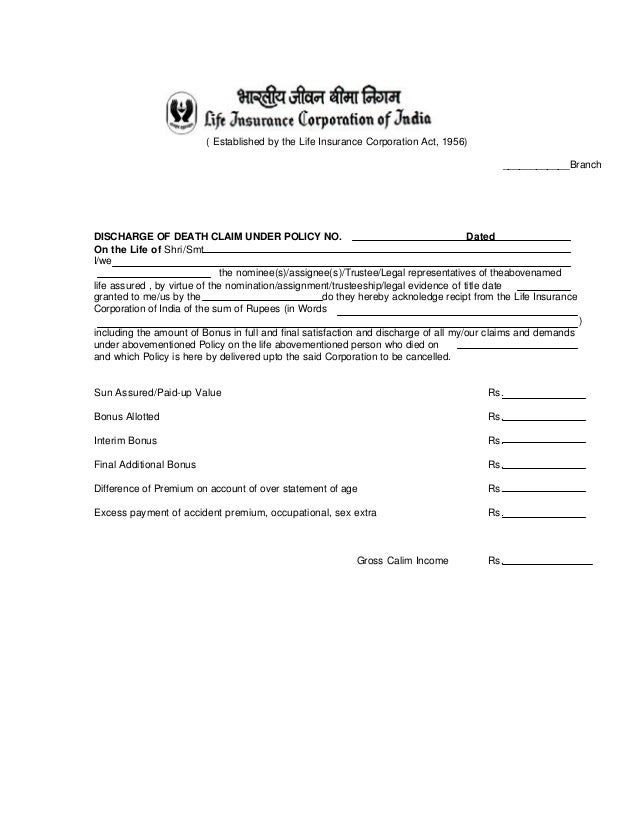

They shall be provided with an awaz health insurance card, post submitting and processing of enrolment details pertaining to biometric information. Life insurance corporation of india established in 1956, life insurance corporation of india (lic) is the oldest and largest insurance company and boasts of a very large customer base. There are several advantageous features of a term plan that you should know before buying one. Term plan offers a sufficiently large amount to your family at the time of death of policyholder. This combination provides financial protection against death throughout the lifetime of the policyholder with the provision of payment of lumpsum at the end of the selected policy term in case of his/her survival.

Source: dnaindia.com

Source: dnaindia.com

Claiming for more than two policies if the beneficiary makes claims for two or more term insurance policies, then they should follow the steps as per the guidelines of the insurance regulatory and development authority of india. Usually, it is 180 days from the accident. Best life insurance companies in india. In most term insurance plans like the future generali express term life plan , the policy gets void if the life assured dies by suicide within one year of taking the insurance policy. Claiming for more than two policies if the beneficiary makes claims for two or more term insurance policies, then they should follow the steps as per the guidelines of the insurance regulatory and development authority of india.

Source: youtube.com

Source: youtube.com

Term insurance is that form of life insurance that is most easy to understand. Subsequently, the beneficiary of the policy receives the sum assured amount as a death benefit by the insurance company. At reliance general insurance, we endeavor to provide you with the best possible personal accident insurance cover for you. The plan covers your family from the risk of death for the limited period called term. Save tax u/s 80c & 80d of income tax act 1961.

Source: columbushot.blogspot.com

Source: columbushot.blogspot.com

Kotak life insurance provides a wide range of life insurance products such as term insurance, health insurance, annuity and. The cases of suicide in india are also increasing every year, which has pushed our country among the top 12 countries with the maximum number of suicide cases per year. Get all your premium money back at the end of policy. People are however less aware about the benefits of insurance that extend beyond death benefit or maturity benefit. Term plan offers a sufficiently large amount to your family at the time of death of policyholder.

Source: uslegalforms.com

Source: uslegalforms.com

100 % payment of the sum insured in the event of loss of. Usually, it is 180 days from the accident. This page lists some of the top personal accident insurance policies available in india. If you have an individual health insurance policy, you alone will be eligible to claim the benefit of the entire sum assured. 100 % of the sum insured on the accidental death of the insured person.

Source: healthinsuranceindia.blogspot.com

Source: healthinsuranceindia.blogspot.com

Best term insurance company in india 2022. The health insurance coverage offered under awaz health insurance is rs.15000, while the cover for death is rs.2 lakh. They shall be provided with an awaz health insurance card, post submitting and processing of enrolment details pertaining to biometric information. Personal accident insurance plans provide coverage against accidental death, disabilities, and hospitalisation expenses that one might incur due to an accident. If you have an individual health insurance policy, you alone will be eligible to claim the benefit of the entire sum assured.

Source: insurancefunda.in

Source: insurancefunda.in

The health insurance coverage offered under awaz health insurance is rs.15000, while the cover for death is rs.2 lakh. It is the one plan we recommend if you want to assure your loved ones of cost effective protection, if the worst were to happen. Types of life insurance policies. Kotak life insurance provides a wide range of life insurance products such as term insurance, health insurance, annuity and. For a long time, insurance has been associated with death and how you can leave something behind for your loved ones.

Source: myinsuranceclub.com

Source: myinsuranceclub.com

Term insurance is that form of life insurance that is most easy to understand. Max life is known for offering customized policy terms from 10 years to 35 years based on customer needs. Subsequently, the beneficiary of the policy receives the sum assured amount as a death benefit by the insurance company. Buy the best term insurance plan in india at just rs. Life insurance policy gives us chance to make positive changes in our life.

Source: columbushot.blogspot.com

Source: columbushot.blogspot.com

At icici lombard, our accident insurance policy covers disability insurance along with accidental death insurance. 100 % of the sum insured on the accidental death of the insured person. 5 type of health insurance policies in india #1. For a long time, insurance has been associated with death and how you can leave something behind for your loved ones. The plan covers your family from the risk of death for the limited period called term.

Source: taylorimagecollection.blogspot.com

Source: taylorimagecollection.blogspot.com

Hdfc standard life insurance is a highly reputed private insurance company operating in india today. Types of insurance policies available in india. We all work hard to enhance our family’s financial status &lifestyle, to fund our children’s education and. At reliance general insurance, we endeavor to provide you with the best possible personal accident insurance cover for you. People are however less aware about the benefits of insurance that extend beyond death benefit or maturity benefit.

Source: slideshare.net

Source: slideshare.net

Types of insurance policies available in india. Max life is known for offering customized policy terms from 10 years to 35 years based on customer needs. Every year, more than 8,000,00 people commit suicide around the world and 17% of them are from india. 100 % payment of the sum insured in the event of loss of. Personal accident insurance plans provide coverage against accidental death, disabilities, and hospitalisation expenses that one might incur due to an accident.

Source: slideshare.net

Source: slideshare.net

Types of insurance policies available in india. Apply for max life insurance. Term insurance is that form of life insurance that is most easy to understand. The health insurance coverage offered under awaz health insurance is rs.15000, while the cover for death is rs.2 lakh. There are several advantageous features of a term plan that you should know before buying one.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title death insurance policy india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information