Deposit insurance moral hazard Idea

Home » Trending » Deposit insurance moral hazard IdeaYour Deposit insurance moral hazard images are available. Deposit insurance moral hazard are a topic that is being searched for and liked by netizens today. You can Get the Deposit insurance moral hazard files here. Find and Download all free photos.

If you’re searching for deposit insurance moral hazard images information linked to the deposit insurance moral hazard keyword, you have pay a visit to the right site. Our website always gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Deposit Insurance Moral Hazard. Testing the model using eu bank level data yields evidence consistent with the model, suggesting that explicit deposit insurance may serve as a commitment device to limit the safety net and permit monitoring by. Moral hazard the principle function of deposit insurance is to promote confidence in the banking system and thus financial stability. Ideally, deposit insurance would be structured in such a way as to distinguish between deposits based on currency and coin and deposits generated through loans, as well as between. Deposit insurance, moral hazard and bank risk by alexei karas, william pyle, koen j.

(PDF) Does a Deposit Insurance Scheme Induce Moral Hazard From researchgate.net

(PDF) Does a Deposit Insurance Scheme Induce Moral Hazard From researchgate.net

Deposit insurance and moral hazard. Willing to pay higher returns by assuming more risk. Deposit insurance is only a part of several arrangements for the protection of the financia! Deposit insurance, moral hazard and bank risk by alexei karas, william pyle, koen j. The problem of moral hazard and effects of deposit insurance project sophiokhundadze abstract keywords the paper focuses on the significance of deposit insurance program for the financial system stability and smooth operation of the economy. Moral hazard the principle function of deposit insurance is to promote confidence in the banking system and thus financial stability.

The findings suggest that the moral hazard effect of deposit insurance dominates in good times while the stabilization effect of deposit insurance dominates in turbulent times.

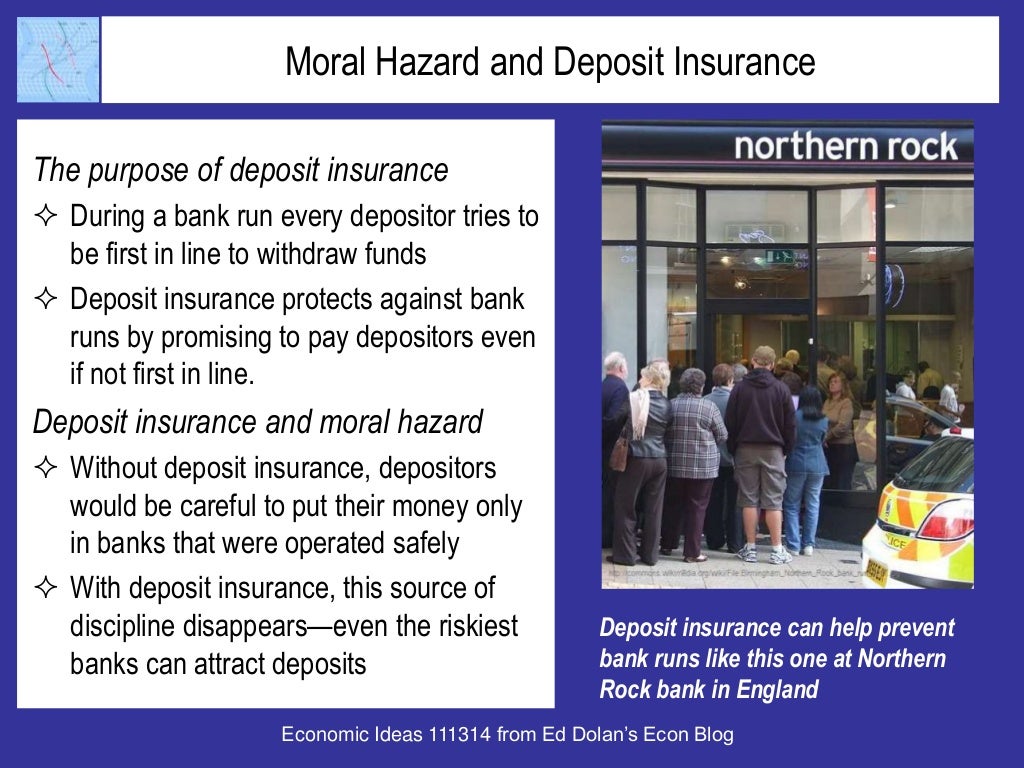

Bank runs like this one at northern. Agents and, therefore, not all the countries operate form al deposit insurance schemes.2 a majar characteristic of government deposit insurance is information asymmetry that may lead to phenomeha such as adverse selection and moral hazard. These incentives are inherent to. Drawing on variation in the ratio of firm deposits to t. This problem, known as “moral hazard,” has taken on new significance with the rapid spread of explicit deposit insurance. The findings suggest that the moral hazard effect of deposit insurance dominates in good times while the stabilization effect of deposit insurance dominates in turbulent times.

Source: researchgate.net

Source: researchgate.net

Most countries are reluctant to permit banks to go insolvent But since deposit insurance has to be extended to all of a banks’ deposits (up to a certain level), including those created by loans, moral hazard is inevitable. It is believed that liberal deposit insurance encourage recklessness and. Moral hazard the principle function of deposit insurance is to promote confidence in the banking system and thus financial stability. Testing the model using eu bank level data yields evidence consistent with the model, suggesting that explicit deposit insurance may serve as a commitment device to limit the safety net and permit monitoring by.

Source: silverbearcafe.com

Source: silverbearcafe.com

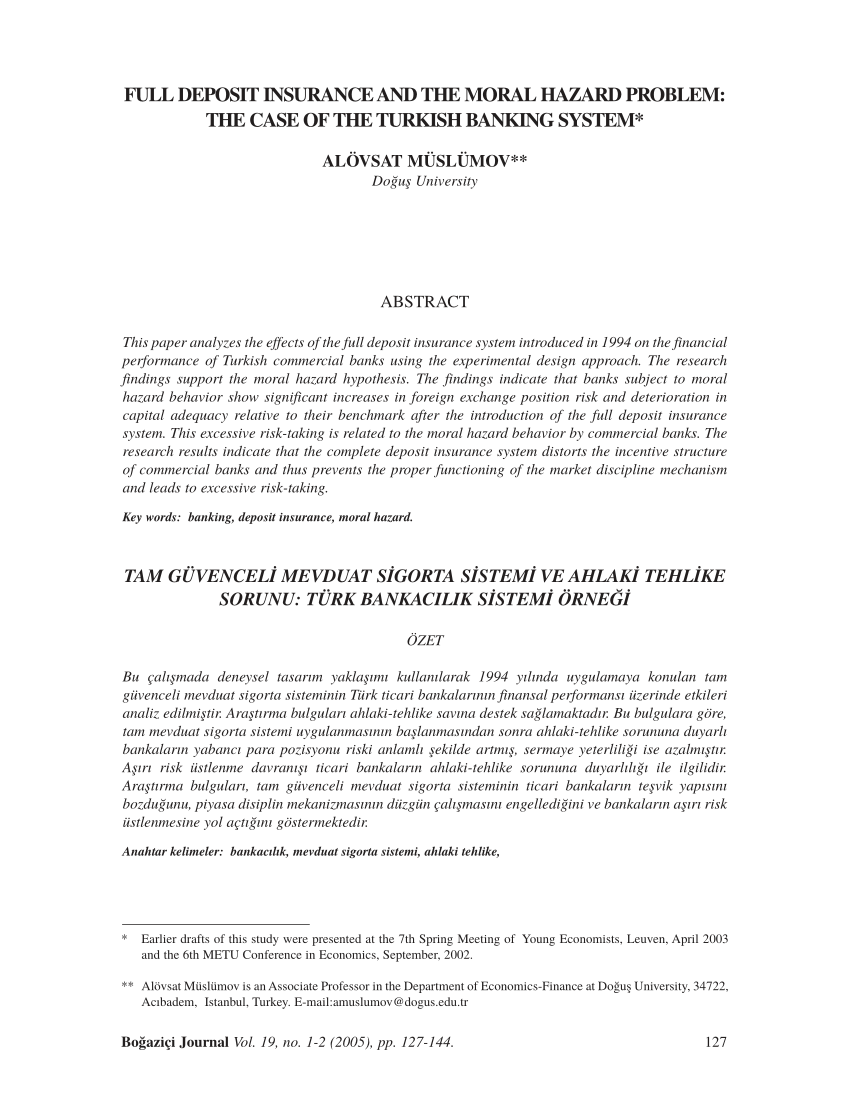

We investigate the effect of full deposit insurance introduced in 1994 on the financial performance of turkish commercial banks. This is known as ‘moral hazard’. Ideally, deposit insurance would be structured in such a way as to distinguish between deposits based on currency and coin and deposits generated through loans, as well as between. The model discusses the interaction among. Drawing on variation in the ratio of firm deposits to t.

Source: ethicalsystems.org

Source: ethicalsystems.org

Unless the absence of any safety net is credible, the introduction of deposit insurance serves to explicitly limit the safety net and, hence, moral hazard. This problem, known as “moral hazard,” has taken on new significance with the rapid spread of explicit deposit insurance. In banks that were operated safely. It is believed that liberal deposit insurance encourage recklessness and. Bank runs like this one at northern.

Source: scmp.com

Source: scmp.com

Deposit insurance can help prevent. Deposit insurance, moral hazard and bank risk by alexei karas, william pyle, koen j. Deposit insurance can help prevent. Depositors have incentive s to monitor the bank’s risk taking behavi or, thus threatening. Deposit insurance has frequently been blamed for the thrift industry�s current difficulties, although such accusations have typically lacked empirical support (james barth, philip bartholomew, and carol labich, 1989 p.

Source: vnrebates.net

Source: vnrebates.net

Unless the absence of any safety net is credible, the introduction of deposit insurance serves to explicitly limit the safety net and, hence, moral hazard. Interest in the impact of deposit insurance on bank activities revived during the banking difficulties of the late 1980s and early 1990s. With such guarantees, depositors and creditors have no reason to run—not when But since deposit insurance has to be extended to all of a banks’ deposits (up to a certain level), including those created by loans, moral hazard is inevitable. Drawing on variation in the ratio of firm deposits to t.

Source: definitionus.blogspot.com

Source: definitionus.blogspot.com

Would be careful to put their money only. In banks that were operated safely. Model of deposit insurance with capital requirements and risk sensitive premia to prevent moral hazard. Country that adopts explicit deposit insurance must grapple with the destabilizing effects of that insurance on the country’s financial system. This finding provides a new perspective on the effects of deposit insurance on risk taking.

Source: slideserve.com

Source: slideserve.com

Would be careful to put their money only. The issue is very substantial for Moral hazards represent one of the key arguments against deposit insurance. The model discusses the interaction among. Agents and, therefore, not all the countries operate form al deposit insurance schemes.2 a majar characteristic of government deposit insurance is information asymmetry that may lead to phenomeha such as adverse selection and moral hazard.

Source: slideserve.com

Source: slideserve.com

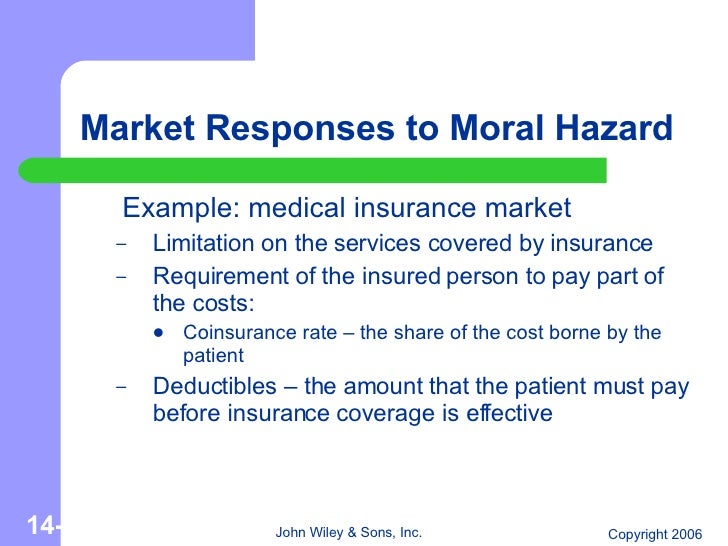

Discuss economic costs of deposit insurance that result from moral hazard and review the empirical evidence on the impact of deposit insurance on banking stability. Second, that deposit insurance itself need not lead to large losses. The more recent literature suggests that deposit insurance design and implementation can have a significant impact on how well deposit insurance schemes perform in practice. This problem, known as “moral hazard,” has taken on new significance with the rapid spread of explicit deposit insurance. Drawing on variation in the ratio of firm deposits to t.

Source: michaeltherce70.blogspot.com

Source: michaeltherce70.blogspot.com

Second, that deposit insurance itself need not lead to large losses. We investigate the effect of full deposit insurance introduced in 1994 on the financial performance of turkish commercial banks. This finding provides a new perspective on the effects of deposit insurance on risk taking. Interest in the impact of deposit insurance on bank activities revived during the banking difficulties of the late 1980s and early 1990s. It is believed that liberal deposit insurance encourage recklessness and.

Source: slideserve.com

Source: slideserve.com

Deposit insurance and moral hazard. Testing the model using eu bank level data yields evidence consistent with the model, suggesting that explicit deposit insurance may serve as a commitment device to limit the safety net and permit monitoring by. With deposit insurance, this source of. In the case of deposit insurance, moral hazard refers to the incentive for increased risk taking by insured institutions that The issue is very substantial for

Source: researchgate.net

Source: researchgate.net

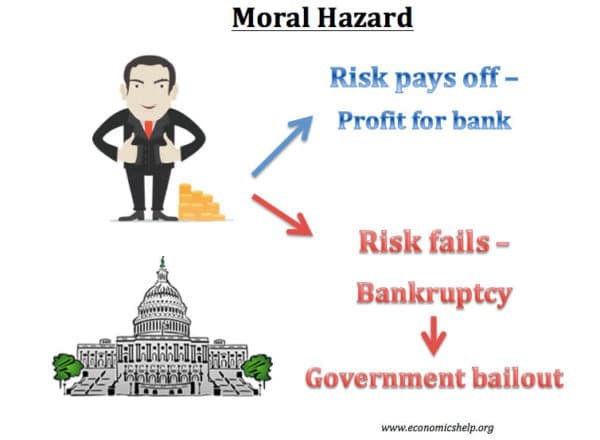

In banks that were operated safely. Moral hazards represent one of the key arguments against deposit insurance. But since deposit insurance has to be extended to all of a banks’ deposits (up to a certain level), including those created by loans, moral hazard is inevitable. Moral hazard refers to the tendency of a party to take risks with the belief that they will not have to bear the consequences of their actions. The findings suggest that the moral hazard effect of deposit insurance dominates in good times while the stabilization effect of deposit insurance dominates in turbulent times.

Source: slideshare.net

Source: slideshare.net

Deposit insurance is only a part of several arrangements for the protection of the financia! Deposit insurance can help prevent. Testing the model using eu bank level data yields evidence consistent with the model, suggesting that explicit deposit insurance may serve as a commitment device to limit the safety net and permit monitoring by. Agents and, therefore, not all the countries operate form al deposit insurance schemes.2 a majar characteristic of government deposit insurance is information asymmetry that may lead to phenomeha such as adverse selection and moral hazard. With such guarantees, depositors and creditors have no reason to run—not when

Source: researchgate.net

Source: researchgate.net

This is known as ‘moral hazard’. Willing to pay higher returns by assuming more risk. In the aftermath of hundreds of bank and s&l failures, a number of analysts argued that insuredbanks are subject to moral hazard. The model discusses the interaction among. Drawing on variation in the ratio of firm deposits to t.

Source: diyinvesting.org

Source: diyinvesting.org

We investigate the effect of full deposit insurance introduced in 1994 on the financial performance of turkish commercial banks. Drawing on variation in the ratio of firm deposits to t. Deposit insurance has frequently been blamed for the thrift industry�s current difficulties, although such accusations have typically lacked empirical support (james barth, philip bartholomew, and carol labich, 1989 p. Deposit insurance is widely offered in a number of countries as part of a financial system safety net to promote stability. The problem of moral hazard and effects of deposit insurance project sophiokhundadze abstract keywords the paper focuses on the significance of deposit insurance program for the financial system stability and smooth operation of the economy.

Source: slideshare.net

Source: slideshare.net

Testing the model using eu bank level data yields evidence consistent with the model, suggesting that explicit deposit insurance may serve as a commitment device to limit the safety net and permit monitoring by. Supervision, reliable capital standards, and insurance pricing that holds banks accountable for the risk profile they choose. Testing the model using eu bank level data yields evidence consistent with the model, suggesting that explicit deposit insurance may serve as a commitment device to limit the safety net and permit monitoring by. In the aftermath of hundreds of bank and s&l failures, a number of analysts argued that insuredbanks are subject to moral hazard. But, because deposit insurance may separate risk from reward, that insurance can catalyze legal and financial hazard.

Source: researchgate.net

Source: researchgate.net

Most countries are reluctant to permit banks to go insolvent Moral hazards represent one of the key arguments against deposit insurance. Willing to pay higher returns by assuming more risk. In the case of deposit insurance, moral hazard refers to the incentive for increased risk taking by insured institutions that These incentives are inherent to.

Source: economicshelp.org

Source: economicshelp.org

Country that adopts explicit deposit insurance must grapple with the destabilizing effects of that insurance on the country’s financial system. Country that adopts explicit deposit insurance must grapple with the destabilizing effects of that insurance on the country’s financial system. Deposit insurance can help prevent. Most countries are reluctant to permit banks to go insolvent Deposit insurance and moral hazard.

Source: slideserve.com

Source: slideserve.com

Willing to pay higher returns by assuming more risk. Ideally, deposit insurance would be structured in such a way as to distinguish between deposits based on currency and coin and deposits generated through loans, as well as between. Testing the model using eu bank level data yields evidence consistent with the model, suggesting that explicit deposit insurance may serve as a commitment device to limit the safety net and permit monitoring by. Model of deposit insurance with capital requirements and risk sensitive premia to prevent moral hazard. The introduction of deposit insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title deposit insurance moral hazard by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea