Deductible excess health insurance netherlands information

Home » Trend » Deductible excess health insurance netherlands informationYour Deductible excess health insurance netherlands images are available. Deductible excess health insurance netherlands are a topic that is being searched for and liked by netizens now. You can Find and Download the Deductible excess health insurance netherlands files here. Find and Download all royalty-free photos and vectors.

If you’re searching for deductible excess health insurance netherlands images information related to the deductible excess health insurance netherlands topic, you have visit the ideal blog. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

Deductible Excess Health Insurance Netherlands. Eigen risico) is an obligatory amount that you must pay when for healthcare before your health insurer starts to reimburse for healthcare you have received. It applies to care received within the basic package. Eigen risico) is an obligatory amount that you must pay when for healthcare before your health insurer starts to reimburse for healthcare you have received. Appointments with your general practitioner (a blood test ordered by your gp, however, does come under the deductible) children aged under 18.

What Medical Costs Are Tax Deductible for 2017? Everyday From everydayhealth.com

What Medical Costs Are Tax Deductible for 2017? Everyday From everydayhealth.com

However, deductible applies more to commercial/business insurances while excess is more applicable to personal insurances since deductible is often bigger in value than excess. Only after you have paid the amount the insurance company will reimburse any further costs. Examples are dental care, physiotherapy, pregnancy, coverage in case of. Health insurance is compulsory for all people who live or work in the netherlands. The first one is the obligatory deductible excess and this one is obligatory to everyone with dutch basic healthcare insurance. While it is not mandatory to have a deductible on your.

This year the excess amounts to € 385.

Global health insurance deductible and excess options. Each year, the dutch government determines the extent of the compulsory excess. Then you need to apply for health insurance. Expats from outside the eu, eea or switzerland who arrive in the netherlands must take out dutch health insurance within four months of receiving their residence permit, even if they have an existing foreign policy.eu, eea or swiss nationals who are working in the netherlands must take out. You can decide for yourself if you want to apply this deductible excess. It applies to care received within the basic package.

Source: imbillionaire.net

Source: imbillionaire.net

In 2022 this still is €385. In order to make it easier for you to decide which dutch basic healthcare insurance best fits your needs, we’ve compared all the student healthcare insurances and made a top 5 of basic healthcare insurances. It applies to care received within the basic package. While it is not mandatory to have a deductible on your. Once you use your basic health insurance you will first have to pay the deductible excess (in dutch:

Source: iamexpat.nl

Source: iamexpat.nl

The health insurance deductible in 2022. The amount of the compulsory deductible is set. Have you just arrived in the netherlands? Examples are dental care, physiotherapy, pregnancy, coverage in case of. Deductible excess the amount of deductible excess in the dutch healthcare system is partly fixed.

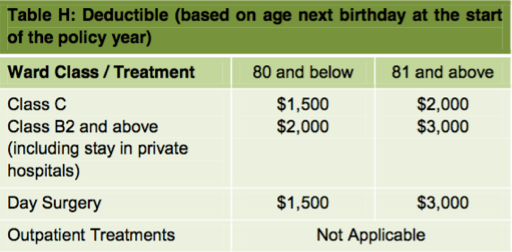

Source: blog.policypal.com

Source: blog.policypal.com

The amount of the compulsory deductible is set. Eigen risico) is an obligatory amount that you must pay when for healthcare before your health insurer starts to reimburse for healthcare you have received. Deductible excess the basic healthcare insurance consists out of two types of deductible excess. This year the excess amounts to € 385. Midwifery care (including insertion of an iud by an obstetrician) obstetric.

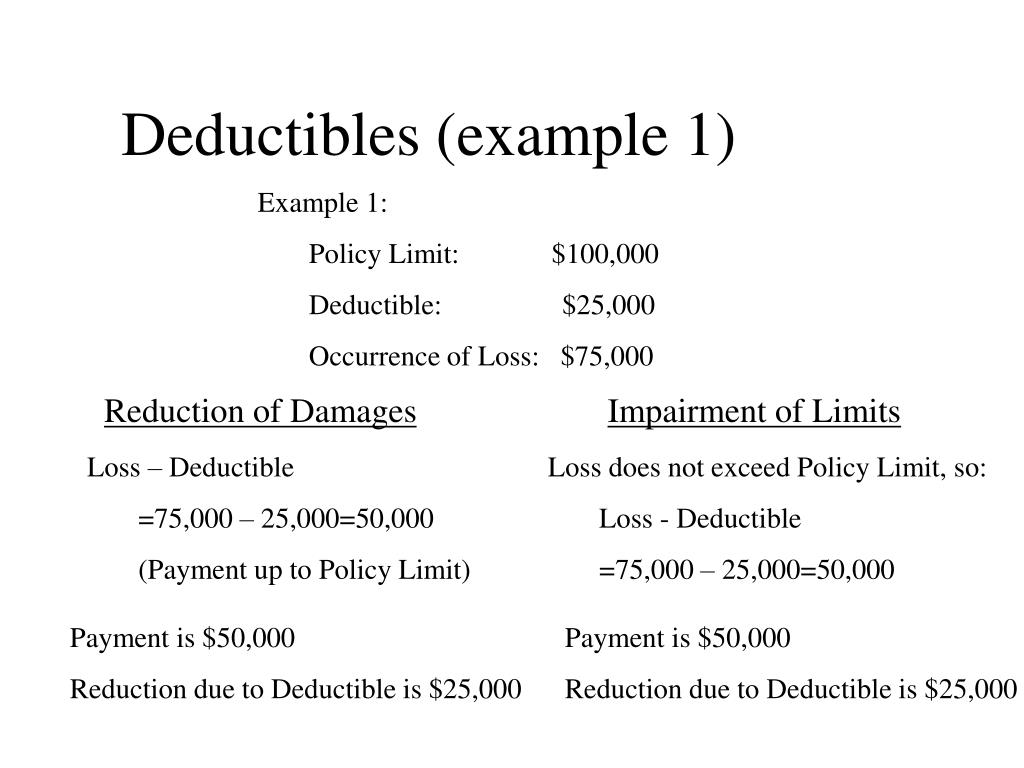

Source: slideserve.com

Source: slideserve.com

However, deductible applies more to commercial/business insurances while excess is more applicable to personal insurances since deductible is often bigger in value than excess. The deductible, or excess (dutch: Eigen risico) is an obligatory amount that you must pay when for healthcare before your health insurer starts to reimburse for healthcare you have received. Appointments with your general practitioner (a blood test ordered by your gp, however, does come under the deductible) children aged under 18. While it is not mandatory to have a deductible on your.

Source: kff.org

Source: kff.org

This deductible amount must be paid by the insurance policy holder to the health insurance provider before the insurer will reimburse healthcare or medical costs made by the policy holder. Sometimes the public (basic) health insurance cover does not suffice and you might need an additional coverage. Eigen risico) is an obligatory amount that you must pay when for healthcare before your health insurer starts to reimburse for healthcare you have received. Have you just arrived in the netherlands? The government determines the level of the excess each year.

Source: pinterest.com

Source: pinterest.com

This deductible amount must be paid by the insurance policy holder to the health insurance provider before the insurer will reimburse healthcare or medical costs made by the policy holder. They must know for sure that you work or live here. Your health insurer may require proof that you are obliged to take out health insurance in the netherlands. The amount of the compulsory deductible is set. In addition to the compulsory deductible, you can also choose a.

Source: everydayhealth.com

Source: everydayhealth.com

Choose a dutch basic healthcare insurance. The first one is the obligatory deductible excess and this one is obligatory to everyone with dutch basic healthcare insurance. Eigen risico) is an obligatory amount that you must pay when for healthcare before your health insurer starts to reimburse for healthcare you have received. The mandatory minimum excess is 385 € / year (2021 and 2022). How do i choose a dutch health insurance?

Source: hshagour.blogspot.com

The compulsory excess applies to every insured aged 18 or over. While it is not mandatory to have a deductible on your. Deductible excess the amount of deductible excess in the dutch healthcare system is partly fixed. How do i choose a dutch health insurance? Two types of deductible excess can be distinguished, the obligatory deductible excess and the voluntary deductible excess.

![Deductible / Excess / Franchise [health insurance] which Deductible / Excess / Franchise [health insurance] which](https://www.englishforum.ch/attachments/insurance/49053d1347446119-deductible-excess-franchise-health-insurance-best-one-choose-franchise.png) Source: englishforum.ch

Source: englishforum.ch

Examples are dental care, physiotherapy, pregnancy, coverage in case of. The deductible does not apply to: The health insurance deductible in 2022. How do i choose a dutch health insurance? Sometimes the public (basic) health insurance cover does not suffice and you might need an additional coverage.

Source: writingroughdraft.blogspot.com

Source: writingroughdraft.blogspot.com

An insurance deductible, also known as an insurance excess, is the amount of money that a policyholder will pay towards the cost of any medical treatment. However, this also means that the deductible excess is 885 euro instead of 385. The amount of the compulsory deductible is set. It applies to care received within the basic package. The mandatory minimum excess is 385 € / year (2021 and 2022).

Source: klforexpats.com

Source: klforexpats.com

In order to make it easier for you to decide which dutch basic healthcare insurance best fits your needs, we’ve compared all the student healthcare insurances and made a top 5 of basic healthcare insurances. When you make a claim, the deductible is subtracted from the total amount of money that you will be reimbursed. In addition to the compulsory deductible, you can also choose a. The health insurance deductible in 2022. Global health insurance deductible and excess options.

Source: studentcover.in

Source: studentcover.in

Then you need to apply for health insurance. You will never incur costs higher than this for health care covered by the basic health insurance than the amount of excess, except for personal contributions. When you make a claim, the deductible is subtracted from the total amount of money that you will be reimbursed. The health insurance deductible in 2022. The first type is obligatory to every single person that has dutch basic healthcare insurance.

Source: youtube.com

Source: youtube.com

When you make a claim, the deductible is subtracted from the total amount of money that you will be reimbursed. The eigen risico (deductible) is the amount you have to pay yourself before you receive a reimbursement from your health insurance company. Everyone insured in the netherlands has a standard, obligatory deductible excess (375 euros in 2015). The government determines the level of the excess each year. Insurance deductible or insurance excess.

Source: obesityhelp.com

Source: obesityhelp.com

Each year, the dutch government determines the extent of the compulsory excess. A deductible is the amount of money specified in the insurance policy that the policyholder pays toward each claim, which is subtracted from the amount of money to be reimbursed by the insurer. The compulsory excess applies to every insured aged 18 or over. This year the excess amounts to € 385. It applies to care received within the basic package.

Source: acko.com

Source: acko.com

You have the option to increase your mandatory excess with a voluntary excess in steps to a maximum of 885 € per year. The obligatory deductible excess changes every year. Insurance deductible or insurance excess. Have you just arrived in the netherlands? The health insurance deductible in 2022.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Deductibles, also known as excesses, can be quite a confusing subject. Everyone insured in the netherlands has a standard, obligatory deductible excess (375 euros in 2015). Basically, a deductible is the total amount of your healthcare expenses that you will pay, with your global health insurance plan covering the remainder of the bill. Your health insurer may require proof that you are obliged to take out health insurance in the netherlands. Deductible excess the basic healthcare insurance consists out of two types of deductible excess.

Source: autoeurope.com

Source: autoeurope.com

Expats from outside the eu, eea or switzerland who arrive in the netherlands must take out dutch health insurance within four months of receiving their residence permit, even if they have an existing foreign policy.eu, eea or swiss nationals who are working in the netherlands must take out. Health insurance is compulsory for all people who live or work in the netherlands. Appointments with your general practitioner (a blood test ordered by your gp, however, does come under the deductible) children aged under 18. Dutch health insurance companies typically charge a contribution to your “own risk” (eigen risico). Global health insurance deductible and excess options.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

For 2020, the standard excess fee for all insurance companies is set at €385. Expats from outside the eu, eea or switzerland who arrive in the netherlands must take out dutch health insurance within four months of receiving their residence permit, even if they have an existing foreign policy.eu, eea or swiss nationals who are working in the netherlands must take out. When you make a claim, the deductible is subtracted from the total amount of money that you will be reimbursed. Deductibles, also known as excesses, can be quite a confusing subject. Both excess and deductible are used for the same purpose and the terms are often used interchangeably, just like “insurance” and “assurance”.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title deductible excess health insurance netherlands by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information