Describes the type of coverage in an insurance agreement information

Home » Trend » Describes the type of coverage in an insurance agreement informationYour Describes the type of coverage in an insurance agreement images are ready in this website. Describes the type of coverage in an insurance agreement are a topic that is being searched for and liked by netizens now. You can Download the Describes the type of coverage in an insurance agreement files here. Download all royalty-free vectors.

If you’re looking for describes the type of coverage in an insurance agreement images information linked to the describes the type of coverage in an insurance agreement interest, you have come to the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

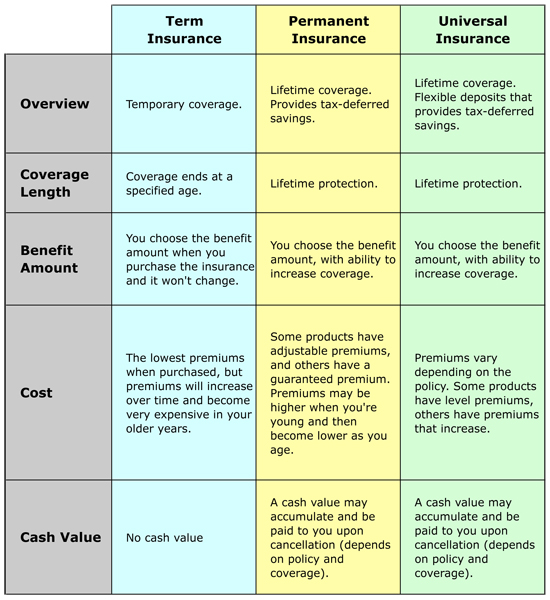

Describes The Type Of Coverage In An Insurance Agreement. Describes the type of coverage in an insurance agreement. For example, the definitions section may define “insured property” as a car, house or business property depending on the type of insurance. Type of insurance that provides an income in case the insured becomes unable to perform. The three major types of exclusions are:

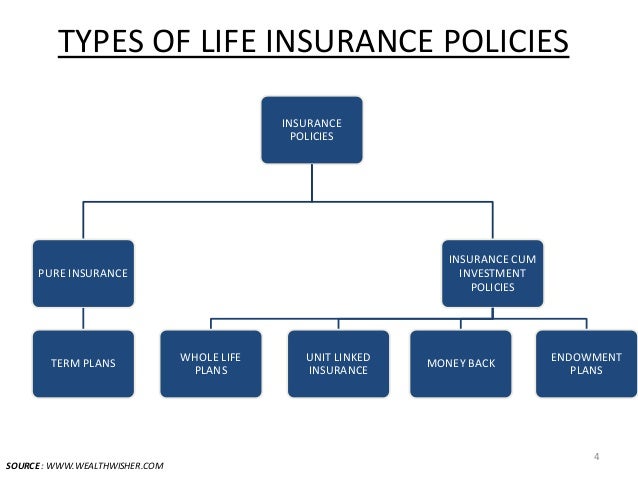

Common Types of Life Insurance Infographic From slideshare.net

Common Types of Life Insurance Infographic From slideshare.net

It is binding unless the party with the right to reject it wishes to do so. There is a break in coverage of more than 33 days. For example, the definitions section may define “insured property” as a car, house or business property depending on the type of insurance. Unnecessary types of insurance and why you don�t need them. The three major types of exclusions are: There is a break in coverage of more than 43 days.

There is a break in coverage of more than 43 days.

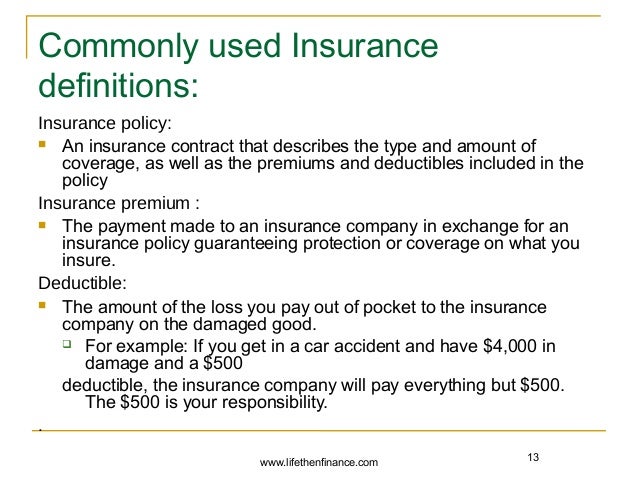

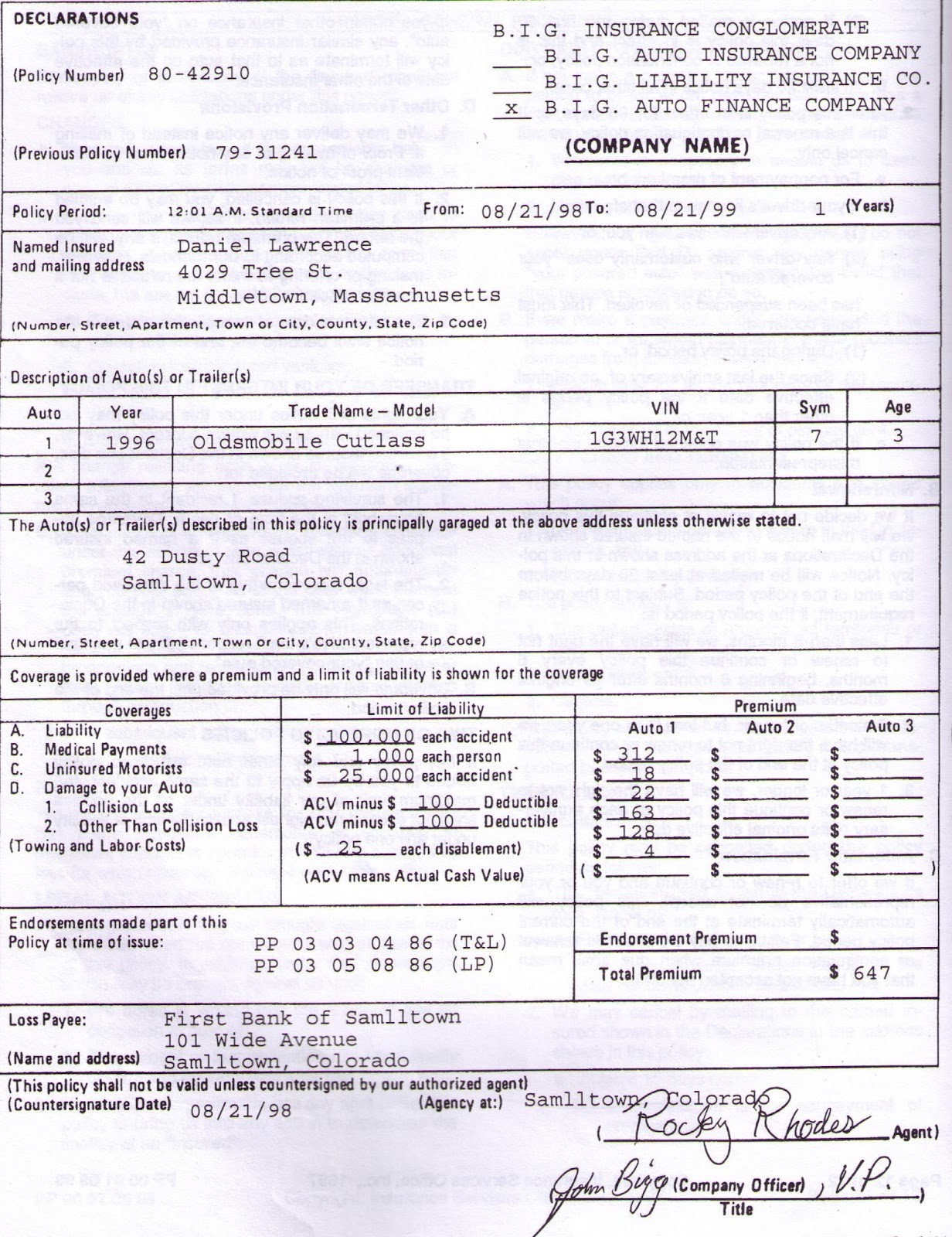

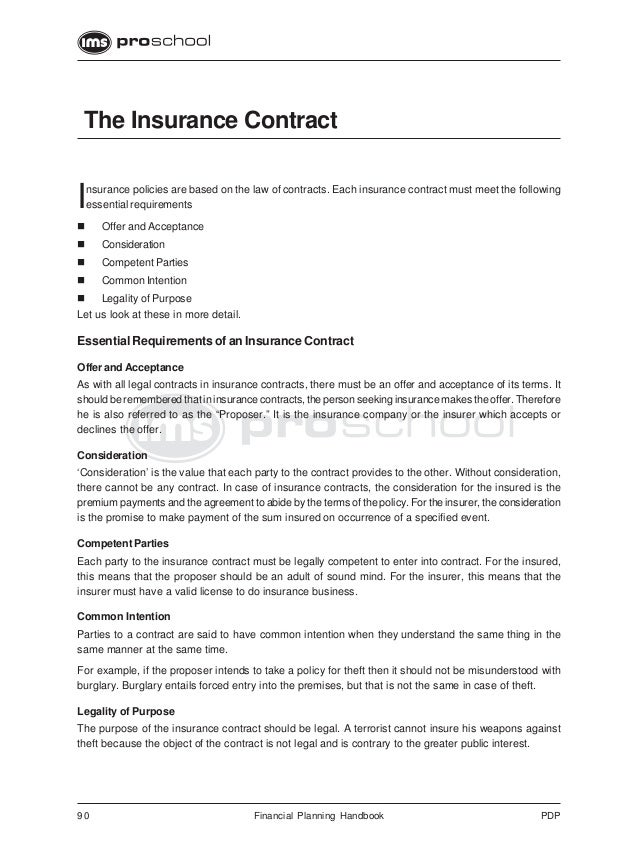

The primary responsibility of the insurance company is to pay claims on your behalf for losses suffered due to covered perils and defend you in the case of. Definitions specify exactly what is covered in the contract. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Describes the type of coverage in an insurance agreement. For example, the definitions section may define “insured property” as a car, house or business property depending on the type of insurance. The primary responsibility of the insurance company is to pay claims on your behalf for losses suffered due to covered perils and defend you in the case of.

Source: ibm.com

Source: ibm.com

It simply outlines the basics of the insurance contract and the responsibilities of both you and your insurance company. This can include hazards, risks and losses that are excluded form the policies coverage. An insurance policy is a legal contract between the insurer (your insurance company) and the insured (the policyholder). Describes the type of coverage in an insurance agreement. The three major types of exclusions are:

Source: fbfinancial.ca

Source: fbfinancial.ca

Amount you pay monthly, quarterly, semiannually or annually to purchase different types of insurance. The insuring agreement is usually contained in a coverage form from which a policy is constructed. Reinsurance does not change the basic nature of an insurance coverage. The insuring agreement states which of the subsequent items and circumstances the insurance company will cover in exchange for a premium. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company).

Source: guitarslinginvagabond.blogspot.com

Source: guitarslinginvagabond.blogspot.com

The primary responsibility of the insurance company is to pay claims on your behalf for losses suffered due to covered perils and defend you in the case of. Describes the type of coverage in an insurance agreement. Describes the type of coverage in an insurance agreement. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). There is a break in coverage of more than 43 days.

Source: slideshare.net

Source: slideshare.net

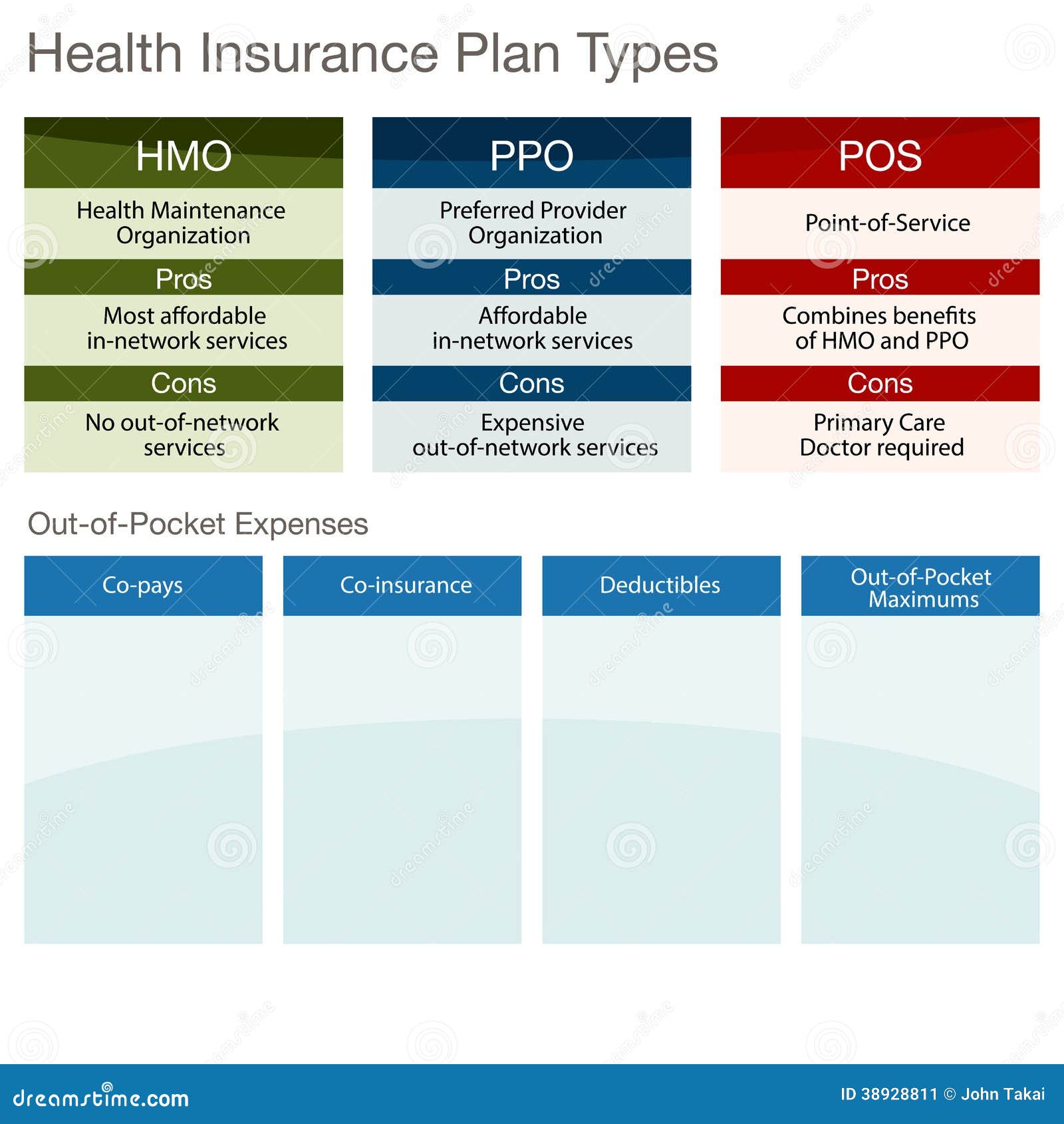

Type of insurance that provides coverage for accidents, damages and losses in a rental (apartment or house) or dormitory; Describes the type of coverage in an insurance agreement. Entitlements, such as health or life insurance, available in accordance with a wage agreement, insurance policy, or program. The declarations page is usually the first part of an insurance contract. Amount you pay monthly, quarterly, semiannually or annually to purchase different types of insurance.

Source: insuranceplanet.blogspot.com

Source: insuranceplanet.blogspot.com

This can include hazards, risks and losses that are excluded form the policies coverage. The insuring agreement is usually contained in a coverage form from which a policy is constructed. The part of the insurance contrac that describes the covered perils, and the nature of coverage of the contractual agreement b/w the insurer and the insured is called the _____. This type of insurance coverage is caused: The three major types of exclusions are:

Source: homeworklib.com

Source: homeworklib.com

Which of the following policies would be a duplicate coverage for your health insurance policy. Describes the type of coverage in an insurance agreement. A legally enforceable declaration of how a person wishes his or her property to be distributed after death. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. An amount of money you will pay to help cover a portion of your medical costs.

Source: tdbm.mn

Describes the type of coverage in an insurance agreement. The declarations page is usually the first part of an insurance contract. Properly treat this kind of coverage as being excess. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. An insurance policy is a legal contract between the insurer (your insurance company) and the insured (the policyholder).

Source: whydowoodburningofnostalgia.blogspot.com

Source: whydowoodburningofnostalgia.blogspot.com

Amount you pay monthly, quarterly, semiannually or annually to purchase different types of insurance. Regardless of the cost of those services. An insurer may also void an insurance policy if a misrepresentation on e application is proven to be material. Type of insurance company that sells policies through the mail or other mass media, eliminating need for agents. Amount you pay monthly, quarterly, semiannually or annually to purchase different types of insurance.

Source: slideserve.com

Source: slideserve.com

It is binding unless the party with the right to reject it wishes to do so. Major medical expense insurance a form of health insurance that provides benefits for most types of medical expense up to a high maximum benefit, such as $250,000 or higher after a substantial deductible, such as $500 or more. It simply outlines the basics of the insurance contract and the responsibilities of both you and your insurance company. Facultative automatic agreements are usually written on a. There is a break in coverage of more than 43 days.

Source: insuranceplansbengao.blogspot.com

Source: insuranceplansbengao.blogspot.com

Describes the type of coverage in an insurance agreement. Quarterly, semiannually or annually to purchase different types of insurance. It is binding unless the party with the right to reject it wishes to do so. This coverage covers impact and damage to your car. The insuring agreement is also found near the front of your policy.

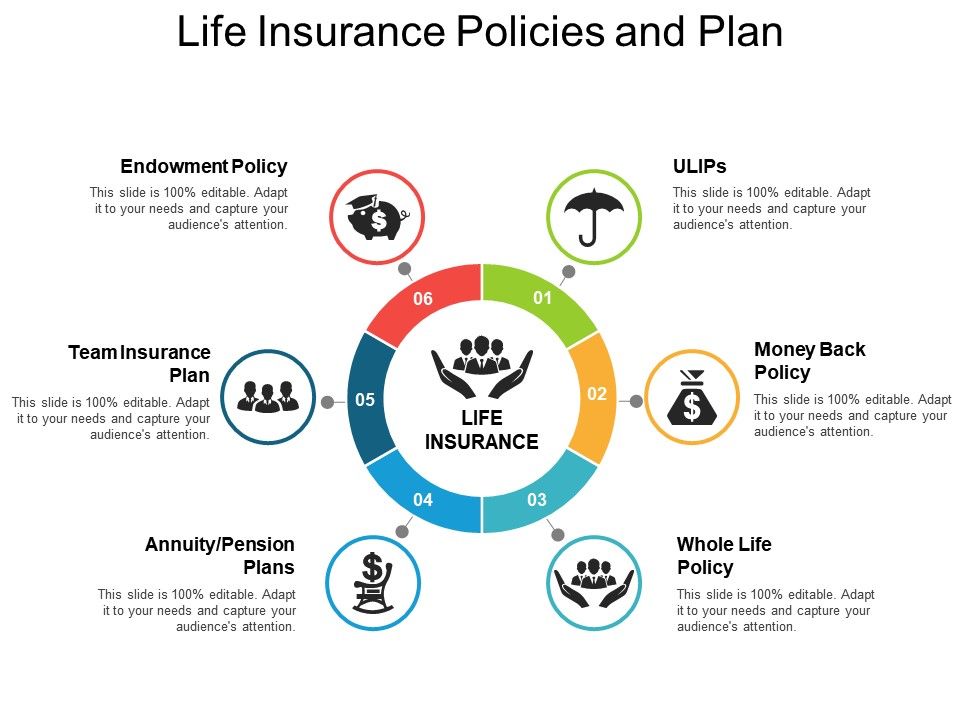

Source: slideteam.net

Source: slideteam.net

Often, insuring agreements outline a broad scope of coverage, which is then narrowed by exclusions and. Unnecessary types of insurance and why you don�t need them. Type of insurance that provides an income in case the insured becomes unable to perform. Properly treat this kind of coverage as being excess. Provides coverage for personal belongings and liability that may.

Source: goldencare.com

Source: goldencare.com

If the loss is not excluded, then it is covered. Major medical expense insurance a form of health insurance that provides benefits for most types of medical expense up to a high maximum benefit, such as $250,000 or higher after a substantial deductible, such as $500 or more. Share with the insured the items or overages that are no included in the policies scope of coverage. For example, the definitions section may define “insured property” as a car, house or business property depending on the type of insurance. The declarations page is usually the first part of an insurance contract.

Source: slideserve.com

Source: slideserve.com

The declarations page is usually the first part of an insurance contract. The three major types of exclusions are: An amount of money you will pay to help cover a portion of your medical costs. Regardless of the cost of those services. Definitions specify exactly what is covered in the contract.

Source: wikihow.com

Source: wikihow.com

Describes the type of coverage in an insurance agreement. An insurance policy is a legal contract between the insurer (your insurance company) and the insured (the policyholder). In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. The part of the insurance contrac that describes the covered perils, and the nature of coverage of the contractual agreement b/w the insurer and the insured is called the _____. This can include hazards, risks and losses that are excluded form the policies coverage.

Source: slideshare.net

Source: slideshare.net

An insurer may also void an insurance policy if a misrepresentation on e application is proven to be material. An insurer may also void an insurance policy if a misrepresentation on e application is proven to be material. Amount you pay monthly, quarterly, semiannually, or annually to purchase different type of insurance. The part of the insurance contrac that describes the covered perils, and the nature of coverage of the contractual agreement b/w the insurer and the insured is called the _____. It simply outlines the basics of the insurance contract and the responsibilities of both you and your insurance company.

Source: groupeconsilium.ca

Source: groupeconsilium.ca

Share with the insured the items or overages that are no included in the policies scope of coverage. Entitlements, such as health or life insurance, available in accordance with a wage agreement, insurance policy, or program. There is a break in coverage of more than 53 days. An insurer may also void an insurance policy if a misrepresentation on e application is proven to be material. Type of insurance that provides an income in case the insured becomes unable to perform.

Source: iruttilethengal.blogspot.com

Source: iruttilethengal.blogspot.com

The three major types of exclusions are: An insurance policy is a legal contract between the insurer (your insurance company) and the insured (the policyholder). Often, insuring agreements outline a broad scope of coverage, which is then narrowed by exclusions and. The declarations page is usually the first part of an insurance contract. The three major types of exclusions are:

Source: slideshare.net

Source: slideshare.net

It simply outlines the basics of the insurance contract and the responsibilities of both you and your insurance company. Unnecessary types of insurance and why you don�t need them. Describes the risks assumed, or nature of coverage for the policy being provided. Reinsurance does not change the basic nature of an insurance coverage. Major medical expense insurance a form of health insurance that provides benefits for most types of medical expense up to a high maximum benefit, such as $250,000 or higher after a substantial deductible, such as $500 or more.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title describes the type of coverage in an insurance agreement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information