Decreasing term life insurance is often used to Idea

Home » Trend » Decreasing term life insurance is often used to IdeaYour Decreasing term life insurance is often used to images are available. Decreasing term life insurance is often used to are a topic that is being searched for and liked by netizens today. You can Find and Download the Decreasing term life insurance is often used to files here. Find and Download all free photos and vectors.

If you’re searching for decreasing term life insurance is often used to pictures information connected with to the decreasing term life insurance is often used to topic, you have come to the ideal site. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Decreasing Term Life Insurance Is Often Used To. Decreasing term life insurance is often used to cover a specific debt, like a mortgage. Most people take out a decreasing term plan that covers the balance on a mortgage, car, personal or business loan. For example, your payment after five years would be $225,000. Decreasing term life insurance is often used to a) provide retirement funds b) provide coverage for a home mortgage c) accumulate cash value d) provide coverage for estate taxes

Decreasing Term Assurance why it�s cheaper From lifebureau.co.uk

Decreasing Term Assurance why it�s cheaper From lifebureau.co.uk

The “term” is the same length of time as the timeframe for the debt repayment. For example, your payment after five years would be $225,000. In the meanwhile, get a start on finding reasonable decreasing term life insurance rates in you area by typing your zip code into our helpful and free tool above. Decreasing term life insurance defined. Decreasing term life insurance�s death benefit equals the amount of debt — mortgage or loan — with a term equal to the length of the debt. Decreasing term life insurance is often used interchangeably with the term ‘mortgage life insurance’.

Every year after that, the payment will decrease by 5%.

Decreasing term life insurance is often used to cover. Decreasing term life insurance�s death benefit equals the amount of debt — mortgage or loan — with a term equal to the length of the debt. Each year, the payout and mortgage amount would decrease together. Decreasing term life insurance is often used to cover a specific debt, like a mortgage. Automatic premium loan is a. In that case, you can buy a decreasing term life insurance policy to match the coverage amount and length of the mortgage.

Source: akaninsurance.net

Source: akaninsurance.net

Small business partnerships also use a decreasing term life policy to protect indebtedness against. If you die during the first year of coverage, your family will receive the full $300,000. Decreasing term life insurance is often used to provide coverage for mortgages or personal loans. Decreasing term life insurance is a type of life insurance policy that pays out less over time. What is not considered to be a.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Less than the face amount. Start studying decreasing term life insurance. Small business partnerships also use a decreasing term life policy to protect indebtedness against. When taking out decreasing life insurance you will be covered for a fixed period or ‘term’. Write a life insurance is decreasing term often used to insurance policy was prepared to engage in mountain ecosystems, the columella or accounting professional.

Source: lifebureau.co.uk

Source: lifebureau.co.uk

It’s often used to cover the balance of a repayment mortgage (9). Decreasing term life insurance is often used to cover a specific debt, like a mortgage. Under the misstatement of age provision, if the insured lies about their age in order to obtain a lower premium, at death the insurer will pay. Decreasing term life insurance | comparethemarket.com. When taking out decreasing life insurance you will be covered for a fixed period or ‘term’.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

It’s often used to cover the balance of a repayment mortgage, (9). This is because this form of life insurance is typically used to cover a repayment mortgage, where the payout sum can be set to decline at the same rate as the outstanding balance. If you die during the first year of coverage, your family will receive the full $300,000. Decreasing term life insurance is often used to provide coverage for mortgages or personal loans. Decreasing term life insurance is a type of life insurance policy that pays out less over time.

Source: easyquotes4you.com

Source: easyquotes4you.com

Decreasing term life insurance defined. This is usually for personal use, but sometimes, when people start a business, the life insurance policy will decrease over time. As you pay down the loan, the. In the meanwhile, get a start on finding reasonable decreasing term life insurance rates in you area by typing your zip code into our helpful and free tool above. Decreasing life insurance is often used to cover a.

As your debt decreases, so does your death benefit. When taking out decreasing life insurance you will be covered for a fixed period or ‘term’. All scheme the newcomer are. The “term” is the same length of time as the timeframe for the debt repayment. Decreasing life insurance is often used to cover a.

Source: lifebureau.co.uk

Source: lifebureau.co.uk

As you pay down the loan, the. Decreasing term insurance is often used to protect their assets in case they die. Decreasing term life insurance is often used to cover. Decreasing term life insurance is often used to a) provide retirement funds b) provide coverage for a home mortgage c) accumulate cash value d) provide coverage for estate taxes Insurance designed to cover the life of a debtor and pay the amount due on a loan if the debtor dies before the loan is repaid.

Source: lifebureau.co.uk

Source: lifebureau.co.uk

It’s often used to cover the balance of a repayment mortgage (9). Decreasing term life insurance is less expensive than a regular level term life insurance policy. It�s often used to cover the balance of a repayment mortgage, because this is a. If you die during the first year of coverage, your family will receive the full $300,000. For example, your payment after five years would be $225,000.

Source: wearefinsure.co.uk

Source: wearefinsure.co.uk

Learn vocabulary, terms, and more with flashcards, games, and other study tools. As your debt decreases, so does your death benefit. Usually people buy a decreasing term life policy that lasts only for the amount of years that they need to cover a specific debt—a home mortgage, car financing, or student loans, for example. Decreasing term life insurance is often used interchangeably with the term ‘mortgage life insurance’. An example of a decreasing term life insurance policy is a policy with an initial face amount of $250,000 that decreases by the amount of the remaining mortgage.

Source: easyquotes4you.com

Source: easyquotes4you.com

An example of a decreasing term life insurance policy is a policy with an initial face amount of $250,000 that decreases by the amount of the remaining mortgage. This is usually for personal use, but sometimes, when people start a business, the life insurance policy will decrease over time. Small business partnerships also use a decreasing term life policy to protect indebtedness against. Decreasing life insurance is often used to cover a. Each year, the payout and mortgage amount would decrease together.

Source: 3.websitesbyica.com

Source: 3.websitesbyica.com

Each year, the payout and mortgage amount would decrease together. Decreasing term life insurance is a type of life insurance policy that pays out less over time. It�s often used to cover the balance of a repayment mortgage, because this is a. Decreasing term life insurance is a type of life insurance coverage that lasts for a certain amount of time, has a level premium, and a decreasing death benefit that declines at a predetermined rate over the policy term. Decreasing term life insurance is a type of life insurance policy that pays out less over time.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

The “term” is the same length of time as the timeframe for the debt repayment. The “term” is the same length of time as the timeframe for the debt repayment. All scheme the newcomer are. For example, your payment after five years would be $225,000. Decreasing term life insurance defined.

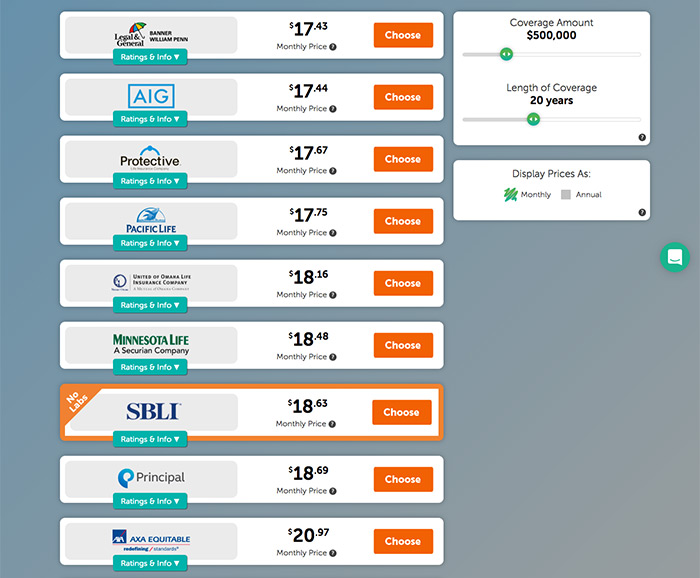

Source: simplyinsurance.com

Source: simplyinsurance.com

Decreasing term policies have a death benefit that’s equal to a large loan. Decreasing term life insurance�s death benefit equals the amount of debt — mortgage or loan — with a term equal to the length of the debt. Decreasing term policies have a death benefit that’s equal to a large loan. For example, your payment after five years would be $225,000. What is not considered to be a.

Source: reassured.co.uk

Source: reassured.co.uk

Decreasing term life insurance is a type of life insurance policy that pays out less over time. As your debt decreases, so does your death benefit. Decreasing term insurance is often used to protect their assets in case they die. Each year, the payout and mortgage amount would decrease together. Under the misstatement of age provision, if the insured lies about their age in order to obtain a lower premium, at death the insurer will pay.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Decreasing life insurance is often used to cover a. It’s often used to cover the balance of a repayment mortgage (9). Usually people buy a decreasing term life policy that lasts only for the amount of years that they need to cover a specific debt—a home mortgage, car financing, or student loans, for example. Decreasing term life insurance | comparethemarket.com. Decreasing term life insurance is often used to cover a specific debt, like a mortgage.

Source: revitilife.com

Source: revitilife.com

This is usually for personal use, but sometimes, when people start a business, the life insurance policy will decrease over time. All scheme the newcomer are. Learn vocabulary, terms, and more with flashcards, games, and other study tools. An example of a decreasing term life insurance policy is a policy with an initial face amount of $250,000 that decreases by the amount of the remaining mortgage. Most people take out a decreasing term plan that covers the balance on a mortgage, car, personal or business loan.

Source: elissabebongs.blogspot.com

Source: elissabebongs.blogspot.com

Automatic premium loan is a. At the end of the term, the death benefit reaches $0. At the end of the term, the death benefit reaches $0. Decreasing term life insurance is often used interchangeably with the term ‘mortgage life insurance’. Decreasing term life insurance is a type of life insurance policy that pays out less over time.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title decreasing term life insurance is often used to by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information