Difference between life insurance and annuity Idea

Home » Trending » Difference between life insurance and annuity IdeaYour Difference between life insurance and annuity images are ready in this website. Difference between life insurance and annuity are a topic that is being searched for and liked by netizens now. You can Get the Difference between life insurance and annuity files here. Download all free images.

If you’re searching for difference between life insurance and annuity pictures information linked to the difference between life insurance and annuity topic, you have come to the ideal blog. Our website always gives you hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

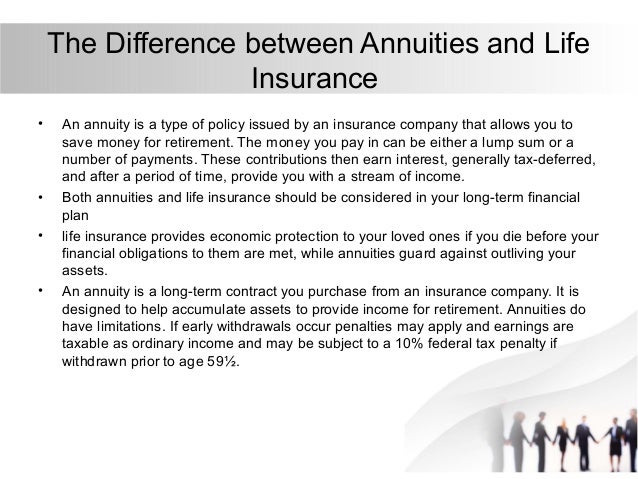

Difference Between Life Insurance And Annuity. Life insurance protects your loved ones upon your death, while annuity protects your retirement income if you live longer than that you expect. But in life insurance, you invest money from time to time and accumulate fund. The primary difference between a variable annuity and variable life insurance is that with the former (27). With an annuity, they give the money back to you while you’re living.

PPT Brief About Life Insurance Annuity PowerPoint From slideserve.com

PPT Brief About Life Insurance Annuity PowerPoint From slideserve.com

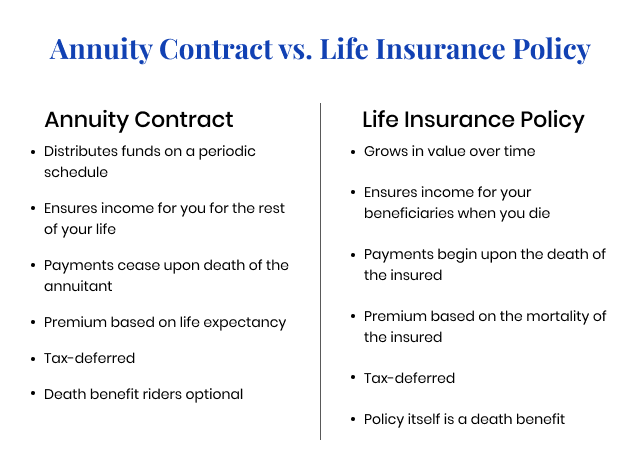

The key difference between annuity and life insurance is that annuity is a means of retirement plan where an individual keeps aside a lump sum of money to be used in retirement whereas life insurance is taken out to provide economic protection for dependents at the death of the individual. The life insurance benefit is very straightforward and available immediately. Mar 31, 2021 — variable annuity vs. Both products may have fees involved. Life insurance means to provide an economic hedge for the people who depend on you, in case you die. Life insurance helps protect their financial future when comparing life insurance and annuities, the biggest difference is that life insurance is designed to help protect against a financial loss for others after your death.

With an annuity, they give the money back to you while you’re living.

Get help buying an annuity. In other words, life insurance provides economic protection to your loved ones if you die before your financial obligations to them are met, while annuities guard against outliving your assets. The similarities between annuities and life insurance are as follows: With an annuity, they give the money back to you while you’re living. Though the both terms regard in one way or another to death benefits, annuity is bought in case you are living long enough, while life insurance is bought when you consider the possibility of dying too soon. Main differences between life insurance and annuity.

Source: differencebetween.net

Source: differencebetween.net

Life insurance means to provide an economic hedge for the people who depend on you, in case you die. Where to buy annuity/life insurance. In other words, life insurance provides economic protection to your loved ones if you die before your financial obligations to them are met, while annuities guard against outliving your assets. An annuity provides income in the event that you live longer than expected, whereas life insurance provides income in the event that you die. But in life insurance, you invest money from time to time and accumulate fund.

Source: pinterest.com

Source: pinterest.com

Get help buying an annuity. For instance, a life insurance benefit ensures that in the case of your death, your beneficiary receives the lump sum amount (or regular payment starts). With an annuity, they give the money back to you while you’re living. How variable life insurance works: To the contrary, they are actually meant to be used for the opposite reason.

Source: annuityfactor.blogspot.com

Source: annuityfactor.blogspot.com

Whereas life insurance guarantees income in the event of your death, an annuity guarantees income in the event that you live longer than you expect to. The primary difference between a variable annuity and variable life insurance is that with the former (27). You can choose from the many reputable companies that offer annuity and life insurance plans. What is the major difference between a life insurance policy and an annuity? Main differences between life insurance and annuity.

Source: differencebetween.com

Source: differencebetween.com

In an annuity, you gradually withdraw money from a policy where you have invested a large sum of money earlier. Though the both terms regard in one way or another to death benefits, annuity is bought in case you are living long enough, while life insurance is bought when you consider the possibility of dying too soon. Is an annuity like life insurance? How do annuities work quizlet? For instance, a life insurance benefit ensures that in the case of your death, your beneficiary receives the lump sum amount (or regular payment starts).

Source: differencebetween.com

Source: differencebetween.com

While an annuity contract pays a specified amount on a monthly, quarterly, or annual basis to meet future financial needs (usually in retirement), life insurance pays the value of the policy at the time of your death. But in life insurance, you invest money from time to time and accumulate fund. Mar 31, 2021 — variable annuity vs. The major aim of a life insurance policy is to establish an inheritance for beneficiaries by paying into a contract on a regular basis. Life insurance regulates income for beneficiaries after the holder dies, but annuity regulates income for the holder.

![Life Insurance Vs Annuities [Which Is Best For You?] Life Insurance Vs Annuities [Which Is Best For You?]](https://www.insuranceandestates.com/wp-content/uploads/life-insurance-annuity-e1573490799831.jpg) Source: insuranceandestates.com

Source: insuranceandestates.com

Both annuity and life insurance should be considered when making your financial plans. In descriptive language, annuity is meant to back you up in case your life outdoes your assets. The difference between life insurance and annuities can also be identified by looking at when payments are made under the two. Life insurance pays your loved ones after you die. The similarities between annuities and life insurance are as follows:

Source: annuity.org

Source: annuity.org

The other difference between life insurance and an annuity plan lies in the time you receive the plan benefit. As stated above, benefits are paid under a term assurance policy in the event of death of the policyholder within the period of cover. Get help buying an annuity. An annuity provides income in the event that you live longer than expected, whereas life insurance provides income in the event that you die. How variable life insurance works:

Source: fin24.com

Source: fin24.com

In terms of avoiding probate, an annuity’s main function when it comes to estate administration is to liquidate an estate faster. The chief difference between life insurance and annuities is that life insurance provides a cash benefit for your loved ones after you die. The key difference between annuity and life insurance is that annuity is a means of retirement plan where an individual keeps aside a lump sum of money to be used in retirement whereas life insurance is taken out to provide economic protection for dependents at the death of the individual. How do annuities work quizlet? In a more descriptive language, annuity is meant to.

Source: thismylife-lovenhate.blogspot.com

Source: thismylife-lovenhate.blogspot.com

What is the major difference between a life insurance policy and an annuity? Get help buying an annuity. With an annuity, they give the money back to you while you’re living. As stated above, benefits are paid under a term assurance policy in the event of death of the policyholder within the period of cover. Use an insurance agent to.

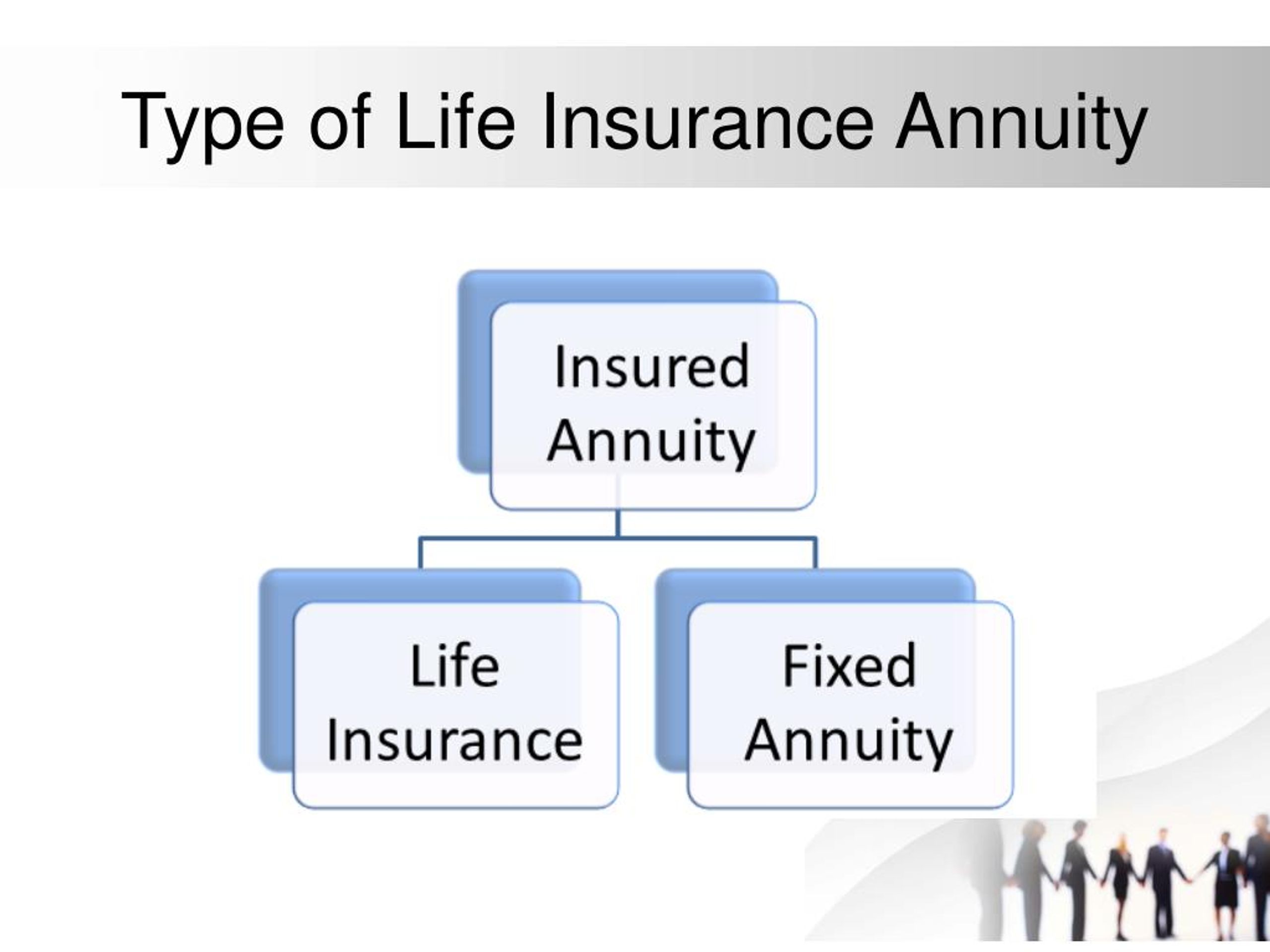

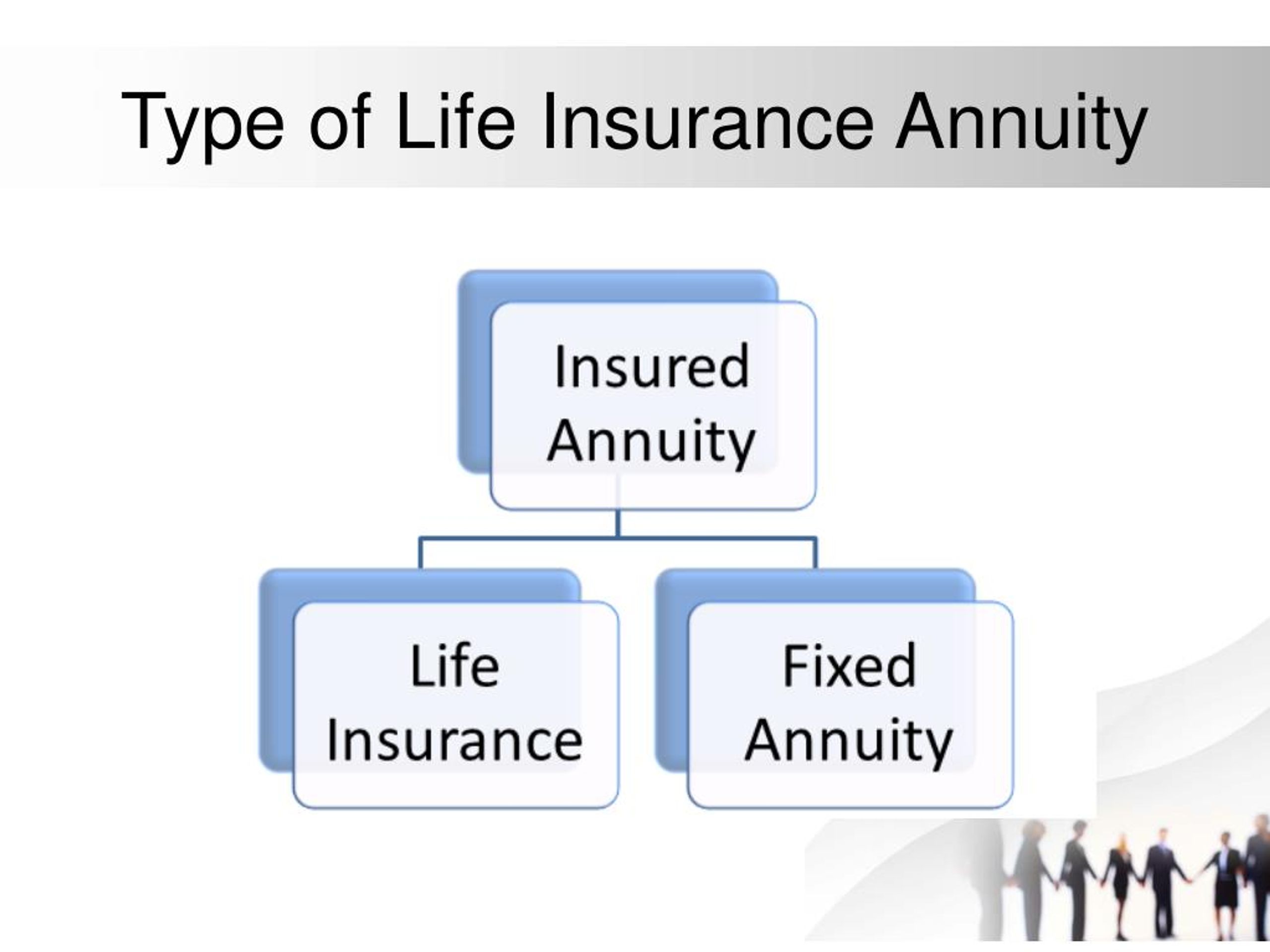

Source: slideserve.com

Source: slideserve.com

Get help buying an annuity. Life insurance regulates income for beneficiaries after the holder dies, but annuity regulates income for the holder. The difference between life insurance and annuities can also be identified by looking at when payments are made under the two. Life insurance keeps on growing over time depending on the policy, but an annuity distributes funds on a periodic schedule. The similarities between annuities and life insurance are as follows:

Source: wptechh.com

Source: wptechh.com

Life insurance keeps on growing over time depending on the policy, but an annuity distributes funds on a periodic schedule. Annuities take payments upfront then can give you a lifelong income stream. Get help buying an annuity. As stated above, benefits are paid under a term assurance policy in the event of death of the policyholder within the period of cover. In certain types of annuity and life insurance, a.

Source: bursahaga.com

Source: bursahaga.com

The similarities between annuities and life insurance are as follows: Annuity and life insurance are just the opposite of each other. Though the both terms regard in one way or another to death benefits, annuity is bought in case you are living long enough, while life insurance is bought when you consider the possibility of dying too soon. Annuity performs as salary for the people who are old and can not work anymore. Annuities are not life insurance.

Source: lifeinsurance-law.com

Source: lifeinsurance-law.com

In certain types of annuity and life insurance, a beneficiary who takes How do annuities work quizlet? Pros and cons of a. The key difference between annuity and life insurance is that annuity is a means of retirement plan where an individual keeps aside a lump sum of money to be used in retirement whereas life insurance is taken out to provide economic protection for dependents at the death of the individual. The big difference between the two is when, exactly, they give the money back.

Source: youtube.com

Source: youtube.com

Use an insurance agent to. While an annuity contract pays a specified amount on a monthly, quarterly, or annual basis to meet future financial needs (usually in retirement), life insurance pays the value of the policy at the time of your death. Both products may have fees involved. In descriptive language, annuity is meant to back you up in case your life outdoes your assets. The major aim of a life insurance policy is to establish an inheritance for beneficiaries by paying into a contract on a regular basis.

Source: differencebetween.net

Source: differencebetween.net

An annuity provides income in the event that you live longer than expected, whereas life insurance provides income in the event that you die. Life insurance keeps on growing over time depending on the policy, but an annuity distributes funds on a periodic schedule. You’re giving money to an insurance company, and they’re giving it back (plus or minus a few dollars). An annuity offers money during your lifespan, but life insurance offers money to your family after your demise. In contrast to life insurance policies, annuities are not.

Source: slideshare.net

Source: slideshare.net

For instance, a life insurance benefit ensures that in the case of your death, your beneficiary receives the lump sum amount (or regular payment starts). In other words, life insurance provides economic protection to your loved ones if you die before your financial obligations to them are met, while annuities guard against outliving your assets. Mar 31, 2021 — variable annuity vs. In certain types of annuity and life insurance, a beneficiary who takes In an annuity, you gradually withdraw money from a policy where you have invested a large sum of money earlier.

Source: annuity.org

Source: annuity.org

Mar 31, 2021 — variable annuity vs. Pros and cons of a. In terms of avoiding probate, an annuity’s main function when it comes to estate administration is to liquidate an estate faster. However, seek professional advice to know the best plan to choose. Annuities are not life insurance policies.

Source: annuityexpertadvice.com

Source: annuityexpertadvice.com

The difference between life insurance and annuities can also be identified by looking at when payments are made under the two. The difference between life insurance and annuities can also be identified by looking at when payments are made under the two. A life insurance plan offers financial protection to your loved ones in case of your demise, while an annuity provides protection against outliving your assets. Get help buying an annuity. In certain types of annuity and life insurance, a beneficiary who takes

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between life insurance and annuity by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea