Difference between life insurance and burial insurance Idea

Home » Trending » Difference between life insurance and burial insurance IdeaYour Difference between life insurance and burial insurance images are available. Difference between life insurance and burial insurance are a topic that is being searched for and liked by netizens now. You can Get the Difference between life insurance and burial insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for difference between life insurance and burial insurance pictures information related to the difference between life insurance and burial insurance topic, you have visit the right blog. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

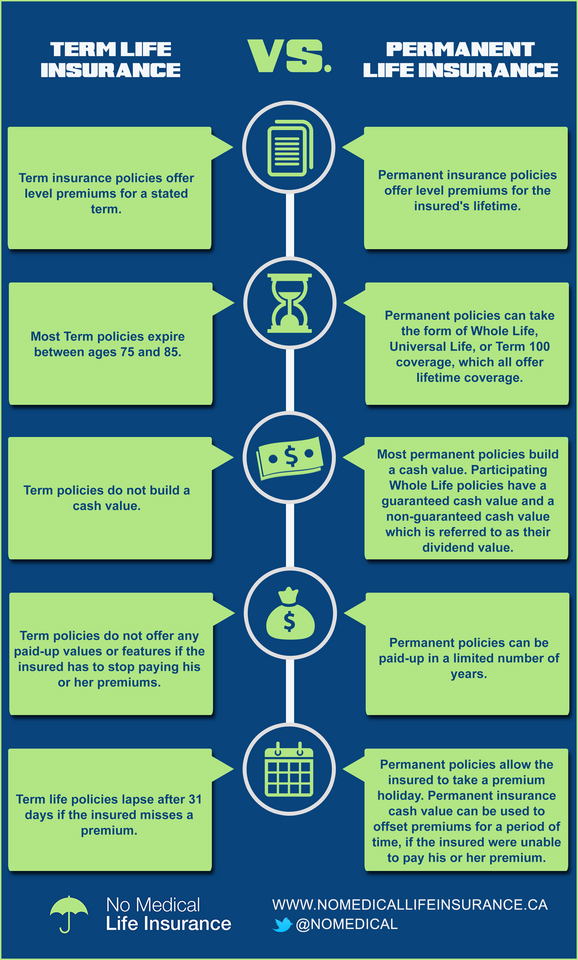

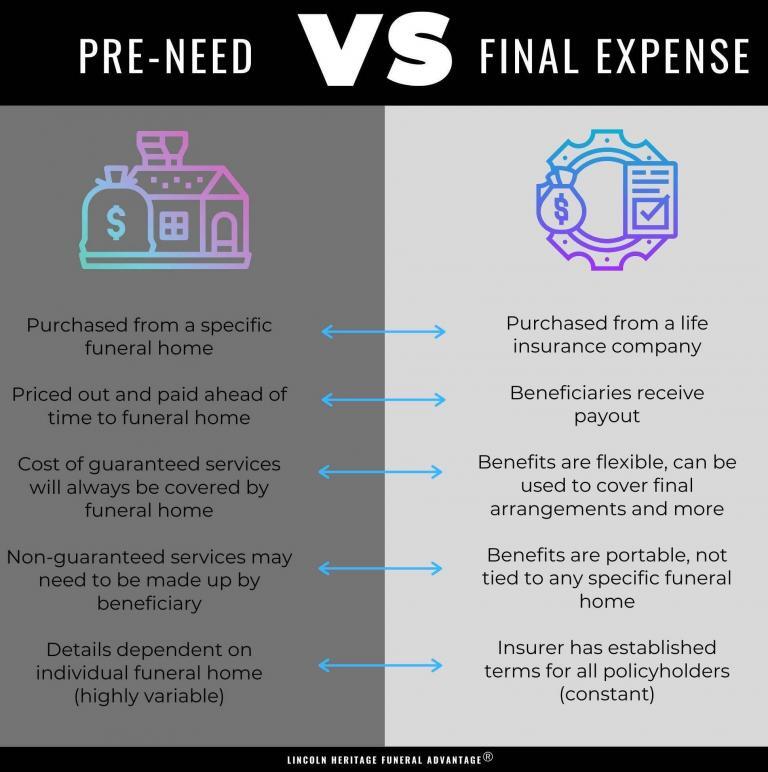

Difference Between Life Insurance And Burial Insurance. There is really no difference between funeral insurance and burial insurance, as they are both commonly used terms which mean a small value, whole life insurance policy.they are designed to simply pay for the funeral expenses and alleviate any. As its nickname implies, people buy this type of policy to provide money for funeral and burial costs for themselves and/or family members. Guaranteed life insurance or simplified life insurance. You can receive coverage with a final expense policy in one of two ways:

4 Things You Should Know About Funeral Insurance From funeral.com

4 Things You Should Know About Funeral Insurance From funeral.com

As its nickname implies, people buy this type of policy to provide money for funeral and burial costs for themselves and/or family members. There is really no difference between funeral insurance and burial insurance, as they are both commonly used terms which mean a small value, whole life insurance policy.they are designed to simply pay for the funeral expenses and alleviate any. The process to get each type of insurance is also different. Do i need burial insurance? Once you qualify, most insurance companies can issue your policy in just a few days. The term “life insurance” is a very broad category, and it caters to different subcategories such as term life insurance, annuity insurance, burial insurance, whole life insurance, etc.

Burial insurance has a more extended waiting period, and this means that its value increases before payout.

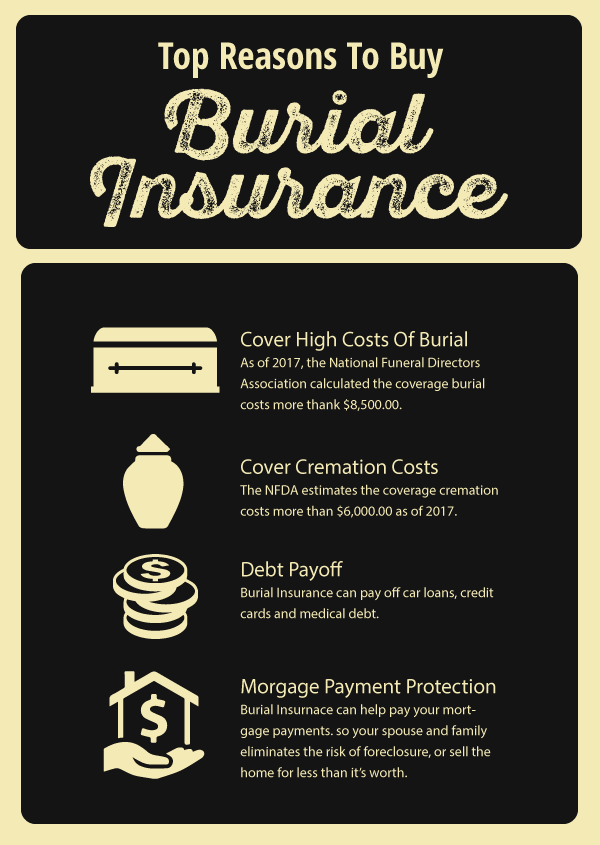

The process to get each type of insurance is also different. Burial insurance has a lower face value than most life insurance because it’s designed to pay only for your final expenses. While life insurance is designed to replace income, burial insurance is protection against leaving the burden of funeral costs behind. Burial insurance usually does not require a medical exam, unlike other life insurance policies. Burial insurance is a low coverage option. Burial insurance (also known as funeral insurance) is promoted as a way to pay in advance for your funeral expenses.

Source: insurance-companies.co

Source: insurance-companies.co

Burial insurance is also referred to as funeral insurance or final expense insurance by some insurance companies. As an example, there is a form of whole life insurance called burial insurance that is also known as “final expense insurance” and “funeral insurance” with respect to the insurer. Once you qualify, most insurance companies can issue your policy in just a few days. There is really no difference between funeral insurance and burial insurance, as they are both commonly used terms which mean a small value, whole life insurance policy.they are designed to simply pay for the funeral expenses and alleviate any. Most people have heard of life insurance, but what about burial insurance?

Source: funeral.com

Source: funeral.com

You can receive coverage with a final expense policy in one of two ways: Burial insurance (aka funeral insurance) is a basic issue life insurance policy that covers people until they reach 100 years old. In addition, both cover the same risk. You can receive coverage with a final expense policy in one of two ways: It is a permanent policy that does not expire.

Source: zimnat.co.zw

Source: zimnat.co.zw

It’s a permanent situation that requires a permanent solution—one that will last your whole life, whether that be long or short. That is, the loss of life, and they do so with an economic benefit, although not in the same way. Every category offers specific distinctive features. It exists to cover expenses at the end of life. Buying a policy for final expense or burial insurance purposes is different because facing death is not a temporary problem that will be resolved within a predetermined number of years.

Source: youtube.com

Source: youtube.com

Also known as burial insurance and permanent life insurance final expense insurance is a type of life insurance policy designed to cover funeral and final expenses. Do i need burial insurance? In addition, both cover the same risk. While life insurance is designed to replace income, burial insurance is protection against leaving the burden of funeral costs behind. As an example, there is a form of whole life insurance called burial insurance that is also known as “final expense insurance” and “funeral insurance” with respect to the insurer.

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

There is no big difference between these ñ whatever the name. First, final expense life insurance offers less coverage than traditional life insurance. Also known as burial insurance and permanent life insurance final expense insurance is a type of life insurance policy designed to cover funeral and final expenses. To qualify for life insurance, you may have to take a medical exam, and your blood and urine analysis results will determine what rate you qualify for. Burial insurance policies generally pay out $5,000 to $50,000.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Final expense insurance can be obtained for an affordable monthly payment with permanent benefits, while life insurance will come in larger coverage amounts and differ in policy structure. Burial insurance is also referred to as funeral insurance or final expense insurance by some insurance companies. Final expense insurance can be obtained for an affordable monthly payment with permanent benefits, while life insurance will come in larger coverage amounts and differ in policy structure. You can receive coverage with a final expense policy in one of two ways: Difference between life insurance and burial insurance.

Source: pinterest.com

Source: pinterest.com

Burial insurance is slightly different than life insurance as its primary purpose is to help your loved ones cover funeral expenses when the time comes. Guaranteed life insurance or simplified life insurance. In addition, both cover the same risk. There is really no difference between funeral insurance and burial insurance, as they are both commonly used terms which mean a small value, whole life insurance policy.they are designed to simply pay for the funeral expenses and alleviate any. One significant distinction between burial insurance and life insurance is that the former does not need a medical examination.

Source: visual.ly

Source: visual.ly

Simply put, burial insurance is a type of life insurance. It is a permanent policy that does not expire. Burial insurance has a more extended waiting period, and this means that its value increases before payout. Life insurance and burial insurance may seem the same at first, but they are distinctly different from each other. Burial insurance policies generally pay out $5,000 to $50,000.

Source: nomedicallifeinsurance.ca

Source: nomedicallifeinsurance.ca

But do not be misled: As an example, there is a form of whole life insurance called burial insurance that is also known as “final expense insurance” and “funeral insurance” with respect to the insurer. Burial insurance is slightly different than life insurance as its primary purpose is to help your loved ones cover funeral expenses when the time comes. Simply put, burial insurance is a type of life insurance. One key difference between burial insurance and life insurance is that a burial insurance policy does not require a medical exam.

Source: pinterest.com

Source: pinterest.com

Do i need burial insurance? Burial insurance is a low coverage option. Guaranteed life insurance or simplified life insurance. As its nickname implies, people buy this type of policy to provide money for funeral and burial costs for themselves and/or family members. Burial insurance is slightly different than life insurance as its primary purpose is to help your loved ones cover funeral expenses when the time comes.

Source: policyarchitects.com

Source: policyarchitects.com

Buying a policy for final expense or burial insurance purposes is different because facing death is not a temporary problem that will be resolved within a predetermined number of years. Burial insurance has a lower face value than most life insurance because it’s designed to pay only for your final expenses. In addition, both cover the same risk. You could take out a small life insurance policy, but most recent statistics show the average life insurance policy value is around $160,000. There is really no difference between funeral insurance and burial insurance, as they are both commonly used terms which mean a small value, whole life insurance policy.they are designed to simply pay for the funeral expenses and alleviate any.

Source: myfinancemd.com

Source: myfinancemd.com

Because of this, burial insurance will often also be referred to as final expense insurance and / or as funeral insurance coverage. Most people have heard of life insurance, but what about burial insurance? Burial insurance has a lower face value than most life insurance because it’s designed to pay only for your final expenses. Burial insurance (also known as funeral insurance) is promoted as a way to pay in advance for your funeral expenses. Because of this, life insurance policies can have coverages up to millions of dollars.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Life insurance and burial insurance may seem the same at first, but they are distinctly different from each other. Burial insurance is also referred to as funeral insurance or final expense insurance by some insurance companies. One significant distinction between burial insurance and life insurance is that the former does not need a medical examination. It exists to cover expenses at the end of life. Burial insurance (aka funeral insurance) is a basic issue life insurance policy that covers people until they reach 100 years old.

Source: oiclife.com

Source: oiclife.com

Your beneficiary will be refunded all premiums paid for life or burial insurance in case you die before the waiting period elapses. As an example, there is a form of whole life insurance called burial insurance that is also known as “final expense insurance” and “funeral insurance” with respect to the insurer. While life insurance is designed to replace income, burial insurance is protection against leaving the burden of funeral costs behind. Most people have heard of life insurance, but what about burial insurance? Burial insurance is also referred to as funeral insurance or final expense insurance by some insurance companies.

![Best Burial Insurance Companies [Top Plans for 2017] Best Burial Insurance Companies [Top Plans for 2017]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2016/08/best-Burial-Insurance-Companies-e1486710162471.png) Source: choicemutual.com

Source: choicemutual.com

Burial insurance is slightly different than life insurance as its primary purpose is to help your loved ones cover funeral expenses when the time comes. Burial insurance (also known as funeral insurance) is promoted as a way to pay in advance for your funeral expenses. As an example, there is a form of whole life insurance called burial insurance that is also known as “final expense insurance” and “funeral insurance” with respect to the insurer. To qualify for life insurance, you may have to take a medical exam, and your blood and urine analysis results will determine what rate you qualify for. Guaranteed life insurance or simplified life insurance.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Once you qualify, most insurance companies can issue your policy in just a few days. Most insurance providers can offer your coverage in as little as a few days if you qualify. Burial insurance (also known as funeral insurance) is promoted as a way to pay in advance for your funeral expenses. One significant distinction between burial insurance and life insurance is that the former does not need a medical examination. Burial insurance has a lower face value than most life insurance because it’s designed to pay only for your final expenses.

Source: lhlic.com

Source: lhlic.com

Most final expense insurance policies have a death benefit capped at $30,000. Burial insurance has a lower face value than most life insurance because it’s designed to pay only for your final expenses. Burial insurance has a specific. Burial insurance is also referred to as funeral insurance or final expense insurance by some insurance companies. One significant distinction between burial insurance and life insurance is that the former does not need a medical examination.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between life insurance and burial insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea