Deer hit car insurance Idea

Home » Trending » Deer hit car insurance IdeaYour Deer hit car insurance images are ready in this website. Deer hit car insurance are a topic that is being searched for and liked by netizens today. You can Download the Deer hit car insurance files here. Find and Download all free photos and vectors.

If you’re searching for deer hit car insurance pictures information connected with to the deer hit car insurance interest, you have visit the right site. Our website always gives you hints for viewing the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

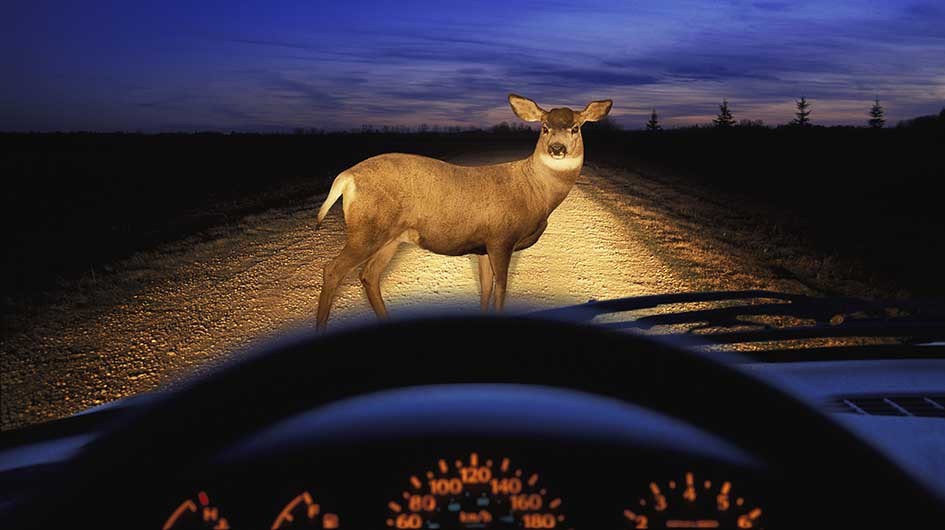

Deer Hit Car Insurance. Hi everyone, hopefully you all can help me where my insurance policy and google have failed! For most car insurance policies, hitting a deer would be covered under a comprehensive package, and if your policy extends to car rentals, you are covered for both collision and liability up to the limits of your coverage. While being involved in an accident with another car, or even a stationary object like a tree or telephone pole is classified as a collision, hitting a deer — or any other. For your comprehensive coverage to cover the accident, your car must come in contact with the animal.

Pennsylvania drivers more likely to hit deer this year From pennlive.com

Pennsylvania drivers more likely to hit deer this year From pennlive.com

If your comprehensive coverage has a deductible of $500, you�d pay $500 toward your vehicle�s repairs, and your insurer would reimburse you for the remaining $1,500. Hitting a deer is an unpredictable car accident that is fortunately covered by a specific component of car insurance called comprehensive, or comp, coverage.this is the part of auto insurance coverage that includes damage sustained from something other than a collision, like theft, vandalism, natural disasters like hurricanes and fires, and animal impact. If your car is damaged in a collision with an animal, or if you or your passengers are injured, then you can make a claim with your car insurance provider. Be sure to check with your insurance company to ensure that you have it as well. About 1.5 million deer, elk and moose are struck each year, causing more than $1 billion in insured losses and affecting about one in 169 drivers, according to the national association of. If you end up hitting a large animal like a deer it can cause massive damage to your car costing thousands of dollars to repair.

If there’s no physical contact with the deer (e.g.

Check with your insurance agent to learn more about how your company classifies these situations and how they could impact your rates. Hi everyone, hopefully you all can help me where my insurance policy and google have failed! Comprehensive can cover damages to your car caused by events that are out of your control, like hitting a deer or other animal. [1] to make things more confusing, if you swerve to avoid the deer and you miss the deer but hit a tree instead, then the damage to your vehicle will no longer be covered under your comprehensive policy.by swerving and missing the deer, you have converted the accident into the type that is covered by collision insurance. “hit the damn deer!” what you may be wondering about deer claims. Again, not all drivers buy collision coverage, so it is.

Source: patch.com

Source: patch.com

Filing a deer hit by car claim. You hit the deer, it’s not. How does hitting a deer affect your car insurance? You swerve and hit a tree), it will probably be considered a collision loss. Hitting a deer is an unpredictable car accident that is fortunately covered by a specific component of car insurance called comprehensive, or comp, coverage.this is the part of auto insurance coverage that includes damage sustained from something other than a collision, like theft, vandalism, natural disasters like hurricanes and fires, and animal impact.

Source: pocketsense.com

Source: pocketsense.com

The fact is most auto insurance companies will not raise your rates due to this type of collision. You will want to know what your comprehensive deductible is as this is the coverage that a deer hit by car claim is covered. The average car insurance claim for deer strikes increased by $162, state farm claims data show. What happens if you hit a deer in a rental car enterprise? Deer collisions are most likely at dawn and dusk during the late fall months, particularly november.

Source: quoteinspector.com

Source: quoteinspector.com

So, check out your insurance provider for more trustworthy information. The average car insurance claim for deer strikes increased by $162, state farm claims data show. How does hitting a deer affect your car insurance? About 1.5 million deer, elk and moose are struck each year, causing more than $1 billion in insured losses and affecting about one in 169 drivers, according to the national association of. What happens if you hit a deer in a rental car enterprise?

Source: quotewizard.com

Source: quotewizard.com

Every insurance company handles this differently, and the procedure to file a claim is not similar. If your comprehensive coverage has a deductible of $500, you�d pay $500 toward your vehicle�s repairs, and your insurer would reimburse you for the remaining $1,500. On the other hand, collision insurance. It will cost $2,000 to repair your vehicle. Again, not all drivers buy collision coverage, so it is.

Source: lieserlawfirm.com

Source: lieserlawfirm.com

If you see a deer, avoid swerving and instead flash your lights or honk your horn to get the animal’s attention and encourage them to move out of. If you see a deer, avoid swerving and instead flash your lights or honk your horn to get the animal’s attention and encourage them to move out of. While being involved in an accident with another car, or even a stationary object like a tree or telephone pole is classified as a collision, hitting a deer — or any other. Vehicle damage from hitting a deer is covered by your auto policy�s comprehensive coverage. How does hitting a deer affect your car insurance?

Source: glenninsurance.com

Source: glenninsurance.com

You will want to know what your comprehensive deductible is as this is the coverage that a deer hit by car claim is covered. For most car insurance policies, hitting a deer would be covered under a comprehensive package, and if your policy extends to car rentals, you are covered for both collision and liability up to the limits of your coverage. If the deer crushes your front bumper, dents the side door and breaks your windshield from the impact, that will be considered under one deductible. On the other hand, say your car is totaled after you hit a deer. For example, say your car is damaged after hitting a deer.

Source: pennlive.com

Source: pennlive.com

The fact is most auto insurance companies will not raise your rates due to this type of collision. They can tell you what coverage you have available and what needs to happen now. What happens if you hit a deer in a rental car enterprise? From pet cats sneaking out and wandering the streets to deer gallivanting around country lanes, it’s no surprise that hitting an animal with your car can be a real concern for some drivers. About 1.5 million deer, elk and moose are struck each year, causing more than $1 billion in insured losses and affecting about one in 169 drivers, according to the national association of.

Source: laclassedemaitressemarie.blogspot.com

Does rental car insurance cover hitting a deer? How does hitting a deer affect your car insurance? Yes, car insurance companies classify hitting a deer as an accident due to the impact. Yesterday i was driving down a country lane, thankfully only going around 40 in a 50 due to having several deer leap out on me in the last few weeks, however this time one jumped out just too close to me and despite my best efforts to avoid i couldn�t help but hit it, thankfully. If your comprehensive coverage has a deductible of $500, you�d pay $500 toward your vehicle�s repairs, and your insurer would reimburse you for the remaining $1,500.

So, check out your insurance provider for more trustworthy information. As odd as it sounds, colliding with a deer is not considered a collision — at least not to insurance companies. An auto accident is any situation where a vehicle collides with a person, animal, another car, or an object. Filing a deer hit by car claim. Read your comprehensive coverage policy to see if collisions with animals are covered.

Source: ksdk.com

Source: ksdk.com

If the deer crushes your front bumper, dents the side door and breaks your windshield from the impact, that will be considered under one deductible. As odd as it sounds, colliding with a deer is not considered a collision — at least not to insurance companies. They can tell you what coverage you have available and what needs to happen now. For example, say your car is damaged after hitting a deer. A collision with a deer is typically a covered loss, according to allstate.

Source: getjerry.com

Read your comprehensive coverage policy to see if collisions with animals are covered. Check with your insurance agent to learn more about how your company classifies these situations and how they could impact your rates. For your comprehensive coverage to cover the accident, your car must come in contact with the animal. For example, say your car is damaged after hitting a deer. On the other hand, collision insurance.

Source: get-quotes.org

Source: get-quotes.org

Comprehensive can cover damages to your car caused by events that are out of your control, like hitting a deer or other animal. [1] to make things more confusing, if you swerve to avoid the deer and you miss the deer but hit a tree instead, then the damage to your vehicle will no longer be covered under your comprehensive policy.by swerving and missing the deer, you have converted the accident into the type that is covered by collision insurance. If you see a deer, avoid swerving and instead flash your lights or honk your horn to get the animal’s attention and encourage them to move out of. For most car insurance policies, hitting a deer would be covered under a comprehensive package, and if your policy extends to car rentals, you are covered for both collision and liability up to the limits of your coverage. A collision with a deer is typically a covered loss, according to allstate.

Source: insurancecommentary.com

Source: insurancecommentary.com

“hit the damn deer!” what you may be wondering about deer claims. While being involved in an accident with another car, or even a stationary object like a tree or telephone pole is classified as a collision, hitting a deer — or any other. Again, not all drivers buy collision coverage, so it is. An auto accident is any situation where a vehicle collides with a person, animal, another car, or an object. For your comprehensive coverage to cover the accident, your car must come in contact with the animal.

Source: obernauerinsuranceagency.com

Source: obernauerinsuranceagency.com

How does hitting a deer affect your car insurance? On the other hand, collision insurance. So, say it with me: So, check out your insurance provider for more trustworthy information. It will cost $2,000 to repair your vehicle.

Source: newsroom.statefarm.com

Source: newsroom.statefarm.com

About 1.5 million deer, elk and moose are struck each year, causing more than $1 billion in insured losses and affecting about one in 169 drivers, according to the national association of. Hitting a deer is an expensive accident that could result in your car insurance rates going up. Hitting a deer is an unpredictable car accident that is fortunately covered by a specific component of car insurance called comprehensive, or comp, coverage.this is the part of auto insurance coverage that includes damage sustained from something other than a collision, like theft, vandalism, natural disasters like hurricanes and fires, and animal impact. Comprehensive can cover damages to your car caused by events that are out of your control, like hitting a deer or other animal. It will cost $2,000 to repair your vehicle.

Source: army.mil

Source: army.mil

Make sure you check the terms and conditions of your policy before claiming. Hitting a deer is an expensive accident that could result in your car insurance rates going up. Read your comprehensive coverage policy to see if collisions with animals are covered. For your comprehensive coverage to cover the accident, your car must come in contact with the animal. Insurance companies will likely consider it an accident when you hit a deer, but that doesn�t necessarily mean it will increase your rates.

Source: scavoneins.com

Source: scavoneins.com

For most car insurance policies, hitting a deer would be covered under a comprehensive package, and if your policy extends to car rentals, you are covered for both collision and liability up to the limits of your coverage. When it comes to deer damage, having liability insurance alone won’t help. Every insurance company handles this differently, and the procedure to file a claim is not similar. For your comprehensive coverage to cover the accident, your car must come in contact with the animal. Hitting a deer is an expensive accident that could result in your car insurance rates going up.

Source: flipboard.com

Source: flipboard.com

Deer collisions are most likely at dawn and dusk during the late fall months, particularly november. For your comprehensive coverage to cover the accident, your car must come in contact with the animal. Comprehensive can cover damages to your car caused by events that are out of your control, like hitting a deer or other animal. The average car insurance claim for deer strikes increased by $162, state farm claims data show. “hit the damn deer!” what you may be wondering about deer claims.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title deer hit car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea