Define twisting in insurance information

Home » Trending » Define twisting in insurance informationYour Define twisting in insurance images are ready. Define twisting in insurance are a topic that is being searched for and liked by netizens today. You can Get the Define twisting in insurance files here. Get all royalty-free vectors.

If you’re looking for define twisting in insurance images information related to the define twisting in insurance interest, you have pay a visit to the right site. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Define Twisting In Insurance. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. You might be refinancing, or adding an addition, and it’s simply a good time to review your existing policy. It is, however, a practice that can lead to ethical lapses. It does not mean that every time an agent replaces.

Twisting Insurance Policy Definition Awesome From xithemes.com

Twisting Insurance Policy Definition Awesome From xithemes.com

“the disreputable practice of selling unnecessary insurance to a customer to earn a commission. Twisting occurs when an insurance agent convinces a life insurance policyholder to replace his or her existing life insurance policy by selling a new similar policy from the agent. The act of twisting when life insurance is being sold is illegal in most states. Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).churning is in effect twisting of policies by the existing insurer (coverage with carrier a is replaced with coverage from carrier a). For example, if an agent offers to share some of his/her commissions earned on the policy sale with the customer, this is rebating and it is.

Twisting is a common term in the insurance industry.

An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. Insurance always deals in risks. Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Most states define insurance rebating as an offer or inducement an agent/broker uses to get a prospective customer to buy an insurance policy where the inducement falls outside of the features of the life insurance contract. Life insurance often presents opportunities for twisting. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics.

Source: insurancereviews911.com

Source: insurancereviews911.com

And if the accident / insurance event occurs, the insurance company. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).churning is in effect twisting of policies by the existing insurer (coverage with carrier a is replaced with coverage from carrier a). Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Unfair and deceptive insurance practices;

Source: topmovielist1.blogspot.com

Source: topmovielist1.blogspot.com

The act of twisting when life insurance is being sold is illegal in most states. Simply convincing you to replace your homeowner’s insurance policy with another isn’t insurance twisting. Insurance fraud occurs when a person or entity makes false insurance claims in order to obtain compensation or benefits to which they are not entitled. It does not mean that every time an agent replaces. Churn can happen for a variety of reasons, natural and unnatural.

Source: khn.org

Source: khn.org

Twisting is almost the same thing but for a little difference. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics. Insurance always deals in risks. Twisting definition, the practice of an insurance agent of tricking the holder of a life insurance policy into letting it lapse so that the insured will replace it with one of a company represented by the agent. It does not mean that every time an agent replaces.

Source: pinterest.com

Source: pinterest.com

After all, you probably went to an agent to get their help in shopping for a new policy. Define twisting insurance is a tool to reduce your risks. Risk is the probability of happening of an unforeseen event or contingency which is never desired. The agent benefits because the commission earned on the sale of a new health insurance policy is substantially. 101 ways to cut business insurance costs.

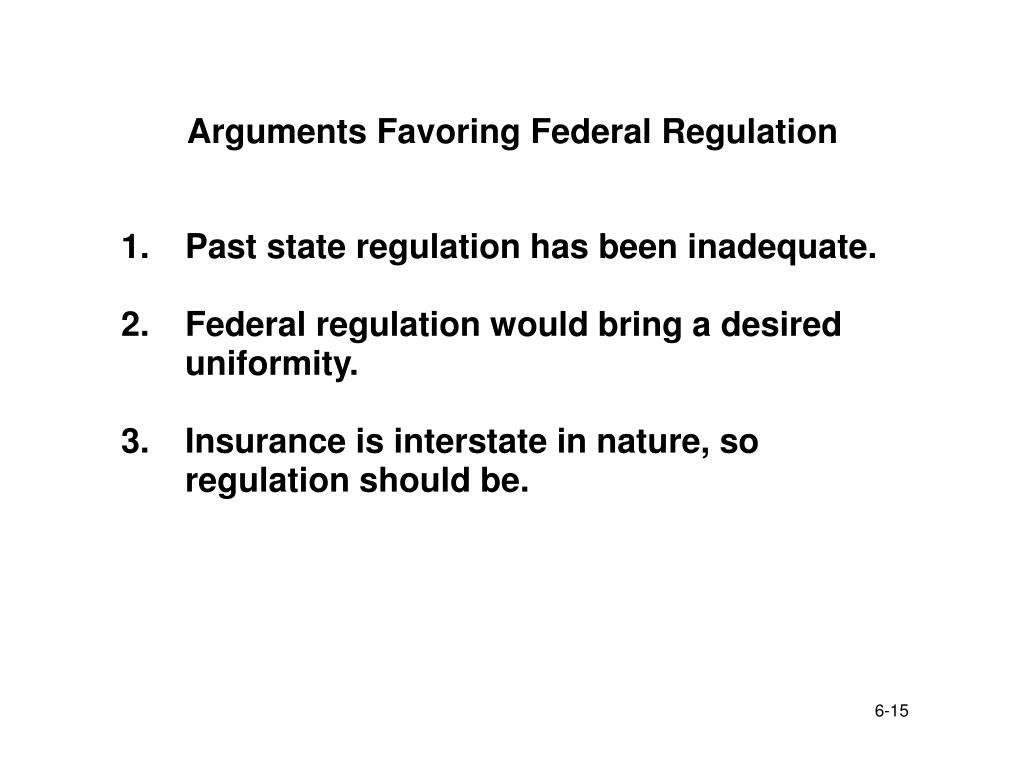

Source: slideserve.com

Source: slideserve.com

Insurance fraud occurs when a person or entity makes false insurance claims in order to obtain compensation or benefits to which they are not entitled. Simply convincing you to replace your homeowner’s insurance policy with another isn’t insurance twisting. Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions. For example, customers can churn when they sell their homes and downsize, or when.

Source: es.slideshare.net

Source: es.slideshare.net

After all, you probably went to an agent to get their help in shopping for a new policy. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions. Define twisting insurance is a tool to reduce your risks. Insurance always deals in risks. Unfair and deceptive insurance practices;

Source: fcarpo.blogspot.com

Source: fcarpo.blogspot.com

The insurance twisting definition that can be found on wikipedia is: Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics. Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies. Insurance always deals in risks. Churn can happen for a variety of reasons, natural and unnatural.

Source: npa1.org

Source: npa1.org

Risk is the probability of happening of an unforeseen event or contingency which is never desired. Back to the insurance terms and definitions index. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions. In order for the act to qualify as twisting, the agent must use misleading or false information to get the person to switch. Churn can happen for a variety of reasons, natural and unnatural.

Source: mishkanet.com

Source: mishkanet.com

Life insurance often presents opportunities for twisting. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics. The insurance twisting definition that can be found on wikipedia is: Most states define insurance rebating as an offer or inducement an agent/broker uses to get a prospective customer to buy an insurance policy where the inducement falls outside of the features of the life insurance contract.

Source: policyholderpulse.com

Source: policyholderpulse.com

Agents should be aware that replacement of coverage can, in some cases, be inappropriate and therefore unethical. Back to the insurance terms and definitions index. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. After all, you probably went to an agent to get their help in shopping for a new policy. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics.

Source: openpr.com

Source: openpr.com

An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale. Twisting occurs when an insurance agent convinces a life insurance policyholder to replace his or her existing life insurance policy by selling a new similar policy from the agent. In the insurance business, rebating is a practice whereby something of value is given to sell the policy that is not provided for in the policy itself. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics. The act of twisting when life insurance is being sold is illegal in most states.

Source: npa1.org

Source: npa1.org

Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Unfair and deceptive insurance practices; To explore this concept, consider the following insurance fraud definition. Life insurance often presents opportunities for twisting. Twisting is almost the same thing but for a little difference.

Source: xithemes.com

Source: xithemes.com

For example, customers can churn when they sell their homes and downsize, or when. Twisting is almost the same thing but for a little difference. Insurance fraud occurs when a person or entity makes false insurance claims in order to obtain compensation or benefits to which they are not entitled. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them. Twisting definition, the practice of an insurance agent of tricking the holder of a life insurance policy into letting it lapse so that the insured will replace it with one of a company represented by the agent.

Source: stats.stackexchange.com

Source: stats.stackexchange.com

Define twisting insurance is a tool to reduce your risks. [noun] the use of misrepresentation or trickery to get someone to lapse a life insurance policy and buy another usually in another company. Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies. Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one.

Source: topmovielist1.blogspot.com

Source: topmovielist1.blogspot.com

“the disreputable practice of selling unnecessary insurance to a customer to earn a commission. Churn can happen for a variety of reasons, natural and unnatural. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics. Twisting — the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies.

Source: kenyachambermines.com

Source: kenyachambermines.com

Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Twisting occurs when an insurance agent replaces an existing life policy with a new one using misleading tactics. You might be refinancing, or adding an addition, and it’s simply a good time to review your existing policy. Define twisting insurance is a tool to reduce your risks. An example of rebating is when the prospective insurance buyer receives a refund of all or part of the commission for the insurance sale.

Source: another-hearts.blogspot.com

Source: another-hearts.blogspot.com

Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Most states define insurance rebating as an offer or inducement an agent/broker uses to get a prospective customer to buy an insurance policy where the inducement falls outside of the features of the life insurance contract. Back to the insurance terms and definitions index. The insurance twisting definition that can be found on wikipedia is: Define twisting insurance is a tool to reduce your risks.

Source: us.dujuz.com

Source: us.dujuz.com

Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. [noun] the use of misrepresentation or trickery to get someone to lapse a life insurance policy and buy another usually in another company. For example, customers can churn when they sell their homes and downsize, or when. Insurance fraud is committed in many forms, but regardless of the type, it is considered a serious crime in all jurisdictions. Twisting is a common term in the insurance industry.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title define twisting in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea