Diminished value letter to insurance Idea

Home » Trending » Diminished value letter to insurance IdeaYour Diminished value letter to insurance images are ready in this website. Diminished value letter to insurance are a topic that is being searched for and liked by netizens today. You can Download the Diminished value letter to insurance files here. Get all royalty-free photos and vectors.

If you’re searching for diminished value letter to insurance images information related to the diminished value letter to insurance keyword, you have visit the ideal blog. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

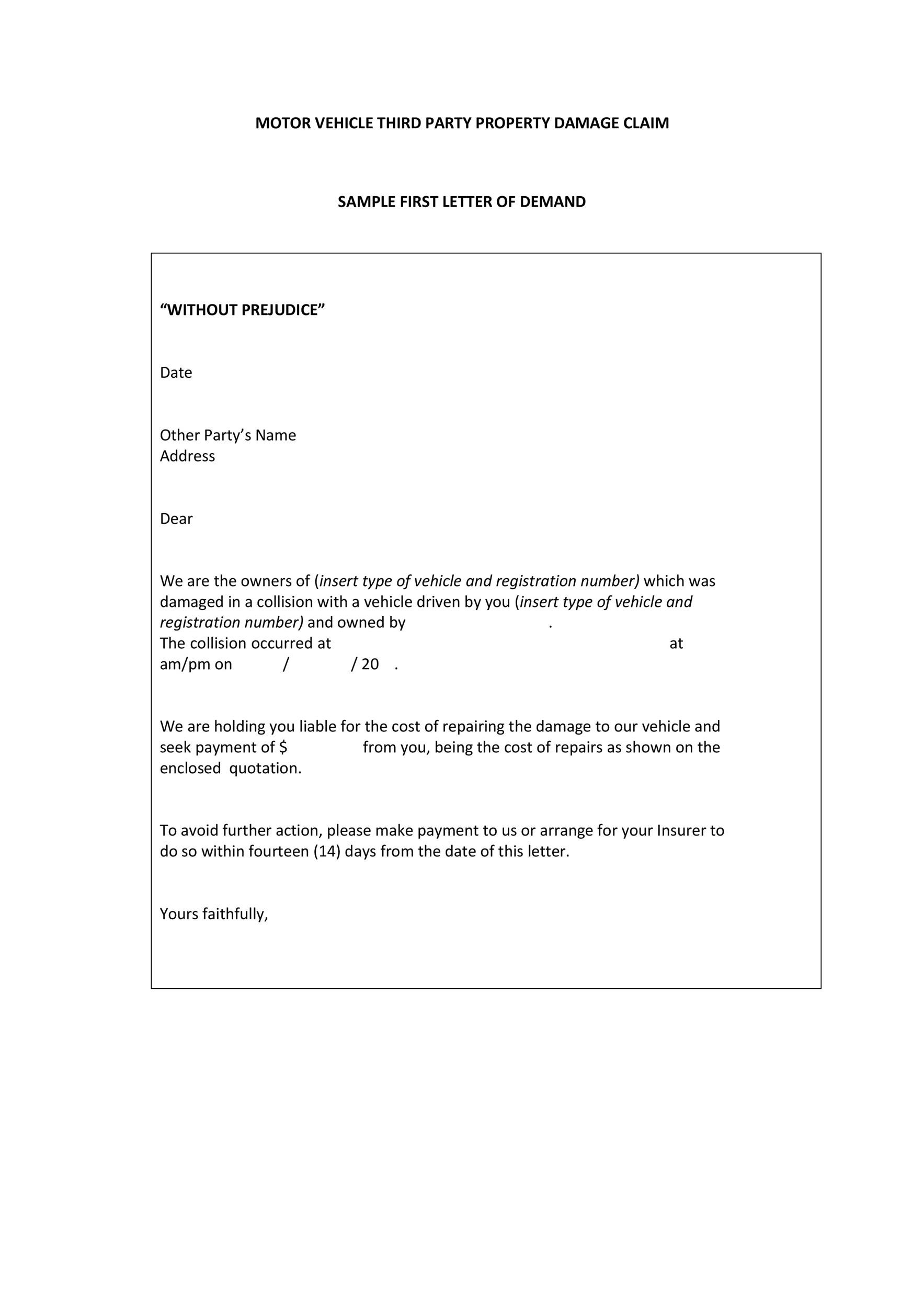

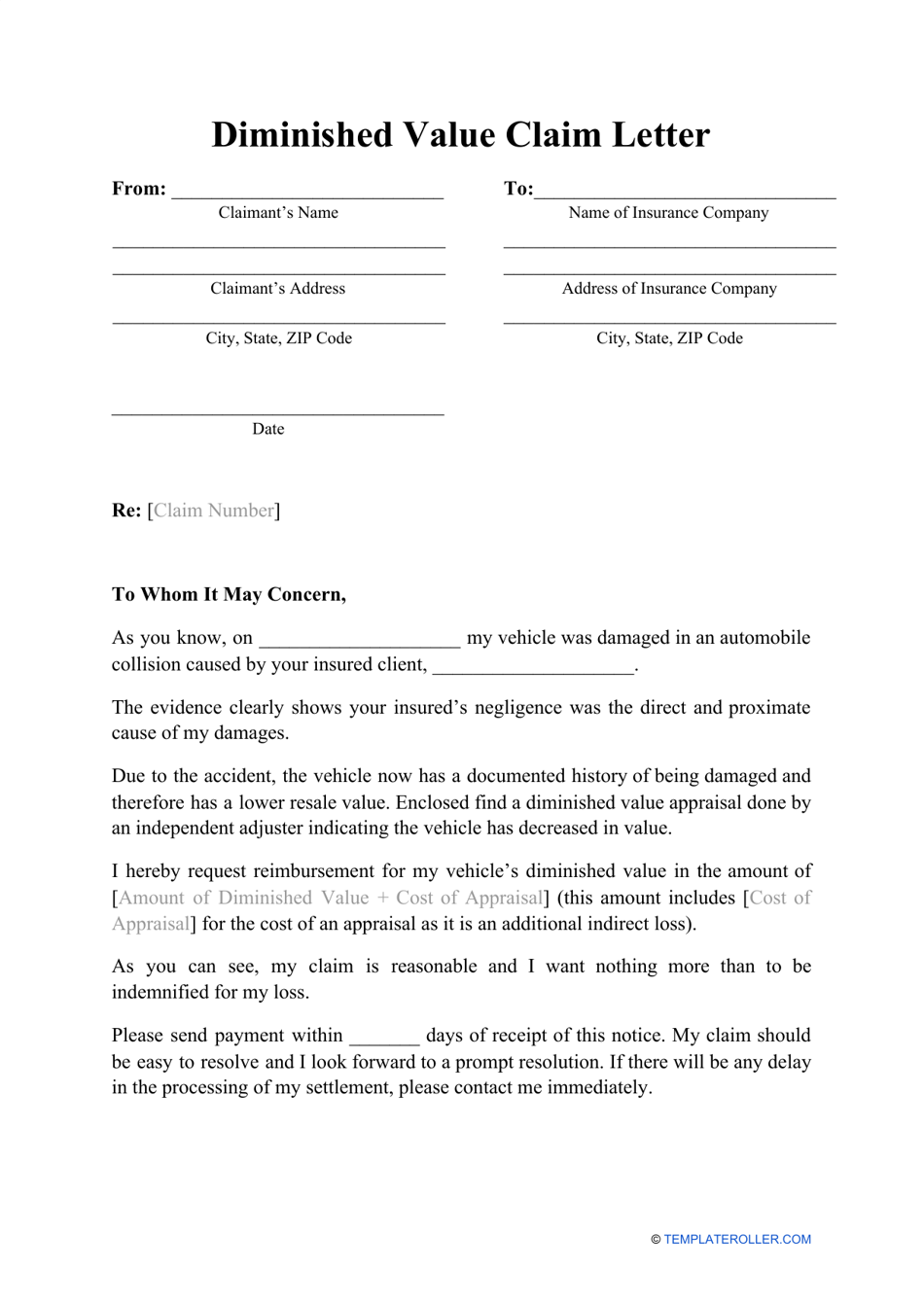

Diminished Value Letter To Insurance. Let’s say the insurance company says your car will need $5000.00 in repairs, but the best quote you have is for $7500.00 and you also aren’t even counting your diminished value. Enclosed find a diminished value appraisal done by an independent adjuster indicating the vehicle has decreased in value. The legal basis of your diminished value claim; Even if you’ve already settled with the insurance company on the body damage, you can still file a separate diminished value claim if the repairs were done recently.

Sample Demand Letter To Insurance Company For Property From mamiihondenk.org

Sample Demand Letter To Insurance Company For Property From mamiihondenk.org

Even after the vehicle has been repaired to it’s optimal value, the market value of the vehicle may still be reduced. Here are the steps to filing a diminished value insurance claim, at a glance: Most companies use the following for structure when calculating damage: Document the amount of your lost value by ordering your diminished value report. The facts of your claim, with proof, if possible; Enclosed find a diminished value appraisal done by an independent adjuster indicating the vehicle has decreased in value.

There are three types of diminished value that your case may fall under:

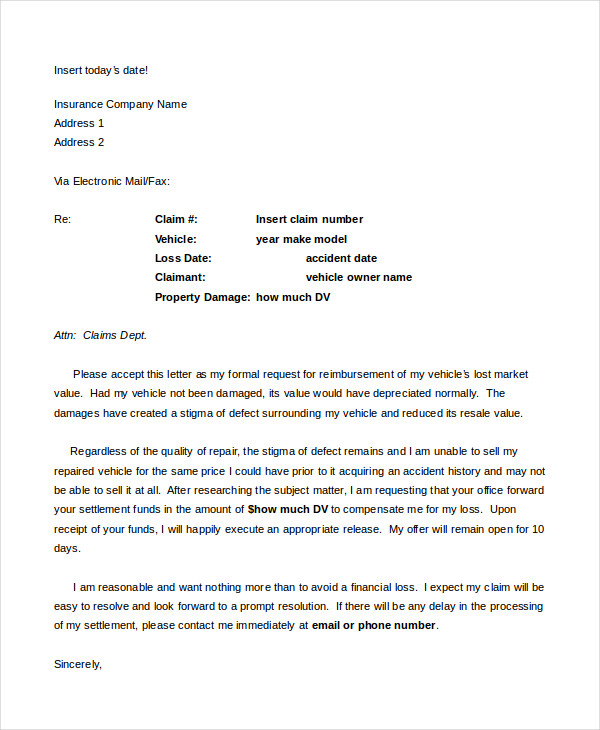

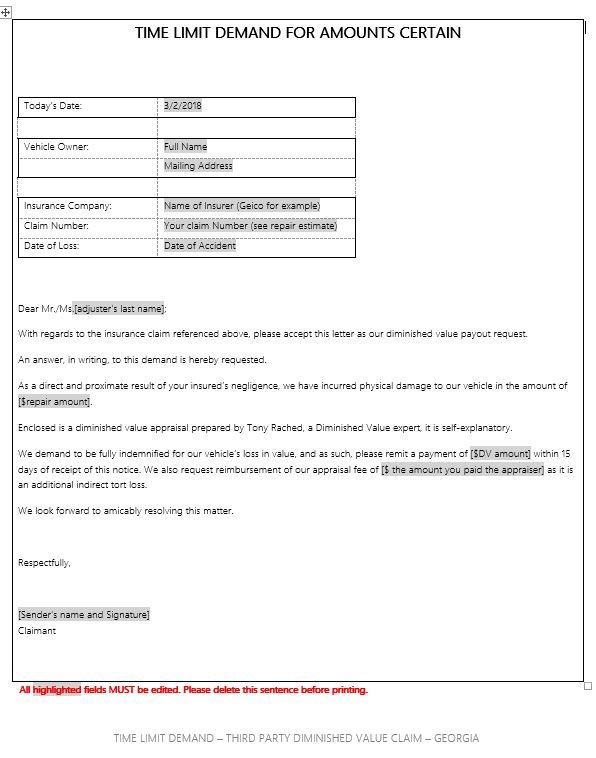

With regards to the insurance claim referenced above, please accept this letter and the documentation attached as our diminished value payout request. Your insurance claim for diminished value can be paid by your own insurance company or the other party’s company. An explanation as to the purpose of the letter; This letter is an attempt to clearly state why i believe i am owed diminished value, and why we believe the denial letter sent by farmers is wrong in its conclusion. Even if you’ve already settled with the insurance company on the body damage, you can still file a separate diminished value claim if the repairs were done recently. I hereby request reimbursement for my vehicle’s diminished value in the amount of $[amount of dv + cost of appraisal] (this amount includes $[cost of appraisal) for the cost of an appraisal as it is an additional indirect loss).

Source: pinterest.co.uk

Source: pinterest.co.uk

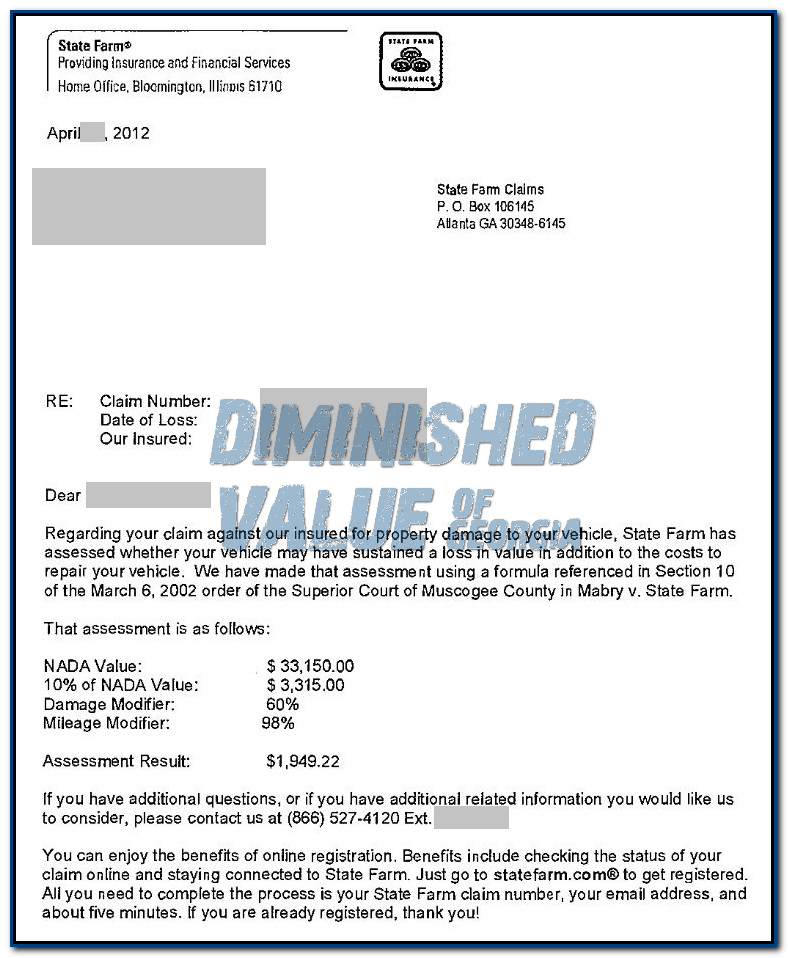

A diminished value insurance claim is when you request money from your car insurance company to pay the difference between your car�s value before the accident and its current value now that it has been repaired. With regards to the insurance claim referenced above, please accept this letter and the documentation attached as our diminished value payout request. You know that to get it fixed right it will cost more than $5k, and even after it is perfectly repaired, it now has a marred history, further reducing it’s marketability. Next, you will apply a damage multiplier. Most insurance companies place a 10 percent cap on any diminished value.

Source: template.net

Source: template.net

A claim letter explains the situation and ends by asking for what you want. Document the amount of your lost value by ordering your diminished value report. The facts of your claim, with proof, if possible; Let’s say the insurance company says your car will need $5000.00 in repairs, but the best quote you have is for $7500.00 and you also aren’t even counting your diminished value. A claim letter explains the situation and ends by asking for what you want.

![diminished value claim [NY] Insurance diminished value claim [NY] Insurance](https://external-preview.redd.it/WjR5zvdqvINF_Cw9gql5fRXMRXGUgH6qKJW6MRzG5i4.jpg?auto=webp&s=ce4869b48eabf8f97dab9fefdb85c55e1dc93e75) Source: reddit.com

Source: reddit.com

The facts of your claim, with proof, if possible; Most insurance companies place a 10 percent cap on any diminished value. Here are the steps to filing a diminished value insurance claim, at a glance: This letter is in response to my inability to collect diminished value damages occurring as a result of an accident where the person insured by farmers was at fault. With regards to the insurance claim referenced above, please accept this letter and the documentation attached as our diminished value payout request.

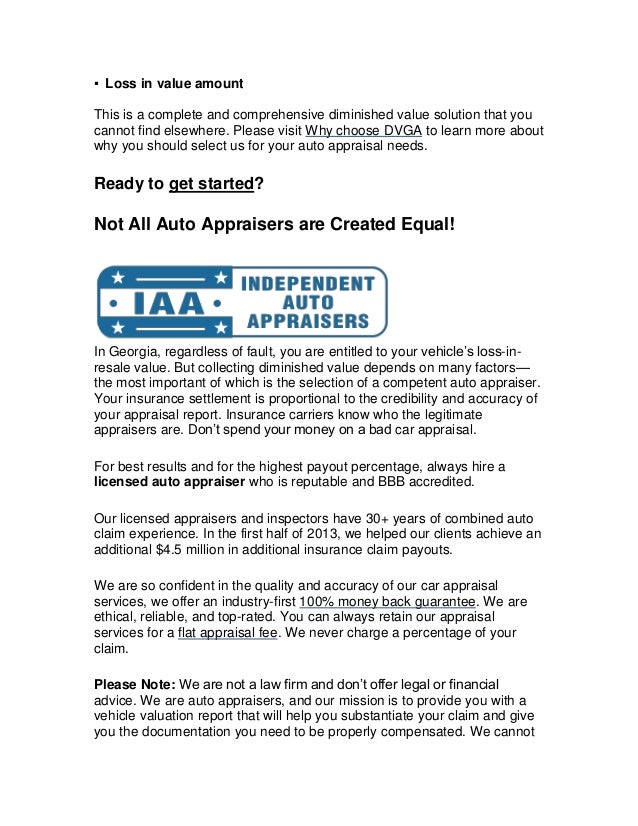

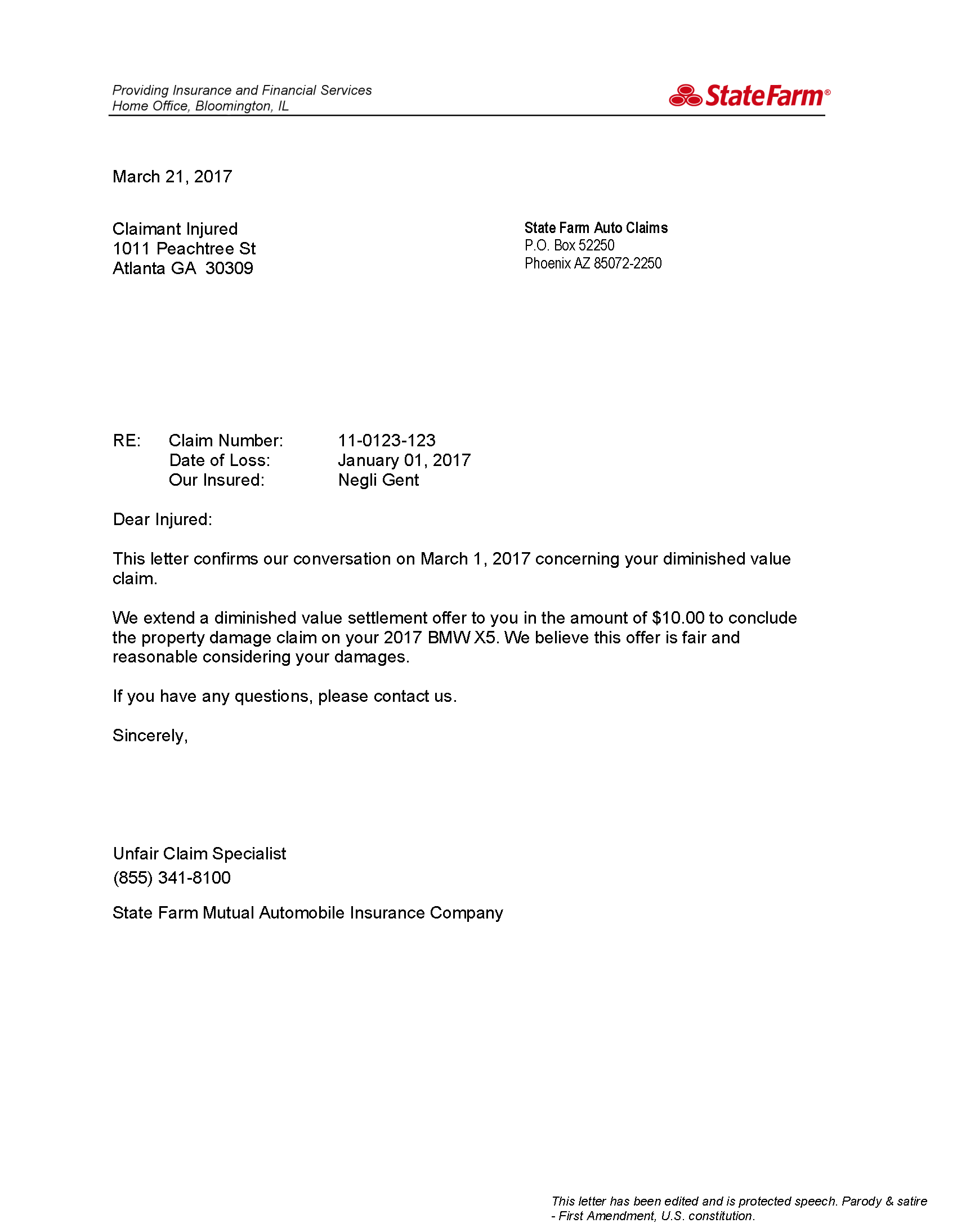

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

Next, you will apply a damage multiplier. Diminished value refers to the reduced value of a vehicle simply because it has a significant damage history. Even if you’ve already settled with the insurance company on the body damage, you can still file a separate diminished value claim if the repairs were done recently. The facts of your claim, with proof, if possible; Pursue a diminished value claim as soon as possible—ideally in the days following the accident—as states have statutes of limitations on property claims.

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

0.00 for no structural damage. An explanation as to the purpose of the letter; You know that to get it fixed right it will cost more than $5k, and even after it is perfectly repaired, it now has a marred history, further reducing it’s marketability. Diminished value refers to the reduced value of a vehicle simply because it has a significant damage history. Document the amount of your lost value by ordering your diminished value report.

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

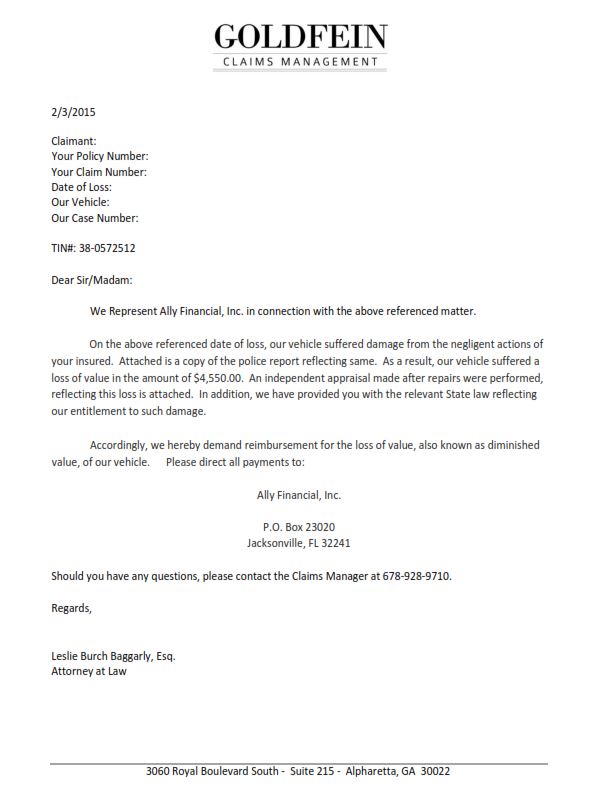

Enclosed find a diminished value appraisal done by an independent adjuster indicating the vehicle has decreased in value. Obtain an independent diminished value appraisal. Negotiation support throughout the claim settlement process from start to finish. The diminished value claim letter typically includes information about the claim, such as the date of loss, claim number, and amount of money being claimed. Negotiate the amount of diminished value with the insurance company.

Source: pinterest.com

Source: pinterest.com

The legal basis of your diminished value claim; Georgia case law has mandated the insurance companies to compensate their insured for the loss of value of their car. An explanation as to the purpose of the letter; Don�t expect the insurance company to help. This value can amount to a.

Source: mamiihondenk.org

Source: mamiihondenk.org

Negotiation support throughout the claim settlement process from start to finish. An explanation of the value of your diminished value claim. The diminished value claim letter typically includes information about the claim, such as the date of loss, claim number, and amount of money being claimed. An explanation as to the purpose of the letter; As a result of your insured’s negligence and recklessness that caused the accident dated november 15th

Source: slideshare.net

Source: slideshare.net

Even after the vehicle has been repaired to it’s optimal value, the market value of the vehicle may still be reduced. This letter is an attempt to clearly state why i believe i am owed diminished value, and why we believe the denial letter sent by farmers is wrong in its conclusion. The legal basis of your diminished value claim; Most companies use the following for structure when calculating damage: Let’s say the insurance company says your car will need $5000.00 in repairs, but the best quote you have is for $7500.00 and you also aren’t even counting your diminished value.

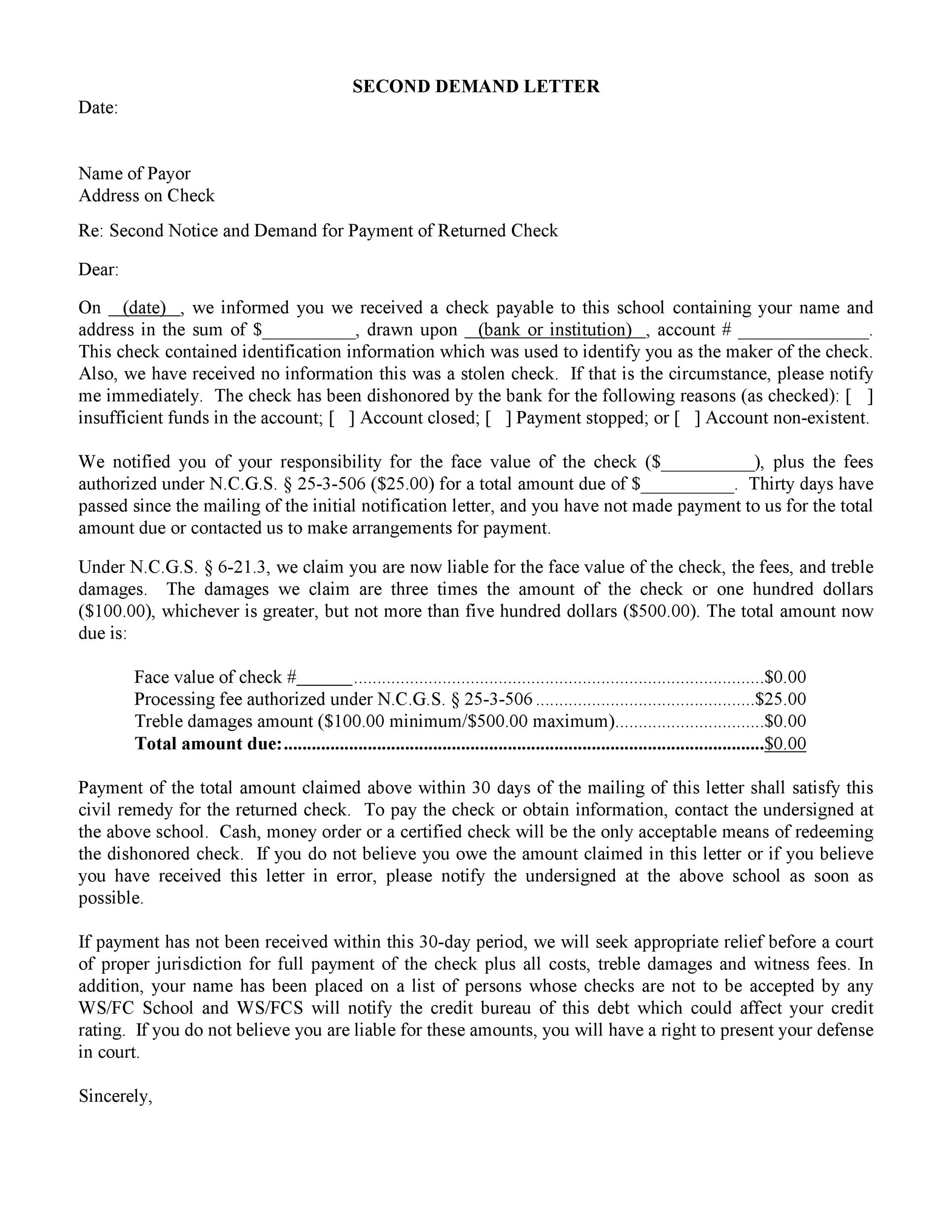

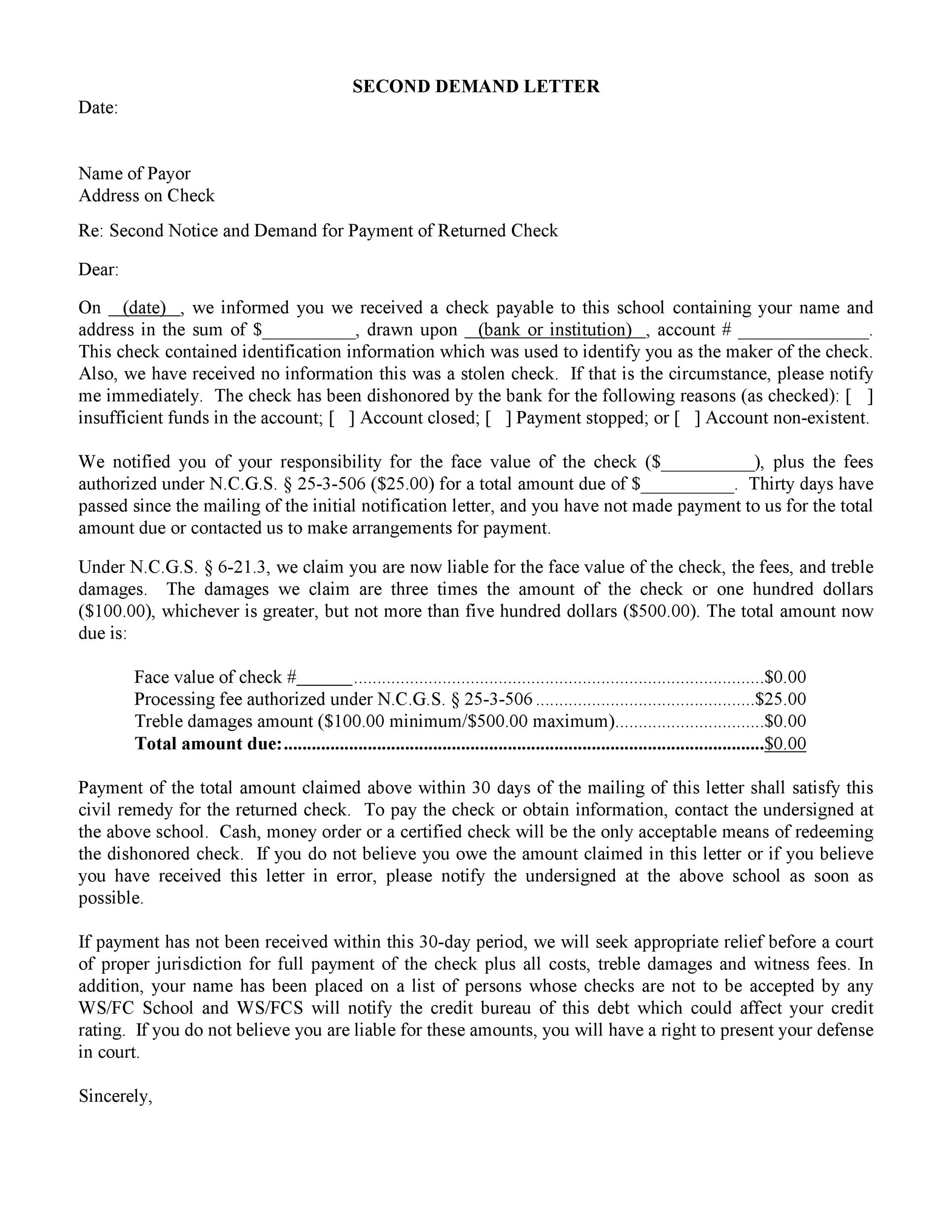

Source: fldefensivedrivingschool.com

Source: fldefensivedrivingschool.com

Filing your georgia diminished value claim for you, along with a demand letter of all your collective losses (past and future) negotiating with the insurance company for a fair settlement. An explanation of the value of your diminished value claim. The diminished value claim letter typically includes information about the claim, such as the date of loss, claim number, and amount of money being claimed. Pursue a diminished value claim as soon as possible—ideally in the days following the accident—as states have statutes of limitations on property claims. Searching for evidence that could support your claim.

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

Obtaining a diminished value appraisal. You know that to get it fixed right it will cost more than $5k, and even after it is perfectly repaired, it now has a marred history, further reducing it’s marketability. This letter is in response to my inability to collect diminished value damages occurring as a result of an accident where the person insured by farmers was at fault. Simply asking for diminished value is not a good idea because that puts you at the insurance company’s mercy. 0.00 for no structural damage.

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

With regards to the insurance claim referenced above, please accept this letter and the documentation attached as our diminished value payout request. A claim letter explains the situation and ends by asking for what you want. This value can amount to a. Therefore, if your trade in value is $30,000, the most you would receive is $3,000. The facts of your claim, with proof, if possible;

Source: pinterest.com

Source: pinterest.com

You know that to get it fixed right it will cost more than $5k, and even after it is perfectly repaired, it now has a marred history, further reducing it’s marketability. Let’s say the insurance company says your car will need $5000.00 in repairs, but the best quote you have is for $7500.00 and you also aren’t even counting your diminished value. Document the amount of your lost value by ordering your diminished value report. Therefore, if your trade in value is $30,000, the most you would receive is $3,000. The diminished value claim letter typically includes information about the claim, such as the date of loss, claim number, and amount of money being claimed.

Source: mamiihondenk.org

Source: mamiihondenk.org

The legal basis of your diminished value claim; This letter is an attempt to clearly state why i believe i am owed diminished value, and why we believe the denial letter sent by farmers is wrong in its conclusion. Even after the vehicle has been repaired to it’s optimal value, the market value of the vehicle may still be reduced. A claim letter explains the situation and ends by asking for what you want. Ultimately, you may need to submit a diminished value demand letter to your insurance company.

Source: pinterest.com

Source: pinterest.com

I hereby request reimbursement for my vehicle’s diminished value in the amount of $[amount of dv + cost of appraisal] (this amount includes $[cost of appraisal) for the cost of an appraisal as it is an additional indirect loss). The facts of your claim, with proof, if possible; Negotiation support throughout the claim settlement process from start to finish. With regards to the insurance claim referenced above, please accept this letter and the documentation attached as our diminished value payout request. 2 simple steps to ask for diminished value.

Source: mamiihondenk.org

Source: mamiihondenk.org

With regards to the insurance claim referenced above, please accept this letter and the documentation attached as our diminished value payout request. One method is using a 17(c) formula. This value can amount to a. Most insurance companies place a 10 percent cap on any diminished value. Your insurance claim for diminished value can be paid by your own insurance company or the other party’s company.

Source: pinterest.com

Source: pinterest.com

The legal basis of your diminished value claim; In an effort “to clarify the department’s position on diminished value claims,” the insurance commissioner issued a second directive on december 2, 2008. A diminished value insurance claim is when you request money from your car insurance company to pay the difference between your car�s value before the accident and its current value now that it has been repaired. This letter is an attempt to clearly state why i believe i am owed diminished value, and why we believe the denial letter sent by farmers is wrong in its conclusion. Let’s say the insurance company says your car will need $5000.00 in repairs, but the best quote you have is for $7500.00 and you also aren’t even counting your diminished value.

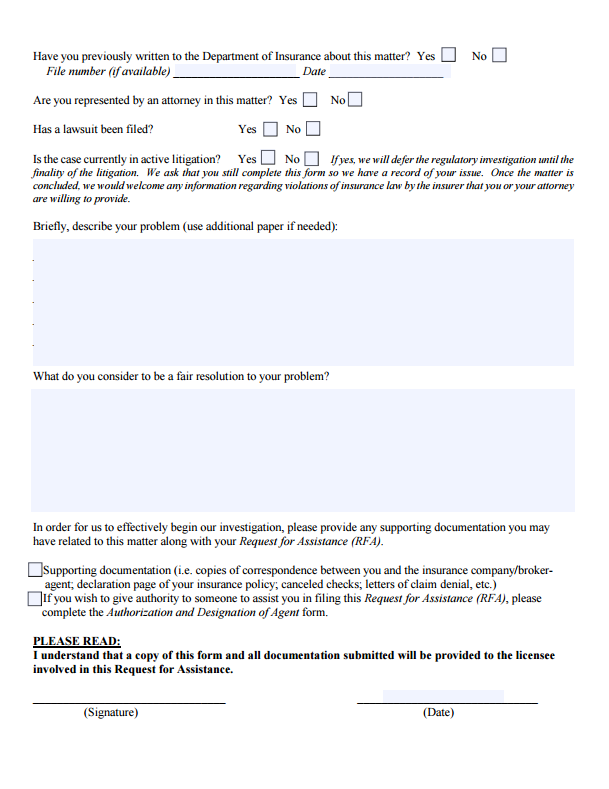

Source: templateroller.com

Source: templateroller.com

In an effort “to clarify the department’s position on diminished value claims,” the insurance commissioner issued a second directive on december 2, 2008. Obtaining a diminished value appraisal. This value can amount to a. Advising you on your decisions. The facts of your claim, with proof, if possible;

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title diminished value letter to insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea