Difference between comprehensive and third party insurance policy information

Home » Trend » Difference between comprehensive and third party insurance policy informationYour Difference between comprehensive and third party insurance policy images are ready. Difference between comprehensive and third party insurance policy are a topic that is being searched for and liked by netizens now. You can Get the Difference between comprehensive and third party insurance policy files here. Find and Download all royalty-free images.

If you’re looking for difference between comprehensive and third party insurance policy pictures information linked to the difference between comprehensive and third party insurance policy interest, you have come to the right blog. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Difference Between Comprehensive And Third Party Insurance Policy. In insurance terminology, first party is the individual or business that is getting insurance policy and the insurance company is called the second party. Given that comprehensive insurance is the most expensive, you may be wondering why you can’t just pick the cheapest. Motor insurance is a mandatory requirement under saudi arabia’s traffic regulations. It’ll provide you with coverage for a range of insured events such as accidents and theft, as well as weather events like hail, fire and storms.

What is the difference between comprehensive insurance and From quora.com

For an extra premium, it can also cover your car for fire and theft for up to $10,000. Third party only (tpo), third party fire & theft and comprehensive insurance. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft. When buying car insurance in singapore, you have three options: In insurance terminology, first party is the individual or business that is getting insurance policy and the insurance company is called the second party. It’ll cover you for a wide range of damage caused by an insured event like an accident, theft and weather events (think hail, fire and storms including cyclones).

Comprehensive car insurance is just that — comprehensive.

A comprehensive insurance policy covers loss and damage to your own vehicle caused by certain events like accidents, fire, theft, vandalism, falling objects, etc. A comprehensive insurance policy covers loss and damage to your own vehicle caused by certain events like accidents, fire, theft, vandalism, falling objects, etc. You could receive monetary compensation for any personal belongings that are stolen or damaged too. For an extra premium, it can also cover your car for fire and theft for up to $10,000. When buying car insurance in singapore, you have three options: Motor insurance is a mandatory requirement under saudi arabia’s traffic regulations.

Source: souqalmal.com

Source: souqalmal.com

Fully comprehensive insurance in simple terms, this type of policy covers you for everything. For an extra premium, it can also cover your car for fire and theft for up to $10,000. But when choosing between the two, you should consider your needs as well as the. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft. What’s the difference between comprehensive and third party car insurance?

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

Third party only (tpo), third party fire & theft and comprehensive insurance. Third party only (tpo), third party fire & theft and comprehensive insurance. When buying car insurance in singapore, you have three options: Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else. Selecting the right kind of insurance is important for you.

Source: revisi.net

Source: revisi.net

Third party only (tpo), third party fire & theft and comprehensive insurance. Comprehensive car insurance is just that — comprehensive. In general, a comprehensive car insurance policy will cover you for a wide range of damages, injuries, and loss to your passengers, your vehicle, and other property. For an extra premium, it can also cover your car for fire and theft for up to $10,000. Selecting the right kind of insurance is important for you.

Source: comparepolicy.com

Source: comparepolicy.com

It’ll provide you with coverage for a range of insured events such as accidents and theft, as well as weather events like hail, fire and storms. If you cause an accident, anyone who suffers damages as a result is known as a ‘third party.’ these people can claim from your insurance for their damages. Motor insurance is a mandatory requirement under saudi arabia’s traffic regulations. This means you don’t necessarily have to compromise on your cover just to save a few pounds. But when choosing between the two, you should consider your needs as well as the.

Source: ringgitplus.com

Source: ringgitplus.com

Qbe’s third party property damage car insurance covers damage caused by the use of your car to other people’s cars and property, but not damage to your own car. A comprehensive insurance cover for a vehicle offers complete safety against the loss and damage to your vehicle i.e. You could receive monetary compensation for any personal belongings that are stolen or damaged too. Comprehensive car insurance generally lives up to its name. Given that comprehensive insurance is the most expensive, you may be wondering why you can’t just pick the cheapest.

Source: nickharedesign.blogspot.com

Source: nickharedesign.blogspot.com

A comprehensive insurance cover for a vehicle offers complete safety against the loss and damage to your vehicle i.e. It also has your back if you cause any damage to someone else’s car and property. Third party property damage car insurance. Third party is the person or company that claims damages after suffering a loss through your car. Read on to know about the difference between third party and comprehensive car insurance.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

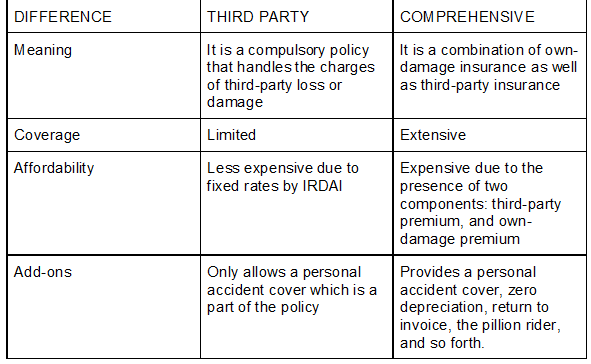

Let us see what the differences between a third party insurance and a comprehensive insurance are. What is the difference between comprehensive and third party insurance? This means you don’t necessarily have to compromise on your cover just to save a few pounds. Your comprehensive insurance could also cover damaged windows or windscreens, replacement locks, trailer cover, and any audio or telephone equipment. Comprehensive insurance is the most advised insurance cover because it covers both own damage and third party liability.

Source: blog.himanshusheth.net

Source: blog.himanshusheth.net

Third party only (tpo), third party fire & theft and comprehensive insurance. Selecting the right kind of insurance is important for you. It also has your back if you cause any damage to someone else’s car and property. This type of policy covers everyone except you (or more to the point; Third party only (tpo), third party fire & theft and comprehensive insurance.

Source: financialsolving.com

Source: financialsolving.com

Comprehensive car insurance generally lives up to its name. Comprehensive car insurance generally lives up to its name. When buying car insurance in singapore, you have three options: Read on to know about the difference between third party and comprehensive car insurance. A comprehensive insurance policy covers loss and damage to your own vehicle caused by certain events like accidents, fire, theft, vandalism, falling objects, etc.

Source: bajajfinservmarkets.in

Source: bajajfinservmarkets.in

This type of policy covers everyone except you (or more to the point; Selecting the right kind of insurance is important for you. If you cause an accident, anyone who suffers damages as a result is known as a ‘third party.’ these people can claim from your insurance for their damages. In addition, to cover your own vehicle, a comprehensive insurance. Motor insurance is a mandatory requirement under saudi arabia’s traffic regulations.

Source: magzjam.com

Source: magzjam.com

But when choosing between the two, you should consider your needs as well as the. In general, a comprehensive car insurance policy will cover you for a wide range of damages, injuries, and loss to your passengers, your vehicle, and other property. Third party insurance would not cover these features. Third party property damage car insurance. A comprehensive insurance policy covers loss and damage to your own vehicle caused by certain events like accidents, fire, theft, vandalism, falling objects, etc.

Source: financialsolving.com

Source: financialsolving.com

In insurance terminology, first party is the individual or business that is getting insurance policy and the insurance company is called the second party. Comprehensive car insurance is just that — comprehensive. Let us see what the differences between a third party insurance and a comprehensive insurance are. It also has your back if you cause any damage to someone else’s car and property. Third party is the person or company that claims damages after suffering a loss through your car.

Source: acko.com

Source: acko.com

Read on to know about the difference between third party and comprehensive car insurance. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft. Own damage (od) and other vehicles and properties i.e. You could receive monetary compensation for any personal belongings that are stolen or damaged too. Third party only (tpo), third party fire & theft and comprehensive insurance.

Source: pinterest.com

Source: pinterest.com

It’ll provide you with coverage for a range of insured events such as accidents and theft, as well as weather events like hail, fire and storms. What’s the difference between comprehensive and third party car insurance? In general, a comprehensive car insurance policy will cover you for a wide range of damages, injuries, and loss to your passengers, your vehicle, and other property. Qbe’s third party property damage car insurance covers damage caused by the use of your car to other people’s cars and property, but not damage to your own car. It’ll provide you with coverage for a range of insured events such as accidents and theft, as well as weather events like hail, fire and storms.

Source: unitrustib.com

Source: unitrustib.com

What’s the difference between comprehensive and third party car insurance? It also has your back if you cause any damage to someone else’s car and property. There was a total of 3,935 traffic accidents reported in the uae during the first ten months of 2015 based on statistics released by the traffic coordination directorate general. Your comprehensive insurance could also cover damaged windows or windscreens, replacement locks, trailer cover, and any audio or telephone equipment. Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else.

Source: buyanyinsurance.ae

Source: buyanyinsurance.ae

In general, a comprehensive car insurance policy will cover you for a wide range of damages, injuries, and loss to your passengers, your vehicle, and other property. This means you don’t necessarily have to compromise on your cover just to save a few pounds. A third party, fire and theft policy covers any damage to a third party or their property resulting from an incident as well as any damage to your own vehicle caused by fire or theft. Qbe’s third party property damage car insurance covers damage caused by the use of your car to other people’s cars and property, but not damage to your own car. Motor insurance is a mandatory requirement under saudi arabia’s traffic regulations.

Source: bankbazaar.com

Source: bankbazaar.com

In addition, to cover your own vehicle, a comprehensive insurance. If you cause an accident, anyone who suffers damages as a result is known as a ‘third party.’ these people can claim from your insurance for their damages. But when choosing between the two, you should consider your needs as well as the. It’ll cover you for a wide range of damage caused by an insured event like an accident, theft and weather events (think hail, fire and storms including cyclones). For an extra premium, it can also cover your car for fire and theft for up to $10,000.

Source: quora.com

Meanwhile, a comprehensive insurance policy will cover all of the above and also cover the costs of any damage to your own vehicle if you’re involved in an incident. When buying car insurance in singapore, you have three options: Read on to know about the difference between third party and comprehensive car insurance. What’s the difference between comprehensive and third party car insurance? Comprehensive insurance is the most advised insurance cover because it covers both own damage and third party liability.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between comprehensive and third party insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information