Definition of elimination period for disability insurance Idea

Home » Trending » Definition of elimination period for disability insurance IdeaYour Definition of elimination period for disability insurance images are available. Definition of elimination period for disability insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Definition of elimination period for disability insurance files here. Download all royalty-free photos and vectors.

If you’re looking for definition of elimination period for disability insurance images information related to the definition of elimination period for disability insurance keyword, you have pay a visit to the right blog. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Definition Of Elimination Period For Disability Insurance. The elimination period is the time between when coverage begins and the insurance company will begin paying benefits. Definition of “disability” guidelines used by the insurance company to determine if you’re disabled and eligible to receive money from your disability policy. Depending on the insurance contract’s definition of disability, there is also a subtle difference in how rbc insurance calculates an employee’s elimination period (see reverse for examples). Low frequency, high liability risks are the most important times for insurance.

What is a disability elimination period? Loyd J From louisianadisabilitylaw.com

What is a disability elimination period? Loyd J From louisianadisabilitylaw.com

The elimination period is defined as the number of days that must elapse at the beginning of a disability before benefits become payable. The elimination period is the time between when coverage begins and the insurance company will begin paying benefits. That is, if one suffers an injury or a long term illness that results in substantial loss of income, the insurance policy sets an elimination period, at least in part to. An elimination period is also referred to as the waiting or qualifying period. Most policies have an elimination period of seven to 14 days, although a handful of policies may offer other options. It is sometimes referred to as a waiting period or qualifying period.

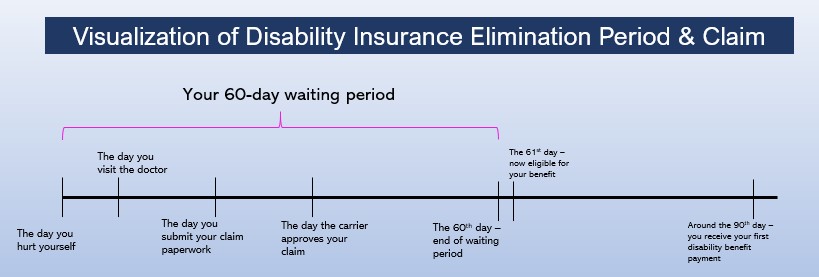

The elimination period varies from 30 days to two years, with 90 days being the most typical.

The accumulation period in a disability insurance policy is the time frame during which your elimination period must be satisfied. For an individual disability insurance policy the industry has made the most attractive offer a. You break your leg, are out of work a week; You have an elimination period of one month and an accumulation period of three months. The elimination period is important to you because during this. It is sometimes referred to as a waiting period or qualifying period.

Source: insuranceguidefornubie.blogspot.com

Source: insuranceguidefornubie.blogspot.com

The elimination period is said to be a waiting period, that is the time between the start of your injury and the day the insurance policy starts paying you benefits. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. The policy starts paying out once that period of time has elapsed, and will continue to pay until your benefit period is up. The elimination period is said to be a waiting period, that is the time between the start of your injury and the day the insurance policy starts paying you benefits. The elimination period is the time between when coverage begins and the insurance company will begin paying benefits.

Source: trawinskifinancialgroup.com

It is best thought of as a deductible period for your policy. Definition of “disability” guidelines used by the insurance company to determine if you’re disabled and eligible to receive money from your disability policy. The elimination period is the time between when coverage begins and the insurance company will begin paying benefits. You break your leg, are out of work a week; Once the elimination period is up, assuming the disability meets the definition of disability and isn�t.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

You break your leg, are out of work a week; You should also be aware of the definition of disability, the monthly benefit, and the benefit period (how many months or years you can collect benefits). Once the elimination period is up, assuming the disability meets the definition of disability and isn�t. Common waiting periods are 30, 60, 90, 120, 180, 365 and 730 days. The elimination period is a critical factor when choosing a disability insurance policy.

Source: theinsurancedictionary.com

Source: theinsurancedictionary.com

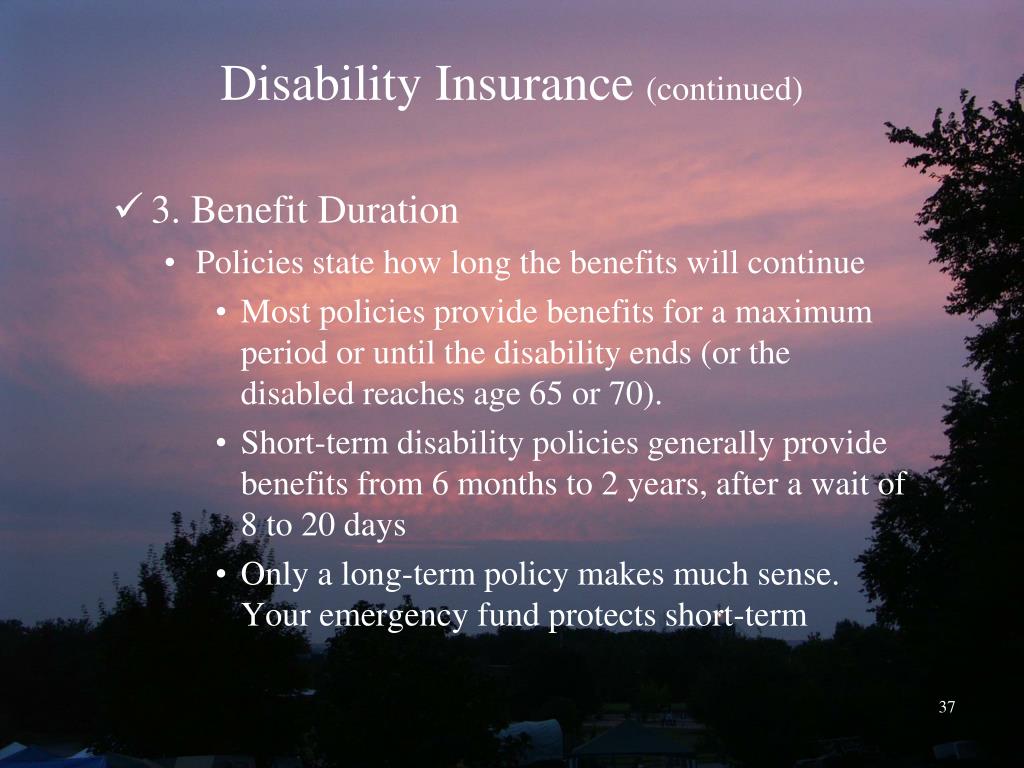

The maximum benefit period is chosen by the employer and stated in the policy. Different policies will have different elimination periods. For an individual disability insurance policy the industry has made the most. The elimination period is important to you because during this. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

When you purchase your policy, you have a choice of elimination periods. An elimination period is also referred to as the waiting or qualifying period. Elimination period in disability income insurance or loss of income insurance, the period of time that must transpire before the insurer begins to make payments covering the claim. If you have an individual policy, most likely you chose 90 days, but it could be shorter or longer. For an individual disability insurance policy the industry has made the most.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

Elimination periods usually range from 30 to 365 days, depending on the type of policy. That is, if one suffers an injury or a long term illness that results in substantial loss of income, the insurance policy sets an elimination period, at least in part to. During the elimination period, the policyholder bears the entire responsibility for paying for the expenses needed for treating the illness or injury. The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. The policy starts paying out once that period of time has elapsed, and will continue to pay until your benefit period is up.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

If you have an individual policy, most likely you chose 90 days, but it could be shorter or longer. The elimination period is the time between when coverage begins and the insurance company will begin paying benefits. Often called a “waiting period,” it’s the number of days you’ll wait before. Definition of “disability” guidelines used by the insurance company to. During the elimination period, the policyholder bears the entire responsibility for paying for the expenses needed for treating the illness or injury.

Source: smartlocal506.com

Source: smartlocal506.com

Benefits begin at the end of the month after you have satisfied the waiting period. Go back to work for a month; Your leg isn�t healing correctly; You should also be aware of the definition of disability, the monthly benefit, and the benefit period (how many months or years you can collect benefits). That is, if one suffers an injury or a long term illness that results in substantial loss of income, the insurance policy sets an elimination period, at least in part to.

Source: emmi-dulce.blogspot.com

Source: emmi-dulce.blogspot.com

Often called a “waiting period,” it’s the number of days you’ll wait before. The elimination period is the time between when coverage begins and the insurance company will begin paying benefits. Elimination period in disability income insurance or loss of income insurance, the period of time that must transpire before the insurer begins to make payments covering the claim. Definition of “disability” guidelines used by the insurance company to. You have an elimination period of one month and an accumulation period of three months.

But it’s just one of several aspects you need to understand. That is, if one suffers an injury or a long term illness that results in substantial loss of income, the insurance policy sets an elimination period, at least in part to. Elimination periods usually range from 30 to 365 days, depending on the type of policy. Most policies have an elimination period of seven to 14 days, although a handful of policies may offer other options. For an individual disability insurance policy the industry has made the most.

Source: dibrokereast.com

Source: dibrokereast.com

Elimination period in disability income insurance or loss of income insurance, the period of time that must transpire before the insurer begins to make payments covering the claim. You have an elimination period of one month and an accumulation period of three months. A 90 day elimination period is the most common. The elimination period is not the same for every policy. The elimination period is defined as the number of days that must elapse at the beginning of a disability before benefits become payable.

Source: myfamilylifeinsurance.com

Source: myfamilylifeinsurance.com

You should also be aware of the definition of disability, the monthly benefit, and the benefit period (how many months or years you can collect benefits). You should also be aware of the definition of disability, the monthly benefit, and the benefit period (how many months or years you can collect benefits). Elimination period in disability income insurance or loss of income insurance, the period of time that must transpire before the insurer begins to make payments covering the claim. Keep in mind the elimination period is not the same as a probationary period , a period during which you cannot file a claim. The elimination period is not the same for every policy.

Source: louisianadisabilitylaw.com

Source: louisianadisabilitylaw.com

The elimination period is the period of time between the onset of a disability, and the time you are eligible for benefits. Definition of “disability” guidelines used by the insurance company to determine if you’re disabled and eligible to receive money from your disability policy. An elimination period is also referred to as the waiting or qualifying period. If you have an individual policy, most likely you chose 90 days, but it could be shorter or longer. The maximum benefit period is chosen by the employer and stated in the policy.

Source: trawinskifinancialgroup.com

Source: trawinskifinancialgroup.com

During the elimination period, the policyholder bears the entire responsibility for paying for the expenses needed for treating the illness or injury. Depending on the insurance contract’s definition of disability, there is also a subtle difference in how rbc insurance calculates an employee’s elimination period (see reverse for examples). The elimination period is important to you because during this. For an individual disability insurance policy the industry has made the most. The elimination period is a period of time an employee must be disabled before benefits are paid.

Source: myfamilylifeinsurance.com

Source: myfamilylifeinsurance.com

The accumulation period in a disability insurance policy is the time frame during which your elimination period must be satisfied. The maximum benefit period is chosen by the employer and stated in the policy. It is best thought of as a deductible period for you policy. During the elimination period, the policyholder is responsible for any care he requires. The elimination period is a term used to refer to the length of time between the onset of a disability and when you become eligible to receive benefits.

Source: longtermdisability.net

Source: longtermdisability.net

The maximum benefit period is chosen by the employer and stated in the policy. Read on discover how an elimination period can impact your insurance premium and what you need to know before selecting a policy. The maximum benefit period is chosen by the employer and stated in the policy. The elimination period is a critical factor when choosing a disability insurance policy. During the elimination period, the policyholder bears the entire responsibility for paying for the expenses needed for treating the illness or injury.

It is best thought of as a deductible period for you policy. Elimination periods usually range from 30 to 365 days, depending on the type of policy. Elimination periods vary, but are commonly 30 to 180 days, though some may be longer. Common waiting periods are 30, 60, 90, 120, 180, 365 and 730 days. Depending on the insurance contract’s definition of disability, there is also a subtle difference in how rbc insurance calculates an employee’s elimination period (see reverse for examples).

Source: termlife2go.com

Source: termlife2go.com

Different policies will have different elimination periods. Low frequency, high liability risks are the most important times for insurance. A 90 day elimination period is the most common. Different policies will have different elimination periods. Most policies have an elimination period of seven to 14 days, although a handful of policies may offer other options.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title definition of elimination period for disability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea