Difference between perils and hazard insurance information

Home » Trend » Difference between perils and hazard insurance informationYour Difference between perils and hazard insurance images are available in this site. Difference between perils and hazard insurance are a topic that is being searched for and liked by netizens now. You can Get the Difference between perils and hazard insurance files here. Find and Download all royalty-free vectors.

If you’re looking for difference between perils and hazard insurance images information related to the difference between perils and hazard insurance topic, you have pay a visit to the ideal site. Our site always gives you suggestions for seeing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

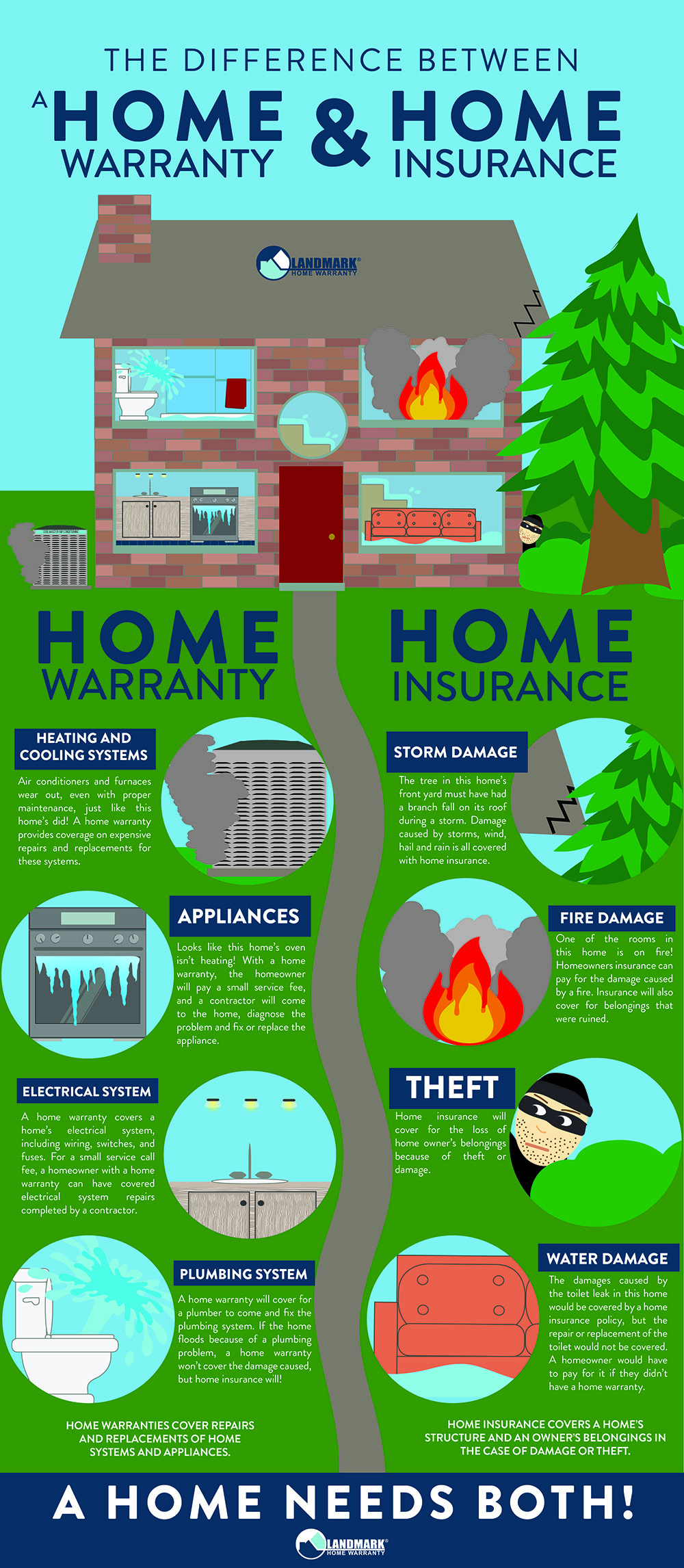

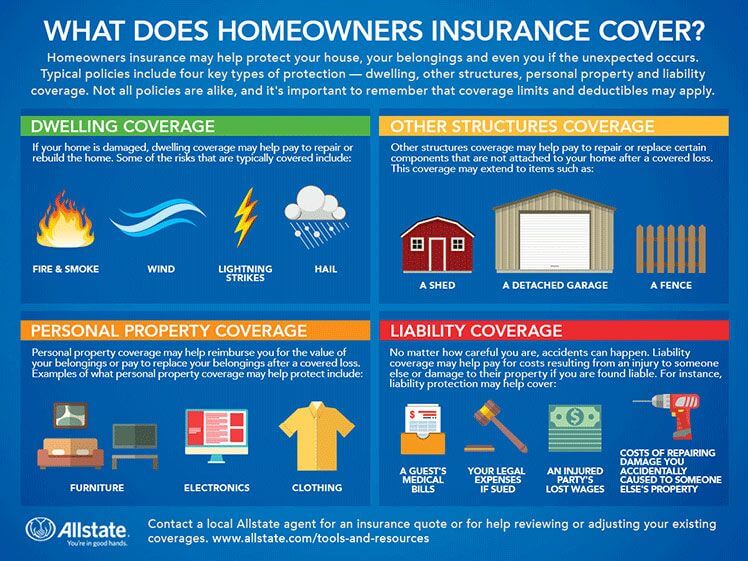

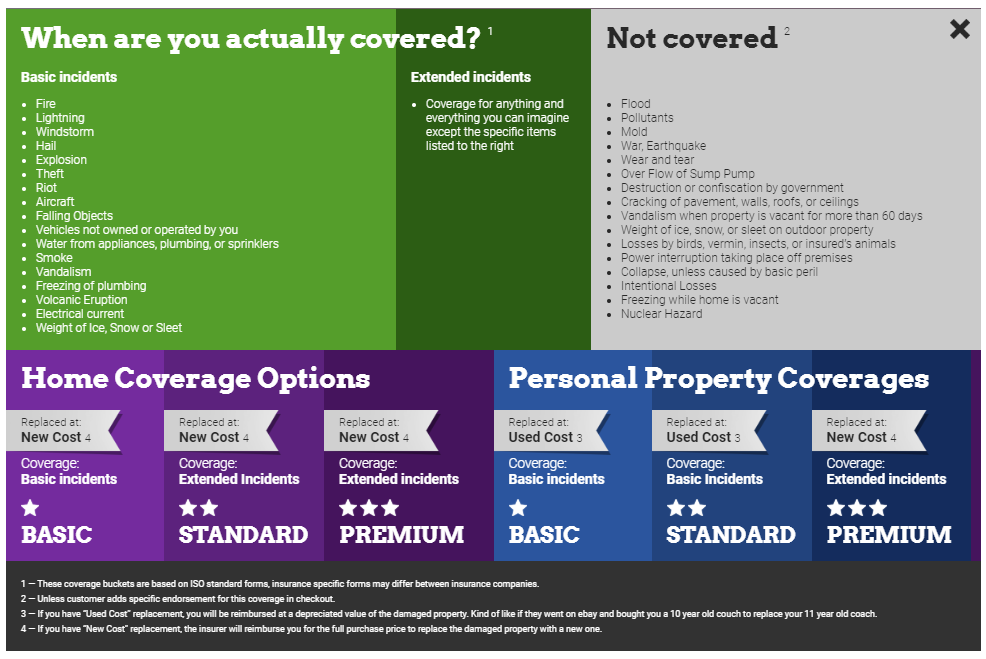

Difference Between Perils And Hazard Insurance. It is also known as property hazard insurance and real estate hazard insurance. To insure you against lawsuits that may be filed against you if someone is injured on your property Difference between perils and hazards on a home policy. Hazards are an activity or factor that causes or accelerates a loss, like not having the brakes on your vehicle regularly checked or leaving a bonfire burning unsupervised close to your home.

Peril, risk, and hazard What’s the difference? From intermap.com

Peril, risk, and hazard What’s the difference? From intermap.com

Consider the same words as defined by the glossary of insurance and risk management terms: If your policy only covers identified perils, you will not be reimbursed for harm caused by unnamed hazards. Essentially, a hazard makes a peril more likely to occur or makes it worse. Simply put, a peril is the cause of the loss and a hazard increases the likelihood of a peril happening. Sometimes, the phrase hazard insurance can be used to describe the portion of a home insurance policy that covers your dwelling from perils. To insure you against lawsuits that may be filed against you if someone is injured on your property

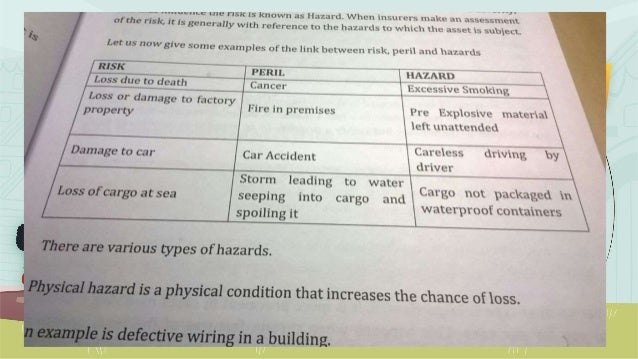

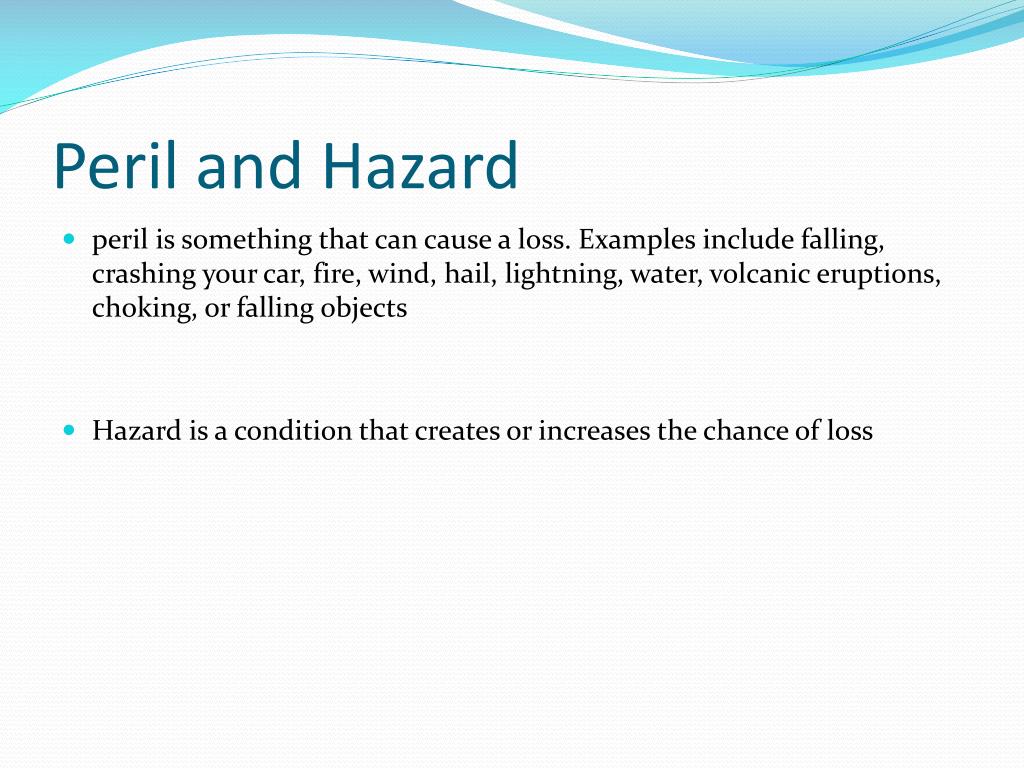

Risk describes the likelihood that a specific peril, or perils overall, will cause damage to you or your property.

To understand perils, we also need to talk about what a hazard is. Perils and hazards are mistakenly interchanged when discussing home insurance. A peril is something that can cause a financial loss. This is the key difference between peril and hazard. Hazards are divided into three. When a building burns, fire is the peril.

Source: youtube.com

Source: youtube.com

Condition that increases the probability of loss. A hazard is the source of danger. In this case, the fire itself is a source of potential damage. Home hazard insurance protects a homeowner from damages caused by fires, storms, and other natural disasters. Key takeaways a peril is a potential adverse event.

Source: slideshare.net

Source: slideshare.net

Simply put, a peril is the cause of the loss and a hazard increases the likelihood of a peril happening. When discussing homeowners insurance, it is very common for perils and hazards to. Home hazard insurance protects a homeowner from damages caused by fires, storms, and other natural disasters. Key takeaways a peril is a potential adverse event. When you are exposed to fire, for instance, you face the risk of getting burnt, which is perilous.

Source: sweephoenixazhomes.com

Source: sweephoenixazhomes.com

These types of hazards can make a peril or loss more likely to occur or worsen it. A hazard is something that increases the probability that a peril will occur. Perils and hazards are mistakenly interchanged when discussing home insurance. For example, being too lazy to go and lock your garage door every night could lead to a burglary. The possibility of a loss occurring

Source: laurennn87.blogspot.com

Source: laurennn87.blogspot.com

A hazard is something that increases the probability that a peril will occur. When discussing homeowners insurance, it is very common for perils and hazards to. Key takeaways a peril is a potential adverse event. The best way to tell the difference between a hazard vs. A hazard is anything that increases the chance of loss

Source: property-casualty-insurance1.blogspot.com

This is the key difference between peril and hazard. The difference between perils and hazards. Condition that increases the probability of loss. Perils and hazards are mistakenly interchanged when discussing home insurance. The best way to tell the difference between a hazard vs.

Source: clovered.com

Source: clovered.com

And the peril is the specific event that causes a loss. Examples include falling, crashing your car, fire, wind, hail, lightning, water, volcanic eruptions, falling. Perils commonly covered by insurance A peril is something that can cause a financial loss. What is the difference between a peril and a hazard?

Source: alliedinsurance-agency.com

Source: alliedinsurance-agency.com

And the peril is the specific event that causes a loss. A hazard increases the possibility of a peril occurring, or makes it worse. In insurance, peril is something that causes a financial loss whereas a hazard is a condition or circumstance that increases the probability of peril. Simply put, a peril is the cause of the loss and a hazard increases the likelihood of a peril happening. Examples include falling, crashing your car, fire, wind, hail, lightning, water, volcanic eruptions, falling.

Source: youngalfred.com

Source: youngalfred.com

A peril is something that can cause a financial loss. The best way to tell the difference between a hazard vs. A condition that increases the likelihood of a loss occurring; For example, insurance agents routinely use worksheets to determine a family’s life insurance needs. Difference between perils and hazards on a home policy simply put, a peril is the cause of the loss and a hazard increases the likelihood of a peril happening.

Source: youngalfred.com

Source: youngalfred.com

Perils and hazards are mistakenly interchanged when discussing home insurance. A hazard increases the possibility of a peril occurring, or makes it worse. Condition that increases the probability of loss. For example, being too lazy to go and lock your garage door every night could lead to a burglary. The cause of a loss;

Source: pinterest.com.mx

Source: pinterest.com.mx

When you are exposed to fire, for instance, you face the risk of getting burnt, which is perilous. This is the key difference between peril and hazard. While perils and hazards sound similar, a peril actually results from a hazard. This has led to the misconception that hazard insurance is somehow separate from homeowners insurance, but the differences between the two are negligible. A condition that increases the likelihood of a loss occurring;

Source: youngalfred.com

Source: youngalfred.com

To insure the structure of your home against covered perils personal property insurance: A peril is something that can cause a financial loss. What is the difference between a peril and a hazard? Sometimes, the phrase hazard insurance can be used to describe the portion of a home insurance policy that covers your dwelling from perils. Hazards are divided into three.

Source: slideshare.net

Source: slideshare.net

The difference is that the action was unintended. The possibility of a loss occurring You’ve learned that risk is the uncertainty of loss. What is the difference between a peril and a hazard with respect to insurance coverage? In insurance, peril is something that causes a financial loss whereas a hazard is a condition or circumstance that increases the probability of peril.

Source: present5.com

Source: present5.com

Perils commonly covered by insurance For insurance purposes, two types of hazard may be distinguished: A peril is the cause of loss. You’ve learned that risk is the uncertainty of loss. Both of these terms are used frequently in insurance policies, particularly property insurance.

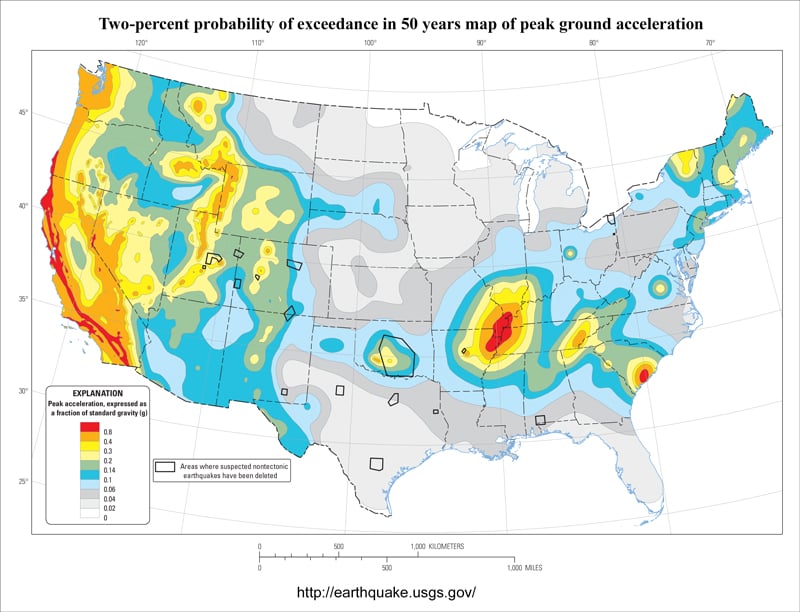

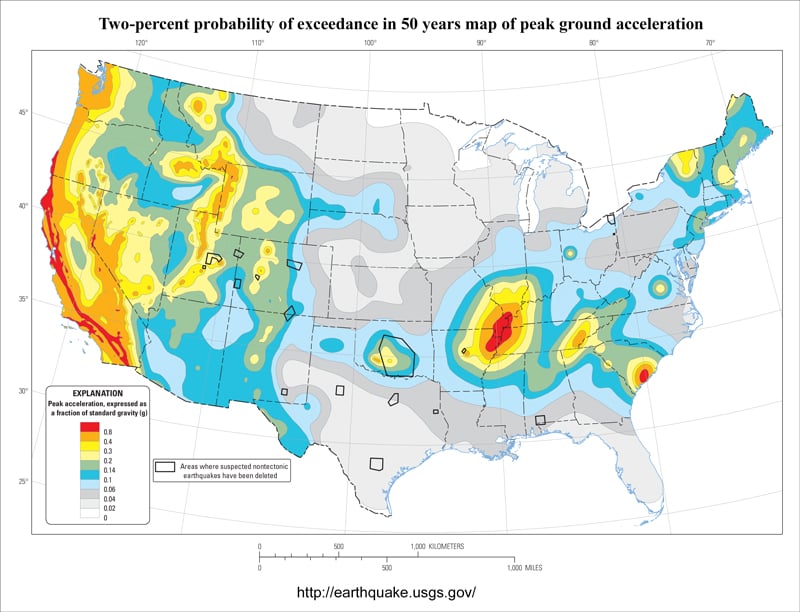

Source: intermap.com

Source: intermap.com

Sometimes, the phrase hazard insurance can be used to describe the portion of a home insurance policy that covers your dwelling from perils. Condition that increases the probability of loss. A hazard increases the possibility of a peril occurring, or makes it worse. When a building burns, fire is the peril. For example, being too lazy to go and lock your garage door every night could lead to a burglary.

Source: allstate.com

Source: allstate.com

A hazard merely increases the likelihood of a loss. A “hazard” increases the chances of a peril occurring. A peril is something that can cause a financial loss. The laziness that led to the peril (theft) would be a morale hazard. Hazard insurance hazard insurance is not a separate.

Source: slideserve.com

Source: slideserve.com

To insure the structure of your home against covered perils personal property insurance: Examples include falling, crashing your car, fire, wind, hail, lightning, water, volcanic eruptions, falling. A hazard makes that event more likely. A risk is the possibility of a loss and a peril is the cause of the loss. Sometimes, the phrase hazard insurance can be used to describe the portion of a home insurance policy that covers your dwelling from perils.

Source: youngalfred.com

Source: youngalfred.com

Hazards, on the other hand, are things that increase the likelihood of a loss. An insurer will always consider potential hazards when it comes to their clients. This has led to the misconception that hazard insurance is somehow separate from homeowners insurance, but the differences between the two are negligible. You might also be able to estimate the cost of a peril mathematically (e.g., 30 years @ $50,000 of average lost income = $1,500,000, plus an inflation factor). A hazard is something that increases the probability that a peril will occur.

Source: tgsinsurance.com

Source: tgsinsurance.com

In insurance, peril is something that causes a financial loss whereas a hazard is a condition or circumstance that increases the probability of peril. It’s easiest if you think of it simply, a peril is the thing that causes a loss and a hazard is a thing that increases a peril’s chances of happening. Difference between perils and hazards on a home policy simply put, a peril is the cause of the loss and a hazard increases the likelihood of a peril happening. Condition that increases the probability of loss. This is the key difference between peril and hazard.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between perils and hazard insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information