Define comprehensive third party insurance information

Home » Trending » Define comprehensive third party insurance informationYour Define comprehensive third party insurance images are ready in this website. Define comprehensive third party insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Define comprehensive third party insurance files here. Find and Download all royalty-free photos.

If you’re searching for define comprehensive third party insurance pictures information related to the define comprehensive third party insurance keyword, you have pay a visit to the ideal blog. Our website always gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

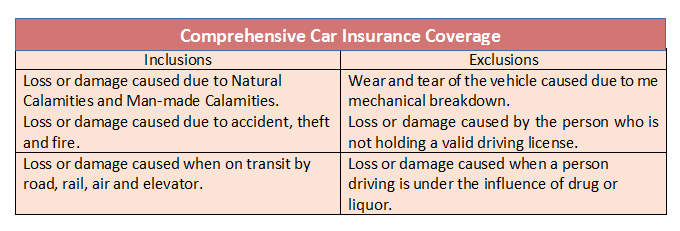

Define Comprehensive Third Party Insurance. Comprehensive third party health insurance (tphi) means comprehensive health care coverage or insurance (including medicare and/or private mco coverage) that does not fall under one of the following categories: You can consider comparing comprehensive vs. Third party car insurance (third party only) is the most basic policy type and is the minimum level of cover required by law, to make sure third parties involved in any accidents are covered. It provides comprehensive coverage against third party liabilities and loss or damages of the car from accidents, vandalism, fire, falling objects or floods.

![Benefits of a Comprehensive Car Insurance [Infographic] Benefits of a Comprehensive Car Insurance [Infographic]](http://infographicjournal.com/wp-content/uploads/2017/06/car-insurance.jpg) Benefits of a Comprehensive Car Insurance [Infographic] From infographicjournal.com

Benefits of a Comprehensive Car Insurance [Infographic] From infographicjournal.com

Comprehensive third party health insurance (tphi) means comprehensive health care coverage or insurance (including medicare and/or private mco coverage) that does not fall under one of the following categories: This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. Ctp insurance is compulsory in all states of australia you cannot register your vehicle without having a policy in place Ctp insurance stands for compulsory third party insurance. Although the question is, what if you want more than the bare minimum covered? This cover will come in handy in case of losses due to natural calamities, theft, riots, accidents, etc.

You can consider comparing comprehensive vs.

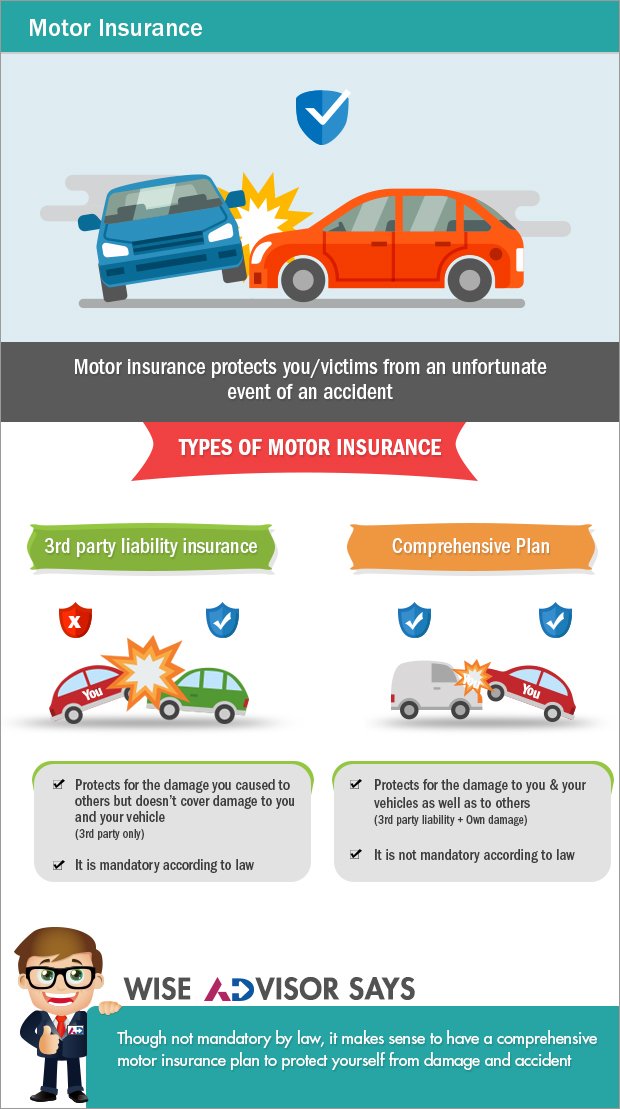

Thus, a third party car insurance is a legal contract between the first party and the second party where the latter promises to pay for any legal liabilities of the former arising out of third party injuries or damages in return for a premium price. Although the question is, what if you want more than the bare minimum covered? There are 3 primary types of car insurance; Coverage offers financial coverage on your behalf if your vehicle has damaged someone’s property, injured the person, or caused the death: Comprehensive car insurance covers you for accidental damage caused by. This means that if you have an accident you can claim to have your car fixed, and your insurance provider may also compensate anyone else involved if eligible.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

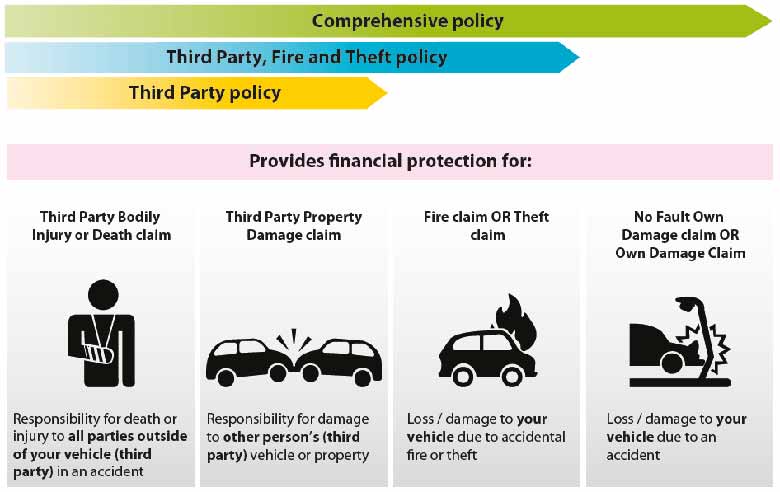

Fully comprehensive, third party (fire and theft) and third party only. Comprehensive third party health insurance (tphi) means comprehensive health care coverage or insurance (including medicare and/or private mco coverage) that does not fall under one of the following categories: Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. This type of plan is offered by most insurers and meets the minimum legal requirements for driving under singapore law. In the indian context, automobile dealers arrange for a comprehensive insurance cover along with vehicle registration.

Source: authorstream.com

Source: authorstream.com

Meaning and definitions the most basic and cheapest type of car insurance you can get on the market is the third party only (tpo). Ctp insurance is compulsory in all states of australia you cannot register your vehicle without having a policy in place Besides third party insurance, car insurance also provides comprehensive insurance to your car. So in effect, there are two main types of insurance. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident.

Source: youtube.com

Source: youtube.com

Comprehensive third party health insurance (tphi) means comprehensive health care coverage or insurance (including medicare and/or private mco coverage) that does not fall under one of the following categories: Coverage offers financial coverage on your behalf if your vehicle has damaged someone’s property, injured the person, or caused the death: Comprehensive insurance is a car insurance policy that covers certain damages to your vehicle that are not caused by a collision with another car. As mentioned above, comprehensive car insurance is a combination of third party insurance and own damage insurance. There are 3 primary types of car insurance;

Source: youtube.com

Source: youtube.com

Comprehensive insurance is a car insurance policy that covers certain damages to your vehicle that are not caused by a collision with another car. This means you may only buy the cover you can afford, rather than the cover you need. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. This means you don’t necessarily have to compromise on your cover just to save a few pounds. Meaning and definitions the most basic and cheapest type of car insurance you can get on the market is the third party only (tpo).

Source: pinterest.com

Source: pinterest.com

There are 3 primary types of car insurance; Fully comprehensive, third party (fire and theft) and third party only. You can consider comparing comprehensive vs. Thus, a third party car insurance is a legal contract between the first party and the second party where the latter promises to pay for any legal liabilities of the former arising out of third party injuries or damages in return for a premium price. Third party insurance, also known as third party liability policy or tp only is a legal requirement in our country.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

So in effect, there are two main types of insurance. The policy is usually cheaper compared to a comprehensive policy and covers damages caused to another party by your car. Thus, a third party car insurance is a legal contract between the first party and the second party where the latter promises to pay for any legal liabilities of the former arising out of third party injuries or damages in return for a premium price. Comprehensive third party health insurance (tphi) means comprehensive health care coverage or insurance (including medicare and/or private mco coverage) that does not fall under one of the following categories: In the indian context, automobile dealers arrange for a comprehensive insurance cover along with vehicle registration.

Source: hoi.my

Source: hoi.my

Comprehensive insurance is a car insurance policy that covers certain damages to your vehicle that are not caused by a collision with another car. As mentioned above, comprehensive car insurance is a combination of third party insurance and own damage insurance. Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. This means you may only buy the cover you can afford, rather than the cover you need. Third party car insurance (third party only) is the most basic policy type and is the minimum level of cover required by law, to make sure third parties involved in any accidents are covered.

Source: pioneer.com.ph

Source: pioneer.com.ph

Thus, a third party car insurance is a legal contract between the first party and the second party where the latter promises to pay for any legal liabilities of the former arising out of third party injuries or damages in return for a premium price. Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. Choosing the right kind of insurance for your vehicle is crucial in india. Meaning and definitions the most basic and cheapest type of car insurance you can get on the market is the third party only (tpo).

Source: banksathi.com

Source: banksathi.com

This type of plan is offered by most insurers and meets the minimum legal requirements for driving under singapore law. Choosing the right kind of insurance for your vehicle is crucial in india. You can consider comparing comprehensive vs. This type of plan is offered by most insurers and meets the minimum legal requirements for driving under singapore law. Comprehensive insurance will cover your vehicle if destroyed by a.

Source: fincash.com

Source: fincash.com

Coverage offers financial coverage on your behalf if your vehicle has damaged someone’s property, injured the person, or caused the death: That’s where comprehensive car insurance comes in. Comprehensive insurance will cover your vehicle if destroyed by a. Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. It provides comprehensive coverage against third party liabilities and loss or damages of the car from accidents, vandalism, fire, falling objects or floods.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

This cover will come in handy in case of losses due to natural calamities, theft, riots, accidents, etc. Fully comprehensive, third party (fire and theft) and third party only. Third party car insurance is less expensive than comprehensive car insurance, with good reason: This means you don’t necessarily have to compromise on your cover just to save a few pounds. There are 3 primary types of car insurance;

Source: ringgitplus.com

Source: ringgitplus.com

Comprehensive third party health insurance (tphi) means comprehensive health care coverage or insurance (including medicare and/or private mco coverage) that does not fall under one of the following categories: Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. Coverage offers financial coverage on your behalf if your vehicle has damaged someone’s property, injured the person, or caused the death: Ctpl allows third parties to be covered by insurance, meaning that this can prevent any unsuspecting pedestrians or any third party persons to be without any assistance when involved in a car accident. Third party car insurance (third party only) is the most basic policy type and is the minimum level of cover required by law, to make sure third parties involved in any accidents are covered.

Source: bankbazaar.com

Source: bankbazaar.com

So in effect, there are two main types of insurance. This means you don’t necessarily have to compromise on your cover just to save a few pounds. That’s where comprehensive car insurance comes in. As mentioned above, comprehensive car insurance is a combination of third party insurance and own damage insurance. Third party car insurance is less expensive than comprehensive car insurance, with good reason:

Source: simplehai.axisdirect.in

Source: simplehai.axisdirect.in

Meaning and definitions the most basic and cheapest type of car insurance you can get on the market is the third party only (tpo). Besides third party insurance, car insurance also provides comprehensive insurance to your car. Comprehensive insurance will cover your vehicle if destroyed by a. This insurance provides for compensation for people injured or killed when your vehicle is involved in an accident. Third party insurance, also known as third party liability policy or tp only is a legal requirement in our country.

Source: indianmoney.com

Third party car insurance (third party only) is the most basic policy type and is the minimum level of cover required by law, to make sure third parties involved in any accidents are covered. Ctpl allows third parties to be covered by insurance, meaning that this can prevent any unsuspecting pedestrians or any third party persons to be without any assistance when involved in a car accident. Meaning and definitions the most basic and cheapest type of car insurance you can get on the market is the third party only (tpo). Ctp insurance stands for compulsory third party insurance. Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision.

Source: slideshare.net

Source: slideshare.net

Besides third party insurance, car insurance also provides comprehensive insurance to your car. Thus, a third party car insurance is a legal contract between the first party and the second party where the latter promises to pay for any legal liabilities of the former arising out of third party injuries or damages in return for a premium price. Fully comprehensive, third party (fire and theft) and third party only. Comprehensive car insurance covers you for accidental damage caused by. Meaning and definitions the most basic and cheapest type of car insurance you can get on the market is the third party only (tpo).

Source: marketbusinessnews.com

Source: marketbusinessnews.com

However, the price difference isn’t always significant, so don’t assume the lower premium justifies the drop in cover. Ctp insurance is compulsory in all states of australia you cannot register your vehicle without having a policy in place It is required on leased vehicles, and on vehicles that are currently being paid for by a loan. Comprehensive third party health insurance (tphi) means comprehensive health care coverage or insurance (including medicare and/or private mco coverage) that does not fall under one of the following categories: So in effect, there are two main types of insurance.

Source: ilainfo.com

Source: ilainfo.com

Comprehensive car insurance covers you for accidental damage caused by. Besides third party insurance, car insurance also provides comprehensive insurance to your car. There are 3 primary types of car insurance; However, the price difference isn’t always significant, so don’t assume the lower premium justifies the drop in cover. Comprehensive car insurance covers you for accidental damage caused by.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title define comprehensive third party insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea