Difference between beneficiary and nominee in insurance Idea

Home » Trend » Difference between beneficiary and nominee in insurance IdeaYour Difference between beneficiary and nominee in insurance images are ready in this website. Difference between beneficiary and nominee in insurance are a topic that is being searched for and liked by netizens now. You can Get the Difference between beneficiary and nominee in insurance files here. Get all royalty-free images.

If you’re looking for difference between beneficiary and nominee in insurance pictures information connected with to the difference between beneficiary and nominee in insurance topic, you have visit the right blog. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

Difference Between Beneficiary And Nominee In Insurance. The insurance company might refuse this nomination. Ashok nominated his brother arun as nominee prior to ashok marriage. Difference between nominee and beneficiary. Nomination ensure smooth transfer of funds from bank or financial institution to the nominee of deceased person’s account.

Reliance Health Insurance gets final nod from Irdai to From moneycontrol.com

Reliance Health Insurance gets final nod from Irdai to From moneycontrol.com

Assignment means �transfer of ownership� whereas nomination means �secondary owner� assignment comes to force as soon as the policy assignment formalities are completed and all benefits of the policy plan are given to the �assignee� only, irrespective of the policy holder being. Nomination an act by which the policy holders authorises another person to receive the policy moneys. Even if legal heirs try to claim the death claim amount, they will not be successful as per the new rules of nomination. Beneficiary is the person who can use and enjoy the death payout from your life insurance. This means that nominee and beneficiaries can be different, for example. Your nominee is your beneficiary.

But if the nominee is not the legal heir or if he is not appointed as the beneficiary of the amount through a registered.

On the death of any nominee, the nominee’s interest in the policy moneys will form part of the nominee’s estate. Beneficiary the person (s) or entity (ies) (e.g. What is the difference between a beneficiary and a nominee? Ashok did not change nomination in policy and died. The death benefit is paid to the nominee of the policy, if the policyholder dies during the policy tenure. The person so authorised is called nominee.

Source: animationdiscoverycollection.blogspot.com

Source: animationdiscoverycollection.blogspot.com

While considering a life insurance plan, there is always a misconception between the beneficiary and the nominee. The death benefit is paid to the nominee of the policy, if the policyholder dies during the policy tenure. Nomination ensure smooth transfer of funds from bank or financial institution to the nominee of deceased person’s account. There is usually a misunderstanding between the beneficiary and the nominee when selecting a life insurance plan. What is the difference between beneficiary and nominee.

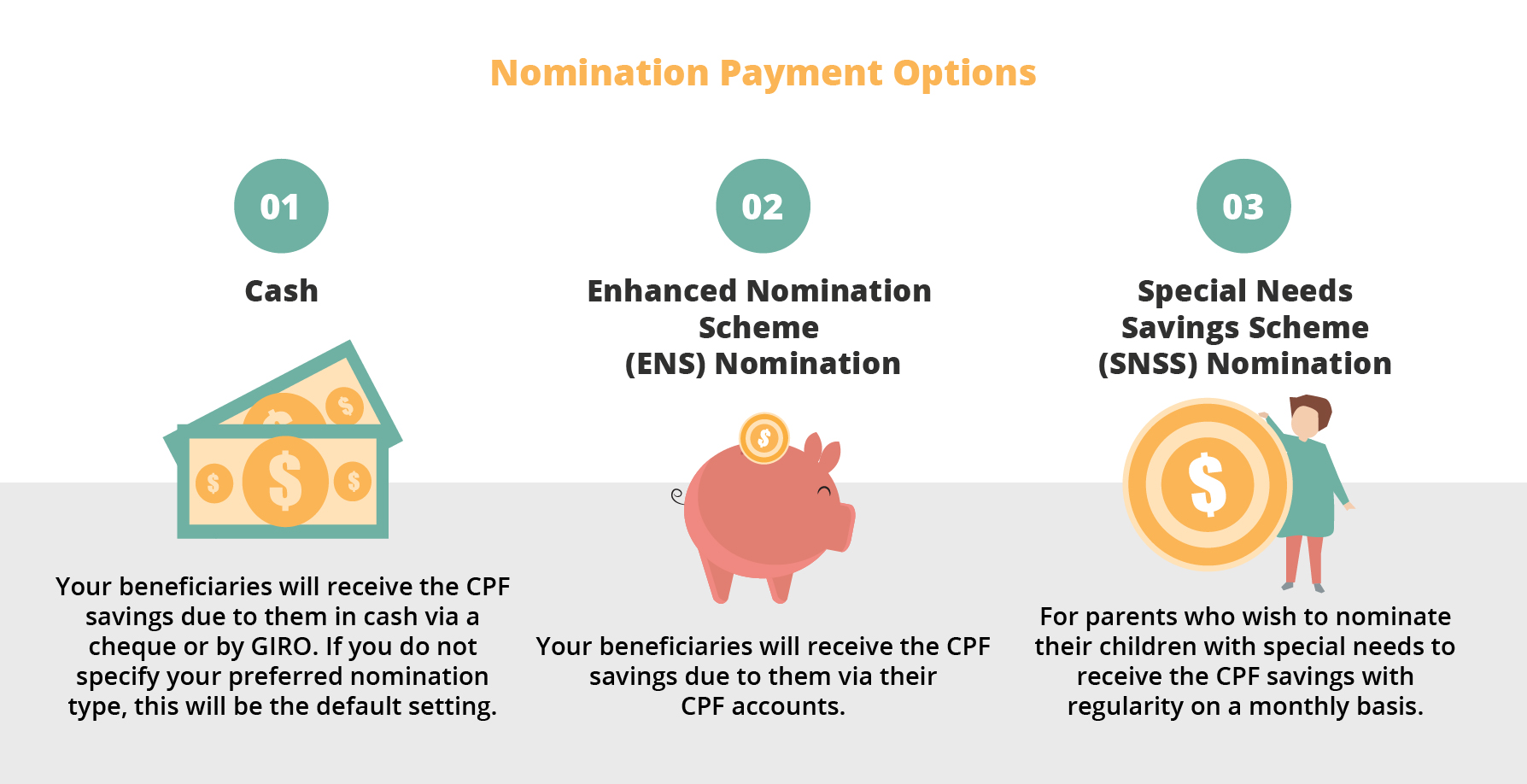

In simple words, a life insurance beneficiary is a person you are entitled to inherit the profits from your life insurance policy after you pass away. Beneficiary the person (s) or entity (ies) (e.g. If your intention is for your nominee(s) to receive the policy money beneficially and not as executor, you have to assign the policy benefits to them, Hence now nominee=beneficial nominee to whom the death benefits will be payable irrespective of legal heirs claim. Will ensure smooth transfer of funds/assets to legal heir as per the wish of the person.

Source: moneymag.com.au

Source: moneymag.com.au

There has always been confusion on rights of nominee. Nominee is the person you nominate to claim the death payout from your life insurance. (correct me if im wrong) :) Assignment means �transfer of ownership� whereas nomination means �secondary owner� assignment comes to force as soon as the policy assignment formalities are completed and all benefits of the policy plan are given to the �assignee� only, irrespective of the policy holder being. However beneficiary term is largely used in life insurance.

Source: wmaproperty.com

Source: wmaproperty.com

Suppose mr.a applied for maturity claim amount. The policy beneficiary can be any individual whom the life assured trusts. The death benefit is paid to the nominee of the policy, if the policyholder dies during the policy tenure. On the death of any nominee, the nominee’s interest in the policy moneys will form part of the nominee’s estate. If your intention is for your nominee(s) to receive the policy money beneficially and not as executor, you have to assign the policy benefits to them,

Source: blog.bankbazaar.com

Source: blog.bankbazaar.com

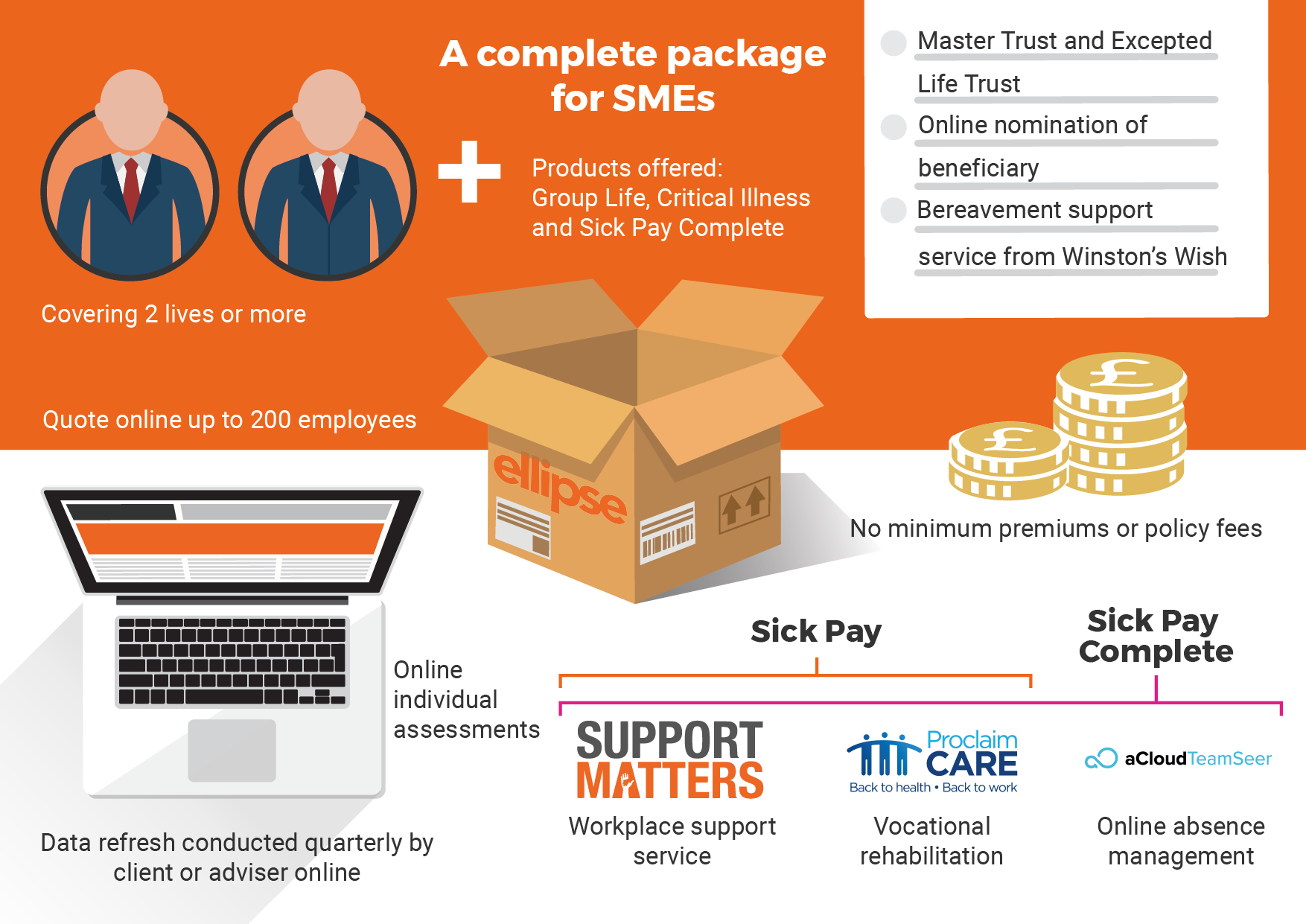

The death benefit is paid to the nominee of the policy, if the policyholder dies during the policy tenure. You can appoint one or multiple persons as your nominee for your life insurance. The appointed heir is called a life policy nominee or beneficiary. A revocable nomination allows the policy owner who is at least 18 years to nominate any person as a beneficiary of the whole or any portion of the death benefits under the policy. Under this law, a policyholder can name his spouse, parents, or his children, or any of them separately or together, as the beneficial nominee.

Source: openfinancialservice.com

Source: openfinancialservice.com

(correct me if im wrong) :) Difference between nominee and beneficiary. Under this law, a policyholder can name his spouse, parents, or his children, or any of them separately or together, as the beneficial nominee. To obtain the death benefit, the policyholder names a nominee when enrolling for term insurance. What is a revocable nomination?

Source: blog.pzl.sg

Source: blog.pzl.sg

Protected eg if policy is assigned to a bank then insurer will first clear the bank liability then pay the balance to nominee. The appointed heir is called a life policy nominee or beneficiary. The nominee and beneficiary can be used as synonyms. Once you understand the nominee meaning, you will be in a better position to decide on who you want to nominate for your. Your nominee will be the legal owner of your claim amount.

Source: wadepickel.blogspot.com

Source: wadepickel.blogspot.com

Corporation, trust, etc.) named in the policy as the recipient of insurance proceeds upon the death of the insured. Beneficiary the person (s) or entity (ies) (e.g. A nominee is a person or a group of members nominated by the policyholder for health insurance benefits. The person so authorised is called nominee. Nominee is the person you nominate to claim the death payout from your life insurance.

Source: sarahathina311.blogspot.com

Source: sarahathina311.blogspot.com

Ashok did not change nomination in policy and died. Life insurance nomination process is governed under the rule sec 39 of insurance act 1938. Ashok nominated his brother arun as nominee prior to ashok marriage. Beneficiary is the person who can use and enjoy the death payout from your life insurance. A nominee is a person or a group of members nominated by the policyholder for health insurance benefits.

Source: npa1.org

Source: npa1.org

The following info are quoted and simplified from section 166 of the insurance act. Nomination an act by which the policy holders authorises another person to receive the policy moneys. If the policyholder loses his/her life during medical treatment, the assured sum will be entitled to the nominee. To obtain the death benefit, the policyholder names a nominee when enrolling for term insurance. The appointed heir is called a life policy nominee or beneficiary.

Source: insuranceterminology2021.blogspot.com

Source: insuranceterminology2021.blogspot.com

You can change the nominee multiple times and the latest nominee will supersede all the previous nominees. The death benefit is paid to the nominee of the policy, if the policyholder dies during the policy tenure. You can appoint one or multiple persons as your nominee for your life insurance. Nominee is a person who is nominated or appointed by the policyholder. Your nominee will be the legal owner of your claim amount.

Source: sarahathina311.blogspot.com

Source: sarahathina311.blogspot.com

What is a revocable nomination? If the policyholder loses his/her life during medical treatment, the assured sum will be entitled to the nominee. Beneficiary the person (s) or entity (ies) (e.g. Nomination an act by which the policy holders authorises another person to receive the policy moneys. In 2015, the government of india had introduced the concept of a beneficial nominee.

Source: cjhfinance.com

Source: cjhfinance.com

But if the nominee is not the legal heir or if he is not appointed as the beneficiary of the amount through a registered. On the death of any nominee, the nominee’s interest in the policy moneys will form part of the nominee’s estate. Hence now nominee=beneficial nominee to whom the death benefits will be payable irrespective of legal heirs claim. Protected eg if policy is assigned to a bank then insurer will first clear the bank liability then pay the balance to nominee. Your nominee will be the legal owner of your claim amount.

Source: keydifferences.com

Source: keydifferences.com

However, the heirs have to be appointed by the policyholder to avoid any kind of confusion. Assignment means �transfer of ownership� whereas nomination means �secondary owner� assignment comes to force as soon as the policy assignment formalities are completed and all benefits of the policy plan are given to the �assignee� only, irrespective of the policy holder being. One of the most important aspects to consider is the difference between the nominee and heir when it comes to insurance claims. Ashok nominated his brother arun as nominee prior to ashok marriage. To obtain the death benefit, the policyholder names a nominee when enrolling for term insurance.

One major benefit of a trust nomination is the protection of the policy proceeds against claims from your creditors in the event of bankruptcy. However, the heirs have to be appointed by the policyholder to avoid any kind of confusion. Beneficiary is the person who can use and enjoy the death payout from your life insurance. Beneficiary is an individual who has a financial interest in the life of the policyholder. Nominee is the person you nominate to claim the death payout from your life insurance.

Source: wadepickel.blogspot.com

While considering a life insurance plan, there is always a misconception between the beneficiary and the nominee. Such a nominee shall not act as a mere caretaker or trustee but will be treated as the ultimate beneficiary of the proceeds payable by the insurer. To obtain the death benefit, the policyholder names a nominee when enrolling for term insurance. Nominee is considered to be a trustee of money received for the beneficiaries of policy. A nominee is a person or a group of members nominated by the policyholder for health insurance benefits.

Source: vtalkinsurance.com

Source: vtalkinsurance.com

There has always been confusion on rights of nominee. There has always been confusion on rights of nominee. Ashok did not change nomination in policy and died. However, the heirs have to be appointed by the policyholder to avoid any kind of confusion. The appointed heir is called a life policy nominee or beneficiary.

Source: sg-lifeinsurance.blogspot.com

Source: sg-lifeinsurance.blogspot.com

Beneficiary is the person who can use and enjoy the death payout from your life insurance. Beneficiary the person (s) or entity (ies) (e.g. If your intention is for your nominee(s) to receive the policy money beneficially and not as executor, you have to assign the policy benefits to them, To obtain the death benefit, the policyholder names a nominee when enrolling for term insurance. Nominee is considered to be a trustee of money received for the beneficiaries of policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between beneficiary and nominee in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information