Difference between dwelling and homeowners insurance Idea

Home » Trend » Difference between dwelling and homeowners insurance IdeaYour Difference between dwelling and homeowners insurance images are ready. Difference between dwelling and homeowners insurance are a topic that is being searched for and liked by netizens today. You can Download the Difference between dwelling and homeowners insurance files here. Download all free vectors.

If you’re searching for difference between dwelling and homeowners insurance images information connected with to the difference between dwelling and homeowners insurance topic, you have visit the right blog. Our website always gives you hints for seeking the highest quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

Difference Between Dwelling And Homeowners Insurance. Renters insurance is very similar, except it does not include dwelling coverage since you do not own the structure. Insurance companies usually define “most of the year” as at least six months. Differences between a homeowners policy and a dwelling policy. And since there is no full time resident a vacant dwelling tends to cost more to insure.

Learn what is the Difference between a Rental Dwelling From youtube.com

Learn what is the Difference between a Rental Dwelling From youtube.com

A dwelling policy covers only the physical structure of the home. A dwelling policy is also referred to as second home insurance. These include the actual house and the property inside, such as clothing, furniture, and collectibles. Homeowners insurance protects your house, but it insures more than dwelling insurance does. Unlike homeowners insurance, dwelling insurance does not cover theft of personal property. They serve clients in and around lancaster county, helping people navigate the confusing insurance.

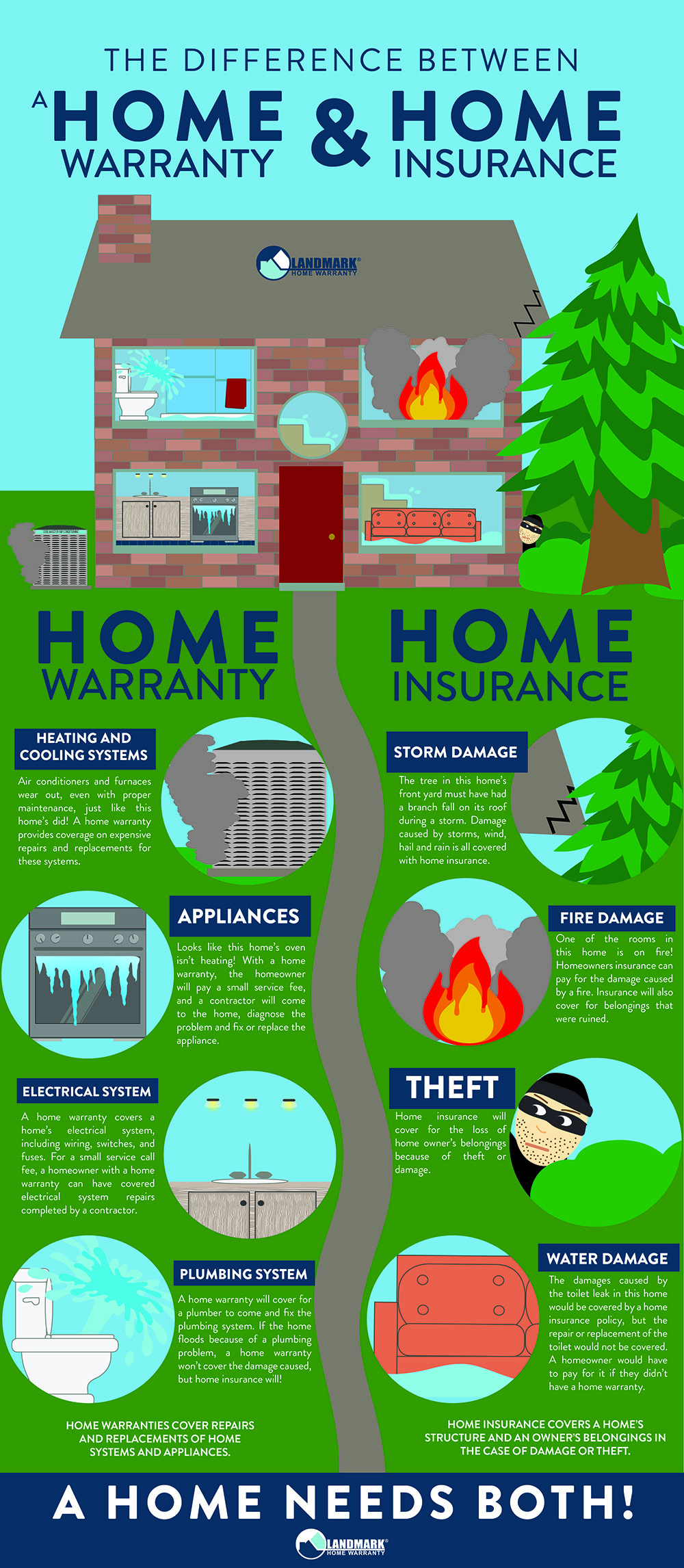

Additional living expense coverage covers the cost of any additional expenses that may arise if a fire occurs.

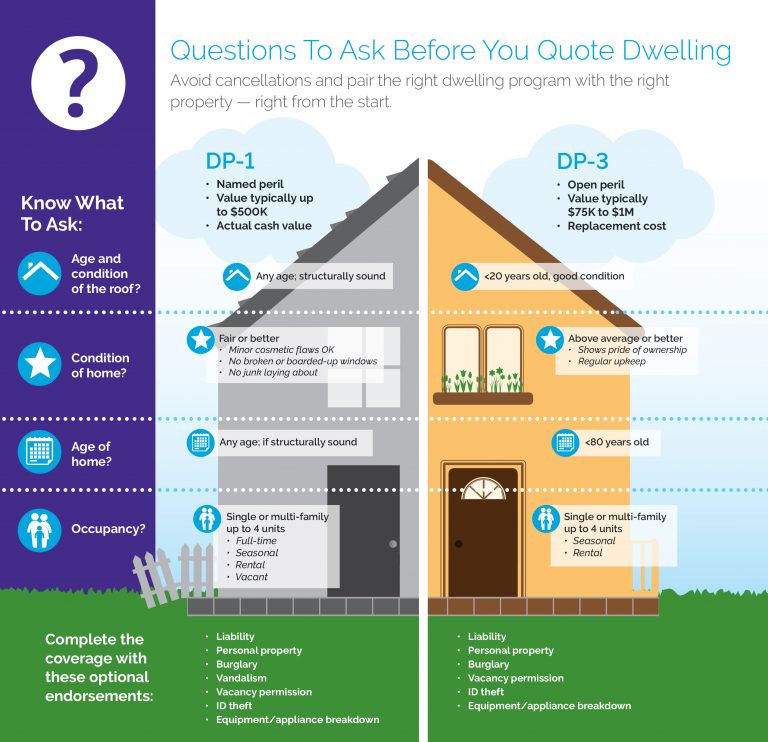

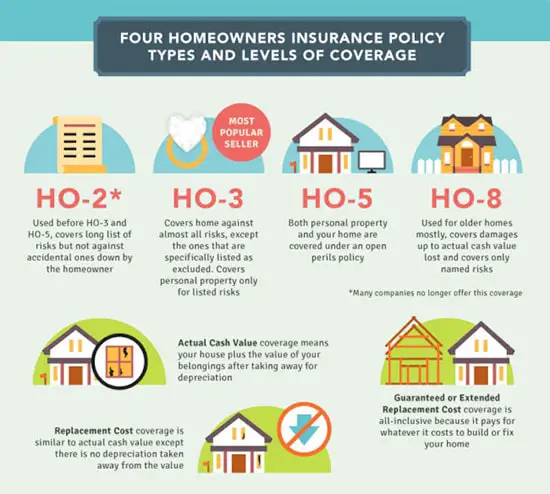

Homeowners insurance often covers “open perils” while dwelling insurance covers “named perils” that will need to be specified. Dwelling insurance, sometimes called “second home insurance” or “investment property insurance,” covers only the. When you have a homeowners insurance policy in place, everything is covered during a catastrophe, from the actual property to the furniture inside it, as well as. Homeowners policy is more comprehensive than the dwelling coverage. Homeowners and dwelling insurance both cover the structure of the main house, including elements attached to the main house like garages. Unlike homeowners insurance, dwelling insurance does not cover theft of personal property.

Source: erinnewmansite.blogspot.com

Source: erinnewmansite.blogspot.com

Dwelling insurance protects your home structure from many (4). Therefore, regardless if you’d like to rent out your own property or maybe buy an investment property, it’s safe to say that by having only a. A homeowners insurance policy is more comprehensive and covers not only the physical structure but also the contents inside the home. Sometimes called �investment property insurance�, or even in some instances �second home insurance� dwelling insurance is commonly used to insure only the structure, or �dwelling.�. Insurance companies usually define “most of the year” as at least six months.

Source: nl.pinterest.com

Source: nl.pinterest.com

It does not provide liability of personal property coverage, but simply insures the structures on the property against loss and damage. Unlike homeowners insurance, dwelling insurance does not cover theft of personal property. And since there is no full time resident a vacant dwelling tends to cost more to insure. Homeowners policy is more comprehensive than the dwelling coverage. Renters insurance is very similar, except it does not include dwelling coverage since you do not own the structure.

Source: pinterest.com

Source: pinterest.com

Unlike homeowners insurance, dwelling insurance does not cover theft of personal property. Now, dwelling coverage does include installed fixtures like cabinets and counters, and permanently attached appliances connected to public utilities, like some stoves or a water heater. Sometimes you may have difficulty obtaining coverage for a vacant dwelling, (1). Homeowners insurance protects your house, but it insures more than dwelling insurance does. These three types of coverage are standard in a homeowner�s policy, but not in other types of home coverage, such as a dwelling policy.

Source: priorityhomewarranty.com

Source: priorityhomewarranty.com

With fair rental value coverage, your insurance provider will cover the loss of rent if the home is not able to be lived in after a fire. It is “coverage a” in a home policy. Differences between a homeowners policy and a dwelling policy. And since there is no full time resident a vacant dwelling tends to cost more to insure. A dwelling policy covers only the physical structure of the home.

![[INFOGRAPHIC] The difference between home insurance and [INFOGRAPHIC] The difference between home insurance and](https://i.pinimg.com/originals/f9/ea/90/f9ea90f3da3e1d33a9ed4a461908e650.jpg) Source: pinterest.fr

Source: pinterest.fr

A homeowners insurance policy can vary in coverage limits and options from company to company but one thing is common across all companies, and that is a homeowners policy is more comprehensive than a. Homeowners policy is more comprehensive than the dwelling coverage. Dwelling coverage also protects attached structures like decks, porches, and attached garages. These include the actual house and the property inside, such as clothing, furniture, and collectibles. They serve clients in and around lancaster county, helping people navigate the confusing insurance.

Source: youtube.com

Source: youtube.com

Like homeowner’s insurance, your dwelling coverage policy will cover the costs of repairs or rebuilding when fire damage occurs. Therefore, regardless if you’d like to rent out your own property or maybe buy an investment property, it’s safe to say that by having only a. While dwelling insurance only covers the physical structure of your home, the homeowners insurance covers everything. Differences between a homeowners policy and a dwelling policy. Like homeowner’s insurance, your dwelling coverage policy will cover the costs of repairs or rebuilding when fire damage occurs.

Source: wqcorp.com

Source: wqcorp.com

Homeowners insurance also has the benefit of covering other identified detached structures on the property, such as sheds and pools. Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Generally speaking, dwelling policies are less comprehensive than homeowners policies. With fair rental value coverage, your insurance provider will cover the loss of rent if the home is not able to be lived in after a fire. Likewise, people ask, why does dwelling coverage increases?

Source: laurennn87.blogspot.com

Source: laurennn87.blogspot.com

Dwelling insurance provides the following coverages: Dwelling insurance provides the following coverages: Renters insurance is very similar, except it does not include dwelling coverage since you do not own the structure. Dwelling insurance, sometimes referred to as “investment property insurance” or “second home insurance,” covers only the building. Your renters are required to purchase a separate policy to cover their own belongings.

Source: amig.com

Source: amig.com

Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. When you have a homeowners insurance policy in place, everything is covered during a catastrophe, from the actual property to the furniture inside it, as well as. Dwelling insurance provides the following coverages: What’s the difference between homeowners and dwelling policy? Liability and theft coverages are available by customizing a dwelling policy with an endorsement.

Source: hwahomewarranty.com

Source: hwahomewarranty.com

This type of insurance is important, along with liability coverage, if you own a rental property. Dwelling and homeowners insurance are designed to provide coverage under two different circumstances. Dwelling insurance protects your home structure from many (4). They serve clients in and around lancaster county, helping people navigate the confusing insurance. What’s the difference between homeowners and dwelling policy?

Source: financebuddha.com

Source: financebuddha.com

A homeowners insurance policy is more comprehensive and covers not only the physical structure but also the contents inside the home. Sometimes called ‘investment property insurance’, or even in some instances ‘second home insurance’ dwelling insurance is commonly used to insure only the structure, or ‘dwelling.’ homeowners insurance provides dwelling coverage, but also includes, as standard coverage, personal property and personal liability protection. Renters insurance is very similar, except it does not include dwelling coverage since you do not own the structure. Like homeowner’s insurance, your dwelling coverage policy will cover the costs of repairs or rebuilding when fire damage occurs. Now, dwelling coverage does include installed fixtures like cabinets and counters, and permanently attached appliances connected to public utilities, like some stoves or a water heater.

Source: bascombrealestate.com

Source: bascombrealestate.com

Dwelling coverage also protects attached structures like decks, porches, and attached garages. Dwelling insurance protects your home structure from many (4). This type of insurance is important, along with liability coverage, if you own a rental property. Personal property is covered in homeowners insurance but not in dwelling insurance. Dwelling insurance provides the following coverages:

Source: rockriverrealty.com

Source: rockriverrealty.com

Personal property is covered in homeowners insurance but not in dwelling insurance. Likewise, people ask, why does dwelling coverage increases? It does not provide liability of personal property coverage, but simply insures the structures on the property against loss and damage. Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. Dwelling insurance, sometimes referred to as “investment property insurance” or “second home insurance,” covers only the building.

Source: homeownersinsurancecover.net

Source: homeownersinsurancecover.net

However, dwelling insurance doesn’t provide liability coverage or protection for possessions inside the home. It does not provide liability of personal property coverage, but simply insures the structures on the property against loss and damage. Sometimes you may have difficulty obtaining coverage for a vacant dwelling, (1). Dwelling insurance, sometimes referred to as “investment property insurance” or “second home insurance,” covers only the building. Dwelling insurance, sometimes called “second home insurance” or “investment property insurance,” covers only the.

Source: youtube.com

Source: youtube.com

Dwelling and homeowners insurance are designed to provide coverage under two different circumstances. Homeowners policy is more comprehensive than the dwelling coverage. Standard homeowners insurance, however, does not cover damage from floods or earthquakes. Additional living expense coverage covers the cost of any additional expenses that may arise if a fire occurs. Now, dwelling coverage does include installed fixtures like cabinets and counters, and permanently attached appliances connected to public utilities, like some stoves or a water heater.

Source: sweephoenixazhomes.com

Source: sweephoenixazhomes.com

Generally speaking, dwelling policies are less comprehensive than homeowners policies. Generally speaking, dwelling policies are less comprehensive than homeowners policies. With fair rental value coverage, your insurance provider will cover the loss of rent if the home is not able to be lived in after a fire. Therefore, regardless if you’d like to rent out your own property or maybe buy an investment property, it’s safe to say that by having only a. Sometimes you may have difficulty obtaining coverage for a vacant dwelling, (1).

Source: punjabirealtors.com

Source: punjabirealtors.com

Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. Three ways your dwelling value increases your value on your home insurance policy can increase. Your renters are required to purchase a separate policy to cover their own belongings. Homeowners insurance also has the benefit of covering other identified detached structures on the property, such as sheds and pools. These three types of coverage are standard in a homeowner�s policy, but not in other types of home coverage, such as a dwelling policy.

Source: youtube.com

Source: youtube.com

Personal property is covered in homeowners insurance but not in dwelling insurance. Your renters are required to purchase a separate policy to cover their own belongings. With fair rental value coverage, your insurance provider will cover the loss of rent if the home is not able to be lived in after a fire. And since there is no full time resident a vacant dwelling tends to cost more to insure. Now, dwelling coverage does include installed fixtures like cabinets and counters, and permanently attached appliances connected to public utilities, like some stoves or a water heater.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between dwelling and homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information