Difference between homeowners and dwelling insurance Idea

Home » Trend » Difference between homeowners and dwelling insurance IdeaYour Difference between homeowners and dwelling insurance images are available. Difference between homeowners and dwelling insurance are a topic that is being searched for and liked by netizens today. You can Download the Difference between homeowners and dwelling insurance files here. Find and Download all free vectors.

If you’re looking for difference between homeowners and dwelling insurance images information related to the difference between homeowners and dwelling insurance keyword, you have pay a visit to the right blog. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

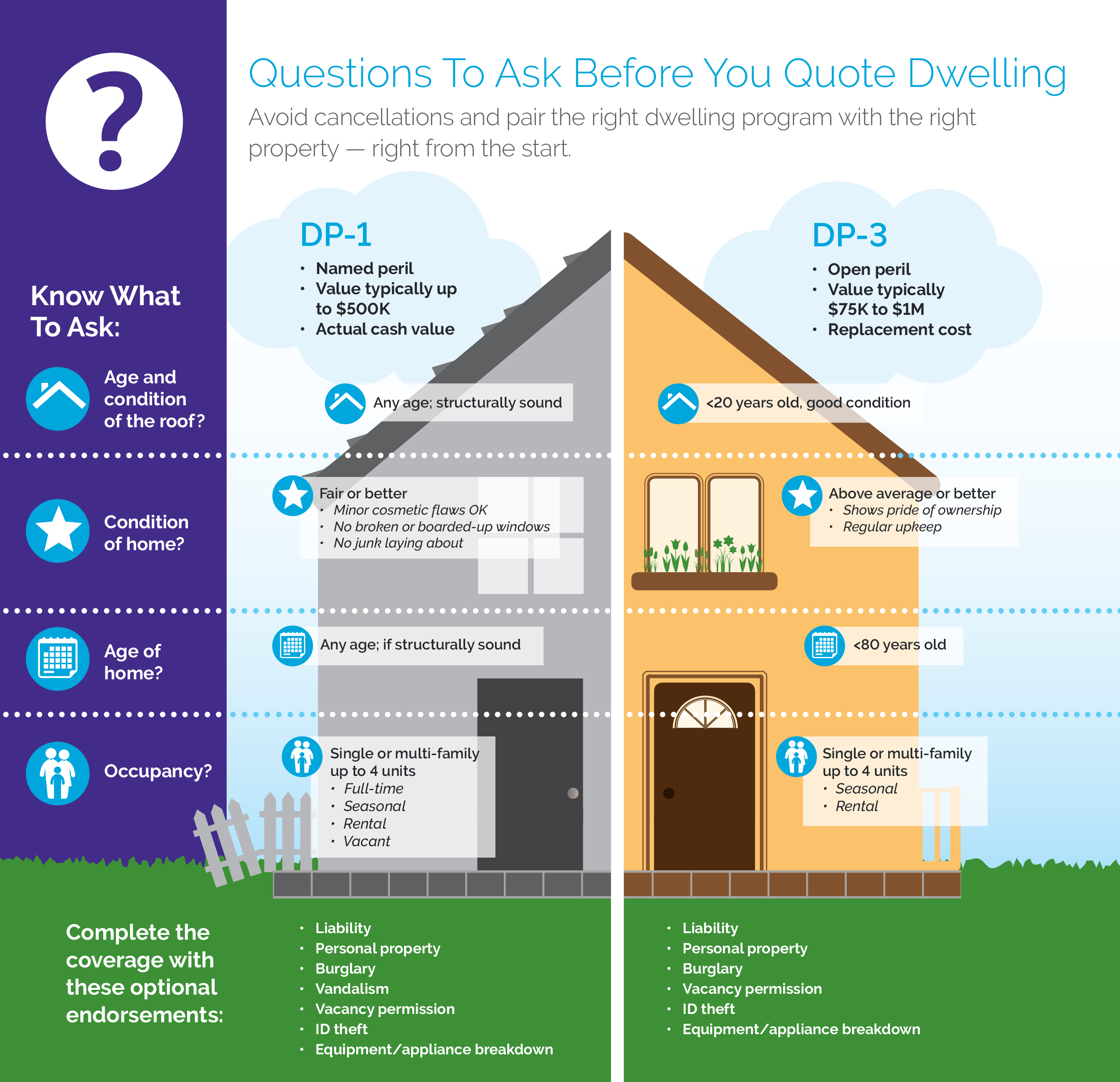

Difference Between Homeowners And Dwelling Insurance. Home insurance covers the individual�s primary residence; The product information contained on this website is informational only and not a statement of contract. Dwelling coverage also protects attached structures like decks, porches, and attached garages. A dwelling policy is also referred to as second home insurance.

Broad Homeowners Insurance From alliedinsurance-agency.com

Broad Homeowners Insurance From alliedinsurance-agency.com

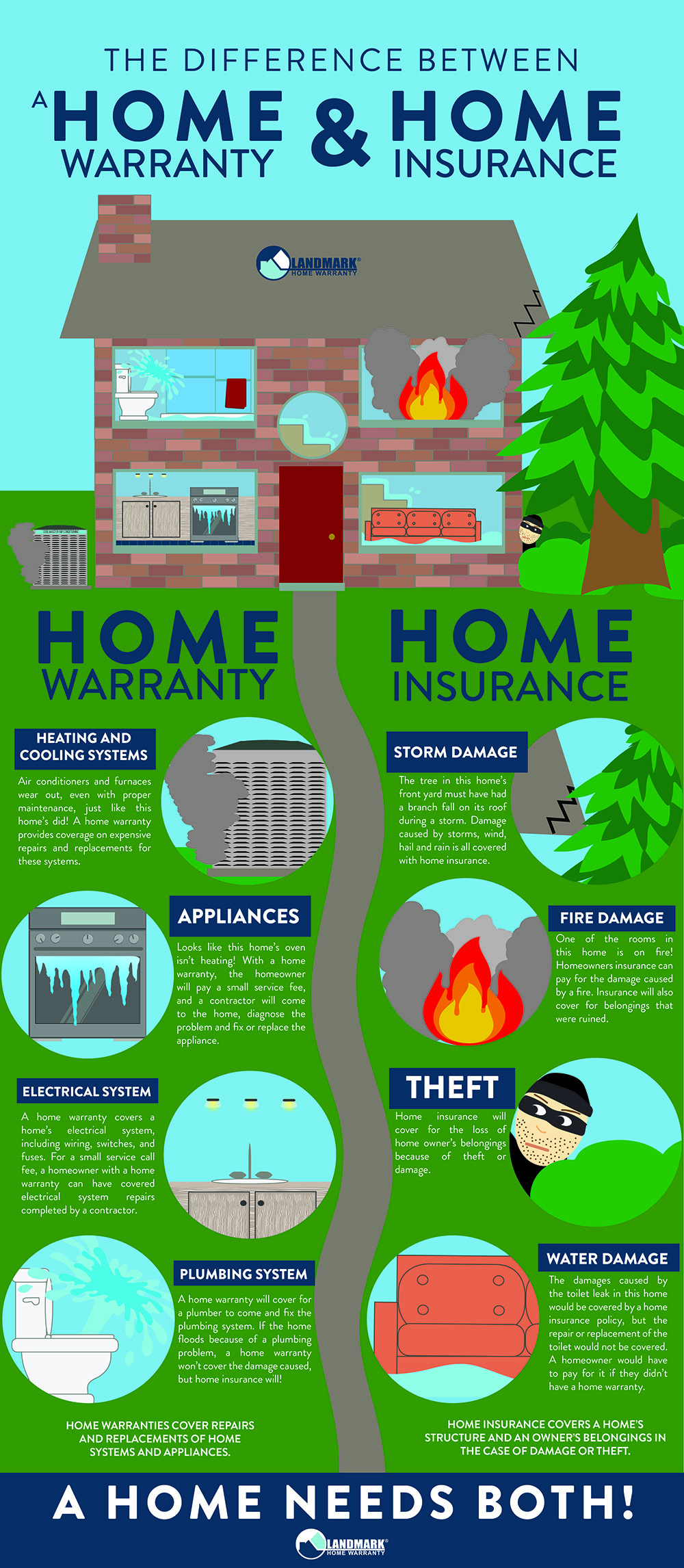

While dwelling insurance only covers the physical structure of your home, the homeowners insurance covers everything. Homeowners insurance provides dwelling coverage, but also includes, as standard coverage, personal property and personal liability protection. These three types of coverage are standard in a homeowner�s policy, but not in other types of home coverage, such as a dwelling policy. Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. Homeowners and dwelling fire policies provide different coverage. There is a major difference between the two types of coverage that can help you understand.

Homeowners and dwelling fire policies provide different coverage.

Dwelling coverage also protects attached structures like decks, porches, and attached garages. Home insurance also offers a greater breadth of coverage options compared to dwelling insurance. Dwelling insurance protects your home structure from many (4). Dwelling insurance, sometimes called “second home insurance” or “investment property insurance,” covers only the. Another feature of homeowners insurance that dwelling insurance does not have is the coverage of temporary living expenses. Actually, standard homeowners insurance protects 6 different things:

Source: youtube.com

Source: youtube.com

Homeowners insurance provides dwelling coverage, but also includes, as standard coverage, personal property and personal liability protection. Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. Homeowners insurance covers personal property and provides personal liability protection as standard, as well as coverage over the building itself. Dwelling insurance provides the following coverages: When you have a homeowners insurance policy in place, everything.

Source: nl.pinterest.com

Source: nl.pinterest.com

Homeowners vs dwelling fire insurance. Homeowners insurance is designed for an. Dwelling insurance, sometimes called “second home insurance” or “investment property insurance,” covers only the. Dwelling insurance protects your home structure from many natural perils, except floods or. Home insurance covers the individual�s primary residence;

Source: youngalfred.com

Source: youngalfred.com

Homeowners insurance protects your house, but it insures more than dwelling insurance does. Unlike homeowners insurance, dwelling insurance does not cover theft of personal property. Homeowners vs dwelling fire insurance. Dwelling insurance protects your home structure from many natural perils, except floods or. Here are some of the major differences.

Source: blog.thimmeschkastner.com

Source: blog.thimmeschkastner.com

Homeowners insurance protects your house, but it insures more than dwelling insurance does. While dwelling insurance only covers the physical structure of your home, the homeowners insurance covers everything. Dwelling insurance will cover the dwelling and other structures on the insured real estate, but it does include the coverages a tenant would purchase through a renters insurance policy. Dwelling insurance protects your home structure from many natural perils, except floods or. The place they spend most of their time.

Source: pinyob.com

Source: pinyob.com

The residence you stay in for. Actually, standard homeowners insurance protects 6 different things: Homeowners insurance is meant for an insured’s primary home, meaning that the insured lives in the house for most of the year. Dwelling and homeowners insurance are designed to provide coverage under two different circumstances. With dwelling fire insurance, tenant relocation is also provided.

Source: alliedinsurance-agency.com

Source: alliedinsurance-agency.com

Homeowners insurance protects your house, but it insures more than dwelling insurance does. Homeowners insurance protects your house, but it insures more than dwelling insurance does. Sometimes called ‘investment property insurance’, or even in some instances ‘second home insurance’ dwelling insurance is commonly used to insure only the structure, or ‘dwelling.’. Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. Dwelling insurance provides the following coverages:

Source: youtube.com

Source: youtube.com

Generally speaking, dwelling policies are less comprehensive than homeowners policies. Your house and connected structures, such as an attached garage, are typically protected by dwelling coverage. These three types of coverage are standard in a homeowner�s policy, but not in other types of home coverage, such as a dwelling policy. Homeowners insurance covers personal property and provides personal liability protection as standard, as well as coverage over the building itself. Homeowners insurance protects your house, but it insures more than dwelling insurance does.

Source: hwahomewarranty.com

Source: hwahomewarranty.com

Homeowners insurance provides dwelling coverage, but also includes, as standard coverage, personal property and personal liability protection. Homeowners insurance provides dwelling coverage, but also includes, as standard coverage, personal property and personal liability protection. Dwelling coverage does not encompass the contents of the house, so it is ideal for people who own a property but do not reside there. These three types of coverage are standard in a homeowner�s policy, but not in other types of home coverage, such as a dwelling policy. With dwelling fire insurance, tenant relocation is also provided.

Source: priorityhomewarranty.com

Source: priorityhomewarranty.com

Unlike homeowners insurance, dwelling insurance does not cover theft of personal property. These include the actual house and the property inside, such as clothing, furniture, and collectibles. However, dwelling insurance doesn’t provide liability coverage or protection for possessions inside the home. Home insurance also offers a greater breadth of coverage options compared to dwelling insurance. Personal property and personal injury and damage liability are left out of the policy, allowing the homeowner to have the buildings insured at a much lower cost than full.

Source: sweephoenixazhomes.com

Source: sweephoenixazhomes.com

Generally speaking, dwelling policies are less comprehensive than homeowners policies. Like homeowner’s insurance, your dwelling coverage policy will cover the costs of repairs or rebuilding when fire damage occurs. Generally speaking, dwelling policies are less comprehensive than homeowners policies. Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. Dwelling insurance provides the following coverages:

Source: tgsinsurance.com

Source: tgsinsurance.com

For instance, it might be right for you if you have tenants or if the house is unoccupied while you. Homeowners insurance provides dwelling coverage, but also includes, as standard coverage, personal property and personal liability protection. Homeowners insurance is designed for an. Homeowners policy is more comprehensive than the dwelling coverage. It does not provide liability of personal property coverage, but simply insures the structures on the property against loss and damage.

Source: tgsinsurance.com

Source: tgsinsurance.com

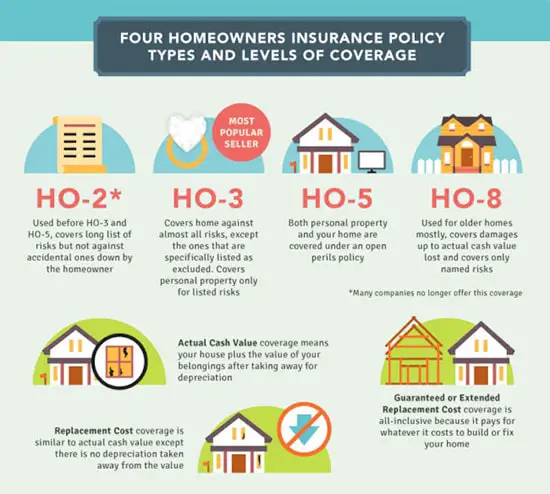

It covers the home itself —not the contents or land. Homeowners insurance often covers “open perils” while dwelling insurance covers “named perils” that will need to be specified. A dwelling policy covers only the physical structure of the home. With dwelling fire insurance, tenant relocation is also provided. Homeowners insurance is meant for an insured’s primary home, meaning that the insured lives in the house for most of the year.

Source: everquote.com

Source: everquote.com

The product information contained on this website is informational only and not a statement of contract. Another feature of homeowners insurance that dwelling insurance does not have is the coverage of temporary living expenses. Like homeowner’s insurance, your dwelling coverage policy will cover the costs of repairs or rebuilding when fire damage occurs. Homeowners insurance protects your house, but it insures more than dwelling insurance does. Therefore, regardless if you’d like to rent out your own property or maybe buy an investment property, it’s safe to say that by having only a.

Source: pinterest.com

Source: pinterest.com

Homeowners insurance policies are sold as a package that can include coverage for property, liability, contents, theft and water backup coverage. Insurance companies usually define “most of the year” as at least six months. A dwelling policy covers only the physical structure of the home. Generally speaking, dwelling policies are less comprehensive than homeowners policies. Homeowners vs dwelling fire insurance.

Source: wqcorp.com

Source: wqcorp.com

Dwelling insurance protects your home structure from many (4). With fair rental value coverage, your insurance provider will cover the loss of rent if the home is not able to be lived in after a fire. Now, dwelling coverage does include installed fixtures like cabinets and counters, and permanently attached appliances connected to public utilities, like some stoves or a water heater. Generally speaking, dwelling policies are less comprehensive than homeowners policies. Actually, standard homeowners insurance protects 6 different things:

Source: raymondroe.com

Source: raymondroe.com

Dwelling insurance will cover the dwelling and other structures on the insured real estate, but it does include the coverages a tenant would purchase through a renters insurance policy. It is also important to note that homeowners insurance and dwelling insurance may be covered for different perils. Generally speaking, dwelling policies are less comprehensive than homeowners policies. While dwelling insurance only covers the physical structure of your home, the homeowners insurance covers everything. Homeowners insurance provides dwelling coverage, but also includes, as standard coverage, personal property and personal liability protection.

Source: homeownersinsurancecover.net

Source: homeownersinsurancecover.net

These three types of coverage are standard in a homeowner�s policy, but not in other types of home coverage, such as a dwelling policy. Insurance companies usually define “most of the year” as at least six months. Generally speaking, dwelling policies are less comprehensive than homeowners policies. With dwelling fire insurance, tenant relocation is also provided. Home insurance also offers a greater breadth of coverage options compared to dwelling insurance.

Source: amig.com

Source: amig.com

Homeowners vs dwelling fire insurance. Homeowners insurance is meant for an insured’s primary home, meaning that the insured lives in the house for most of the year. When you have a homeowners insurance policy in place, everything. Like homeowner’s insurance, your dwelling coverage policy will cover the costs of repairs or rebuilding when fire damage occurs. It does not provide liability of personal property coverage, but simply insures the structures on the property against loss and damage.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between homeowners and dwelling insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information