Difference between nsitf and group life insurance information

Home » Trending » Difference between nsitf and group life insurance informationYour Difference between nsitf and group life insurance images are available in this site. Difference between nsitf and group life insurance are a topic that is being searched for and liked by netizens now. You can Get the Difference between nsitf and group life insurance files here. Download all royalty-free photos.

If you’re looking for difference between nsitf and group life insurance images information connected with to the difference between nsitf and group life insurance keyword, you have visit the right blog. Our website always provides you with hints for refferencing the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

Difference Between Nsitf And Group Life Insurance. Comparison of group life insurance and individual life insurance; As there is no maturity benefit offered by the policy the premium rate of the term plan is lower The way term life insurance works is that you pay a set monthly premium (like $30.00 per month), for a specific amount of coverage (like $100,000), for a set period or term length (like 20 years). Other types of life insurance plans, however, also have a maturity benefit.

Don�t Rely on Group Insurance Get an Individual Life From olympiabenefits.com

Don�t Rely on Group Insurance Get an Individual Life From olympiabenefits.com

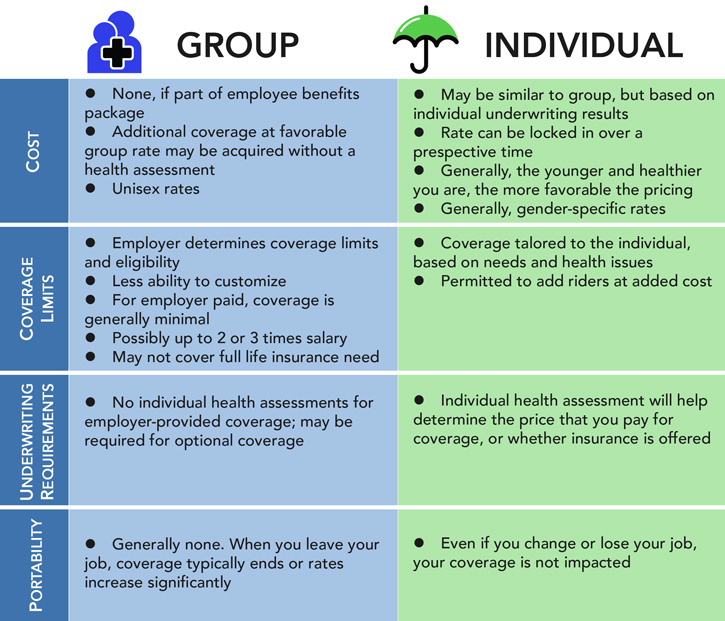

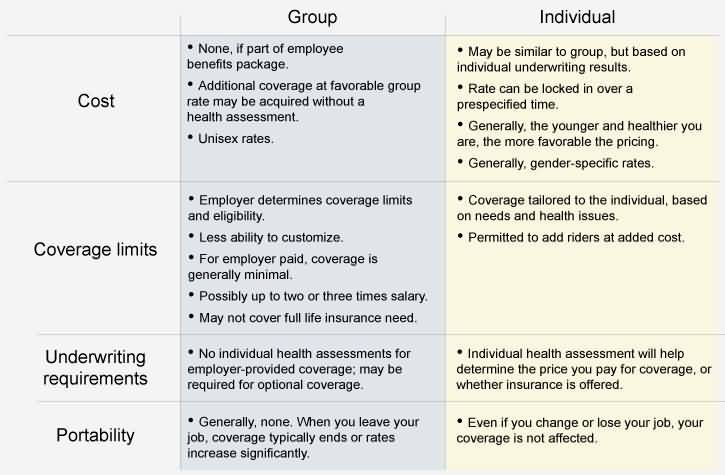

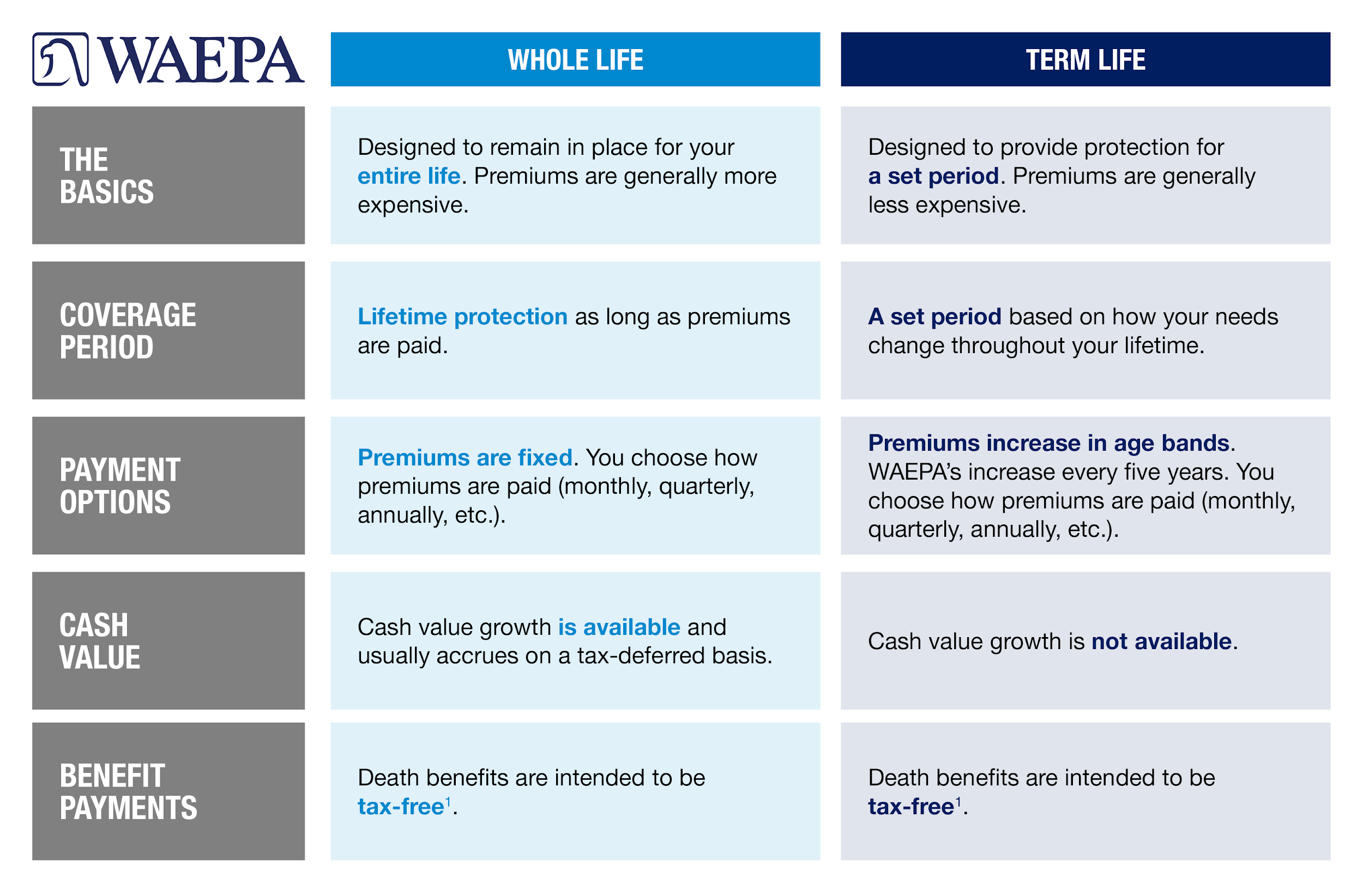

Individual life insurance is a product that you buy and own yourself that is separate from anything that has to do with your work. 1 x salary, 2 x salary, etc. The key difference is that life insurance is designed to cover the policyholder for a specific term, while life assurance. The main difference between term and whole life insurance is the cost. Life insurance is meant to cover most causes of death, provided the policy has (typically) gone through an underwriting process and been approved, and the policyholder has paid all their premiums to date. Comparison of group life insurance and individual life insurance;

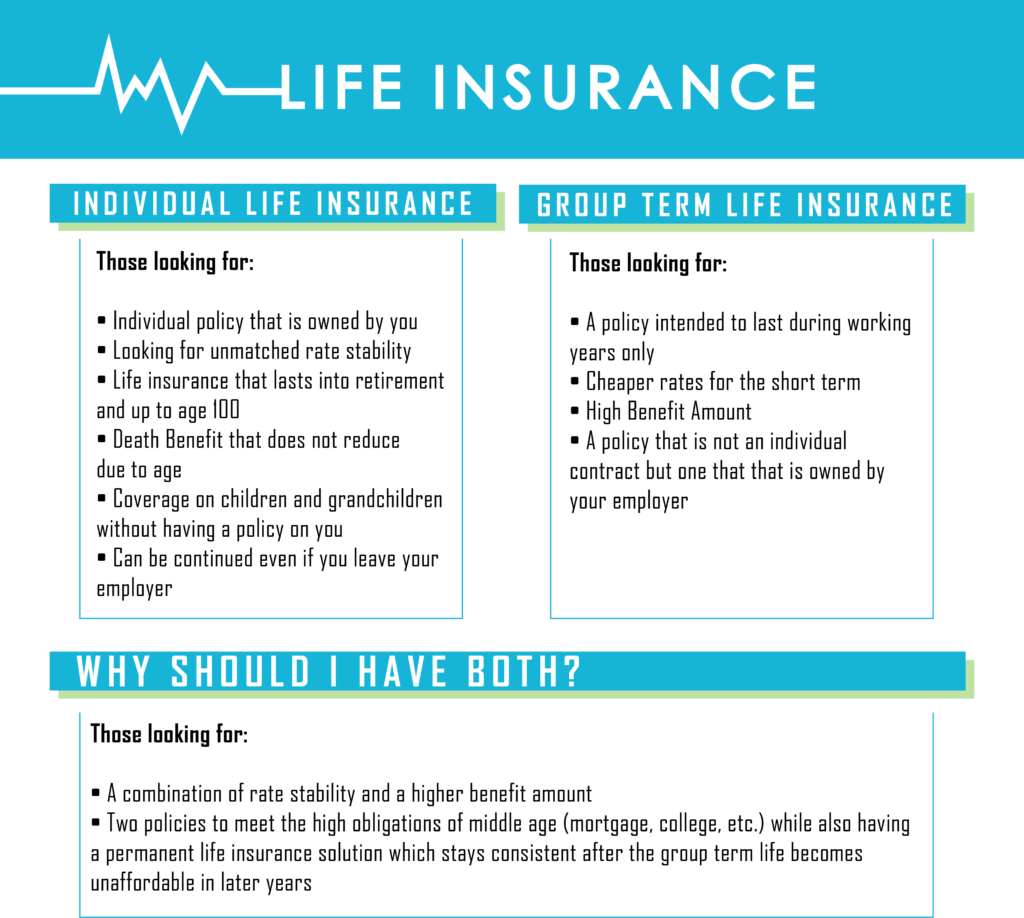

Group term life insurance is a common part of employee benefit packages.

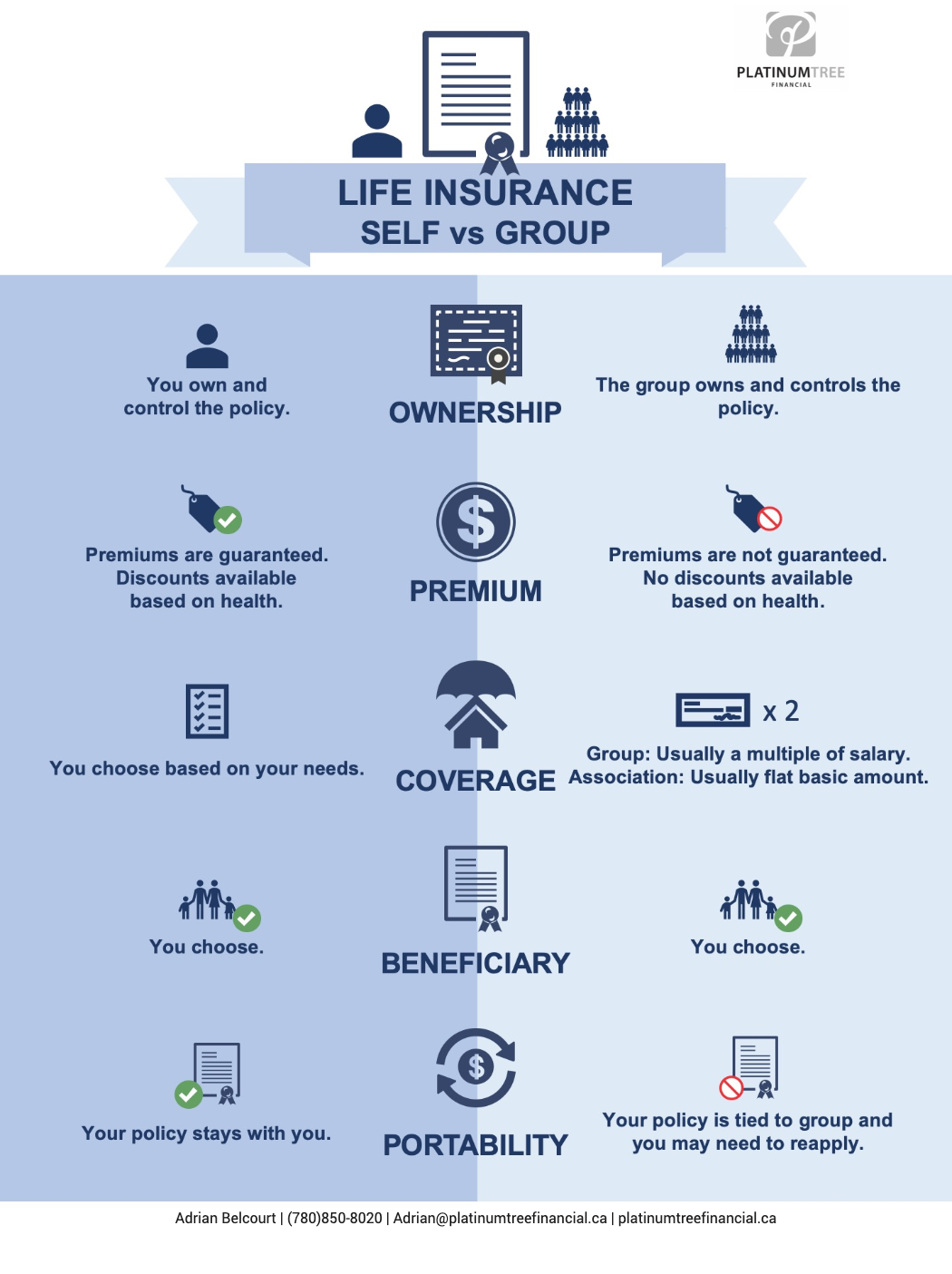

Every employer is expected to maintain a life insurance policy in favour of each of its employees. Understanding employer (group) life insurance. The main difference between term and whole life insurance is the cost. Knowing the difference between group insurance and individual health insurance is necessary before making a decision. Porting is a good solution for employees who are 69 years old or younger and are not terminating employment due to retirement, illness, or injury. The policy must be for at least three times each employee’s annual total emolument and is to be purchased from a life insurance company licensed by the.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

Group life insurance individual life insurance; You can always keep it. Basic term life insurance policy for some, the policy coverage is a flat amount (e.g., $25k of coverage). An employer buys a master policy and issues certificates to employees denoting coverage under the plan. This is in line with section 71(2) of the pra, 2004 and the provisions of the nsitf act, 1993, which statutorily empowered nsitf to manage all social security insurance schemes other than pension.

Source: individualhealthinsurancedenrai.blogspot.com

Source: individualhealthinsurancedenrai.blogspot.com

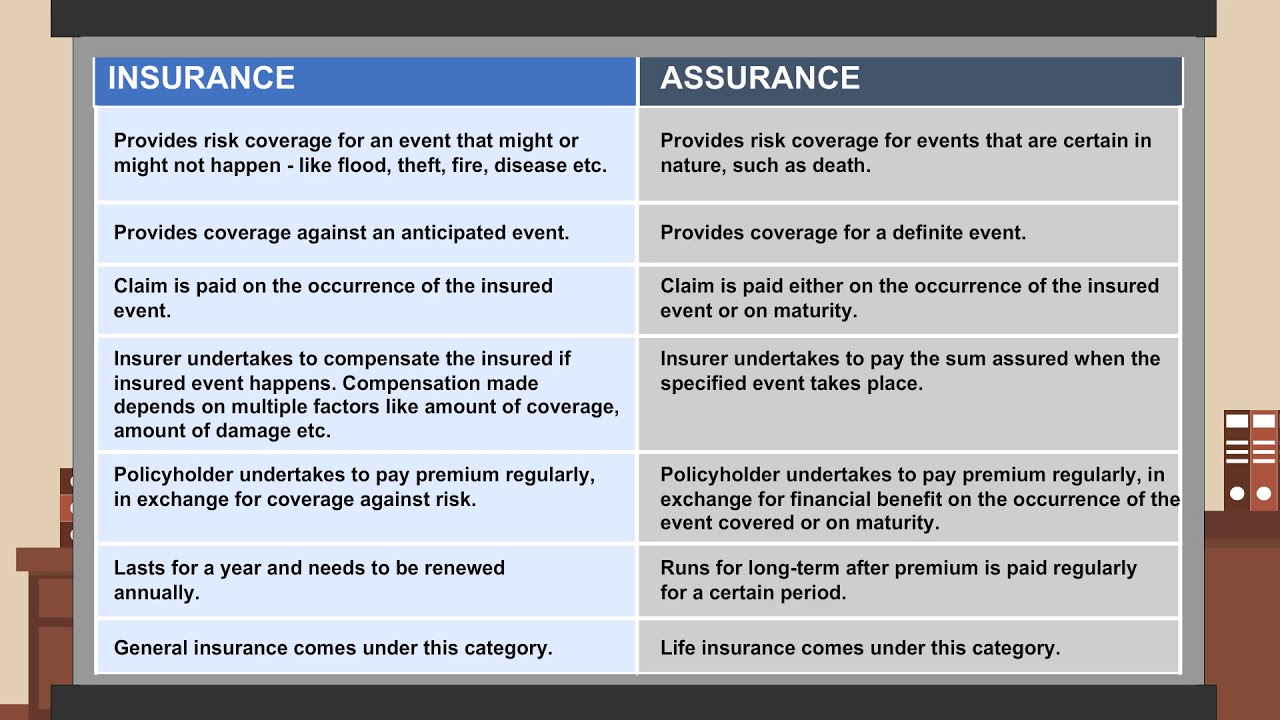

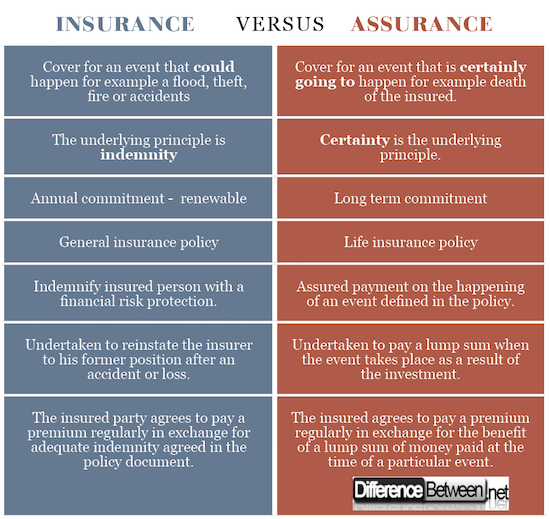

Assurance provides financial coverage for events, whose happening is certain such as death. Understanding employer (group) life insurance. “port”—your group coverage after employment ends. Convenient—sign up at work, premiums get deducted from paycheck Although this doesn’t necessarily guarantee lifetime coverage (like in the case of some universal life insurance policies which might lack guarantees), if it’s a fully guaranteed whole life plan it will mean exactly that.

Source: olympiabenefits.com

Source: olympiabenefits.com

Life insurance can be purchased either individually or through an employer (if offered), and is generally subject to underwriting. The key difference is that life insurance is designed to cover the policyholder for a specific term, while life assurance. It is a policy that is not an individual contract but one that is owned by your employer. Comparison of group life insurance and individual life insurance; Under most term plans, the benefit is paid only if the insured dies during the tenure of the plan.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Porting is a good solution for employees who are 69 years old or younger and are not terminating employment due to retirement, illness, or injury. Every employer is expected to maintain a life insurance policy in favour of each of its employees. A pure protection plan only offers a death benefit to the beneficiary of the policy: Assurance provides financial coverage for events, whose happening is certain such as death. Group life insurance individual life insurance;

Source: quotesbae.com

Source: quotesbae.com

Whole life insurance tends to be a lot more expensive than term policies. Whole life insurance tends to be a lot more expensive than term policies. Group term life insurance is a type of life insurance provided for employees by their employer. A life insurance plan offers both death benefit and maturity benefit to the life assured: Porting is a good solution for employees who are 69 years old or younger and are not terminating employment due to retirement, illness, or injury.

Source: lifeinsure.com

Source: lifeinsure.com

Group life insurance policies are offered through work as a benefit, but often do not provide enough coverage. A pure protection plan only offers a death benefit to the beneficiary of the policy: An employer buys a master policy and issues certificates to employees denoting coverage under the plan. Life insurance is meant to cover most causes of death, provided the policy has (typically) gone through an underwriting process and been approved, and the policyholder has paid all their premiums to date. Insurance helps to reinstate the financial position and achieve financial stability during an unforeseen event.

Source: pinterest.com

Source: pinterest.com

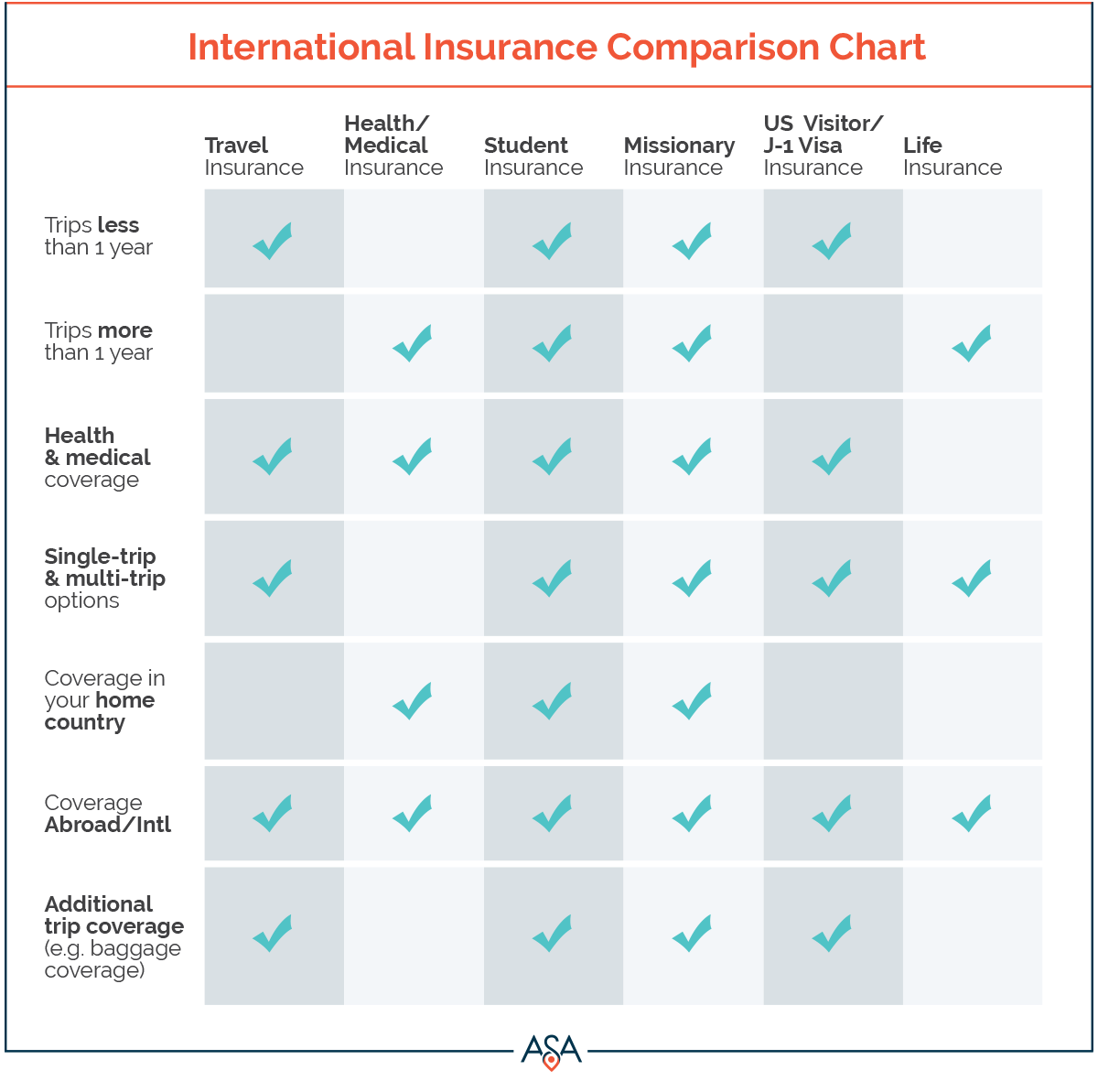

Group term life insurance is a policy intended to last during your working years only. The main difference between group health insurance and individual health insurance is that in a group plan, the coverage is shared among a set of people related under a certain condition. Convenient—sign up at work, premiums get deducted from paycheck Group term life insurance is a type of life insurance provided for employees by their employer. 1 x salary, 2 x salary, etc.

Source: clips-60z.blogspot.com

Source: clips-60z.blogspot.com

Difference between nsitf and group life insurance. Life insurance can be purchased either individually or through an employer (if offered), and is generally subject to underwriting. The way term life insurance works is that you pay a set monthly premium (like $30.00 per month), for a specific amount of coverage (like $100,000), for a set period or term length (like 20 years). Group life insurance policies are offered through work as a benefit, but often do not provide enough coverage. Term life insurance is one of the primary forms of life insurance and is going to be what people think of as the most straightforward type of life policy.

Source: youtube.com

Source: youtube.com

With a group life plan, you do not own your plan. The way term life insurance works is that you pay a set monthly premium (like $30.00 per month), for a specific amount of coverage (like $100,000), for a set period or term length (like 20 years). An individual policy only covers you and will continue till the time of your retirement, or even sometimes later. Term life insurance is one of the primary forms of life insurance and is going to be what people think of as the most straightforward type of life policy. With a group life plan, you do not own your plan.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Understanding employer (group) life insurance. General insurance, mostly, doesn’t give any maturity benefits but just promises a payout amount in case of any loss due to unavoidable circumstances. You are part of your employer’s group contract and can be covered under the group plan, if eligible. Difference between nsitf and group life insurance. Under most term plans, the benefit is paid only if the insured dies during the tenure of the plan.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

A life insurance policy is a powerful way of financially securing. Individual life insurance is a product that you buy and own yourself that is separate from anything that has to do with your work. A life insurance policy is a powerful way of financially securing. That’s the difference between term and whole life insurance. Term life insurance is one of the primary forms of life insurance and is going to be what people think of as the most straightforward type of life policy.

Source: askdrlinda.org

Source: askdrlinda.org

Before deciding between group life and individual life insurance plans, it is important to understand both these kinds of policies and they will be beneficial for you. Insurance provides protection against uncertain events such as fire, theft, accidents and flood etc. Difference between nsitf and group life insurance. Whenever you avail the life insurance policy first, the. General insurance, mostly, doesn’t give any maturity benefits but just promises a payout amount in case of any loss due to unavoidable circumstances.

Source: youtube.com

Source: youtube.com

Other types of life insurance plans, however, also have a maturity benefit. Group term life insurance is a type of life insurance provided for employees by their employer. Porting is a good solution for employees who are 69 years old or younger and are not terminating employment due to retirement, illness, or injury. As there is no maturity benefit offered by the policy the premium rate of the term plan is lower An employer buys a master policy and issues certificates to employees denoting coverage under the plan.

Source: imsguenstony.blogspot.com

Source: imsguenstony.blogspot.com

Many employers provide, at no cost, a base amount of coverage as well as an opportunity for the employee to purchase. As there is no maturity benefit offered by the policy the premium rate of the term plan is lower Ported coverage is term life insurance to age 70, and the employee pays premium for coverage directly to sun life. The policy must be for at least three times each employee’s annual total emolument and is to be purchased from a life insurance company licensed by the. Individual life insurance is a product that you buy and own yourself that is separate from anything that has to do with your work.

Source: youtube.com

Source: youtube.com

The policy must be for at least three times each employee’s annual total emolument and is to be purchased from a life insurance company licensed by the. Group life insurance policies are offered through work as a benefit, but often do not provide enough coverage. Managed by nigeria social insurance trust fund (nsitf). Insurance provides protection against uncertain events such as fire, theft, accidents and flood etc. Assurance provides financial coverage for events, whose happening is certain such as death.

Source: insurechance.com

Source: insurechance.com

The policy must be for at least three times each employee’s annual total emolument and is to be purchased from a life insurance company licensed by the. Life insurance can be seen as an investment apart from insurance as it offers maturity benefits after specific tenures. Major differences between group and individual insurance. 1 x salary, 2 x salary, etc. Group life insurance policies are offered through work as a benefit, but often do not provide enough coverage.

Source: imsguenstony.blogspot.com

Insurance helps to reinstate the financial position and achieve financial stability during an unforeseen event. A life insurance plan offers both death benefit and maturity benefit to the life assured: Whenever you avail the life insurance policy first, the. Although this doesn’t necessarily guarantee lifetime coverage (like in the case of some universal life insurance policies which might lack guarantees), if it’s a fully guaranteed whole life plan it will mean exactly that. Major differences between group and individual insurance.

Source: platinumtreefinancial.ca

Source: platinumtreefinancial.ca

You can always keep it. On the contrary, individual health insurance requires all applicants to undergo medical examination before their policy can be approved. The way term life insurance works is that you pay a set monthly premium (like $30.00 per month), for a specific amount of coverage (like $100,000), for a set period or term length (like 20 years). Group term life insurance is a type of life insurance provided for employees by their employer. Group term life insurance is a common part of employee benefit packages.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between nsitf and group life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea