Disability insurance business Idea

Home » Trend » Disability insurance business IdeaYour Disability insurance business images are available. Disability insurance business are a topic that is being searched for and liked by netizens today. You can Find and Download the Disability insurance business files here. Download all royalty-free photos and vectors.

If you’re looking for disability insurance business images information related to the disability insurance business topic, you have visit the ideal site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

Disability Insurance Business. The best disability insurance companies. You need to provide coverage for both your family and your business. (and rest assured, we will never sell your personal info.) name email cell phone occupation select your occupation annual income get my instant quote However the employee of the business will need to report any disability income benefits received as taxable income.

What is tax free with disability insurance? Paragon From paragonaccountingandtax.com

What is tax free with disability insurance? Paragon From paragonaccountingandtax.com

If you haven’t been in business for two years, you have the following choices: Get a disability insurance quote in seconds. Key person disability many small businesses need the added protection of key person disability insurance. Disability insurance for business owners as a business owner, you want to know that your company is protected in the event you become disabled and unable to work. Business owners lack many of the protections that traditional employees receive from their employers. This type of insurance policy is most often used for temporary disabilities, such as bone fractures, sprains, simple surgeries, and pregnancies.

A disability policy owned by your company can provide a monthly payment.

(and rest assured, we will never sell your personal info.) name email cell phone occupation select your occupation annual income get my instant quote Buy and sell agreement coverage. More on the best disability insurance companies of 2021 As a business owner, you’re the heart of your business. Business owners lack many of the protections that traditional employees receive from their employers. (and rest assured, we will never sell your personal info.) name email cell phone occupation select your occupation annual income get my instant quote

Source: disabilityinsuranceadvisor.com

Source: disabilityinsuranceadvisor.com

Get a disability insurance quote in seconds. Disability insurance for small businesses provides income in a situation where a business owner or employee is unable to work due to an illness or injury that occurred away from work. Business overhead expense insurance, or simply boe insurance, is a type of disability coverage that helps business owners cover office costs, debts, payroll, employee benefits, and more if they become too sick or hurt to work. The value of individual disability income insurance for business. You need to provide coverage for both your family and your business.

Source: stlrecord.com

Source: stlrecord.com

The value of individual disability income insurance for business. Disability insurance for small businesses provides income in a situation where a business owner or employee is unable to work due to an illness or injury that occurred away from work. This type of insurance policy is most often used for temporary disabilities, such as bone fractures, sprains, simple surgeries, and pregnancies. The business should purchase disability insurance to ensure it stays up and running while the owner is recovering from a disability or to transfer/sell the business to someone else. If an illness or injury keeps someone from working for an extended period, disability insurance provides financial assistance to replace a portion of lost income.

Source: highincomeprotection.com

Source: highincomeprotection.com

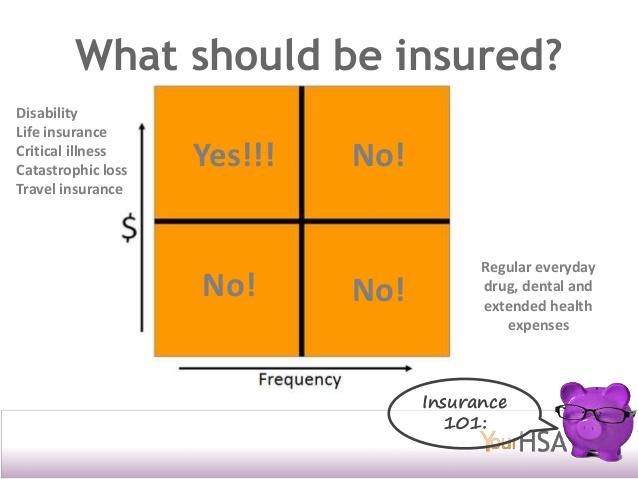

The best small business disability insurance plans include business overhead coverage, which provides funds to take care of building leases, taxes, staffing expenses, and other operating expenses in the event the owner becomes disabled. Employers can offer either or both depending on their needs. For example… let�s use our our laundromat owner. While a disability can often be visible to the naked eye, not all disabilities are so easily recognized. Group health and dental benefits plans.

Source: huffingtonpost.com

Source: huffingtonpost.com

The hartford has sold equity stakes to allianz se and berkshire life We can help protect you, your key people and your employees with: You’ve built something you and your employees are proud of. However the employee of the business will need to report any disability income benefits received as taxable income. Key person disability many small businesses need the added protection of key person disability insurance.

Source: lampusmarketing.com

Source: lampusmarketing.com

The sudden disability of a partner can be more detrimental than a sudden death. While a disability can often be visible to the naked eye, not all disabilities are so easily recognized. The sudden disability of a partner can be more detrimental than a sudden death. Unum has acquired several disability insurance companies, including paul revere, national employers assurance holding, colonial life, and sun life assurance (uk), among others. Disability insurance is divided into two categories:

Source: healthmarkets.com

Source: healthmarkets.com

Get a disability insurance quote in seconds. Disability insurance for small business owners it is often the case that a small business succeeds or fails based on the ability of the owner to run the business. Business owners lack many of the protections that traditional employees receive from their employers. Yes, but qualifying for individual disability insurance can be difficult. Which means that if you we suddenly became sick or injured and weren’t able to perform your current duties as a business owner, your disability insurance policy would begin to pay you your benefits regardless of whether or not you could perform another job.

Source: arrowbenefitsgroup.com

Source: arrowbenefitsgroup.com

Disability insurance provides income in case a business owner or employee is unable to work due to an illness or injury that occurred away from work. Many times the owner truly is the. We can help protect you, your key people and your employees with: Business overhead expense insurance, or simply boe insurance, is a type of disability coverage that helps business owners cover office costs, debts, payroll, employee benefits, and more if they become too sick or hurt to work. Disability insurance for business owners di done right business owners market snapshot with more than 30 million small businesses in the united states, the business owner market represents a massive disability insurance marketing opportunity.

Source: owensgroup.com

Source: owensgroup.com

In some cases, the disabled partner continues to earn a salary, but does not contribute to the company. Disability insurance for business owners as a business owner, you want to know that your company is protected in the event you become disabled and unable to work. The business should purchase disability insurance to ensure it stays up and running while the owner is recovering from a disability or to transfer/sell the business to someone else. More on the best disability insurance companies of 2021 Which means that if you we suddenly became sick or injured and weren’t able to perform your current duties as a business owner, your disability insurance policy would begin to pay you your benefits regardless of whether or not you could perform another job.

Source: imcfinancial.ca

Source: imcfinancial.ca

The sudden disability of a partner can be more detrimental than a sudden death. Key person disability many small businesses need the added protection of key person disability insurance. Disability insurance for business owners di done right business owners market snapshot with more than 30 million small businesses in the united states, the business owner market represents a massive disability insurance marketing opportunity. Get a disability insurance quote in seconds. Owner art evans had built the business from the ground.

Source: coolbuzz.org

Source: coolbuzz.org

Disability insurance will qualify for a business expense if the business pays for the policy and does not receive any of the benefit received. More on the best disability insurance companies of 2021 Business overhead expense insurance, or simply boe insurance, is a type of disability coverage that helps business owners cover office costs, debts, payroll, employee benefits, and more if they become too sick or hurt to work. Disability insurance for small businesses provides income in a situation where a business owner or employee is unable to work due to an illness or injury that occurred away from work. While a disability can often be visible to the naked eye, not all disabilities are so easily recognized.

Source: paragonaccountingandtax.com

Source: paragonaccountingandtax.com

Buy and sell agreement coverage. Disability income for you and disability insurance for your business are two different issues. The value of individual disability income insurance for business. The sudden disability of a partner can be more detrimental than a sudden death. However the employee of the business will need to report any disability income benefits received as taxable income.

Source: stone-hedgefinancialgroup.ca

Source: stone-hedgefinancialgroup.ca

The best small business disability insurance plans include business overhead coverage, which provides funds to take care of building leases, taxes, staffing expenses, and other operating expenses in the event the owner becomes disabled. Policygenius can help you choose a plan that provides you with the coverage you need while not putting you in the red. Disability insurance for business owners di done right business owners market snapshot with more than 30 million small businesses in the united states, the business owner market represents a massive disability insurance marketing opportunity. Buy and sell agreement coverage. Disability income for you and disability insurance for your business are two different issues.

Source: youtube.com

Source: youtube.com

However the employee of the business will need to report any disability income benefits received as taxable income. Buy sell disability insurance is designed to mirror the requirements of the buy sell agreement. The percentage of income that is covered can range, but typically employers purchase plans that cover 50 to 60 percent of income. As a business owner, you’re the heart of your business. Buy and sell agreement coverage.

Source: highincomeprotection.com

Source: highincomeprotection.com

Disability insurance will qualify for a business expense if the business pays for the policy and does not receive any of the benefit received. A personal disability insurance policy can protect you if you cannot work, but will likely not feature a large enough benefit to keep your business afloat as well. Disability insurance is divided into two categories: Employers can offer either or both depending on their needs. We can help protect you, your key people and your employees with:

Source: newsyoucanuse.equitable.com

Source: newsyoucanuse.equitable.com

If you haven’t been in business for two years, you have the following choices: We can help protect you, your key people and your employees with: The value of individual disability income insurance for business. A personal disability insurance policy can protect you if you cannot work, but will likely not feature a large enough benefit to keep your business afloat as well. Owner art evans had built the business from the ground.

Source: youtube.com

Source: youtube.com

Disability insurance provides income in case a business owner or employee is unable to work due to an illness or injury that occurred away from work. If an illness or injury keeps someone from working for an extended period, disability insurance provides financial assistance to replace a portion of lost income. Unum has acquired several disability insurance companies, including paul revere, national employers assurance holding, colonial life, and sun life assurance (uk), among others. The best disability insurance companies. In 2019, metro commercial plumbing had its best financial year ever.

Source: businessdeccan.com

Source: businessdeccan.com

Unum has acquired several disability insurance companies, including paul revere, national employers assurance holding, colonial life, and sun life assurance (uk), among others. A disability policy owned by your company can provide a monthly payment. Business owners lack many of the protections that traditional employees receive from their employers. The business should purchase disability insurance to ensure it stays up and running while the owner is recovering from a disability or to transfer/sell the business to someone else. Policygenius can help you choose a plan that provides you with the coverage you need while not putting you in the red.

Source: moneyunder30.com

Source: moneyunder30.com

Employers can offer either or both depending on their needs. The sudden disability of a partner can be more detrimental than a sudden death. In some cases, the disabled partner continues to earn a salary, but does not contribute to the company. Disability insurance provides income in case a business owner or employee is unable to work due to an illness or injury that occurred away from work. Disability insurance will qualify for a business expense if the business pays for the policy and does not receive any of the benefit received.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title disability insurance business by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information