Delivery insurance pay as you go Idea

Home » Trend » Delivery insurance pay as you go IdeaYour Delivery insurance pay as you go images are ready in this website. Delivery insurance pay as you go are a topic that is being searched for and liked by netizens now. You can Download the Delivery insurance pay as you go files here. Find and Download all free images.

If you’re searching for delivery insurance pay as you go pictures information linked to the delivery insurance pay as you go keyword, you have pay a visit to the ideal blog. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Delivery Insurance Pay As You Go. The criteria for taking car delivery insurance policy with zego is as follows: Pay as you go insurance is usually a rolling contract, so you can cancel the policy at any time without being charged a fee, but it’s worth checking your policy to be sure. Third party only, third party, fire & theft or fully comprehensive cover available. If, however, you need cover for longer than one or two months, it may work out cheaper to get annual cover., you will need to compare quotes to see what will work out best for you and your.

Behind the popularity of payasyougo insurance Canadian From canadianunderwriter.ca

Behind the popularity of payasyougo insurance Canadian From canadianunderwriter.ca

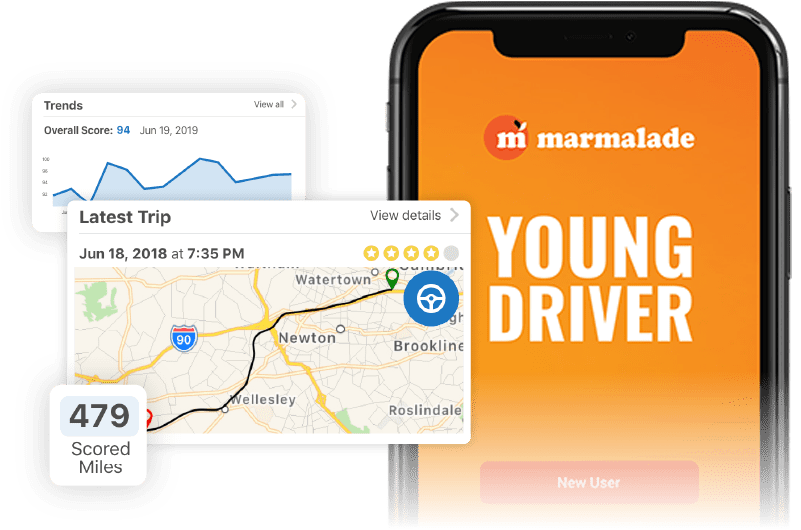

Companies like zego have created a “pay as you go” insurance system. New and learner drivers can get insurance on demand on a parent’s car with our pay as you drive car insurance option, only paying for the miles they need! At zego, we offer a range of policies designed to suit you, however you choose to work. Zego was created by former deliveroo directors, zego is a system where you pay per hour to use your motorbike for work. By reducing the burden of high insurance costs, these couriers can increase their revenue stream while still being legal when they are working. It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the.

By reducing the burden of high insurance costs, these couriers can increase their revenue stream while still being legal when they are working.

At zego, we offer a range of policies designed to suit you, however you choose to work. Pay as you go car insurance. Insurance for food delivery and courier riders (including deliveroo, uber eats, just eat and more) cover that lasts from 1 day to 3 months. The costs of pay as you go food delivery insurance can vary. The criteria for taking car delivery insurance policy with zego is as follows: You cannot deliver for uber eats, deliveroo or just eat (or other providers) with your standard car insurance policy or business policy.

Source: metrobi.com

Source: metrobi.com

The pay as you go or use model is relatively new to the uk insurance marketplace. Pay as you go car insurance. The pay as you go courier insurance is the low cost solution part time couriers have been hoping for. It covers you for food delivery or courier work. If, however, you need cover for longer than one or two months, it may work out cheaper to get annual cover., you will need to compare quotes to see what will work out best for you and your.

Source: businesscloud.co.uk

Source: businesscloud.co.uk

It covers you for food delivery or courier work. You only pay for the hours you’re working. At zego, we offer a range of policies designed to suit you, however you choose to work. First introduced in 2013 under the cuvva brand. Constantly being on the road carries risks, and as such it is important to have adequate insurance cover in place, whether you’re driving a car, a moped or you’re even using a bicycle.

Source: thebig.ca

Source: thebig.ca

This type of policy costs from £122 to £350 a month. This type of policy costs from £122 to £350 a month. You cannot deliver for uber eats, deliveroo or just eat (or other providers) with your standard car insurance policy or business policy. It covers you for food delivery or courier work. How does pay as you go motorcycle insurance work?

Source: coverager.com

Source: coverager.com

This type of policy costs from £122 to £350 a month. Constantly being on the road carries risks, and as such it is important to have adequate insurance cover in place, whether you’re driving a car, a moped or you’re even using a bicycle. New and learner drivers can get insurance on demand on a parent’s car with our pay as you drive car insurance option, only paying for the miles they need! The cost for these can start at as little as £0.70 per hour for a small 125cc motorbike (via zego). You can insure your own vehicle for deliveroo, just eat, uber eats and stuart deliveries, but you’ll need a specialist fast food delivery insurance for whilst you’re working.

Source: cmtelematics.com

Source: cmtelematics.com

Zego was created by former deliveroo directors, zego is a system where you pay per hour to use your motorbike for work. Insurance for food delivery and courier riders (including deliveroo, uber eats, just eat and more) cover that lasts from 1 day to 3 months. Everyday activities such as going to the shops or visiting a friend are. Business car insurance for hot food delivery. It is suitable for food delivery and for courier drivers working from their homes on a flexible basis.

Source: youtube.com

Source: youtube.com

It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the. By reducing the burden of high insurance costs, these couriers can increase their revenue stream while still being legal when they are working. The criteria for taking car delivery insurance policy with zego is as follows: It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the. The pay as you go courier insurance is the low cost solution part time couriers have been hoping for.

Source: pinterest.com

Source: pinterest.com

You cannot deliver for uber eats, deliveroo or just eat (or other providers) with your standard car insurance policy or business policy. Zego was created by former deliveroo directors, zego is a system where you pay per hour to use your motorbike for work. It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the. A standard vehicle insurance is not legally suitable for food delivery services. Constantly being on the road carries risks, and as such it is important to have adequate insurance cover in place, whether you’re driving a car, a moped or you’re even using a bicycle.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the. Pay as you go insurance is usually a rolling contract, so you can cancel the policy at any time without being charged a fee, but it’s worth checking your policy to be sure. The pay as you go or use model is relatively new to the uk insurance marketplace. This type of policy costs from £122 to £350 a month. You cannot deliver for uber eats, deliveroo or just eat (or other providers) with your standard car insurance policy or business policy.

Source: blog.fusebill.com

If you are being paid for delivering food, then the car you drive is no longer being used for a personal journey, but for a business purpose. First introduced in 2013 under the cuvva brand. You can insure your own vehicle for deliveroo, just eat, uber eats and stuart deliveries, but you’ll need a specialist fast food delivery insurance for whilst you’re working. Constantly being on the road carries risks, and as such it is important to have adequate insurance cover in place, whether you’re driving a car, a moped or you’re even using a bicycle. Insurance for food delivery and courier riders (including deliveroo, uber eats, just eat and more) cover that lasts from 1 day to 3 months.

Source: coverager.com

Source: coverager.com

New and learner drivers can get insurance on demand on a parent’s car with our pay as you drive car insurance option, only paying for the miles they need! The policy is payable by the hour and is offered nationwide. The cost for these can start at as little as £0.70 per hour for a small 125cc motorbike (via zego). By reducing the burden of high insurance costs, these couriers can increase their revenue stream while still being legal when they are working. The costs of pay as you go food delivery insurance can vary.

Source: canadianunderwriter.ca

Source: canadianunderwriter.ca

A courier car policy with acorn will give you that comfort and peace of mind, knowing that you have the right level of protection in place to suit your needs in. Our courier car insurance policy will cover you so you can use your car to make deliveries. The pay as you go or use model is relatively new to the uk insurance marketplace. The criteria for taking car delivery insurance policy with zego is as follows: Third party only, third party, fire & theft or fully comprehensive cover available.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

It is suitable for food delivery and for courier drivers working from their homes on a flexible basis. It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the. If, however, you need cover for longer than one or two months, it may work out cheaper to get annual cover., you will need to compare quotes to see what will work out best for you and your. This type of policy costs from £122 to £350 a month. You only pay for the hours you’re working.

Source: finder.com

Source: finder.com

The policy is payable by the hour and is offered nationwide. Our courier car insurance policy will cover you so you can use your car to make deliveries. It covers you for food delivery or courier work. A standard vehicle insurance is not legally suitable for food delivery services. It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the.

Source: slideshare.net

Source: slideshare.net

You are the vehicle owner or registered keeper. Third party only, third party, fire & theft or fully comprehensive cover available. It’s important for us to stress that we’re in no way affiliated or associated with just eat, deliveroo or uber eats, but at the time of writing, we’re aware you’ll be required to prove you have the. Pay as you go insurance is rated 4.4 /5 from 6816 reviews. You can insure your own vehicle for deliveroo, just eat, uber eats and stuart deliveries, but you’ll need a specialist fast food delivery insurance for whilst you’re working.

Source: dulibaninsurance.com

Source: dulibaninsurance.com

Pay as you go insurance is usually a rolling contract, so you can cancel the policy at any time without being charged a fee, but it’s worth checking your policy to be sure. You can insure your own vehicle for deliveroo, just eat, uber eats and stuart deliveries, but you’ll need a specialist fast food delivery insurance for whilst you’re working. Everyday activities such as going to the shops or visiting a friend are. This type of policy costs from £122 to £350 a month. A current rough estimate would be between from £0.80 to £3.00 an hour.

Source: 3rdrailprintspace.co.uk

Source: 3rdrailprintspace.co.uk

By reducing the burden of high insurance costs, these couriers can increase their revenue stream while still being legal when they are working. Companies like zego have created a “pay as you go” insurance system. Standard car insurance policies don’t cover you if you’re delivering food from restaurants or takeaways. You cannot deliver for uber eats, deliveroo or just eat (or other providers) with your standard car insurance policy or business policy. You can insure your own vehicle for deliveroo, just eat, uber eats and stuart deliveries, but you’ll need a specialist fast food delivery insurance for whilst you’re working.

Source: autovehicleinsurance.info

Source: autovehicleinsurance.info

Constantly being on the road carries risks, and as such it is important to have adequate insurance cover in place, whether you’re driving a car, a moped or you’re even using a bicycle. First introduced in 2013 under the cuvva brand. Companies like zego have created a “pay as you go” insurance system. Constantly being on the road carries risks, and as such it is important to have adequate insurance cover in place, whether you’re driving a car, a moped or you’re even using a bicycle. The cost for these can start at as little as £0.70 per hour for a small 125cc motorbike (via zego).

Source: alsetminerals.com

Source: alsetminerals.com

This type of policy costs from £122 to £350 a month. A standard vehicle insurance is not legally suitable for food delivery services. Standard car insurance policies don’t cover you if you’re delivering food from restaurants or takeaways. You cannot deliver for uber eats, deliveroo or just eat (or other providers) with your standard car insurance policy or business policy. Business car insurance for hot food delivery.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title delivery insurance pay as you go by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information