Defined contribution plan health insurance information

Home » Trend » Defined contribution plan health insurance informationYour Defined contribution plan health insurance images are available. Defined contribution plan health insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Defined contribution plan health insurance files here. Download all royalty-free photos.

If you’re looking for defined contribution plan health insurance pictures information linked to the defined contribution plan health insurance interest, you have pay a visit to the right blog. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

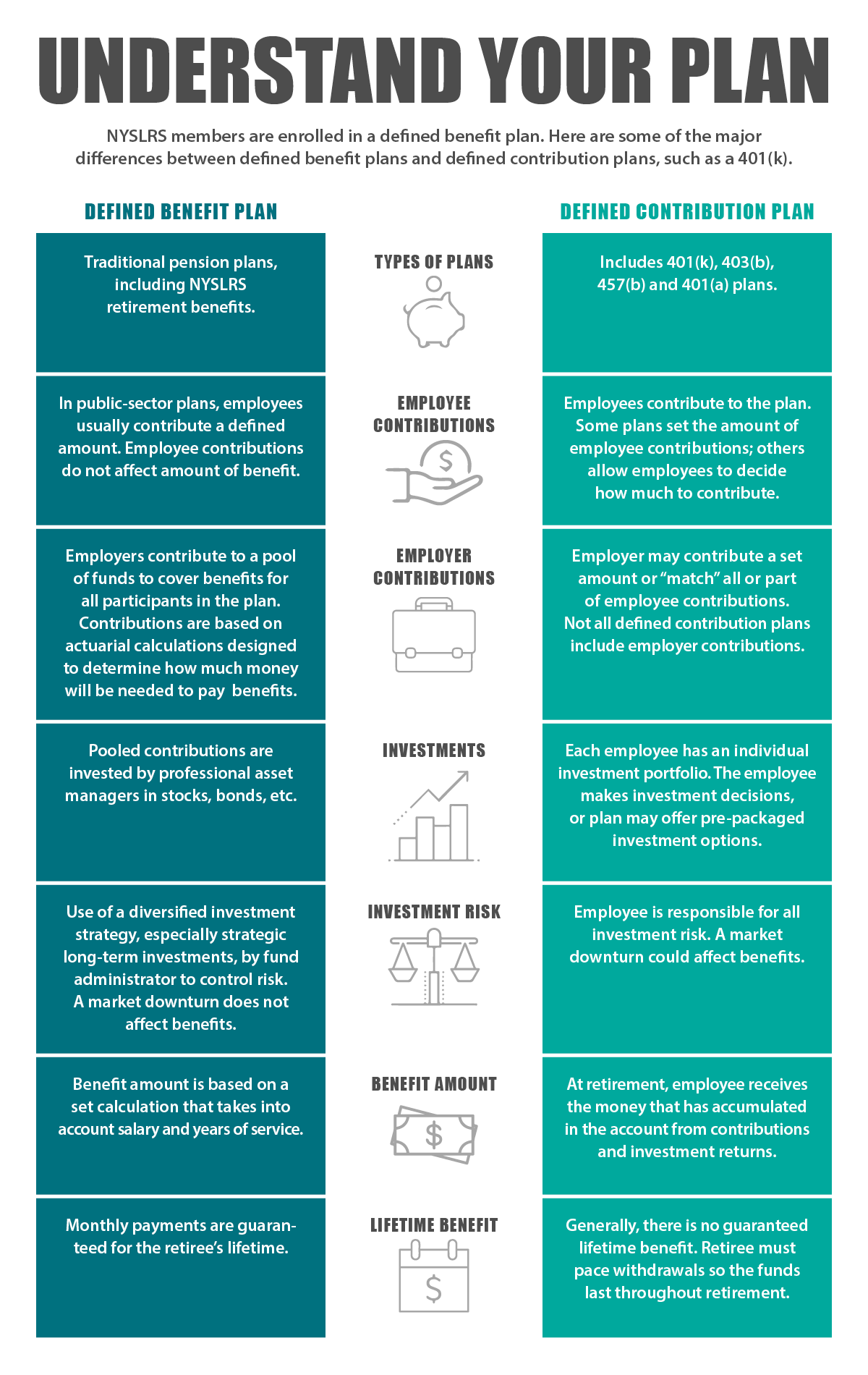

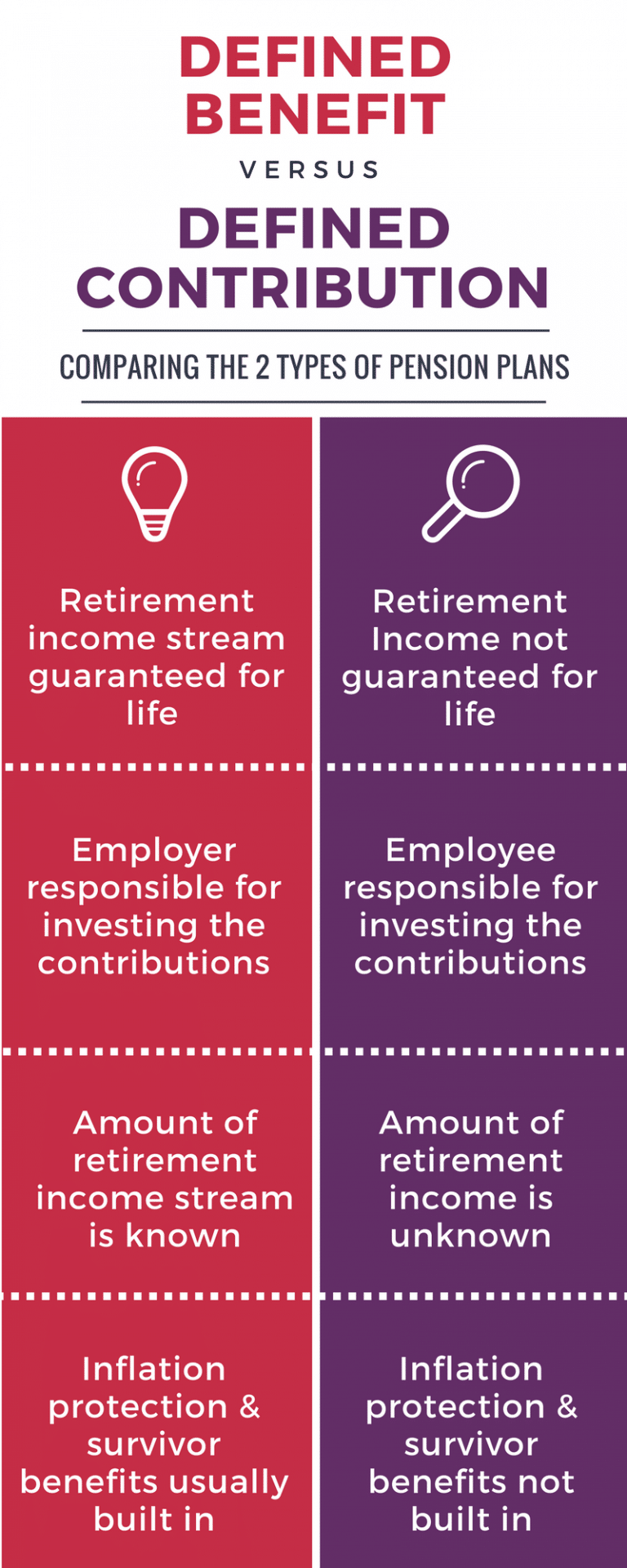

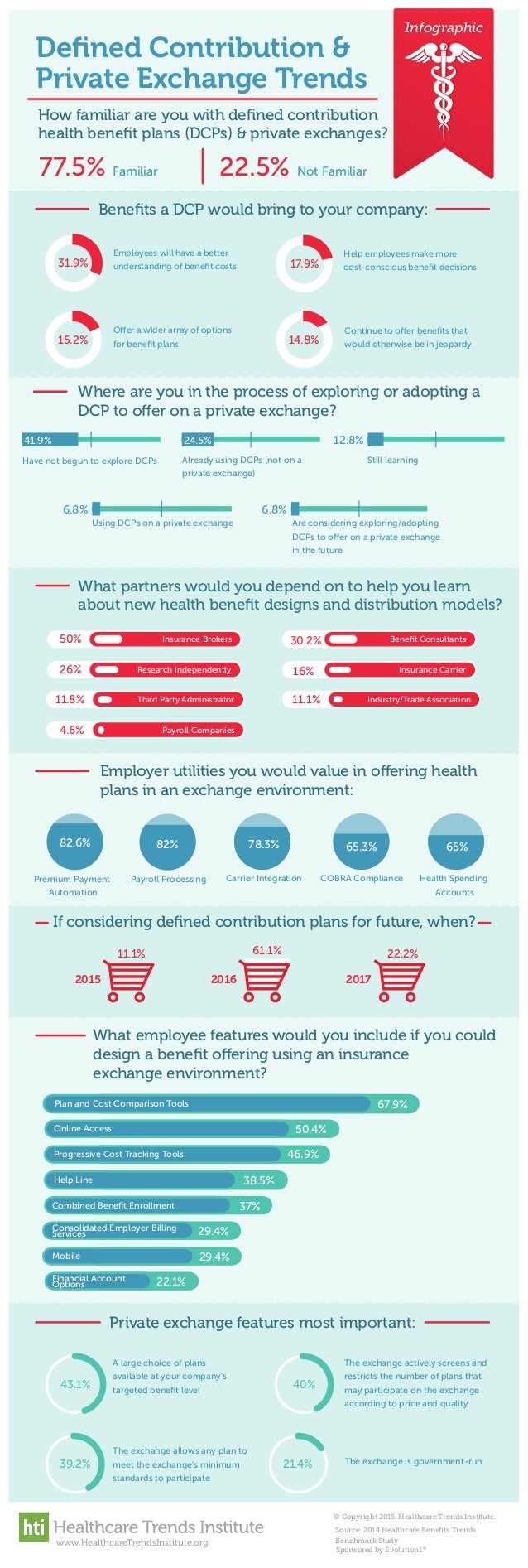

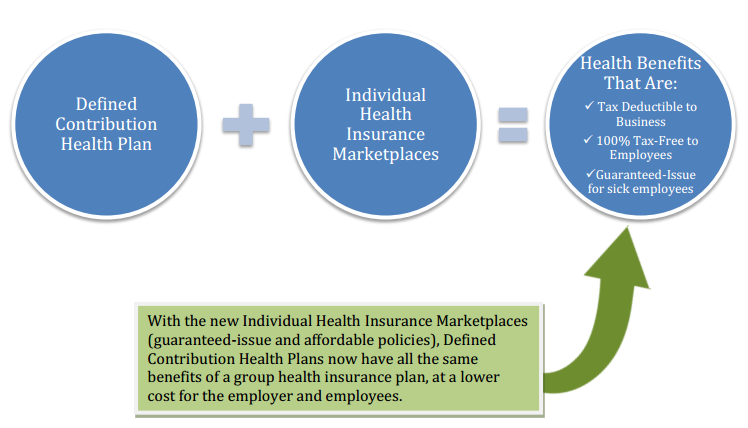

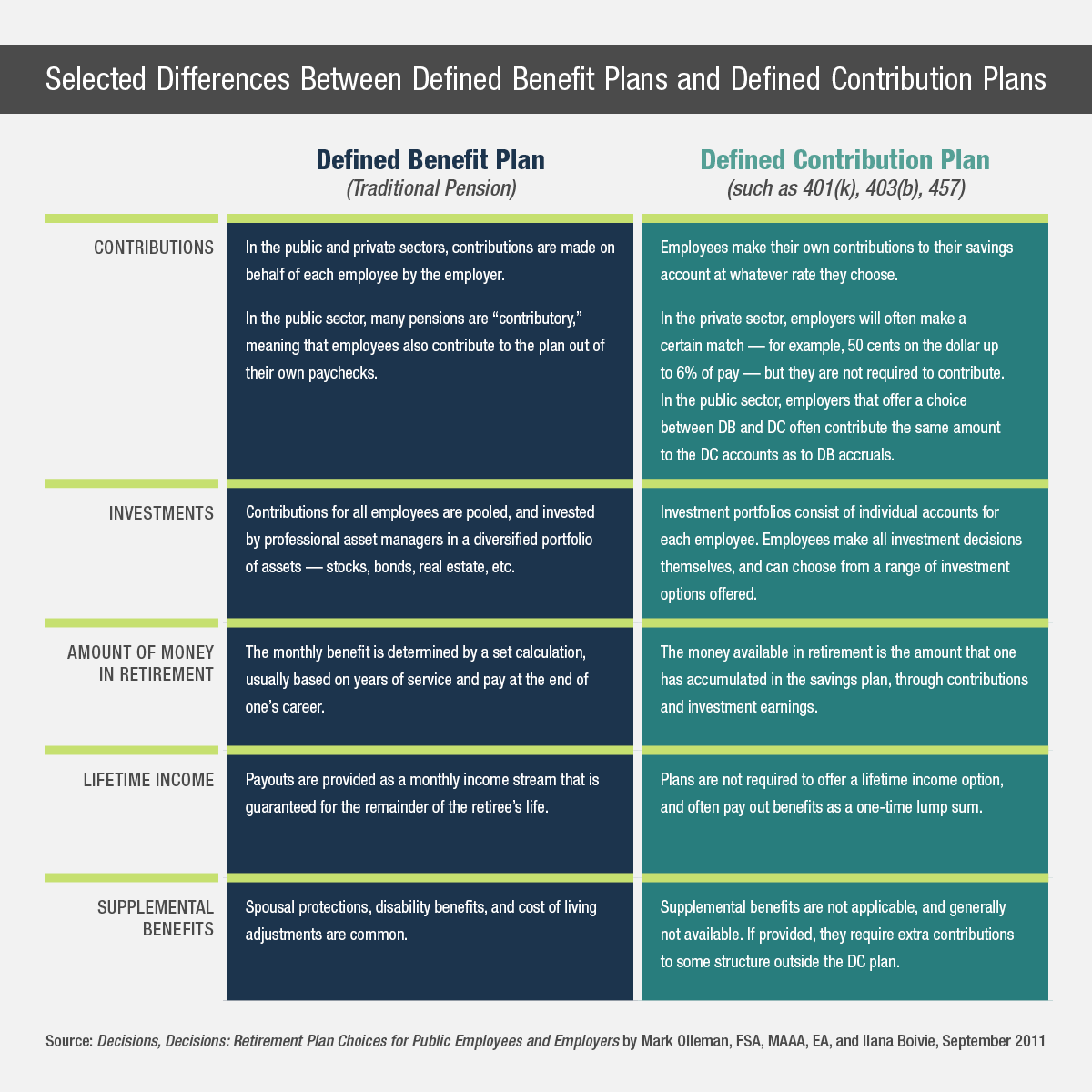

Defined Contribution Plan Health Insurance. The shift from employer sponsored plans (a defined benefit) to defined contribution health plans is similar to the shift in retirement savings from pensions (a defined benefit) to 401ks (a defined contribution). There has been a significant increase in interest surrounding guaranteed income, especially for defined contribution plans recently. Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage. However, uptake of annuities in dc plans has been relatively slow despite innovations in the space and a growing agreement regarding their potential value.

What is a defined contribution health plan? From olympiabenefits.com

Parente, and ruth taylor abstract: The employees don’t have any coverage options. Products that offer guaranteed income, such as annuities, have the potential to. An employee uses the employer contribution to select products that best meet their needs. With db, the employer chooses and administers the insurance plan. However, uptake of annuities in dc plans has been relatively slow despite innovations in the space and a growing agreement regarding their potential value.

Employees use that money to buy or help pay for a health insurance plan they select for themselves.

However, uptake of annuities in dc plans has been relatively slow despite innovations in the space and a growing agreement regarding their potential value. When following the above guidelines it allows the employer to contribute to an individual health insurance plan maintaining compliance with federal law. Parente, and ruth taylor abstract: Defined contribution plan — a pension plan calling for definite annual contributions by the employer but. Defined contribution (dc) is a newer model. Post wwii policies led to db health plans.

Source: pinterest.com

Source: pinterest.com

Defined contribution health plans are not really health plans, at least not in the traditional sense. However, uptake of annuities in dc plans has been relatively slow despite innovations in the space and a growing agreement regarding their potential value. In a defined contribution plan employers are able to give employees different contributions based on their class or position within the company. Defined benefit plan refers to the type of health insurance benefits that employers have traditionally offered their employees. The employee uses these funds to purchase a health insurance policy of his or her own choice.

Source: nyretirementnews.com

Source: nyretirementnews.com

Defined contribution health plans are programs that allow employees to be more involved in their health care choices. Post wwii policies led to db health plans. With a pure defined contribution plan a business contributes a fixed dollar amount (a defined contribution) toward employees� health insurance expenses. There has been a significant increase in interest surrounding guaranteed income, especially for defined contribution plans recently. A lack of strategy around.

Source: nysretirementnews.com

Source: nysretirementnews.com

Parente, and ruth taylor abstract: An employee uses the employer contribution to select products that best meet their needs. Health (8 days ago) the new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal. Defined benefit plan refers to the type of health insurance benefits that employers have traditionally offered their employees. Defined contribution health plans are not really health plans, at least not in the traditional sense.

Source: zanebenefits.com

Source: zanebenefits.com

Defined contribution plan — a pension plan calling for definite annual contributions by the employer but. Essentially, under a defined contribution health plan, the employer gives workers a set amount of money to choose from an array of employee health insurance coverage options — like getting money to shop the. Post wwii policies led to db health plans. Development and prospects a new model is working its way into the benefit offerings of large employers, signaling a shift from traditional managed care plans. Defined benefit plan refers to the type of health insurance benefits that employers have traditionally offered their employees.

Source: pharmatax.ca

Source: pharmatax.ca

Parente, and ruth taylor abstract: Defined contribution health care allows employers to provide workers with a set dollar amount to purchase a plan through a private exchange, increasing employers control over their future costs. In contrast, with a dc plan, the employer provides the employee with a fixed quantity of money; In a defined contribution health plan (similar to a 401(k)), employers make fixed contributions to health accounts that employees tap to purchase health insurance on private exchanges. A lack of strategy around.

Source: slideshare.net

Source: slideshare.net

Therefore, it’s imperative that the benefits administrator and the insurance broker develop a sustainable contribution strategy that makes sense for the employer and workforce. In defined contribution plans, the employee takes the reigns and controls health care costs by the choices they make. With db, the employer chooses and administers the insurance plan. The shift from employer sponsored plans (a defined benefit) to defined contribution health plans is similar to the shift in retirement savings from pensions (a defined benefit) to 401ks (a defined contribution). With a pure defined contribution plan a business contributes a fixed dollar amount (a defined contribution) toward employees� health insurance expenses.

Source: pinterest.com

Source: pinterest.com

A defined contribution plan is a retirement plan funded by contributions from employers or employees—or both. Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage. When following the above guidelines it allows the employer to contribute to an individual health insurance plan maintaining compliance with federal law. A defined contribution plan is a retirement plan funded by contributions from employers or employees—or both. Health (8 days ago) the new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal.

Defined contribution health plans are not really health plans, at least not in the traditional sense. Under a defined contribution health plan, an employer gives its employees a fixed contribution to purchase health insurance coverage. Products that offer guaranteed income, such as annuities, have the potential to. Defined contribution strategy for health insurance at. Development and prospects a new model is working its way into the benefit offerings of large employers, signaling a shift from traditional managed care plans.

Source: zanebenefits.com

Source: zanebenefits.com

In a defined contribution health plan (similar to a 401(k)), employers make fixed contributions to health accounts that employees tap to purchase health insurance on private exchanges. Post wwii policies led to db health plans. Products that offer guaranteed income, such as annuities, have the potential to. Health (8 days ago) the new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal. This class can be based on job categories, geographic.

Source: researchgate.net

Source: researchgate.net

Therefore, it’s imperative that the benefits administrator and the insurance broker develop a sustainable contribution strategy that makes sense for the employer and workforce. Health (8 days ago) the new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal. Defined contribution health care allows employers to provide workers with a set dollar amount to purchase a plan through a private exchange, increasing employers control over their future costs. Defined contribution health plans are not really health plans, at least not in the traditional sense. An employee uses the employer contribution to select products that best meet their needs.

Source: zanebenefits.com

Source: zanebenefits.com

With a pure defined contribution plan a business contributes a fixed dollar amount (a defined contribution) toward employees� health insurance expenses. Under a defined contribution health plan, an employer gives its employees a fixed contribution to purchase health insurance coverage. This class can be based on job categories, geographic. Defined contribution (dc) is a newer model. The employees don’t have any coverage options.

Source: offers.zanebenefits.com

Source: offers.zanebenefits.com

However, uptake of annuities in dc plans has been relatively slow despite innovations in the space and a growing agreement regarding their potential value. Under a defined contribution health plan, an employer gives its employees a fixed contribution to purchase health insurance coverage. They earn valuable tax breaks, and help you grow your retirement savings over time. The employee uses these funds to purchase a health insurance policy of his or her own choice. Essentially, under a defined contribution health plan, the employer gives workers a set amount of money to choose from an array of employee health insurance coverage options — like getting money to shop the.

![Defined Contribution Trends in Health Plans [Infographic] Defined Contribution Trends in Health Plans [Infographic]](https://cdn.slidesharecdn.com/ss_cropped_thumbnails/definedcontributiontrends-140131120821-phpapp01/thumbnail-large.jpg?cb=1447710032) Source: slideshare.net

Source: slideshare.net

With db, the employer chooses and administers the insurance plan. Under a defined contribution health plan, an employer gives its employees a fixed contribution to purchase health insurance coverage. Parente, and ruth taylor abstract: Under a defined contribution health plan, an employer gives its employees a fixed contribution to purchase health insurance coverage. Defined contribution health plans are programs that allow employees to be more involved in their health care choices.

Source: olympiabenefits.com

Health (8 days ago) the new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal. A lack of strategy around. Defined contribution (dc) is a newer model. They earn valuable tax breaks, and help you grow your retirement savings over time. Essentially, under a defined contribution health plan, the employer gives workers a set amount of money to choose from an array of employee health insurance coverage options — like getting money to shop the.

Source: prweb.com

Source: prweb.com

There has been a significant increase in interest surrounding guaranteed income, especially for defined contribution plans recently. Although still in the early stages, interest in dc approaches has. Under a defined contribution health plan, an employer gives its employees a fixed contribution to purchase health insurance coverage. Essentially, under a defined contribution health plan, the employer gives workers a set amount of money to choose from an array of employee health insurance coverage options — like getting money to shop the. What is a defined contribution health plan?

Source: mbaileygroup.com

Source: mbaileygroup.com

Defined contribution plan — a pension plan calling for definite annual contributions by the employer but. Regarding a defined contribution arrangement, if an employer chooses to exercise control over the defined contribution arrangement, it will likely be considered a group health plan, and the employer will need to comply with erisa plan requirements. Although still in the early stages, interest in dc approaches has. Therefore, it’s imperative that the benefits administrator and the insurance broker develop a sustainable contribution strategy that makes sense for the employer and workforce. Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage.

Source: leadingretirement.com

Source: leadingretirement.com

When following the above guidelines it allows the employer to contribute to an individual health insurance plan maintaining compliance with federal law. A defined contribution plan is a retirement plan funded by contributions from employers or employees—or both. Regarding a defined contribution arrangement, if an employer chooses to exercise control over the defined contribution arrangement, it will likely be considered a group health plan, and the employer will need to comply with erisa plan requirements. However, uptake of annuities in dc plans has been relatively slow despite innovations in the space and a growing agreement regarding their potential value. The shift from employer sponsored plans (a defined benefit) to defined contribution health plans is similar to the shift in retirement savings from pensions (a defined benefit) to 401ks (a defined contribution).

Source: nyretirementnews.com

Source: nyretirementnews.com

When following the above guidelines it allows the employer to contribute to an individual health insurance plan maintaining compliance with federal law. The employees don’t have any coverage options. Parente, and ruth taylor abstract: The employer picks a plan or plans, and offers them to the employee, with a predetermined premium amount that the employee will have to contribute via payroll deduction. What is a defined contribution health plan?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title defined contribution plan health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information