Difference between surety and insurance information

Home » Trending » Difference between surety and insurance informationYour Difference between surety and insurance images are ready. Difference between surety and insurance are a topic that is being searched for and liked by netizens today. You can Get the Difference between surety and insurance files here. Download all royalty-free images.

If you’re searching for difference between surety and insurance pictures information related to the difference between surety and insurance topic, you have visit the ideal site. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

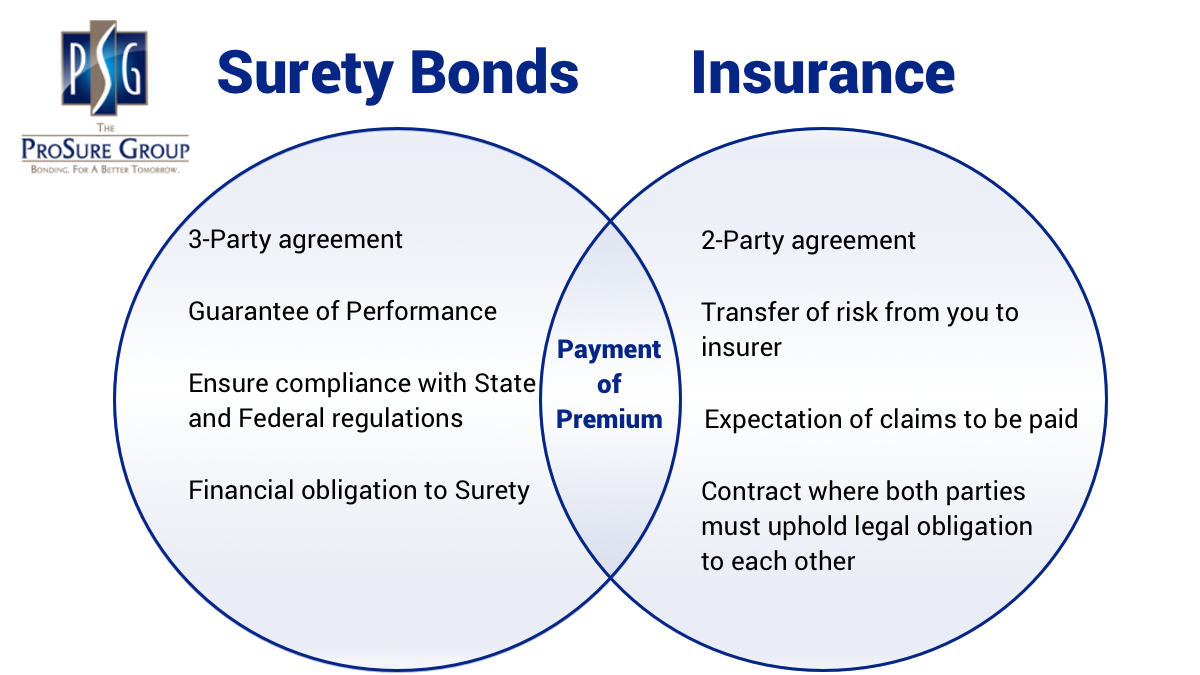

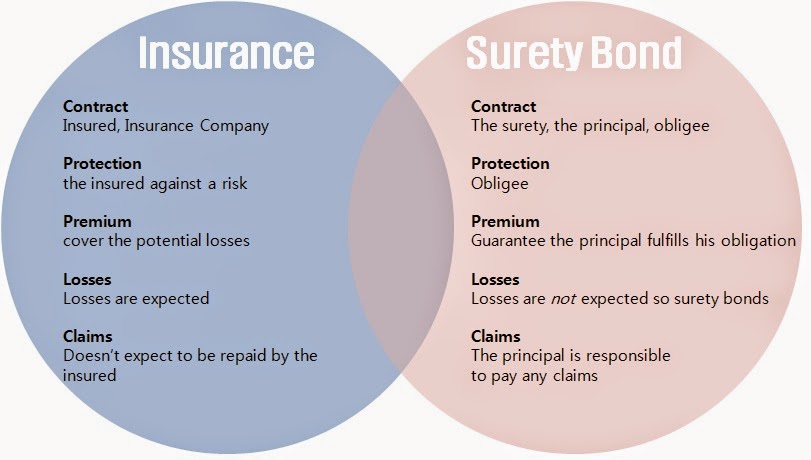

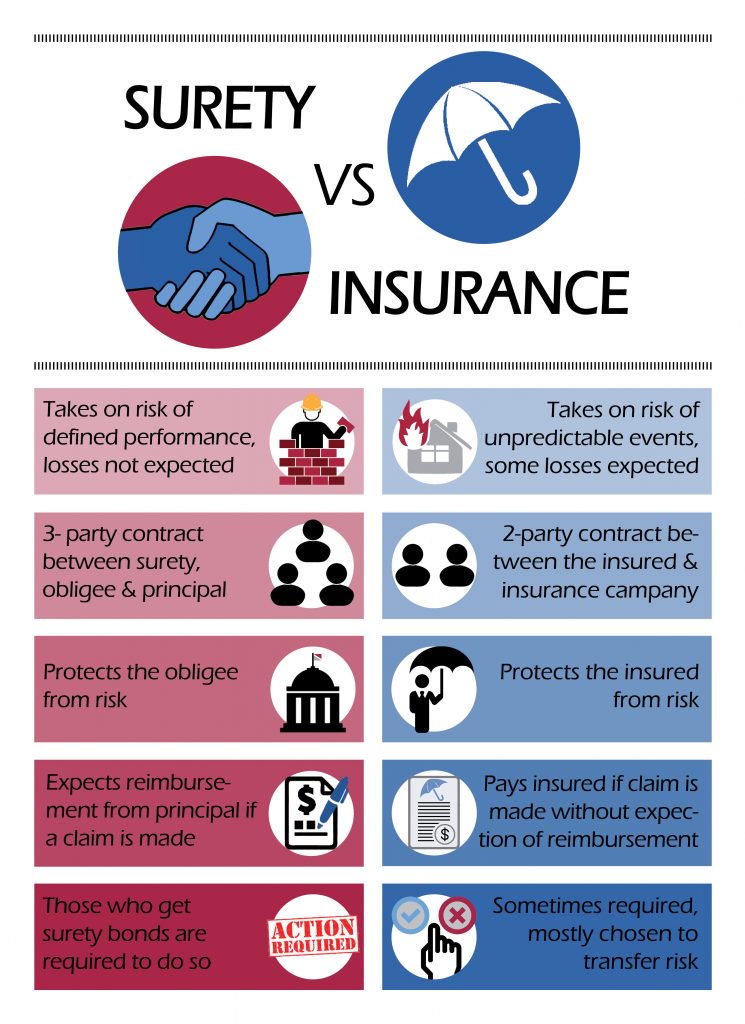

Difference Between Surety And Insurance. Surety bonds and insurance are often mistaken for each other. In this post, we will examine the differences between surety bonds and insurance so that you can understand how each form of protection works. Insurance, on the other hand, protects against financial loss and liabilities. But with surety bonds, risk is always with the principal (the person purchasing the bond), not an insurance company.

What is a Surety Bond and How Does it Differ From From myinsuranceshark.com

What is a Surety Bond and How Does it Differ From From myinsuranceshark.com

Depending on the industry, companies may need either a surety bond, certificate of liability insurance, or both to engage in business or meet contractual obligations.a surety bond and certificate of liability insurance serve two different purposes. Exploring the difference between surety bonds and business insurance many consumers assume that business insurance and surety bonds are the same, but this is a huge misconception. This means that a surety follows the main obligation. In the case of the contractor, an insurance policy usually refers to liability insurance or workers’ compensation. Insurance takes on the risk of unpredictable events that may or may not occur, such as your house burning down. While they share some similarities, there are key distinctions between the two.

While they share some similarities, there are key distinctions between the two.

In this post, we will examine the differences between surety bonds and insurance so that you can understand how each form of protection works. Insurance takes on the risk of unpredictable events that may or may not occur, such as your house burning down. The insurance policy guarantees that the insurance company will compensate the insured when a covered loss occurs. Surety bonds and insurance are often mistaken for each other. Important distinctions a surety is not an insurance policy. The payment made to the surety company is paying for the bond, but the principal is.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

Surety bonds involve 3 people: The person doing the work (principal), the person requiring the work (obligee), and the surety company providing the bond (surety). The guarantor, an insurer or a bank, promises the same performance as the principal debtor. The object of a surety is therefore the. If you decide to get business insurance coverage, which is a great idea, it will not suffice for specific components of your business operation.

Source: tbeblog.com

Source: tbeblog.com

Now that you know the basics of how a surety bond and insurance policy both work, we can discuss the differences between them: This means that a surety follows the main obligation. As nouns the difference between insurance and surety is that insurance is a means of indemnity against a future occurrence of an uncertain event while surety is certainty. The most basic difference between surety and insurance is that surety is a three party arrangement and insurance is a two party arrangement. The only similarity between the two is that businesses pay the premium to have either of them in effect.

Source: focusinsuranceatlanta.com

Source: focusinsuranceatlanta.com

But with surety bonds, risk is always with the principal (the person purchasing the bond), not an insurance company. In other words, surety companies do not assume liability for the violation of bond agreements on behalf of bond principals. The payment made to the surety company is paying for the bond, but the principal is. Insurance, on the other hand, protects against financial loss and liabilities. Exploring the difference between surety bonds and business insurance many consumers assume that business insurance and surety bonds are the same, but this is a huge misconception.

Source: bondexchange.com

Source: bondexchange.com

With traditional insurance, the risk of loss is transferred to the insurance company but in surety, the risk remains with the principal. The object of a surety is therefore the. For many clients, hearing that a contractor is also bonded, gives the project owner confidence that they will be protected, in the case that the contract is not satisfactorily completed. Surety bonds involve 3 people: The only similarity between the two is that businesses pay the premium to have either of them in effect.

Source: rlicorp.com

Source: rlicorp.com

The guarantor, an insurer or a bank, promises the same performance as the principal debtor. As nouns the difference between insurance and surety is that insurance is a means of indemnity against a future occurrence of an uncertain event while surety is certainty. The difference from insurance however is the surety company has the option to after the contractor for not holding up their end of the contract, recouping any financial lose the surety company paid out. In other words, surety companies do not assume liability for the violation of bond agreements on behalf of bond principals. Insurance policies involve 2 people:

![[Education] Surety Bonds vs Auto Insurance Risk vs Reward [Education] Surety Bonds vs Auto Insurance Risk vs Reward](https://www.autoinsuresavings.org/wp-content/uploads/2018/06/Surety-bonds-vs-auto-insurance-price-comparison.-min-1.jpg) Source: autoinsuresavings.org

Source: autoinsuresavings.org

Unlike most types of insurance a surety bond is required by, and protects the interest of,. The insurance policy guarantees that the insurance company will compensate the insured when a covered loss occurs. They’re mistaken for insurance because they often involve payment when things don’t go as planned. Because insurance does not require the contractor to pay up ahead, it might be less expensive than a surety bond. This risk transfer in surety is handled through an indemnity clause that is signed by the applicant as part of the bond application.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

A surety[1] is an accessory security for a main obligation. What’s the difference between insurance and a surety bond? While they share some similarities, there are key distinctions between the two. The guarantor, an insurer or a bank, promises the same performance as the principal debtor. The coverage insurance an insurance contract protects you, the insured, from any costs incurred on the job site.

Source: prosuregroup.com

Source: prosuregroup.com

Surety bonds are actually a form of credit. Because insurance does not require the contractor to pay up ahead, it might be less expensive than a surety bond. They’re mistaken for insurance because they often involve payment when things don’t go as planned. What is the difference between surety and insurance or indemnity? One serious difference between insurance and surety is to whom we are transferring the risk and the kind of risk we are transferring.

Source: blog.suretysolutionsllc.com

Source: blog.suretysolutionsllc.com

For example, an insurer has access to assets that can be liquidated when necessary, while a surety only has the ability to collect from its contracted parties or refer them to collections agencies if necessary. Again, this usually takes the form of a contract. Important distinctions a surety is not an insurance policy. With traditional insurance, the risk of loss is transferred to the insurance company but in surety, the risk remains with the principal. But with surety bonds, risk is always with the principal (the person purchasing the bond), not an insurance company.

Source: pinterest.com

Source: pinterest.com

If you decide to get business insurance coverage, which is a great idea, it will not suffice for specific components of your business operation. Insurance policies involve 2 people: Now that you know the basics of how a surety bond and insurance policy both work, we can discuss the differences between them: Again, this usually takes the form of a contract. The guarantor, an insurer or a bank, promises the same performance as the principal debtor.

Source: smallbizdaily.com

Source: smallbizdaily.com

The payment made to the surety company is paying for the bond, but the principal is. Because insurance does not require the contractor to pay up ahead, it might be less expensive than a surety bond. It’s an important distinction to make, though it can be confusing. What’s the difference between insurance and a surety bond? Insurance takes on the risk of unpredictable events that may or may not occur, such as your house burning down.

Source: swiftbonds.com

Source: swiftbonds.com

The person doing the work (principal), the person requiring the work (obligee), and the surety company providing the bond (surety). It’s an important distinction to make, though it can be confusing. Insurance policies involve 2 people: Now that you know the basics of how a surety bond and insurance policy both work, we can discuss the differences between them: Surety, which is also often called “surety bonds,” is a contract which involves three parties.

![Surety Bonds vs Insurance Policy The Difference [Infographic] Surety Bonds vs Insurance Policy The Difference [Infographic]](https://www.performancesuretybonds.com/blog/wp-content/uploads/2019/07/Surety-Bonds-vs.-Insurance-Policies-Infographic_v1.jpg) Source: performancesuretybonds.com

Source: performancesuretybonds.com

As nouns the difference between insurance and surety is that insurance is a means of indemnity against a future occurrence of an uncertain event while surety is certainty. Surety bonds are actually a form of credit. Insurance policies involve 2 people: They’re mistaken for insurance because they often involve payment when things don’t go as planned. The difference from insurance however is the surety company has the option to after the contractor for not holding up their end of the contract, recouping any financial lose the surety company paid out.

Source: netsurance.ca

Source: netsurance.ca

Surety bonds with surety bonds, the risk remains with the principal, and the protection is for the obligee (s). In the case of the contractor, an insurance policy usually refers to liability insurance or workers’ compensation. While surety bonds take on the risk of defined performance that actually should occur. In this post, we will examine the differences between surety bonds and insurance so that you can understand how each form of protection works. The coverage insurance an insurance contract protects you, the insured, from any costs incurred on the job site.

Source: insucompany.com

Source: insucompany.com

This risk transfer in surety is handled through an indemnity clause that is signed by the applicant as part of the bond application. But with surety bonds, risk is always with the principal (the person purchasing the bond), not an insurance company. A surety bond is also a contract, but between three parties: Insurance policies involve 2 people: The person doing the work (principal), the person requiring the work (obligee), and the surety company providing the bond (surety).

Source: alphasurety.com

Source: alphasurety.com

Surety bonds and insurance are often mistaken for each other. Who is involved in a surety bond vs insurance policy a surety bond involves three parties: A surety[1] is an accessory security for a main obligation. In this post, we will examine the differences between surety bonds and insurance so that you can understand how each form of protection works. Now that you know the basics of how a surety bond and insurance policy both work, we can discuss the differences between them:

Source: pinterest.com

Source: pinterest.com

Again, this usually takes the form of a contract. The object of a surety is therefore the. One serious difference between insurance and surety is to whom we are transferring the risk and the kind of risk we are transferring. They do not protect the project owner, but rather the workers. For many clients, hearing that a contractor is also bonded, gives the project owner confidence that they will be protected, in the case that the contract is not satisfactorily completed.

Source: suretybonds.org

Source: suretybonds.org

Exploring the difference between surety bonds and business insurance many consumers assume that business insurance and surety bonds are the same, but this is a huge misconception. Exploring the difference between surety bonds and business insurance many consumers assume that business insurance and surety bonds are the same, but this is a huge misconception. Surety bonds are actually a form of credit. Surety bonds involve 3 people: In this post, we will examine the differences between surety bonds and insurance so that you can understand how each form of protection works.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title difference between surety and insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea