Difference between reinsurance and stop loss insurance Idea

Home » Trending » Difference between reinsurance and stop loss insurance IdeaYour Difference between reinsurance and stop loss insurance images are ready. Difference between reinsurance and stop loss insurance are a topic that is being searched for and liked by netizens today. You can Download the Difference between reinsurance and stop loss insurance files here. Download all free photos.

If you’re looking for difference between reinsurance and stop loss insurance images information connected with to the difference between reinsurance and stop loss insurance topic, you have come to the right site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

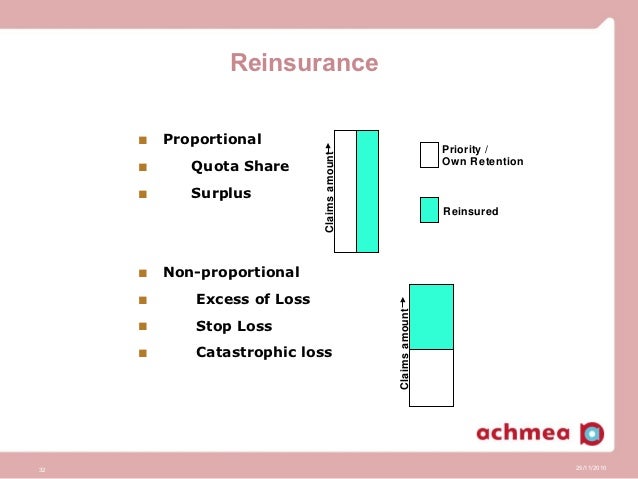

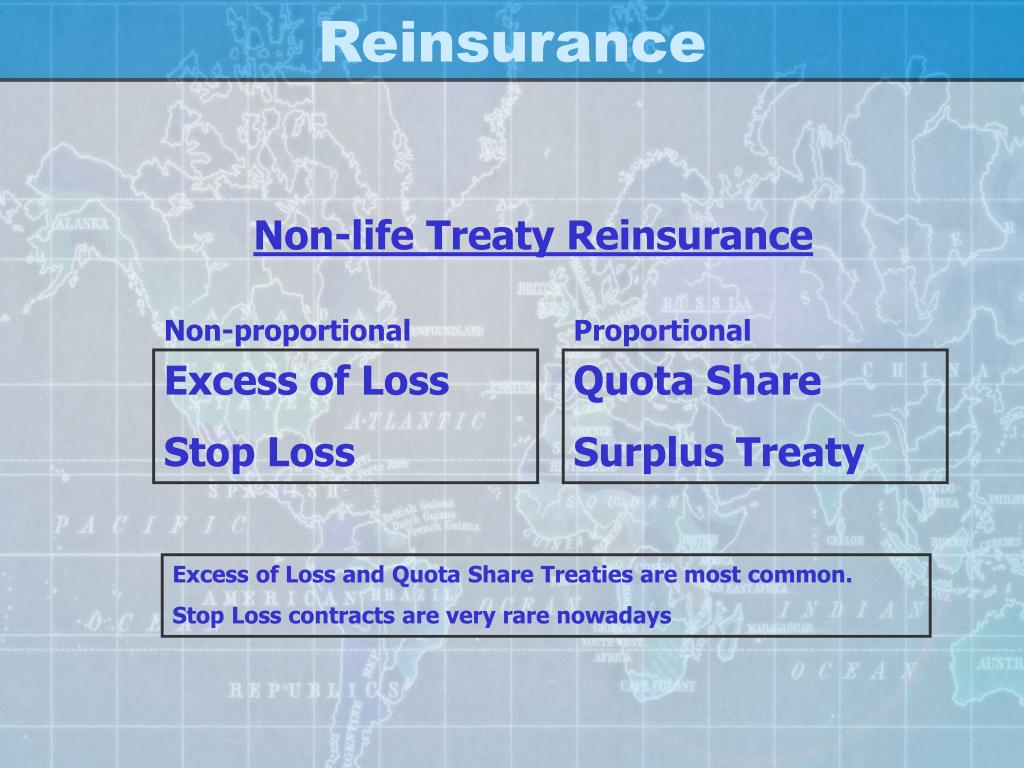

Difference Between Reinsurance And Stop Loss Insurance. Reinsurance comes in a few flavors. There are a number of factors involved in setting this number. In essence, this is a way for an insurance company to protect itself against too many. Proportional reinsurance is called so because both premium and losses are shared between the cedant and the reinsurers based on the cession percentage.

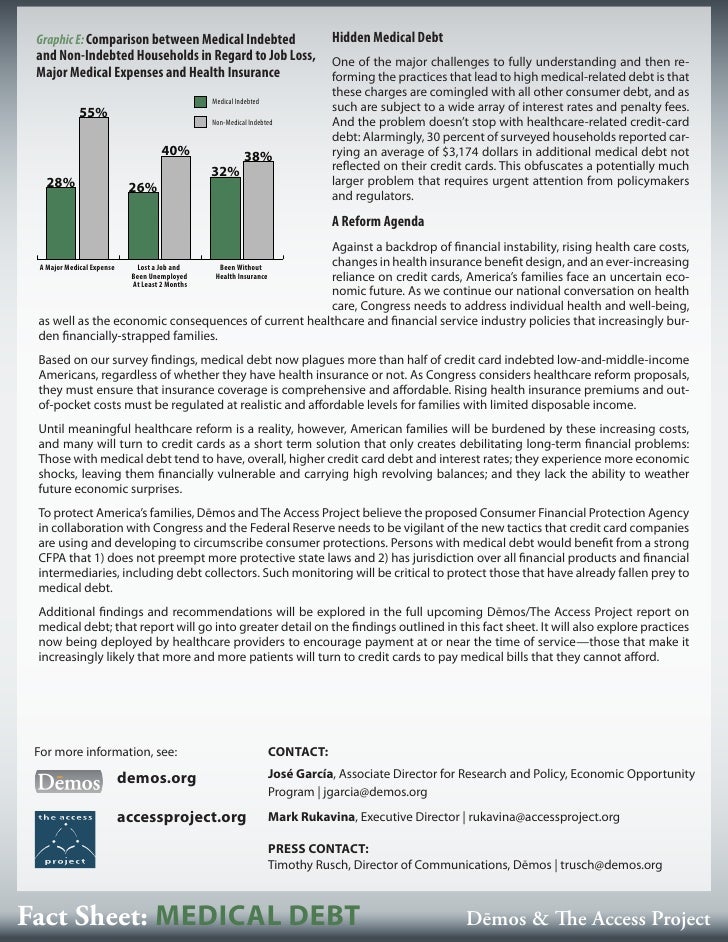

Account Stop Loss Reinsurance Insurance Statutory Audit From jlkrosenberger.com

Account Stop Loss Reinsurance Insurance Statutory Audit From jlkrosenberger.com

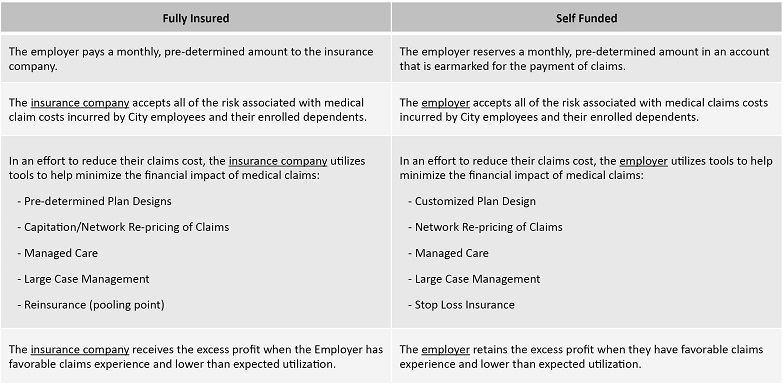

The difference between reinsurance and coinsurance: The differences between insurance and reinsurance. • insurance is a more commonly known concept that describes the. The stop loss reinsurance is designed to protect the primary insurer, the ceding party, from bad results. Aggregate excess reinsurance treaty (stop loss treaty, aggregate excess of loss reinsurance or excess of loss ratio reinsurance) a form of reinsurance where the reinsurer indemnifies the ceding company This handout explains the meaning and difference between insurance and reinsurance.

Any amounts below this attachment point would be paid for by the primary insurance company.

Proportional reinsurance is called so because both premium and losses are shared between the cedant and the reinsurers based on the cession percentage. Stop loss contracts are subject to a specified percentage or monetary amount and then further subject to additional minimum and. They both allow for the transfer of potential loss from one entity to another in exchange for a financial payment in the form of a premium. Specific annual stop loss reinsurance limits the primary carrier�s liability each year to a specified percentage of total. But the core idea is the same: Reinsurance comes in a few flavors.

Source: slideshare.net

Source: slideshare.net

There are a number of factors involved in setting this number. Stop loss contracts are subject to a specified percentage or monetary amount and then further subject to additional minimum and. Conversely, reinsurance is when the insurance company takes up insurance to gaurd itself against risk of. While reinsurance is an act when an insurance providing company purchases an insurance policy to protect itself from the risk of. Specific annual stop loss reinsurance limits the primary carrier�s liability each year to a specified percentage of total.

Source: varipro.com

Source: varipro.com

While reinsurance is an act when an insurance providing company purchases an insurance policy to protect itself from the risk of. This handout explains the meaning and difference between insurance and reinsurance. Here, a relationship is usually drawn between the gross premium and the gross claim over a year in a particular class of. What is the difference between stop loss and reinsurance? See also excess of loss reinsurance, which slr resembles.

This handout explains the meaning and difference between insurance and reinsurance. A form of excess of loss reinsurance under which the reinsurer reimburses the insurer for losses incurred in an annual period by the amount which those losses exceed a specified percentage loss ratio. As example, if the cession percentage is 60 percent and premium is $1,000 and losses are $10,000, the reinsurer receives $600 in reinsurance premium and pays $6,000 in loss. The differences between insurance and reinsurance. Like with aggregate stop loss policies, a specific stop loss policy has a specific deductible.

They both allow for the transfer of potential loss from one entity to another in exchange for a financial payment in the form of a premium. Insurance and reinsurance provide financial protection to an individual or company to guard against risk. See also excess of loss reinsurance, which slr resembles. In order to avoid these issues, healthcare payers often pass on excess risk that they cannot tolerate to secondary payers. Conversely, reinsurance is when the insurance company takes up insurance to gaurd itself against risk of.

Source: slideserve.com

Source: slideserve.com

Buying some insurance protection against. Double insurance is not exactly same as reinsurance, as it is a transfer of risk on a policy by the insurance company, by insuring the same with another insurer.so, there exist a fine line of differences between double insurance and reinsurance, which are explained in this article. If the retention on a reinsurance policy is $500,000, then $500,000 is the “attachment point” and any losses beyond that would be covered by the reinsurance treaty (written as an excess of loss treaty). Is a percentage the insured/policyholder must pay for losses they incur. They both allow for the transfer of potential loss from one entity to another in exchange for a financial payment in the form of a premium.

Source: springgroup.com

Source: springgroup.com

Like with aggregate stop loss policies, a specific stop loss policy has a specific deductible. In essence, this is a way for an insurance company to protect itself against too many. Difference between insurance and reinsurance. Insurance can be simply defined as an act of indemnifying the risk caused to another person. In order to avoid these issues, healthcare payers often pass on excess risk that they cannot tolerate to secondary payers.

Source: slideshare.net

Source: slideshare.net

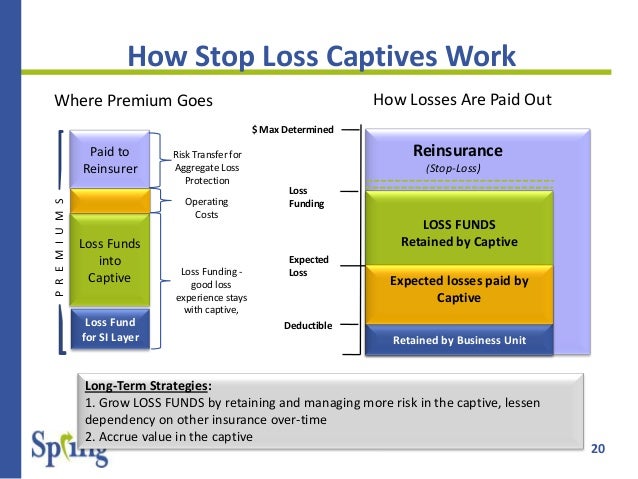

Aggregate excess reinsurance treaty (stop loss treaty, aggregate excess of loss reinsurance or excess of loss ratio reinsurance) a form of reinsurance where the reinsurer indemnifies the ceding company A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either. See also excess of loss reinsurance, which slr resembles. Stop loss reinsurance is a form of reinsurance under which the reinsurer pays the cedant�s losses in any year over a particular percentage of the earned premium. They each function to pool risk;

Source: osstoploss.com

Source: osstoploss.com

Conversely, reinsurance is when the insurance company takes up insurance to gaurd itself against risk of. In order to avoid these issues, healthcare payers often pass on excess risk that they cannot tolerate to secondary payers. A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either. Insurance and reinsurance provide financial protection to an individual or company to guard against risk. Reinsurance, once a sleepy part of managed care, is changing.

Source: entreaspas-pi.blogspot.com

Source: entreaspas-pi.blogspot.com

Reinsurance comes in a few flavors. Proportional reinsurance is called so because both premium and losses are shared between the cedant and the reinsurers based on the cession percentage. The players in the reinsurance market. A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Reinsurance, once a sleepy part of managed care, is changing.

Source: entreaspas-pi.blogspot.com

Source: entreaspas-pi.blogspot.com

There are a number of factors involved in setting this number. Reinsurance comes in a few flavors. Somewhere around $200,000 to $300,000 is a pretty typical range. While reinsurance is an act when an insurance providing company purchases an insurance policy to protect itself from the risk of. If the retention on a reinsurance policy is $500,000, then $500,000 is the “attachment point” and any losses beyond that would be covered by the reinsurance treaty (written as an excess of loss treaty).

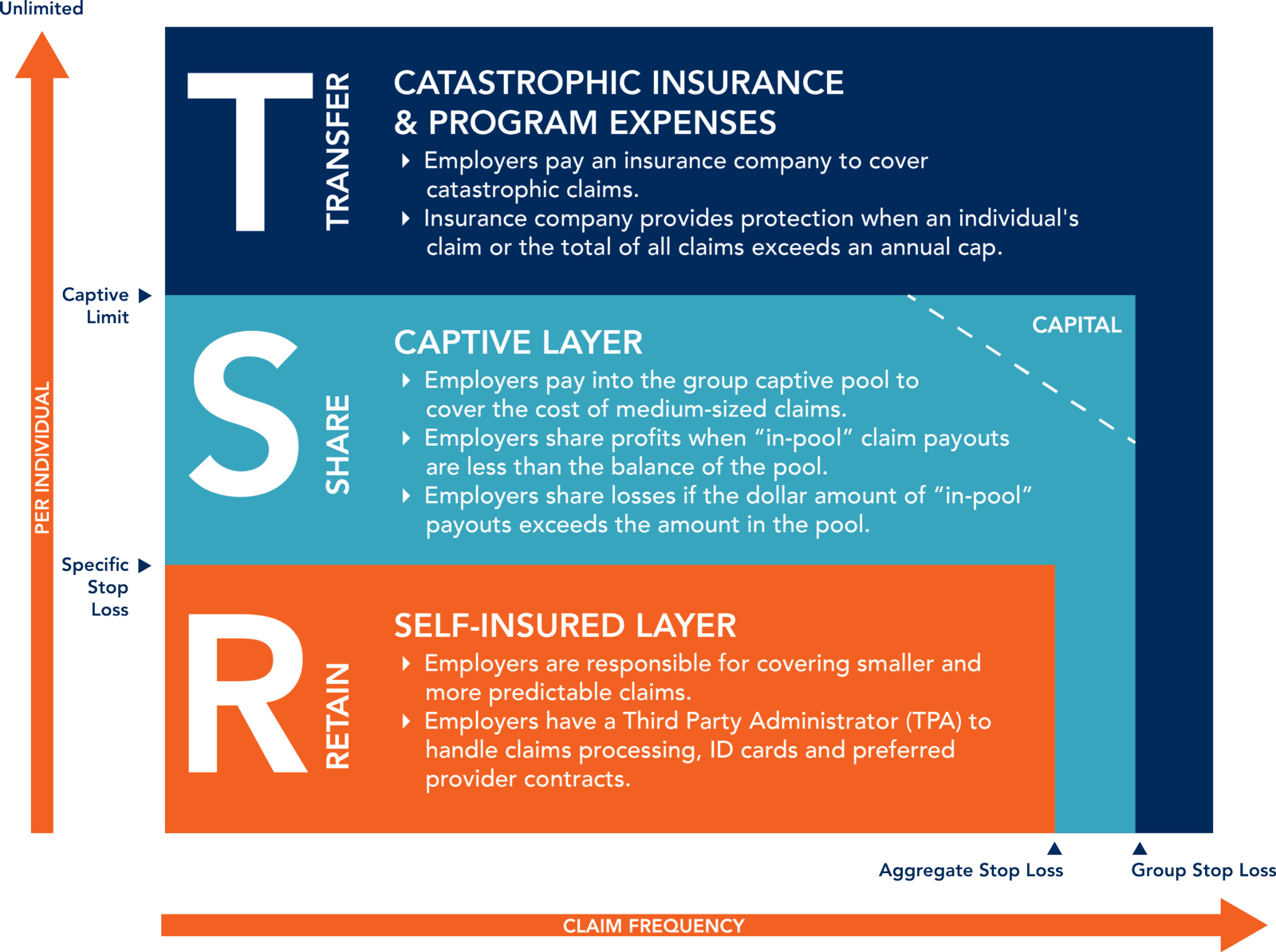

Source: connerstrong.com

Source: connerstrong.com

Stop loss reinsurance is a form of reinsurance under which the reinsurer pays the cedant�s losses in any year over a particular percentage of the earned premium. But the core idea is the same: In order to avoid these issues, healthcare payers often pass on excess risk that they cannot tolerate to secondary payers. While reinsurance is an act when an insurance providing company purchases an insurance policy to protect itself from the risk of. A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit.

Source: jlkrosenberger.com

Source: jlkrosenberger.com

A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Proportional reinsurance is called so because both premium and losses are shared between the cedant and the reinsurers based on the cession percentage. Stop loss contracts are subject to a specified percentage or monetary amount and then further subject to additional minimum and. Usually 12 months, for all reinsurance losses sustained under a treaty during such period. Any amounts below this attachment point would be paid for by the primary insurance company.

Source: slideserve.com

Source: slideserve.com

See also excess of loss reinsurance, which slr resembles. Reinsurance, once a sleepy part of managed care, is changing. Double insurance is not exactly same as reinsurance, as it is a transfer of risk on a policy by the insurance company, by insuring the same with another insurer.so, there exist a fine line of differences between double insurance and reinsurance, which are explained in this article. The players in the reinsurance market. Aggregate excess reinsurance treaty (stop loss treaty, aggregate excess of loss reinsurance or excess of loss ratio reinsurance) a form of reinsurance where the reinsurer indemnifies the ceding company

Source: embroker.com

Source: embroker.com

Difference between insurance and reinsurance. Reinsurance, once a sleepy part of managed care, is changing. The company transfers risk of large loss by purchasing insurance from a “ reinsurer ”. In essence, this is a way for an insurance company to protect itself against too many. The differences between insurance and reinsurance.

Source: providerrisk.com

Source: providerrisk.com

Aggregate excess reinsurance treaty (stop loss treaty, aggregate excess of loss reinsurance or excess of loss ratio reinsurance) a form of reinsurance where the reinsurer indemnifies the ceding company Proportional reinsurance is called so because both premium and losses are shared between the cedant and the reinsurers based on the cession percentage. Reinsurance comes in a few flavors. Insurance is the act of indemnifying the risk, caused to another person. Excess of loss ratio treaty reinsurance.

Source: jlkrosenberger.com

Source: jlkrosenberger.com

A stop loss reinsurance provides reinsurance coverage when the total amount of claims incurred during a specific period (usually one year), exceeds either a loss ratio, either in excess which is a specified amount up to a limit. Is a product the insurance company purchases to insure against large losses. The differences between insurance and reinsurance. Insurance can be simply defined as an act of indemnifying the risk caused to another person. Double insurance is not exactly same as reinsurance, as it is a transfer of risk on a policy by the insurance company, by insuring the same with another insurer.so, there exist a fine line of differences between double insurance and reinsurance, which are explained in this article.

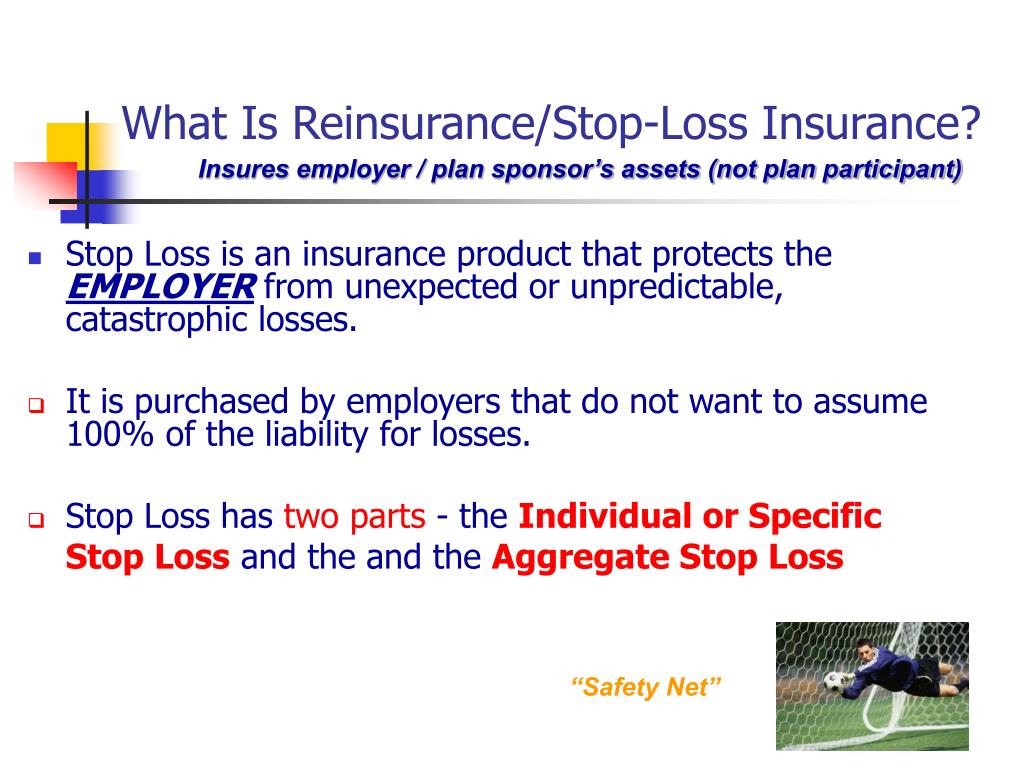

Source: slideserve.com

Source: slideserve.com

See also excess of loss reinsurance, which slr resembles. I saw different definitions of these reinsurance treaties. Difference between insurance and reinsurance. Managed care executives call it reinsurance. If the retention on a reinsurance policy is $500,000, then $500,000 is the “attachment point” and any losses beyond that would be covered by the reinsurance treaty (written as an excess of loss treaty).

Source: entreaspas-pi.blogspot.com

Source: entreaspas-pi.blogspot.com

Difference between insurance and reinsurance. See also excess of loss reinsurance, which slr resembles. They each function to pool risk; In essence, this is a way for an insurance company to protect itself against too many. Reinsurance, once a sleepy part of managed care, is changing.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between reinsurance and stop loss insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea