Difference between universal life and variable universal life insurance Idea

Home » Trend » Difference between universal life and variable universal life insurance IdeaYour Difference between universal life and variable universal life insurance images are ready. Difference between universal life and variable universal life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Difference between universal life and variable universal life insurance files here. Download all royalty-free photos and vectors.

If you’re looking for difference between universal life and variable universal life insurance images information linked to the difference between universal life and variable universal life insurance interest, you have come to the ideal site. Our site frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

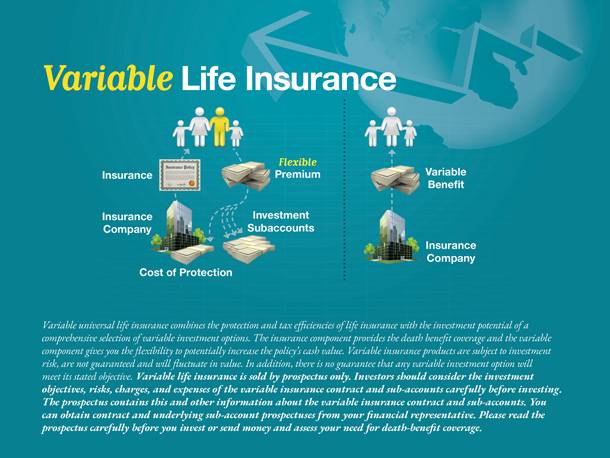

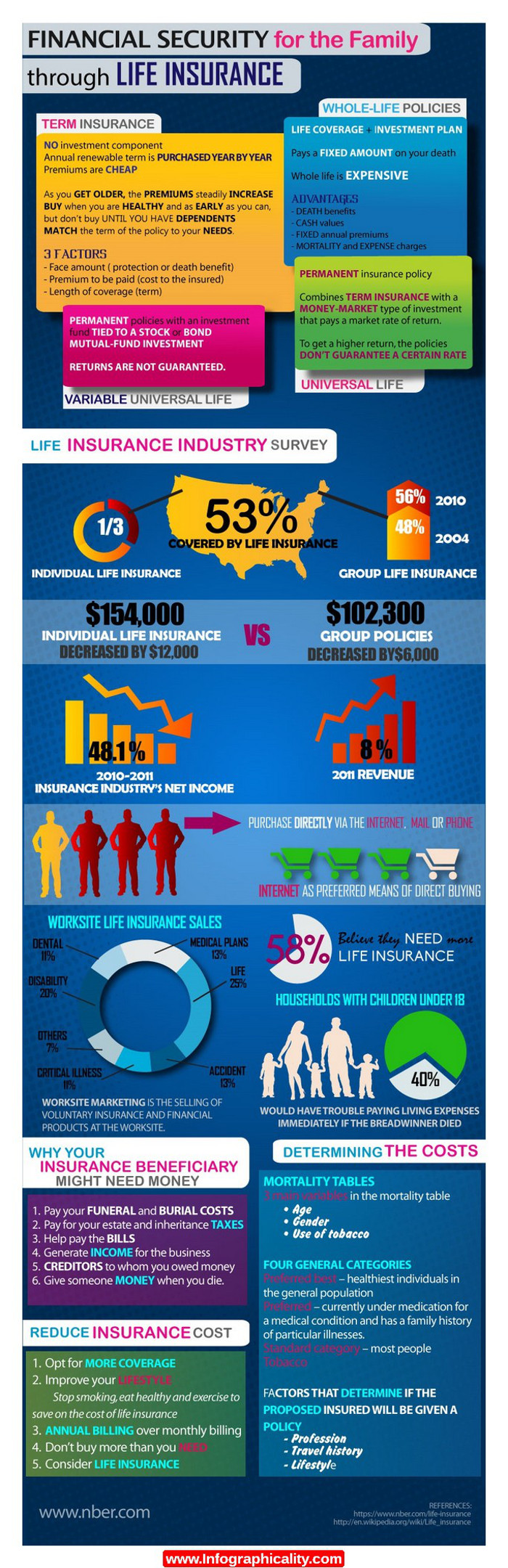

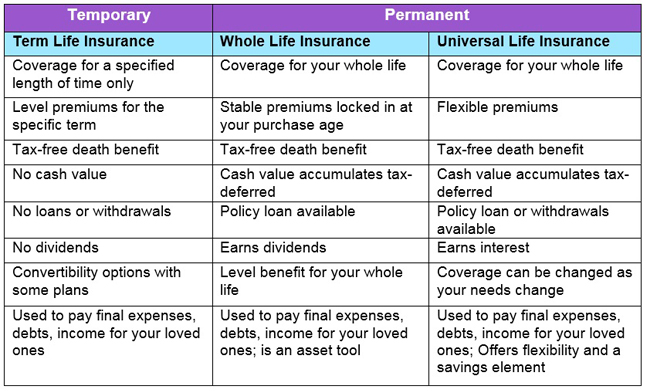

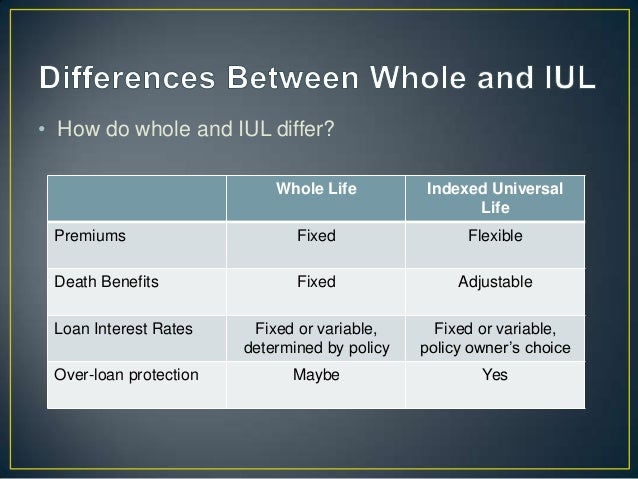

Difference Between Universal Life And Variable Universal Life Insurance. While both function similarly in terms of the flexibility of premium payments, cash value accrual account, and changes in premium payments, the difference lies in the way the cash value account earns money. These policies also charge higher premiums than the cost of insuring you; Like the iul, a vul allows policyholders to adjust their. For investors that love to watch the market, variable life insurance products are interesting.

Whats the difference between whole life and term life From greatoutdoorsabq.com

Whats the difference between whole life and term life From greatoutdoorsabq.com

Learn vocabulary, terms, and more with flashcards, games, and other study tools. Each type remains effective throughout your life as long as the premiums are up to date, but they provide different financial tools that could affect the final value of the policy. Another key difference would be how the interest is paid. Many people like the fixed premium of whole life because they know what they have to pay and can budget accordingly. The other major benefit whole/universal life insurance offers is that the premiums have the capability of growing as cash value over the life of the policy. Variable universal life insurance gives owners more control than other types of life insurance products.

Adjustable life vs universal life vs variable life.

If the policy performs well,. Of the $50,000 year one premium, $6,866 went toward various administrative and insurance fees, leaving $43,134 in cash value before any account growth. Learn vocabulary, terms, and more with flashcards, games, and other study tools. The other major benefit whole/universal life insurance offers is that the premiums have the capability of growing as cash value over the life of the policy. These policies also charge higher premiums than the cost of insuring you; Variable universal life insurance (vul) for retirement.

Source: policygenius.com

Source: policygenius.com

While some types of permanent life insurance policies have savings components that can grow above and beyond a normal interest rate, a universal life policy will only pay a set amount of interest each year. Adjustable life vs universal life vs variable life. The policy could be variable whole life, universal whole life, or some other type altogether. The simple answer is that in most cases, a traditional whole life insurance policy is a better choice than a variable universal life insurance contract. A traditional whole life insurance contract has scheduled premiums that do not change, the dividend growth is relatively predictable and has minimum guarantees, and as long as the premiums are.

Source: termlifeadvice.com

Source: termlifeadvice.com

Of the two “variable” options, variable universal life is the more popular. If the cost of insurance rises dramatically and the interest rate paid to the policy falls to the guaranteed rate, many adjustable or. Variable universal life insurance gives owners more control than other types of life insurance products. While some types of permanent life insurance policies have savings components that can grow above and beyond a normal interest rate, a universal life policy will only pay a set amount of interest each year. Adjustable life vs universal life vs variable life.

Source: personalcapital.com

Source: personalcapital.com

With this extended period, premiums are considerably more expensive. Of the $50,000 year one premium, $6,866 went toward various administrative and insurance fees, leaving $43,134 in cash value before any account growth. Of the two “variable” options, variable universal life is the more popular. Variable and universal life insurance are both types of permanent life. For investors that love to watch the market, variable life insurance products are interesting.

Source: nomedicallifeinsurance.ca

Source: nomedicallifeinsurance.ca

The simple answer is that in most cases, a traditional whole life insurance policy is a better choice than a variable universal life insurance contract. Another key difference would be how the interest is paid. Some people may prefer the set death benefit, level premiums, and the potential for growth of a whole life policy. Start studying life chart : Adjustable life vs universal life vs variable life.

Source: aspenwealthmgmt.com

Source: aspenwealthmgmt.com

Each type remains effective throughout your life as long as the premiums are up to date, but they provide different financial tools that could affect the final value of the policy. Whole life vs variable universal life. Variable life insurance policies are permanent life insurance policies with a death benefit, just like universal and whole life policies. Start studying life chart : The key difference between variable and universal life insurance is the way the cash value grows.

Source: easyquotes4you.com

Source: easyquotes4you.com

Reducing the index cap is specific to iul policies, but increasing costs can be a risk with many different types of life insurance policies. The main downside of universal life insurance is the interest rate, which is often dependent on market conditions. Of the two “variable” options, variable universal life is the more popular. Like the iul, a vul allows policyholders to adjust their. Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Some people may prefer the set death benefit, level premiums, and the potential for growth of a whole life policy. Like the iul, a vul allows policyholders to adjust their. With this extended period, premiums are considerably more expensive. While variable life insurance gives you investment options to grow your cash value, the cash value in a universal life insurance policy grows at a rate set by the insurer. There are three main types of permanent life insurance:

Source: insuranceandestates.com

Source: insuranceandestates.com

Learn vocabulary, terms, and more with flashcards, games, and other study tools. Whole and universal life insurance differ from term insurance in that they last for your whole life. With this extended period, premiums are considerably more expensive. Variable universal life insurance gives owners more control than other types of life insurance products. While a universal life insurance product pays interest, a variable.

Source: healthresearchfunding.org

Source: healthresearchfunding.org

Whole life insurance is much more expensive than term life insurance, and variable life insurance can be more costly than whole life coverage. Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance. While variable life insurance gives you investment options to grow your cash value, the cash value in a universal life insurance policy grows at a rate set by the insurer. These policies also charge higher premiums than the cost of insuring you; Variable universal life insurance and universal life insurance are two very different products.

Source: abramsinc.com

Source: abramsinc.com

Variable universal life insurance and universal life insurance are two very different products. Whole life, universal life, and variable life. All other permanent life insurance policies are based on. Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance. The estate planning advantage of universal life policies over whole life policies.

Source: womanslife.org

Source: womanslife.org

Whole life insurance benefits include fixed premiums which can be supplemented through dividends, whereas variable universal life has more flexibility built into the policy. If the cost of insurance rises dramatically and the interest rate paid to the policy falls to the guaranteed rate, many adjustable or. (the exact amount that goes into savings is determined by your individual policy.) Of the $50,000 year one premium, $6,866 went toward various administrative and insurance fees, leaving $43,134 in cash value before any account growth. A whole life insurance policy is a broad definition.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

For investors that love to watch the market, variable life insurance products are interesting. (the exact amount that goes into savings is determined by your individual policy.) But life insurance is important, so it�s crucial to understand the types of policies available to you. The main downside of universal life insurance is the interest rate, which is often dependent on market conditions. While the interest paid on universal life insurance can be subject to prevailing interest rate environments, interest on a whole life insurance policy is fixed.

Source: easyquotes4you.com

Source: easyquotes4you.com

If the cost of insurance rises dramatically and the interest rate paid to the policy falls to the guaranteed rate, many adjustable or. Universal life insurance is a type of permanent life insurance that focuses more on flexible premiums rather than cash value growth. The other major benefit whole/universal life insurance offers is that the premiums have the capability of growing as cash value over the life of the policy. The estate planning advantage of universal life policies over whole life policies. When it comes to preserving and transferring wealth from one generation to the next, ul policies really do the job well.

Source: khafdesign.blogspot.com

With a fixed premium, guaranteed cash value accumulation, and a guaranteed death benefit, this is a popular choice among consumers. Variable life insurance policies are permanent life insurance policies with a death benefit, just like universal and whole life policies. If the policy performs well,. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Variable universal life insurance and universal life insurance are two very different products.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Variable universal life insurance and universal life insurance are two very different products. Universal life insurance is a type of permanent life insurance that focuses more on flexible premiums rather than cash value growth. Universal life, such as indexed universal life (iul) and variable universal life (vul), is a form of permanent life insurance, also known as cash value life insurance. (the exact amount that goes into savings is determined by your individual policy.) With a fixed premium, guaranteed cash value accumulation, and a guaranteed death benefit, this is a popular choice among consumers.

Source: youtube.com

Source: youtube.com

This is what the average american pays each month for a $250,000 whole life policy, depending on their gender and the age that they enrolled: The policy could be variable whole life, universal whole life, or some other type altogether. In this article, we’re going to discuss the finer details of whole life insurance vs variable universal. But life insurance is important, so it�s crucial to understand the types of policies available to you. Of the $50,000 year one premium, $6,866 went toward various administrative and insurance fees, leaving $43,134 in cash value before any account growth.

Source: slideshare.net

Source: slideshare.net

This provides flexibility in regards to premium. With this extended period, premiums are considerably more expensive. A whole life insurance policy is a broad definition. Whole life, universal life, and variable life. Variable universal life insurance gives owners more control than other types of life insurance products.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

These policies also charge higher premiums than the cost of insuring you; Reducing the index cap is specific to iul policies, but increasing costs can be a risk with many different types of life insurance policies. Like the iul, a vul allows policyholders to adjust their. Of the $50,000 year one premium, $6,866 went toward various administrative and insurance fees, leaving $43,134 in cash value before any account growth. Many people like the fixed premium of whole life because they know what they have to pay and can budget accordingly.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between universal life and variable universal life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information