Defamation in insurance Idea

Home » Trending » Defamation in insurance IdeaYour Defamation in insurance images are available. Defamation in insurance are a topic that is being searched for and liked by netizens today. You can Get the Defamation in insurance files here. Get all royalty-free photos.

If you’re searching for defamation in insurance pictures information related to the defamation in insurance topic, you have pay a visit to the right blog. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

Defamation In Insurance. Umbrella insurance provides liability protection that may help pay your expenses in a number of situations, such as if you�re sued for alleged libel or slander. Property damage and bodily injury. Insurance litigation defense encompasses many different forms of civil liability, and thus offers a number of practice areas. Media liability and general liability policies typically provide coverage for claims alleging defamation (although general liability policies exclude such coverage for insureds engaged in media businesses is can be purchased.

Libel Insurance NENPA From nenpa.com

Libel Insurance NENPA From nenpa.com

Regardless of the activities your business undertakes, it could be destroyed by legal costs and fines as a result of a defamation case. Here, we’ll discuss what defamation is — including terms like slander and libel — and how this important insurance coverage protects businesses in instances of misguided advertising or communications. You can read more about this in our defending against defamation claims section. However, these coverages provide protection only to a certain extent. Personal insurance like a homeowners or auto policy is always a worthwhile investment. Although that is a simple way to put it, that is not the entire story.

In case a defamation suit was filed against you, the insurance company is liable for paying all the expenses resulting from the lawsuit.

Efrain jovel, real estate agent re/max capital realty. Defamation you may know it as calumny, vilification, traducement, slander (for transitory statements), and libel (for written, broadcast, or otherwise published words) is the communication of a statement that makes a claim, expressly stated or implied to be factual, that may give an individual, business, product, group, government, or nation a negative image. However, the costs could be steep for small blogs—the minimum annual premium is generally $2,500 for a $1 million limit, with a minimum deductible of $5,000. Defamation is generally considered to be the publication by any means of communication of material concerning an individual or organisation which either injures or lowers their its reputation in a business or profession. You can read more about this in our defending against defamation claims section. False arrest, detention, or imprisonment.

Source: lalalato.blogspot.com

Professional indemnity insurance can cover the legal fees in defending your business against a defamation claim, as. We have been known to say that commercial general liability insurance covers two primary things: Media liability and general liability policies typically provide coverage for claims alleging defamation (although general liability policies exclude such coverage for insureds engaged in media businesses). Media liability and general liability policies (4). Defamation in an insurance policy.

Source: npa1.org

Source: npa1.org

Defamation insurance is also called calumny, vilification, slander (for verbal statements), and libel (for written or published words). The internet defamation lawyers of minc law are here to help explain whether defamation insurance is right for you, or how a defendant’s defamation insurance coverage may affect your claim. Personal insurance like a homeowners or auto policy is always a worthwhile investment. Personal injury insurance is typically included in standard commercial general liability policies. When executing an insurance policy, talk to your insurance agent about adding “excess liability” to a new or existing insurance policy.

Source: npa1.org

Source: npa1.org

Defamation in an insurance policy. For instance, what if you�re sued for something you say or something you write? Media liability and general liability policies (4). Defamation in an insurance policy. Although that is a simple way to put it, that is not the entire story.

Source: kellywarnerlaw.com

Source: kellywarnerlaw.com

However, the costs could be steep for small blogs—the minimum annual premium is generally $2,500 for a $1 million limit, with a minimum deductible of $5,000. Defamation — any written or oral communication about a person or thing that is both untrue and unfavorable. Efrain jovel, real estate agent re/max capital realty. Defamation is generally considered to be the publication by any means of communication of material concerning an individual or organisation which either injures or lowers their its reputation in a business or profession. Generally, defamation is a false and unprivileged statement of fact that is harmful to someone’s reputation, and published “with fault,” meaning as a result of negligence or malice.state laws often define defamation in specific ways.libel is a written defamation;.

Source: simpleartifact.com

Source: simpleartifact.com

Here, we’ll discuss what defamation is — including terms like slander and libel — and how this important insurance coverage protects businesses in instances of misguided advertising or communications. Property damage and bodily injury. Any written or oral communication about a person or thing that is both untrue and unfavorable. Defamation — any written or oral communication about a person or thing that is both untrue and unfavorable. Insurance litigation defense encompasses many different forms of civil liability, and thus offers a number of practice areas.

Source: theage.com.au

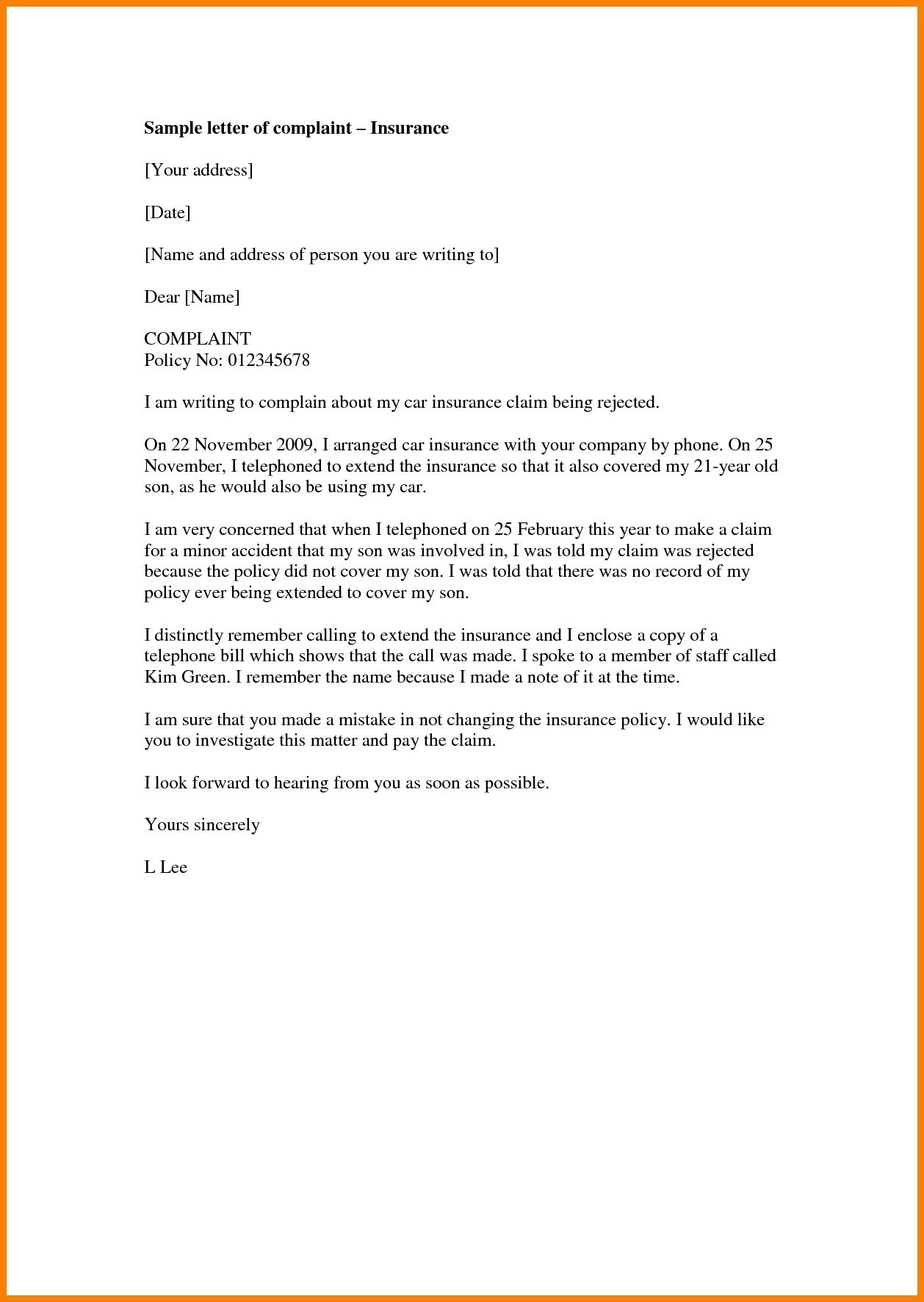

The legal representative may need to communicate with the carrier and determine how to proceed best. If you have das commercial legal expenses insurance as part of your policy, you can find more on defamation on das businesslaw, including guides on defamation and a template for drafting a letter before action. If you have an insurance policy that covers defamation, contact your insurer or insurance adviser as soon as possible. Reach out today to discuss. General liability insurance is providing coverage for common risks that occur in a business.

Source: nenpa.com

Source: nenpa.com

Reach out today to discuss. Defamation you may know it as calumny, vilification, traducement, slander (for transitory statements), and libel (for written, broadcast, or otherwise published words) is the communication of a statement that makes a claim, expressly stated or implied to be factual, that may give an individual, business, product, group, government, or nation a negative image. The extra policy can pay for expenses arising. Defamation insurance coverage exists to protect businesses from a lawsuit after an incidence of defamation, whether it was intentional or not. In cases like as a defamation, libel, or slander lawsuit, it can offer liability coverage for situations that aren’t covered by other types of insurance.

Source: einsurance.com

Source: einsurance.com

Regardless of the activities your business undertakes, it could be destroyed by legal costs and fines as a result of a defamation case. Media liability and general liability policies typically provide coverage for claims alleging defamation (although general liability policies exclude such coverage for insureds engaged in media businesses is can be purchased. You can read more about this in our defending against defamation claims section. Understanding umbrella insurance defamation coverage. What is defamation in insurance.the legal information institute defines defamation as a statement that injures a third party�s reputation.

Source: ecosfera.cat

Source: ecosfera.cat

Defamation insurance is a complex topic that shouldn’t be approached without the help of an experienced defamation attorney. In most defamation cases, the defamation statute of limitations may begin to run when the plaintiff discovers (or should have discovered) the publication of the defamatory statement. Media liability and general liability policies typically provide coverage for claims alleging defamation (although general liability policies exclude such coverage for insureds engaged in media businesses). “excess liability” coverage can protect against some of the following defamation and legal claims: Defamation — any written or oral communication about a person or thing that is both untrue and unfavorable.

Source: legaldictionary.net

Source: legaldictionary.net

The legal representative may need to communicate with the carrier and determine how to proceed best. In most defamation cases, the defamation statute of limitations may begin to run when the plaintiff discovers (or should have discovered) the publication of the defamatory statement. However, the costs could be steep for small blogs—the minimum annual premium is generally $2,500 for a $1 million limit, with a minimum deductible of $5,000. Personal insurance like a homeowners or auto policy is always a worthwhile investment. For instance, what if you�re sued for something you say or something you write?

Source: gwii.co.za

Source: gwii.co.za

Defamation you may know it as calumny, vilification, traducement, slander (for transitory statements), and libel (for written, broadcast, or otherwise published words) is the communication of a statement that makes a claim, expressly stated or implied to be factual, that may give an individual, business, product, group, government, or nation a negative image. S takes out a health insurance policy which contains a. Defamation in an insurance policy. Reach out today to discuss. Any written or oral communication about a person or thing that is both untrue and unfavorable.

Source: evrendesign.blogspot.com

Source: evrendesign.blogspot.com

Property damage and bodily injury. Any written or oral communication about a person or thing that is both untrue and unfavorable. “excess liability” coverage can protect against some of the following defamation and legal claims: This includes personal injury, property damage, and advertising injuries such as slander, libel, and defamation claims. Property damage and bodily injury.

Source: honeyattorneys.co.za

Source: honeyattorneys.co.za

However, the costs could be steep for small blogs—the minimum annual premium is generally $2,500 for a $1 million limit, with a minimum deductible of $5,000. Regardless of the activities your business undertakes, it could be destroyed by legal costs and fines as a result of a defamation case. The legal representative may need to communicate with the carrier and determine how to proceed best. Media liability and general liability policies typically provide coverage for claims alleging defamation (although general liability policies exclude such coverage for insureds engaged in media businesses). Defamation insurance is also called calumny, vilification, slander (for verbal statements), and libel (for written or published words).

Source: newsmax.com

Media liability and general liability policies typically provide coverage for claims alleging defamation (although general liability policies exclude such coverage for insureds engaged in media businesses is can be purchased. Defamation insurance coverage exists to protect businesses from a lawsuit after an incidence of defamation, whether it was intentional or not. Defamation — any written or oral communication about a person or thing that is both untrue and unfavorable. What is defamation in insurance.the legal information institute defines defamation as a statement that injures a third party�s reputation. If the carrier is unwilling to provide the necessary coverage during valid claims where no intentional defamation occurred, the policyholder may need to contact a lawyer.

Source: kenyachambermines.com

Source: kenyachambermines.com

Efrain jovel, real estate agent re/max capital realty. Although that is a simple way to put it, that is not the entire story. This includes personal injury, property damage, and advertising injuries such as slander, libel, and defamation claims. Defamation in an insurance policy. Defamation insurance is also called calumny, vilification, slander (for verbal statements), and libel (for written or published words).

Source: firthandscott.co.uk

Source: firthandscott.co.uk

Efrain jovel, real estate agent re/max capital realty. Defamation — any written or oral communication about a person or thing that is both untrue and unfavorable. Reach out today to discuss. When executing an insurance policy, talk to your insurance agent about adding “excess liability” to a new or existing insurance policy. If the carrier is unwilling to provide the necessary coverage during valid claims where no intentional defamation occurred, the policyholder may need to contact a lawyer.

Source: scic.com

Source: scic.com

Defamation in an insurance policy. When executing an insurance policy, talk to your insurance agent about adding “excess liability” to a new or existing insurance policy. Professional indemnity insurance can cover the legal fees in defending your business against a defamation claim, as. Media liability and general liability policies typically provide coverage for claims alleging defamation (although general liability policies exclude such coverage for insureds engaged in media businesses). Liability protection is part of the umbrella policy that an insurance company may provide through a lawyer’s services.

Source: superpages.com

Source: superpages.com

In certain scenarios, you can address the coverage deficit by getting umbrella insurance. The internet defamation lawyers of minc law are here to help explain whether defamation insurance is right for you, or how a defendant’s defamation insurance coverage may affect your claim. Any written or oral communication about a person or thing that is both untrue and unfavorable. For instance, what if you�re sued for something you say or something you write? However, these coverages provide protection only to a certain extent.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title defamation in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea