Difference between bonded and insured Idea

Home » Trending » Difference between bonded and insured IdeaYour Difference between bonded and insured images are ready in this website. Difference between bonded and insured are a topic that is being searched for and liked by netizens today. You can Get the Difference between bonded and insured files here. Get all royalty-free images.

If you’re looking for difference between bonded and insured pictures information related to the difference between bonded and insured topic, you have come to the ideal blog. Our website frequently provides you with hints for viewing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Difference Between Bonded And Insured. When hiring a household help, you can use a firm to offer the service. Most companies really want to be both as that provides a level of assurance to any potential client or business partner. Because a contractor must pay back a surety bond if it is ever used, it costs very little to put one in place. The difference between the two if you hire a contracting company to do work on your home and something goes awry, you need to know that the mistakes made will not be paid for out of your pocket.

기업보험전문가그룹(인슈캄파니) 5 Key Differences Between Insurance and From insucompany.com

기업보험전문가그룹(인슈캄파니) 5 Key Differences Between Insurance and From insucompany.com

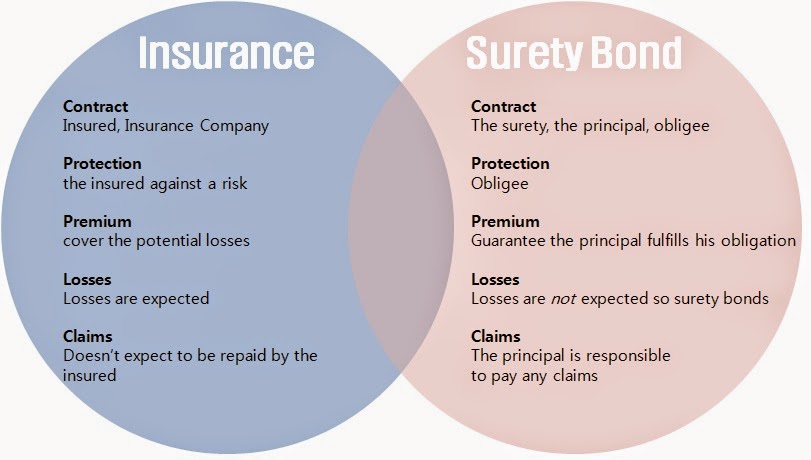

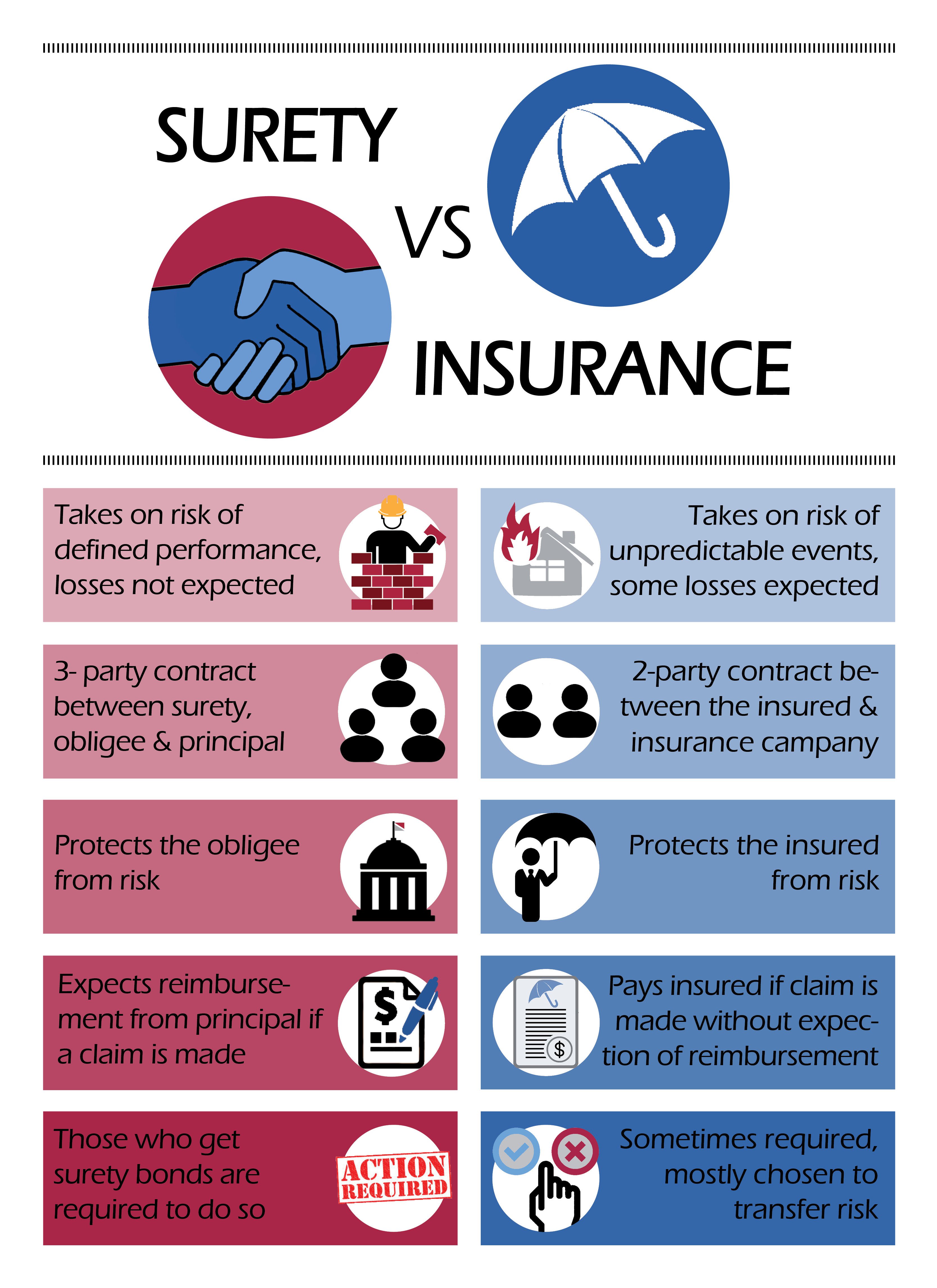

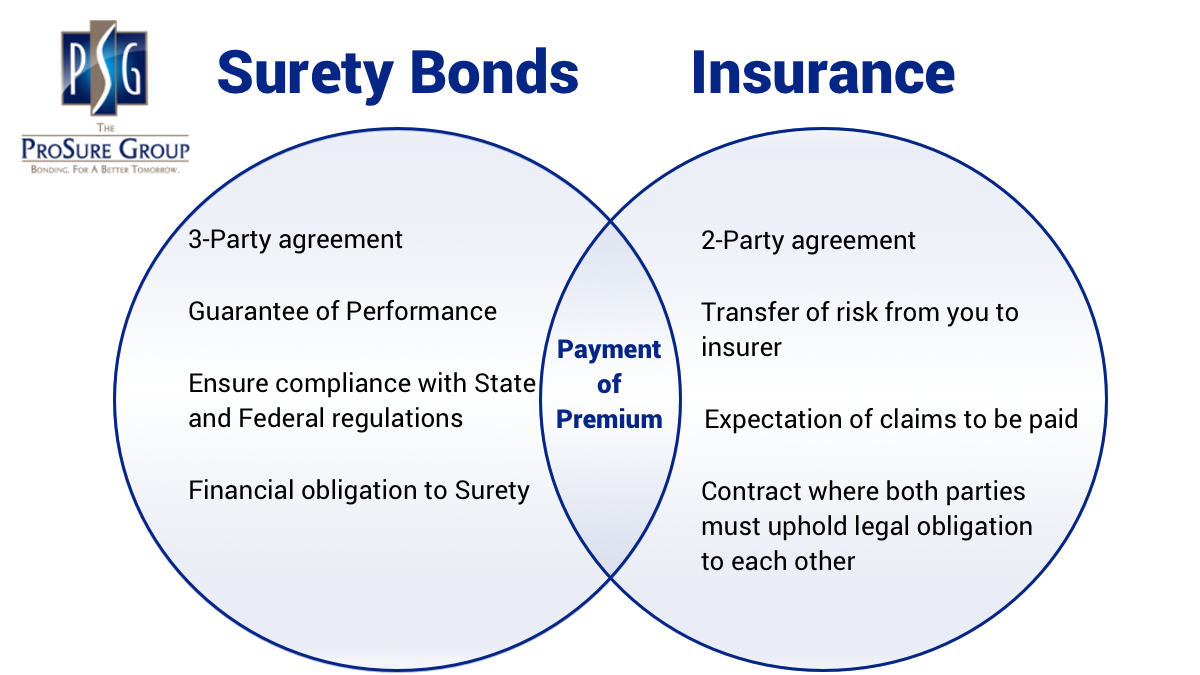

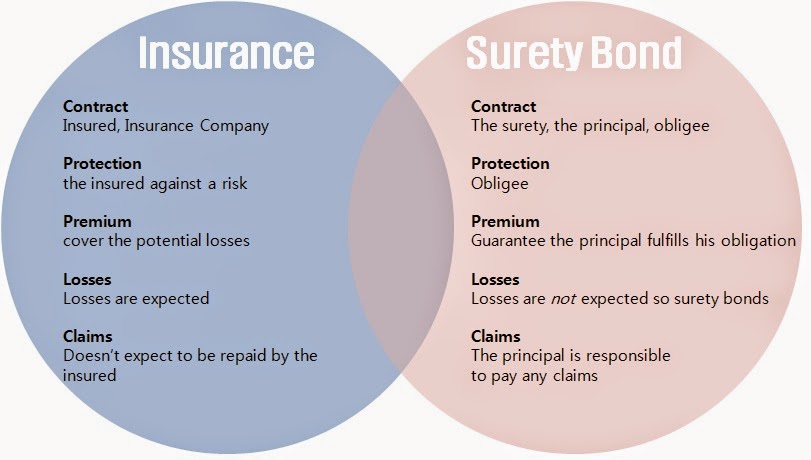

The main differences between insurance and bonds. The insurance policy provides coverage to the business/company or the individual who has purchased the product. Bonds offer the client peace of mind too, so it is a way of building trust with them, and may be the difference between you getting a job or one of your competitors. For example, if someone partially completed the work, the obligee can file a claim to the surety for the cost of finishing the work under a different contractor. When comparing bonds and insurance, there are some key differences to consider. What they do have in common is that both provide forms of financial compensation in.

The principal is the business or individual purchasing the bond from the second party, called the surety.

For a contractor, one of the biggest differences between insurance and bonding is which entity takes on the risk; There are three parties involved in the bond contract. The terms bonded and insured often are misunderstood. Insurance plans are to protect the insured against any financial claim. Being bonded, especially a performance guaranteee bond, is typically used for a government contract pursuant to the miller act, or similar state or municipal. A bond is like an added level of insurance on your coverage plan.

Source: alphasurety.com

Source: alphasurety.com

Typically, insurers pay a percentage of losses after the insured pays a deductible amount. What they do have in common is that both provide forms of financial compensation in. About difference between insured and bonded. The insured does not pay any amount to the insurance company other than the insurance premium. A bond is like an added level of insurance on your coverage plan.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

Most companies really want to be both as that provides a level of assurance to any potential client or business partner. A bond protects a business from negligence within the workplace. For example, if someone partially completed the work, the obligee can file a claim to the surety for the cost of finishing the work under a different contractor. What they do have in common is that both provide forms of financial compensation in. Difference between bonded and insured.

Source: suretybondsdirect.com

Source: suretybondsdirect.com

Typically, insurers pay a percentage of losses after the insured pays a deductible amount. Licenses and bonding are designed specially to protect businesses and their customers in the event of accidents, disasters, or errors. A bond protects a business from negligence within the workplace. Typically, insurers pay a percentage of losses after the insured pays a deductible amount. We would like to show you a description here but the site won’t allow us.

Source: youtube.com

Source: youtube.com

The difference between being bonded and being insured. Here are a few ways to understand how they differ. Main difference between being bonded and insured. For a contractor, one of the biggest differences between insurance and bonding is which entity takes on the risk; When comparing bonds and insurance, there are some key differences to consider.

Source: pinterest.com.mx

Source: pinterest.com.mx

The terms bonded and insured often are misunderstood. And the third party is the surety company. Instead, it provides assurance against the risk of default of a single entity (such as a general contractor). In the event of a claim, the. Bonds offer the client peace of mind too, so it is a way of building trust with them, and may be the difference between you getting a job or one of your competitors.

Source: swiftbonds.com

Source: swiftbonds.com

Main difference between being bonded and insured. Many people do not know the difference between being insured and being licensed and bonded. For example, if someone partially completed the work, the obligee can file a claim to the surety for the cost of finishing the work under a different contractor. Bonding and insuring are both forms of protection against financial loss, but they work slightly differently, and in some industries, people may be bonded and insured so that they are thoroughly covered. Here are a few ways to understand how they differ.

Source: insurancenoon.com

Source: insurancenoon.com

There is a difference between being insured and being bonded. The terms bonded and insured often are misunderstood. For a contractor, one of the biggest differences between insurance and bonding is which entity takes on the risk; While both terms are forms of financial guarantee, they mean different things. Both involve coverage for financial risk or loss, and in some instances there is little difference between the two.

Source: prosuregroup.com

Source: prosuregroup.com

Here are a few ways to understand how they differ. The insured does not pay any amount to the insurance company other than the insurance premium. For a contractor, one of the biggest differences between insurance and bonding is which entity takes on the risk; The terms bonded and insured often are misunderstood. Insurance plans are to protect the insured against any financial claim.

Source: suretybondsdirect.com

Source: suretybondsdirect.com

Surety bonds and insurance coverage serve different purposes. Insurance plans are to protect the insured against any financial claim. It’s important to understand the difference between bonding and insurance. Here are a few ways to understand how they differ. While there is a definite difference regarding bonded vs insured individuals, bonds and insurance policies are still sometimes made available by the same financial organization, because the two serve similar purposes and must be backed by a company with the resources to pay out any claims made against them.

Source: prosuregroup.com

Source: prosuregroup.com

The main difference between liability insurance and surety bonds is which party gets financially restored, according to alliance marketing & insurance services, or amis. The first party is the company requesting the bond, referred to as the principal. The second party is the customer, referred to as the obligee. Both involve coverage for financial risk or loss, and in some instances there is little difference between the two. A bond is like an added level of insurance on your coverage plan.

Source: itsaboutjustice.law

Source: itsaboutjustice.law

When you say that you are licensed, bonded and insured, you have the required licensing for your business, proper insurance and you have made payments for additional coverage with a bond. When you say that you are licensed, bonded and insured, you have the required licensing for your business, proper insurance and you have made payments for additional coverage with a bond.a bond is like an added level of insurance on your coverage plan. The main difference between liability insurance and surety bonds is which party gets financially restored, according to alliance marketing & insurance services, or amis. When hiring a household help, you can use a firm to offer the service. Typically, insurers pay a percentage of losses after the insured pays a deductible amount.

Source: bondexchange.com

Source: bondexchange.com

For a contractor, one of the biggest differences between insurance and bonding is which entity takes on the risk; The principal is the business or individual purchasing the bond from the second party, called the surety. The terms bonded and insured often are misunderstood. And the third party is the surety company. For example, if someone partially completed the work, the obligee can file a claim to the surety for the cost of finishing the work under a different contractor.

Source: alphasurety.com

Source: alphasurety.com

The first party is the company requesting the bond, referred to as the principal. Most businesses will already have general liability insurance or professional liability insurance. What is the difference between bonded vs. A bond is like an added level of insurance on your coverage plan. The second party is the customer, referred to as the obligee.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

Only reputable hvac contractors may be bonded and insured and these two forms of protection are very important for you as a consumer. When you say that you are licensed, bonded and insured, you have the required licensing for your business, proper insurance and you have made payments for additional coverage with a bond.a bond is like an added level of insurance on your coverage plan. Although the two seem similar, there is a thin difference between the. The principal is the business or individual purchasing the bond from the second party, called the surety. A bond is like an added level of insurance on your coverage plan.

Source: insucompany.com

Source: insucompany.com

We would like to show you a description here but the site won’t allow us. When comparing bonds and insurance, there are some key differences to consider. The second party is the customer, referred to as the obligee. The first party is the company requesting the bond, referred to as the principal. The insurance policy provides coverage to the business/company or the individual who has purchased the product.

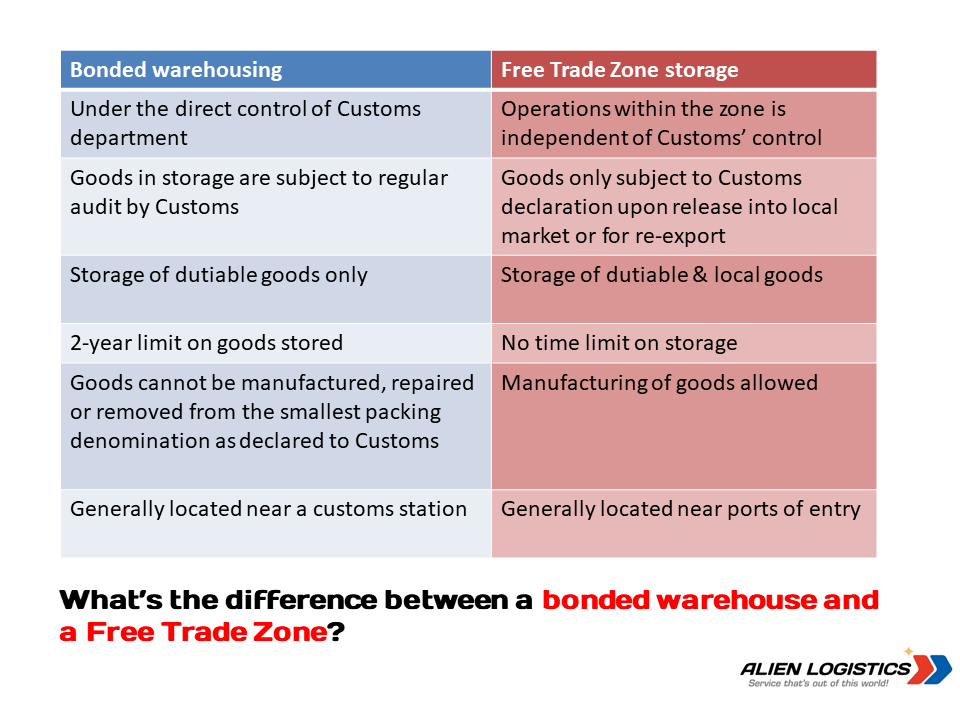

Source: alienlogistics.com

Source: alienlogistics.com

The first party is the company requesting the bond, referred to as the principal. They are designed to protect a person or a business in the event of something going wrong. Most companies really want to be both as that provides a level of assurance to any potential client or business partner. An insurance policy transfers the risk to the insurer, while a bond ultimately keeps the risk with the bonded principal (the contractor himself/herself). The difference between being bonded and being insured.

Source: suretybonds.org

Source: suretybonds.org

Although the two seem similar, there is a thin difference between the. Bonds offer the client peace of mind too, so it is a way of building trust with them, and may be the difference between you getting a job or one of your competitors. For a contractor, one of the biggest differences between insurance and bonding is which entity takes on the risk; Bonds are frequently confused with insurance, but there are some major differences between the two. It’s important to understand the difference between bonding and insurance.

![Surety Bonds vs Insurance Policy The Difference [Infographic] Surety Bonds vs Insurance Policy The Difference [Infographic]](https://www.performancesuretybonds.com/blog/wp-content/uploads/2019/07/Surety-Bonds-vs.-Insurance-Policies-Infographic_v1.jpg) Source: performancesuretybonds.com

Source: performancesuretybonds.com

Being bonded, especially a performance guaranteee bond, is typically used for a government contract pursuant to the miller act, or similar state or municipal. Both involve coverage for financial risk or loss, and in some instances there is little difference between the two. For a contractor, one of the biggest differences between insurance and bonding is which entity takes on the risk; What is the difference between bonded vs. Only reputable hvac contractors may be bonded and insured and these two forms of protection are very important for you as a consumer.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between bonded and insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea