Disability vs life insurance Idea

Home » Trending » Disability vs life insurance IdeaYour Disability vs life insurance images are available in this site. Disability vs life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Disability vs life insurance files here. Download all royalty-free photos and vectors.

If you’re searching for disability vs life insurance pictures information connected with to the disability vs life insurance keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

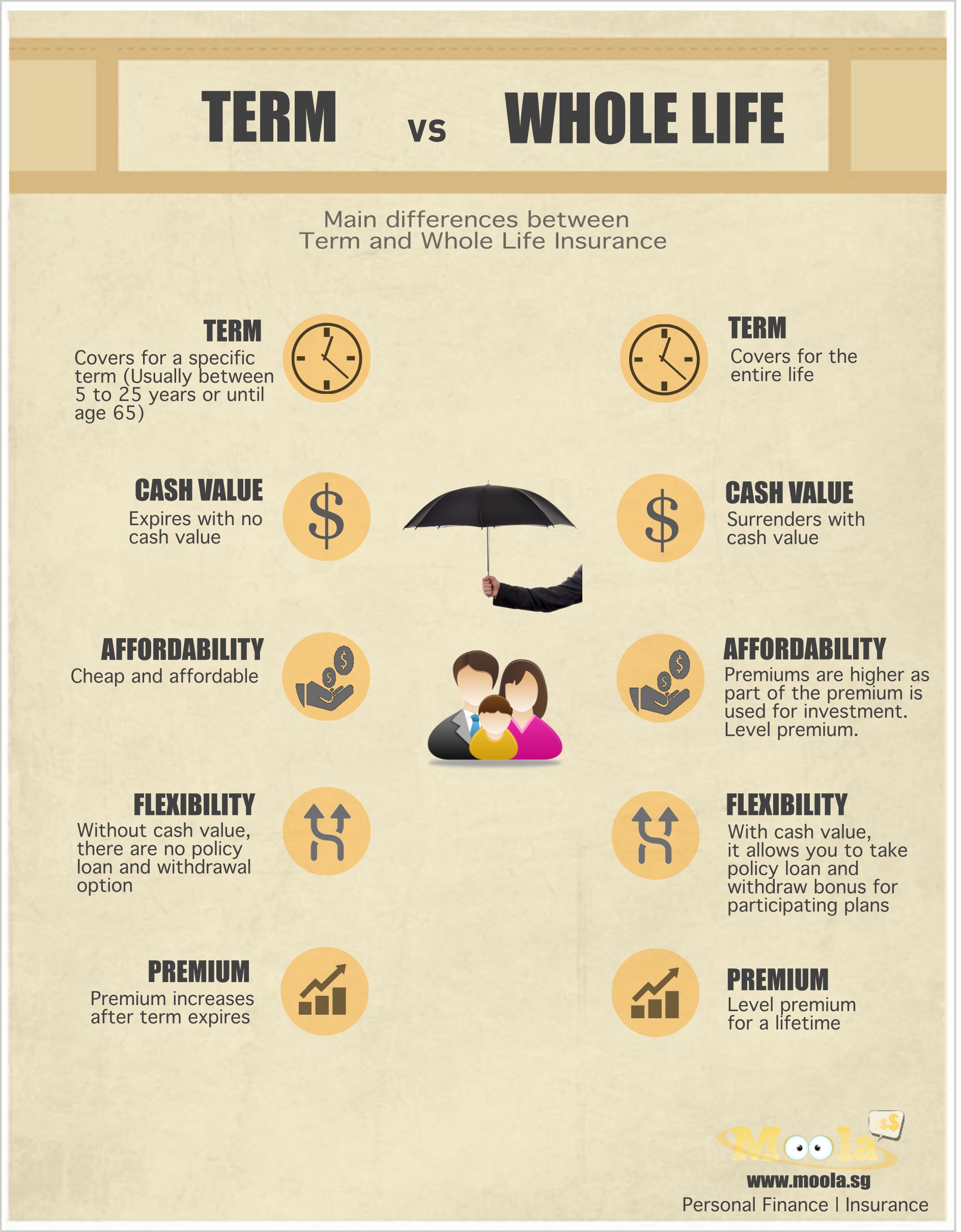

Disability Vs Life Insurance. Let’s break down each of these. Life insurance pays a benefit to the policy beneficiaries upon the death of the policy insured. Workers’ compensation helps if you are hurt or get sick at your workplace. Life insurance is a mortality product and disability insurance is a morbidity product.

Pin on Budgeting tips From br.pinterest.com

Pin on Budgeting tips From br.pinterest.com

I consider that most men and women would concur that the we are living in a point out of insurance overload in this place. Life insurance is designed to provide financial support to your family (or whoever you name in the policy) after you pass away. Both private disability insurance and social security disability insurance can offer protection if you can’t work after experiencing a disability. Life insurance pays a benefit to the policy beneficiaries upon the death of the policy insured. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Life insurance protects the financial health of your beneficiaries after you die, whereas disability insurance pays out to you while you are alive and if you become too disabled to work.

There are seven significant differences between life and disability insurance.

Private disability insurance pays a higher monthly amount and can cover you in the short term and long term, but it can also be expensive and you’ll need to purchase it before your disability. Learn the difference between disability insurance and key man disability coverage. While life and disability insurance both offer income replacement, they are not the same. I consider that most men and women would concur that the we are living in a point out of insurance overload in this place. With life insurance, someone is either dead or alive. Disability insurance is designed to protect you after an illness or injury prevents you from working.

Source: quotesgram.com

Source: quotesgram.com

Life insurance protects the financial health of your beneficiaries after you die, whereas disability insurance pays out to you while you are alive and if you become too disabled to work. Life insurance is a mortality product and disability insurance is a morbidity product. Yet most workers would never think of going without life insurance protection for their families. Those individuals generally earn commissions from. I consider that most men and women would concur that the we are living in a point out of insurance overload in this place.

Source: allinsurancesforyou.blogspot.com

Source: allinsurancesforyou.blogspot.com

The risk of disability during a worker’s career is greater than the risk of premature death. Both disability insurance and workers’ compensation insurance offer protection, but with different benefits and drawbacks. However, many life insurance (3). There are seven significant differences between life and disability insurance. If you own a business and rely on a few few key people, key man disability insurance is probably crucial to.

Source: pinterest.com

Source: pinterest.com

There are seven significant differences between life and disability insurance. Depending on the policy, life insurance guarantees the spouse and/or children of the deceased a payout that reflects their former income or salary. Which do you have a higher chance of using? There are seven significant differences between life and disability insurance. Both private disability insurance and social security disability insurance can offer protection if you can’t work after experiencing a disability.

Source: wrsinsurancesolutions.com

Source: wrsinsurancesolutions.com

You’ve probably noticed the similarities between life insurance and disability insurance: Let’s break down each of these. You need insurance to drive a car, you need it to buy a house (at least you do if you want to get a mortgage from a bank!), you need health insurance to cover medical costs. The risk of disability during a worker’s career is greater than the risk of premature death. Depending on the policy, life insurance guarantees the spouse and/or children of the deceased a payout that reflects their former income or salary.

Source: pinterest.com

Source: pinterest.com

You need insurance to drive a car, you need it to buy a house (at least you do if you want to get a mortgage from a bank!), you need health insurance to cover medical costs. The big difference between the two is that with disability insurance, you’re alive to see the benefit paid, whereas, with life insurance, you’re not. You’ve probably noticed the similarities between life insurance and disability insurance: However, disability insurance and critical illness insurance are not the same. Yet most workers would never think of going without life insurance protection for their families.

Source: towhomimayconcern.info

Source: towhomimayconcern.info

Both disability insurance and workers’ compensation insurance offer protection, but with different benefits and drawbacks. However, many life insurance (3). Life insurance pays a benefit to the policy beneficiaries upon the death of the policy insured. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. There are seven significant differences between life and disability insurance.

Source: moneydigest.sg

Source: moneydigest.sg

Yet most workers would never think of going without life insurance protection for their families. Disability policies generally provide monthly payments to you to cover your needs instead of covering specific expenses. Texas auto insurance no medical exam life insurance payday lenders credit card help faxless payday loans installment loans zero percent credit cards faxless payday loan instant loan payday loan consolidation mortgage quotes. Life insurance is a mortality product and disability insurance is a morbidity product. While both are important, they cover different needs.

Source: nomedicallifeinsurance.ca

Source: nomedicallifeinsurance.ca

If you own a business and rely on a few few key people, key man disability insurance is probably crucial to. Americans are more likely to have life insurance than disability coverage, yet the chances of needing disability insurance are higher. Life insurance on the other hand, covers death which occurs from natural causes. Texas auto insurance no medical exam life insurance payday lenders credit card help faxless payday loans installment loans zero percent credit cards faxless payday loan instant loan payday loan consolidation mortgage quotes. It seems like everywhere you turn there�s more insurance to buy!

Source: visual.ly

Source: visual.ly

Life insurance is designed to provide financial support to your family (or whoever you name in the policy) after you pass away. Buying term life insurance in tandem with disability insurance is part. Both disability insurance and workers’ compensation insurance offer protection, but with different benefits and drawbacks. Workers’ compensation helps if you are hurt or get sick at your workplace. Not infrequently, i find myself saying those simple words, “time of death….9:21.” there really isn�t a “time of disability.”

Source: industriesvanier.net

Source: industriesvanier.net

Life insurance pays a benefit to the policy beneficiaries upon the death of the policy insured. Not infrequently, i find myself saying those simple words, “time of death….9:21.” there really isn�t a “time of disability.” It seems like everywhere you turn there�s more insurance to buy! Buying term life insurance in tandem with disability insurance is part. Insurance, both life and disability, is a product that’s sold by salespeople or brokers.

Source: insurancemd.com

Source: insurancemd.com

If you own a business and rely on a few few key people, key man disability insurance is probably crucial to. Life insurance on the other hand, covers death which occurs from natural causes. Yet most workers would never think of going without life insurance protection for their families. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Should you become disabled, your private disability insurance policy is designed to replace your after tax income.

Source: thinkglink.com

Source: thinkglink.com

Those individuals generally earn commissions from. While life insurance protects your loved ones from financial loss after you’ve passed away, disability insurance ensures that you and your family are financially (2). You’ve probably noticed the similarities between life insurance and disability insurance: Get a free, personalized disability insurance quote in seconds. I consider that most men and women would concur that the we are living in a point out of insurance overload in this place.

Source: blog.disabilitycanhappen.org

Source: blog.disabilitycanhappen.org

Life insurance, on the one hand, makes sure that your family is taken care of after your passing why disability allows you to keep taking care of your family while you’re alive. Americans are more likely to have life insurance than disability coverage, yet the chances of needing disability insurance are higher. It seems like everywhere you turn there�s more insurance to buy! Workers’ compensation helps if you are hurt or get sick at your workplace. You have to have insurance to generate a auto, you have to have it to invest in a home (at minimum you do if you want to.

Source: insuranceexplainer.com

Source: insuranceexplainer.com

Yet most workers would never think of going without life insurance protection for their families. Disability policies generally provide monthly payments to you to cover your needs instead of covering specific expenses. Life insurance the bad news is that life insurance only really becomes a factor after you die. All of those things are natural which an insurer might use against you to deny your claim. If you own a business and rely on a few few key people, key man disability insurance is probably crucial to.

Source: olympiabenefits.com

Source: olympiabenefits.com

Private disability insurance pays a higher monthly amount and can cover you in the short term and long term, but it can also be expensive and you’ll need to purchase it before your disability. The risk of disability during a worker’s career is greater than the risk of premature death. They keep your income arriving when you can’t. Which do you have a higher chance of using? Insurance, both life and disability, is a product that’s sold by salespeople or brokers.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Workers’ compensation helps if you are hurt or get sick at your workplace. Both insurance plans provide a level of protection against the financial losses brought about by sickness. You need insurance to drive a car, you need it to buy a house (at least you do if you want to get a mortgage from a bank!), you need health insurance to cover medical costs. Buying term life insurance in tandem with disability insurance is part. Life insurance is a mortality product and disability insurance is a morbidity product.

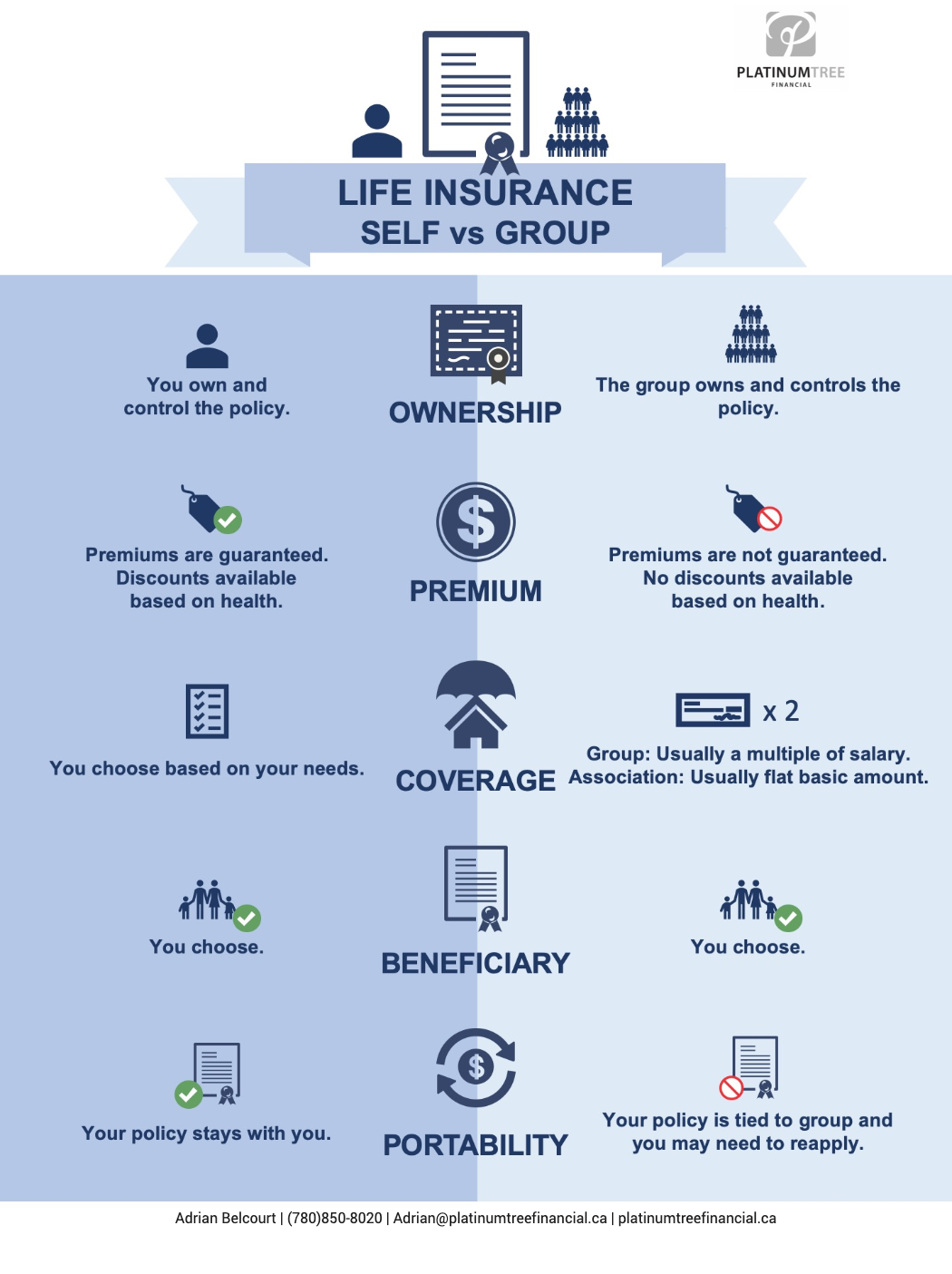

Source: platinumtreefinancial.ca

Source: platinumtreefinancial.ca

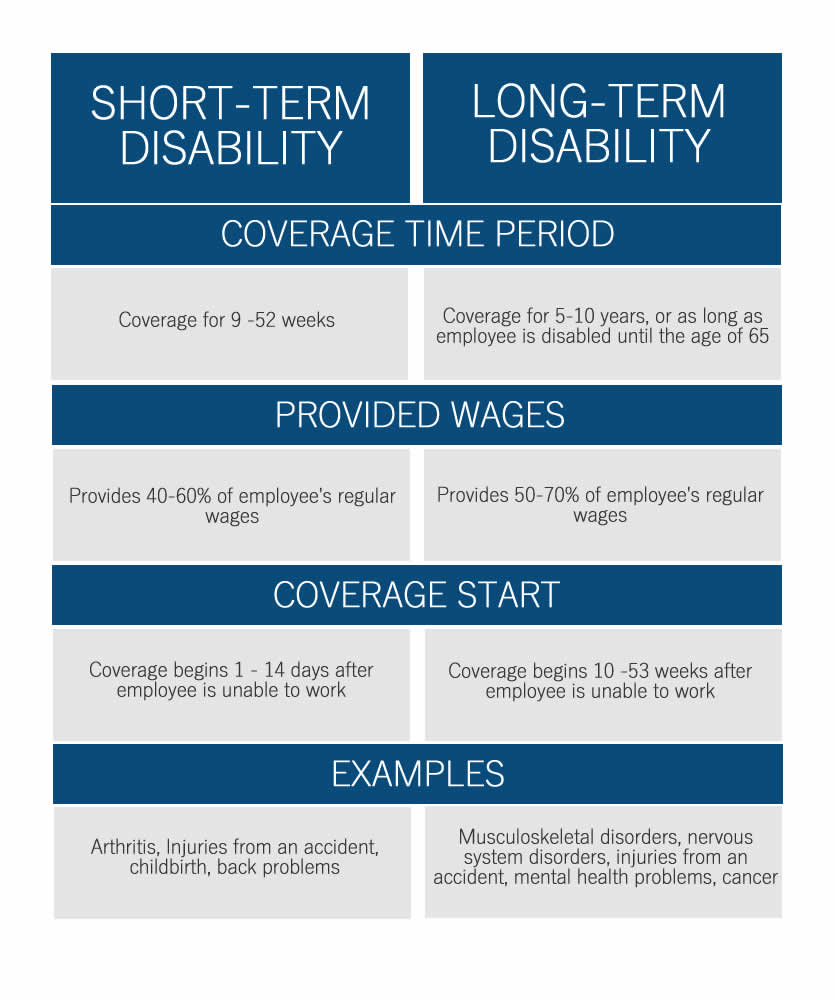

As with life insurance, there are two basic forms of disability insurance: You’ve probably noticed the similarities between life insurance and disability insurance: Buying term life insurance in tandem with disability insurance is part. Private disability insurance pays a higher monthly amount and can cover you in the short term and long term, but it can also be expensive and you’ll need to purchase it before your disability. Should you become disabled, your private disability insurance policy is designed to replace your after tax income.

Source: br.pinterest.com

Source: br.pinterest.com

Disability insurance is designed to protect you after an illness or injury prevents you from working. If you own a business and rely on a few few key people, key man disability insurance is probably crucial to. Short term and long term. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. As with life insurance, there are two basic forms of disability insurance:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title disability vs life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea