Direct to consumer insurance companies information

Home » Trending » Direct to consumer insurance companies informationYour Direct to consumer insurance companies images are ready. Direct to consumer insurance companies are a topic that is being searched for and liked by netizens today. You can Get the Direct to consumer insurance companies files here. Get all royalty-free photos and vectors.

If you’re looking for direct to consumer insurance companies pictures information linked to the direct to consumer insurance companies interest, you have come to the right blog. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

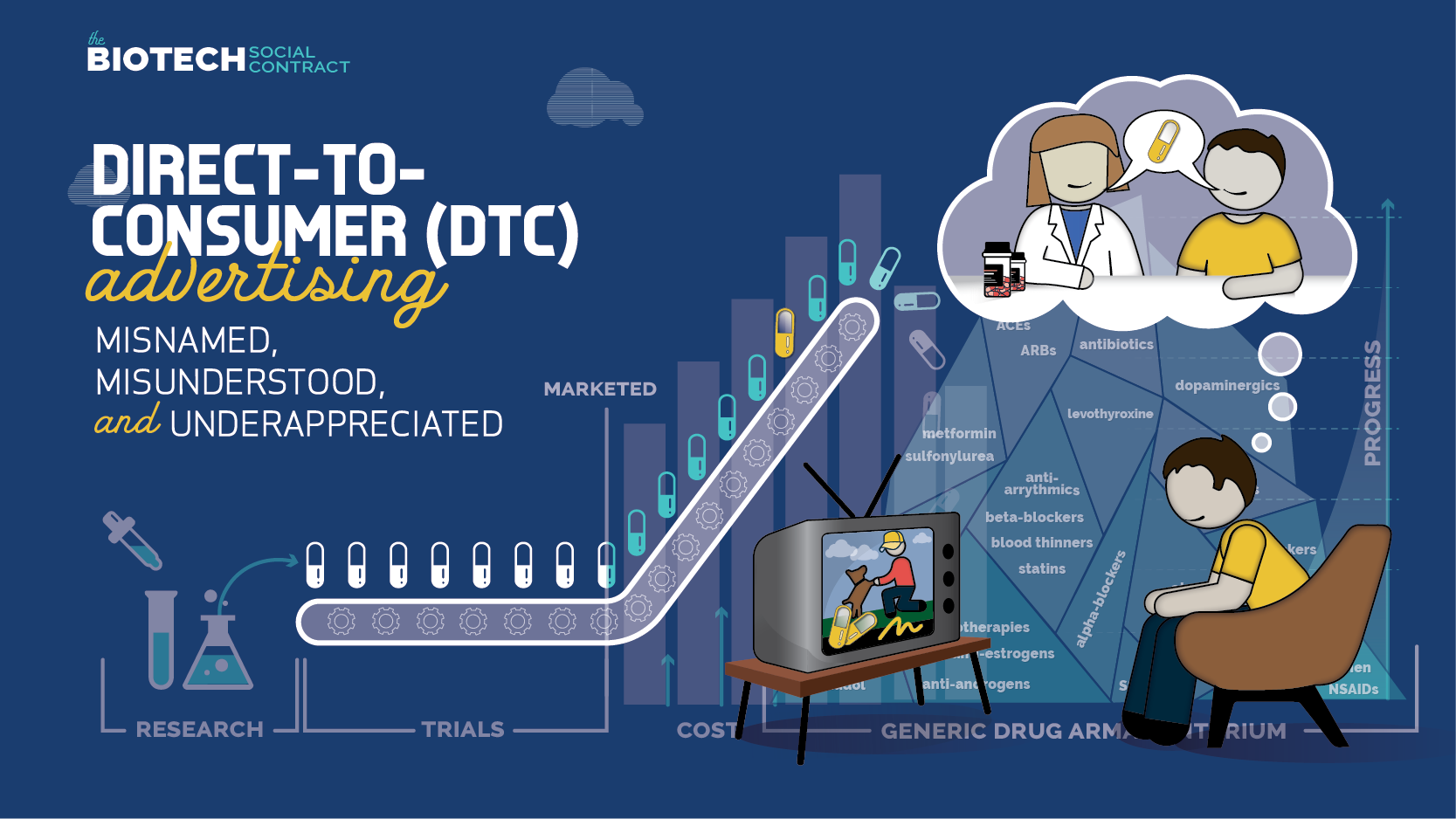

Direct To Consumer Insurance Companies. Our dedicated agents work to help you understand medicare and your insurance needs. It is our goal to provide our clients with the most competitive rates. Digital healthcare has been a rising space in the last few years, but while the structural and cultural change in the healthtech industry is moving toward b2c, where companies sell directly to the consumer, we�re still in a b2b2c world, where an insurance company, or an employer, still stands in between. From how those products are distributed, to the role that agents and brokers play in the sale.

Why Smart Insurance Companies are Going Direct to Consumer From blog.gwi.com

Why Smart Insurance Companies are Going Direct to Consumer From blog.gwi.com

A recent nyt article raised a number of red flags, citing criticism from optometrists and ophthalmologists who claim the company bypasses eye care professionals and does not properly vet prescriptions. It may help you be more proactive about your health. We are direct to consumer insurance. Also, they offer themed packs and variety packs to give their audience what they want. One, it leads to better margins. Companies must stay on top of the market and hone in on their own growth.

Youse, owned by brazil’s caixa seguradora, is inspired by international players that leverage technology to enchance customer experience and has built web and mobile.

Direct to customer model helps insurance companies generate revenue by engaging the customers in the right way, to use data collected from various sources as insights and provide seamless customer experience as opposed to the insurance selling. We are direct to consumer insurance. Over the past 18 years, he’s worked across a multitude of industries including energy, insurance and financial services leading marketing programs and initiatives to improve the consumer experience. By selling straight to customers through their websites — rather than selling to physical retailers at reduced wholesale prices — these brands save money, which allows them to spend a little extra on superior customer experience. It provides personalized information about your health, disease risk, and other traits. It does not require approval from a healthcare provider or health insurance company.

Source: h0ly-mc.blogspot.com

Source: h0ly-mc.blogspot.com

Also, they offer themed packs and variety packs to give their audience what they want. It is our goal to provide our clients with the most competitive rates. Youse is a brazilian based insurance platform that is planning to sell policies directly to consumers. The law will guarantee healthcare coverage while providing consumers the power to pick and choose their own plans. Our dedicated agents work to help you understand medicare and your insurance needs.

Source: the-digital-insurer.com

Source: the-digital-insurer.com

Direct to consumer insurance companies can develop and take complete control over the purchase journey, putting the incremental steps in place that move customers down the funnel. Digital healthcare has been a rising space in the last few years, but while the structural and cultural change in the healthtech industry is moving toward b2c, where companies sell directly to the consumer, we�re still in a b2b2c world, where an insurance company, or an employer, still stands in between. In 2018, geico and progressive captured $7.8 billion in direct written premiums, or 54 percent of the auto insurance industry’s gains. As the “people of the united sodas of america,” they invite you to find your unique flavor. It provides personalized information about your health, disease risk, and other traits.

Source: onespan.com

Source: onespan.com

Director of customer experience, aaa life dustin hoffman is a career veteran in the marketing and customer experience arena. It does not require approval from a healthcare provider or health insurance company. Selling directly to consumers provides insurance carriers the most powerful tool available against adverse selection: It provides personalized information about your health, disease risk, and other traits. Over the past 18 years, he’s worked across a multitude of industries including energy, insurance and financial services leading marketing programs and initiatives to improve the consumer experience.

Source: programbusiness.com

Source: programbusiness.com

Direct to customer model helps insurance companies generate revenue by engaging the customers in the right way, to use data collected from various sources as insights and provide seamless customer experience as opposed to the insurance selling through traditional distribution channels. A recent nyt article raised a number of red flags, citing criticism from optometrists and ophthalmologists who claim the company bypasses eye care professionals and does not properly vet prescriptions. It does not require approval from a healthcare provider or health insurance company. It is our goal to provide our clients with the most competitive rates. Our dedicated agents work to help you understand medicare and your insurance needs.

Source: h0ly-mc.blogspot.com

Source: h0ly-mc.blogspot.com

But to everything, there is a limit. Meanwhile, mckinsey & company says that direct sales have grown from a €13 billion industry to a €24 billion industry in 10 years, and nearly half of. Companies must stay on top of the market and hone in on their own growth. Going direct to the consumer gives brands a couple of key advantages. It provides personalized information about your health, disease risk, and other traits.

Source: h0ly-mc.blogspot.com

Source: h0ly-mc.blogspot.com

By selling straight to customers through their websites — rather than selling to physical retailers at reduced wholesale prices — these brands save money, which allows them to spend a little extra on superior customer experience. It is our goal to provide our clients with the most competitive rates. In 2018, geico and progressive captured $7.8 billion in direct written premiums, or 54 percent of the auto insurance industry’s gains. And when competition is fierce, making small errors can be detrimental. Selling directly to consumers provides insurance carriers the most powerful tool available against adverse selection:

Source: axegroup.com

Source: axegroup.com

A digital insurance agency built on customer service. Hubble, of course, disputed these claims. But to everything, there is a limit. Selling directly to consumers provides insurance carriers the most powerful tool available against adverse selection: But to everything, there is a limit.

Source: openpr.com

Source: openpr.com

Direct to customer model helps insurance companies generate revenue by engaging the customers in the right way, to use data collected from various sources as insights and provide seamless customer experience as opposed to the insurance selling through traditional distribution channels. It may help you be more proactive about your health. Kin’s proprietary technology enables customers to insure their homes in minutes online, bringing. The term “direct to consumer” (dtc) refers to companies that make products and sell them to consumers, usually online but also in their own. In 2018, geico and progressive captured $7.8 billion in direct written premiums, or 54 percent of the auto insurance industry’s gains.

Source: h0ly-mc.blogspot.com

Going direct to the consumer gives brands a couple of key advantages. Direct to customer model helps insurance companies generate revenue by engaging the customers in the right way, to use data collected from various sources as insights and provide seamless customer experience as opposed to the insurance selling. Direct to consumer insurance companies can develop and take complete control over the purchase journey, putting the incremental steps in place that move customers down the funnel. The law will guarantee healthcare coverage while providing consumers the power to pick and choose their own plans. One, it leads to better margins.

Source: silvervinesoftware.com

Source: silvervinesoftware.com

Meanwhile, mckinsey & company says that direct sales have grown from a €13 billion industry to a €24 billion industry in 10 years, and nearly half of. Youse is a brazilian based insurance platform that is planning to sell policies directly to consumers. The term “direct to consumer” (dtc) refers to companies that make products and sell them to consumers, usually online but also in their own. Kin’s proprietary technology enables customers to insure their homes in minutes online, bringing. We are direct to consumer insurance.

Source: blog.gwi.com

Source: blog.gwi.com

The term “direct to consumer” (dtc) refers to companies that make products and sell them to consumers, usually online but also in their own. Hubble, of course, disputed these claims. Director of customer experience, aaa life dustin hoffman is a career veteran in the marketing and customer experience arena. Meanwhile, mckinsey & company says that direct sales have grown from a €13 billion industry to a €24 billion industry in 10 years, and nearly half of. Selling directly to consumers provides insurance carriers the most powerful tool available against adverse selection:

Source: nomiddleman.com

Source: nomiddleman.com

Our dedicated agents work to help you understand medicare and your insurance needs. We are direct to consumer insurance. Kin’s proprietary technology enables customers to insure their homes in minutes online, bringing. But to everything, there is a limit. Youse is a brazilian based insurance platform that is planning to sell policies directly to consumers.

Source: blog.gwi.com

Source: blog.gwi.com

A recent nyt article raised a number of red flags, citing criticism from optometrists and ophthalmologists who claim the company bypasses eye care professionals and does not properly vet prescriptions. Director of customer experience, aaa life dustin hoffman is a career veteran in the marketing and customer experience arena. We are direct to consumer insurance. The law will guarantee healthcare coverage while providing consumers the power to pick and choose their own plans. Digital healthcare has been a rising space in the last few years, but while the structural and cultural change in the healthtech industry is moving toward b2c, where companies sell directly to the consumer, we�re still in a b2b2c world, where an insurance company, or an employer, still stands in between.

Source: medium.com

Source: medium.com

We are direct to consumer insurance. Digital healthcare has been a rising space in the last few years, but while the structural and cultural change in the healthtech industry is moving toward b2c, where companies sell directly to the consumer, we�re still in a b2b2c world, where an insurance company, or an employer, still stands in between. As the “people of the united sodas of america,” they invite you to find your unique flavor. Going direct to the consumer gives brands a couple of key advantages. A digital insurance agency built on customer service.

Source: h0ly-mc.blogspot.com

Source: h0ly-mc.blogspot.com

And when competition is fierce, making small errors can be detrimental. It does not require approval from a healthcare provider or health insurance company. In geico’s case, its heavy advertising and continued release of digital. Over the past 18 years, he’s worked across a multitude of industries including energy, insurance and financial services leading marketing programs and initiatives to improve the consumer experience. Also, they offer themed packs and variety packs to give their audience what they want.

Source: programbusiness.com

Source: programbusiness.com

It provides personalized information about your health, disease risk, and other traits. Going direct to the consumer gives brands a couple of key advantages. Youse is a brazilian based insurance platform that is planning to sell policies directly to consumers. It may help you be more proactive about your health. Hubble, of course, disputed these claims.

Source: onlinecollegesforinteriordesign.blogspot.com

From how those products are distributed, to the role that agents and brokers play in the sale. We are direct to consumer insurance. It may help you be more proactive about your health. The term “direct to consumer” (dtc) refers to companies that make products and sell them to consumers, usually online but also in their own. A recent nyt article raised a number of red flags, citing criticism from optometrists and ophthalmologists who claim the company bypasses eye care professionals and does not properly vet prescriptions.

Source: agencychecklists.com

Source: agencychecklists.com

Direct to consumer insurance companies can develop and take complete control over the purchase journey, putting the incremental steps in place that move customers down the funnel. Companies must stay on top of the market and hone in on their own growth. Over the past 18 years, he’s worked across a multitude of industries including energy, insurance and financial services leading marketing programs and initiatives to improve the consumer experience. Meanwhile, mckinsey & company says that direct sales have grown from a €13 billion industry to a €24 billion industry in 10 years, and nearly half of. Hubble, of course, disputed these claims.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title direct to consumer insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea