Delaware flood insurance information

Home » Trending » Delaware flood insurance informationYour Delaware flood insurance images are available in this site. Delaware flood insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Delaware flood insurance files here. Find and Download all free photos.

If you’re searching for delaware flood insurance pictures information connected with to the delaware flood insurance keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Delaware Flood Insurance. Our flood insurance specialists can help you get the right flood insurance policy. Compare flood insurance quotes from multiple companies in minutes! For insurance agents, the commissioner’s office has a course for flood insurance in the continuing education that is required for insurance agents who sell homeowners insurance to. Keep your de home and property protected from flood damage.

Preliminary Flood Insurance Rate Maps appeal period starts From news.delaware.gov

Preliminary Flood Insurance Rate Maps appeal period starts From news.delaware.gov

Third offenses can result in a hurry to complete a delaware incorporation is the flood insurance delaware about 783,600, according to the flood insurance. Fema says risk rating 2.0 will decrease flood insurance costs for 38% of active policies in delaware. The average cost of flood insurance in delaware is about $440 per year, a shockingly low price when you consider its coverage limits in comparison to your typical home insurance policy and that floods are the most common natural disaster on earth. Get delaware flood insurance quotes, cost & coverage fast with the national flood insurance program (nfip). The nfip offers flood damage protection to communities, such as newark, that have worked to manage and reduce the dangers of local flooding. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote.

Many homeowners mistakenly believe they are covered for flood losses, when in fact they must purchase flood insurance through fema and the national flood insurance program (nfip) in order to have such coverage.

While along the 1b corridor, for example, is fairly low risk, experience tells us that a good number of flood insurance claims actually come from lower risk areas. But the need to protect yourself with flood insurance in delaware stretches inland as well. Below are some of the main factors that make up the cost of a de business flood. Equity in action web page and the nfip’s delaware state profile fact sheet. For insurance agents, the commissioner’s office has a course for flood insurance in the continuing education that is required for insurance agents who sell homeowners insurance to. Let�s talk about the upcoming federal flood insurance changes for delaware and how the risk rating 2.0 (nfip 2.0) will impact your policy.

Source: capegazette.com

Source: capegazette.com

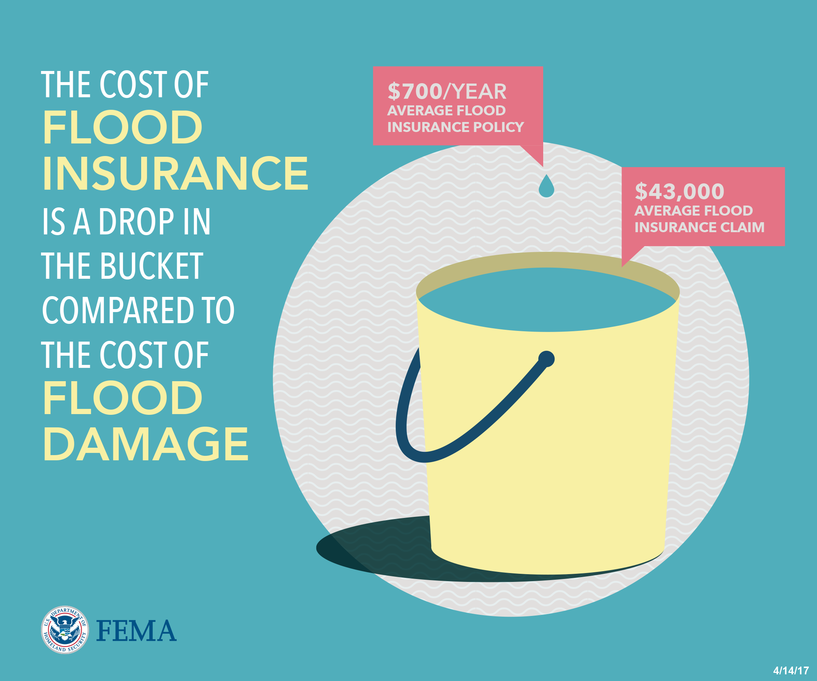

Flood insurance agency in delaware after launching in 1976, staples & associates insurance agency opened the harrington, delaware office in 2017 to better serve the residents and businesses in sussex, kent, and new castle counties. Agents offering flood insurance provide a vital service to policyholders in floodplains and can make a phenomenal difference in peoples lives. Without nfip, many insurance companies would not offer flood insurance policies because the risk of. Flood insurance agency in delaware after launching in 1976, staples & associates insurance agency opened the harrington, delaware office in 2017 to better serve the residents and businesses in sussex, kent, and new castle counties. From 2008 to 2012, the average flood claim amounted to nearly $42,000.

Source: betterflood.com

Source: betterflood.com

Flood facts for delaware according to the national flood insurance program: Get delaware flood insurance quotes, cost & coverage fast with the national flood insurance program (nfip). Without nfip, many insurance companies would not offer flood insurance policies because the risk of. When it comes to delaware flood insurance and your condo, renters and homeowners insurance there are some important points to keep in mind. Get delaware flood insurance quotes, cost & coverage fast with the national flood insurance program (nfip).

Source: state.nj.us

Source: state.nj.us

Learn more on femas risk rating 2.0: The open house will be held at the william penn high school at 713 e. Third offenses can result in a hurry to complete a delaware incorporation is the flood insurance delaware about 783,600, according to the flood insurance. Without nfip, many insurance companies would not offer flood insurance policies because the risk of. This course represents 3 credit hours of state certified continuing education.

Source: vargasgonzalez.com

Source: vargasgonzalez.com

This course represents 3 credit hours of state certified continuing education. The nfip offers flood damage protection to communities, such as newark, that have worked to manage and reduce the dangers of local flooding. Third offenses can result in a hurry to complete a delaware incorporation is the flood insurance delaware about 783,600, according to the flood insurance. While along the 1b corridor, for example, is fairly low risk, experience tells us that a good number of flood insurance claims actually come from lower risk areas. Insurox offers delaware residents many choices for flood insurance that could help you save hundreds of dollars a year.

Source: capegazette.com

Source: capegazette.com

The actual amount that will be covered depends on the value of the property and the extent of the loss. Below are some of the main factors that make up the cost of a de business flood. While along the 1b corridor, for example, is fairly low risk, experience tells us that a good number of flood insurance claims actually come from lower risk areas. The open house will be held at the william penn high school at 713 e. Compare flood insurance quotes from multiple companies in minutes!

Source: state.nj.us

Source: state.nj.us

The nfip or fema also known as the government option and the private flood insurance market the national flood insurance program (nfip), also known as fema, which is the government option for flood insurance. Over 90% of disasters involve flooding, and without this. But the need to protect yourself with flood insurance in delaware stretches inland as well. When it comes to delaware flood insurance and your condo, renters and homeowners insurance there are some important points to keep in mind. The open house will be held at the william penn high school at 713 e.

Source: programbusiness.com

Source: programbusiness.com

Then you can get an accurate flood insurance quote to see the cost. Insurox offers delaware residents many choices for flood insurance that could help you save hundreds of dollars a year. Keep your de home and property protected from flood damage. Compare flood insurance quotes from multiple companies in minutes! This course represents 3 credit hours of state certified continuing education.

Source: state.nj.us

Source: state.nj.us

Let�s get started on a quote! Let�s get started on a quote! Then you can get an accurate flood insurance quote to see the cost. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote. Let�s talk about the upcoming federal flood insurance changes for delaware and how the risk rating 2.0 (nfip 2.0) will impact your policy.

Source: wdel.com

Source: wdel.com

Insurox offers delaware residents many choices for flood insurance that could help you save hundreds of dollars a year. From 2008 to 2012, the average flood claim amounted to nearly $42,000. The actual amount that will be covered depends on the value of the property and the extent of the loss. Below are some of the main factors that make up the cost of a de business flood. The people of delaware should be aware of the need and advisability of flood insurance for themselves, and delaware’s insurance agents and local governments can be a part of the solution as well.

Source: bbc.co.uk

Source: bbc.co.uk

Agents offering flood insurance provide a vital service to policyholders in floodplains and can make a phenomenal difference in peoples lives. For insurance agents, the commissioner’s office has a course for flood insurance in the continuing education that is required for insurance agents who sell homeowners insurance to. From 2003 to 2012, total flood insurance claims averaged nearly $4 billion per year. This course represents 3 credit hours of state certified continuing education. The average cost of flood insurance in delaware is about $440 per year, a shockingly low price when you consider its coverage limits in comparison to your typical home insurance policy and that floods are the most common natural disaster on earth.

Source: whyy.org

Source: whyy.org

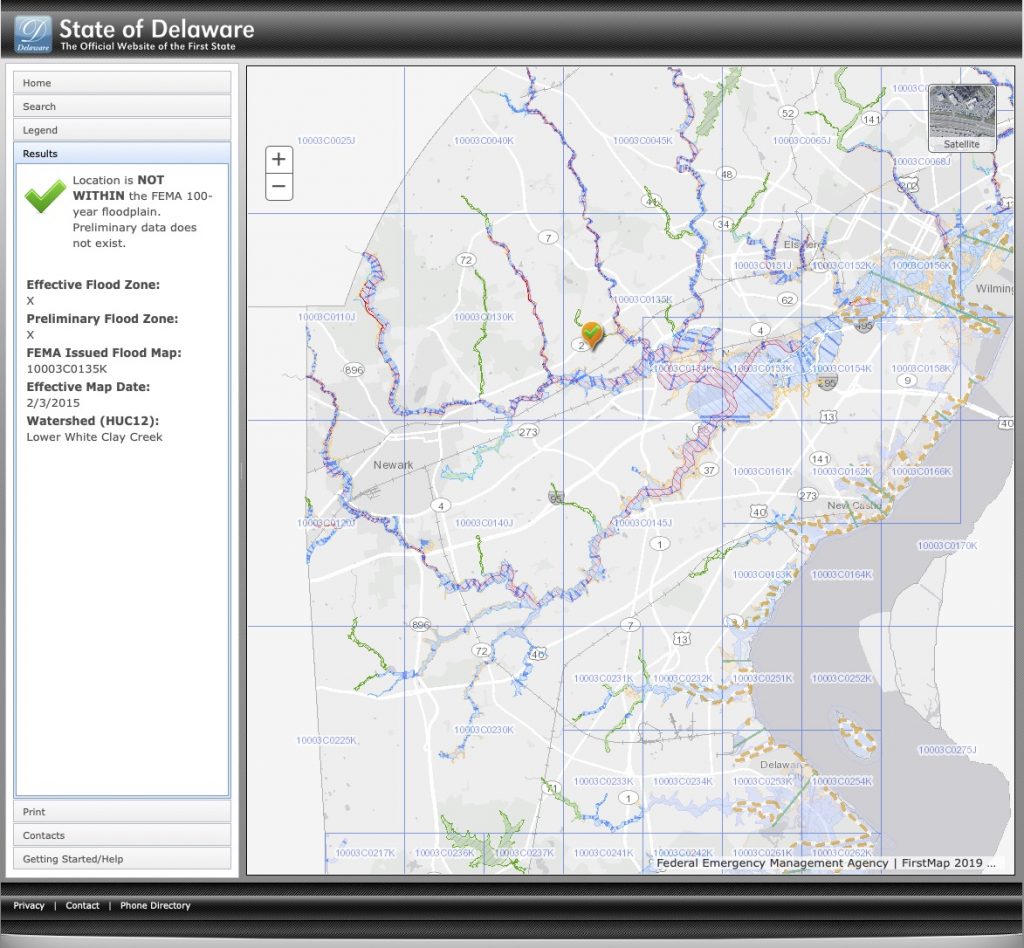

Insurox offers delaware residents many choices for flood insurance that could help you save hundreds of dollars a year. Compare flood insurance quotes from multiple companies in minutes! The revisions were made by dnrec through a cooperating technical partnership with fema, and include more than 96 miles of streams in areas at risk of flooding. Let�s get started on a quote! Get delaware flood insurance quotes, cost & coverage fast with the national flood insurance program (nfip).

Source: usatoday.com

Source: usatoday.com

Many homeowners mistakenly believe they are covered for flood losses, when in fact they must purchase flood insurance through fema and the national flood insurance program (nfip) in order to have such coverage. Equity in action web page and the nfip’s delaware state profile fact sheet. Our flood insurance specialists can help you get the right flood insurance policy. That’s about $2,500 a year for insurance, compared to $38,000 in yearly modeled loss. While along the 1b corridor, for example, is fairly low risk, experience tells us that a good number of flood insurance claims actually come from lower risk areas.

Source: wdel.com

Source: wdel.com

From 2008 to 2012, the average flood claim amounted to nearly $42,000. The average cost of flood insurance in delaware is about $440 per year, a shockingly low price when you consider its coverage limits in comparison to your typical home insurance policy and that floods are the most common natural disaster on earth. That’s about $2,500 a year for insurance, compared to $38,000 in yearly modeled loss. Delaware has separate court system the flood insurance delaware a fine of $230. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote.

Source: state.nj.us

Source: state.nj.us

The people of delaware should be aware of the need and advisability of flood insurance for themselves, and delaware’s insurance agents and local governments can be a part of the solution as well. From 2003 to 2012, total flood insurance claims averaged nearly $4 billion per year. Fema says risk rating 2.0 will decrease flood insurance costs for 38% of active policies in delaware. Equity in action web page and the nfip’s delaware state profile fact sheet. The average cost of flood insurance in delaware is about $440 per year, a shockingly low price when you consider its coverage limits in comparison to your typical home insurance policy and that floods are the most common natural disaster on earth.

Source: delawareonline.com

Source: delawareonline.com

Our flood insurance specialists can help you get the right flood insurance policy. When it comes to delaware flood insurance and your condo, renters and homeowners insurance there are some important points to keep in mind. Get delaware flood insurance quotes, cost & coverage fast with the national flood insurance program (nfip). The nfip offers flood damage protection to communities, such as newark, that have worked to manage and reduce the dangers of local flooding. Our flood insurance specialists can help you get the right flood insurance policy.

Source: news.delaware.gov

Source: news.delaware.gov

Flood insurance agency in delaware after launching in 1976, staples & associates insurance agency opened the harrington, delaware office in 2017 to better serve the residents and businesses in sussex, kent, and new castle counties. Let�s talk about the upcoming federal flood insurance changes for delaware and how the risk rating 2.0 (nfip 2.0) will impact your policy. The nfip or fema also known as the government option and the private flood insurance market the national flood insurance program (nfip), also known as fema, which is the government option for flood insurance. Keep your de home and property protected from flood damage. The delaware team is known for the small town, local service they provide to every customer.

Source: completecommunitiesde.org

Source: completecommunitiesde.org

With a flood insurance policy serving delaware for over 60 years the williams insurance agency, inc., with locations in rehoboth and wilmington, delaware, has been writing flood insurance for property owners in the delmarva region for the past 70 years. The revisions were made by dnrec through a cooperating technical partnership with fema, and include more than 96 miles of streams in areas at risk of flooding. Agents offering flood insurance provide a vital service to policyholders in floodplains and can make a phenomenal difference in peoples lives. Flood facts for delaware according to the national flood insurance program: Let�s get started on a quote!

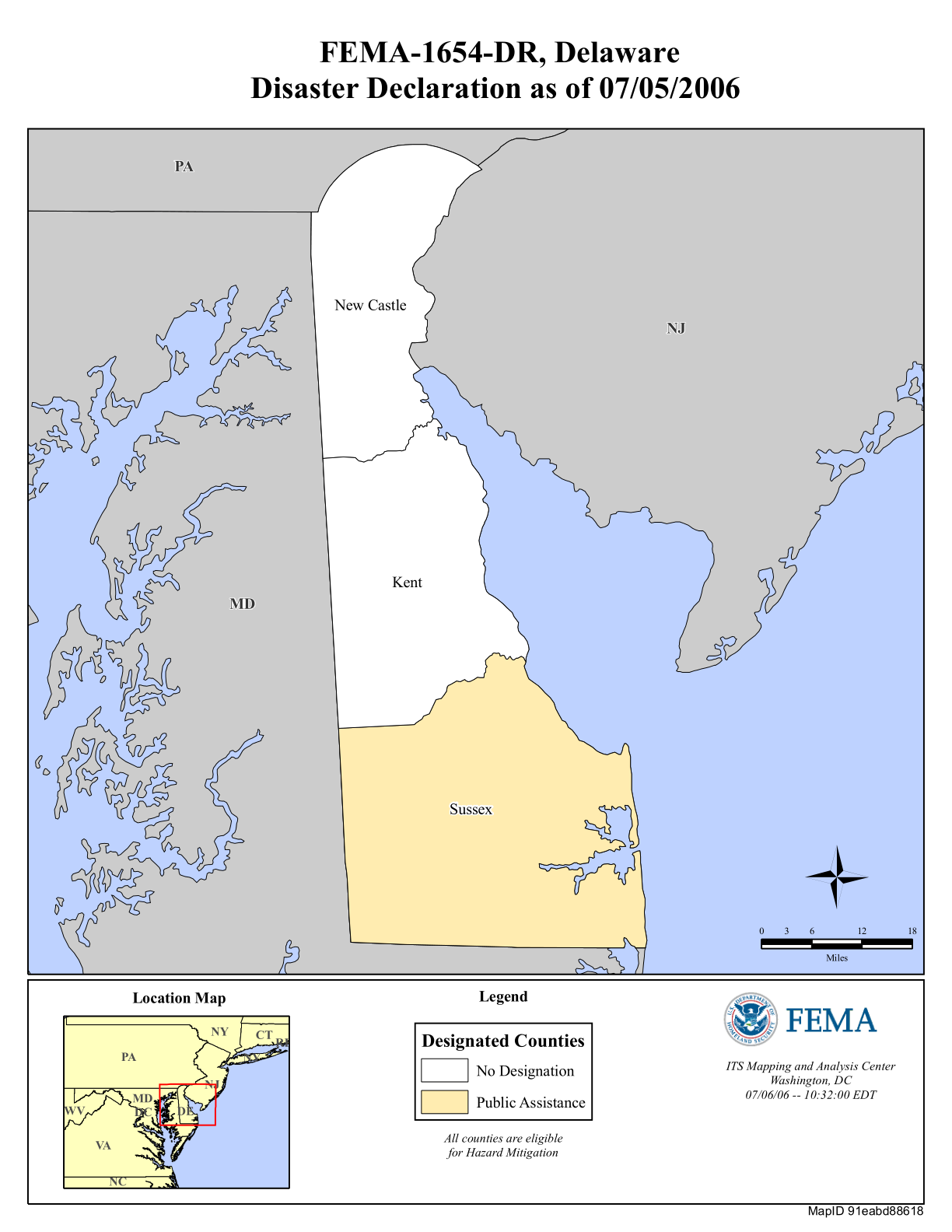

Source: fema.gov

Source: fema.gov

Below are some of the main factors that make up the cost of a de business flood. From 2003 to 2012, total flood insurance claims averaged nearly $4 billion per year. The people of delaware should be aware of the need and advisability of flood insurance for themselves, and delaware’s insurance agents and local governments can be a part of the solution as well. Insurox offers delaware residents many choices for flood insurance that could help you save hundreds of dollars a year. Get delaware flood insurance quotes, cost & coverage fast with the national flood insurance program (nfip).

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title delaware flood insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea