Death insurance singapore Idea

Home » Trending » Death insurance singapore IdeaYour Death insurance singapore images are ready. Death insurance singapore are a topic that is being searched for and liked by netizens today. You can Find and Download the Death insurance singapore files here. Get all free photos and vectors.

If you’re looking for death insurance singapore images information linked to the death insurance singapore topic, you have come to the right blog. Our site frequently provides you with hints for seeking the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

Death Insurance Singapore. If you have made a nomination, we will pay one lump sum to the recipient as shown in the table below. Moreover, life insurance plans also exclude the death of an individual due to involvement in adventure sports like skydiving, parachuting, rafting, bungee jumping, etc. Singlife�s term life insurance policy allows consumers to purchase up to s$10,000,000 of death and terminal illness coverage online with the option to purchase total & permanent disability or critical illness riders. A car accident which results in damage to property (property damage or personal injury claims).

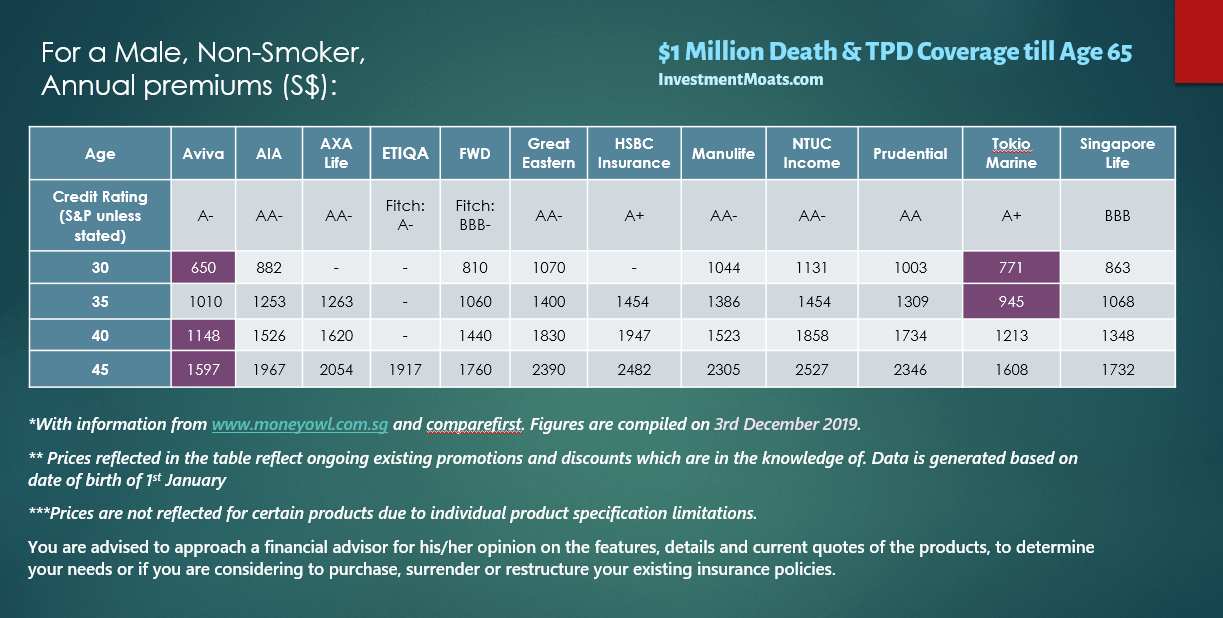

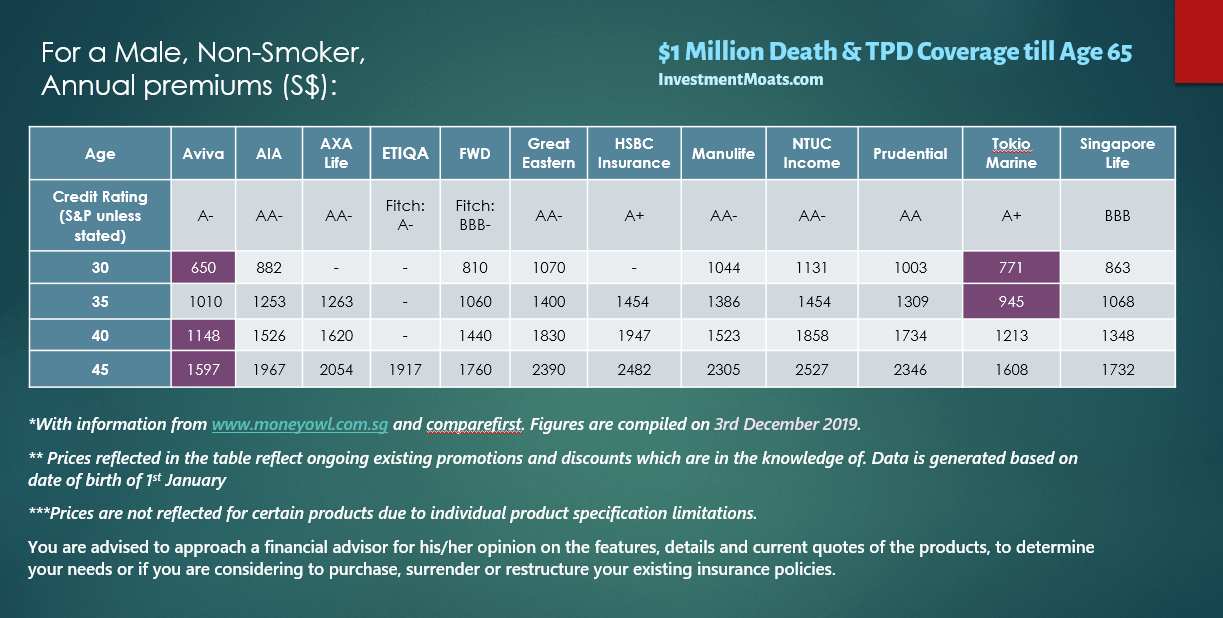

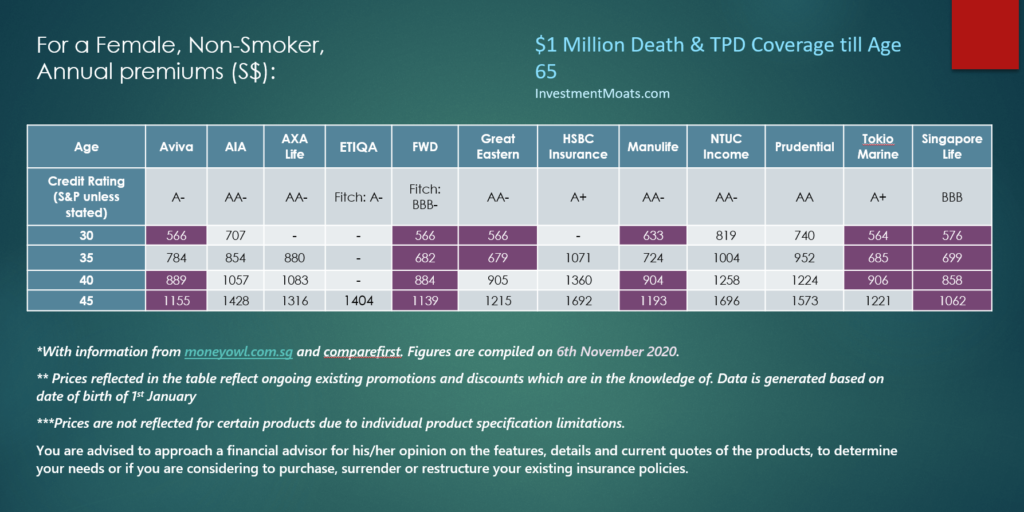

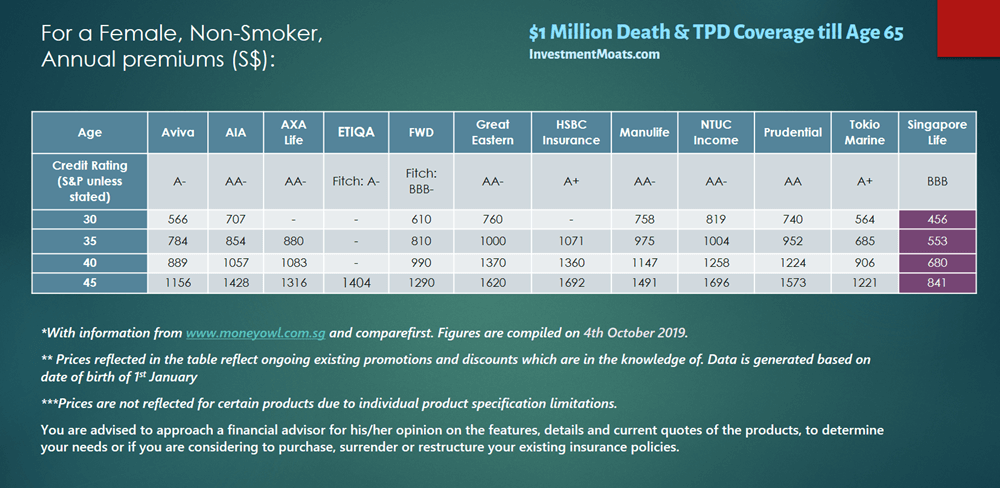

The Cheapest Term Life Insurance in Singapore **Updated From investmentmoats.com

The Cheapest Term Life Insurance in Singapore **Updated From investmentmoats.com

For overseas deaths (singaporeans or permanent residents), please certify the death certificate at our customer service centre. Death claim proceeds will be paid based on your nomination. The starting point in insurance claims is invariably where there is a claim by the insured against the insurer when an insured event has occurred. Terminal illness insurance provides a lump sum payment if you are diagnosed with a terminal illness, which can help you and your family cover the high costs of medical care that may incur during your last few months. Etiqa covers death, terminal illness and tpd in its basic plan. It confirms receipt of the singapore ic, passport and overseas death certificate

Singlife�s term life insurance policy allows consumers to purchase up to s$10,000,000 of death and terminal illness coverage online with the option to purchase total & permanent disability or critical illness riders.

Guaranteed renewal when policy expires total and permanent disability protection From the deceased’s life insurance. 1) newspaper clipping (if any) 2) police report and/or coroner’s report Eldershield plans comparison portal (compare across all insurers in singapore) ideal insurance coverage in the event of death let the final gift to those left behind may be financial assurance. Singapore�s health insurance industry to quadruple to $8.7b by 2020: It confirms receipt of the singapore ic, passport and overseas death certificate

Source: smartwealth.sg

Source: smartwealth.sg

We encourage you to make a nomination. S$2,000 for fractures s$50 daily hospital cash s$1,000 home recuperation s$10,000 emergency medical evacuation Etiqa covers death, terminal illness and tpd in its basic plan. This letter is issued by ica for singaporeans or permanent residents who died overseas. The starting point in insurance claims is invariably where there is a claim by the insured against the insurer when an insured event has occurred.

![6 Best Personal Accident Insurance in Singapore [2020] 6 Best Personal Accident Insurance in Singapore [2020]](https://www.bestinsingapore.co/wp-content/uploads/2020/03/2-min-31-768x309.png) Source: bestinsingapore.co

Source: bestinsingapore.co

If you have made a nomination, we will pay one lump sum to the recipient as shown in the table below. Term insurance pays out only upon death or total and permanent disability and only within a fixed period of time. Examples of insured events may be: With the rise of insurance savings plans, you might have multiple plans that provide you with death payouts. Certified true copy of a death certificate.

Source: indexmundi.com

Source: indexmundi.com

Examples of insured events may be: Singapore�s health insurance industry to quadruple to $8.7b by 2020: S$2,000 for fractures s$50 daily hospital cash s$1,000 home recuperation s$10,000 emergency medical evacuation Eldershield plans comparison portal (compare across all insurers in singapore) ideal insurance coverage in the event of death let the final gift to those left behind may be financial assurance. A car accident which results in damage to property (property damage or personal injury claims).

Source: investmentmoats.com

Source: investmentmoats.com

Singapore�s health insurance industry to quadruple to $8.7b by 2020: A life insurance policy pays out an amount of money (that has been agreed between the insurance holder and the insurance company) to the named beneficiaries of the insurance holder when certain circumstances occur, such as the death of the insurance holder. Eldershield plans comparison portal (compare across all insurers in singapore) ideal insurance coverage in the event of death let the final gift to those left behind may be financial assurance. The starting point in insurance claims is invariably where there is a claim by the insured against the insurer when an insured event has occurred. Term insurance pays out only upon death or total and permanent disability and only within a fixed period of time.

Source: investmentmoats.com

Source: investmentmoats.com

For accidental/unnatural death, or for death occurred overseas, we require these additional documents: A life insurance policy pays out an amount of money (that has been agreed between the insurance holder and the insurance company) to the named beneficiaries of the insurance holder when certain circumstances occur, such as the death of the insurance holder. Just choose your sum assured (s$401,000 up to s$2 million) and your desired protection term. Etiqa covers death, terminal illness and tpd in its basic plan. The starting point in insurance claims is invariably where there is a claim by the insured against the insurer when an insured event has occurred.

Source: corecu.ie

Source: corecu.ie

Singapore�s health insurance industry to quadruple to $8.7b by 2020: Singapore�s health insurance industry to quadruple to $8.7b by 2020: Letter from immigration and checkpoint authority (ica). Etiqa covers death, terminal illness and tpd in its basic plan. Examples of insured events may be:

iStock_000037836406XLarge.jpg “Death Claims Process Tokio Marine Singapore An”) Source: tokiomarine.com

Terminal illness insurance provides a lump sum payment if you are diagnosed with a terminal illness, which can help you and your family cover the high costs of medical care that may incur during your last few months. A car accident which results in damage to property (property damage or personal injury claims). Coverage up to s$500,000 and premium guaranteed throughout the policy term. Eldershield plans comparison portal (compare across all insurers in singapore) ideal insurance coverage in the event of death let the final gift to those left behind may be financial assurance. Online insurance company, insurance claims | fwd singapore

![The 5 Best Health Insurance in Singapore [2020] The 5 Best Health Insurance in Singapore [2020]](https://www.bestinsingapore.co/wp-content/uploads/2020/02/Best-Health-Insurance-in-Singapore-min.png) Source: bestinsingapore.co

Source: bestinsingapore.co

Etiqa covers death, terminal illness and tpd in its basic plan. The letter is issued by ica for singaporeans or permanent residents who died overseas. We encourage you to make a nomination. Moreover, life insurance plans also exclude the death of an individual due to involvement in adventure sports like skydiving, parachuting, rafting, bungee jumping, etc. Additional documents required if death was due to an accident or if death occurred overseas:

Source: youtube.com

Source: youtube.com

We encourage you to make a nomination. Certified true copy of a death certificate. For accidental/unnatural death, or for death occurred overseas, we require these additional documents: Documents provided that the original document is issued in singapore by the relevant authorities and fsc/ir is not related to the policy owner and/or claimant by blood or marriage. Must be provided if the selected payment method is direct credit to a singapore bank account or telegraphic fund transfer to an overseas bank account.

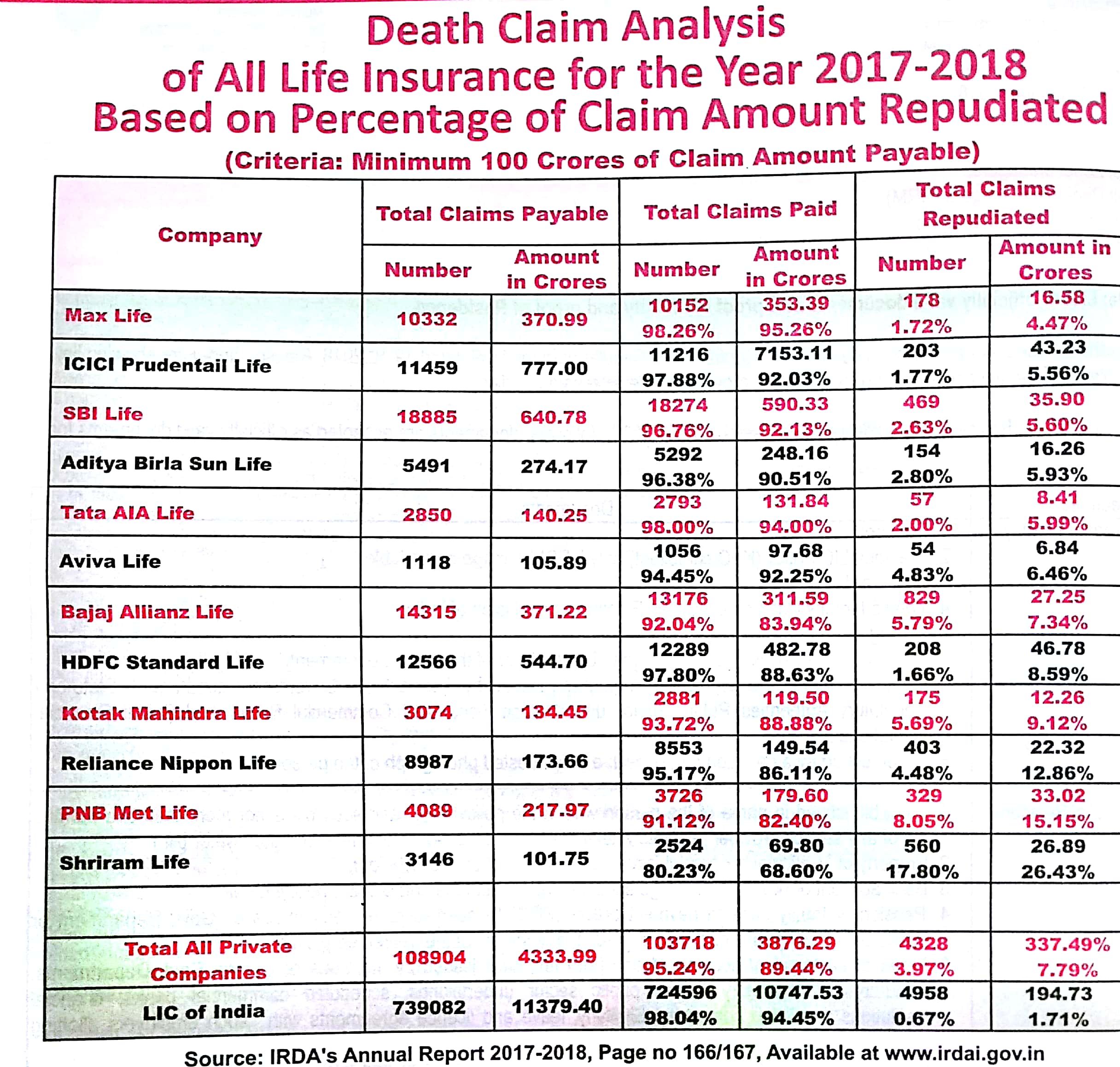

Source: licinsurance.online

Source: licinsurance.online

Term insurance pays out only upon death or total and permanent disability and only within a fixed period of time. Documents provided that the original document is issued in singapore by the relevant authorities and fsc/ir is not related to the policy owner and/or claimant by blood or marriage. Term insurance coverage for death, terminal illness and total and permanent disability (tpd before age 65). Terminal illness insurance provides a lump sum payment if you are diagnosed with a terminal illness, which can help you and your family cover the high costs of medical care that may incur during your last few months. Term insurance pays out only upon death or total and permanent disability and only within a fixed period of time.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

The company reserves the right to obtain further information. The starting point in insurance claims is invariably where there is a claim by the insured against the insurer when an insured event has occurred. Term insurance coverage for death, terminal illness and total and permanent disability (tpd before age 65). Examples of insured events may be: Singlife�s term life insurance policy allows consumers to purchase up to s$10,000,000 of death and terminal illness coverage online with the option to purchase total & permanent disability or critical illness riders.

Source: youtube.com

Source: youtube.com

Documents provided that the original document is issued in singapore by the relevant authorities and fsc/ir is not related to the policy owner and/or claimant by blood or marriage. Examples of insured events may be: The death claim form must be completed by the claimant (above age 18 years). Certified true copy of a death certificate. For overseas deaths (singaporeans or permanent residents), please certify the death certificate at our customer service centre.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Documents provided that the original document is issued in singapore by the relevant authorities and fsc/ir is not related to the policy owner and/or claimant by blood or marriage. Terminal illness insurance provides a lump sum payment if you are diagnosed with a terminal illness, which can help you and your family cover the high costs of medical care that may incur during your last few months. Term insurance is usually cheaper than other forms of life insurance. Online insurance company, insurance claims | fwd singapore We encourage you to make a nomination.

Source: mysip.net.in

Source: mysip.net.in

Etiqa covers death, terminal illness and tpd in its basic plan. This policy is protected under the policy owners’ protection scheme which is administered by the singapore deposit insurance corporation (sdic). Online insurance company, insurance claims | fwd singapore Just choose your sum assured (s$401,000 up to s$2 million) and your desired protection term. Must be provided if the selected payment method is direct credit to a singapore bank account or telegraphic fund transfer to an overseas bank account.

Source: blog.moneysmart.sg

Source: blog.moneysmart.sg

Food poisoning which results in death (life insurance claims). Coverage for your policy is automatic and no further action is required from you. For all deaths that occurred in singapore, please certify the death certificate at our customer service centre or through a financial representative. Etiqa eprotect term life is very simple. Just choose your sum assured (s$401,000 up to s$2 million) and your desired protection term.

Source: sbo.sg

Source: sbo.sg

The letter is issued by ica for singaporeans or permanent residents who died overseas. Moreover, life insurance plans also exclude the death of an individual due to involvement in adventure sports like skydiving, parachuting, rafting, bungee jumping, etc. Examples of insured events may be: The starting point in insurance claims is invariably where there is a claim by the insured against the insurer when an insured event has occurred. Term insurance is usually cheaper than other forms of life insurance.

Source: termlife2go.com

Source: termlife2go.com

Coverage up to s$500,000 and premium guaranteed throughout the policy term. A life insurance policy pays out an amount of money (that has been agreed between the insurance holder and the insurance company) to the named beneficiaries of the insurance holder when certain circumstances occur, such as the death of the insurance holder. From the deceased’s life insurance. If you have made a nomination, we will pay one lump sum to the recipient as shown in the table below. For all deaths that occurred in singapore, please certify the death certificate at our customer service centre or through a financial representative.

Source: lerablog.org

Source: lerablog.org

A car accident which results in damage to property (property damage or personal injury claims). Moreover, life insurance plans also exclude the death of an individual due to involvement in adventure sports like skydiving, parachuting, rafting, bungee jumping, etc. Guaranteed renewal when policy expires total and permanent disability protection 1) newspaper clipping (if any) 2) police report and/or coroner’s report This type of insurance greatly benefits your family, as the payout will help reduce any medical debt.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title death insurance singapore by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea