Difference between public and product liability insurance Idea

Home » Trend » Difference between public and product liability insurance IdeaYour Difference between public and product liability insurance images are available. Difference between public and product liability insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Difference between public and product liability insurance files here. Download all free photos.

If you’re searching for difference between public and product liability insurance pictures information related to the difference between public and product liability insurance interest, you have come to the right blog. Our website frequently provides you with hints for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Difference Between Public And Product Liability Insurance. Product liability insurance offers a few different coverage options and availability. Learn more about public liability insurance It is sometimes defined in a policy as follows: Public liability insurance covers compensation claims made against your business by a third party for injury or damage.

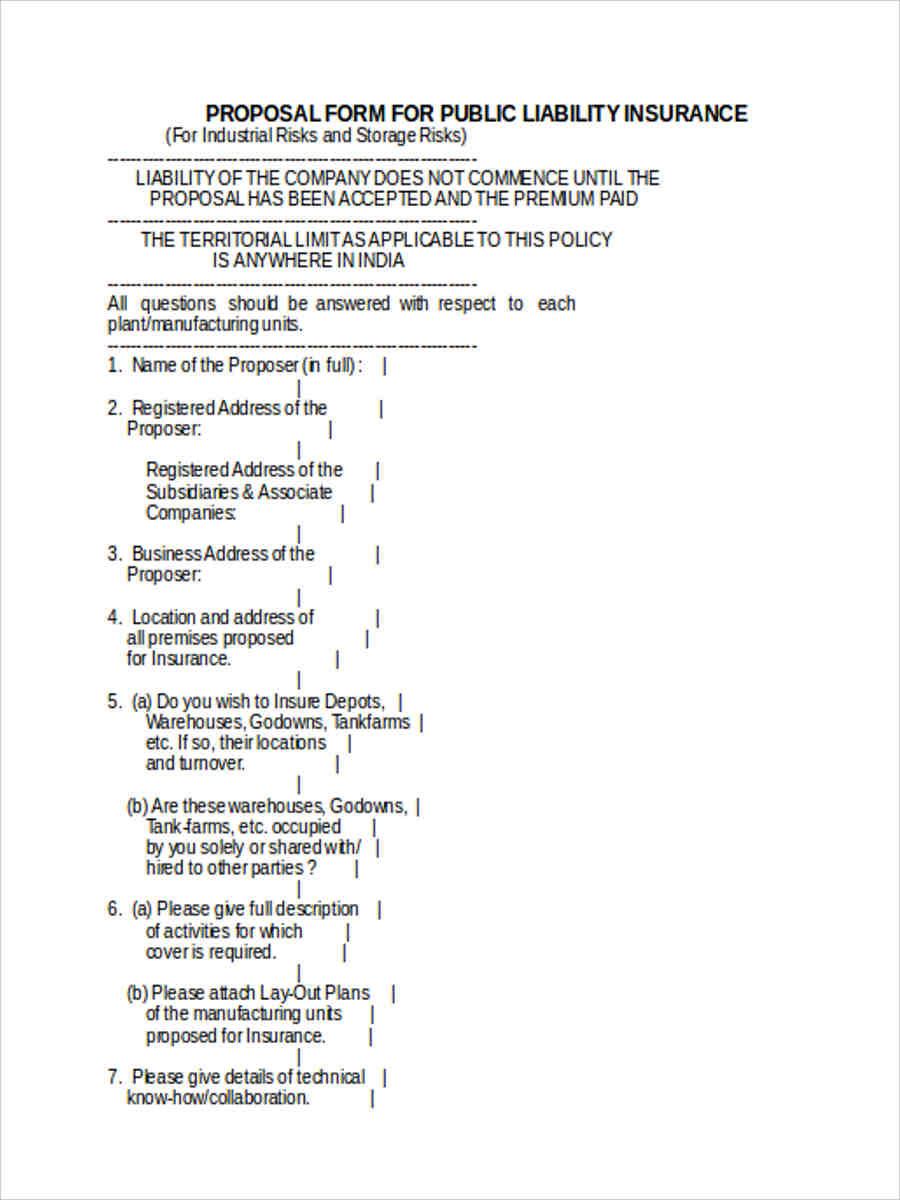

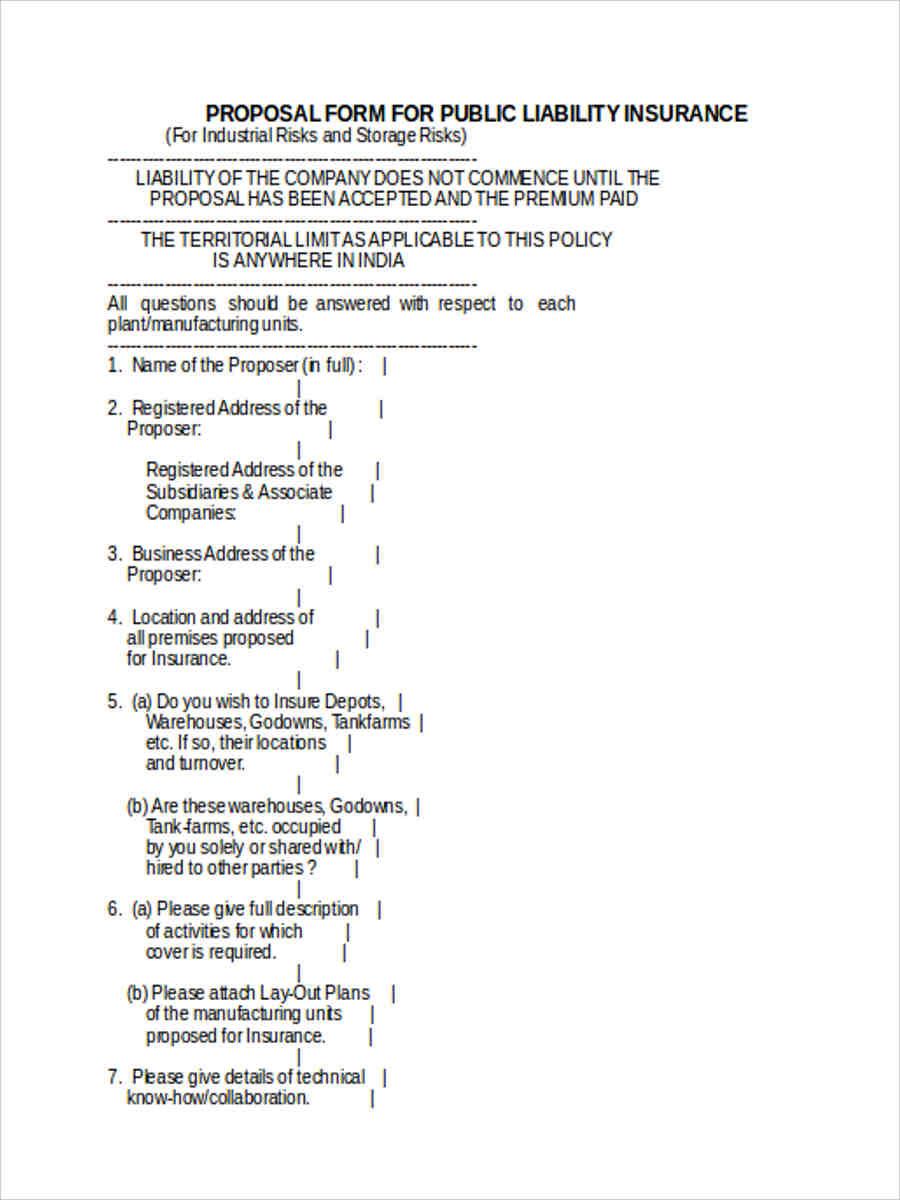

FREE 6+ Public Liability Forms in MS Word PDF From sampleforms.com

FREE 6+ Public Liability Forms in MS Word PDF From sampleforms.com

Public and products liability insurance also known as general liability (gl) protects you and your business against financial loss arising from your legal liability to pay compensation to a third party when they have suffered a personal injury, property damage or an advertising injury. Product liability insurance is covered under a general liability policy in conjunction with liability work that has been completed. Public liability insurance isn’t a legal requirement, although it may be required by your client contracts. What’s the difference between public liability and product liability? Product liability insurance protects the policy holder from harm caused by a product because of an inherent quality of the product or defect in the product. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money.

Public and products liability insurance also known as general liability (gl) protects you and your business against financial loss arising from your legal liability to pay compensation to a third party when they have suffered a personal injury, property damage or an advertising injury.

Work with an experienced insurance advisor to make sure. Product liability insurance, as the name suggests, protects against claims arising against the products that a company manufactures or supplies. A business may be held liable when duty of care to its customers is breached, so it�s important to know the difference between public and product liability, and professional indemnity. In some ways you could say that it is more about the physical actions (or consequences) of your business activities. However, the difference here is that injury or damage isn’t caused directly by a product. Public liability insurance (pli) protects the interests of a business owner in the event of.

Source: dualaustralia.com.au

Product liability insurance is covered under a general liability policy in conjunction with liability work that has been completed. What’s the difference between public liability and product liability? Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. “public liability means your legal liability in respect of personal injury or property damage or advertising injury happening in connection with the business…… other than products liability” The difference is that public liability relates to injury or property damage whilst you’re on the job, and products liability relates to injury or damage caused by any products you distribute, supply or manufacture.

Source: matrixinsurance.net.au

Source: matrixinsurance.net.au

Public liability insurance (pli) protects the interests of a business owner in the event of. $20,000,0000 for any claim for public liability for an unlimited number of claims. Both public and products liability provide coverage for third party injury or property damage that you might cause. The difference between these two types of coverage lies in what caused the injury or property damage in the first place. In some ways you could say that it is more about the physical actions (or consequences) of your business activities.

Source: sampleforms.com

Source: sampleforms.com

In some ways you could say that it is more about the physical actions (or consequences) of your business activities. Public liability insurance (pli) protects the interests of a business owner in the event of an injury (suffered, for example, by tripping over a cable, slipping, or falling down the stairs), property damage or other loss a third party would suffer while on the business premises, or as a result of your business activities. A member of the public like a client, customer, supplier or passerby), while employers’ liability insurance covers injury claims made by an employee. Product and public liability insurance both cover legal defence costs and compensation related to injury or property damage claims brought by a third party against a business. What’s the difference between public liability and product liability?

Source: clema-rs.cn

Source: clema-rs.cn

The difference is that public liability relates to injury or property damage whilst you’re on the job, and products liability relates to injury or damage caused by any products you distribute, supply or manufacture. For example if a supplier trips on a trailing cable in your shop, or if you visit a client and spill coffee on their computer. Public liability insurance helps you out if you or your business is held accountable for third party injury or property damage. Product liability insurance, also called product recall insurance, is designed to help you do all of those things. Public liability insurance isn’t a legal requirement, although it may be required by your client contracts.

Source: bizcover.com.au

Source: bizcover.com.au

Product liability insurance, as the name suggests, protects against claims arising against the products that a company manufactures or supplies. This is a major difference between public liability insurance vs contractor all risk insurance. Product liability insurance is covered under a general liability policy in conjunction with liability work that has been completed. $20,000,0000 for any claim for public liability for an unlimited number of claims. Similarly to product, public liability can cover claims for injury or property damage/ and loss.

Source: iniwoo.net

Source: iniwoo.net

This is a major difference between public liability insurance vs contractor all risk insurance. Public liability insurance covers you for property damage or personal injury suffered by a third party where you are deemed to be responsible. Product liability insurance protects the policy holder from harm caused by a product because of an inherent quality of the product or defect in the product. “public liability means your legal liability in respect of personal injury or property damage or advertising injury happening in connection with the business…… other than products liability” Product and public liability insurance both cover legal defence costs and compensation related to injury or property damage claims brought by a third party against a business.

Source: caunceohara.co.uk

Source: caunceohara.co.uk

Both public and products liability provide coverage for third party injury or property damage that you might cause. Basically, public liability insurance is associated with more intangible accidents. In some ways you could say that it is more about the physical actions (or consequences) of your business activities. What’s the difference between public liability and product liability? Only contractors all risk insurance covers damage to contract works due to major risks like fire, explosions, lightning, water damage, and more.

Source: hiscox.co.uk

Source: hiscox.co.uk

Product liability insurance, as the name suggests, protects against claims arising against the products that a company manufactures or supplies. However, the difference here is that injury or damage isn’t caused directly by a product. Public liability insurance isn’t a legal requirement, although it may be required by your client contracts. Product, equipment, property, etc.) and injury claims that result from negligence on behalf of you or one of your employees. Product liability insurance, as the name suggests, protects against claims arising against the products that a company manufactures or supplies.

Source: blackfriarsgroup.com

Source: blackfriarsgroup.com

Accidents that aren’t directly linked with a product or service. Public liability insurance (pli) protects the interests of a business owner in the event of. A business may be held liable when duty of care to its customers is breached, so it�s important to know the difference between public and product liability, and professional indemnity. In some ways you could say that it is more about the physical actions (or consequences) of your business activities. Similarly to product, public liability can cover claims for injury or property damage/ and loss.

Source: blog.tapoly.com

Source: blog.tapoly.com

Public liability insurance does not cover such damage. Public liability policies have a limit in respect of each and very claim and product liability policy limits are based on any one claim and in the aggregate. Product and public liability insurance both cover legal defence costs and compensation related to injury or property damage claims brought by a third party against a business. Public liability insurance helps you out if you or your business is held accountable for third party injury or property damage. It’s worth noting, right at the outset, that public and product liability usually come as a package (we’ll discuss the pricing in more detail later on).

Source: professionalindemnityinsuranceguide.com.au

Source: professionalindemnityinsuranceguide.com.au

The difference between these two types of coverage lies in what caused the injury or property damage in the first place. Public liability insurance protects the policy holder from injuries that take place on his or her property due to negligence in its maintenance. Similarly to product, public liability can cover claims for injury or property damage/ and loss. Public liability insurance helps you out if you or your business is held accountable for third party injury or property damage. A policy will usually cover all claims made during the period of the policy up to the specified limit, e.g.

Source: planinsurance.co.uk

Source: planinsurance.co.uk

Both public and products liability provide coverage for third party injury or property damage that you might cause. The difference is that public liability relates to injury or property damage whilst you’re on the job, and products liability relates to injury or damage caused by any products you distribute, supply or manufacture. Difference between public and product liability insurance. Public liability insurance (pli) protects the interests of a business owner in the event of an injury (suffered, for example, by tripping over a cable, slipping, or falling down the stairs), property damage or other loss a third party would suffer while on the business premises, or as a result of your business activities. It is sometimes defined in a policy as follows:

Source: paratextsupport.com

Source: paratextsupport.com

Public and products liability insurance also known as general liability (gl) protects you and your business against financial loss arising from your legal liability to pay compensation to a third party when they have suffered a personal injury, property damage or an advertising injury. Work with an experienced insurance advisor to make sure. What’s the difference between public liability and product liability? Accidents that aren’t directly linked with a product or service. Similarly to product, public liability can cover claims for injury or property damage/ and loss.

The difference between these two types of coverage lies in what caused the injury or property damage in the first place. Both public and products liability provide coverage for third party injury or property damage that you might cause. Basically, public liability insurance is associated with more intangible accidents. A member of the public like a client, customer, supplier or passerby), while employers’ liability insurance covers injury claims made by an employee. The difference between these two types of coverage lies in what caused the injury or property damage in the first place.

Source: mbib.com.au

Source: mbib.com.au

Public and products liability insurance also known as general liability (gl) protects you and your business against financial loss arising from your legal liability to pay compensation to a third party when they have suffered a personal injury, property damage or an advertising injury. 5 rows both public liability insurance and products liability insurance policies cover third. “public liability means your legal liability in respect of personal injury or property damage or advertising injury happening in connection with the business…… other than products liability” Product, equipment, property, etc.) and injury claims that result from negligence on behalf of you or one of your employees. Public liability insurance covers you against material damage (i.e.

Source: johnheath.com

Source: johnheath.com

5 rows both public liability insurance and products liability insurance policies cover third. Public liability insurance covers you for property damage or personal injury suffered by a third party where you are deemed to be responsible. Product liability insurance is covered under a general liability policy in conjunction with liability work that has been completed. $20,000,0000 for any claim for public liability for an unlimited number of claims. This injury or damage must be in the direct course of your.

Source: johnheath.com

Source: johnheath.com

Both public liability insurance and products liability insurance policies cover third party claims for injury or damage to property, however each insurance will react in different circumstances. Both public and products liability provide coverage for third party injury or property damage that you might cause. Public liability insurance isn’t a legal requirement, although it may be required by your client contracts. Professional indemnity insurance/professional liability covers your business for claims against professional mistakes or negligence that end up causing your clients to lose money. Again this area demonstrated the difference between the two covers;

Source: providecover.com

Source: providecover.com

Public liability insurance (pli) protects the interests of a business owner in the event of an injury (suffered, for example, by tripping over a cable, slipping, or falling down the stairs), property damage or other loss a third party would suffer while on the business premises, or as a result of your business activities. It is sometimes defined in a policy as follows: Product liability insurance offers a few different coverage options and availability. Similarly to product, public liability can cover claims for injury or property damage/ and loss. Both public and products liability provide coverage for third party injury or property damage that you might cause.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between public and product liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information