Define endowment insurance information

Home » Trending » Define endowment insurance informationYour Define endowment insurance images are ready. Define endowment insurance are a topic that is being searched for and liked by netizens today. You can Download the Define endowment insurance files here. Find and Download all royalty-free images.

If you’re searching for define endowment insurance pictures information linked to the define endowment insurance keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

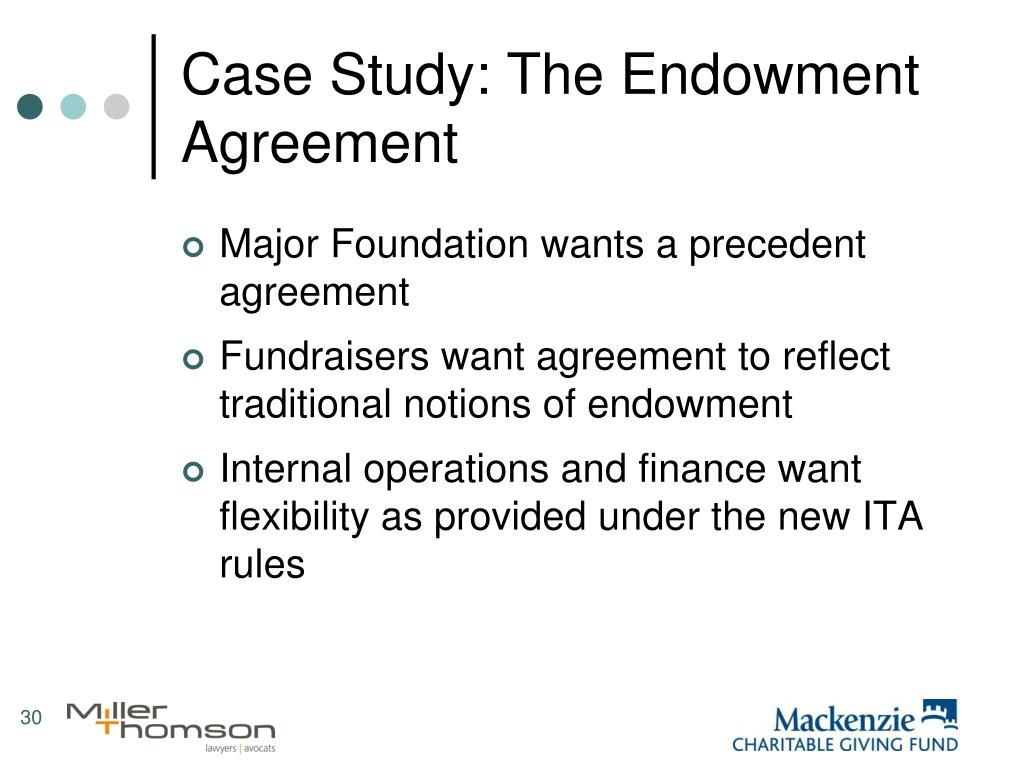

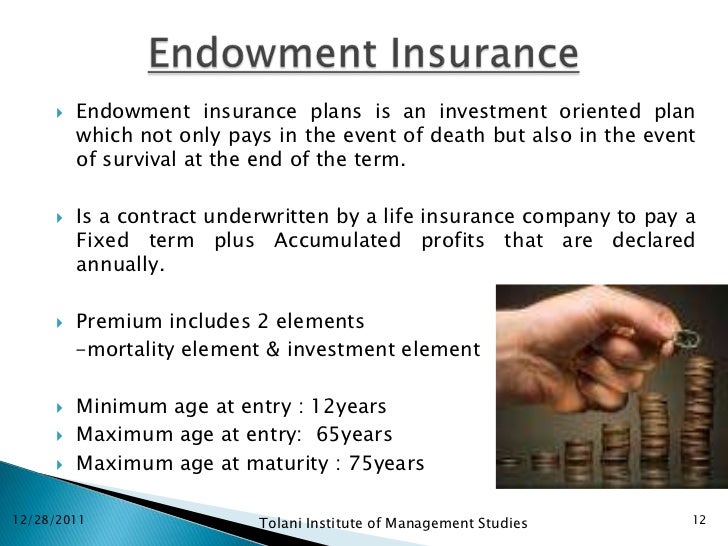

Define Endowment Insurance. For example, an endowment policy that provides benefits for 20 years until the insured is 65 pays its face value after 20 years whether the insured lives or. An endowment life insurance is an insurance product that has similarities to a certificate of deposit. Endowment insurance is a policy that aims to combine the features of a life insurance and a financial plan, usually a college education for the child of the insured. The source of income with which an institution, etc, is endowed b.

The Endowment Policy Was a Sure Thing • The Insurance Pro Blog From theinsuranceproblog.com

The Endowment Policy Was a Sure Thing • The Insurance Pro Blog From theinsuranceproblog.com

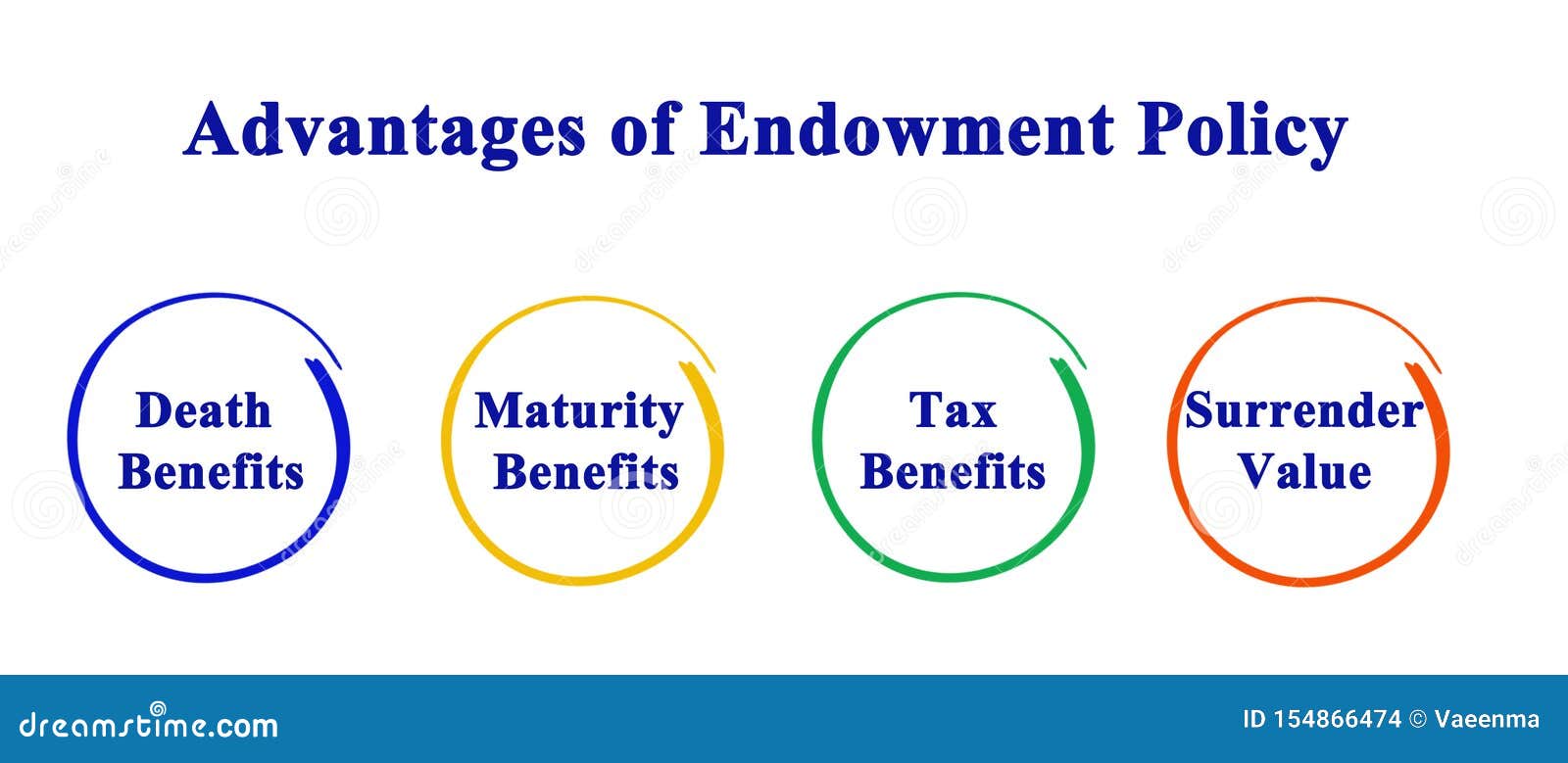

For example, an endowment policy that provides benefits for 20 years until the insured is 65 pays its face value after 20 years whether the insured lives or. Endowment insurance products are often marketed as a savings plan to help you meet a specific financial goal, such as paying for your children’s education, or building up a pool of savings over a fixed term. Endowment period of time, in life insurance, at which the face amount of the policy is payable to the insured. Endowment insurance law and legal definition. An endowment life insurance is an insurance product that has similarities to a certificate of deposit. Legal definition of endowment insurance.

Life assurance , life insurance insurance paid to named beneficiaries when the insured person dies

These payments are usually made as a lump sum. That is, the institution invests its endowment and helps finance its activities with the profit from the investments. Life insurance that pays the face amount at the end of a specified time period if the insured is alive; Endowment ( ɪnˈdaʊmənt) n 1. Endowment insurance definition, life insurance providing for the payment of a stated sum to the insured if he or she lives beyond the maturity date of the policy, or to a beneficiary if the insured dies before that date. Endowment period of time, in life insurance, at which the face amount of the policy is payable to the insured.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

Endowment life insurance a life insurance policy that provides benefits for a specified period (for example, 20 years or until age 65) and that may be redeemed at face value if the insured is alive at the end of the specified period. An endowment is a nonprofit�s investable assets, which are used for operations or programs that are consistent with the wishes of the donor(s). The face amount is payable in the event of death before the end of the period. 1 n life insurance for a specified amount which is payable to the insured person at the expiration of a certain period of time or to a designated beneficiary immediately upon the death of the insured type of: The property (as a fund) donated to an institution or organization that is invested and producing income an endowment to maintain the gallery.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

For example, an endowment policy that provides benefits for 20 years until the insured is 65 pays its face value after 20 years whether the insured lives or. But unlike deposits, you may not get back what you put in. Endowment period of time, in life insurance, at which the face amount of the policy is payable to the insured. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. That is, the institution invests its endowment and helps finance its activities with the profit from the investments.

Source: youtube.com

Source: youtube.com

The face amount is payable in the event of death before the end of the period. Foundation chairwoman of the state�s arts endowment. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital. Legal definition of endowment insurance. But unlike deposits, you may not get back what you put in.

Source: slideserve.com

Source: slideserve.com

The face amount is payable in the event of death before the end of the period. The property (as a fund) donated to an institution or organization that is invested and producing income an endowment to maintain the gallery. These payments are usually made as a lump sum. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. Endowment insurance definition, life insurance providing for the payment of a stated sum to the insured if he or she lives beyond the maturity date of the policy, or to a beneficiary if the insured dies before that date.

Source: slideshare.net

Source: slideshare.net

The endowment life insurance policy promises a. A pure endowment is a type of life insurance policy in which an insurance company agrees to pay the insured a certain amount of money if the insured is still alive at the end of a specific time period. Endowment ( ɪnˈdaʊmənt) n 1. That is, the institution invests its endowment and helps finance its activities with the profit from the investments. Endowment insurance products are often marketed as a savings plan to help you meet a specific financial goal, such as paying for your children’s education, or building up a pool of savings over a fixed term.

Source: slideshare.net

Source: slideshare.net

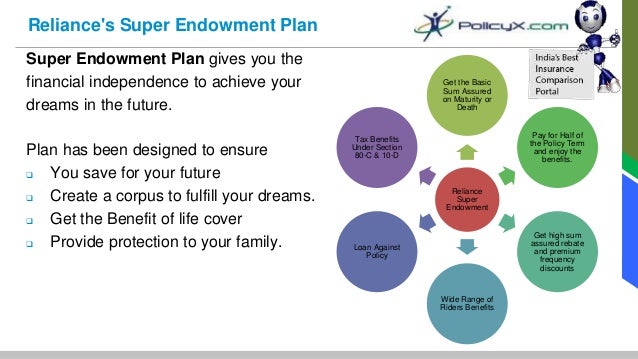

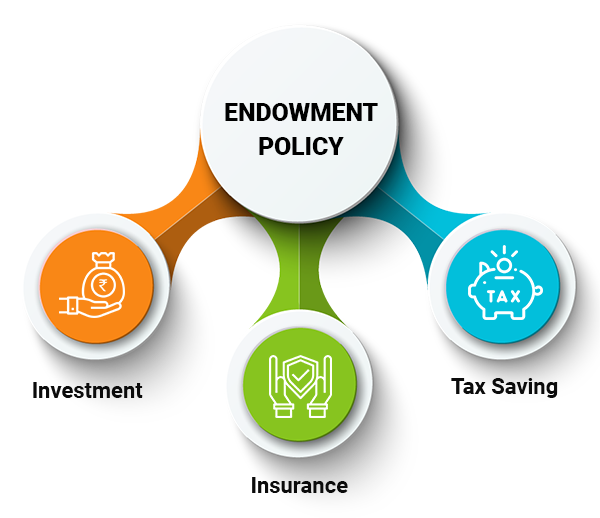

That is, the institution invests its endowment and helps finance its activities with the profit from the investments. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital. These payments are usually made as a lump sum. The fund’s portfolio can be made up of cash, publicly traded securities, real estate, life insurance, retirement accounts, and other assets. Endowment plan is a combination of insurance and investment.

Source: dreamstime.com

Source: dreamstime.com

The face amount is payable in the event of death before the end of the period. The fund’s portfolio can be made up of cash, publicly traded securities, real estate, life insurance, retirement accounts, and other assets. The source of income with which an institution, etc, is endowed b. Foundation chairwoman of the state�s arts endowment. Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years)

Source: slideshare.net

Source: slideshare.net

Endowment ( ɪnˈdaʊmənt) n 1. The source of income with which an institution, etc, is endowed b. Life assurance , life insurance insurance paid to named beneficiaries when the insured person dies Endowment ( ɪnˈdaʊmənt) n 1. The big difference is that it pays a death benefit unlike a certificate of deposit.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

Endowment plan is a combination of insurance and investment. An endowed organization or institution : Foundation chairwoman of the state�s arts endowment. The property (as a fund) donated to an institution or organization that is invested and producing income an endowment to maintain the gallery. An endowment life insurance is an insurance product that has similarities to a certificate of deposit.

Source: aegonlife.com

Source: aegonlife.com

Endowment insurance is a life insurance policy that pays an assured sum on a fixed date or upon the death of the insured, whichever is earlier. 1 n life insurance for a specified amount which is payable to the insured person at the expiration of a certain period of time or to a designated beneficiary immediately upon the death of the insured type of: Endowment insurance law and legal definition. The endowment life insurance policy promises a. Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years)

Source: jaxcf.org

Source: jaxcf.org

The policy matures on a fixed date and that is when the insured gets his or her payout. The property (as a fund) donated to an institution or organization that is invested and producing income an endowment to maintain the gallery. Endowment insurance is a policy that aims to combine the features of a life insurance and a financial plan, usually a college education for the child of the insured. An endowed organization or institution : An endowment life insurance is an insurance product that has similarities to a certificate of deposit.

Source: slideshare.net

Source: slideshare.net

Endowment ( ɪnˈdaʊmənt) n 1. This is in contrast to life insurance, which pays the face value only in the event of the insured�s death. For example, an endowment policy that provides benefits for 20 years until the insured is 65 pays its face value after 20 years whether the insured lives or. That is, the institution invests its endowment and helps finance its activities with the profit from the investments. The face amount is payable in the event of death before the end of the period.

Source: study.com

Source: study.com

Life insurance in which the benefit is paid to the policyowner if he or she is still living at the end of the policy�s term (as 20 years) The policy matures on a fixed date and that is when the insured gets his or her payout. The endowment life insurance policy promises a. An endowment fund is an investment portfolio held by a nonprofit organization—such as a university, hospital, or museum—for the purpose of generating a permanent stream of capital. Its premiums are more expensive compared to similar policies.

Source: clipsbykelley.blogspot.com

Source: clipsbykelley.blogspot.com

Endowment insurance law and legal definition. An endowed organization or institution : The face amount is payable in the event of death before the end of the period. 1 n life insurance for a specified amount which is payable to the insured person at the expiration of a certain period of time or to a designated beneficiary immediately upon the death of the insured type of: An endowment life insurance is an insurance product that has similarities to a certificate of deposit.

Source: planmoneytax.com

Source: planmoneytax.com

An endowment is a nonprofit�s investable assets, which are used for operations or programs that are consistent with the wishes of the donor(s). A term endowment is a type of fund that all or a part of the principal can only be used after a certain time or the occurrence of a certain event. Its premiums are more expensive compared to similar policies. Endowment period of time, in life insurance, at which the face amount of the policy is payable to the insured. The face amount is payable in the event of death before the end of the period.

Source: insurancesamadhan.com

Source: insurancesamadhan.com

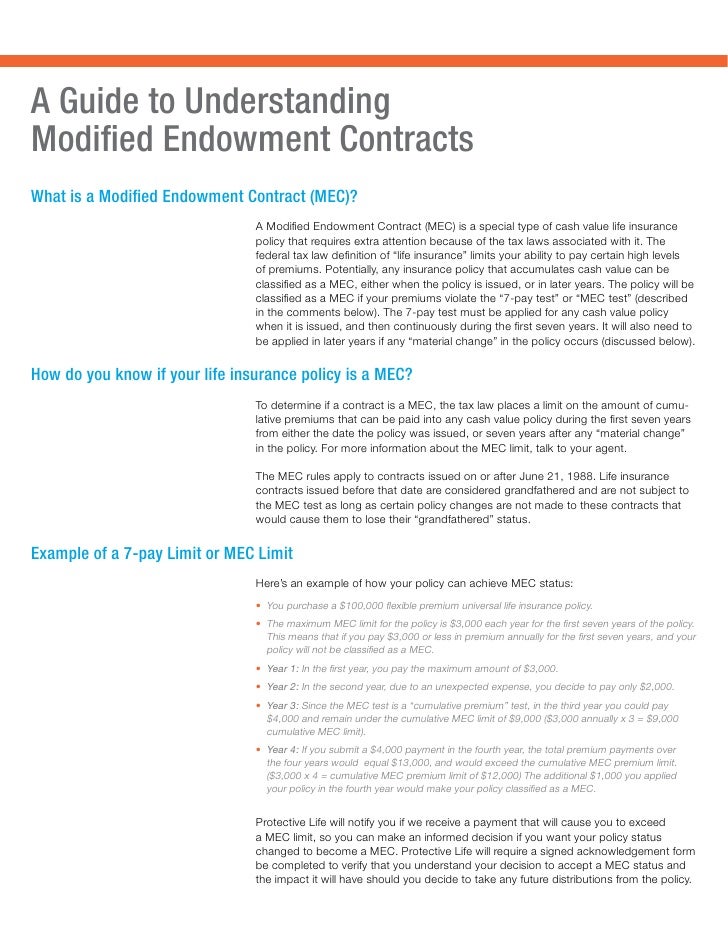

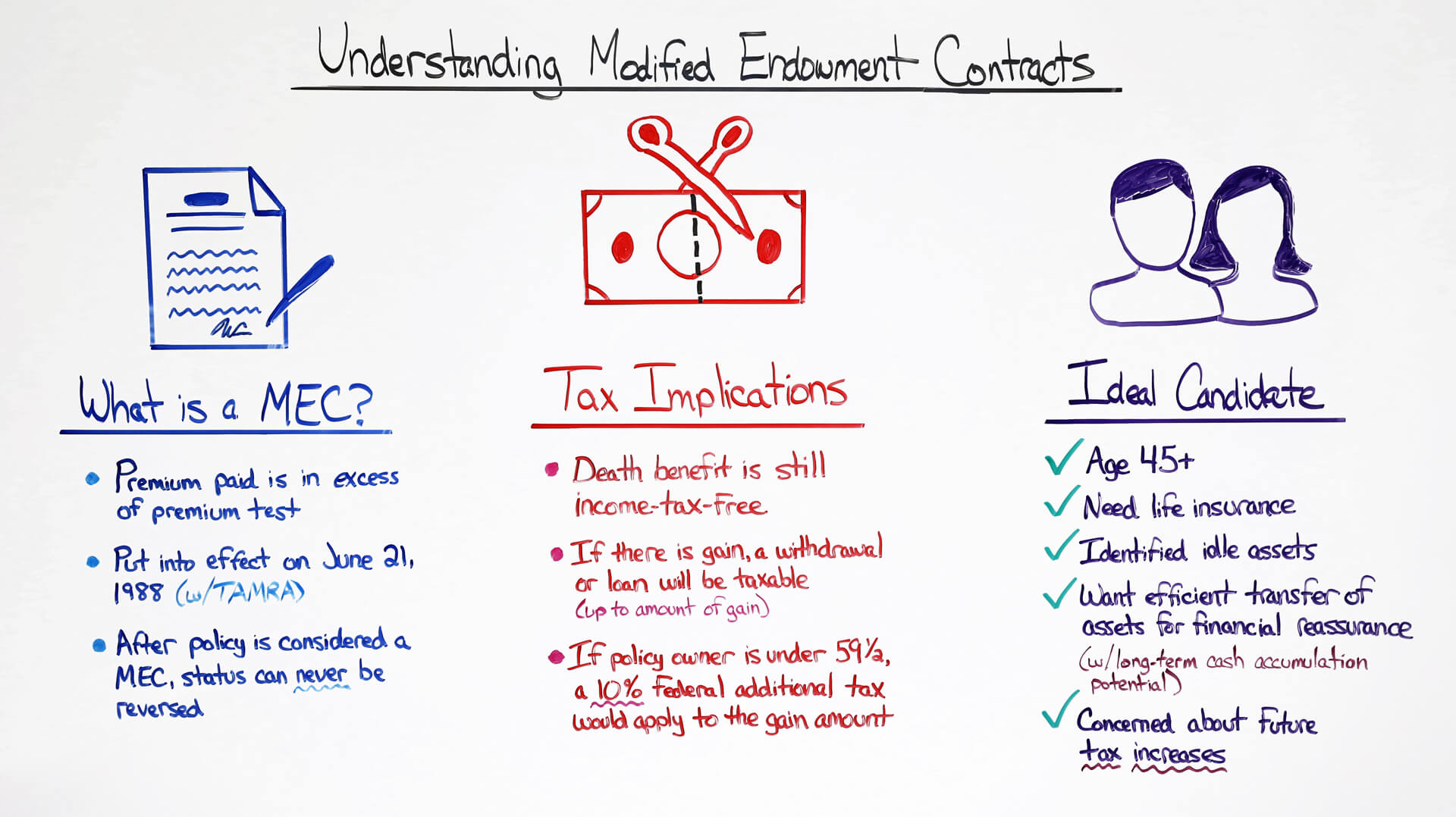

Endowment insurance products are often marketed as a savings plan to help you meet a specific financial goal, such as paying for your children’s education, or building up a pool of savings over a fixed term. Life insurance that pays the face amount at the end of a specified time period if the insured is alive; Endowment insurance law and legal definition. Endowment plan is a combination of insurance and investment. This is in contrast to life insurance, which pays the face value only in the event of the insured�s death.

Source: probuxmantapgan.blogspot.com

Source: probuxmantapgan.blogspot.com

In term plan which is a pure insurance there is no maturity benefit. The source of income with which an institution, etc, is endowed b. But unlike deposits, you may not get back what you put in. In term plan which is a pure insurance there is no maturity benefit. These payments are usually made as a lump sum.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

For example, an endowment policy that provides benefits for 20 years until the insured is 65 pays its face value after 20 years whether the insured lives or. Endowment life insurance is a specialized insurance product that�s often dressed up as a college savings plan. Endowment plan is a combination of insurance and investment. Endowment insurance is a policy that aims to combine the features of a life insurance and a financial plan, usually a college education for the child of the insured. The endowment life insurance policy promises a.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title define endowment insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea