Dividends from a mutual insurance company are paid to whom information

Home » Trend » Dividends from a mutual insurance company are paid to whom informationYour Dividends from a mutual insurance company are paid to whom images are available in this site. Dividends from a mutual insurance company are paid to whom are a topic that is being searched for and liked by netizens today. You can Download the Dividends from a mutual insurance company are paid to whom files here. Download all free images.

If you’re searching for dividends from a mutual insurance company are paid to whom images information connected with to the dividends from a mutual insurance company are paid to whom keyword, you have come to the right blog. Our site always gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

Dividends From A Mutual Insurance Company Are Paid To Whom. Federal law, rather than state. A mutual fund’s net asset value is the total value of all securities held by the fund. Some life insurance companies don’t even have shareholders; Dividends—cash or stock rewards from a company to its shareholders—are typically paid quarterly to qualifying shareholders.

Best Dividend Paying Whole Life Insurance for Cash Value From bankingtruths.com

Best Dividend Paying Whole Life Insurance for Cash Value From bankingtruths.com

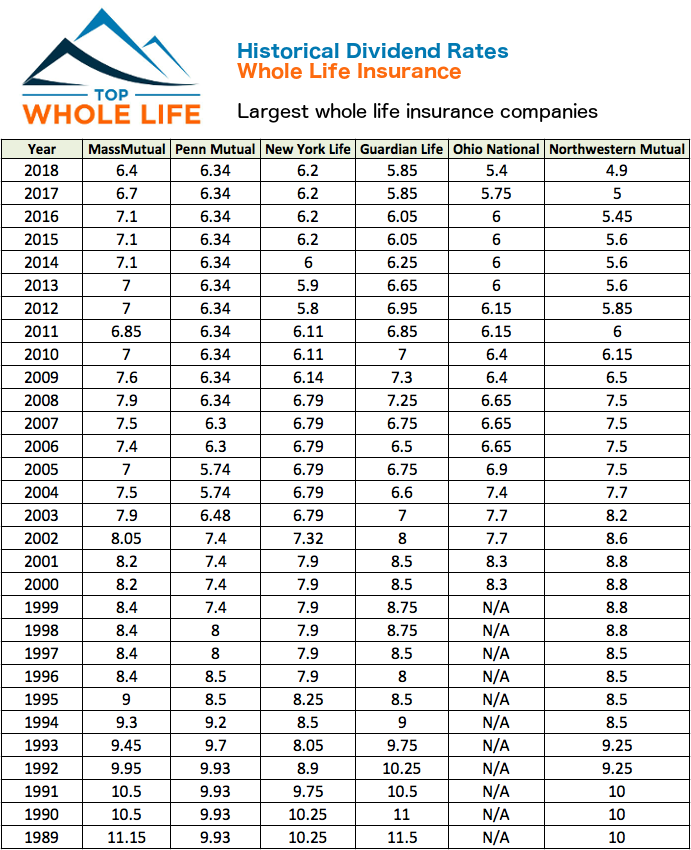

2003 $6,000 2004 3,000 2005 4,500 2006 2,929 dividends to policyholders country pays dividends on its crop hail policies. Those companies are called mutual companies (northwestern mutual happens to be one of those). You see, with a stock company, the profits pass on to the shareholders. Unlike dividends from a stock life insurer, which are taxable to shareholders like other corporate dividends, the dividends paid by a mutual life insurance company to policyholders are nontaxable. Historical dividend studies from massachusetts mutual life insurance company (massmutual) as a mutual life insurance company, massmutual does not have shareholders. These companies pay dividends back to those policy holders from their profits.

(3) persons associating to form a mutual insurance company shall shall amollnt to at least $50,000, which shall have been actually paid in, in cash, by.

Unlike dividends from a stock life insurer, which are taxable to shareholders like other corporate dividends, the dividends paid by a mutual life insurance company to policyholders are nontaxable. He has the right to vote for members of the board of directors. Unlike dividends from a stock life insurer, which are taxable to shareholders like other corporate dividends, the dividends paid by a mutual life insurance company to policyholders are nontaxable. Anyone purchasing insurance from a mutual insurer is both a customer and an owner. These companies pay dividends back to those policy holders from their profits. A participating policy is one that pays dividends to the policy holder.

Source: topwholelife.com

Source: topwholelife.com

The insurance dividend can be given in cash also, but often it is applied as a discount against future premium payments. Any profits earned by a mutual insurance company are either retained within the company or rebated to policyholders in the form of dividend distributions or reduced future premiums. He has the right to vote for members of the board of directors. All dividends and interest payments earned by the fund initially become part of the fund’s total net asset value and would, therefore, increase the fund’s daily nav.a dividend distribution made by the fund would be removing assets from a fund’s nav.when a dividend distribution is made, the fund’s. Federal law, rather than state.

Source: bankingtruths.com

Source: bankingtruths.com

Taxing dividends since dividends are considered a return of premium they are not taxable to the owner of the policy. A mutual fund’s net asset value is the total value of all securities held by the fund. All dividends and interest payments earned by the fund initially become part of the fund’s total net asset value and would, therefore, increase the fund’s daily nav.a dividend distribution made by the fund would be removing assets from a fund’s nav.when a dividend distribution is made, the fund’s. Those companies are called mutual companies (northwestern mutual happens to be one of those). By issuing participating policies that pay policy dividends, mutual insurers allow their policyowners to share in any company earnings.

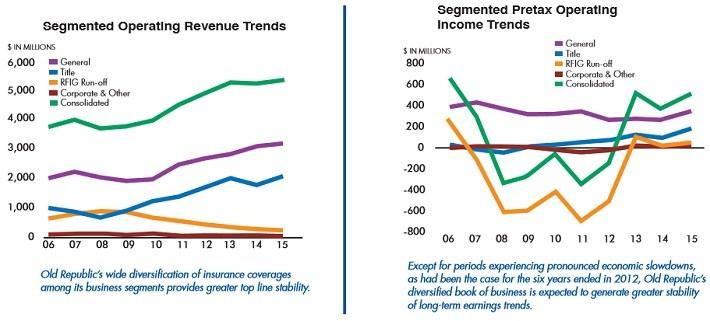

Source: seekingalpha.com

Source: seekingalpha.com

Those companies are called mutual companies (northwestern mutual happens to be one of those). 2003 $6,000 2004 3,000 2005 4,500 2006 2,929 dividends to policyholders country pays dividends on its crop hail policies. A mutual insurer is owned entirely by its policyholders. Do whole life insurance policies pay dividends? In contrast, “stock” insurance companies are corporations owned by shareholders of company stocks.

Source: blog.massmutual.com

Those profits are theoretically the difference between the premiums paid by policy holders and the sum of all claims paid and administrative expenses the company incurs. A participating policy is one that pays dividends to the policy holder. The reason mutual companies pay dividends is that they do not have stockholders. However, with a mutual insurance company, the profits pass on to the policyholders, such as life insurance dividends. This can vary from company to company.

Source: californialifeinsurancecompany.us

Source: californialifeinsurancecompany.us

In addition, the company provides life, accident and health insurance products. Holyoke mutual insurance company in salem 4 dividends to shareholders the company declared and paid dividends during the examination period as follows: In contrast, “stock” insurance companies are corporations owned by shareholders of company stocks. However, with a mutual insurance company, the profits pass on to the policyholders, such as life insurance dividends. Mutual trust offers many dividend options.

Source: bankingtruths.com

Source: bankingtruths.com

The reason mutual companies pay dividends is that they do not have stockholders. Under state laws, however, the interest of policyholders takes precedence over stockholder interests. A mutual insurance company is jointly owned by its policy holders. Section 500.1343 ‑, ordinary shareholder dividends paid by domestic insurers; (3) persons associating to form a mutual insurance company shall shall amollnt to at least $50,000, which shall have been actually paid in, in cash, by.

Source: imsguenstony.blogspot.com

Source: imsguenstony.blogspot.com

Allstate offers property and causality insurance to its customers. The reason mutual companies pay dividends is that they do not have stockholders. A participating policy is one that pays dividends to the policy holder. The insurance dividend can be given in cash also, but often it is applied as a discount against future premium payments. Taxing dividends since dividends are considered a return of premium they are not taxable to the owner of the policy.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Mutual insurance companies that offer participating life insurance have a long history of paying annual dividends. Find mutual car insurance companies. The reason mutual companies pay dividends is that they do not have stockholders. A mutual insurer is owned entirely by its policyholders. All dividends and interest payments earned by the fund initially become part of the fund’s total net asset value and would, therefore, increase the fund’s daily nav.a dividend distribution made by the fund would be removing assets from a fund’s nav.when a dividend distribution is made, the fund’s.

Source: bankingtruths.com

Source: bankingtruths.com

The reason mutual companies pay dividends is that they do not have stockholders. Mutual insurance companies that offer participating life insurance have a long history of paying annual dividends. A mutual insurance company is jointly owned by its policy holders. Mutual trust offers many dividend options. Federal law, rather than state.

Source: mylovingstardoll.blogspot.com

Source: mylovingstardoll.blogspot.com

In addition, the company provides life, accident and health insurance products. To get paid dividends from your car insurance, you first need to buy from a company that pays dividends. Find mutual car insurance companies. A mutual fund’s net asset value is the total value of all securities held by the fund. However, with a mutual insurance company, the profits pass on to the policyholders, such as life insurance dividends.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Under state laws, however, the interest of policyholders takes precedence over stockholder interests. Definition of a mutual insurance company: Group owned by stockholders to whom company earnings are paid in the form of shareholder dividends. He has the right to vote for members of the board of directors. A participating policy is one that pays dividends to the policy holder.

Source: slideshare.net

Source: slideshare.net

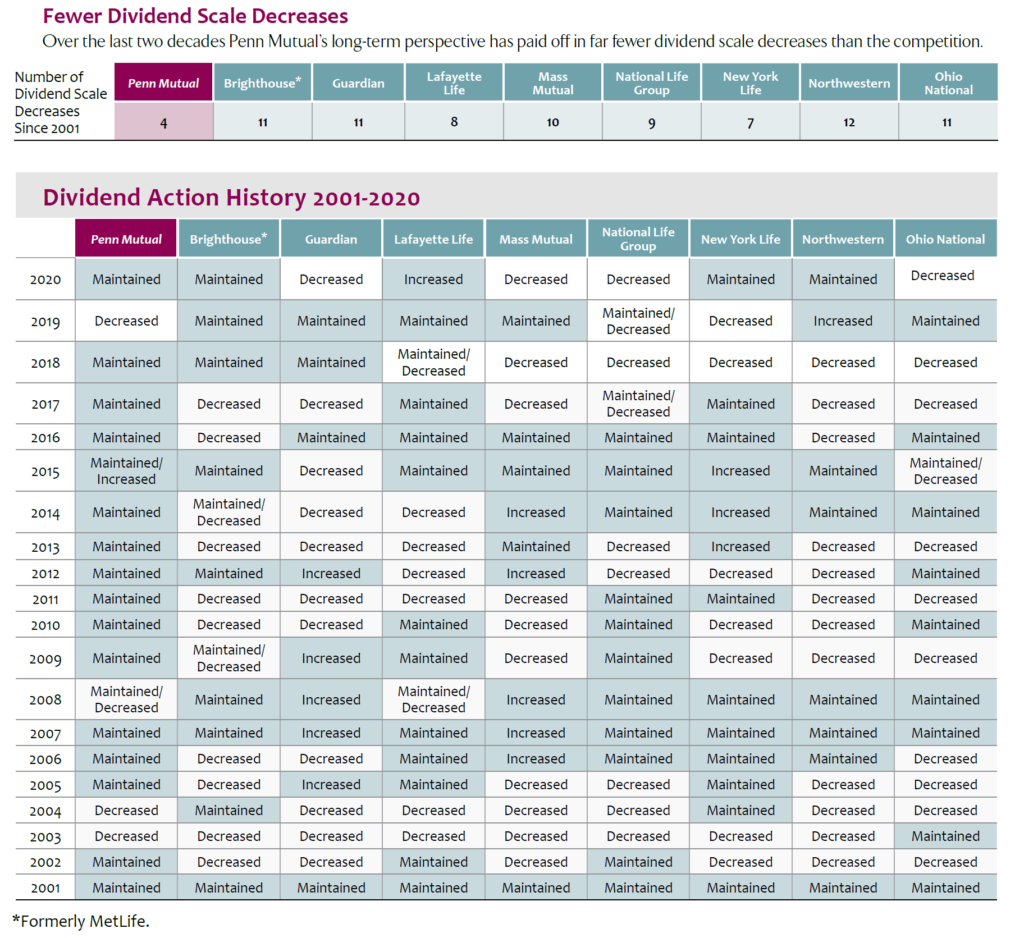

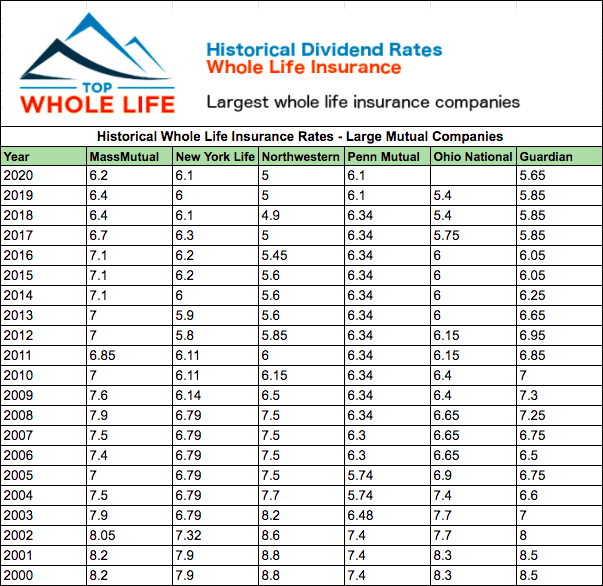

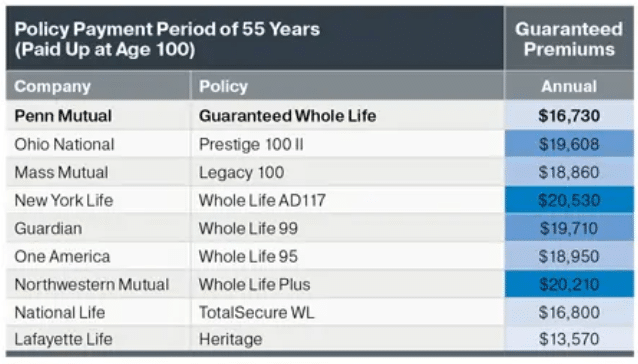

But understand how the company’s dividend payouts work and consider other insurance companies to make sure the dividend policy offers you the best value. The participating whole life policies issued by massmutual are eligible to receive a dividend each year. Group owned by stockholders to whom company earnings are paid in the form of shareholder dividends. Historical dividend studies from massachusetts mutual life insurance company (massmutual) as a mutual life insurance company, massmutual does not have shareholders. When it comes to the top whole life insurance companies, participating whole life from mutual insurance companies, where the insurance company pays a dividend to participating policyholders, are the best whole life insurance companies available in the marketplace.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Mutual insurance companies make investments in portfolios like a regular mutual fund, with any profits returned to members as dividends or a reduction in premiums. The participating whole life policies issued by massmutual are eligible to receive a dividend each year. In contrast, “stock” insurance companies are corporations owned by shareholders of company stocks. The most competitive participating policies are from mutual companies. Policies that pay whole life dividends are also known as “participating life insurance,” or a “participating policy contract.” that simply means that the policy owners “participate” in.

Source: bankingtruths.com

Source: bankingtruths.com

The reason mutual companies pay dividends is that they do not have stockholders. Mutual insurance companies are companies owned by the policyholders. With a market cap of $32 billion, allstate corporation is one of the larger insurance companies in the stock market. In addition, the company provides life, accident and health insurance products. Those companies are called mutual companies (northwestern mutual happens to be one of those).

Source: bankingtruths.com

Source: bankingtruths.com

Dividends from a mutual insurance company are paid to whom? Those companies are called mutual companies (northwestern mutual happens to be one of those). (3) persons associating to form a mutual insurance company shall shall amollnt to at least $50,000, which shall have been actually paid in, in cash, by. To get paid dividends from your car insurance, you first need to buy from a company that pays dividends. A participating policy is one that pays dividends to the policy holder.

Source: partners4prosperity.com

Source: partners4prosperity.com

Mutual trust offers many dividend options. The participating whole life policies issued by massmutual are eligible to receive a dividend each year. Dividends—cash or stock rewards from a company to its shareholders—are typically paid quarterly to qualifying shareholders. A participating policy is one that pays dividends to the policy holder. With a market cap of $32 billion, allstate corporation is one of the larger insurance companies in the stock market.

Source: topwholelife.com

Source: topwholelife.com

But understand how the company’s dividend payouts work and consider other insurance companies to make sure the dividend policy offers you the best value. Those companies are called mutual companies (northwestern mutual happens to be one of those). Federal law, rather than state. 2003 $6,000 2004 3,000 2005 4,500 2006 2,929 dividends to policyholders country pays dividends on its crop hail policies. This can vary from company to company.

Source: bankingtruths.com

Source: bankingtruths.com

So at mutual companies, dividends are paid solely to policyowners. Find mutual car insurance companies. By issuing participating policies that pay policy dividends, mutual insurers allow their policyowners to share in any company earnings. These companies pay dividends back to those policy holders from their profits. How to get dividends from your car insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title dividends from a mutual insurance company are paid to whom by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information