Deposit insurance around the world Idea

Home » Trending » Deposit insurance around the world IdeaYour Deposit insurance around the world images are available in this site. Deposit insurance around the world are a topic that is being searched for and liked by netizens today. You can Download the Deposit insurance around the world files here. Get all free images.

If you’re looking for deposit insurance around the world pictures information connected with to the deposit insurance around the world keyword, you have come to the ideal blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

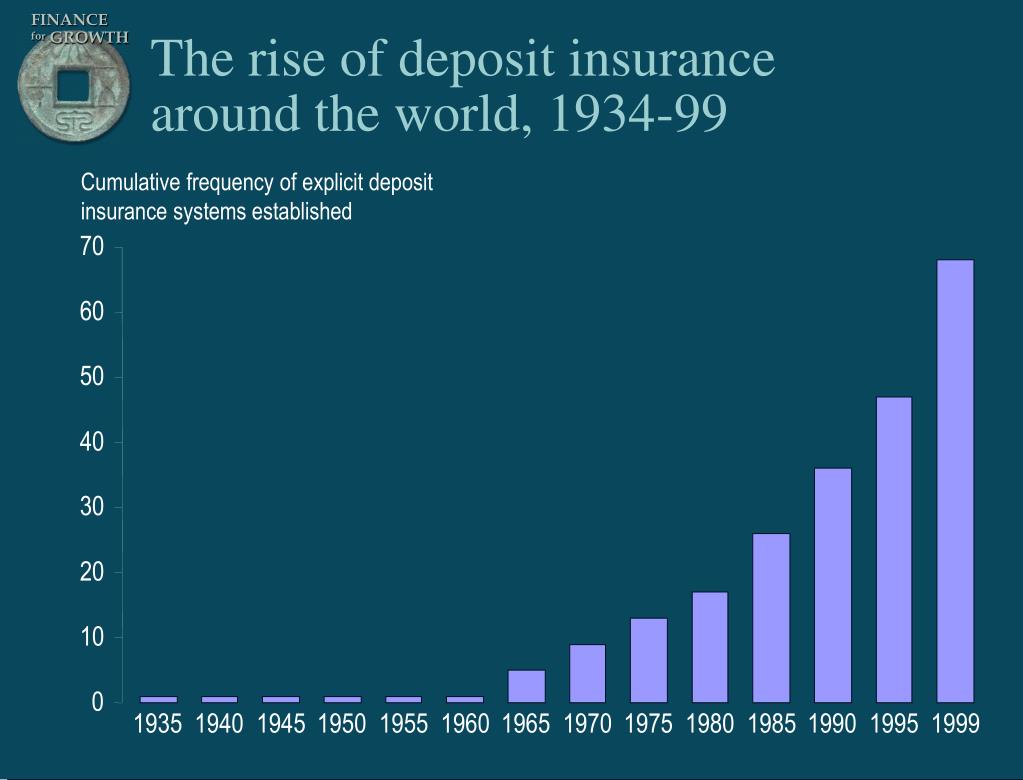

Deposit Insurance Around The World. For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. The explicit rules of a deposit insurance system provide transparency and added certainty regarding the resolution process for failed banks. Predictably, di systems have proliferated in the developing world. In the past two decades, in a series of banking crises around the world, banks have become systematically insolvent.

(PDF) Deposit Insurance Around the World A Comprehensive From researchgate.net

(PDF) Deposit Insurance Around the World A Comprehensive From researchgate.net

Of these policies, explicit deposit insurance has been gaining popularity in recent years. We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis. To make such financial system breakdowns less likely and to limit Main features of deposit insurance schemes around the world. For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. The explicit rules of a deposit insurance system provide transparency and added certainty regarding the resolution process for failed banks.

To make such financial system breakdowns less likely and to limit

These crises have occurred in developed and developing economi The number of countries offering explicit deposit. Figure 1 displays a map of the world depicting a detailed characterization of deposit insurance adoption around the world as of 2003. Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis. Deposit insurance adoption around the world as of 2003.

Source: weforum.org

Source: weforum.org

Figure 1 displays a map of the world depicting a detailed characterization of deposit insurance adoption around the world as of 2003. The countries with edis are. For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. The number of countries with explicit deposit insurance schemes has continued to increase. The importance of deposit insurance design for cross‐border deposits economic inquiry, vol.58, no.2 29 september 2019 monetary policy and the asset risk‐taking channel

Source: researchgate.net

Source: researchgate.net

The growth of explicit deposit insurance can be explained by the strong support given by the international monetary fund (imf) and the world bank for. In the past two decades, in a series of banking crises around the world, banks have become systematically insolvent. We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis. Deposit insurance around the world: Cameroo n (201 1) 7 / angola ghana rwanda.

Source: researchgate.net

Source: researchgate.net

For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. The revised iadi cp from 2014, which still have to be adopted by the imf and the world bank, have been used as a reference in this assessment. Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. Colored grey, whereas the count ries with idis are colore d white. Since the 1980s the number of countries with explicit deposit insurance schemes almost tripled, with most oecd countries and an increasing number of developing economies adopting some form of explicit depositor protection.

Source: researchgate.net

Source: researchgate.net

For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. The travels of a bank deposit in turbulent times: The revised iadi cp from 2014, which still have to be adopted by the imf and the world bank, have been used as a reference in this assessment. Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. The number of countries offering explicit deposit.

Source: slideserve.com

Source: slideserve.com

Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. Figure 1 displays a map of the world depicting a detailed characterization of deposit insurance adoption around the world as of 2003. Predictably, di systems have proliferated in the developing world. A portrait of deposit insurance around the world the design of deposit insurance schemes varies substantially across countries.3 the high degree of variation suggests that an optimal worldwide blueprint is not likely to be found. The revised iadi cp from 2014, which still have to be adopted by the imf and the world bank, have been used as a reference in this assessment.

Source: baogaoting.com

Source: baogaoting.com

The countries with edis are colored grey, whereas the countries with idis are colored white. A portrait of deposit insurance around the world the design of deposit insurance schemes varies substantially across countries.3 the high degree of variation suggests that an optimal worldwide blueprint is not likely to be found. Deposit insurance scheme (edis) does not exist, then the country has implicit deposit insurance. Deposit insurance adoption around the world as of 2003. Book deposit insurance around the world description/summary:

Source: researchgate.net

Source: researchgate.net

Of these policies, explicit deposit insurance has been gaining popularity in recent years. This new data set identifies both recent adopters and the ones that were not covered earlier due to a lack of data. Figure 1 displays a map of the world depicting a detailed characterization of deposit insurance adoption around the world as of 2003. Deposit insurance scheme (edis) does not exist, then the country has implicit deposit insurance. We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis.

Source: researchgate.net

Source: researchgate.net

To make such financial system breakdowns less likely and to limit Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. The growth of explicit deposit insurance can be explained by the strong support given by the international monetary fund (imf) and the world bank for. The following tables provide a summary overview of the key aspects of deposit insurance organisations around the world. We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis.

Source: ask.careers

Source: ask.careers

Predictably, di systems have proliferated in the developing world. The revised iadi cp from 2014, which still have to be adopted by the imf and the world bank, have been used as a reference in this assessment. The following tables provide a summary overview of the key aspects of deposit insurance organisations around the world. The growth of explicit deposit insurance can be explained by the strong support given by the international monetary fund (imf) and the world bank for. This paper provides a comprehensive, global database of deposit insurance arrangements as of 2013.

Source: researchgate.net

Source: researchgate.net

The travels of a bank deposit in turbulent times: The number of countries offering explicit deposit guarantees rose from twenty in 1980 to. This paper provides a comprehensive, global database of deposit insurance arrangements as of 2013. The countries with edis are colored grey, whereas the countries with idis are colored white. In the past two decades, in a series of banking crises around the world, banks have become systematically insolvent.

Source: researchgate.net

Source: researchgate.net

Book deposit insurance around the world description/summary: The importance of deposit insurance design for cross‐border deposits economic inquiry, vol.58, no.2 29 september 2019 monetary policy and the asset risk‐taking channel Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. The number of countries offering explicit deposit guarantees rose from twenty in 1980 to. Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets.

![The World’s Top Gold Mines [Infographic] The World’s Top Gold Mines [Infographic]](https://thumbor.forbes.com/thumbor/fit-in/1200x0/filters:format%28jpg%29/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5f72edce3895775706144241%2F0x0.jpg%3FcropX1%3D0%26cropX2%3D1200%26cropY1%3D48%26cropY2%3D723) Source: forbes.com

Source: forbes.com

Since the 1980s the number of countries with explicit deposit insurance schemes almost tripled, with most oecd countries and an increasing number of developing economies adopting some form of explicit depositor protection. These crises have occurred in developed and developing economi For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. Deposit insurance scheme (edis) does not exist, then the country has implicit deposit insurance. The countries with edis are colored grey, whereas the countries with idis are colored white.

Source: researchgate.net

Source: researchgate.net

The number of countries offering explicit deposit guarantees rose from twenty in 1980 to. For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. For this reason, establishing a di system is frequently recommended by outside. Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. The revised iadi cp from 2014, which still have to be adopted by the imf and the world bank, have been used as a reference in this assessment.

Source: researchgate.net

Source: researchgate.net

The growth of explicit deposit insurance can be explained by the strong support given by the international monetary fund (imf) and the world bank for. For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. Main features of deposit insurance schemes around the world. For this reason, establishing a di system is frequently recommended by outside. Colored grey, whereas the count ries with idis are colore d white.

Source: thaipbsworld.com

Source: thaipbsworld.com

Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. Predictably, di systems have proliferated in the developing world. In the past two decades, in a series of banking crises around the world, banks have become systematically insolvent. Deposit insurance adoption around the world as of 2003. These crises have occurred in developed and developing economi

Source: researchgate.net

Source: researchgate.net

World bank policy research working paper no. Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. For this reason, establishing a di system is frequently recommended by outside experts to countries undergoing reform. We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis. Deposit insurance adoption around the world as of 2003.

Source: baogaoting.com

Source: baogaoting.com

Predictably, di systems have proliferated in the developing world. The travels of a bank deposit in turbulent times: We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis. World bank policy research working paper no. Cameroo n (201 1) 7 / angola ghana rwanda.

Source: likosherbbq.org

Explicit deposit insurance (di) is widely held to be a crucial element of modern financial safety nets. To make such financial system breakdowns less likely and to limit Figure 1 displays a map of the world depicting a detailed characterization of deposit insurance adoption around the world as of 2003. Colored grey, whereas the count ries with idis are colore d white. We extend our earlier dataset by including recent adopters of deposit insurance and information on the use of government guarantees on banks’ assets and liabilities, including during the recent global financial crisis.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title deposit insurance around the world by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea