Disadvantages of insurance brokers Idea

Home » Trending » Disadvantages of insurance brokers IdeaYour Disadvantages of insurance brokers images are ready. Disadvantages of insurance brokers are a topic that is being searched for and liked by netizens now. You can Get the Disadvantages of insurance brokers files here. Get all free photos and vectors.

If you’re searching for disadvantages of insurance brokers images information related to the disadvantages of insurance brokers interest, you have visit the right blog. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Disadvantages Of Insurance Brokers. The pros freedom to choose. Some of the pros to buying insurance direct are: Benefits of using a broker. They also shop your policies annually.

Private Health Insurance From firstquotehealth.com

Private Health Insurance From firstquotehealth.com

Buying insurance directly from the company has its benefits. Some of the pros to buying insurance direct are: A broker can guide clients on these decisions, and provide a range of quotes. Like with any career, there are pluses and minuses to being a health insurance broker. To help you make the right choice, take a look at the advantages and disadvantages of working with an insurance broker. I’ve been a used car salesman and hated it.

Risk managers view insurance policies in much the same way.

The benefits of using an insurance broker. Much of your decision depends on your level of experience, financial situation, and general knowledge of running a business. Consumers like to shop around and compare products that best fit their needs and budgets. With this information, a client can make an informed decision about what type of insurance is necessary and how much insurance protection to purchase. We believe the benefits far outweigh the disadvantages. I’ve been a used car salesman and hated it.

Source: enterslice.com

Source: enterslice.com

You can buy direct from the insurer, use a comparison website such as comparethemarket or utilise the services of an insurance broker. Life insurance, for example, protects a family from financial hardship when a major breadwinner dies. She has three years of experience writing for insurance websites such as bankrate.com. Consumers will find that several advantages and potential disadvantages come with using an insurance broker. Because so many kinds of insurance are mandatory, insurance sales is often thought of as a very lucrative career.

Source: tecreals.com

Source: tecreals.com

Because so many kinds of insurance are mandatory, insurance sales is often thought of as a very lucrative career. We believe the benefits far outweigh the disadvantages. As an insurance broker, i see the pros and cons to splitting up your insurance book. They may pose as specialists and look to scam others and make money. Benefits of working with an insurance broker.

Source: kingstreetexchange.org

Source: kingstreetexchange.org

The benefits of being an insurance agent. As an insurance broker, i see the pros and cons to splitting up your insurance book. Like with any career, there are pluses and minuses to being a health insurance broker. They also shop your policies annually. Six commercial insurance brokers in the real estate sector were named 2021 power brokers.

Source: youtube.com

Source: youtube.com

Benefits of independent insurance agents. Pros and cons of being an insurance agent. If you agree, and you want to explore your opportunities, visit the word & brown future broker web page, or contact any of our six offices in california and nevada. When shopping for insurance, there are several key things that customers look at, including cost, speed, ease, security of personal data, and peace of mind that all essentials are covered. A broker can compare rates based on the personal information about a client in a very short period of time.

Source: directlineforbusiness.co.uk

Source: directlineforbusiness.co.uk

We believe the benefits far outweigh the disadvantages. They may even work without a valid license or work using a fake license. They also shop your policies annually. We believe that best way to secure reliable, suitable insurance for your business, is through an independent and experienced broker. The pros of having life insurance outweigh the cons for most people with financial responsibilities.

Source: minimalistjourneys.com

Source: minimalistjourneys.com

They also shop your policies annually. A broker can guide clients on these decisions, and provide a range of quotes. In the end, you should carefully evaluate all the pros and cons of working in the insurance sector so that you can make a profound decision regarding this important topic. The pros freedom to choose. We believe the benefits far outweigh the disadvantages.

Source: enterslice.com

Source: enterslice.com

If you die, your beneficiaries receive a payout called a death benefit that replaces any income you provided while you were alive. With this information, a client can make an informed decision about what type of insurance is necessary and how much insurance protection to purchase. And can free up your time to. Insurance brokers work exclusively for you (rather than the insurance company like a captive agent). They also shop your policies annually.

There are a number of regulatory bodies that ensure that the function and practices of our members are properly regulated and to protect the interests of. Independent insurance brokers use their experience as leverage to keep insurance companies honest with their rates. Consumers like to shop around and compare products that best fit their needs and budgets. Following are the disadvantages of using insurance brokers: Going direct avoids the back and forth that you have if you go through an agent.

Source: swaritadvisors.com

Source: swaritadvisors.com

Benefits of working with an insurance broker. The main advantage of owning a life insurance policy: The benefits of using an insurance broker. We believe that best way to secure reliable, suitable insurance for your business, is through an independent and experienced broker. If you die, your beneficiaries receive a payout called a death benefit that replaces any income you provided while you were alive.

Source: newslax.com

Source: newslax.com

The pros freedom to choose. The 2021 real estate power brokers. Sometimes the insurance brokers may show a lack of professionalism. The benefits of being an insurance agent. They may even work without a valid license or work using a fake license.

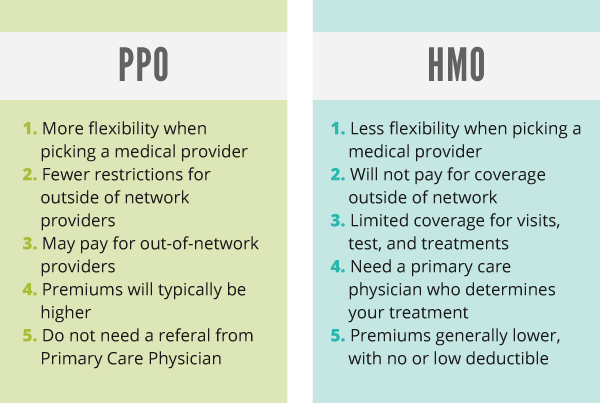

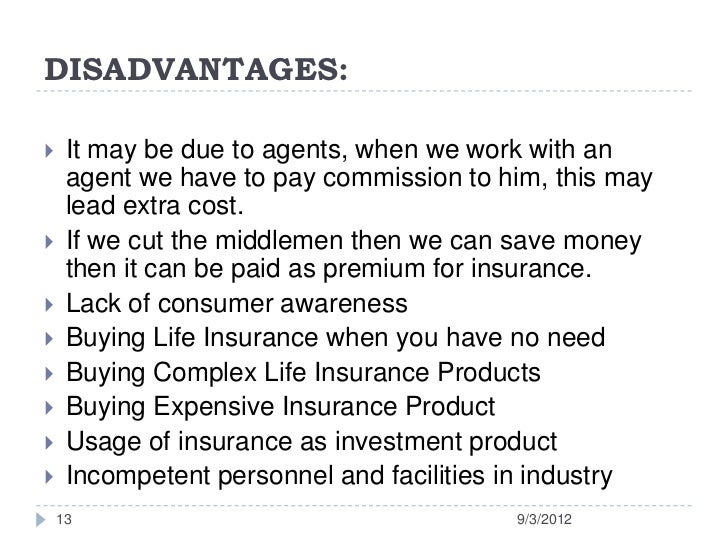

Source: firstquotehealth.com

Source: firstquotehealth.com

The pros of having life insurance outweigh the cons for most people with financial responsibilities. Much of your decision depends on your level of experience, financial situation, and general knowledge of running a business. The benefits of using an insurance broker. Buying insurance directly from the company has its benefits. A broker can guide clients on these decisions, and provide a range of quotes.

Source: dreamstime.com

Source: dreamstime.com

Buying insurance directly from the company has its benefits. This may mean working for a specific company and only selling that “brand” of. I’ve been a used car salesman and hated it. Mandy sleight has been a licensed insurance agent since 2005. There are a number of regulatory bodies that ensure that the function and practices of our members are properly regulated and to protect the interests of.

Source: enterslice.com

Source: enterslice.com

If you’re keen to find a better deal, or you’re unsure of the level of cover required, an insurance broker could be right for you. If one brokerage goes out of business, there is an established relationship with another broker already in place. Pros and cons of being an insurance agent. A broker can guide clients on these decisions, and provide a range of quotes. While the latter represents a single company, an insurance broker represents a variety of insurance companies.

Source: insuranceweb.com.au

Source: insuranceweb.com.au

She has three years of experience writing for insurance websites such as bankrate.com. If you die, your beneficiaries receive a payout called a death benefit that replaces any income you provided while you were alive. There are a number of regulatory bodies that ensure that the function and practices of our members are properly regulated and to protect the interests of. Keep this in mind when choosing between an insurance broker and insurance agent. She has three years of experience writing for insurance websites such as bankrate.com.

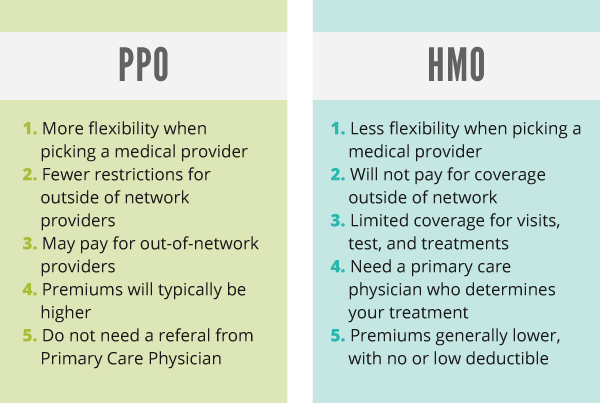

Source: slideshare.net

Source: slideshare.net

Six commercial insurance brokers in the real estate sector were named 2021 power brokers. Consumers like to shop around and compare products that best fit their needs and budgets. Life insurance, for example, protects a family from financial hardship when a major breadwinner dies. Pros to buying insurance directly from the company. 1.) the insured has a perceived level of control over their accounts by splitting up the business between two reputable brokers.

Source: mccartyinsurance.com

Source: mccartyinsurance.com

Like with any career, there are pluses and minuses to being a health insurance broker. 1.) the insured has a perceived level of control over their accounts by splitting up the business between two reputable brokers. The pros of having life insurance outweigh the cons for most people with financial responsibilities. Keep this in mind when choosing between an insurance broker and insurance agent. Independent insurance brokers use their experience as leverage to keep insurance companies honest with their rates.

Source: farahfinancials.com

You can choose to represent one carrier or multiple brands through your agency. Benefits of working with an insurance broker. Mandy sleight has been a licensed insurance agent since 2005. I’ve been a used car salesman and hated it. Buying insurance directly from the company has its benefits.

Source: pinterest.com

Source: pinterest.com

Going direct avoids the back and forth that you have if you go through an agent. Sometimes the insurance brokers may show a lack of professionalism. This may mean working for a specific company and only selling that “brand” of. A broker will help his or her clients identify their individual, family, business or organization liability risks. 5 benefits of having an insurance agent.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title disadvantages of insurance brokers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea