Disadvantages of captive insurance information

Home » Trend » Disadvantages of captive insurance informationYour Disadvantages of captive insurance images are available. Disadvantages of captive insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Disadvantages of captive insurance files here. Download all free images.

If you’re searching for disadvantages of captive insurance images information linked to the disadvantages of captive insurance keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

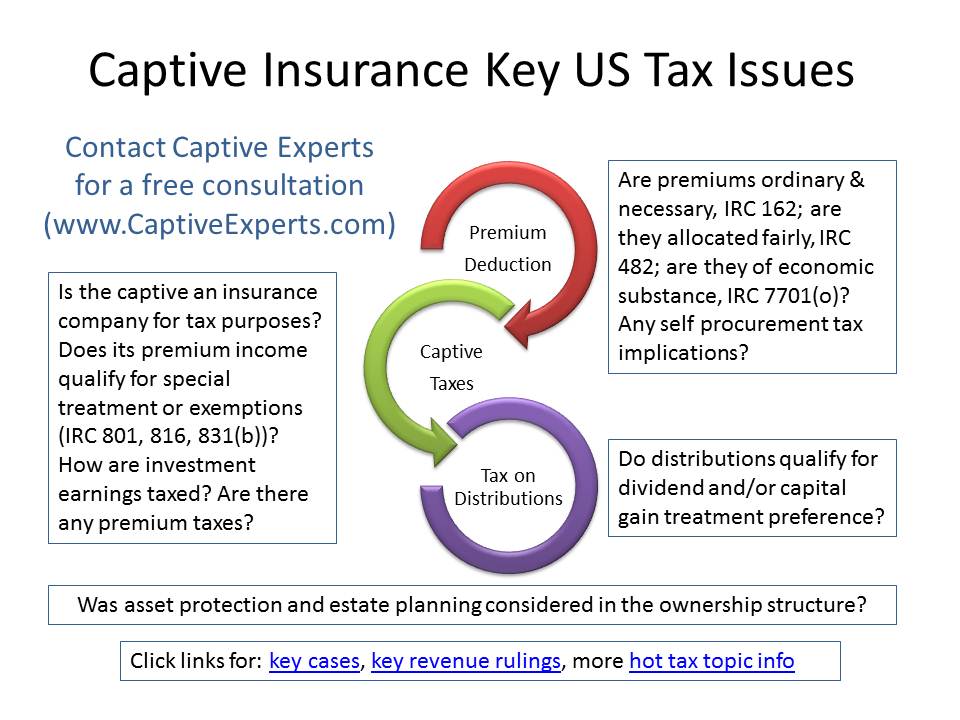

Disadvantages Of Captive Insurance. And leaving a captive brings its. The coronavirus pandemic and natural catastrophe losses have only made matters worse. As shown above, there are many advantages to the captive insurance model. Other disadvantages the advantages and disadvantages of a captive insurance administration:

The Disadvantages of Captive Insurance India Dictionary From 1investing.in

The Disadvantages of Captive Insurance India Dictionary From 1investing.in

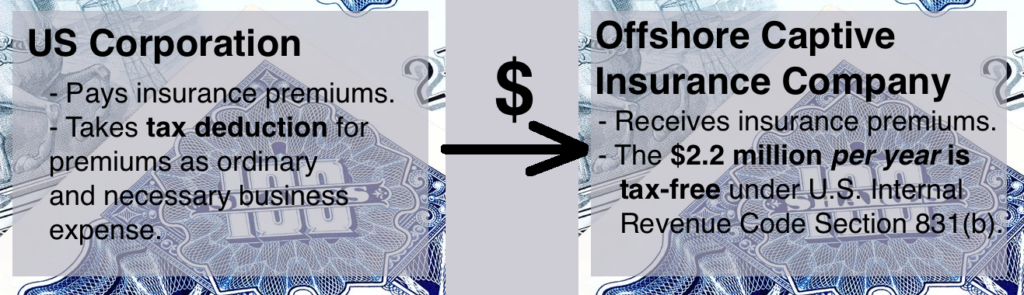

With captive insurance, you are betting on your risk. As a result, insurance carriers continue to respond with steep price increases, dramatically larger deductibles and lower coverage limits. Risks one of the risks that you can take with captive insurance is that there will not be enough funds to pay a claim if the captive. This is due to the captive insurance company being a legally formed corporation. Disadvantages of using a captive insurance plan, compared with other risk financing plans, include: Anyone wishing to purchase a captive policy of their own must be able and willing to, invest their own resources into the policy.

Disadvantages of using a captive insurance plan, compared with other risk financing plans, include:

Your capital is at risk. Facing higher insurance rates, a lack of capacity, and more stringent terms and conditions, many leaders are exploring alternative ways to finance. Companies that utilize captive insurance have more control over safety, losses, and claims administration. Still, there are several potential drawbacks companies must be aware of before considering a captive as a valid insurance solution. Small captive insurance companies that elect under sec. With captive insurance, you are betting on your risk.

Source: thebrokerageinc.com

Source: thebrokerageinc.com

There can be barriers to entry and exit. Insurance groups often need to bring in people to handle the daily operations and responsibilities of policy administration. Captive insurance arrangements are often more difficult for the entity regarding entrance and exit than is purchasing insurance on the open market. And leaving a captive brings its. As the world’s largest captive manager, marsh offers a comprehensive approach to innovative captive solutions, helping organizations of all sizes navigate complex global risks.

Source: techtrendexpert.com

Source: techtrendexpert.com

Only their investment income is. Small captive insurance companies that elect under sec. There can be barriers to entry and exit. With captive insurance, you are betting on your risk. Insurance groups often need to bring in people to handle the daily operations and responsibilities of policy administration.

Source: spotoninsurance.com

Source: spotoninsurance.com

With captive insurance, companies are not attempting to make a profit, but simply to provide themselves with low cost insurance coverage. Hardened insurance market and captive insurance. Companies that utilize captive insurance have more control over safety, losses, and claims administration. Pooling of risks in the captive and “bulk discounts”. If you have a captive insurance program, however, you can create whatever coverage you need and avoid needing to “sell” a carrier on your business plan.

Source: jeremysmithacademy.com

Source: jeremysmithacademy.com

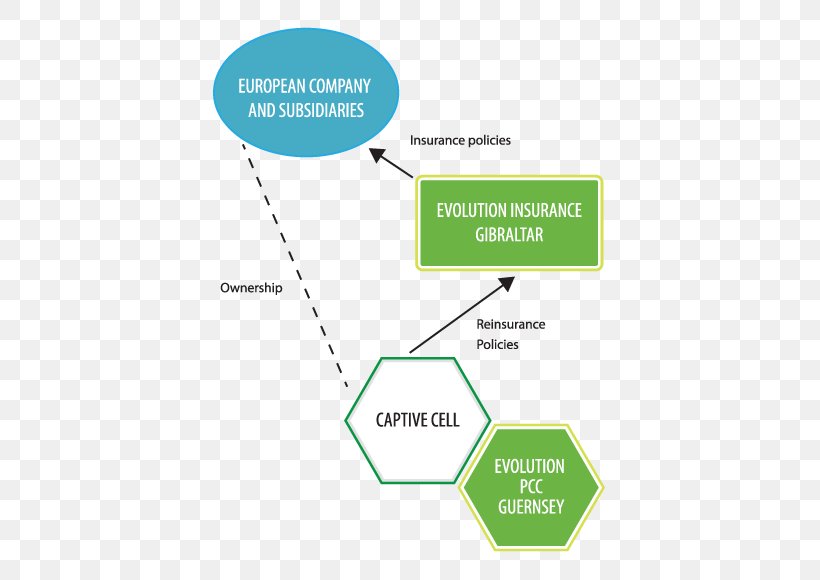

As noted above, starting a captive insurance company can be expensive and complicated due to the regulations surrounding the industry. The coronavirus pandemic and natural catastrophe losses have only made matters worse. Section f of the oecd’s new guidance on financial transactions the oecd’s new guidance covers background on captives, the commercial rationale for captive insurance / reinsurance arrangements, accurate delineation of the transaction, and pricing methods and issues. Captive insurance requires more resources and time, which contributes to its higher overall cost. It�s also more flexible than traditional insurance, because the company can adjust the proportion of assumption of risk or the amount of reinsurance depending on how soft or hard the market is.

Source: krdcpas.com

Source: krdcpas.com

As a result, insurance carriers continue to respond with steep price increases, dramatically larger deductibles and lower coverage limits. Your capital is at risk. The cons of a captive insurance program. Their premium income is not subject to tax; Potential drawbacks of captive insurance solutions.

Source: nisivoccia.com

Source: nisivoccia.com

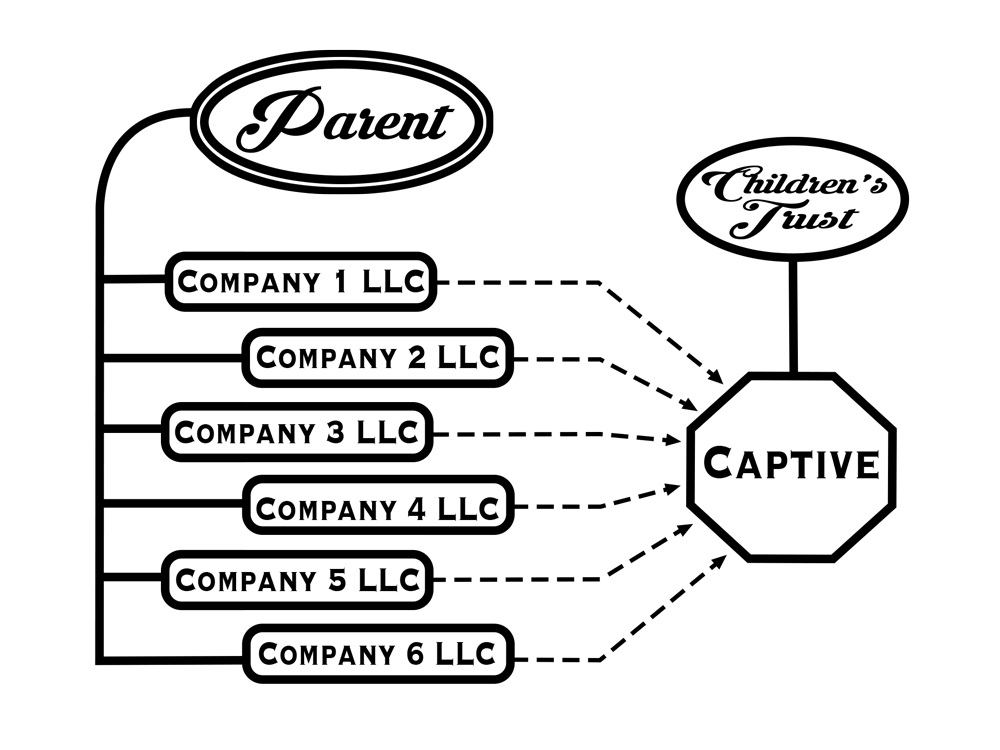

The captive insurance company covers parents risks and the parent pays premiums into the captive. Only their investment income is. It can also pose significant challenges. If you have a captive insurance program, however, you can create whatever coverage you need and avoid needing to “sell” a carrier on your business plan. As shown above, there are many advantages to the captive insurance model.

Source: youtube.com

Source: youtube.com

Potential drawbacks of captive insurance solutions. Insurance groups often need to bring in people to handle the daily operations and responsibilities of policy administration. The number one disadvantage of a captive insurance plan is the fact your company must put its own capital at risk. And leaving a captive brings its. However, sophisticated insurance buyers are taking.

Source: youtube.com

Source: youtube.com

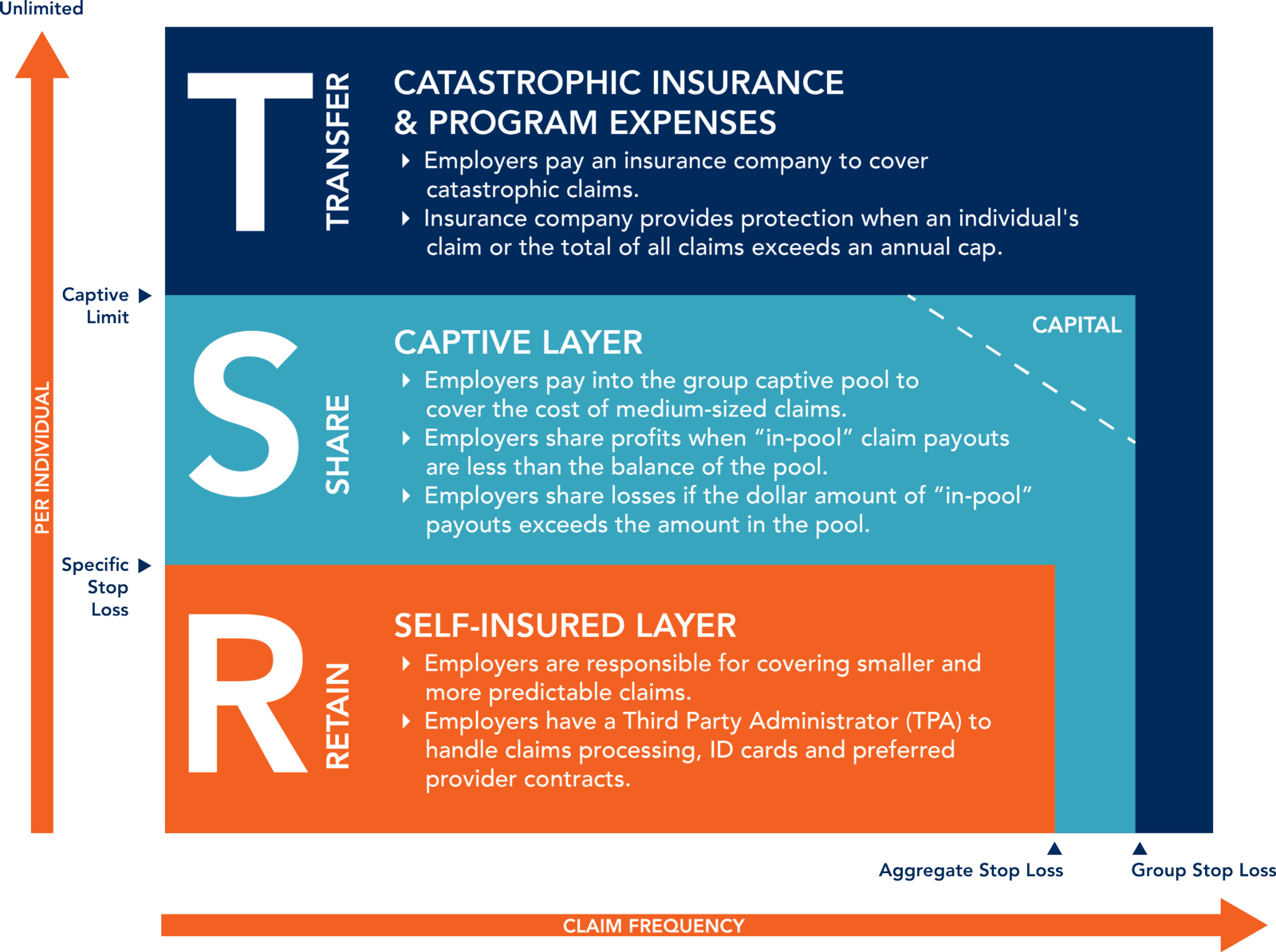

Risks one of the risks that you can take with captive insurance is that there will not be enough funds to pay a claim if the captive. First of all, all premiums an. This infographic will explain how captive insurance works. Companies that utilize captive insurance have more control over safety, losses, and claims administration. As shown above, there are many advantages to the captive insurance model.

Source: 1investing.in

Source: 1investing.in

Evaluating the pros and cons of adding a layer of complexity impacting your personal, business, philanthropic and/or public relationships, even your family, is at the heart of deciding whether it is worthwhile and exciting to start a new business venture or a new operating department, division or subsidiary of an existing. At the outset of 2020, risk professionals who were trying to purchase or renew insurance policies had to navigate an increasingly hardening insurance market characterized by higher rates in almost all lines. Pooling of risks in the captive and “bulk discounts”. As a result, insurance carriers continue to respond with steep price increases, dramatically larger deductibles and lower coverage limits. While they may not be considered “disadvantages” of captive insurance, there are some potential drawbacks to consider:

Source: finance-review.com

Source: finance-review.com

The cons of a captive insurance program. As noted above, starting a captive insurance company can be expensive and complicated due to the regulations surrounding the industry. With captive insurance, you are betting on your risk. Facing higher insurance rates, a lack of capacity, and more stringent terms and conditions, many leaders are exploring alternative ways to finance. The captive model also incentivizes safer workplaces and behaviors because the capital belongs to the company.

Source: 1investing.in

Source: 1investing.in

The number one disadvantage of a captive insurance plan is the fact your company must put its own capital at risk. The captive insurance company covers parents risks and the parent pays premiums into the captive. Their premium income is not subject to tax; With captive insurance, companies are not attempting to make a profit, but simply to provide themselves with low cost insurance coverage. While they may not be considered “disadvantages” of captive insurance, there are some potential drawbacks to consider:

Source: overheadwatch.com

Source: overheadwatch.com

There can be barriers to entry and exit. Insurance groups often need to bring in people to handle the daily operations and responsibilities of policy administration. Still, there are several potential drawbacks companies must be aware of before considering a captive as a valid insurance solution. Case law and the irs require captive insurance companies to meet certain requirements. Captive insurance arrangements are often more difficult for the entity regarding entrance and exit than is purchasing insurance on the open market.

Source: 1investing.in

Source: 1investing.in

Potential drawbacks of captive insurance solutions. Hardened insurance market and captive insurance. However, sophisticated insurance buyers are taking. As shown above, there are many advantages to the captive insurance model. The captive insurance company covers parents risks and the parent pays premiums into the captive.

Source: theolsongroup.com

Source: theolsongroup.com

Evaluating the pros and cons of adding a layer of complexity impacting your personal, business, philanthropic and/or public relationships, even your family, is at the heart of deciding whether it is worthwhile and exciting to start a new business venture or a new operating department, division or subsidiary of an existing. It can also pose significant challenges. Your capital is at risk. Potential drawbacks of captive insurance solutions. The number one disadvantage of a captive insurance plan is the fact your company must put its own capital at risk.

Source: uscaptive.com

Source: uscaptive.com

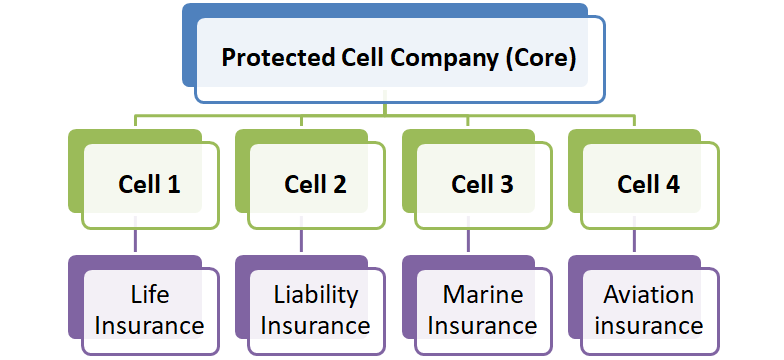

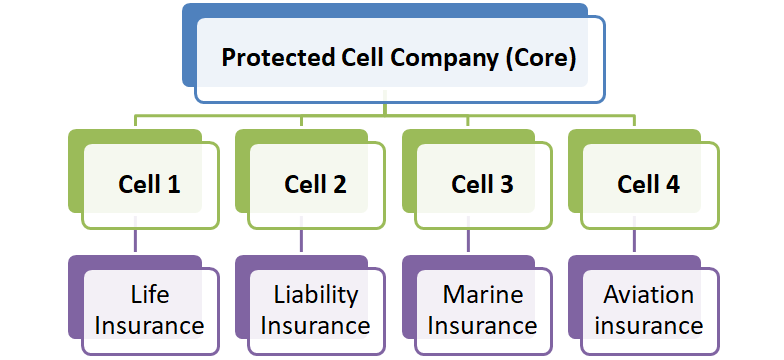

Evaluating the pros and cons of adding a layer of complexity impacting your personal, business, philanthropic and/or public relationships, even your family, is at the heart of deciding whether it is worthwhile and exciting to start a new business venture or a new operating department, division or subsidiary of an existing. It can also pose significant challenges. Parent company has diverse insurance needs and forms a captive insurance company to cover their risks. Only their investment income is. Small captive insurance companies that elect under sec.

Source: pinterest.com

Source: pinterest.com

Captive insurance requires more resources and time, which contributes to its higher overall cost. Captive insurance arrangements are often more difficult for the entity regarding entrance and exit than is purchasing insurance on the open market. And leaving a captive brings its. Dependency on service providers / quality of service difficulty of entrance and exit administrative costs additional management internal administrative costs/increased administration Only their investment income is.

Source: earneasycash20.blogspot.com

Source: earneasycash20.blogspot.com

Pooling of risks in the captive and “bulk discounts”. Only their investment income is. And leaving a captive brings its. Dependency on service providers / quality of service difficulty of entrance and exit administrative costs additional management internal administrative costs/increased administration Captive insurance policies can be difficult to purchase.

Source: offshorecorporation.com

Source: offshorecorporation.com

The captive model also incentivizes safer workplaces and behaviors because the capital belongs to the company. Hardened insurance market and captive insurance. Your capital is at risk. While they may not be considered “disadvantages” of captive insurance, there are some potential drawbacks to consider: And leaving a captive brings its.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title disadvantages of captive insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information