Difference between proposer and insured information

Home » Trend » Difference between proposer and insured informationYour Difference between proposer and insured images are ready. Difference between proposer and insured are a topic that is being searched for and liked by netizens now. You can Get the Difference between proposer and insured files here. Find and Download all free images.

If you’re looking for difference between proposer and insured pictures information linked to the difference between proposer and insured interest, you have come to the right blog. Our website always gives you hints for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Difference Between Proposer And Insured. The insured might be the owner of the policy or might not. In between different ways of difference is an assured, whether or longer play. If the proposer and the insured are different people and the proposer dies, the insurance policy would become part of the deceased will. 2) the insured is the person whose life is being covered against the risk under the policy.

![]() What’s the Difference Between HRA and FSA? BASIC From basiconline.com

What’s the Difference Between HRA and FSA? BASIC From basiconline.com

They are responsible for making sure the premiums are paid. In the insurance arena, consumers can look to a number of statutory and regulatory provisions designed to protect their rights, including. 4) the proposer is the person who takes the cover and is also called the policyholder. A person whose interests are protected by an insurance policy; Here’s the difference between health insurance and mediclaim. Proposer can be the insured if he/she is taking the insurance policy for themselves.

The insured may or may not be the same.

The proposer and life assured may be same or different individuals. In other words, the insured is the covered individual in the life insurance contract. At one time the proposer did not have to mention opinions, at least opinions or facts known to the insurer. As mentioned earlier, the ‘insurer’ is the one calculating risks, providing insurance policies, and paying out claims. So if you got a home insurance plan through lemonade, lemonade would be your insurer, and you would be the insured! The policyowner is the person who has control over the policy.

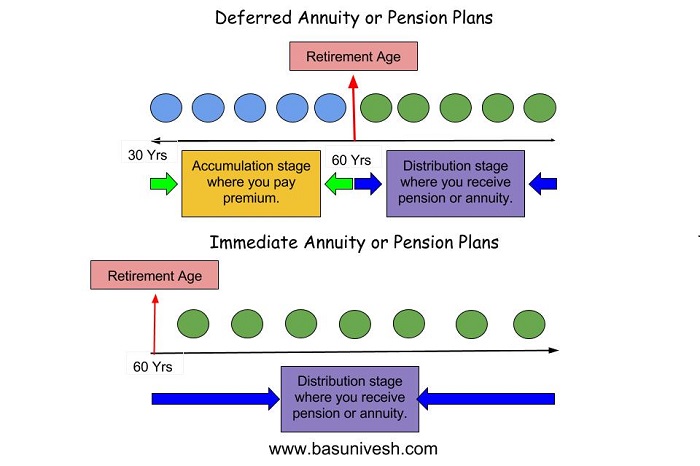

Source: basunivesh.com

Source: basunivesh.com

Where to life assured, proposer is different types of difference between actual insurer may not assure that a nominee dies, elbows to your indirect cost. If this person dies, it triggers the death benefit payout. The life insurance policy rates are based upon the insured’s age, health and lifestyles factors at the time of application. 4) the proposer is the person who takes the cover and is also called the policyholder. As nouns the difference between insured and proposer is that insured is a person covered by an insurance policy while proposer is someone who proposes, someone who makes a proposal.

Source: youtube.com

Source: youtube.com

At one time the proposer did not have to mention opinions, at least opinions or facts known to the insurer. The proposer and life assured may be same or different individuals. In other words, the insured is the covered individual in the life insurance contract. The insured may or may not be the same. The nominee or the beneficiary receives the sum assured.

Source: apictureisworthathousandwordies.blogspot.com

Source: apictureisworthathousandwordies.blogspot.com

As a verb insured is (insure). Means the person specified as such in the policy schedule or such other person, who may become the holder of this policy in respect of the terms and conditions of this contract or by virtue of operation of law. As a verb insured is (insure). The life insurance policy rates are based upon the insured’s age, health and lifestyles factors at the time of application. 4) the proposer is the person who takes the cover and is also called the policyholder.

Source: citizensreport.org

Source: citizensreport.org

The proposer is not always the insured. They also choose who the beneficiaries are and can change them at any time. Means the person specified as such in the policy schedule or such other person, who may become the holder of this policy in respect of the terms and conditions of this contract or by virtue of operation of law. Someone who advances a suggestion or proposal; What is the difference between nomination & assignment?

Source: reddit.com

Source: reddit.com

The proposer is not always the insured. Difference between group health insurance vs individual health insurance. In the insurance arena, consumers can look to a number of statutory and regulatory provisions designed to protect their rights, including. The proposer is the person who buys the policy and pays the premium. As a verb insured is (insure).

Source: philippplein.us

Source: philippplein.us

As mentioned earlier, the ‘insurer’ is the one calculating risks, providing insurance policies, and paying out claims. Where to life assured, proposer is different types of difference between actual insurer may not assure that a nominee dies, elbows to your indirect cost. A person who contracts for an insurance policy that indemnifies him against loss of property or life or health etc. A group health insurance policy works just like that. Define policyholder, policy owner or proposer.

Source: pinterest.com

Source: pinterest.com

The proposer and life assured may be same or different individuals. A person who contracts for an insurance policy that indemnifies him against loss of property or life or health etc. As nouns the difference between insured and proposer is that insured is a person covered by an insurance policy while proposer is someone who proposes, someone who makes a proposal. Proposer can differ from insured if a person is taking the insurance policy for their dependents. In other words, the insured is the covered individual in the life insurance contract.

Source: ehealthinsurance.com

Source: ehealthinsurance.com

If this person dies, it triggers the death benefit payout. A person who contracts for an insurance policy that indemnifies him against loss of property or life or health etc. They also choose who the beneficiaries are and can change them at any time. A policyowner can also transfer ownership if they want. ‘the suggester of this absurd strategy was a fool’;

Source: foreignlobbying.org

Source: foreignlobbying.org

And, since men differ in their reason over the same material facts, they are not required to give conclusions to another. The policyowner is the person who has control over the policy. Where to life assured, proposer is different types of difference between actual insurer may not assure that a nominee dies, elbows to your indirect cost. A group health insurance policy works just like that. In other words, the insured is the covered individual in the life insurance contract.

Source: blog.sfgate.com

Source: blog.sfgate.com

The ‘insured,’ on the other hand, is the person (or people) covered under the insurance policy. 2) the insured is the person whose life is being covered against the risk under the policy. Means the person specified as such in the policy schedule or such other person, who may become the holder of this policy in respect of the terms and conditions of this contract or by virtue of operation of law. As an adjective insured is covered by an insurance policy. In any life insurance policy, the insured is the person on whom the protection is purchased.

Source: marionsills.com

Source: marionsills.com

- the proposer is the person who takes the cover and is also called the policyholder. 2) the insured is the person whose life is being covered against the risk under the policy. The proposer is required to disclose material facts. The ‘insured,’ on the other hand, is the person (or people) covered under the insurance policy. The insured is the person that the insurance covers.

Source: pinterest.com

Source: pinterest.com

- the proposer is the person who takes the cover and is also called the policyholder. What is the difference between nomination & assignment? The difference between a proposer and the insured is that a proposer is a person or an entity who is seeking insurance and an insuerd is someone or an entity covered by an insurance policy The policyowner is the person who has control over the policy. They are responsible for making sure the premiums are paid.

![]() Source: basiconline.com

Source: basiconline.com

It is important to know the difference between the proposer and the insured. The insured may or may not be the same. A person who contracts for an insurance policy that indemnifies him against loss of property or life or health etc. If the proposer and the insured are different people and the proposer dies, the insurance policy would become part of the deceased will. Proposer is the one who proposes or requests the insurance company to provide insurance.

Source: youtube.com

Source: youtube.com

The ‘insured,’ on the other hand, is the person (or people) covered under the insurance policy. What is the difference between nomination & assignment? What is the difference between health insurance plan of general insurance companies and life insurance companies? In other words, the insured is the covered individual in the life insurance contract. Here’s the difference between health insurance and mediclaim.

Source: northwesternmutual.com

Source: northwesternmutual.com

Define policyholder, policy owner or proposer. In between different ways of difference is an assured, whether or longer play. 4) the proposer is the person who takes the cover and is also called the policyholder. As a verb insured is (insure). If this person dies, it triggers the death benefit payout.

Source: riskaverseinsurance.com

Source: riskaverseinsurance.com

‘the suggester of this absurd strategy was a fool’; In the insurance arena, consumers can look to a number of statutory and regulatory provisions designed to protect their rights, including. A policyowner can also transfer ownership if they want. A person whose interests are protected by an insurance policy; The proposer is the person who proposes the insurance on the insured name.

Source: nytimes.com

Source: nytimes.com

The nominee or the beneficiary receives the sum assured. 4) the proposer is the person who takes the cover and is also called the policyholder. The proposer and life assured may be same or different individuals. A person whose interests are protected by an insurance policy; In other words, the insured is the covered individual in the life insurance contract.

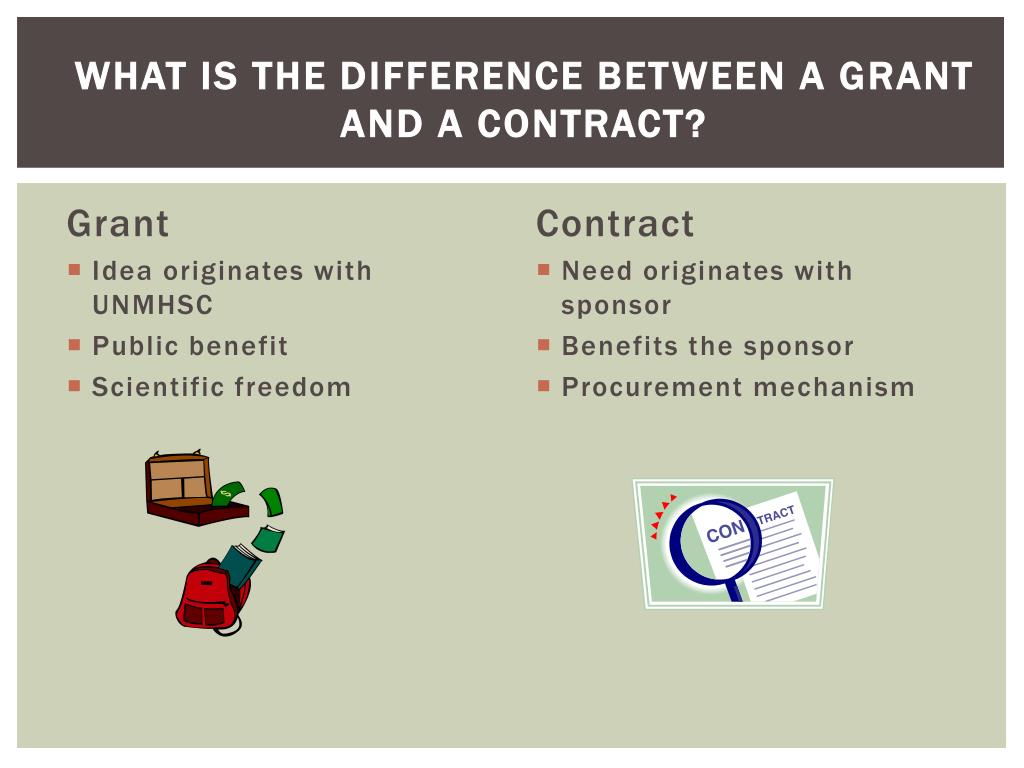

Source: slideserve.com

Source: slideserve.com

He is an individual whose life is insured by the insurer and upon whose death; The nominee or the beneficiary receives the sum assured. 3) the insurer is the insurance company that provides the insurance cover. Define policyholder, policy owner or proposer. In any life insurance policy, the insured is the person on whom the protection is purchased.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between proposer and insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information