Defined contribution strategy for health insurance Idea

Home » Trend » Defined contribution strategy for health insurance IdeaYour Defined contribution strategy for health insurance images are ready. Defined contribution strategy for health insurance are a topic that is being searched for and liked by netizens now. You can Download the Defined contribution strategy for health insurance files here. Download all royalty-free vectors.

If you’re searching for defined contribution strategy for health insurance pictures information related to the defined contribution strategy for health insurance keyword, you have come to the right blog. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

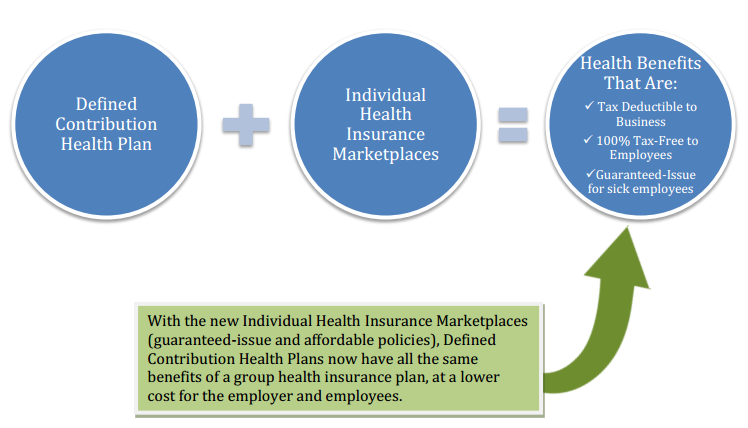

Defined Contribution Strategy For Health Insurance. However, suppose the employee has a family and the family premium is $1300. Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage. Defined contribution strategy for health insurance at. A contribution strategy is critically important to the success of your health plan.

How "defined contribution" is changing small business From takecommandhealth.com

How "defined contribution" is changing small business From takecommandhealth.com

It’s strictly an increase in salary. The general concept of a defined contribution health plan is that an employer gives each employee a fixed dollar amount (a “defined contribution”) that the employees can then choose how to spend towards benefits. Defined contribution means you the business owner set an amount each month that you�ll reimburse your employees for their own individual policies. In other words, you can not make it a line item as paying for health insurance (like you do/did when you pay for a group policy). Instead of offering a set of benefits and committing to pay the same percentage of them each year, the employer defines a flat dollar amount to contribute to the cost of employees’ health plan. However, suppose the employee has a family and the family premium is $1300.

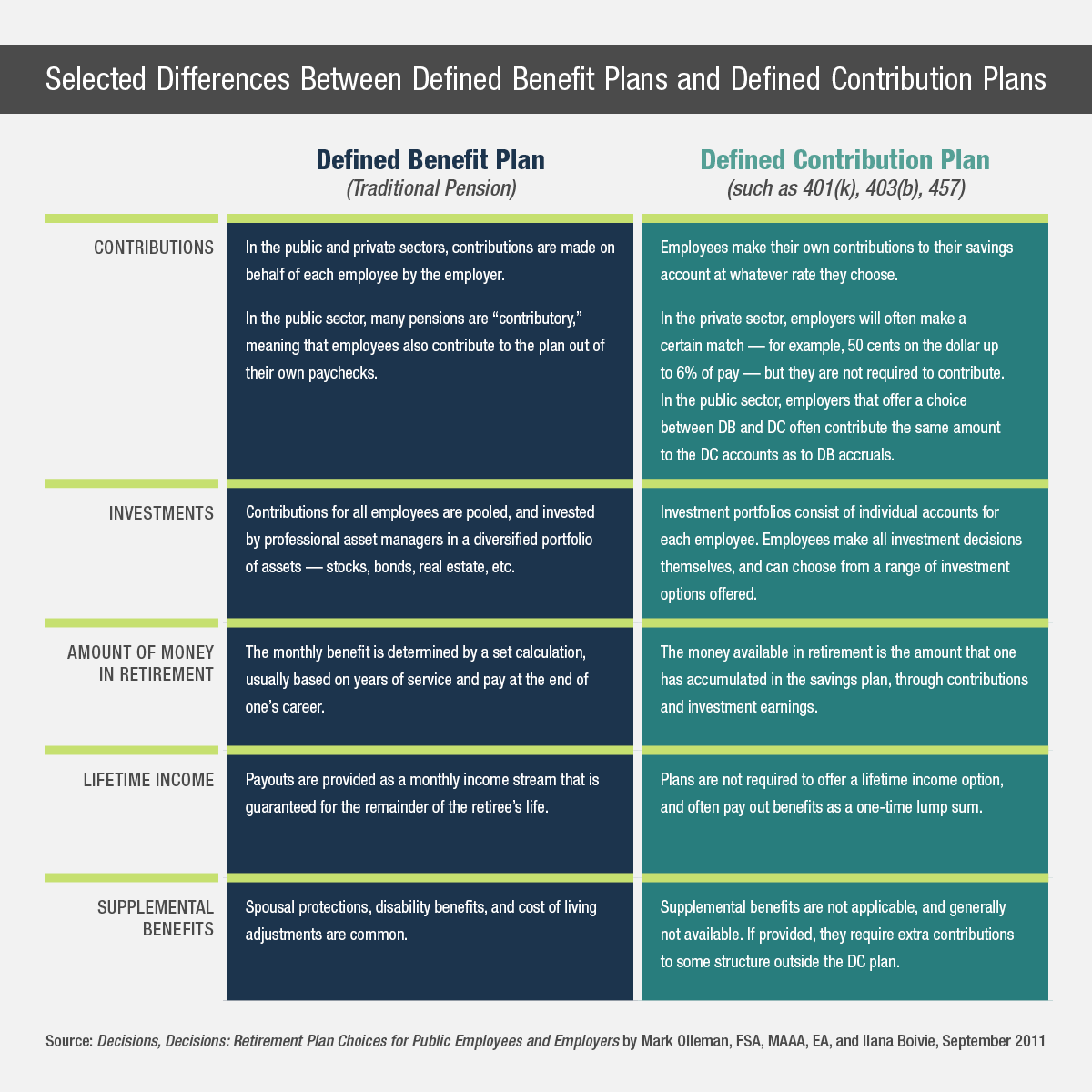

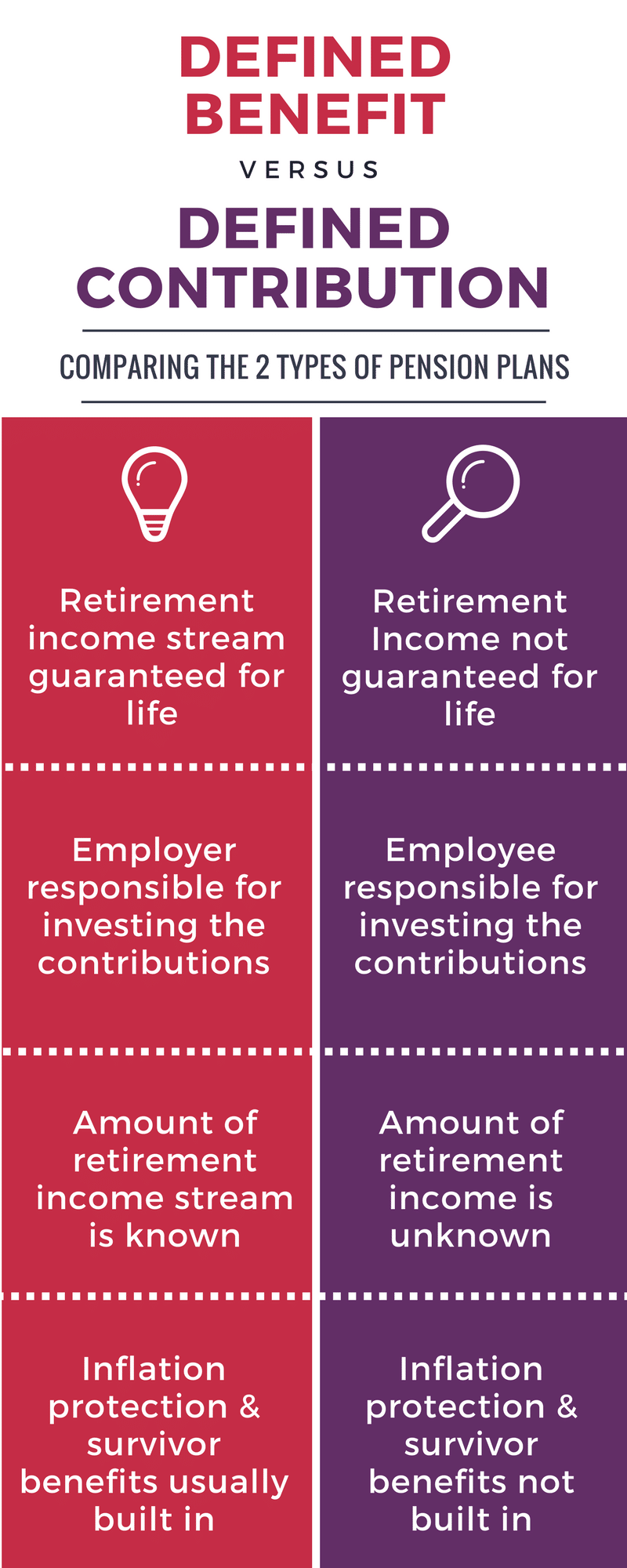

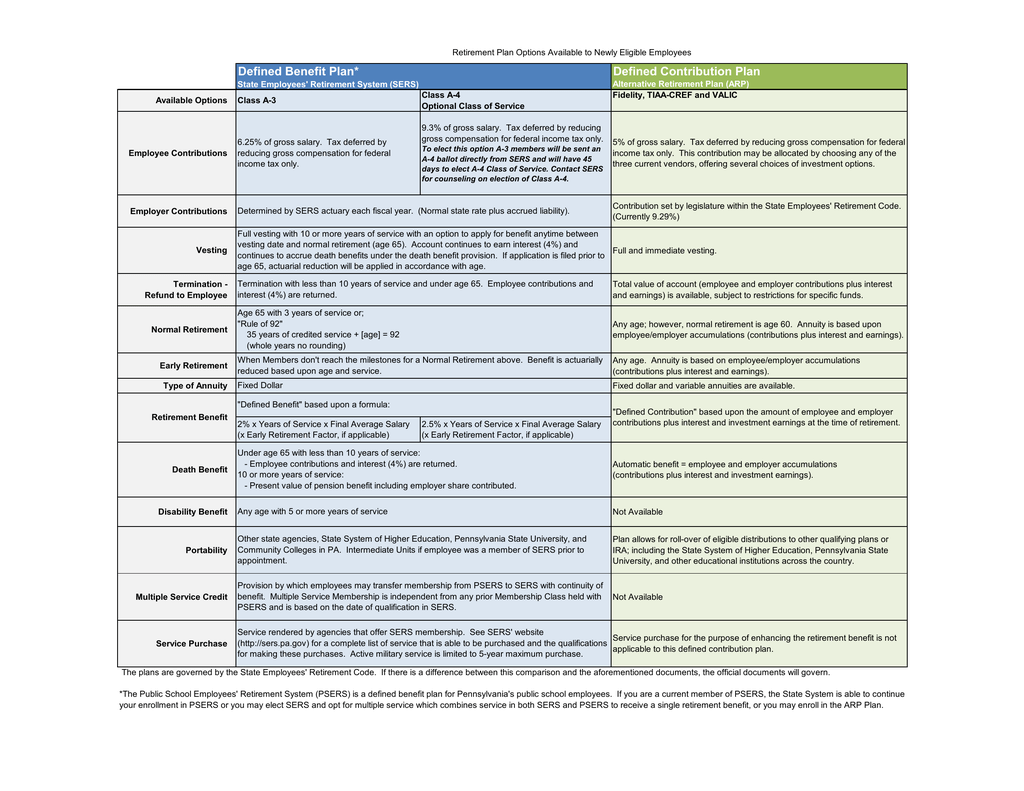

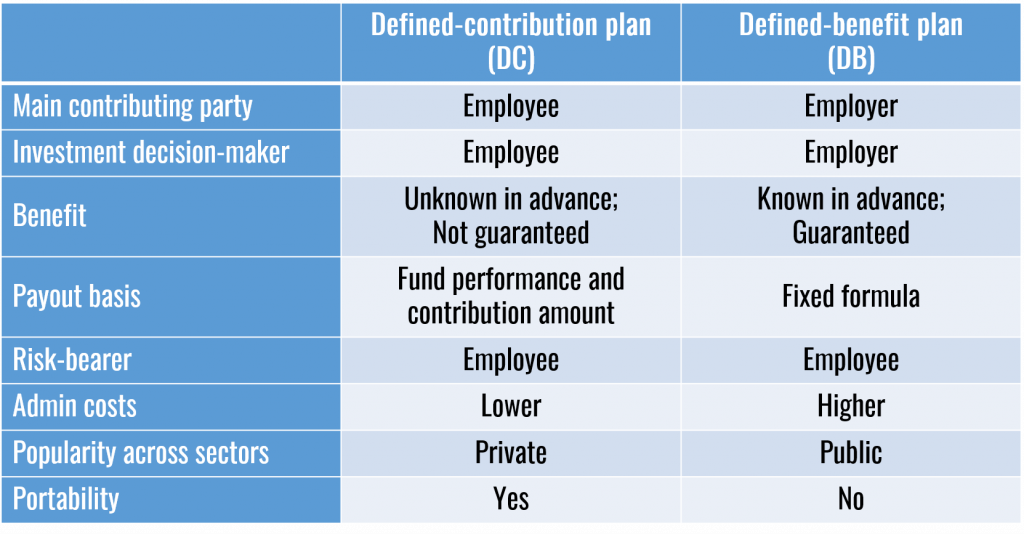

A defined contribution strategy is an alternative to the defined benefits model.

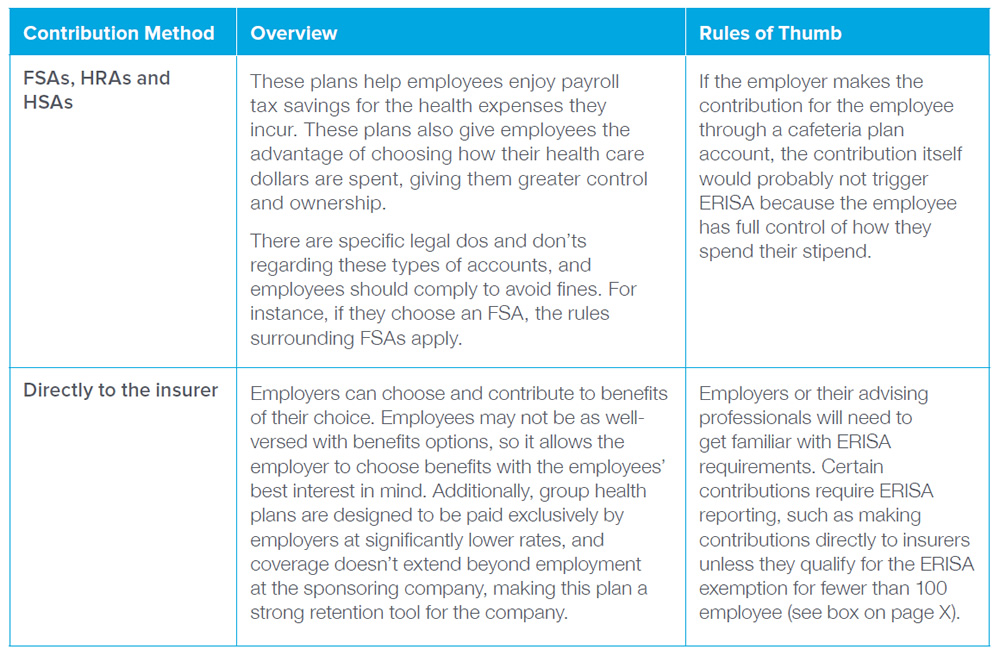

In group health insurance plans, employers manage the health care costs by adjusting benefit levels or copayments annually. So, if their premium is $450 a month with a 50% split between employer and employee, that obviously means they pay $225 and you pay the other $225. The bump can not be tax deducted on the employer’s end. The general strategy of a defined contribution health plan is that: Employees access these hra funds to purchase health insurance on a private exchange consisting of policy options from either a single or multiple health carriers. What is a defined contribution?

Source: slideserve.com

Source: slideserve.com

Instead of offering a set of benefits and committing to pay the same percentage of them each year, the employer defines a flat dollar amount to contribute to the cost of employees’ health plan. There’s a new mindset for employers, and it’s beginning to be understood by employees. Controlling the employer’s rising costs of health care Many small businesses have been doing this, but in the past you�d end up having to pay expensive payroll taxes and your employees would have to pay income taxes. The bump can not be tax deducted on the employer’s end.

Source: pinterest.com

Source: pinterest.com

A contribution strategy is critically important to the success of your health plan. A lack of strategy creates all kinds of problems and will continue to do so as the aca increases its impact on employee benefit plan offerings. So, if their premium is $450 a month with a 50% split between employer and employee, that obviously means they pay $225 and you pay the other $225. The general strategy of a defined contribution health plan is that: Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage.

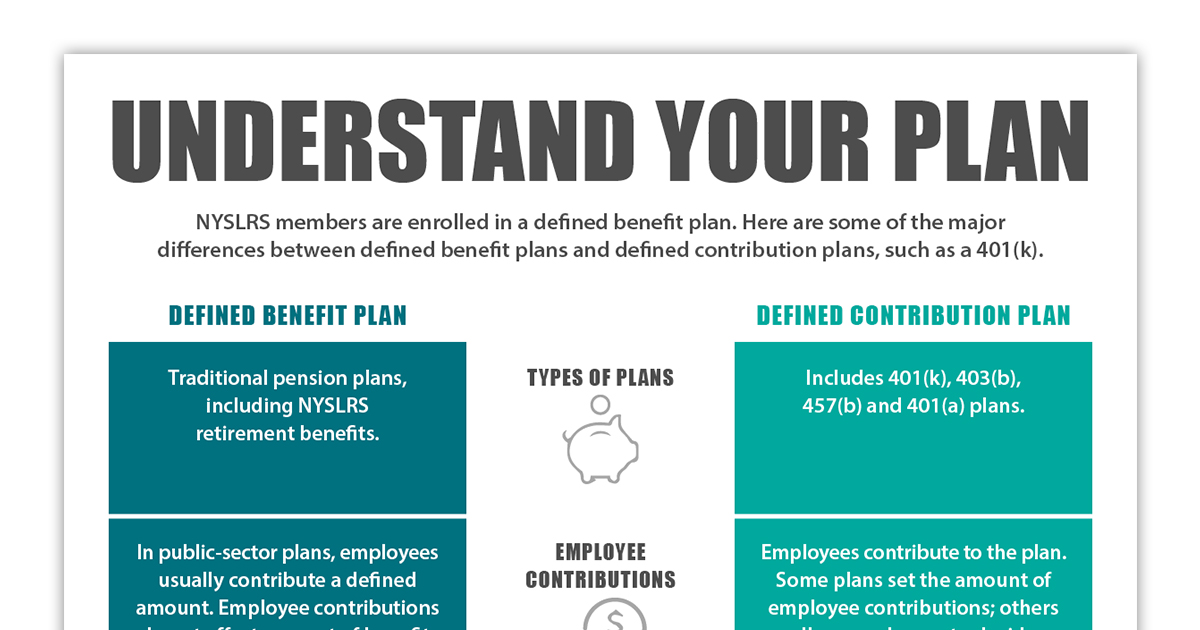

Source: nyretirementnews.com

Source: nyretirementnews.com

In group health insurance plans, employers manage the health care costs by adjusting benefit levels or copayments annually. Consider the example in figure 1 that illustrates a benefit An employee uses the employer contribution to select products that best meet their needs Defined contribution means you the business owner set an amount each month that you�ll reimburse your employees for their own individual policies. This might be a direct contribution to a savings account or an allowance the employer agrees to reimburse employees after the expenses are incurred.

Source: pharmatax.ca

Source: pharmatax.ca

A defined contribution strategy is an alternative to the defined benefits model. Many small businesses have been doing this, but in the past you�d end up having to pay expensive payroll taxes and your employees would have to pay income taxes. Controlling the employer’s rising costs of health care Here’s how to implement the defined contribution strategy: The bump can not be tax deducted on the employer’s end.

Source: pinterest.com

Source: pinterest.com

Employees access these hra funds to purchase health insurance on a private exchange consisting of policy options from either a single or multiple health carriers. A defined contribution strategy is an alternative to the defined benefits model. An employee uses the employer contribution to select products that best meet their needs A lack of strategy creates all kinds of problems and will continue to do so as the aca increases its impact on employee benefit plan offerings. Controlling the employer’s rising costs of health care

Source: aflac.com

Source: aflac.com

Controlling the employer’s rising costs of health care The employer offers each employee a fixed monthly dollar amount to spend on qualified medical expenses. Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage. A defined contribution strategy is an alternative to the defined benefits model. The general strategy of a defined contribution health plan is that:

Source: studylib.net

Source: studylib.net

A defined contribution strategy is an alternative to the defined benefits model. It’s strictly an increase in salary. Small tech companies looking to set up health benefits with defined contribution generally work with a health insurance broker, and follow these four simple steps: In group health insurance plans, employers manage the health care costs by adjusting benefit levels or copayments annually. The general concept of a defined contribution health plan is that an employer gives each employee a fixed dollar amount (a “defined contribution”) that the employees can then choose how to spend towards benefits.

Source: mbaileygroup.com

Source: mbaileygroup.com

The new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal funds to the employer’s contribution, usually. A defined contribution strategy is an alternative to the defined benefits model. Controlling the employer’s rising costs of health care In other words, you can not make it a line item as paying for health insurance (like you do/did when you pay for a group policy). An employee uses the employer contribution to select products that best meet their needs

Source: nyretirementnews.com

Source: nyretirementnews.com

So, if their premium is $450 a month with a 50% split between employer and employee, that obviously means they pay $225 and you pay the other $225. Consider the example in figure 1 that illustrates a benefit In group health insurance plans, employers manage the health care costs by adjusting benefit levels or copayments annually. Controlling the employer’s rising costs of health care Instead of offering a set of benefits and committing to pay the same percentage of them each year, the employer defines a flat dollar amount to contribute to the cost of employees’ health plan.

Source: zanebenefits.com

Source: zanebenefits.com

Health (8 days ago) the new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal. Instead of offering a set of benefits and committing to pay the same percentage of them each year, the employer defines a flat dollar amount to contribute to the cost of employees’ health plan. You can give them a “bump” in salary to help them pay for their insurance. It’s strictly an increase in salary. However, suppose the employee has a family and the family premium is $1300.

Source: definitionus.blogspot.com

The general strategy of a defined contribution health plan is that: It’s strictly an increase in salary. In other words, you can not make it a line item as paying for health insurance (like you do/did when you pay for a group policy). In this example, they would pay $650 and you would pay the $650 balance. In group health insurance plans, employers manage the health care costs by adjusting benefit levels or copayments annually.

Source: zanebenefits.com

Source: zanebenefits.com

There’s a new mindset for employers, and it’s beginning to be understood by employees. A lack of strategy creates all kinds of problems and will continue to do so as the aca increases its impact on employee benefit plan offerings. This might be a direct contribution to a savings account or an allowance the employer agrees to reimburse employees after the expenses are incurred. Controlling the employer’s rising costs of health care Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage.

Source: pinterest.com

Source: pinterest.com

Controlling the employer’s rising costs of health care Defined contribution allows employers to establish an annual dollar contribution amount per employee to spend on all health care plan coverage. In defined contribution plans, the employee takes the reigns and controls health care costs by the choices they make. Instead of offering a set of benefits and committing to pay the same percentage of them each year, the employer defines a flat dollar amount to contribute to the cost of employees’ health plan. In group health insurance plans, employers manage the health care costs by adjusting benefit levels or copayments annually.

Source: 365financialanalyst.com

Source: 365financialanalyst.com

The new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal funds to the employer’s contribution, usually. The general strategy of a defined contribution health plan is that: (1) defined contribution health care allows employers to provide workers with a set dollar amount to purchase a plan through a private exchange, (2). A lack of strategy creates all kinds of problems and will continue to do so as the aca increases its impact on employee benefit plan offerings. Many small businesses have been doing this, but in the past you�d end up having to pay expensive payroll taxes and your employees would have to pay income taxes.

Source: youtube.com

Source: youtube.com

A defined contribution strategy is an alternative to the defined benefits model. Small tech companies looking to set up health benefits with defined contribution generally work with a health insurance broker, and follow these four simple steps: Instead of offering a set of benefits and committing to pay the same percentage of them each year, the employer defines a flat dollar amount to contribute to the cost of employees’ health plan. In defined contribution plans, the employee takes the reigns and controls health care costs by the choices they make. The general concept of a defined contribution health plan is that an employer gives each employee a fixed dollar amount (a “defined contribution”) that the employees can then choose how to spend towards benefits.

Source: definitionus.blogspot.com

Source: definitionus.blogspot.com

You can give them a “bump” in salary to help them pay for their insurance. Defined contribution strategy for health insurance at. Employee contribution approaches defined contribution a common approach to employee contributions is a defined contribution. In other words, you can not make it a line item as paying for health insurance (like you do/did when you pay for a group policy). Consider the example in figure 1 that illustrates a benefit

Source: prweb.com

Source: prweb.com

The new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal funds to the employer’s contribution, usually. This might be a direct contribution to a savings account or an allowance the employer agrees to reimburse employees after the expenses are incurred. There’s a new mindset for employers, and it’s beginning to be understood by employees. It’s strictly an increase in salary. In defined contribution plans, the employee takes the reigns and controls health care costs by the choices they make.

Source: pinterest.com

Source: pinterest.com

The general strategy of a defined contribution health plan is that: The employer offers each employee a fixed monthly dollar amount to spend on qualified medical expenses. Defined contribution health care allows employers to provide workers with a set dollar amount to purchase a plan through a private exchange, increasing employers control over their future costs. Employees access these hra funds to purchase health insurance on a private exchange consisting of policy options from either a single or multiple health carriers. Health (8 days ago) the new health care strategy is being called “defined contribution.” somewhat like standard “defined contribution” retirement programs, an employer gives employees a fixed amount of cash with the understanding that he or she will use the money to purchase health insurance, adding personal.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title defined contribution strategy for health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information