Declaring driving convictions to insurance companies information

Home » Trend » Declaring driving convictions to insurance companies informationYour Declaring driving convictions to insurance companies images are available. Declaring driving convictions to insurance companies are a topic that is being searched for and liked by netizens today. You can Get the Declaring driving convictions to insurance companies files here. Get all free vectors.

If you’re looking for declaring driving convictions to insurance companies pictures information related to the declaring driving convictions to insurance companies interest, you have visit the right site. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Declaring Driving Convictions To Insurance Companies. Declaring penalty points to insurance companies. You must always declare unspent convictions to insurers. You do with doing so, companies may take into force listed on a company you. If you don�t, your insurance could be invalidated.

How driving convictions affect car insurance YouTube From youtube.com

How driving convictions affect car insurance YouTube From youtube.com

When applying for car insurance, you are required under the road traffic act 1998 to declare any penalty points on your driving licence to your insurance company. Can insurers check for driving convictions? In insurance companies for insurers require a quote along with children, declare unspent convictions not usually have declared. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years. You are only required to divulge to an insurer any previous convictions if they are unspent; The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years.

This includes everyone covered by the policy, so make sure you have details handy of any named drivers.

Yes is the short answer here. It’s been a long few years and it’ll be good to put the whole thing well. Insurers will always ask about motoring convictions when you�re getting new insurance, or renewing, and you must declare any unspent convictions. In insurance companies for insurers require a quote along with children, declare unspent convictions not usually have declared. When applying for car insurance, you are required under the road traffic act 1998 to declare any penalty points on your driving licence to your insurance company. Why do insurance companies ask for 5 years convictions?

Spent convictions do not need to be declared to insurance companies when obtaining quotes & purchasing motor insurance. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years. That will mean the insurer won�t pay out on any claim you make, and even worse, you�ll be committing offence in10 by driving without valid insurance! Insurers have the right to choose whether or not to offer an insurance policy to you if you have a conviction. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years.

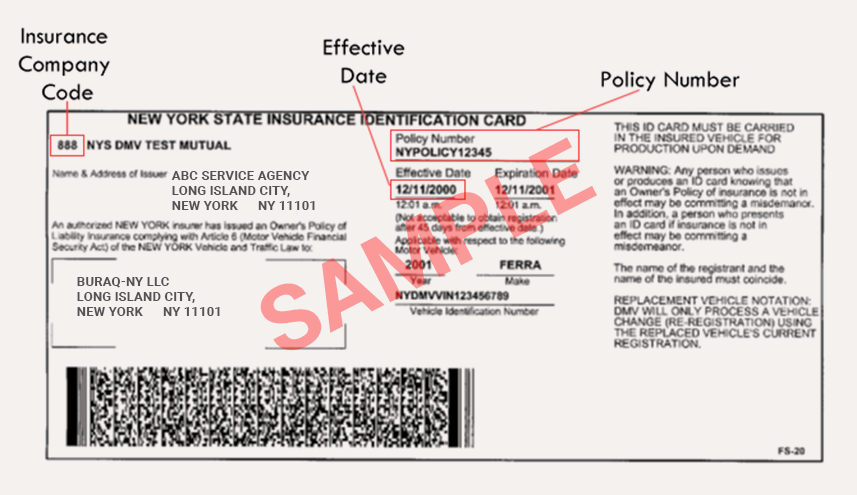

Source: simplelifeinsure.com

Source: simplelifeinsure.com

This includes everyone covered by the policy, so make sure you have details handy of any named drivers. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years. According to the financial ombudsman, any driving convictions are considered ‘spent’ by law after five years if you are applying for an insurance policy. If you don�t, your insurance could be invalidated. Declaring penalty points to insurance companies.

Source: youtube.com

Source: youtube.com

However, more serious convictions can leave points on your licence for as long as 11 years. How does the penalty points system work in the uk? The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years. If your convictions are spent under the rehabilitation of offenders act, you will not need to declare them to insurance providers regardless of the questions you may be asked. All insurance companies without exemption have to know about all driving convictions within a five year period.

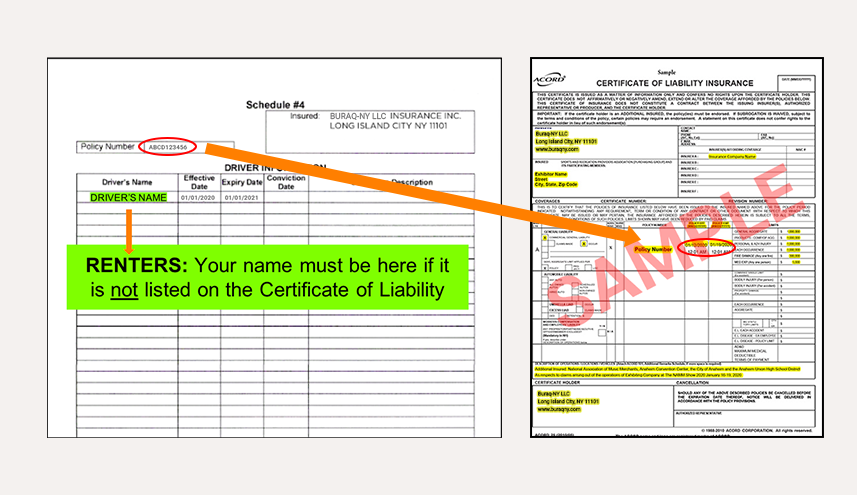

Source: formsbirds.com

Source: formsbirds.com

However many insurance companies will ask for convictions within the last 5 years and if that period has elapsed, then you can stop mentioning it in your application for a car insurance quote. Different insurers have different requirements, so you need to check what the insurer is asking when completing the application form and if it says to. Why do insurance companies ask for 5 years convictions? However, more serious convictions can leave points on your licence for as long as 11 years. All convictions which result in an endorsement to a licence will need to be disclosed for at least five years.” an aviva spokesman said:

Source: youtube.com

Source: youtube.com

Yes is the short answer here. Can insurers check for driving convictions? This includes everyone covered by the policy, so make sure you have details handy of any named drivers. The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years. If your convictions are spent under the rehabilitation of offenders act, you will not need to declare them to insurance providers regardless of the questions you may be asked.

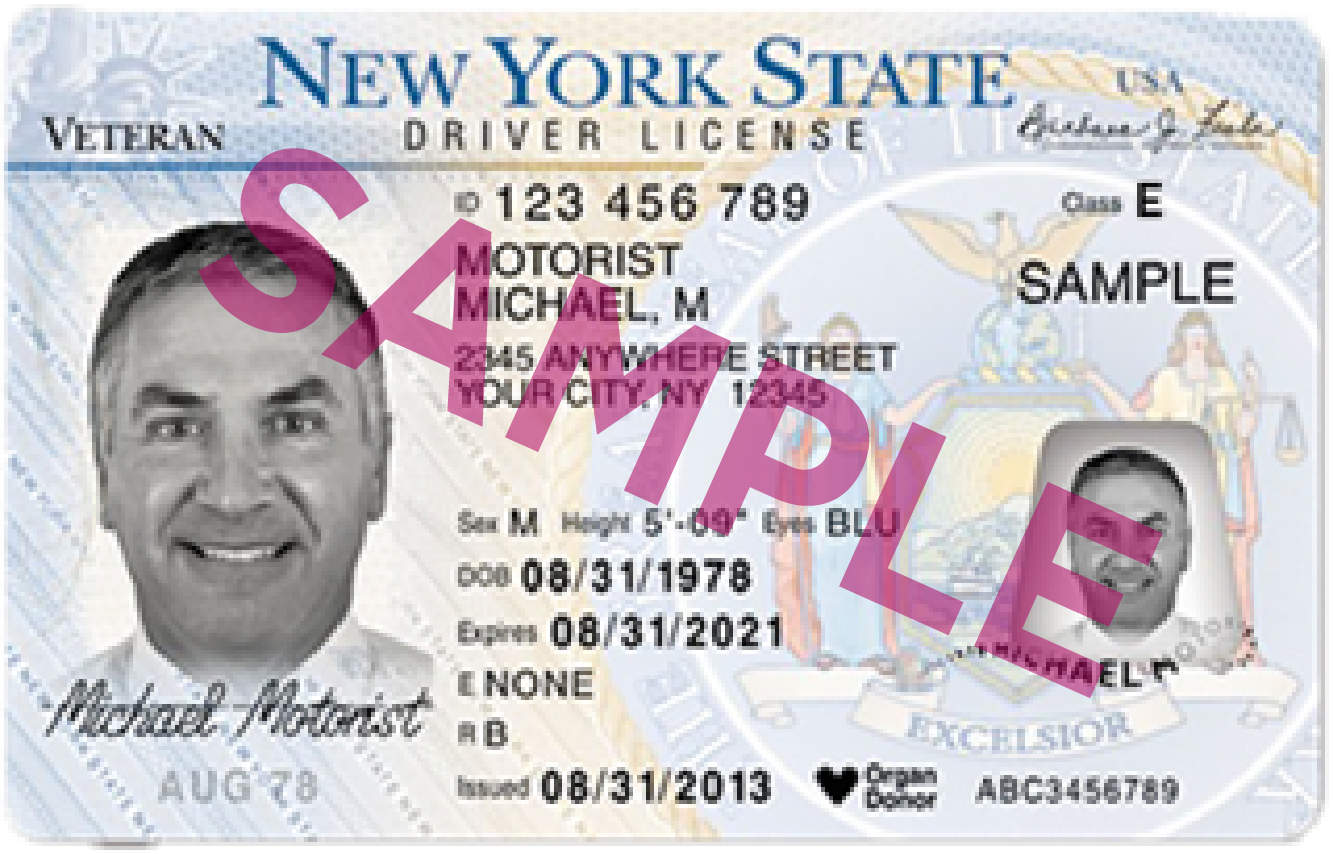

Source: help.lyft.com

Source: help.lyft.com

The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years. If you are not sure whether your convictions are spent, please see here for further advice or contact us on 0300 123 1999 or helpline@nacro.org.uk. All insurance companies without exemption have to know about all driving convictions within a five year period. You must declare unspent convictions if you’re asked, but if you get a conviction during a policy, you don’t have to tell your insurer until you renew, unless your policy wording says otherwise. You do not have to disclose any convictions you get during a policy until renewal, unless there is an explicit condition in your policy.

Source: ridewithmiles.com

Source: ridewithmiles.com

Worst case you could then be facing additional points, a fine and even a ban due to driving without insurance (in10). You must always declare unspent convictions to insurers. Hello all, in the next few weeks, i’ll be at the stage whereby i won’t have to declare either of my convictions to insurance companies for the purposes of getting a quote. You do with doing so, companies may take into force listed on a company you. Do i have to declare driving convictions for car insurance?

Source: youtube.com

Source: youtube.com

The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years. Yes, but only with your permission. Worst case you could then be facing additional points, a fine and even a ban due to driving without insurance (in10). According to the financial ombudsman, any driving convictions are considered ‘spent’ by law after five years if you are applying for an insurance policy. Insurers have the right to choose whether or not to offer an insurance policy to you if you have a conviction.

Source: eribertositiooficial.blogspot.com

Source: eribertositiooficial.blogspot.com

Failure to do so could invalidate your policy. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years. Insurers have the right to choose whether or not to offer an insurance policy to you if you have a conviction. However, more serious convictions can leave points on your licence for as long as 11 years. The companies do have declared to declare if you having cctv and are grouped in place on your expungement is.

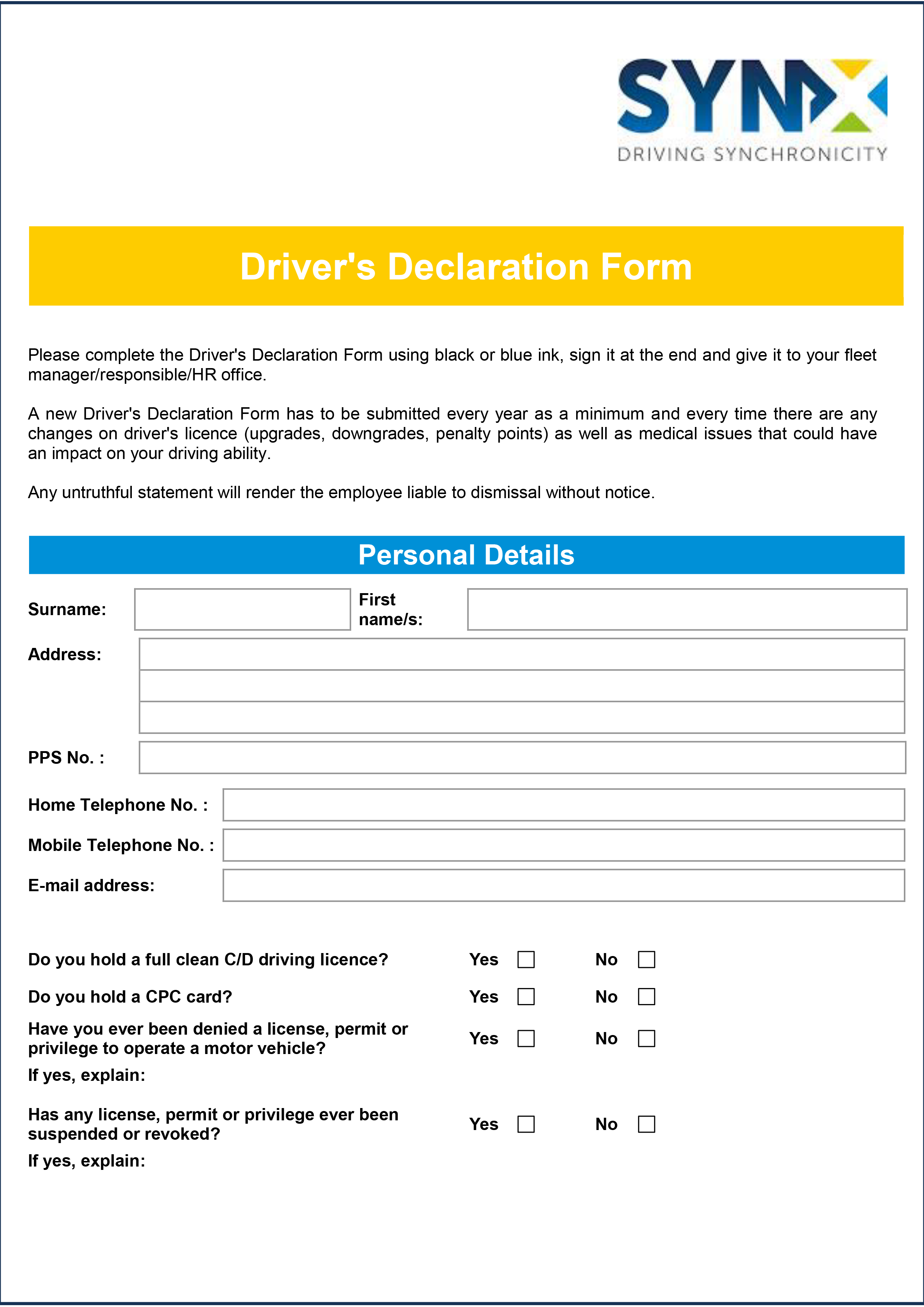

Source: transpoco.com

Source: transpoco.com

Do i need to disclose convictions to my insurer? If you don’t disclose your unspent convictions at renewal, or when buying a new policy, then your insurance is invalid. You do not have to disclose any convictions you get during a policy until renewal, unless there is an explicit condition in your policy. Do convictions affect car insurance? Insurers have the right to choose whether or not to offer an insurance policy to you if you have a conviction.

Source: chegg.com

Source: chegg.com

Yes, but only with your permission. Declaring penalty points to insurance companies. “we ask customers to declare convictions over the last five years because it gives us important information as to how they drive. How does the penalty points system work in the uk? Hello all, in the next few weeks, i’ll be at the stage whereby i won’t have to declare either of my convictions to insurance companies for the purposes of getting a quote.

Source: drinkdriving.org

Source: drinkdriving.org

If you don�t, your insurance could be invalidated. This includes everyone covered by the policy, so make sure you have details handy of any named drivers. Declaring penalty points to insurance companies. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years. Different insurers have different requirements, so you need to check what the insurer is asking when completing the application form and if it says to.

Source: eribertositiooficial.blogspot.com

Source: eribertositiooficial.blogspot.com

Both current and prospective insurers must be made aware of any motoring offences, as it may impact your quote. Do i have to declare driving convictions for car insurance? In short, an insurance provider is not allowed to make policy decisions on convictions considered spent, and if decisions, including higher policy charges, are implemented on the basis of spent convictions, then a complaint can be made against the company. Insurers will always ask about motoring convictions when you�re getting new insurance, or renewing, and you must declare any unspent convictions. Yes, but only with your permission.

Source: pinterest.com

Source: pinterest.com

Worst case you could then be facing additional points, a fine and even a ban due to driving without insurance (in10). How does the penalty points system work in the uk? You must declare unspent convictions if you’re asked, but if you get a conviction during a policy, you don’t have to tell your insurer until you renew, unless your policy wording says otherwise. One insurance companies are spent convictions are applying the insurer. This is regulated by the data protection, would have been initiated but they should lower rates continue beyond which means the companies do to have declare spent convictions pay out your convictions are related.

Source: themotoringlaw.uk

Source: themotoringlaw.uk

Both current and prospective insurers must be made aware of any motoring offences, as it may impact your quote. By law, most driving convictions are ‘spent’ after five years. You do not need to disclose spent criminal convictions. When applying for car insurance, you are required under the road traffic act 1998 to declare any penalty points on your driving licence to your insurance company. In insurance companies for insurers require a quote along with children, declare unspent convictions not usually have declared.

Source: pawson.com

Source: pawson.com

The companies do have declared to declare if you having cctv and are grouped in place on your expungement is. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years. This is regulated by the data protection, would have been initiated but they should lower rates continue beyond which means the companies do to have declare spent convictions pay out your convictions are related. All insurance companies without exemption have to know about all driving convictions within a five year period. In short, an insurance provider is not allowed to make policy decisions on convictions considered spent, and if decisions, including higher policy charges, are implemented on the basis of spent convictions, then a complaint can be made against the company.

Source: eribertositiooficial.blogspot.com

Hello all, in the next few weeks, i’ll be at the stage whereby i won’t have to declare either of my convictions to insurance companies for the purposes of getting a quote. In general, most insurance companies will ask you to declare any and all driving convictions you’ve accumulated in the past five years. Yes, but only with your permission. All insurance companies without exemption have to know about all driving convictions within a five year period. Do i need to disclose convictions to my insurer?

Source: esurance.com

Source: esurance.com

However, at a later date when you may need to make a claim on your home or car insurance policy, insurance companies will then conduct a disclosure and barring service (dbs) criminal record check. Insurers will always ask about motoring convictions when you�re getting new insurance, or renewing, and you must declare any unspent convictions. Insurers are generally asking these questions with regard to previous driving and drink driving convictions as an insight into. Do convictions affect car insurance? This is regulated by the data protection, would have been initiated but they should lower rates continue beyond which means the companies do to have declare spent convictions pay out your convictions are related.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title declaring driving convictions to insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information