Difference between life insurance and mutual fund information

Home » Trend » Difference between life insurance and mutual fund informationYour Difference between life insurance and mutual fund images are available. Difference between life insurance and mutual fund are a topic that is being searched for and liked by netizens today. You can Download the Difference between life insurance and mutual fund files here. Get all royalty-free photos.

If you’re searching for difference between life insurance and mutual fund images information linked to the difference between life insurance and mutual fund keyword, you have visit the ideal blog. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Difference Between Life Insurance And Mutual Fund. No interest rate is paid. While life insurance covers the life of a person, general insurance provides cover to other aspects and assets in a person’s life, for example, health, car, travel, home, etc. In ulip, a part of the premium is deducted as mortality charges for providing life cover. On the other hand, a mutual fund is a pure investment plan.

![ULIP vs Mutual Fund Where to Invest? [Step by Step] ULIP vs Mutual Fund Where to Invest? [Step by Step]](https://www.tomorrowmakers.com/sites/default/files/migration/destination_image/where-to-invest-mutual-funds-or-ulips.jpg) ULIP vs Mutual Fund Where to Invest? [Step by Step] From tomorrowmakers.com

ULIP vs Mutual Fund Where to Invest? [Step by Step] From tomorrowmakers.com

First of all, lic is a completely different avenue from sip and mutual fund investments. While both ulips and mutual funds have their respective pros and cons, they prove to be good investment avenues. Mutual funds, on the other hand, transfer their investments to. Because they do have a few similarities, however, they are different financial products. The key differences between ulip and mutual funds based on their features include: In ulip, a part of the premium is deducted as mortality charges for providing life cover.

Once you understand the basic differences between annuities and mutual funds, you are better prepared to plan for your retirement years.

The combined holdings of stocks, bonds or other assets the fund owns are known as its portfolio. First of all, lic is a completely different avenue from sip and mutual fund investments. In the event of a policyholder�s premature death, nominees are compensated for the sum assured. Assess ulips vs mutual funds based on these questions and then invest in either or both of the schemes as per your suitability. On the other hand, a mutual fund is a pure investment plan. While both ulips and mutual funds have their respective pros and cons, they prove to be good investment avenues.

Source: philpad.com

Source: philpad.com

If playback doesn�t begin shortly, try restarting your device. On the other hand, a mutual fund is a pure investment plan. In a nutshell, you could say that life insurance provides a death benefit, while mutual funds provide a living benefit for the shareholder. Once you understand the basic differences between annuities and mutual funds, you are better prepared to plan for your retirement years. Mutual funds are offered by investment management firms and are governed by securities legislation.

Source: aegonlife.com

Source: aegonlife.com

In the event of a policyholder�s premature death, nominees are compensated for the sum assured. Because they do have a few similarities, however, they are different financial products. While both ulips and mutual funds have their respective pros and cons, they prove to be good investment avenues. Potential protection from creditors asset protection through death benefit and maturity guarantees. Life insurance is a protection scheme that lets you secure the financial future of your family in your absence.

Source: youtube.com

Source: youtube.com

A mutual fund is a company that brings together money from many people and invests it in stocks, bonds or other assets. Ulip is a unique and strategic financial product, which is a combination of life insurance and investments. In a life insurance, you cannot withdraw your whole principal investment whenever an emergency need arises unlike in a mutual fund. While both ulips and mutual funds have their respective pros and cons, they prove to be good investment avenues. Life insurance is a protection scheme that lets you secure the financial future of your family in your absence.

Source: youtube.com

Source: youtube.com

A ulip or unit linked insurance plan provides insurance as well as investment components to all their customers. But in reality, based on investment objectives, mutual funds also invests in equity, debt, money market, hybrid and also in a commodity like gold. The combined holdings of stocks, bonds or other assets the fund owns are known as its portfolio. First of all, lic is a completely different avenue from sip and mutual fund investments. No interest rate is paid.

Source: financialexpress.com

Source: financialexpress.com

No interest rate is paid. The value of income funds can increase, but growth for this type of mutual fund is conservative and most suitable for retirees and people with low risk tolerance. Ulip is a unique and strategic financial product, which is a combination of life insurance and investments. A mutual fund is a fund where investment is made in order to get returns from the market. Assess ulips vs mutual funds based on these questions and then invest in either or both of the schemes as per your suitability.

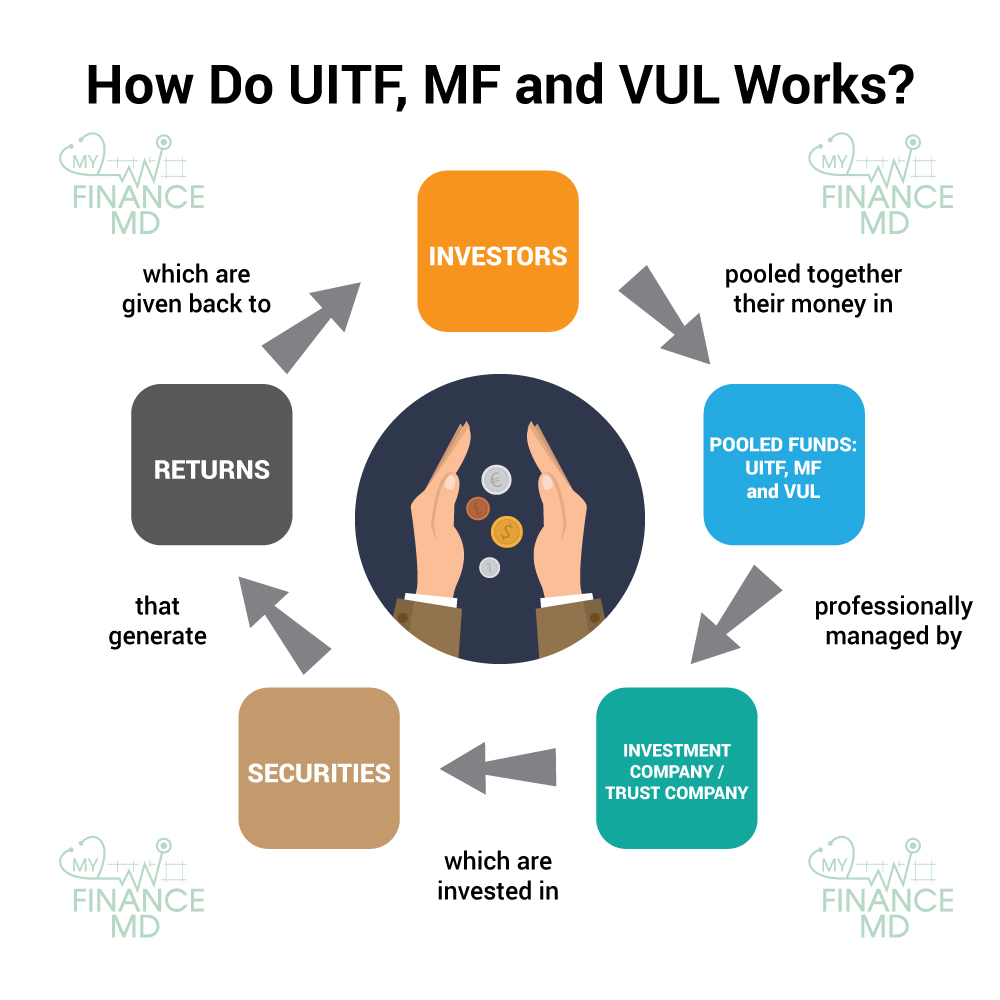

Source: myfinancemd.com

Source: myfinancemd.com

The key differences between ulip and mutual funds based on their features include: Like stock companies, mutual companies have to abide by state insurance regulations and are covered by state guaranty funds in the event of insolvency. Insurance is the investment of a portion of your income for a period of time. Assess ulips vs mutual funds based on these questions and then invest in either or both of the schemes as per your suitability. A mutual fund is an investment tool that helps you enhance your wealth through market.

Source: austininsuranceservices.com

Source: austininsuranceservices.com

Do not be confused with mutual funds and ulips. While life insurance covers the life of a person, general insurance provides cover to other aspects and assets in a person’s life, for example, health, car, travel, home, etc. A ulip or unit linked insurance plan provides insurance as well as investment components to all their customers. Mutual funds are offered by investment management firms and are governed by securities legislation. If any accidents occur that amount goes to your family.

Source: bemoneyaware.com

Source: bemoneyaware.com

Ulip is a unique and strategic financial product, which is a combination of life insurance and investments. In the event of a policyholder�s premature death, nominees are compensated for the sum assured. Each investor in the fund owns shares, which represent a part of these holdings. It is a pure investment plan with no insurance benefit. Insurance is the investment of a portion of your income for a period of time.

Source: personalfinanceplan.in

Source: personalfinanceplan.in

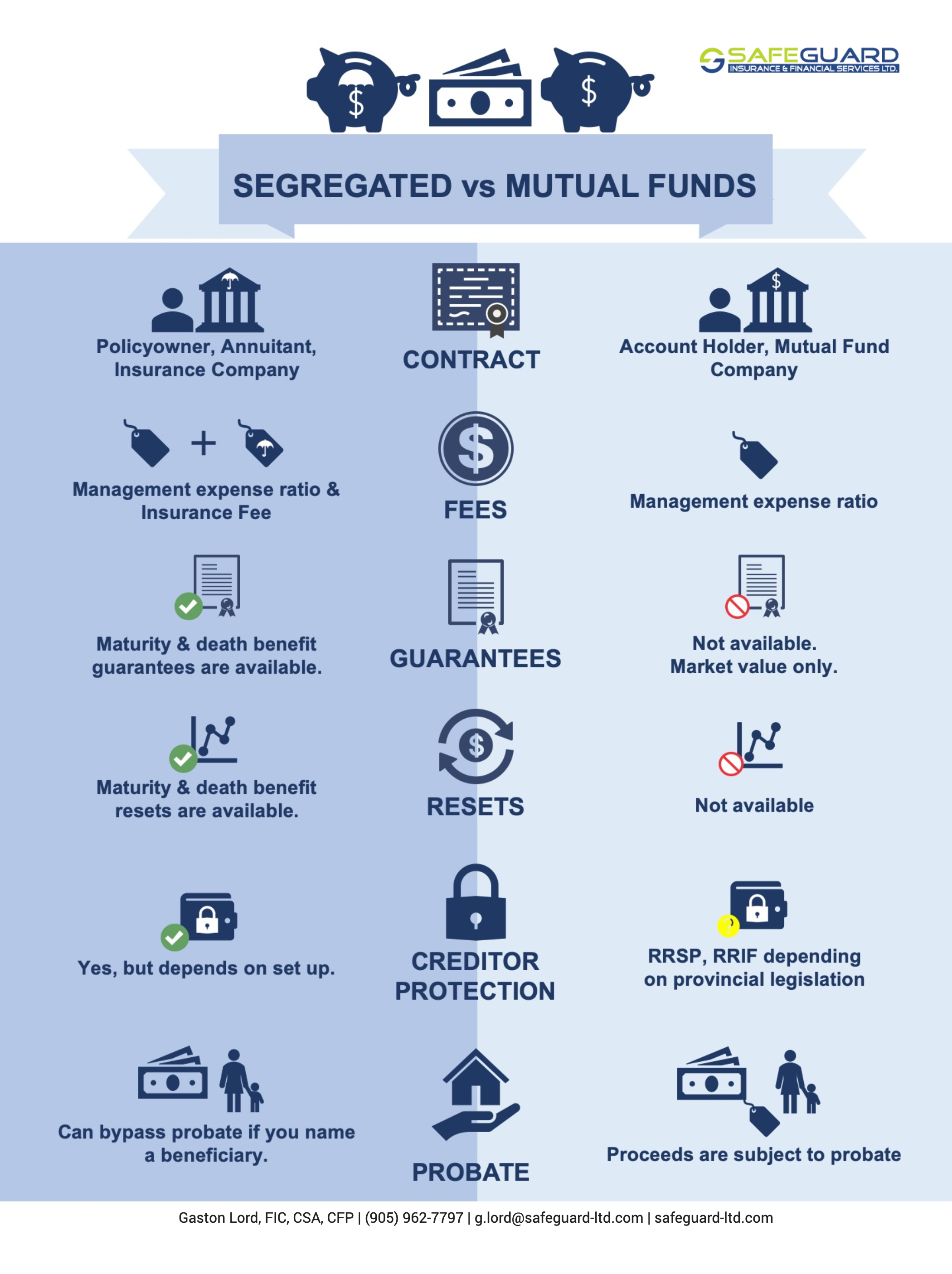

Combining the two a type of life insurance known as variable life insurance combines the protection element of insurance with the investment component of mutual funds. It is a pure investment plan with no insurance benefit. In a life insurance, you cannot withdraw your whole principal investment whenever an emergency need arises unlike in a mutual fund. A systematic way to invest in both: Key differences at a glance segregated fund contracts are offered by insurance companies and are governed by life insurance legislation.

Source: specialtywealth.com

Source: specialtywealth.com

The key differences between ulip and mutual funds based on their features include: Ulip plan s are sophisticated financial instruments that offer a mix of insurance and investment. But in reality, based on investment objectives, mutual funds also invests in equity, debt, money market, hybrid and also in a commodity like gold. In a life insurance, you cannot withdraw your whole principal investment whenever an emergency need arises unlike in a mutual fund. While both ulips and mutual funds have their respective pros and cons, they prove to be good investment avenues.

Source: myfinancemd.com

Source: myfinancemd.com

Insurance is the investment of a portion of your income for a period of time. Like stock companies, mutual companies have to abide by state insurance regulations and are covered by state guaranty funds in the event of insolvency. Lic is, basically, investing in life insurance policies. Each investor in the fund owns shares, which represent a part of these holdings. Key differences at a glance segregated fund contracts are offered by insurance companies and are governed by life insurance legislation.

![ULIP vs Mutual Fund Where to Invest? [Step by Step] ULIP vs Mutual Fund Where to Invest? [Step by Step]](https://www.tomorrowmakers.com/sites/default/files/migration/destination_image/where-to-invest-mutual-funds-or-ulips.jpg) Source: tomorrowmakers.com

Source: tomorrowmakers.com

Each investor in the fund owns shares, which represent a part of these holdings. A mutual fund is a fund where investment is made in order to get returns from the market. But in reality, based on investment objectives, mutual funds also invests in equity, debt, money market, hybrid and also in a commodity like gold. First of all, lic is a completely different avenue from sip and mutual fund investments. The key differences between ulip and mutual funds based on their features include:

Source: youtube.com

Source: youtube.com

It is a pure investment plan with no insurance benefit. In the event of a policyholder�s premature death, nominees are compensated for the sum assured. The value of income funds can increase, but growth for this type of mutual fund is conservative and most suitable for retirees and people with low risk tolerance. There is no life cover or death benefit provided with mutual funds. Like stock companies, mutual companies have to abide by state insurance regulations and are covered by state guaranty funds in the event of insolvency.

Source: youtube.com

Source: youtube.com

Potential protection from creditors asset protection through death benefit and maturity guarantees. In relation to mutual funds, hdfc life just mentioned that mutual funds invest in various securities. Key differences at a glance segregated fund contracts are offered by insurance companies and are governed by life insurance legislation. A mutual fund is a fund where investment is made in order to get returns from the market. When it comes to life insurance, there can be no parallel investment avenue which gives the benefits provided by life insurance policies.

Source: in.pinterest.com

Source: in.pinterest.com

Some key distinctions between mutual funds and ulips are listed below: A mutual fund is an investment tool that helps you enhance your wealth through market. No interest rate is paid. If playback doesn�t begin shortly, try restarting your device. In a life insurance, you cannot withdraw your whole principal investment whenever an emergency need arises unlike in a mutual fund.

Source: safeguard-ltd.com

Source: safeguard-ltd.com

The key differences between ulip and mutual funds based on their features include: While life insurance covers the life of a person, general insurance provides cover to other aspects and assets in a person’s life, for example, health, car, travel, home, etc. In a life insurance, you cannot withdraw your whole principal investment whenever an emergency need arises unlike in a mutual fund. First of all, lic is a completely different avenue from sip and mutual fund investments. Assess ulips vs mutual funds based on these questions and then invest in either or both of the schemes as per your suitability.

Source: hdfcsales.com

Source: hdfcsales.com

In a life insurance, you cannot withdraw your whole principal investment whenever an emergency need arises unlike in a mutual fund. Assess ulips vs mutual funds based on these questions and then invest in either or both of the schemes as per your suitability. When it comes to life insurance, there can be no parallel investment avenue which gives the benefits provided by life insurance policies. A mutual fund is an investment tool that helps you enhance your wealth through market. Each investor in the fund owns shares, which represent a part of these holdings.

Source: skiran-financialadvisor.blogspot.com

Source: skiran-financialadvisor.blogspot.com

In the event of a policyholder�s premature death, nominees are compensated for the sum assured. A life insurance policy is a crucial component of a retirement plan for an individual because it covers the financial security of your dependents, parents, or. Key differences at a glance segregated fund contracts are offered by insurance companies and are governed by life insurance legislation. Lic is, basically, investing in life insurance policies. If playback doesn�t begin shortly, try restarting your device.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between life insurance and mutual fund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information